Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The weekend’s volatile price action was reflected in the sharp dip in both the put-call skew and the future-implied yields, both of which have since recovered somewhat following the post-selloff rally. This was seen in the derivatives markets of both BTC and ETH, which continue to price downside protection at a higher implied volatility than OTM calls in the latter asset. The term structure of at-the-money implied volatility is inverted for both assets, showing that the market expects higher volatility in the short term.

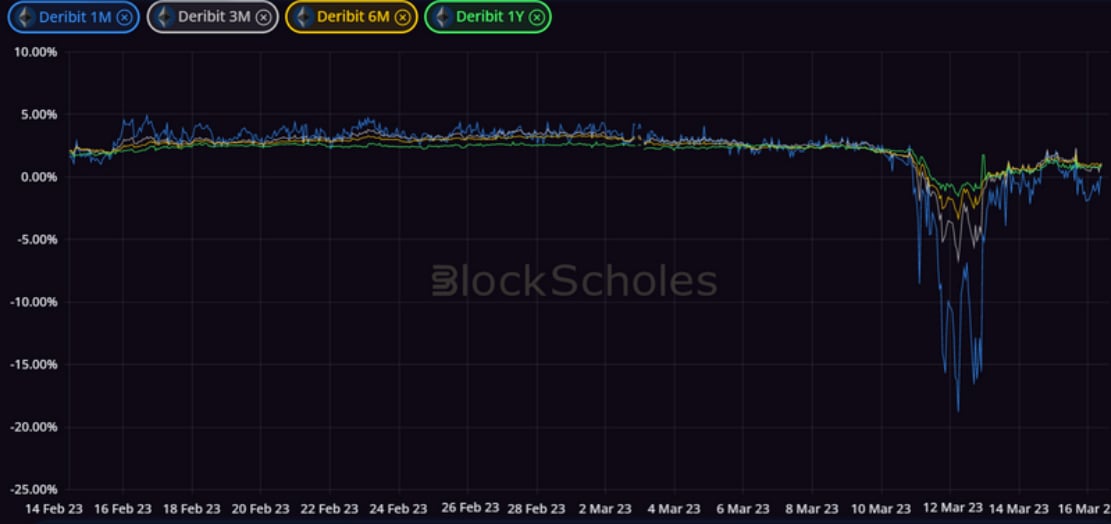

Futures

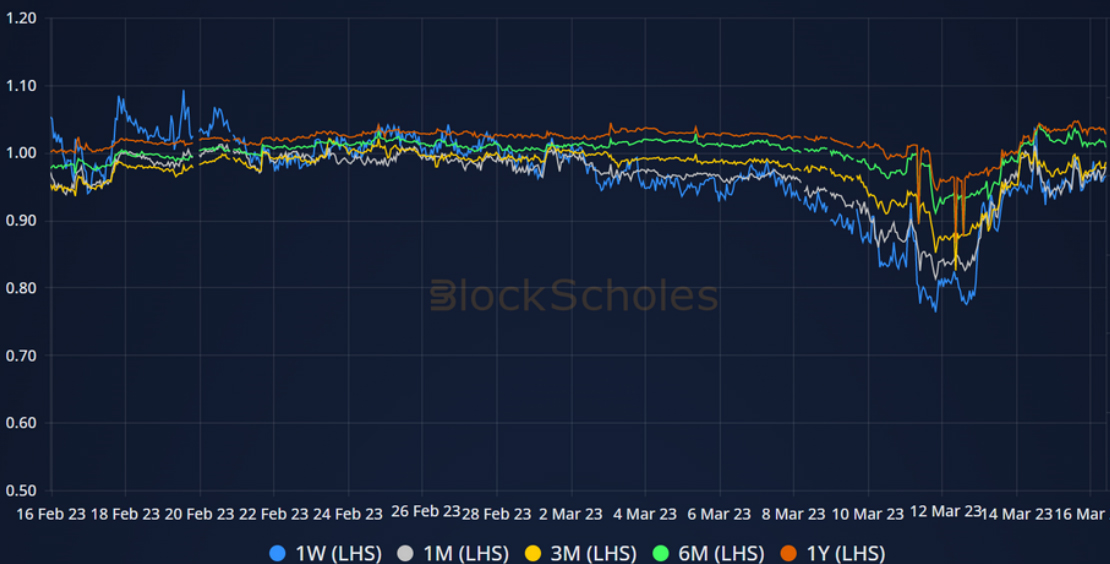

BTC ANNUALISED YIELDS – dip strongly negative over the weekend, before recovering to trade near to zero just days later.

