Strong Rebound Along With Risk Assets

Crypto markets have stabilized after last week’s sharp declines, with BTC and ETH showing strong recoveries. Key resistance levels at $63k for BTC and $2.8k for ETH are in focus. Positive inflows suggest U.S. investors see value in accumulating BTC below $60k and ETH below $2.8k. The recent sharp drop cleared significant leverage, reducing the likelihood of further steep declines. Institutional investors are buying the dip, with 400,000 BTC ($23B) transferred to permanent holders in the last 30 days. The upcoming U.S. CPI report and geopolitical events are key to watch.

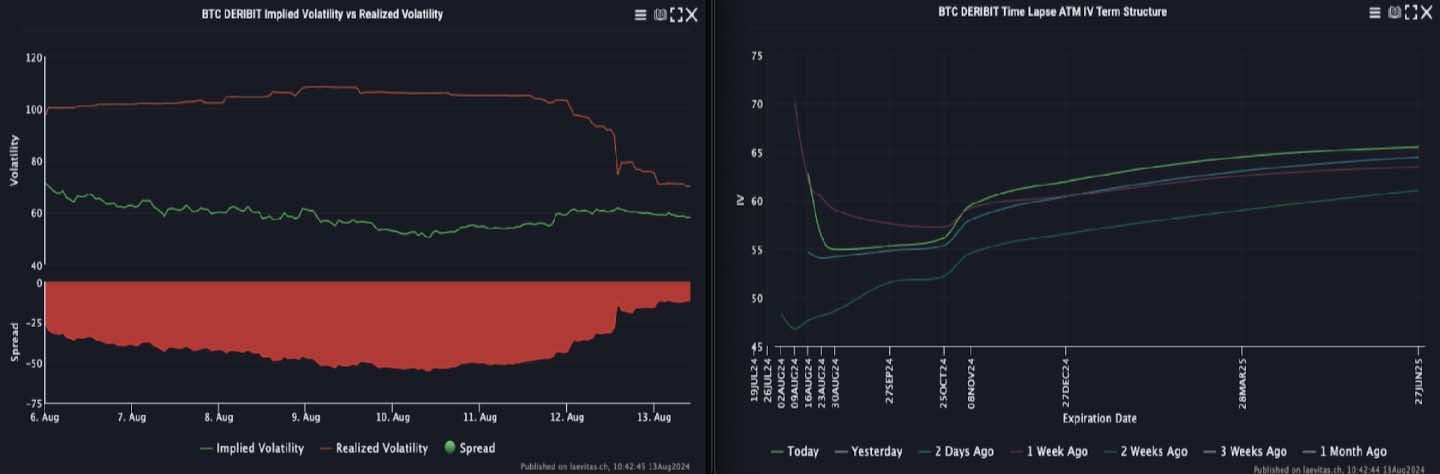

Realized Vol Converges With Implied

Crypto realized volatility has nearly aligned with implied volatility as major moves drop from the lookback period. Implied vol for BTC is mixed, with short-term vol firm due to geopolitical risks, 1 to 2 month vol better offered and longer-term vol capturing U.S. elections is in demand. ETH implied vol is slightly softer across the curve. Although carry is still negative, it’s less severe than last week. We expect front-end vols to drift lower post-CPI and once geopolitical tensions ease.

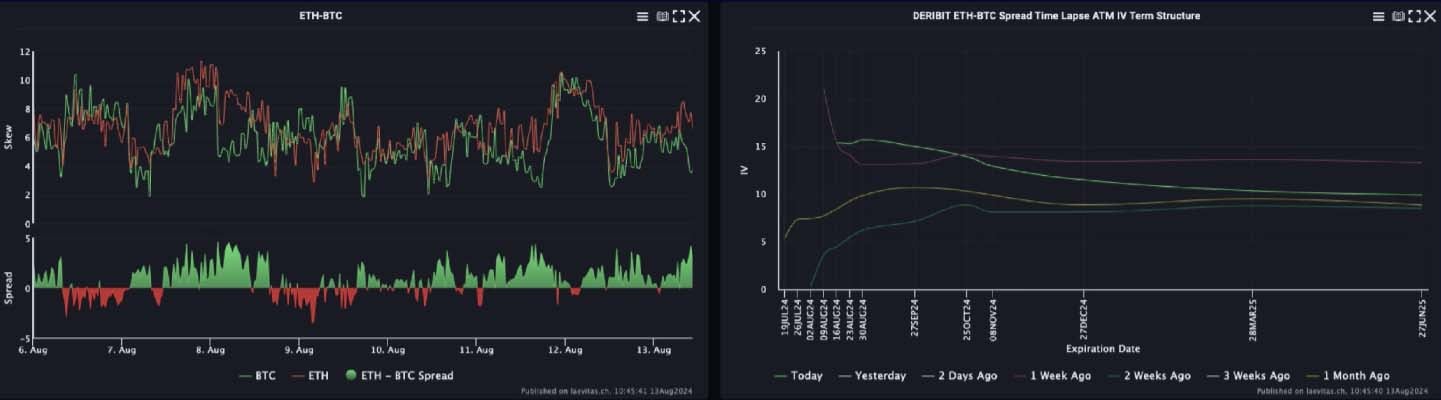

ETH/BTC Vol Spread Well Bid

ETC/BTC spot is stabilising after a sharp decline. The ETH/BTC vol spread is well-bid at the front end, matching short-term realized vol, while the back-end spread remains around 10 vols, with potential to decrease as BTC has political attention. BTC put skew is lower in the near term, but ETH 1Y calls carry more premium, despite BTC’s near-term dominance.

Option Flows

BTC option volumes hit $14B last week, one of the year’s highest. Short-dated puts in the $58k-$54k range were monetized, with hedges and bullish trades added in December. Longer-term call options were bought, funded by selling lower strikes. ETH volumes rose 25% to $4B, dominated by short- dated options. Protection was bought in the $2500-$2000 range, with upside added later in the week, maintaining ETH’s high vol premium. Notably, 4000 calls for 8Nov were bought outright.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)