Bitcoin Trades Higher With Risk Assets

Bitcoin continues to hold above $80K, supported by steady buying interest despite a complex macro environment.

Trade tensions between the U.S. and China have eased temporarily, with tariffs now largely symbolic at 145% and 125%. A 90-day pause on new tariffs has brought short-term calm.

Meanwhile, U.S. Treasury yields have stabilized, equities have firmed, and the dollar is weakening – all signaling market expectations of future Fed rate cuts.

Despite sticky inflation, dovish Fed signals and signs of economic slowdown have reassured investors. There’s growing belief the Fed will step in if volatility returns.

Long-term Bitcoin holders are accumulating, suggesting they see current prices as good value.

Bitcoin’s next major move may depend on clearer Fed signals, more regulatory progress, or shifts in risk appetite. Until then, the price remains range-bound — with upside potential building.

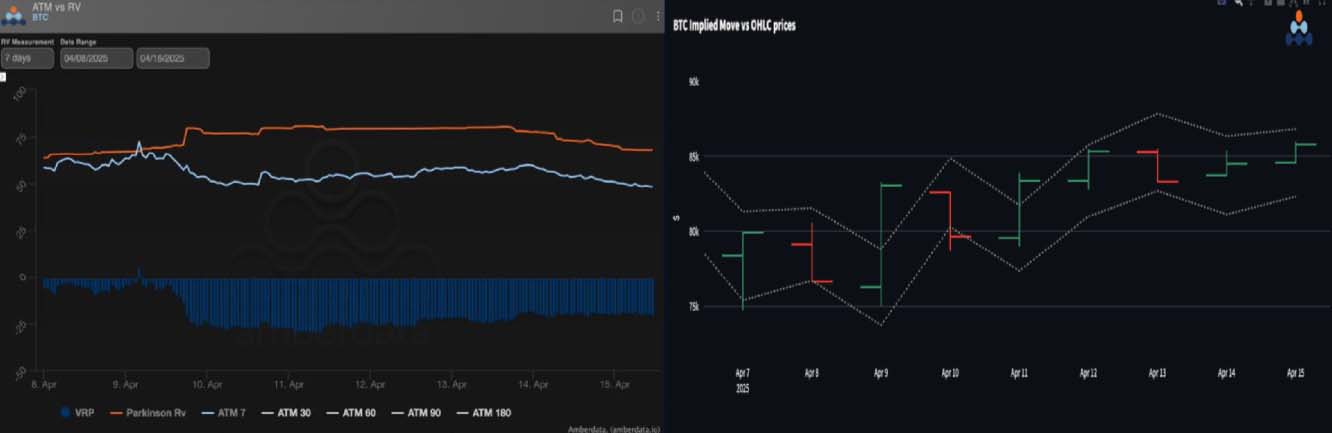

Front-End Vol Crushes

Realized volatility remains elevated after last week’s large market swings.

Implied weekly volatilities dropped sharply as price ranges tightened and markets consolidated.

Carry is deeply negative across assets, with implied volatility falling as markets stabilize.

Most price action stayed within expected ranges, as shown by the OHLC charts.

With the risk of renewed tariff headlines and implied volatility already low, selling gamma remains risky in this environment.