ETH ANNUALISED YIELDS – see a similar selloff in futures relative to spot before recovering more recently.

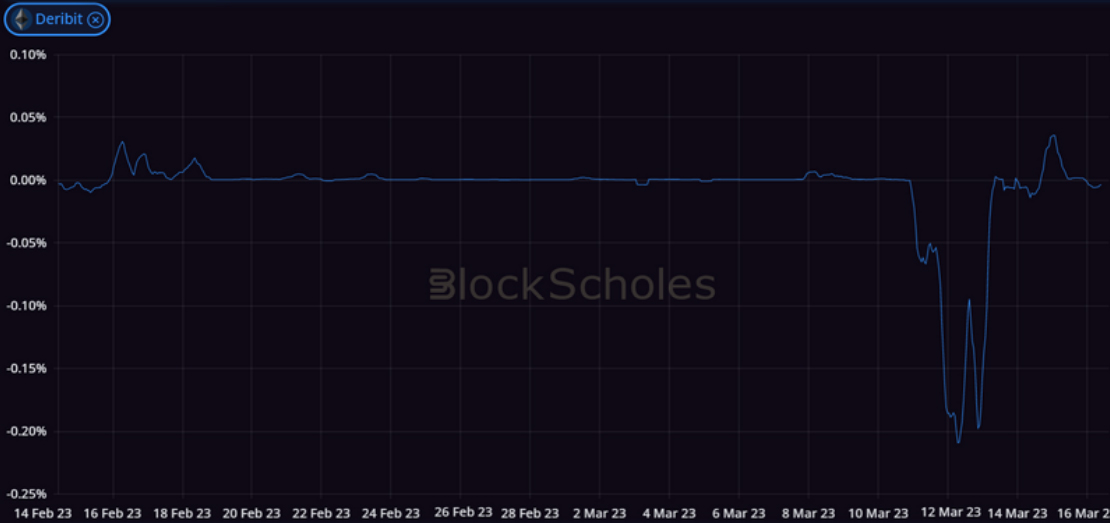

Perpetual Swap Funding Rate

BTC FUNDING RATE – highlight the extreme demand for short exposure during the weekend’s selloff, before flipping positive as BTC spikes.

ETH FUNDING RATE – follows the movement of BTC’s perpetual funding rate in both directions.

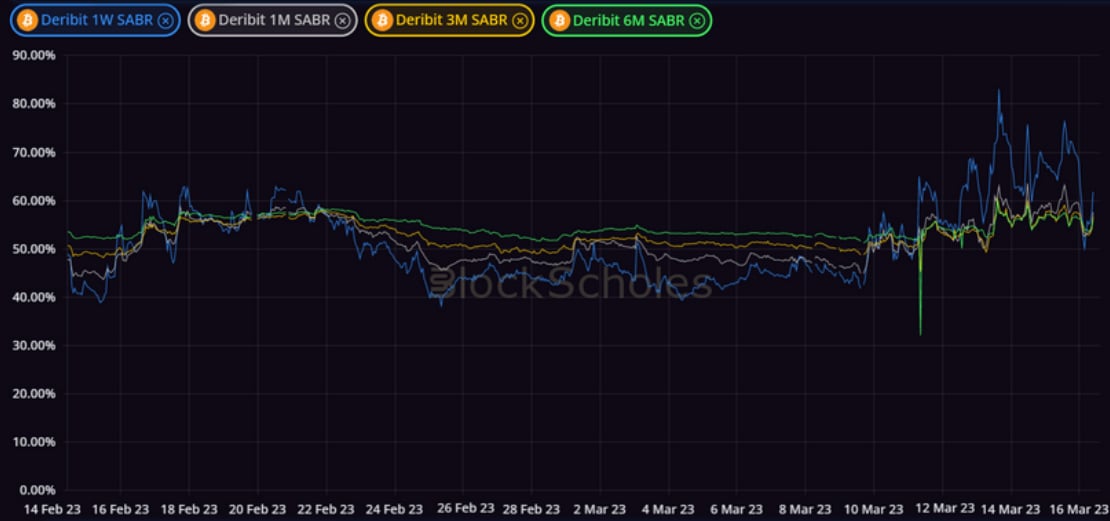

Options

BTC SABR ATM IMPLIED VOLATILITY – rises rapidly as the term structure inverts to value implied vol higher for shorter tenor options.

