BTC Breaks $66K Resistance

Bitcoin has surged past $66K, currently trading at $68K, following more than $100 million in BTC and ETH short liquidations. With Mt. Gox extending repayments to 2025 and October historically favouring crypto, the momentum continues. The U.S. election is just three weeks away, with Polymarket odds shifting toward Donald Trump-mirroring BTC’s bullish patterns seen in 2016 and 2020. Digital assets saw inflows of $419 million, heavily influenced by political shifts rather than monetary policy.

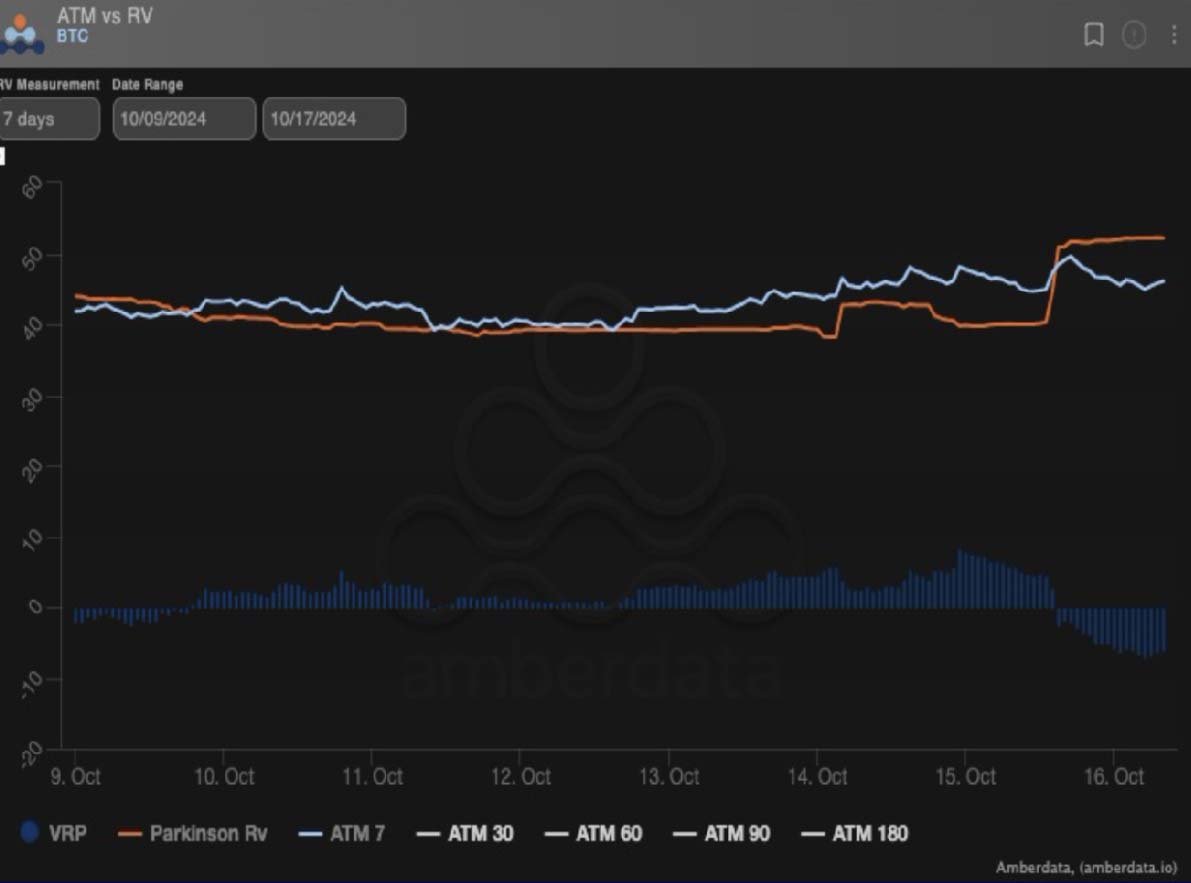

Bid in Volatility Returns

BTC realized volatility climbed to 52, ETH to 60, while implied vol lagged. Negative carry persists in both assets. Upward moves have strained short gamma players, driving vol demand. Trump’s rising odds and ‘Uptober’ seasonality have fuelled crypto strength, as Middle East risks appear to have eased.

