Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

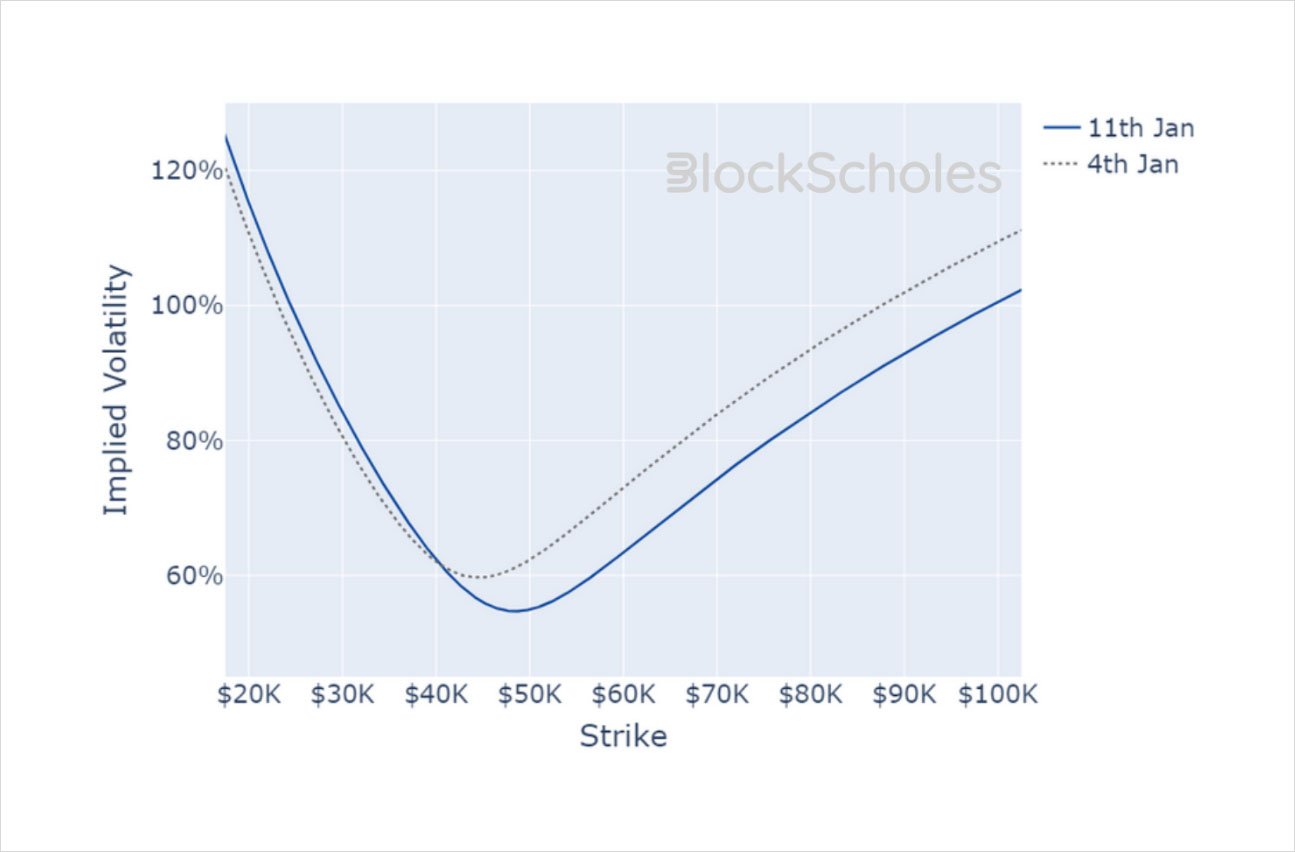

The passing of the ETF announcement event risk is clear in the selloff of implied volatility at the front end of the term structure, which none-the-less remains moderately inverted for both BTC and ETH. The increased demand for short-term OTM puts that caused a negative skew in short-dated volatility smiles in the days before has passed as concerns of a “sell-the-news” event appear to have dissipated. Both majors’ futures markets report healthy demand for leveraged long exposure in both listed and perpetual markets, but both remain far below the high rates that we saw at the beginning of the month.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