ETH SABR ATM IMPLIED VOLATILITY – also spiked strongly in response to the weekend’s volatility spot price action.

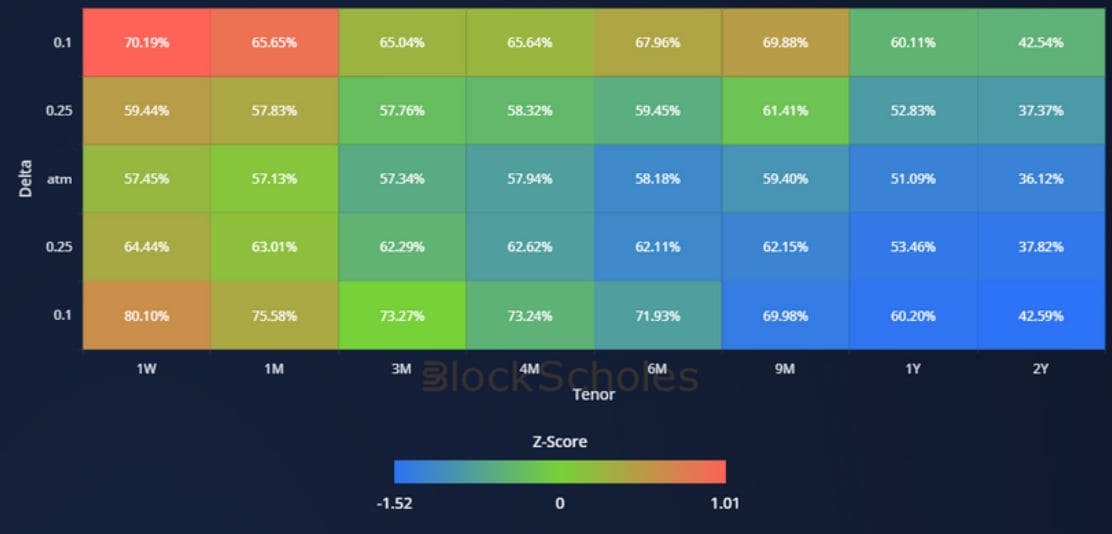

Volatility Surface

BTC IMPLIED VOL SURFACE – all tenors shorter than 1Y see a sharp increase in implied volatility across the delta domain.

ETH IMPLIED VOL SURFACE – sees a more muted increase in short term implied volatility, particularly in 10-delta calls at 1W and 1M tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

Put-Call Skew

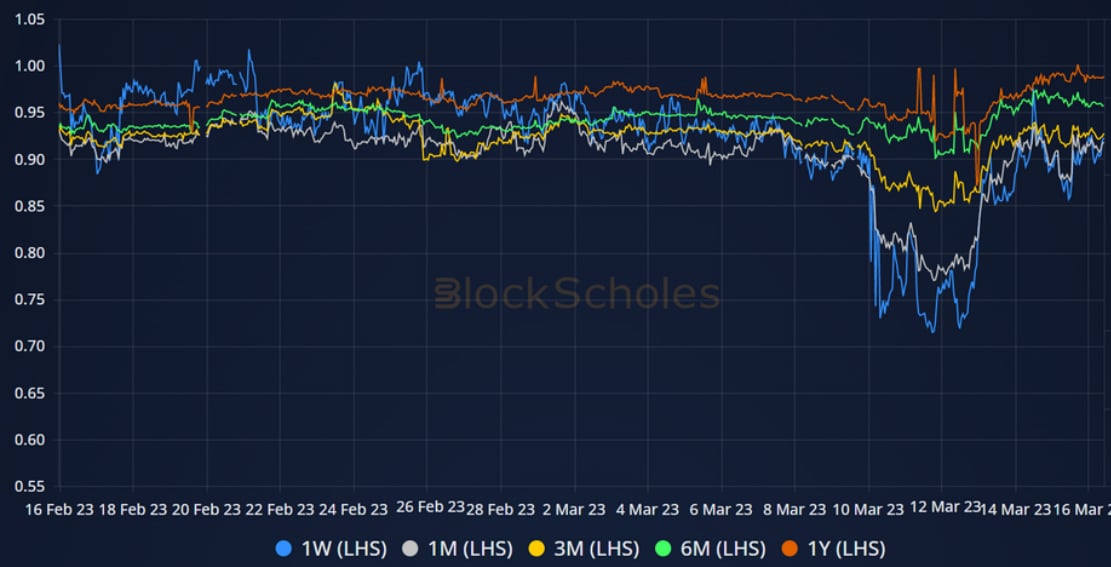

BTC 25 DELTA PC SKEW – skewed sharply towards downside protection over the weekend, before recovering its neutral pricing.

