Macro View: A Market in Transition

Bitcoin enters the final days of October steady but directionless. The market is fixated on two key events – the Fed’s policy meeting and the Trump–Xi trade negotiations – both of which could dictate short-term risk sentiment.

Institutional liquidity remains thin since the October 10 sell-off, with treasury buyers largely on the sidelines. Retail and tactical funds are now carrying the market, leaving it more fragile.

Still, the broader setup is turning more constructive. Expectations that the Fed may end its quantitative tightening, stronger equity markets, and progress on U.S. crypto regulation are all supportive signals. Meanwhile, a new wave of capital – more disciplined, data-driven, and less speculative – is reshaping crypto’s investor base. Bitcoin’s next leg higher will likely depend on this shift from hype to conviction.

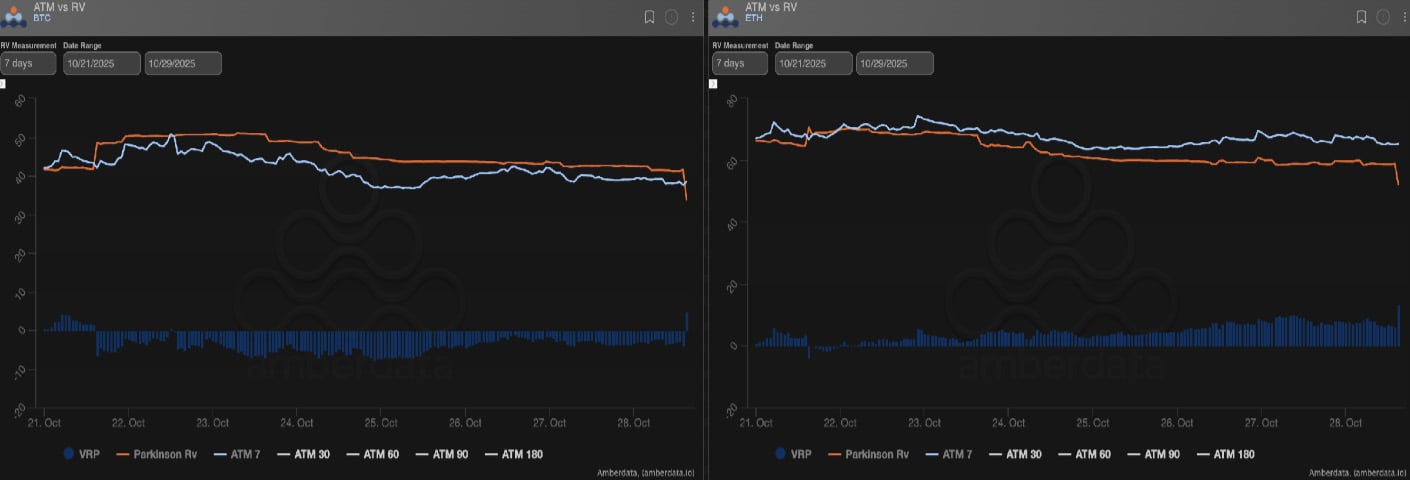

Realized Volatility: Calm Before the Fed

Both BTC and ETH realized volatility have drifted lower, sitting near 30 and 50 respectively. Front- end implied vols fell roughly five points last week as prices settled into tight ranges.

Carry has turned modestly positive in both assets – a sign that short-vol positions are again paying off – though traders remain cautious ahead of the Fed meeting and the U.S.-China summit. Apart from a brief weekend spike, implied ranges have held well.

