BTC Breaks Higher – But The Real Story Is Building Underneath

After weeks of tight range trading, Bitcoin finally broke — dipping briefly to $100K before snapping back to $110K. Buyers remain firmly in control, even without a clear macro trigger.

But the bigger price action came from ETH, which cleanly broke through the key $2.7K resistance, triggering fresh momentum and renewed upside flows.

Behind the scenes, stablecoins are quietly reshaping the landscape. Circle’s IPO was 20x oversubscribed, drawing heavy demand from institutions like BlackRock and ARK, pushing the sector to a $250B market cap and $20T in annual volume.

Meanwhile, pending legislation (GENIUS Act) may soon bring regulatory clarity, potentially unlocking deeper institutional adoption. While BTC grabs headlines, the foundation for crypto’s next growth phase is quietly being laid.

ETH Volatility Surges as Market Eyes Fresh Highs

BTC realised vol remains steady near 32%, but ETH is stealing the spotlight, with realized vol jumping to 65% and front-end implieds spiking nearly 20 points. Both BTC and ETH broke below implied ranges last week only to reverse sharply higher. ETH now leads the upside push. Short gamma positions in ETH got squeezed, while headline carry stays positive for both. Volatility feels unstable here — exactly the type of backdrop that can fuel further breakout moves.

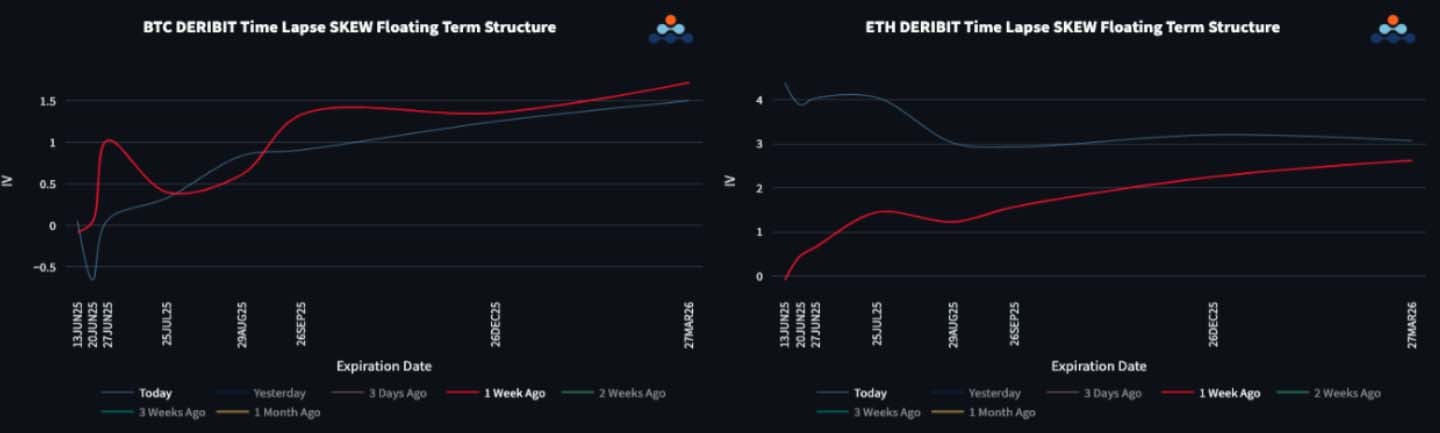

ETH Skew Signals Growing Upside Appetite

BTC skew held steady, with mild put premium in the front and a small call premium further out. ETH, however, saw an aggressive flip into call premium, with front-end skew reaching as high as 7 vols before easing to 4 vols. Out-the-curve, call skew remains elevated at 3 vol from August. Strong upside call buying in ETH continues to push skew higher, while BTC lags below 110K. The market is starting to price in asymmetric upside risk in ETH.

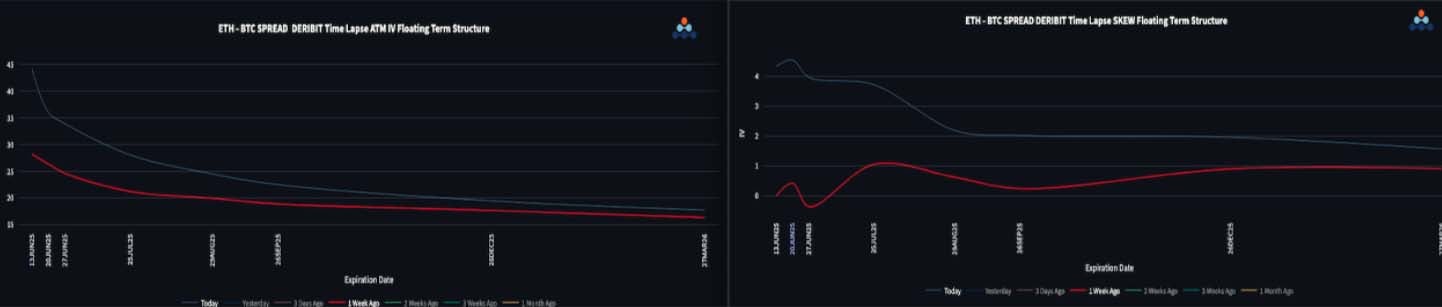

ETH/BTC Setting Up for Potential Breakout

ETH/BTC held key support and is now grinding toward resistance at 0.026. Options traders are heavily pricing in upside: front-end vol spreads exploded to 40 vols, with back-end spreads still elevated near 20. The entire skew curve shows a strong bias toward ETH calls — the most pronounced it’s been in months. The options market is clearly positioning for a potential ETH breakout on the cross.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)