Uptrend in BTC Intact Despite Trump Election Odds Fading To 60%

BTC is showing strong resilience, with dips primarily bought and highs of $68k tested. ETH hasn’t matched this momentum but is starting to recover some ground after a positive first day of inflows on the ETH spot ETFs launched this Tuesday. BTC’s strength is notable, even with Mt. Gox supply entering the market and the recent decline in equities. The market remains bullish, anticipating a Trump election win. Biden stepping down and endorsing Kamala Harris hasn’t affected this momentum so far. All eyes are now on Trump’s appearance at the Nashville Bitcoin conference this weekend, with rumours of Elon Musk attending the Bitcoin 2024 conference alongside Trump.

Positive Carry Environment

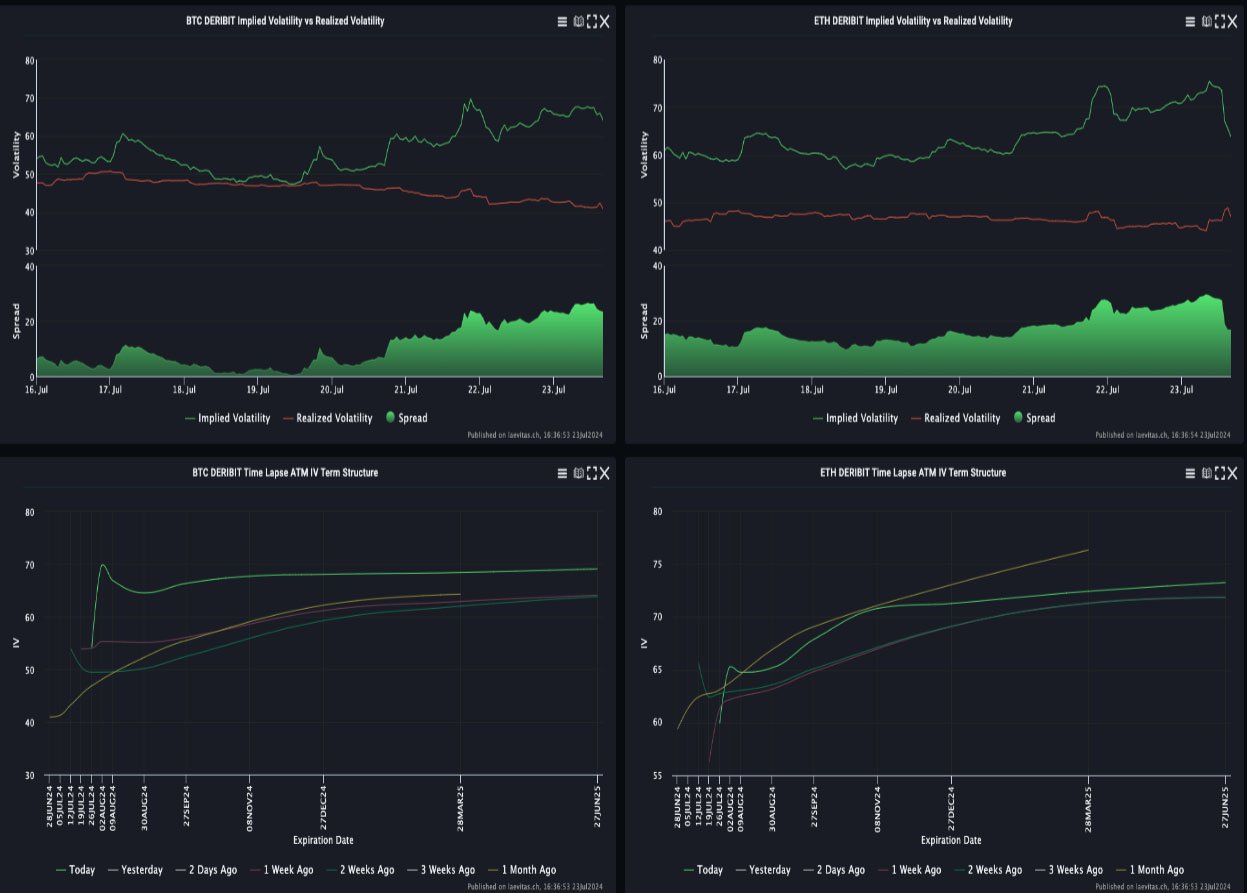

Crypto realized volatility has drifted lower this week, settling in the mid to low 40s. In contrast, implied volatility has risen with BTC’s new narrative as a potential strategic reserve asset and ETH’s ETF launch. This creates a very positive carry environment, making short gamma attractive for those who can handle the event risks. ETH volatility is already resetting lower, as spot prices have not made significant moves. BTC’s term structure is inverted due to the 02Aug kink, capturing Trump’s speech in the BTC conference in Nashville.

Skew: BTC Call Premium Overtakes ETH

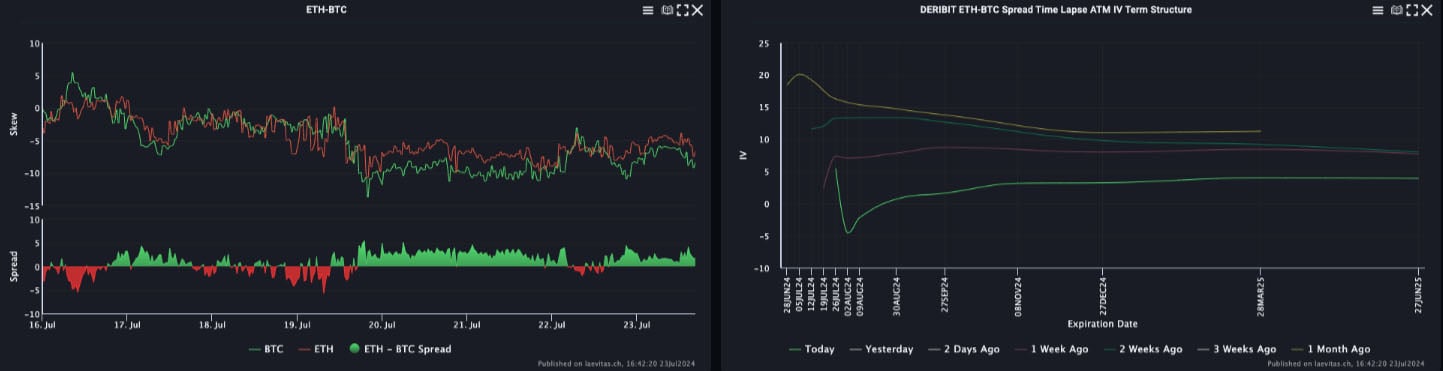

BTC call premiums have surpassed ETH across all tenors, indicating a narrative shift. ETH/BTC spot prices are moving lower and may accelerate if ETH ETF inflows are disappointing. BTC’s explosive upside potential has flipped the ETH/BTC volatility spread in the front end to -5 (favoring BTC). The rest of the curve still shows a mild ETH premium but has reset to below 5 vol points, as predicted last week.

Option Flows

Volumes have spiked 70% to around $12Bn, with significant call buying across tenors as BTC retests $68k on Trump reserve asset rumors. On-screen buying has also surged. There’s some selling of July calls closer to ATM but buying of OTM calls from Aug to Dec24. ETH volumes are up 55% at $2.8Bn but still trail BTC, despite the ETF launch. The narrative has shifted back to BTC upside, with mostly call selling flows in ETH and some put buying in Aug 3100 strikes, indicating weak relative price action in ETH.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)