BTC Nears Record Highs as Risk Sentiment Improves

Bitcoin climbed above $122K over the weekend, erasing last week’s drop and moving closer to record highs as risk appetite improved globally. The rally coincided with equity gains, and Tuesday’s U.S. CPI data failed to dent sentiment. Headline inflation remains contained, though persistent services inflation may keep the Fed cautious on rate cuts.

Ethereum continues to outperform after gaining 50% in July and another 30% in August, suggesting growing institutional interest beyond BTC. However, overall crypto growth is uneven. Token-specific catalysts—such as Lido’s buyback plan, Coinbase’s Base-Aerodrome integration, and Chainlink’s revenue-linked tokenomics—have driven sharp moves, mostly from capital rotation rather than new inflows.

Institutions bought over $7.8B in crypto for corporate treasuries in July, but activity has slowed in August. Spot BTC ETFs saw $1.36B in outflows last week, with ETH ETFs also seeing redemptions. A notable regulatory shift came as the SEC signaled certain liquid staking programs may avoid securities status, opening doors for ETF inclusion.

BTC’s resilience despite whale selling supports a long-term bullish view, but near-term direction hinges on macro data.

Volatility Steady, BTC Holds Ranges While ETH Breaks Higher

Realized volatility is steady—BTC near 30, ETH near 60;

- Front-end BTC vol fell 2 points; ETH firmed by 2.

- Carry remains slightly positive but is narrowing.

- BTC’s implied ranges have held most days, while ETH breaks higher regularly.

- Gamma selling remains more comfortable in BTC.

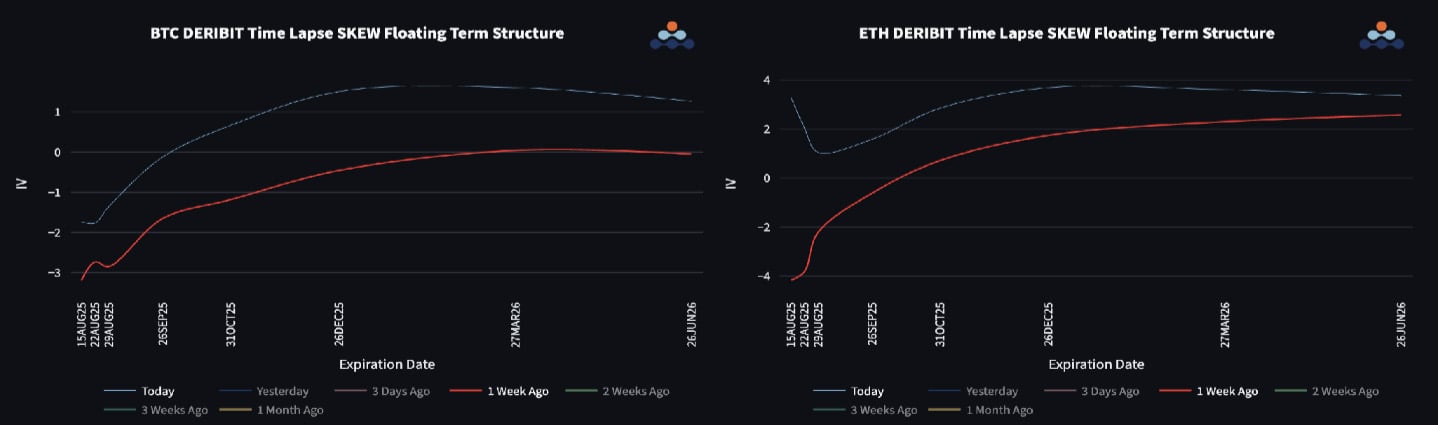

Options Skew Highlights Stronger Bullish Bias in ETH

So far we are seeing moves towards a higher price on ETH;

- BTC’s skew curve is shifting higher in parallel with the spot rebound. The front end still shows a slight put premium, turning neutral in September and peaking near 1.5 vols of call premium in Dec 2025–Mar 2026.

- ETH’s curve holds a consistent call premium as upside momentum resumes, with the long end peaking at 4 vols into Dec 2025.

- The contrast is clear: options markets are more bullish on ETH after recent price action.

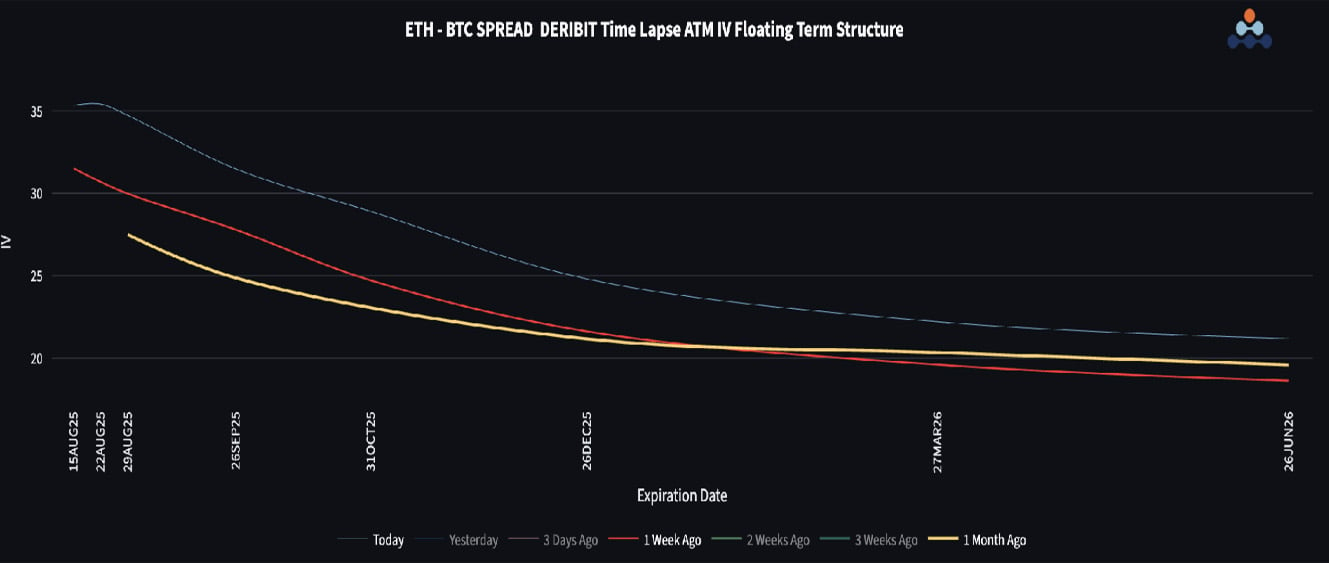

ETH/BTC Rally Tests Key Resistance with Vol Spread Rising

ETH/BTC has gained 25% in the past 10 days, nearing long-term downtrend resistance at 0.039;

- Front-end vol spread rebounded to 35 as ETH’s realized vol stays elevated.

- Back-end vol spread is also rising as call spreads roll higher into Dec 2025.

- I exited my short ETH/long BTC vega spread, as ETH may have more upside.

- RV skew curve shows a bullish bias toward ETH across all maturities.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)