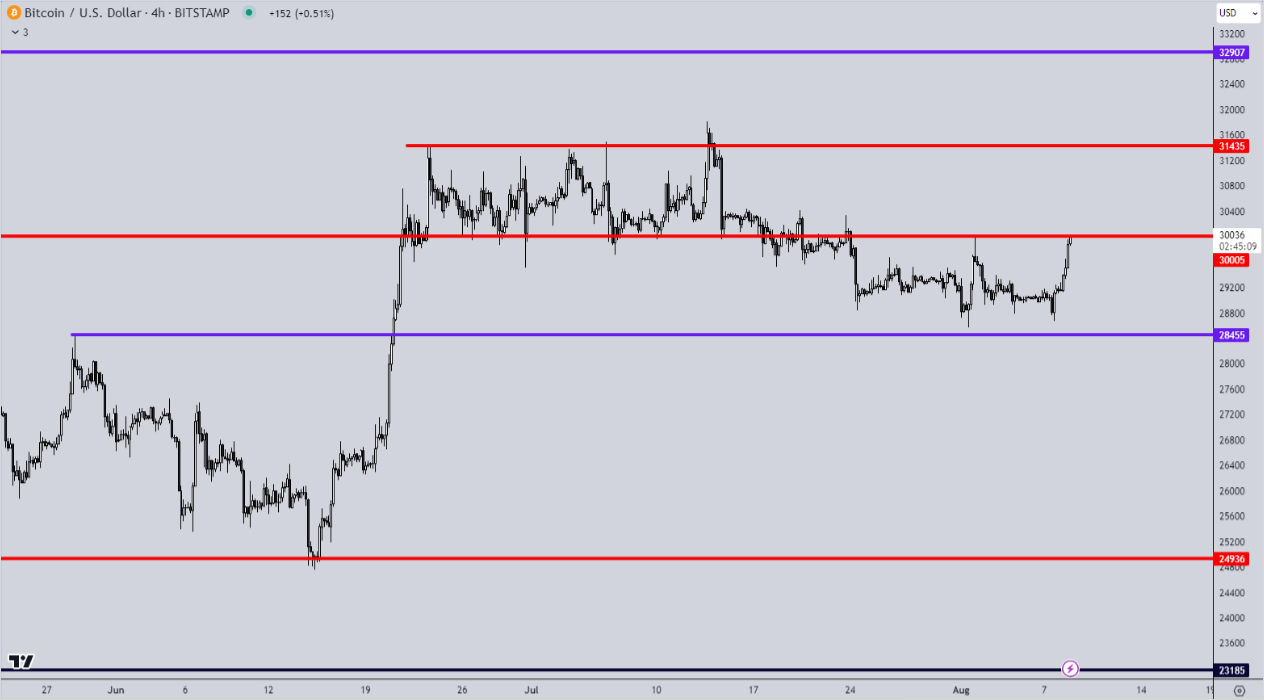

Retest Of 30k Resistance Amidst Lack Of Catalysts

After going through a constrained range, BTC is having another go at the 30k resistance level, leaving behind the lack of momentum to thrust it into the spotlight once again. Similarly, Ethereum is also exhibiting a touch more animation, recovering its mojo after being recently embroiled in DeFi- related matters, particularly with the Curve exploit.

It remains to be seen whether or not the current rally, which may have something to do with the launch of Paypal’s new stablecoin on the Ethereum main net (PYUSD) will last. The subdued capital influx we’ve seen in crypto over recent months has led to decreasing trading volumes, which is really what’s required to enhance the value of these assets in a more sustainable fashion. Failure to attract fresh inflows, ideally from big money institutions, will take us back into the ‘chop and bleed’ we’ve been used to in recent months.

Events to keep under one’s radar for potential catalysts include Bitcoin ETF decisions, the ongoing legal scuffle involving Coinbase, international regulatory progress beyond American shores, and shifts in monetary policy in H2 2023. On the flip side, the emergence of CBDCs demands scrutiny of possible regulatory actions against Tether, and the wider consequences of any DoJ measures against Binance. One should also be vigilant about governmental sales of Bitcoin.

From a fundamental point, the July payroll report took centre stage last week, presenting an increase of 187,000 jobs, falling short of the forecasted 200,000, and with prior months being revised downward. This sort of recalibration may hint at turning tides if a recession is lurking in the wings.

