BTC Surges on Unfounded ETF News

The Bitcoin price briefly surged from $27,000 to $30,000 on false reports of a spot ETF approval, as cited by CoinTelegraph, before stabilizing around $28,500.

This market response underscores the anticipation of a possible spot ETF, especially after the SEC refrained from opposing a court ruling permitting Grayscale’s BTC trust to transition to an ETF.

The swift 10% rise in Bitcoin’s value suggests a potentially robust market response upon legitimate spot ETF confirmation, whenever that is. However, the recent surge, wiping over $1 billion in open interest, indicates that build-up of short positions significantly influence these aggressive spikes. This squeezy price action is not the most healthy way to establish a bullish trend.

In summary, Bitcoin’s current positive trajectory highlights its appeal and optionality for future profitable returns (3-6 months out), pending actual spot ETF approval. Despite the unfounded catalyst, this temporary spike could reignite Bitcoin interest through Q4, as it maintains a strong stance well above recent lows. In the broader context, Bitcoin appears indifferent to macro or geopolitical influences, focusing solely on its own ETF-driven narrative. On the flip side, Ethereum continues to operate lethargically, overshadowed by Bitcoin’s performance.

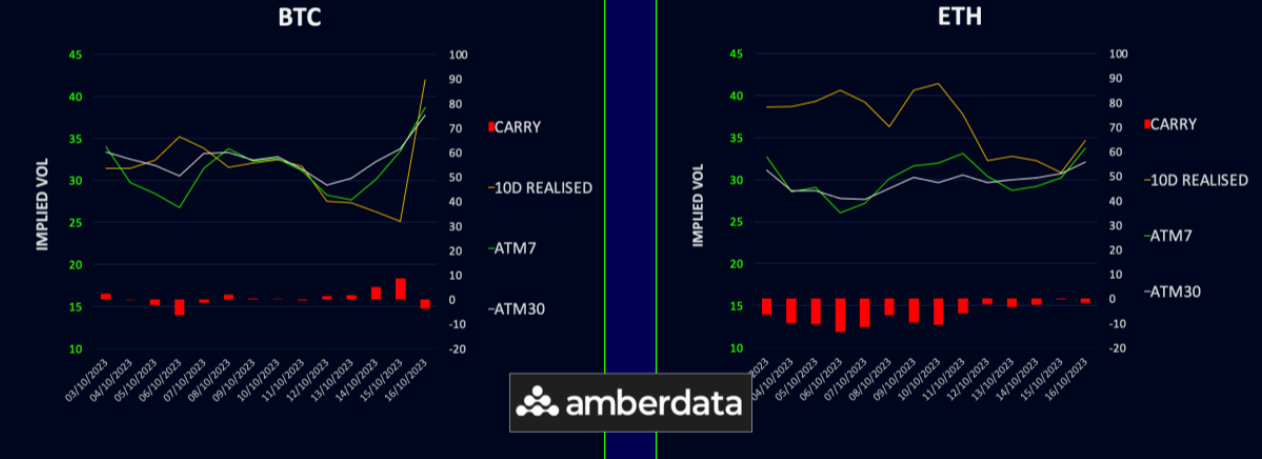

Realized Vol Revived by Fake ETF News

The cryptocurrency market remained stable throughout most of the previous week, with Bitcoin’s 10- day realized volatility decreasing to 25%. However, the tranquillity was disrupted when a false report about ETF approval triggered a swift 10% price increase within minutes. The news, initially posted on Coin Telegraph’s social media, was quickly debunked, leading to an immediate price correction. This sudden volatility propelled the realized volatility into the 40% range, though Ethereum experienced a lesser impact, with its volatility around 35%.

Following the abrupt price movements implied volatility rose, reflecting the spike in realized. However, it has since receded from its peak, as a mean-reversing dynamics emerge, and traders begin to secure profits from long call positions.

This event serves as a cautionary tale for those with short gamma exposure, underscoring the inherent risks of maintaining a short volatility position when market prices can shift dramatically based on unverified news. This instance might indicate a slower-than-usual compression in volatility, given the asset’s demonstrated susceptibility to sharp, news-driven fluctuations.

