Bitcoin Brushes Off Geopolitical Panic, But Option Traders Stay Alert

Despite rising tensions in the Middle East, Bitcoin is holding up remarkably well.

Following Israel’s strike on Iranian nuclear sites, BTC briefly dipped to $103K—but the selloff was short. It quickly bounced back and is now at $105k, even as equities and oil reacted more violently.

Gold and Treasuries saw safe-haven demand, but Bitcoin’s ability to stay above $100K shows increasing institutional confidence. Spot BTC ETFs have now seen seven straight weeks of inflows. Firms like Metaplanet and Strategy are still buying dips.

That said, risks remain. There’s potential disruption in oil transit through the Strait of Hormuz, elevated crypto options gamma, and over $1B in long liquidations recently. US involvement in the conflict is also a risk, hinted at in Trump’s latest remarks.

BTC and ETH are slightly lower again but still holding key support levels.

In short: markets are on edge, but Bitcoin is proving it may be more than just a risk asset with episodes of acting like a modern macro hedge.

Volatility Stable, But Undercurrents Point to Fragile Market Mood

Volatility remains muted—so far.

BTC realized volatility is steady near 30%, while ETH sits higher around 65%. BTC is drifting, but ETH volatility is picking up slightly.

Both assets offer a positive carry of 7–9 vol points. ETH is breaching implied moves more often than BTC, which has stayed more contained.

The broader market feels tense. Near-term downside risk remains. While geopolitical shocks typically fade, this time markets haven’t corrected enough to relax.

I’ve been re-hedging in response with July risk reversals.

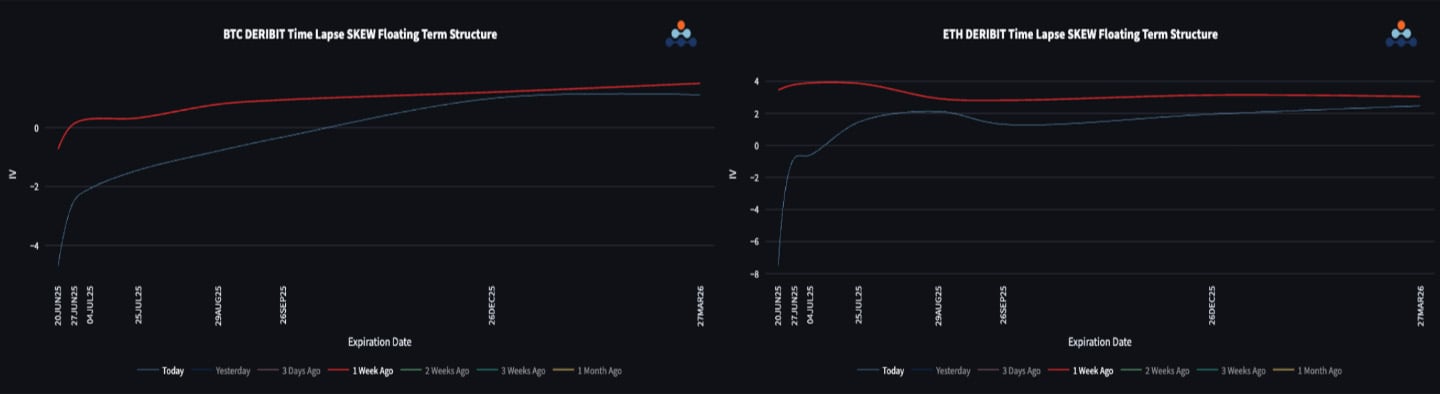

Short-Dated Puts in Demand as Skew Steepens Sharply

Options markets are flashing caution.

Short-dated BTC and ETH puts are in high demand, steepening the skew curve into contango. BTC front-end puts are now priced 4 vols below calls; ETH’s discount is even wider at 7 vols.

From September onward, BTC skew shows a shift to call premiums, pointing to nervous positioning.

Meanwhile, ETH returns to a call-skew in July—reflecting that most of the current demand is for very short-term downside protection due to high implied vol making option premiums more expensive.

ETH/BTC Spread Still Elevated

ETH/BTC hit resistance again and continues to consolidate.

ETH’s front-end vol trades 35 vols above BTC—still justified by higher realized volatility. The back end is stable near a 20 vol spread, which feels expensive but isn’t adjusting.

Relative vol skew now favors ETH puts at the front end, as ETH shows more downside beta amid war-driven jitters.

Interestingly, ETH skew for July still leans toward calls more than BTC—suggesting that traders don’t see war risk as a lasting issue.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)