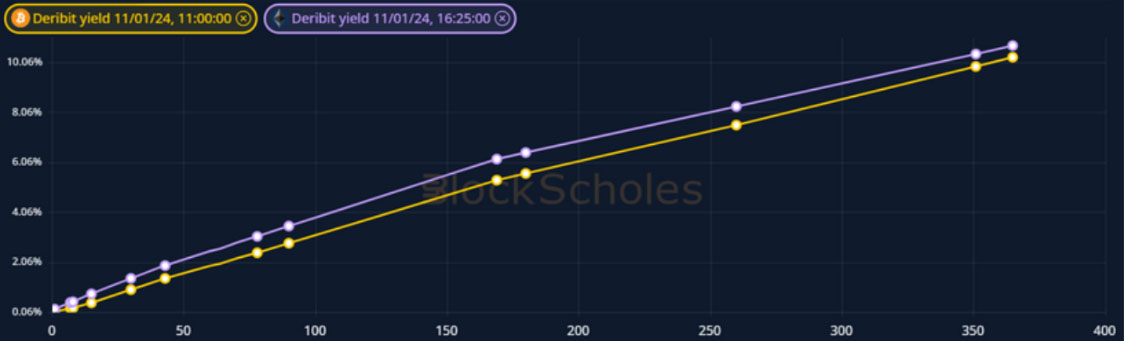

BTC ANNUALISED YIELDS – remain above 10% across the term structure, far below the extremes reached at the beginning of the year.

ETH ANNUALISED YIELDS – have begun to increase once again during ETH’s bout of out-performance in the aftermath of the ETF announcement.

Perpetual Swap Funding Rate

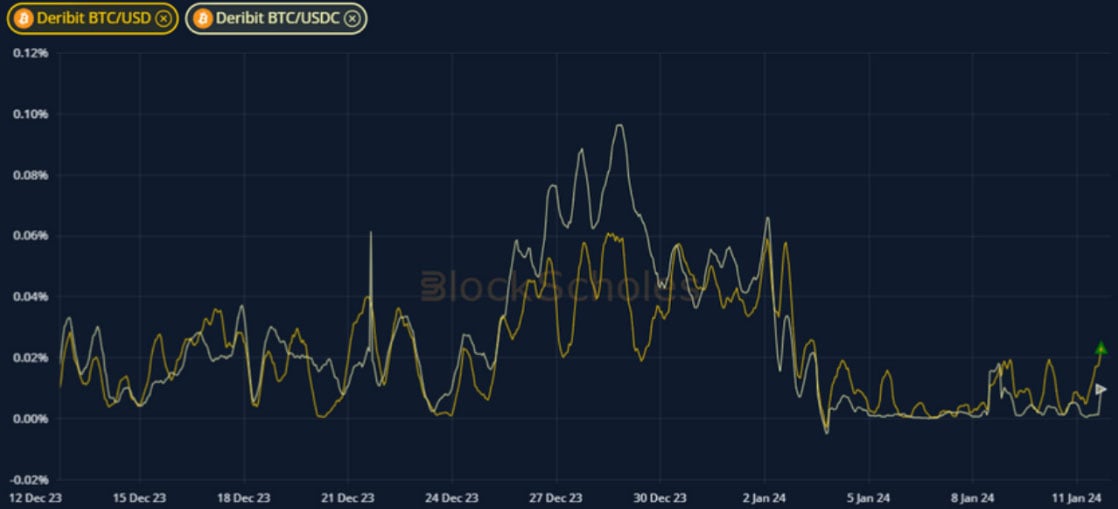

BTC FUNDING RATE – have begun to trend upward following the ETF announcement.

ETH FUNDING RATE – remain positive following the approval of BTC’s ETF, indicating continued demand to pay for leveraged long exposure.

