Crypto Under Selling Pressure

Crypto markets faced selling pressure in the new week of trading. This comes on the back of a strong US nonfarm payrolls report and ahead of US inflation figures and the FOMC meeting. Concerns also exist around the potential delays in the Ether ETFs launch and the selling of BTCs by accounts tied to Mt. Gox. On the flip side, Trump’s pro-crypto stance has continued in his latest appearance. We are headed into summer trading where activity typically slows down, however, the new dynamics at play such as the ongoing spot ETFs inflows on BTC or the ones to come on ETH could sustain higher volumes and volatility in a thinner market.

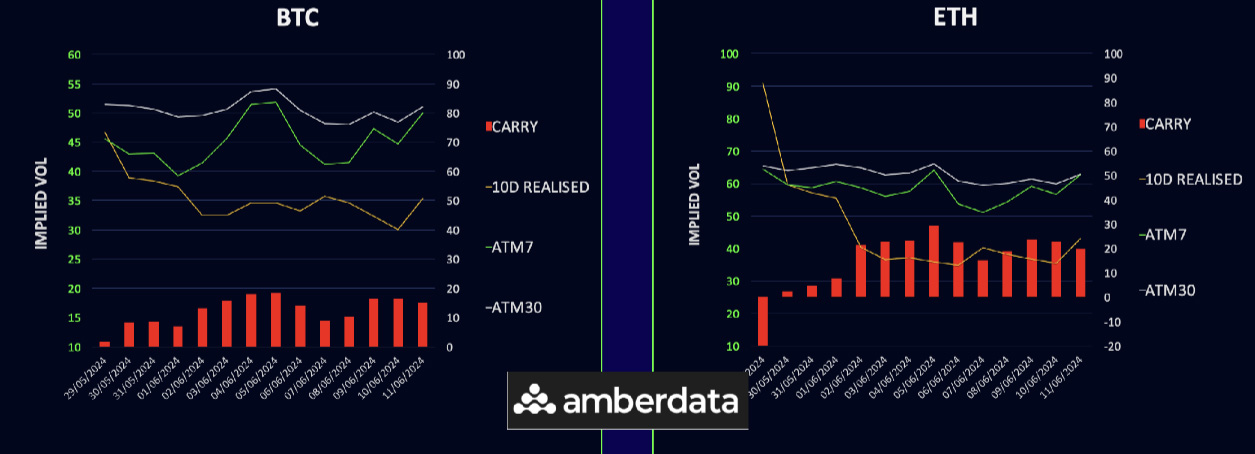

Suppressed Realized Vol About to Revert?

Realized volatility hit new lows in BTC and ETH early in the week, only to spike in the last 24h of trading as BTC and ETH test $67k and $3.5 support lines. The implied volatility remains steady ahead of CPI and FOMC. ETH’s drop below $3500 could affect the positive carry, but any ETF launch delays are unlikely to derail the rally completely.

BTC & ETH Term Structures Move in Tandem

Options market trends show stable gamma but slightly offered VEGA. An overnight drop revived short-term options demand, with longer-dated volatility decreasing. ETH and BTC term structures are aligned, and call skews are adjusting lower and moving into puts in the front end while they remain steady in the back of the curve. Weekly ETH volatility increased, reflecting recent spot price drops.

ETH/BTC Vol Spread a Touch Higher

The ETH/BTC vol spread is higher at the front due to ETH’s sharper drop but lower at the back due to ETF launch delays. ETH maintains a premium across the curve, expected to continue until ETFs launch. The spot spread is entering a support zone, offering a potential entry point.

Skew Steeply Upward Sloping

Skew remained steady until an overnight crypto drop increased front-end put buying, flattening weekly call skew. Skew term structures are upward sloping, with ETH longer-dated calls holding a premium over BTC. The options market suggests staying long ETH for later this year.

Option Flows And Dealer Gamma Positioning

BTC option volumes surged 35% to $9.5Bn, driven by strong ETF inflows and significant call spread activity trying to play a break to new highs. ETH volumes fell 8% to $3.25Bn, with upside flows and call spread buys dominating. Dealer gamma positions in BTC and ETH are balanced, and having minimal impact on spot prices.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)