BTC Testing All-Time High

BTC is experiencing strong momentum, breaking the $70,000 mark and signaling a potential new all- time high.

Key drivers:

Institutional Demand: Bitcoin ETFs saw nearly $1 billion in inflows for three weeks straight, reflecting significant institutional interest and increasing BTC dominance.

Political Influence: Trump’s appearance on Joe Rogan’s podcast boosted his odds on Polymarket, driving positive sentiment in the market.

Tether Concerns: Despite rumors of a U.S. government investigation, Tether’s stability quickly returned after a brief dip.

Geopolitical Tensions: Middle East conflicts have had minimal impact, as markets continue their upward trend.

Looking Ahead: The upcoming non-farm payroll data could hint at Fed actions, with a high likelihood of a 25 bps rate cut in November.

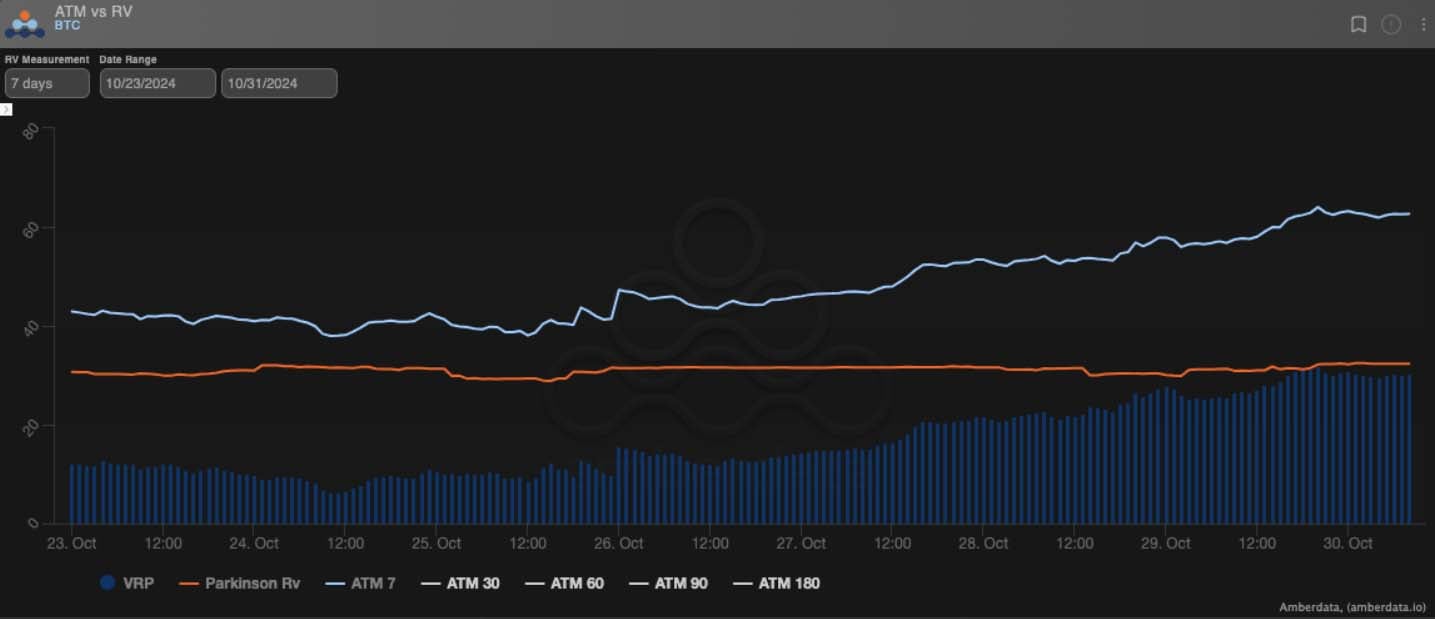

Front-End Implied Vol Pops Ahead Of Election

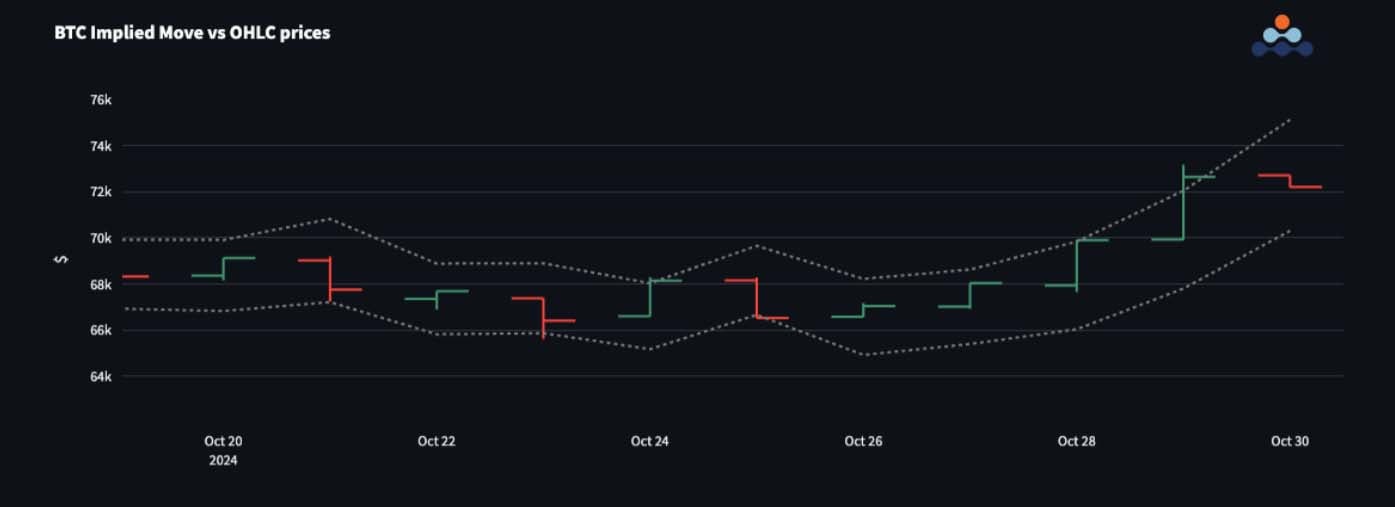

Crypto volatility remains steady, but front-end implied volatility surged in anticipation of the election, with an expected 7% move.

Positive carry of around 30 vol points suggests a post-election volatility reset.

Price Action: BTC has pushed upper implied bands, while ETH’s movement is more controlled.

Market Sentiment: Trump’s recent media appearances and endorsement from figures like Elon Musk have heightened crypto bullish anticipation both in BTC and meme coins like DOGE.

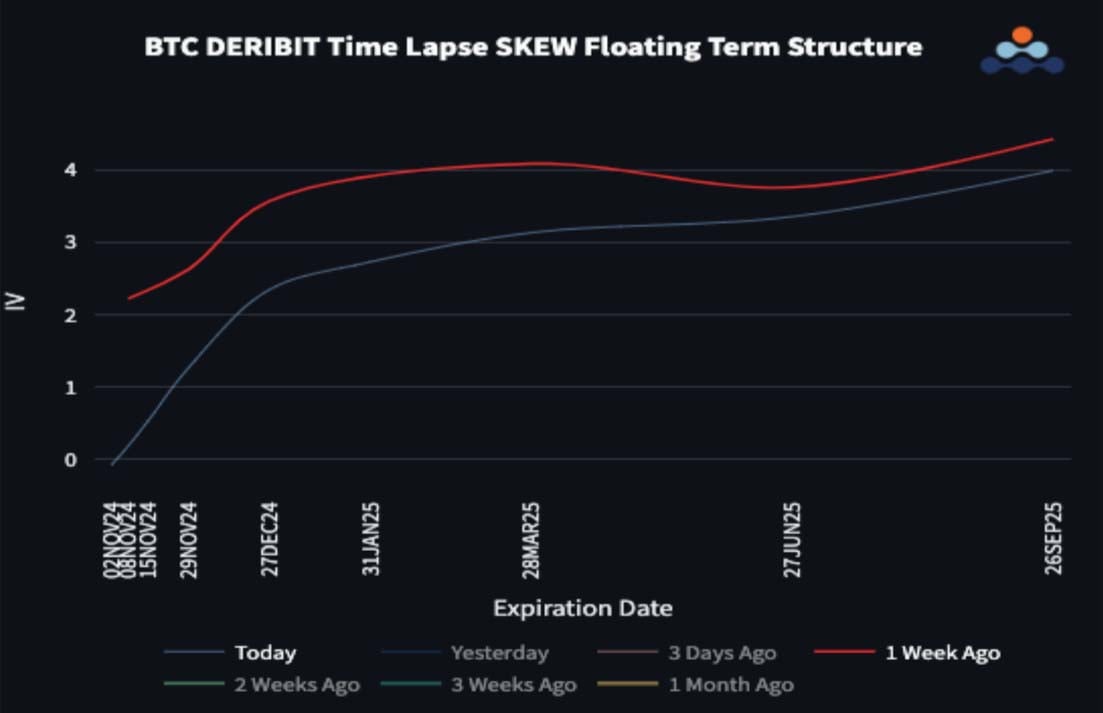

Skew Term Structure Losing Call Premium

Skew term structures have steepened, as front-end call skew reduces as the bullish outcome gets priced in.