BTC Options

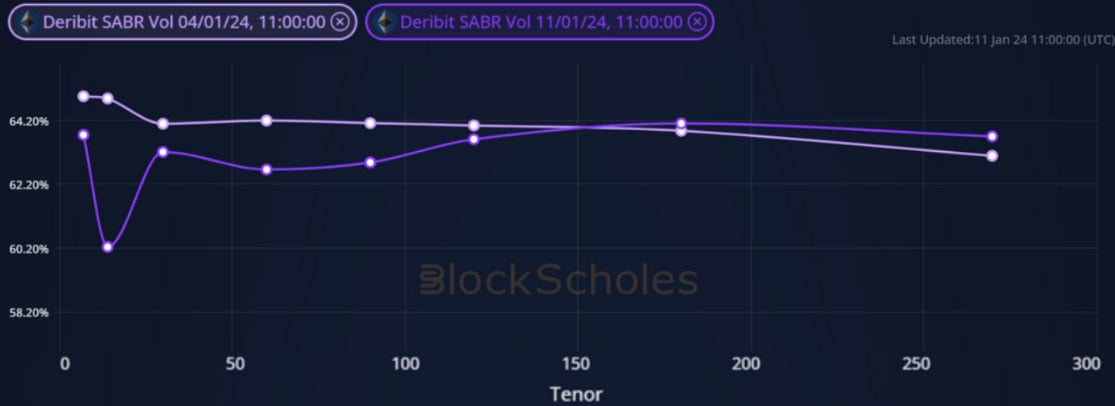

BTC SABR ATM IMPLIED VOLATILITY – having reached 90% ahead of the ETF news, now trades between 50% and 60% across the term structure.