ETH 25 DELTA PC SKEW – saw a similar recovery from the depths it traded at over the weekend, but now trades with a stronger skew towards OTM puts than BTC does at shorter tenors.

Volatility Smiles

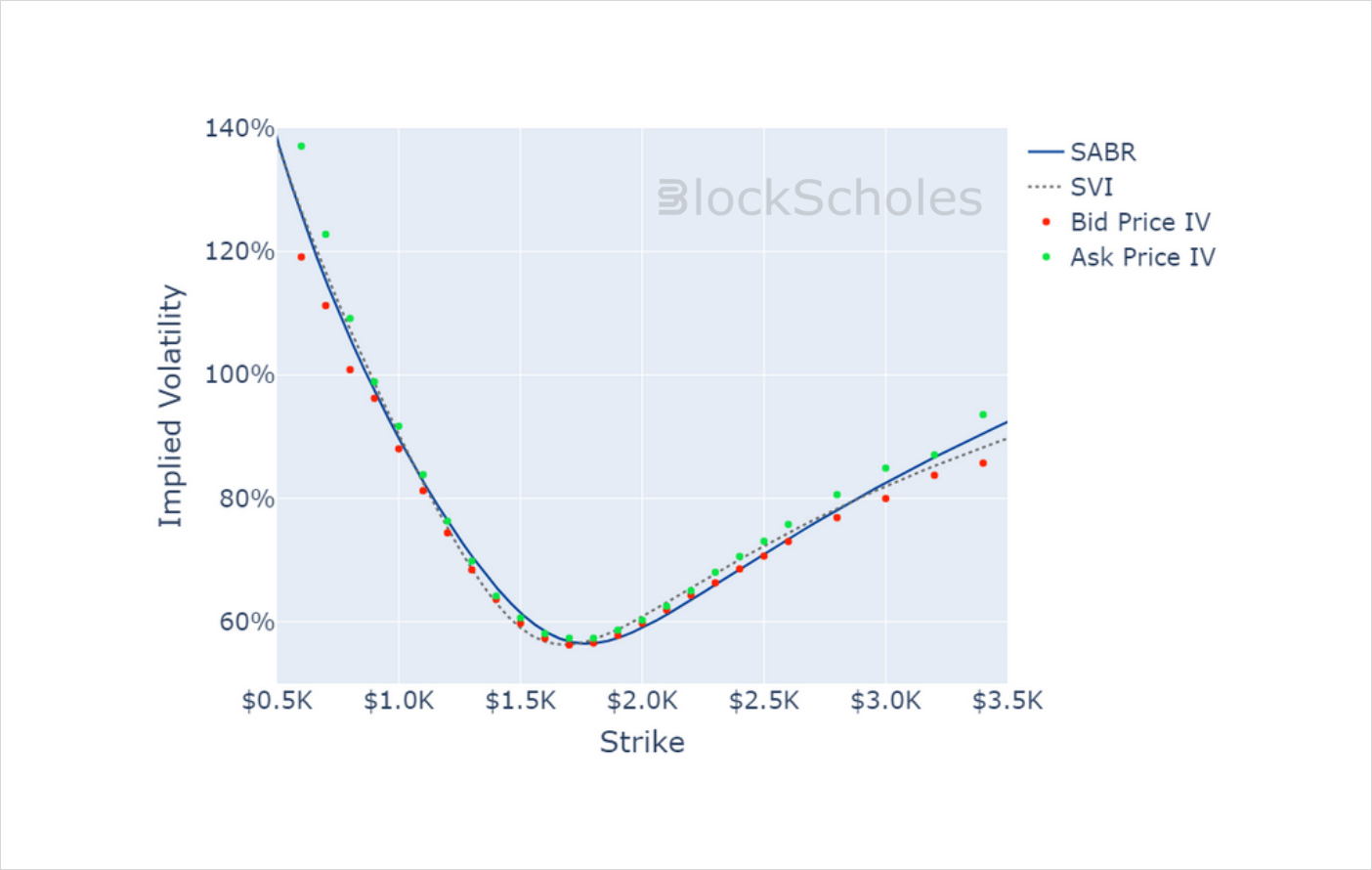

BTC SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 28-Apr-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