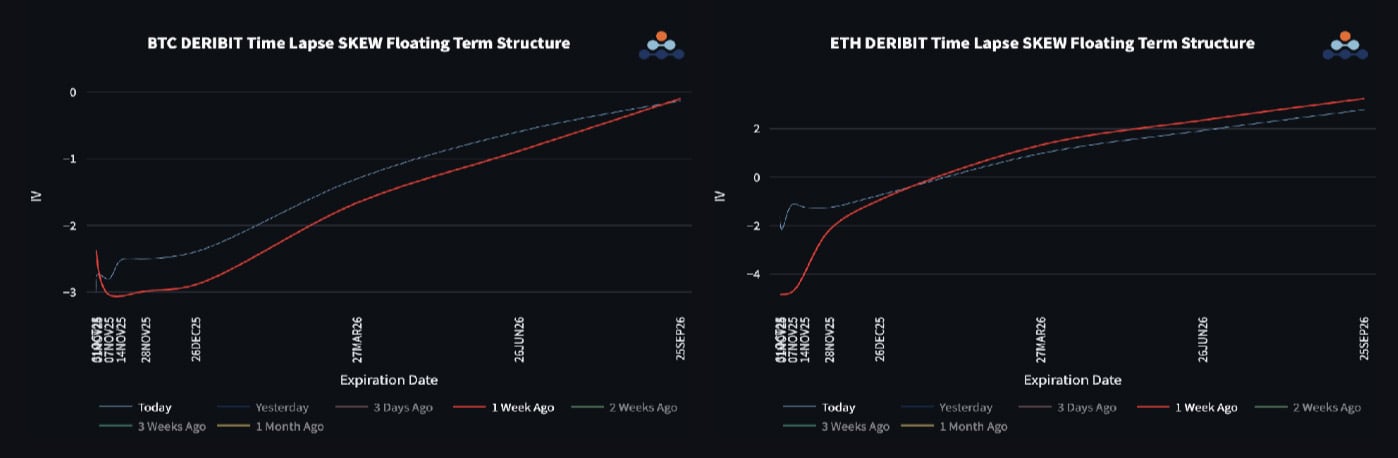

Skew Term Structure: Contango Persists, ETH Keeps Its Call Premium

Option skews remain in contango, though the curve has flattened slightly. Short-dated BTC put skew narrowed sharply from about 10 vols to 2-3, suggesting fading downside protection demand.

Long-term BTC skew is stable with a small put premium, while ETH maintains a persistent call premium of roughly 2-3 vols. The term structure continues to reflect a medium- to long-term bullish bias for ETH and the broader altcoin space.

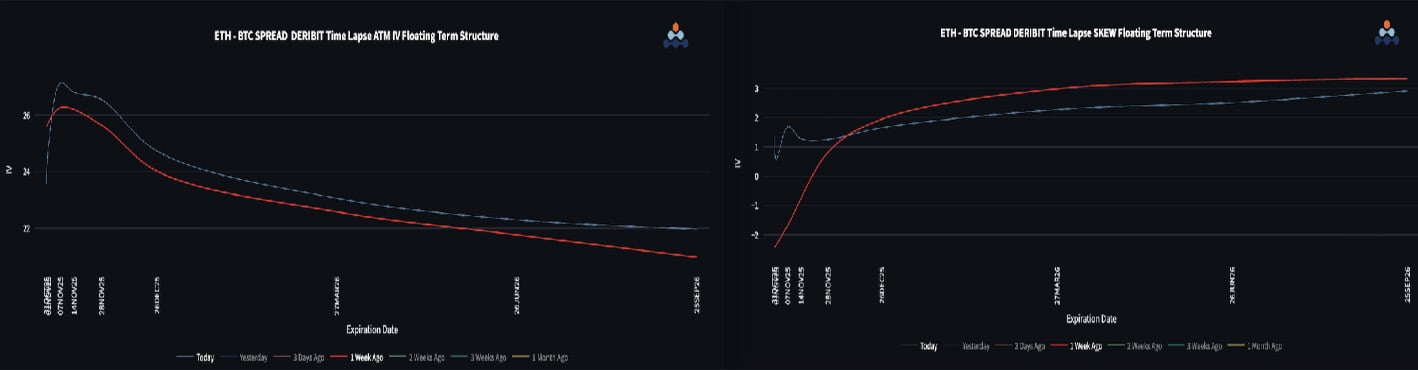

ETH/BTC Dynamics: Vol Spread Stays Wide

ETH/BTC spot remains pinned near 0.036 – a key downtrend resistance. The vol spread between the two assets has risen in parallel, with ETH realized vol holding roughly 20 points above BTC.

That differential supports long-ETH vol trades, even as both assets consolidate. ETH put skew has softened faster than BTC’s, reflecting lighter institutional hedging and a market still prone to chasing spot moves.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)