This week, our attention will be directed at the US Consumer Price Index (CPI) on Thursday, and the Producer Price Index (PPI) come Friday. These figures will be most telling, should they indicate a dent in the disinflation narrative, thus corroborating the recent surge in yields as merited. If not, we may see the dollar quickly retreat and propel risk assets and crypto higher.

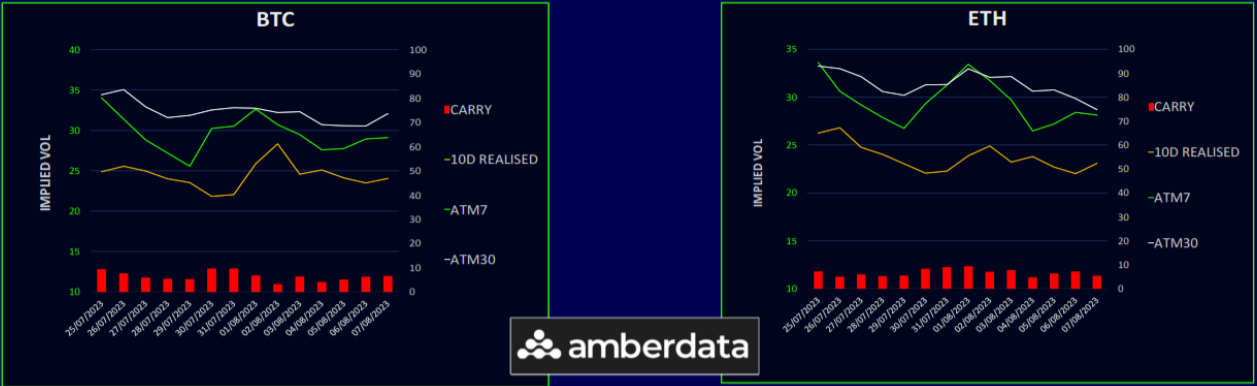

Implied Volatility Driven By The Back-End

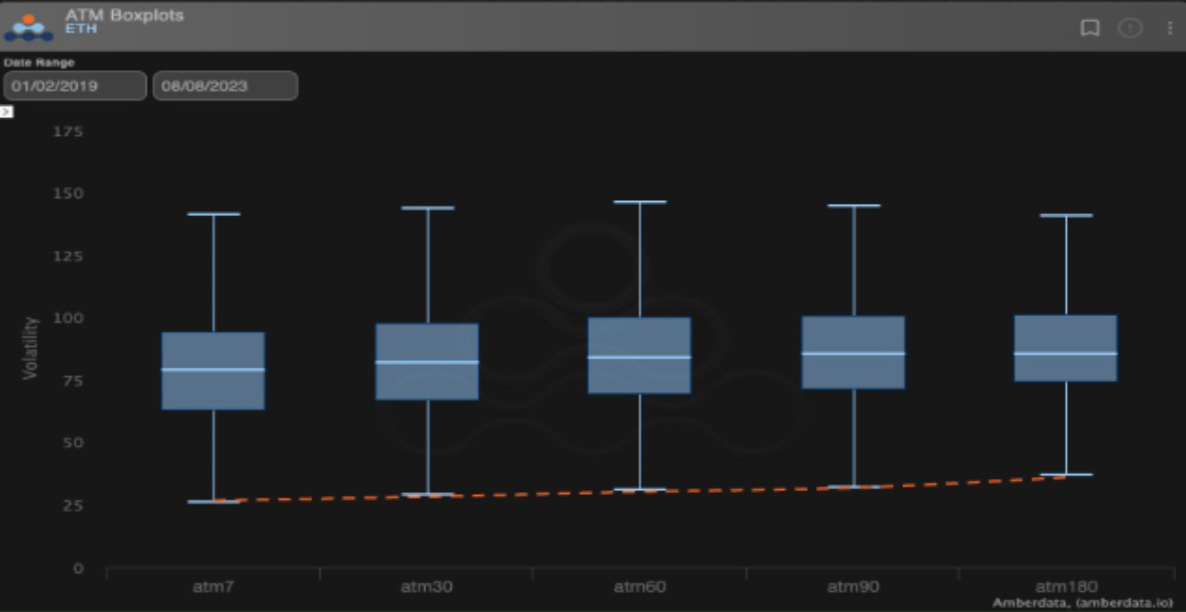

Crypto realised volatility seems to have found its footing, steadying in the low-20s. Both 29k BTC and 1800 ETH have been stubbornly sticky levels, especially in the absence of notable market drivers. Although we saw a mini-spike yesterday to retest 30k, it seems to have been rejected for now.