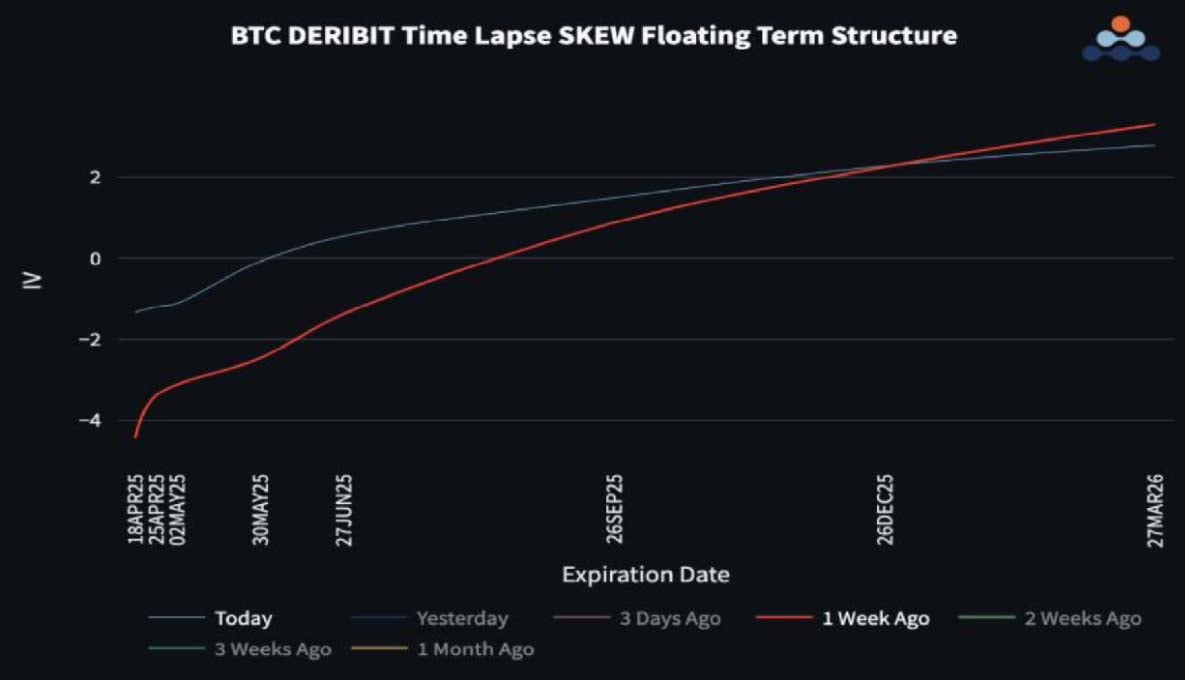

Skew Term Structure Flattens

Skew term structures flattened as crypto rallied alongside broader risk assets on the tariff pause.

Traders sold 75–78K puts and shifted toward 85–100K calls as Bitcoin broke higher.

Front-end skew now favours puts by about 3 vols, though this is far below levels seen near the $75K mark.

Further out, skew softened slightly for calls as traders preferred buying short-dated upside to position for a squeeze.

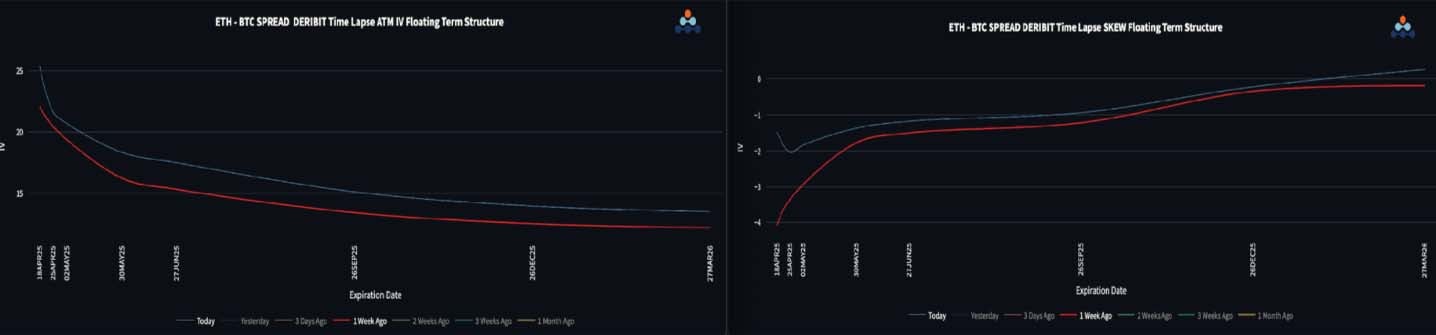

ETH/BTC Lacks A Bullish Catalyst

ETH/BTC remains below 0.02, lacking momentum without a clear catalyst.

The front-end vol spread remains wide at 25, and even longer-dated spreads are ticking higher as BTC vols drop more sharply.

Across the curve, ETH options show heavier put skew, with only the December 2025 expiry pricing in a small call premium. This setup likely persists unless ETH begins to outperform.

If a bullish narrative returns, using bullish risk reversals could offer attractive upside exposure.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)