Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

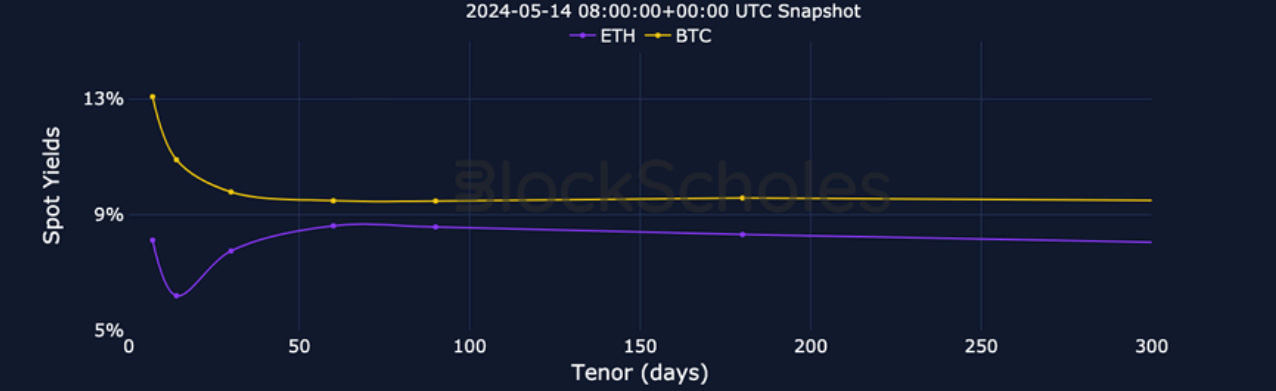

Volatility has gradually risen across the term structure as BTC trades near its range lows of $60K, but has still not deviated from its longer term downward trend. ETH continues to trade 5-7 vols higher than BTC. Despite a strong start to the month where skew recovered following the spot sell-off which saw investors purchase OTM puts for downside protection, the skew at short-dated tenors has traded with some uncertainty recently. ETH’s skew continues to trade lower than BTC’s, indicating more bearish positioning. Leverage – indicated by perpetual swap funding rates and futures-implied yields – has increased, particularly at short-dated tenors which have risen beyond longer-dated tenors, indicating demand for leveraged long exposure as both majors sit at precarious levels.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