While forecasted volatilities (implied vols) continue their decline, it’s the long-term predictions that seem to be the primary drivers now. This is likely because those selling volatility (gamma sellers) are growing hesitant to offload at such historically low implied vol levels, especially with significant economic data like the US Consumer Price Index (CPI) on the horizon for this week.

There’s still a positive carry in volatility, albeit at a reduced magnitude of about 5 vols. This reduction can be attributed to the softening of the implied volatilities since last week.

It’s worth noting that the recent uptick in the VIX hasn’t been mirrored in cryptocurrency volatility. This underscores the ongoing divergence we’re witnessing from traditional finance (tradFi).

Term Structure Steeper As Vol Collapses

The term structure for BTC is moving downwards, most prominently observed in the mid-range of the curve, particularly between September and October.

Given the steepness of the term structure, the long-end volatility can’t avoid being sold off if volatilities decrease. This is primarily because those trading volatility (vol sellers) are keener on selling VEGA rather than GAMMA.

Notably, these longer-term shifts are happening even though there remains a strong demand on the upside for BTC.

ETH’s term structure has seen a significant reduction, with the period between December ’23 and March ’24 suffering the most, attributed to VEGA selling activity.

The front-end segment hasn’t performed much better, trading below the 30% mark.

Long-term volatility is making historic lows, and there’s an apparent lack of liquidity from buyers. This gives us the impression of an overshoot beyond what is fair value. These levels are less a function of the true value of long-term volatility, but rather a function of lack of appetite to warehouse VEGA inventory from liquidity providers who have been hurt by the large declines this year.

We have seen similar dynamics in traditional markets over the years where the long term vol supply becomes overwhelming and the moves in volatility accelerate to the downside.

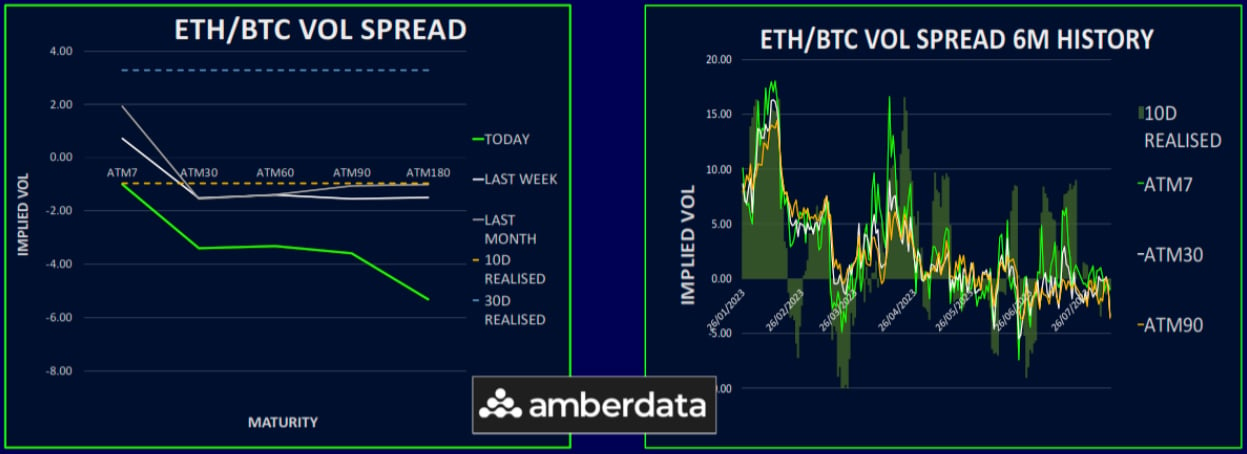

Long-Term Relative Value At Unprecedented Levels

The volatility spread between ETH and BTC has seen a sharp contraction, especially in the longer- term maturities. This has been influenced by divergent flows, and the ETH volatility market has faced challenges in accommodating the selling activity.

In the long term, ETH’s volatility is currently trading 5 vols beneath BTC. This suggests the market anticipates BTC will largely fuel any bullish activity in the upcoming 6-9 months. Such a widespread, particularly in the long-end, is truly out of the ordinary.

