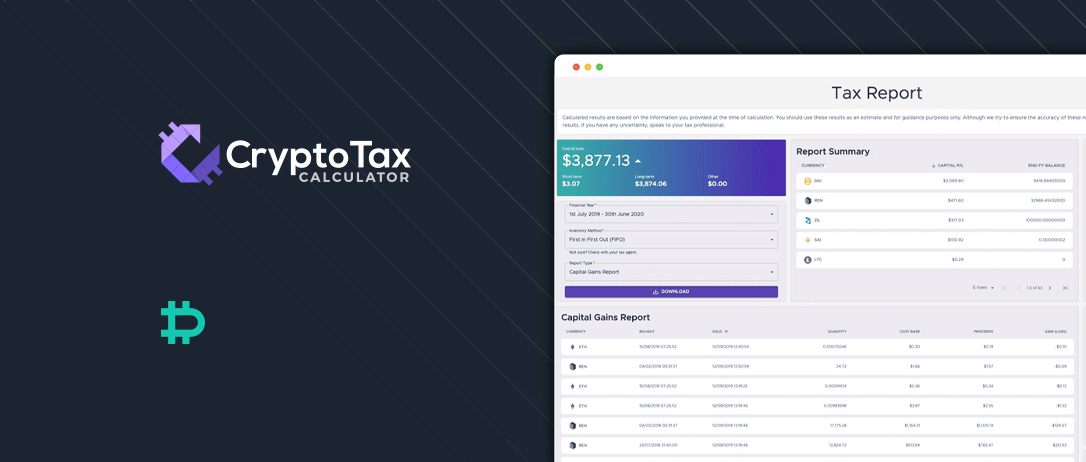

Paying your crypto taxes has never been easier! With CryptoTaxCalculator you can handle your crypto tax calculations on options and margin trading and import your transaction data directly from Deribit. The easy to use crypto tax calculator allows you to import your data and calculate your taxes in seconds. CryptoTaxCalculator supports hundreds of exchanges, as well as non-exchange activities. Calculate all your crypto taxes in one place!

What and how are my crypto transactions taxed?

When it comes to crypto taxes, you can be liable for both capital gains and income tax, depending on the type of cryptocurrency transaction and your individual circumstances. For example, you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on trading income.

Manually, this would be a tiresome task; however, with CryptoTaxCalculator, you just need to import your transaction history. The calculator will do the rest – categorize your transactions and calculate realized profit and income. You can then generate the appropriate reports to send to your accountant and keep detailed records handy for audit purposes.

Prepare your crypto tax report in 3 easy steps:

1 – Import Data

Upload your transaction history with direct CSV and API integrations for hundreds of exchanges, blockchains, and wallets.

2 – Review Transactions

An automated categorization algorithm will help you sort all your transactions and make your crypto trades easy to review and audit.

3 – Get Report

Generate your tax reports for all financial years. CryptoTaxCalculator detailed reports give a breakdown of realized capital gains and income. You can share this with your accountant or import it into your tax software.

Visit CryptoTaxCalculator to learn more!

AUTHOR(S)