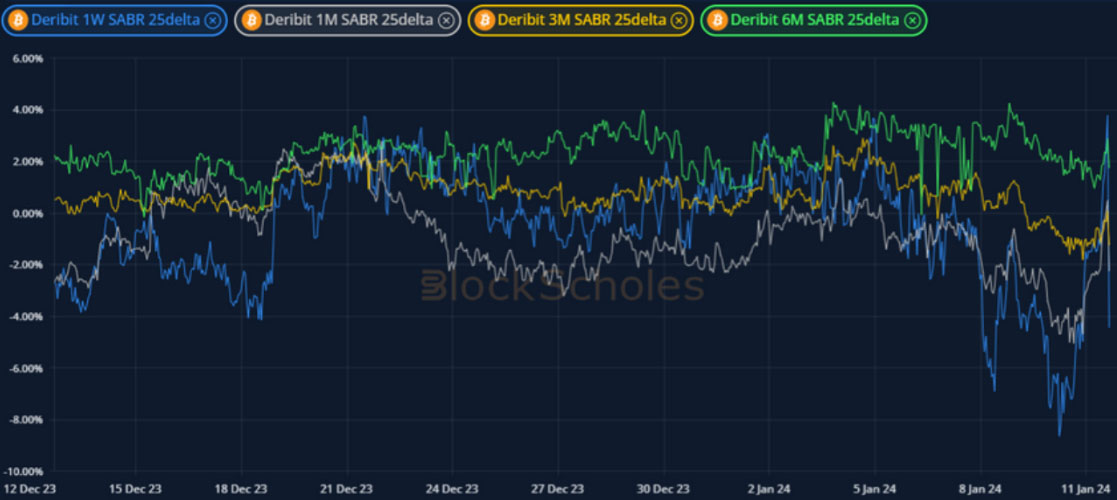

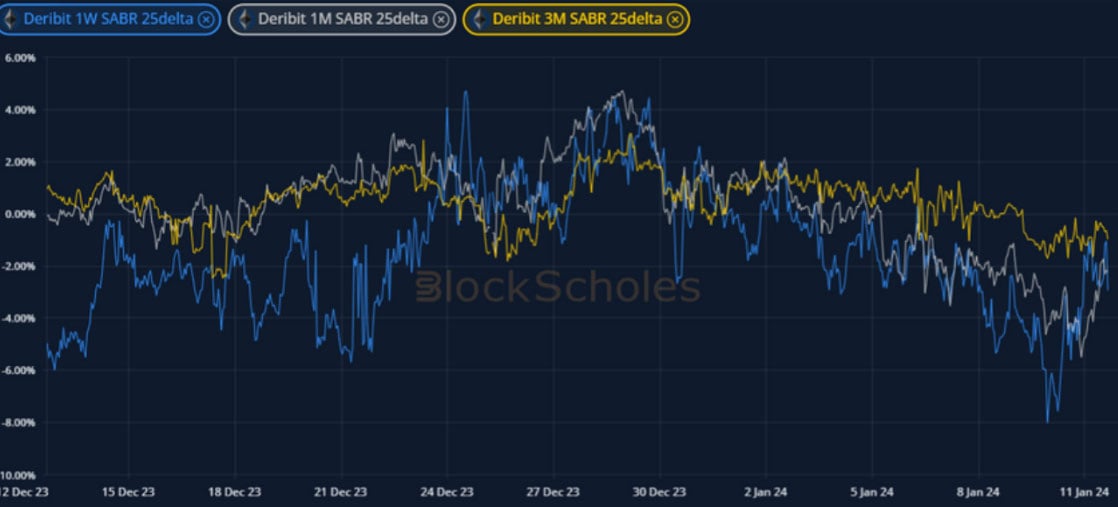

BTC 25-Delta Risk Reversal – first indicated a strong demand for downside protection going into the announcement, before recovering in the last 24H.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – did not reach the same heights as BTC did at a 1W, but follows a similar trajectory following the event.

ETH 25-Delta Risk Reversal – follows the same trajectory as BTC’s skew into and out of the ETF announcement event risk.

Volatility Surface

BTC IMPLIED VOL SURFACE – indicates that 3M tenor OTM calls see the sharpest fall in implied volatility, while long-tenor OTM puts have risen.

ETH IMPLIED VOL SURFACE – remains elevated across the surface when compared with its 30-day historical distribution.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