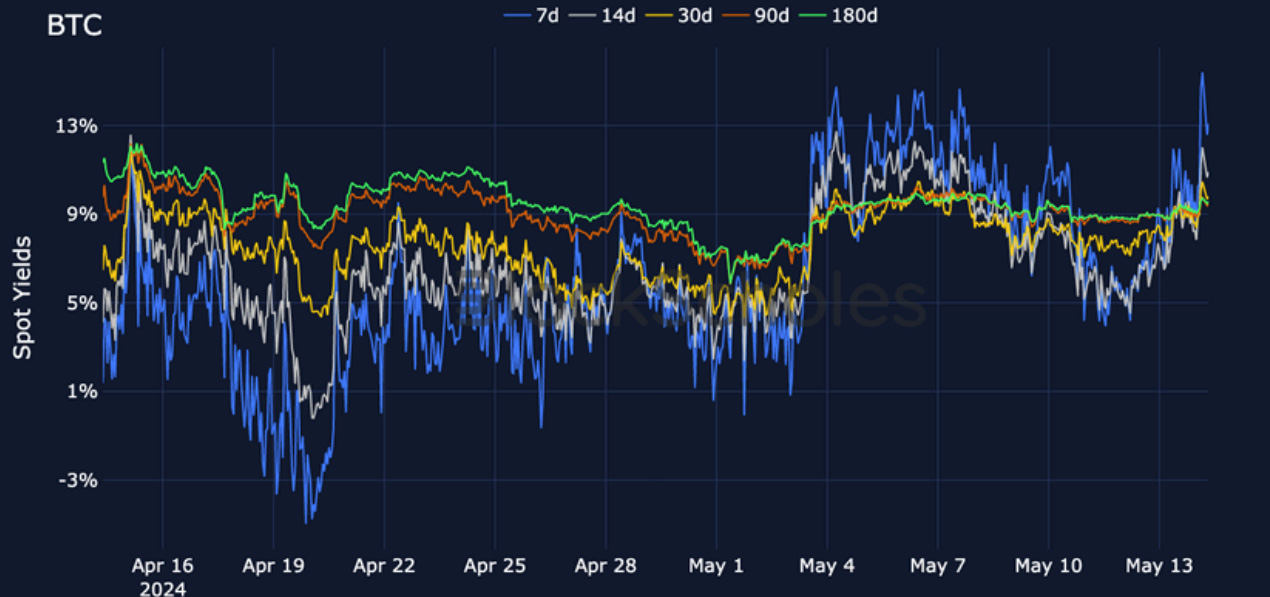

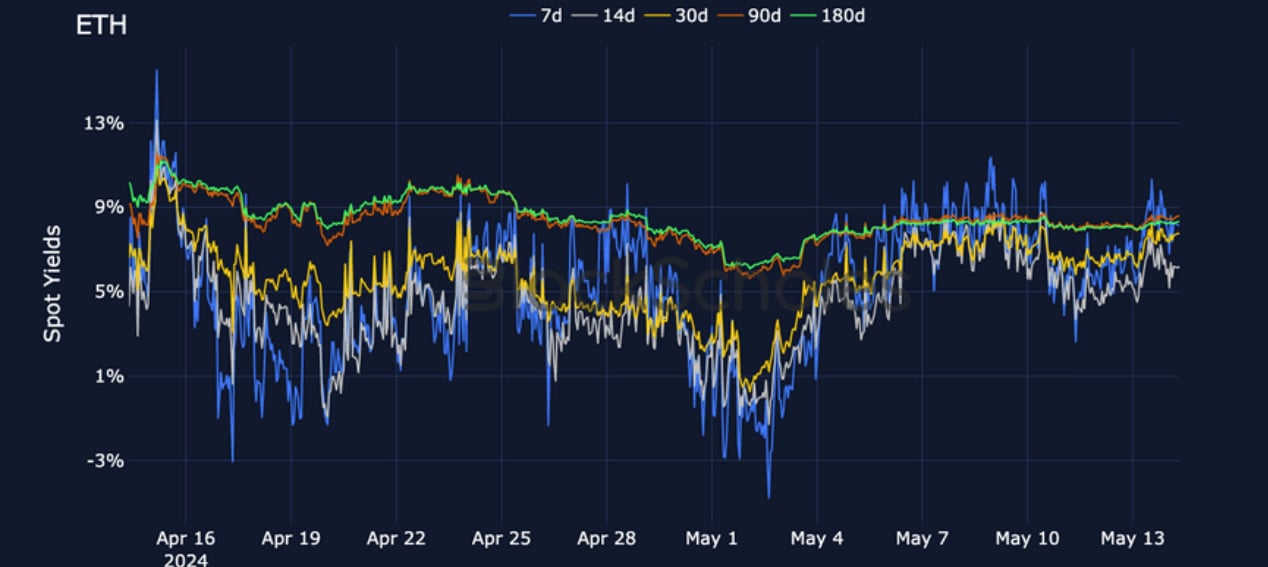

Futures

BTC ANNUALISED YIELDS – yields at short-dated tenors rose beyond longer-dated tenors as BTC bounced at $60K.

ETH ANNUALISED YIELDS – the increase in yields is far less prominent compared to BTC, continuing to trade lower at short-dated tenors.

