Bitcoin On A Tear, Decouples From Stocks

Bitcoin rebounded strongly over Easter, peaking at $94k and reversing early-April losses.

This rally now mirrors the ongoing strength in gold, signalling renewed demand for hard assets amid rising geopolitical tensions and a weakening U.S. dollar.

With equities under renewed pressure, Bitcoin’s positioning as a safe haven and inflation hedge is regaining momentum-fuelling potential institutional inflows as capital exits the U.S.

Technically, BTC is consolidating above the key $89k resistance level, setting up a bullish structure that could pave the way toward $100k.

On the macro front, Fed Chair Jerome Powell reaffirmed a hawkish stance, prioritizing inflation control despite decelerating growth. Mounting concerns around the U.S.’s twin deficits and the high foreign ownership of Treasurys are raising fears of a confidence crisis in U.S. capital markets. Political pressure on Fed independence and expanding fiscal imbalances add to the risk.

These dynamics are strengthening Bitcoin’s case as an alternative store of value. The next few sessions will determine whether this breakout has staying power or is simply holiday-driven volatility.

So far equities are responding positively to the latest statements from the US Administration which softened language against both Powell and China.

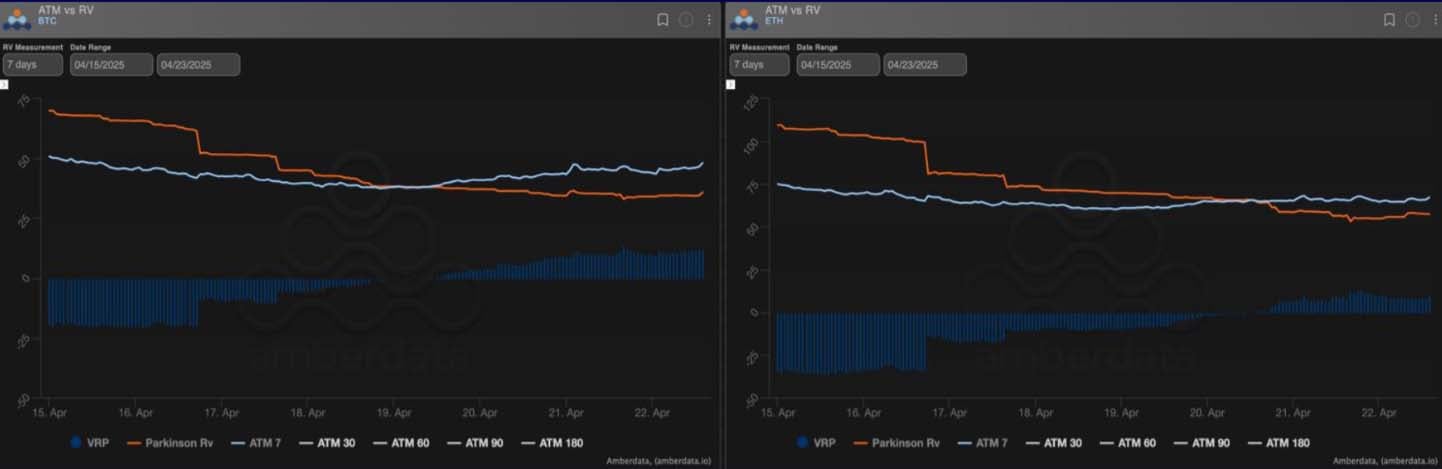

Realized Vol Cut In Half

Realized volatility fell sharply this week as prior large price swings rolled out of the calculation window. BTC’s realized vol is back near 35, while ETH sits around 55. Although, it has started to recover on the latest rally as BTC broke above 90k.

- Front-end weekly implied vols had been drifting lower but spiked today, gaining around 5 points.

- Positive carry has returned to about 10 vols, with implied volatility leading the decline.

- Implied ranges on OHLC charts were respected until today’s breakout.

- The technical breakout and BTC’s decoupling from broader risk assets suggest continued short-term strength.

