Deribit has made the USD Coin (USDC) currency available for use on the Deribit platform. This includes deposits and withdrawals, swapping for other currencies, and of course some trading products that can be traded using USDC as collateral.

For those not yet aware, USDC is a digital dollar stablecoin founded by Coinbase and Circle in 2018. It’s value is pegged to the United States Dollar (USD) such that 1 USDC = 1 USD. For more information on the currency itself, Link.

Creating a deposit address

In order to deposit USDC into your Deribit account, you will need to create a USDC deposit address. To do this, go to either the top left or the top right menu, and click ‘Deposit’. Then make sure USDC is selected as the currency at the top of the page. Click the ‘Generate a deposit address’ button, and you will then see an address. You can copy this and use it in your own wallet or another exchange wallet to send your USDC funds to your Deribit account.

Please note: USDC is available on several different blockchains, however it is very important to remember when depositing USDC onto Deribit, that Deribit’s current implementation only supports the ERC-20 version of USDC on the Ethereum blockchain. Attempting to send funds via any other blockchain network such as BSC could result in the total loss of those funds.

Once you have some USDC in your account, you’re ready to start trading the new USDC perpetual products.

The new USDC perpetual contracts

We will use the BTC-USDC perpetual contract in this example, and we will pay particular attention to the differences between these new linear contracts and the inverse contracts that Deribit traders will already be familiar with.

Traders now have access to two different bitcoin perpetual contracts. The existing inverse contract, where bitcoin is used as the collateral, and the new linear contract where USDC is used as the collateral.

In many ways of course these two contracts are very similar. Both contracts allow traders to speculate on the price of bitcoin in relation to the US dollar. The profit in dollars of equivalent positions will be the same for each contract.

For example, let’s suppose the current price of bitcoin is $50,000, and a trader opens two long positions, one on the inverse perpetual and one on the linear contract. The initial position sizes are $50,000 and 1 BTC respectively, which with a current bitcoin price of $50,000 means the two positions are equivalent in size. If the price of bitcoin then doubles to $100,000, then both of these positions will have made a profit of $50,000. The difference is the currency that these profits are paid in.

Let’s assume the trader now closes both positions. For the inverse contract where bitcoin is used as collateral, the $50,000 profit is paid in bitcoin. With a current bitcoin price of $100,000, this means the trader receives the $50,000 profit as 0.5 BTC.

For the linear contract where USDC is used as collateral, the $50,000 profit is paid in USDC. As 1 USDC = $1, this means the trader receives the $50,000 profit as 50,000 USDC.

So, when measuring profit or loss in dollars, the two different contracts have performed the same. Once the positions are closed though, the funds for the inverse contract will be sitting in BTC, whereas the funds for the linear contract will be sitting in USDC. Therefore the difference is what the trader’s default position is.

With an account balance of BTC, a trader is naturally long bitcoin when they have no open positions. This means the dollar value of their account will continue to fluctuate depending on the price of bitcoin. In order to make their account stable in USD, they would need to add a 1x hedge short on the futures. More details on this can be found on the Deribit blog here.

However, with an account balance of USDC, the trader’s account is already stable in dollar terms by default. This makes trading the USDC linear contracts suitable for those traders who prefer to be in dollars when not in a position, and who are not comfortable or have no desire to use the futures to do so synthetically.

ALT-USDC pairs

Bitcoin is not the only cryptocurrency that can be traded while using USDC as collateral. The new linear ALT-USDC perpetuals all work in this same way. Traders are able to speculate on the price of each coin in relation to the US dollar while using USDC as collateral.

This also allows traders to have positions open on multiple coins at once that share the same pool of collateral. As a result, pairs trades can be executed very efficiently.

This will also allow Deribit to add several more ALT-USDC perpetual contracts with relative speed, as there are no additional wallet integrations required, because they all use USDC.

Position sizing differences

Other than using USDC as collateral, there is one more difference you will notice as soon as you attempt to place an order on the linear USDC contracts. On the inverse contracts, your position size is a fixed dollar amount. However, on the linear USDC contracts, your position size is a fixed amount of the underlying asset, such as bitcoin or ether.

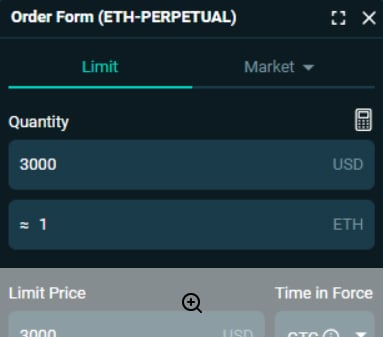

For example, imagine ETH is currently trading at a price of around $3,100, and you want to place a limit order to buy 1 ETH (or the equivalent in dollars) at a price of $3,000. On the inverse contract, you would enter a quantity of 3000 USD like so:

There is also a feature to enter the position size in ETH as well, however on the inverse contract, this will be rounded to the nearest dollar. It is the position size in dollars (3000 here) that will remain fixed until the position is closed or altered.

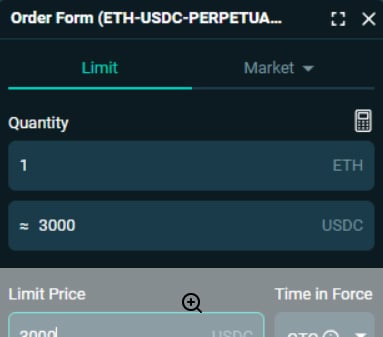

On the linear USDC contracts though, you would enter a quantity of 1 ETH like so:

There is also a feature to enter the position size in USDC as well, however on the linear contract, this will be rounded to the nearest 0.001 ETH. It is the position size in ETH (1 here) that will remain fixed until the position is closed or altered.

As we covered earlier, the profit/loss in dollars of both these positions will still be the same. The difference here in how the position size is measured, is simply a result of the currency that is used for collateral.

You can see more information on how profit and loss is calculated for the inverse contracts on the Deribit blog here.

FAQs

Will the swap function be available for USDC as well?

Yes.

Which blockchain networks will it be possible to deposit and withdraw USDC with?

Only ERC-20 USDC on Ethereum will be available.

Will there also be option products that use USDC as collateral?

Not at this time, no.

Where can I find the contract specifications, tick sizes and margins?

You can find all the USDC specifications here.

Is there a USDC Insurance Fund?

Yes, we will start with a USDC Insurance Fund with a value of USDC 10 million.

Can I move my USDC fee balance to a sub-account?

Yes, go to the Transfer page under My Account and select “Fee Balance to sub-account”

AUTHOR(S)