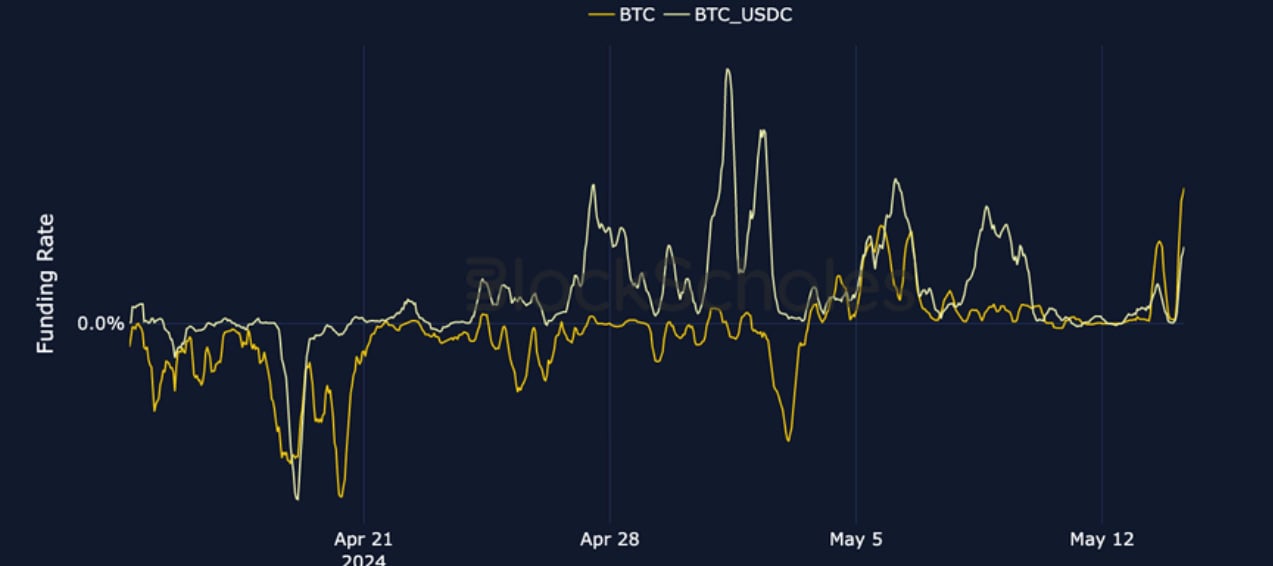

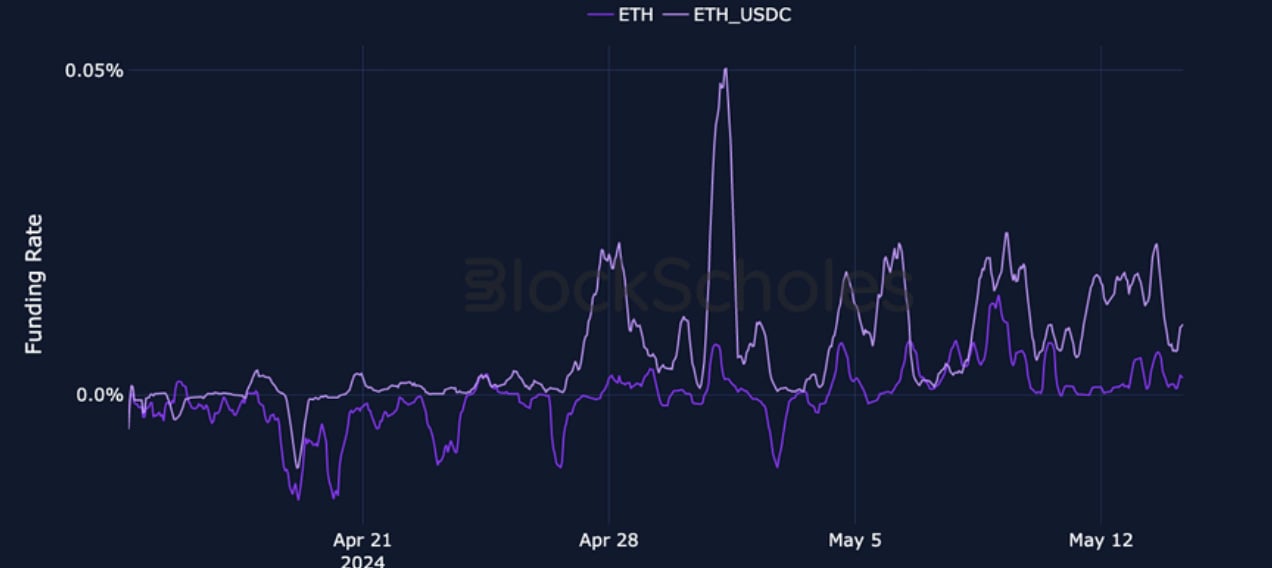

Perpetual Swap Funding Rate

BTC FUNDING RATE – continued to trade near zero throughout the week, but rose sharply as BTC bounced at $60K, indicating a sudden demand for leveraged long exposure.

ETH FUNDING RATE – has traded higher than BTC over the past week, particularly in the more illiquid USDC-margined token.