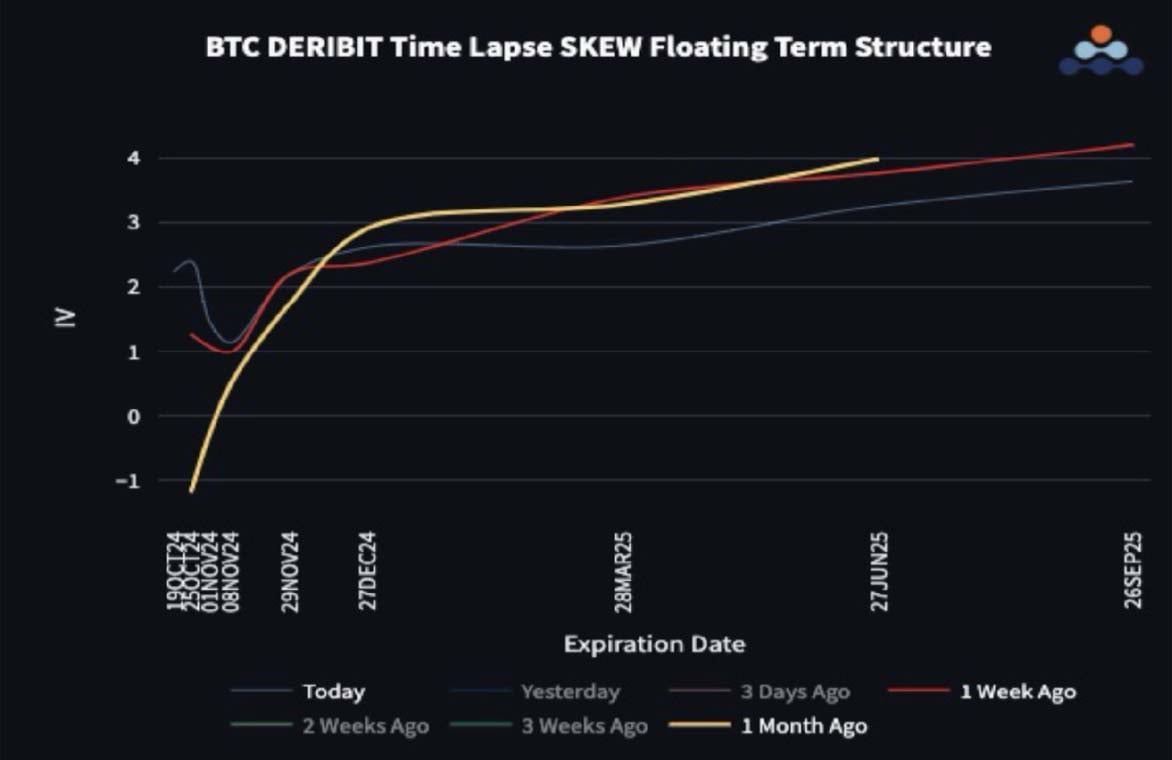

Skew Term Structures Flattening

Short-term call demand rises as traders chase the breakout, flattening skew term structures. Long- term calls soften as upside gets rolled into shorter maturities and closer strikes. The curve shows call skew, but premiums remain below highs. Downside convexity is still cheap-put ratio backspreads offer crash protection without delta risk.

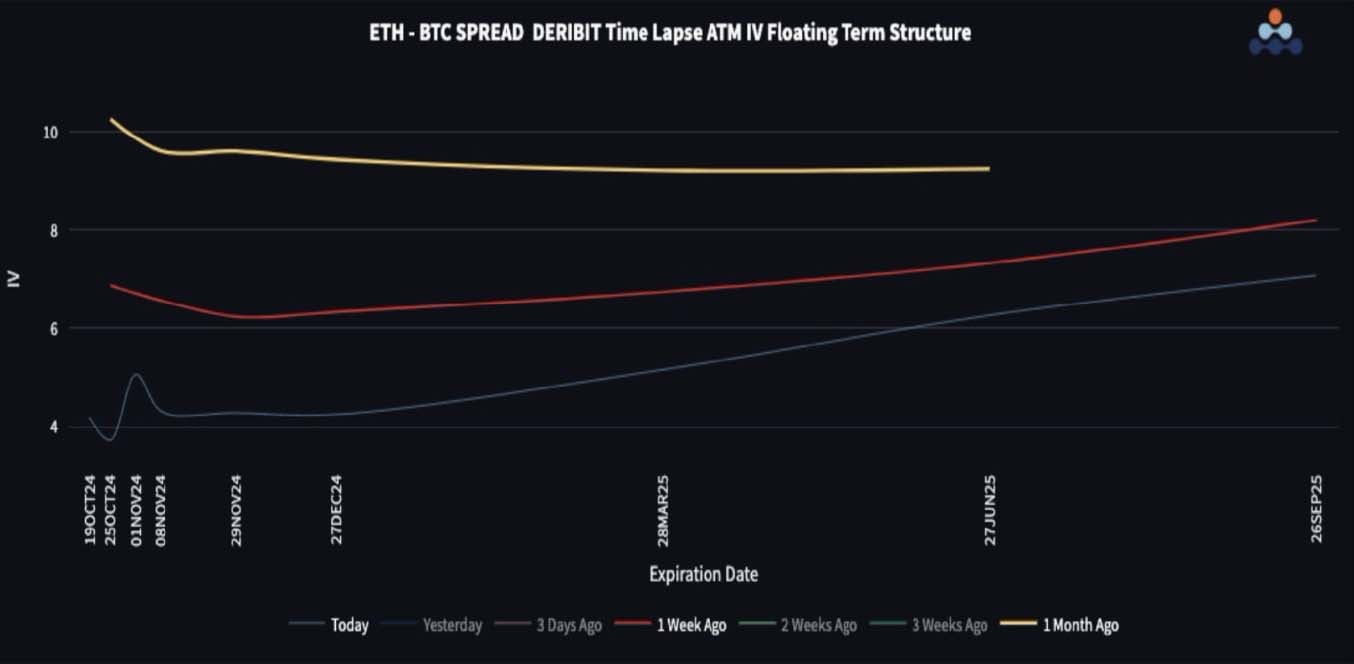

ETH/BTC Spot Back To The Lows

ETH/BTC holds lows without breaking lower, but the chart remains unconvincing. ETH volatility drops compared to BTC, closing the vol spread to 4 points in the front end. We see value in covering ETH vol shorts at these levels, as the downside break in ETH/BTC remains a risk that could see ETH vol spike again.

Option Flows

BTC options volume dipped 15% to $7.4B, with calls favored 63/37. October 65K and 70K strikes saw strong buying, while December 80K calls were paired with higher-strike sales. ETH volumes dropped 30% to $1.35B, with a 60/40 call bias, focusing mainly on short-dated options, but no large trades occurred as BTC dominated interest.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)