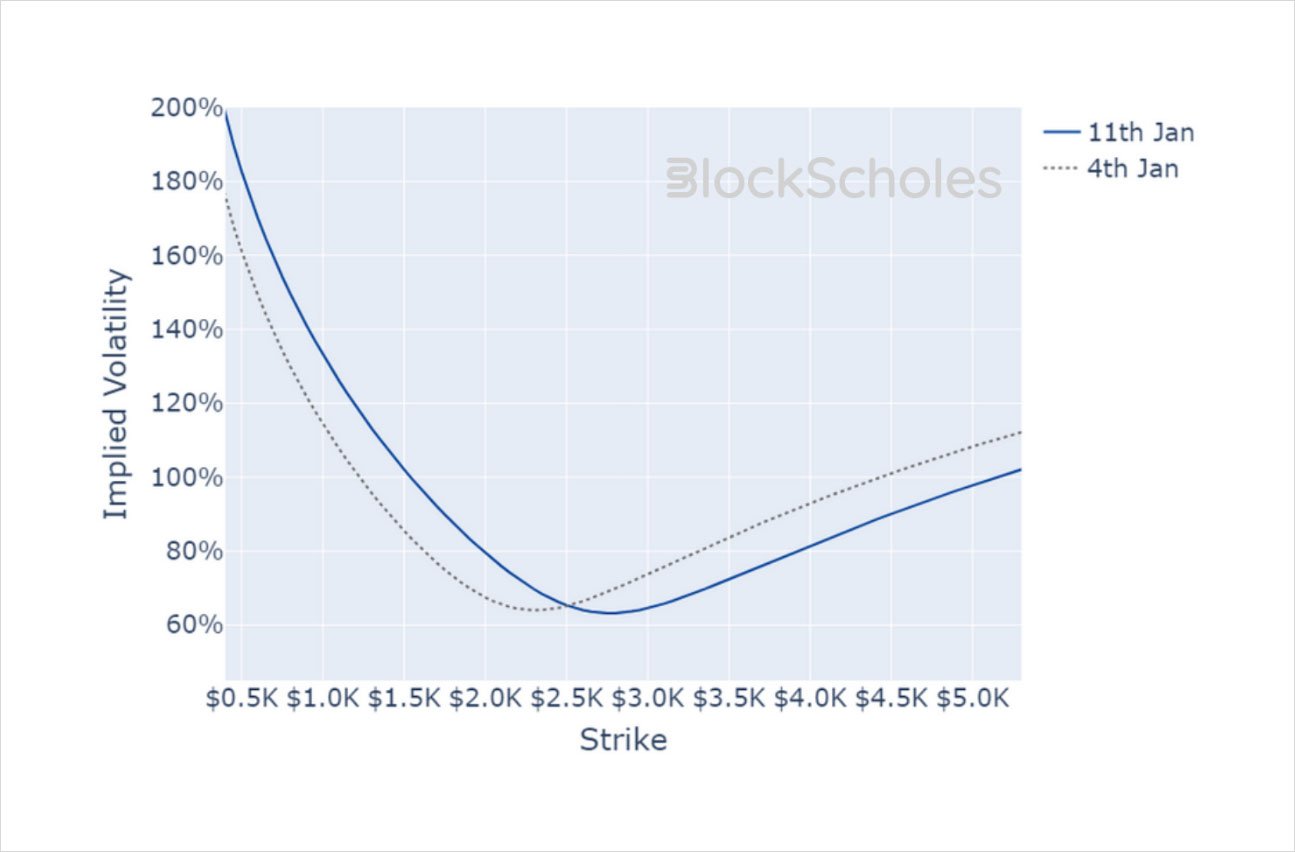

Volatility Smiles

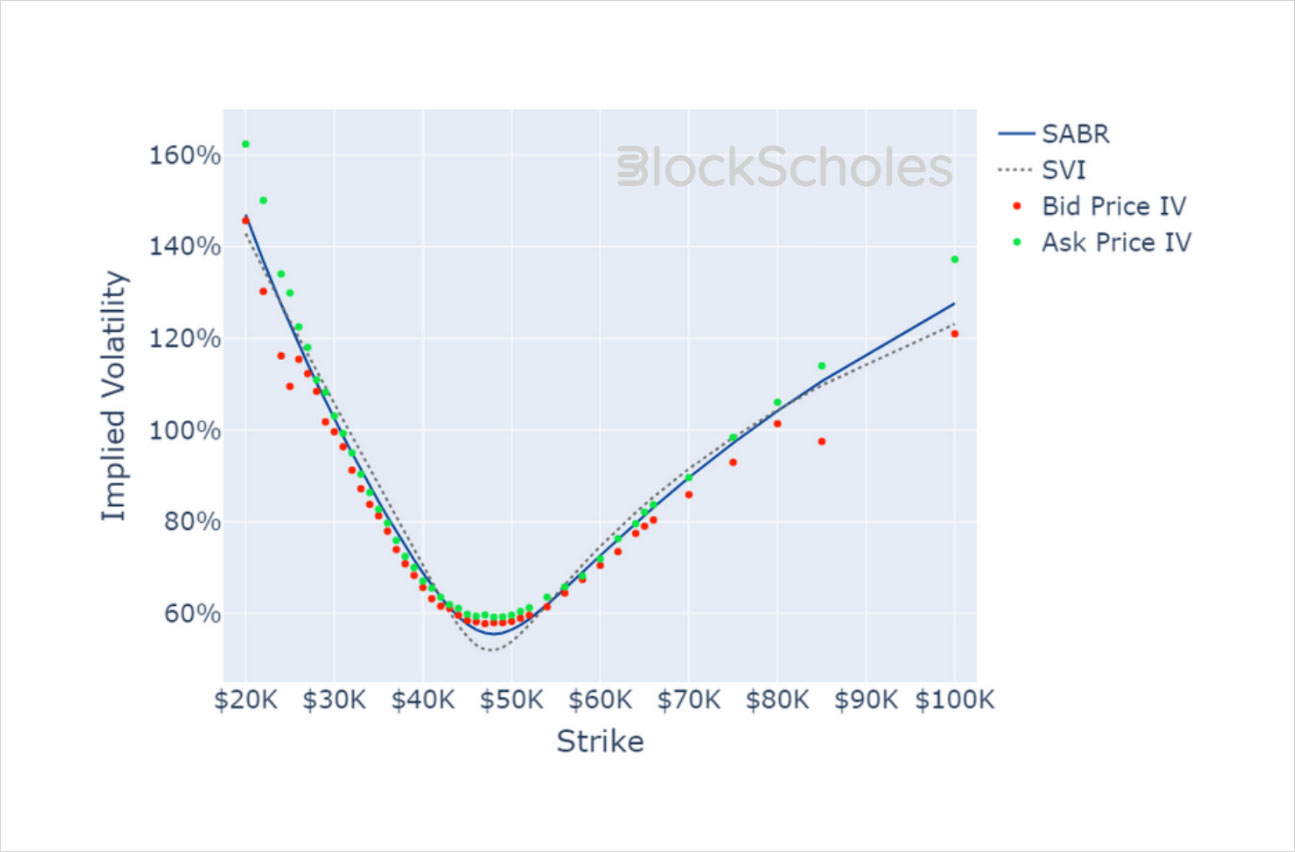

BTC SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

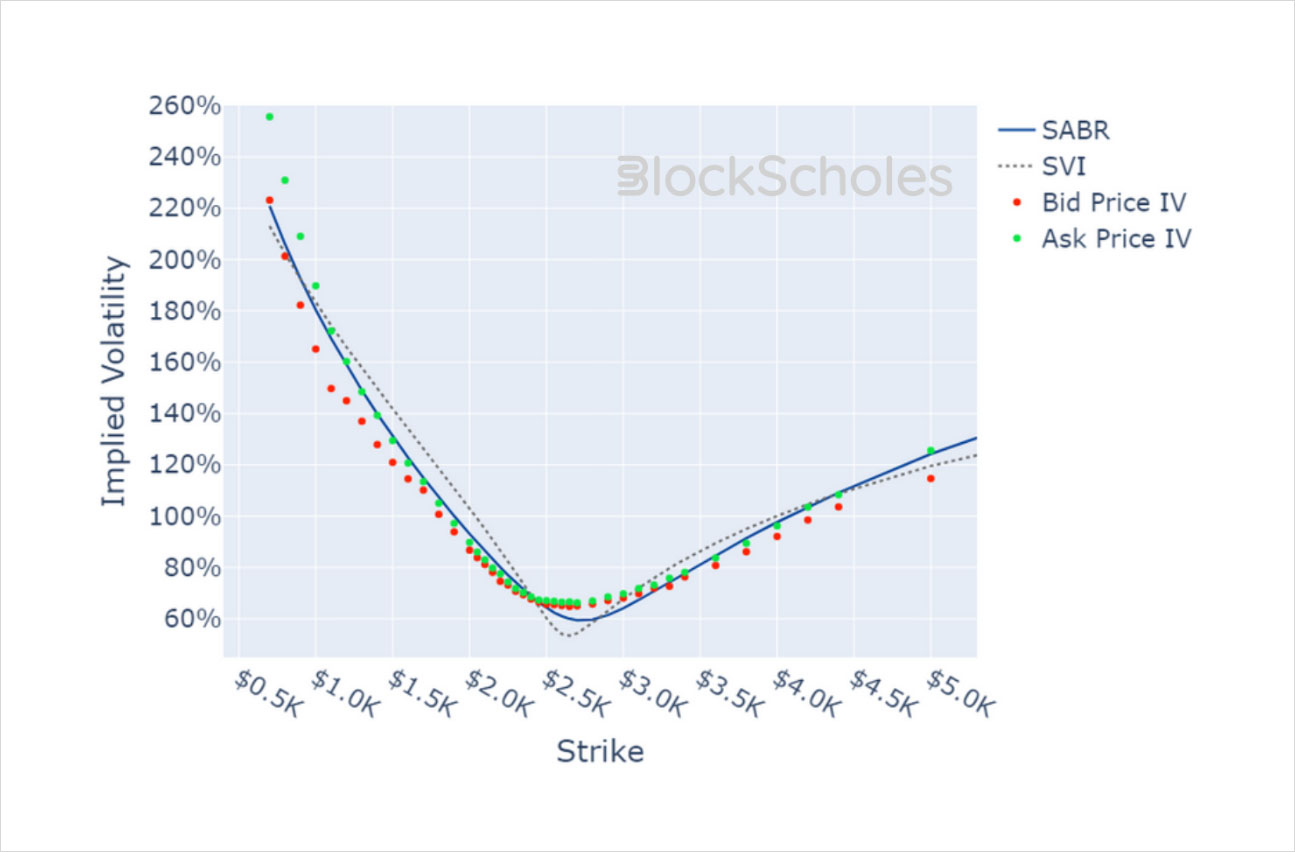

ETH SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)