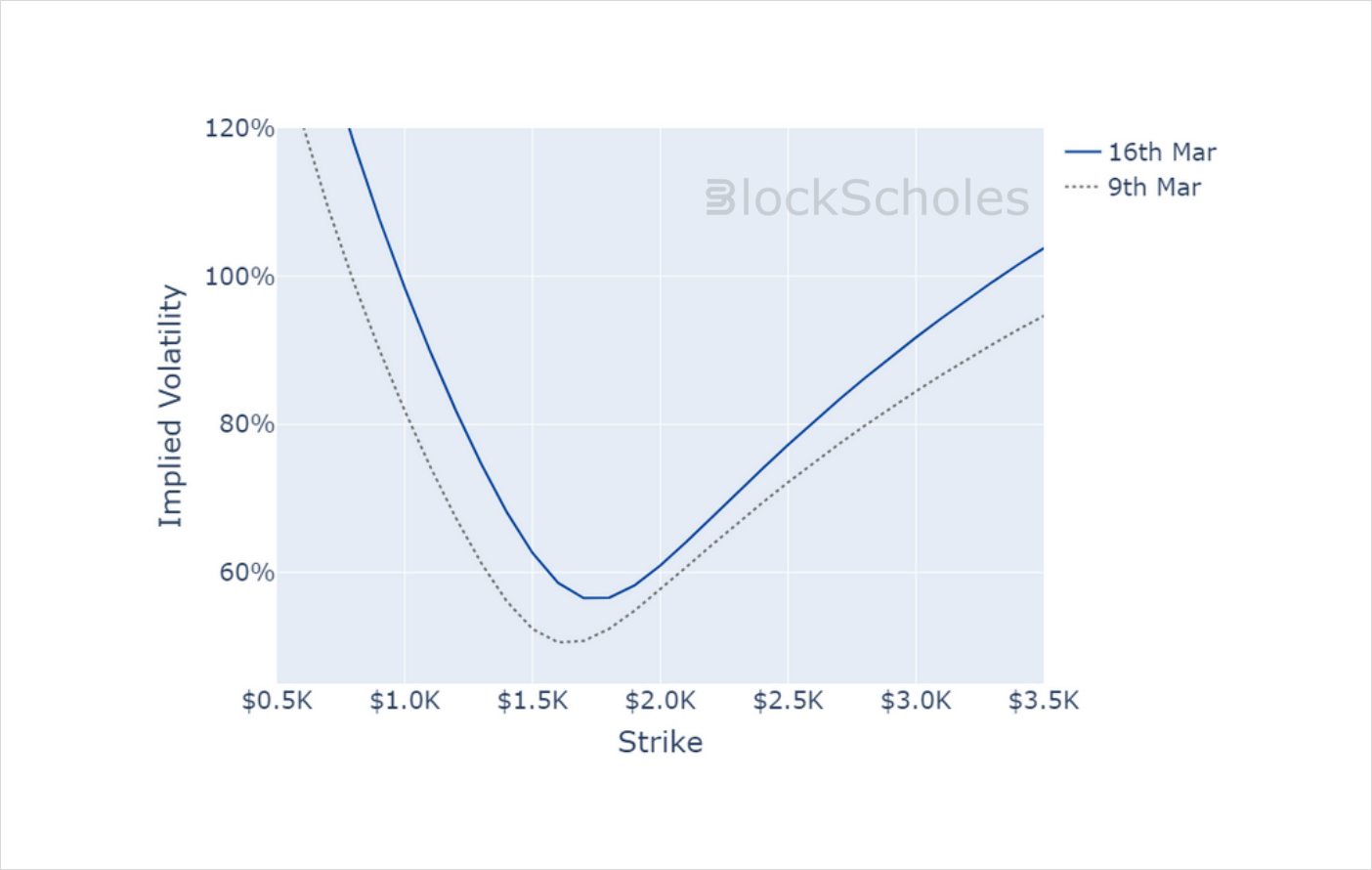

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)