Those looking for value might consider this an opportune moment to invest in long-term ETH volatility, especially given the ongoing bias towards put options, a tendency not mirrored in BTC.

It’s challenging for us to envision a situation where BTC surpasses the 40k mark by year’s end without ETH also marking a significant upward adjustment. We believe this volatility gap is more a result of limited liquidity than a genuine reflection of the underlying value.

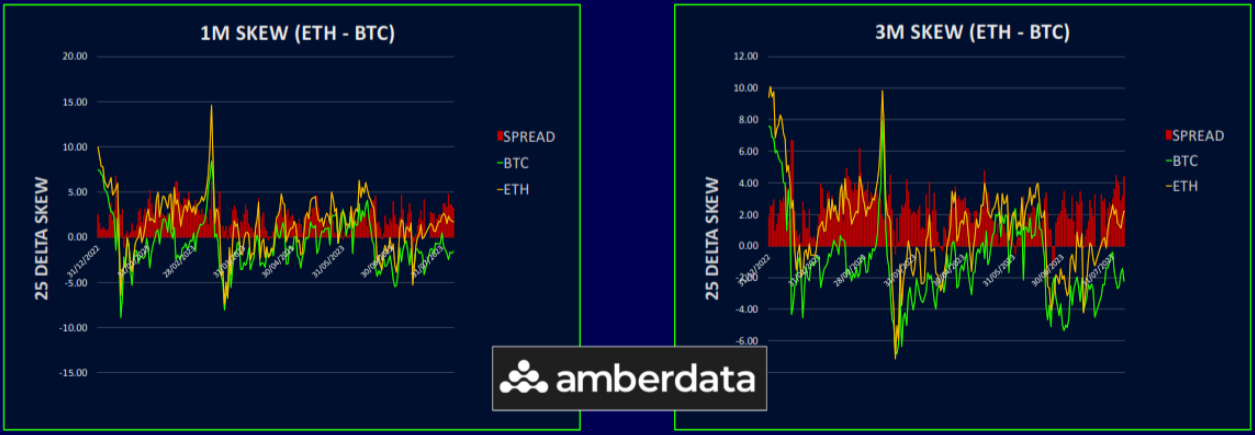

BTC Skew Back To Call Premium Across The Curve

BTC’s skew has gradually adjusted towards a steady call premium across the curve. For durations ranging from 1-week to 3 months, there’s about a 2-vol preference for calls, while the longer-term projections are pointing towards a 4-vol premium for upside.

On the other hand, ETH’s skew remains balanced for the 1-week range. Yet, for longer durations, it exhibits a 2-vol preference for puts. This is mainly attributed to a robust sell-off of calls in the long end, which has dampened the optimism for ETH’s upside.

The pronounced skew disparity between BTC and ETH highlights a much firmer confidence in BTC’s prospects. However, it’s worth noting that this hasn’t yet translated into ETH significantly lagging in its actual market value. While there have been murmurs of concern surrounding the CRV exploit and its ramifications on De-fi, ETH has resiliently maintained its footing, without breaching pivotal levels.

Option Flows And Dealer Gamma Positioning

Last week, trading volumes in BTC options experienced a modest uptick, predominantly driven by robust buying of long-dated calls. Notably, considerable trades were observed for October ’23, December ’23, and June ’24, each in the 1-1.5k size range.

On the ETH front, option volumes surged by approximately 30%, largely attributable to a resurgence in call selling. A particularly large volume of 29th September/29th December call calendar sales was spotted.

As for BTC dealers, their gamma positioning hovered remarkably close to neutral. However, it veered slightly negative this week, chiefly due to purchases at the 30k strike level for 11th August. To put it succinctly, dealers’ books are largely balanced at present.

Contrastingly, ETH’s gamma positioning retains its positive stance. This is due the ongoing VEGA sales, particularly from sizeable entities who continue to sell calendars, adjusting their exposure. It’s worth noting that the market would need to witness substantial movement to induce a significant deviation in the dealers’ gamma profile from its current state.

Strategy Compass: Where Does The Opportunity Lie?

Calls, calls, calls.

We see value in owning short dated BTC calls to play some upside on CPI this week, but the real long-term value is in Dec23-Jun24 ETH calls. Crypto mining stocks have also had a pullback such as MARA and owning some upside there also looks reasonable to us. Take your pick, but to us it’s all about the calls right now.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)