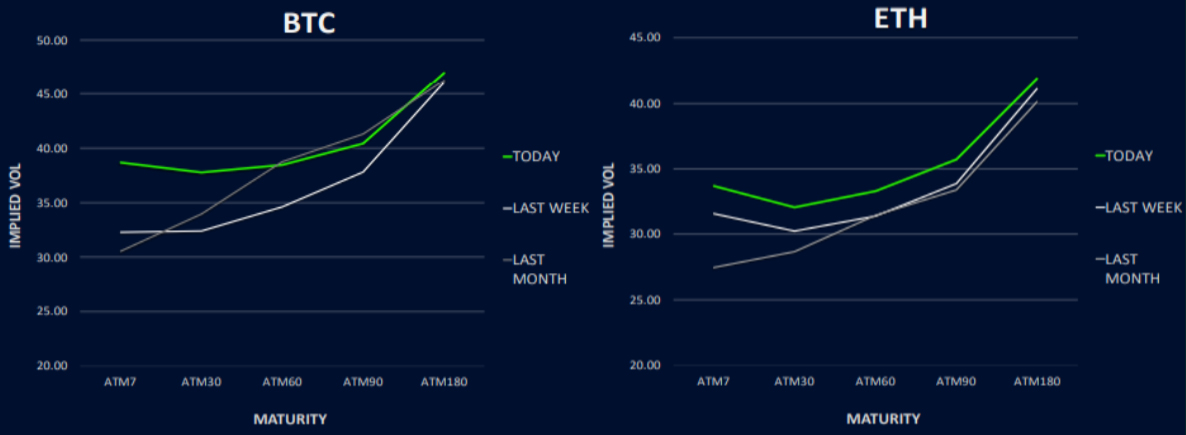

BTC Term Structure Catches a Bid

The Bitcoin term structure experienced a notable increase, especially in the short term, as prices surged based on misleading news. The most significant uptick occurred in the GAMMA buckets for October 2023, which saw an increase of 4 vols. From March 2024 forward, the changes were minimal, given the pre-existing steepness of the curve and no additional demand for VEGA.

Ethereum’s term structure is similarly shifting higher but less so. Immediate volatility increased in tandem with BTC, yet due to lower realized volatility, the appeal for GAMMA was comparatively subdued, with October 2023 rising by approximately 3 vols.

The longer-term expiries, specifically between June and September 2024, slightly softened, decreasing by roughly 0.5 vol.

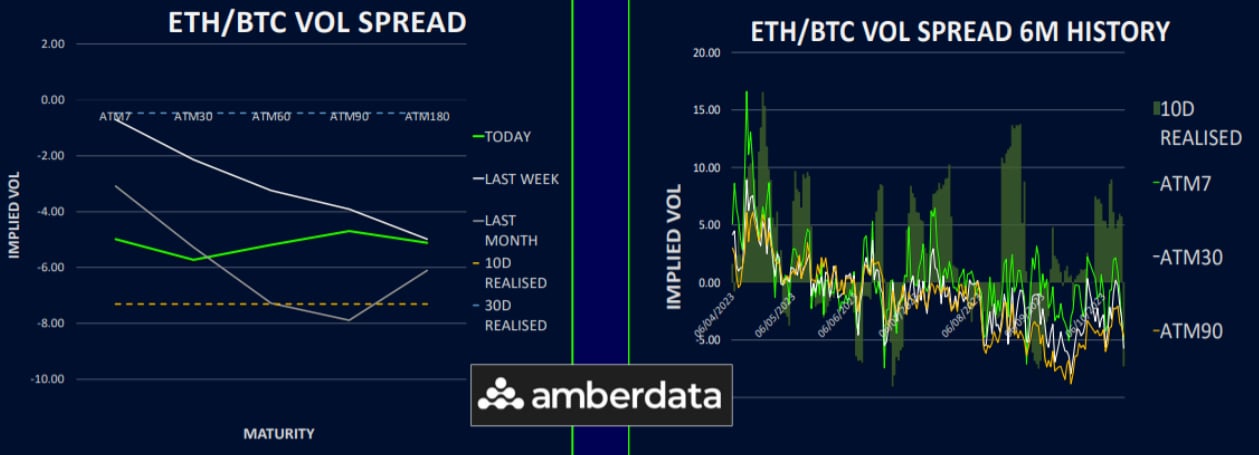

ETH/BTC Vol Spread: BTC Premium is Back

The volatility spread between ETH and BTC has shifted back in favour of a BTC premium across all durations, as Bitcoin’s realized volatility overtakes Ethereum’s by approximately 7 vols over a 10-day period.

The current implied spread stands at around -5 for all expiry points, validating the options market’s initial stance, that Ethereum’s superior realized performance would be short-lived.

