U.S. Downgrade vs. Bitcoin’s Confidence Game

Moody’s just joined the other two major agencies in downgrading U.S. debt. Once a market-shaking event—now barely a ripple.

Stocks held firm. Bitcoin? It rallied above $107K, supported by ETF inflows and Metaplanet’s $104M buy-in. Even after a short-lived dip in Asia, BTC snapped back by Monday’s close.

This isn’t about panic—it’s about confidence. Bitcoin tends to shine not when bombs drop, but when trust in governments and fiat systems starts to crack. The downgrade is another sign of that erosion.

Meanwhile, institutions are doubling down. Coinbase joins the S&P 500. Public companies are adding BTC to balance sheets—not just for returns, but as a strategic signal.

Bitcoin isn’t just a hedge anymore. It’s becoming the alternative when belief in the system fades.

Crypto Vols: Calm Before the Storm?

BTC realized vol is steady at 37. ETH dropped 10 points to 81—but remains elevated.

Front-end vols were flat in BTC and slightly higher in ETH. Carry flipped positive for BTC (+5 vols), but ETH still drags at -8 vols.

OHLC charts show compression—BTC is coiling, while ETH is still nudging boundaries.

The market is quiet… for now.

Vols are low, ranges are tight, and traders are waiting. When the next big catalyst hits, expect a sharp vol reaction—especially in BTC.

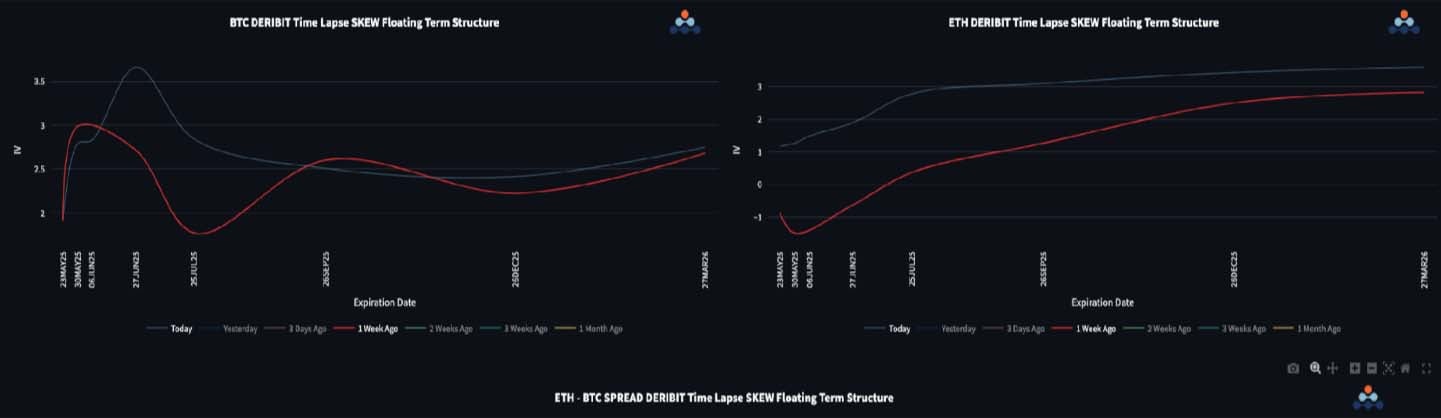

Skew Signals: Bulls Subtly Take Control

Call skews are lifting as markets stay firm.

BTC’s curve shows persistent bullish pressure, with call premiums above 2.5 vols across most maturities—peaking at 3.5 vols in late June.

ETH’s skew curve has flipped from puts to calls. It starts flat, then rises steadily to 3.5 vols at the back end. Strategic call spread buying is muting extremes, but sentiment is clear: upside is back in play.

Buyers are showing their hand—and it’s tilted to the upside.

Relative Value ETH/BTC: Downtrend Intact, But Skew Points to Reversal Bets

ETH/BTC sits around 0.024, still stuck in its downtrend since June 2024:

- Front-end vol spread remains elevated (~30 vols), with realized spread even wider at 44.

- Back-end vol spread is climbing—sellers prefer BTC’s stability.

- Skew favors ETH puts in the short term, but by July, upside bets are showing up as call premiums tick higher.

ETH hasn’t broken out—but positioning suggests some are quietly betting on catch-up.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

AUTHOR(S)