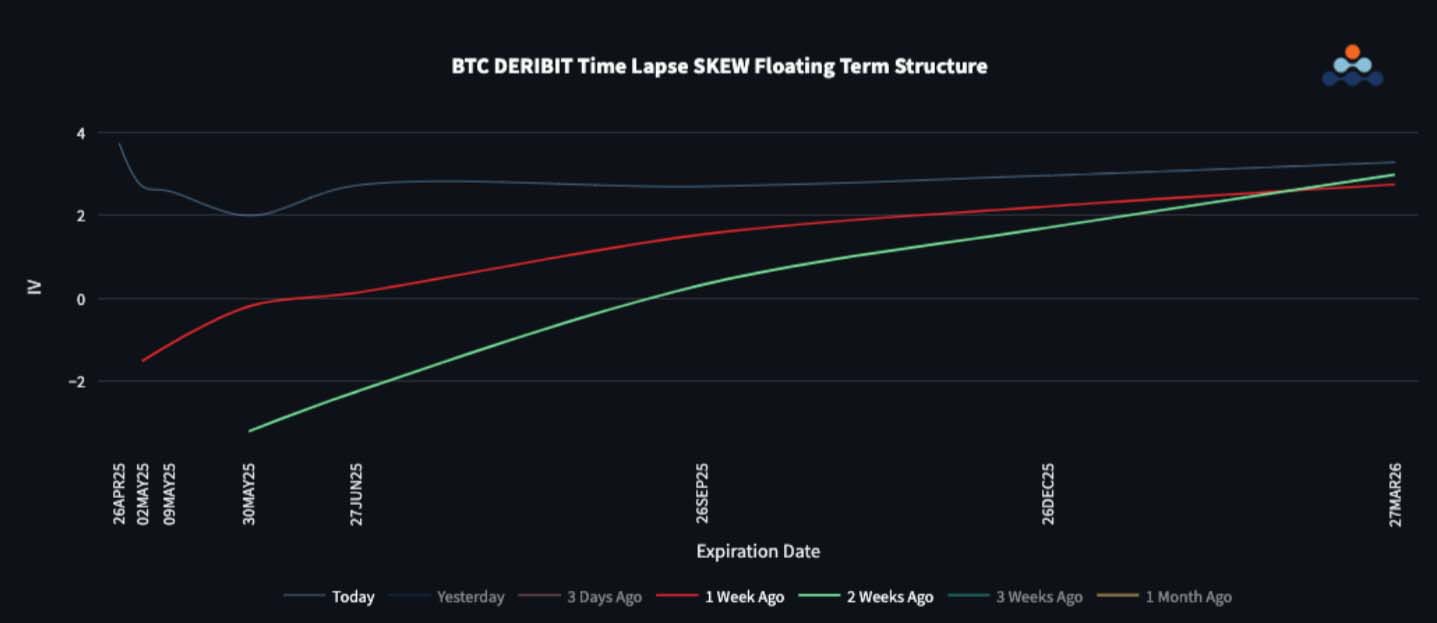

Skew Term Structure: Entire Curve Flips Back To Call Premium

BTC skew has flattened further, with the entire term structure flipping into a call premium.

- ETH’s curve also flattened, though a slight put premium remains from the 1-week to 2-month range.

- The short-term call demand likely reflects traders positioning for a gold-style rally as the U.S. dollar continues to weaken.

- While the back end holds a firm call premium, the focus remains on near-term expiries.

ETH/BTC Still In Heavy Downtrend

ETH/BTC remains in a steep downtrend, recently touching 0.018—a level last seen in 2020.

- Front-end vol spread remains elevated above 25, though the mid-curve has started to soften.

- Skew is favouring puts in ETH for May–June expiries, while BTC calls gained relative strength.

- Bullish risk reversals highlighted last week played out well, particularly in BTC.

- A sustained move above $90k in BTC could trigger spot-led volatility and further upside, as suggested by recent skew reversals.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)