Regarding the ETH/BTC exchange rate, it is nearing its June 2022 support levels. Interestingly, this movement isn’t accompanied by a significant downturn in Ethereum’s spot price. Should Ethereum fall below the 1500 mark, there’s an expectation of increased realized volatility. However, if the broader cryptocurrency market maintains its momentum, Ethereum’s volatility is likely to remain subdued due to existing market positions and call selling flows.

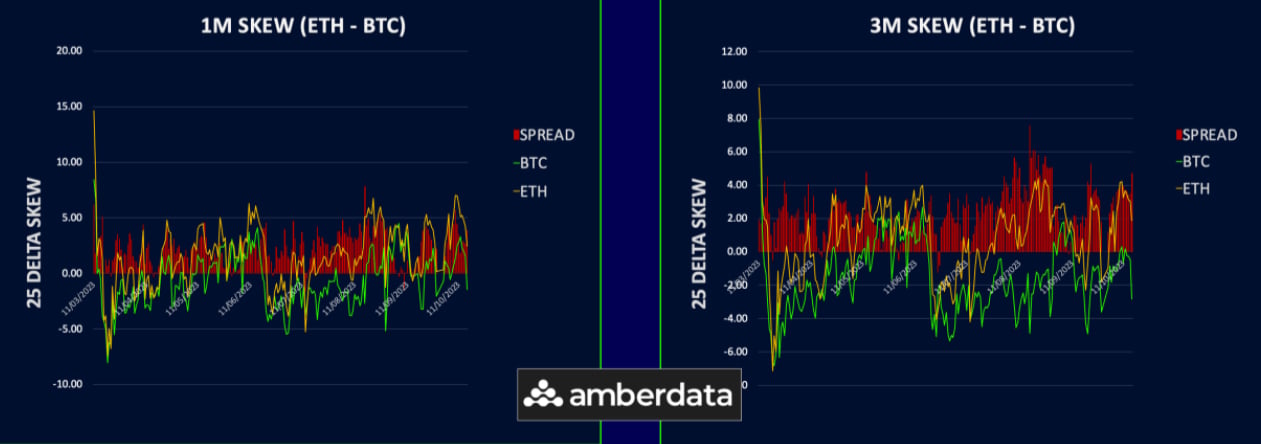

BTC Skew Back into Call Premium Across the Curve

Skew is on the rise again, following a sharp rally that particularly invigorated the call side of Bitcoin. The entire term structure for BTC skew has reverted to favouring calls, exhibiting a 2 vol premium on the short end and escalating to roughly 8 vols for the more distant September 2024 expiry.

Ethereum, while also seeing a pivot towards calls, is experiencing a less pronounced shift. Short-term weeklies are showing a slight call premium. In contrast, the 1–3-month range favours puts by around 2 vols, transitioning back to a call premium in longer terms, almost matching BTC, with 7 vol call skew by September 2024.

A significant disparity in skew pricing between BTC and ETH is most apparent in the 1–3-month segment of the curve. This trend indicates market speculation that Bitcoin may see substantial relative gains, possibly due to anticipated ETF approval within this timeframe.

Option Flows And Dealer Gamma Positioning

Bitcoin trading volumes have decreased by approximately 10% over the past week. However, significant on-screen buying interest in December 2023 36k calls notably elevated upside implied volatilities. This activity drew in demand to buy December 2023 32k/37k call spreads and sell November 2023/December 2023 36k call calendars.

In contrast, Ethereum options saw a 40% volume increase this week, with calls experiencing substantial activity in both directions. The demand for December 2023 2000 calls positively impacted the call wing’s volatilities. The December 2023 1700 calls faced the expected selling pressure.

Regarding dealer gamma positioning in BTC, the past week has been relatively stable, with a temporary downturn as BTC dipped below 30k due to unfounded news. At present levels, the positioning seems more even, trending towards short beyond the 30k mark.

For ETH, dealer gamma is gradually returning to lower levels as some short positions for October 2023 begin to build on dealer portfolios. Should the cryptocurrency market rally and move beyond the significant November 2023 1650 and 1700 strikes, ETH’s gamma positioning is expected to become cleaner, potentially allowing spot ETH to have a stronger participation in a rally.

Strategy Compass: Where Does The Opportunity Lie?

We still like owning call or call spreads out in 2024 as it becomes increasingly apparent that the markets response to ETF approvals is not fully priced in and will likely bring more inflows into the space.

Crypto related stocks also look interesting as they have not been able to rally much from recent lows, making call spreads out to Jan24 look attractive in names like RIOT and MSTR.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)