Longer-term Call Skew: Remains steady, signaling a positive medium-term forecast.

ETF Inflows & Futures: Another $1 billion in BTC ETFs and liquidated shorts are driving the rally, with demand focused on spot rather than speculative calls.

No Signs of Catch-Up Play in ETH

ETC/BTC spot dropped further to 0.036, as BTC leads into the U.S. election.

ETH Volatility: ETH options lost ground in 2024 expires as BTC buyers pushed prices higher.

Election Wait-and-See: Favor BTC until the election outcome, as ETH lacks momentum.

Skew Term Structure: Reflects short-term ETH lag but slight long-term premium over BTC.

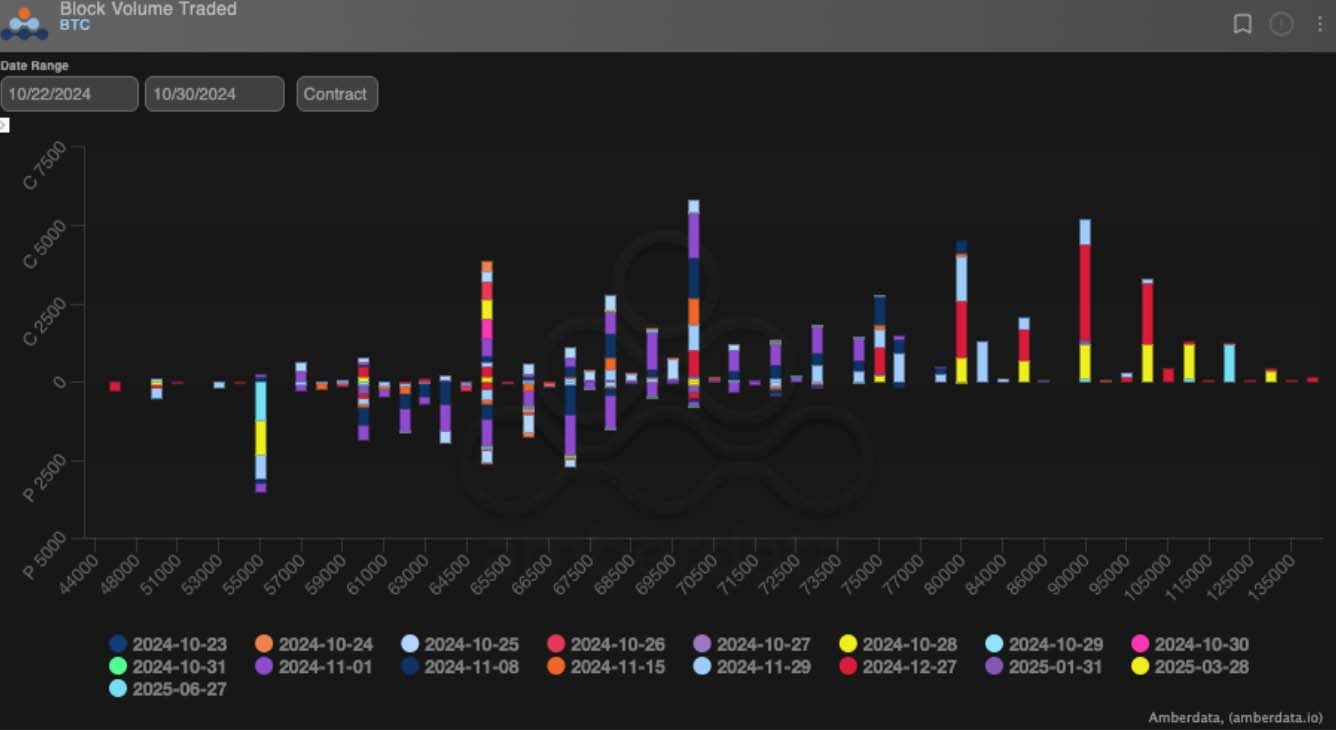

BTC & ETH Option Flows

BTC options volume dipped 10% to $10 billion, with a 67/37 call-to-put ratio. Short-dated calls (Nov) led bullish flows, while Mar25 and Jun25 bearish risk reversals hint at institutional hedging.

ETH volume rose 10% to $2 billion, split 64/36 for calls. Short-dated options saw demand, with 29Nov 2600 calls sold and active call buying for 01Nov and 08Nov in anticipation of election-driven moves.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)