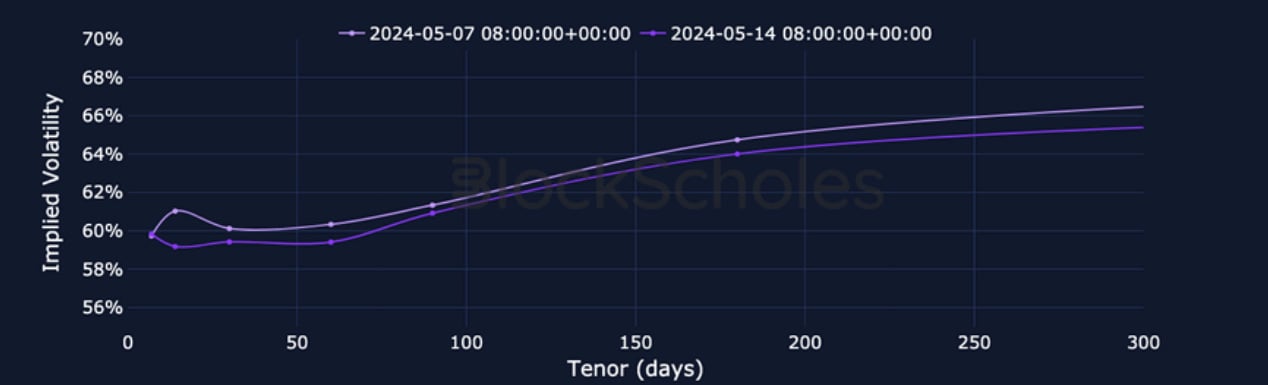

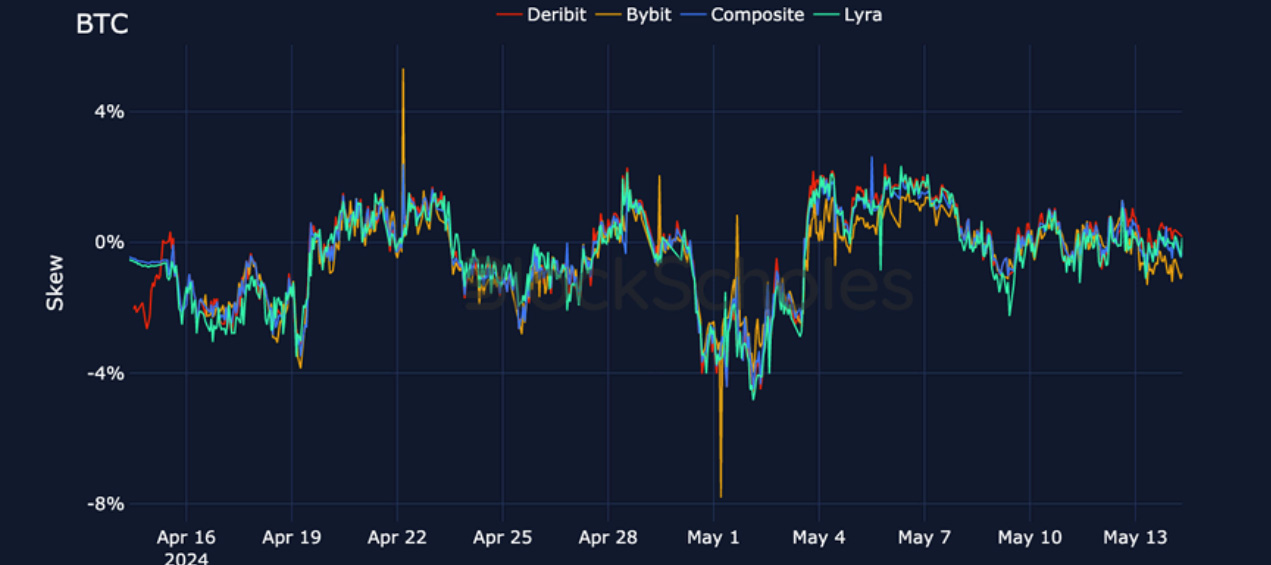

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – vol has been rising steadily within the past week, where the front-end of the term structure briefly became inverted as vol at short-dated tenors spiked.

BTC 25-Delta Risk Reversal – skew at current levels is neutral as there is no obvious preference for OTM call or put options.

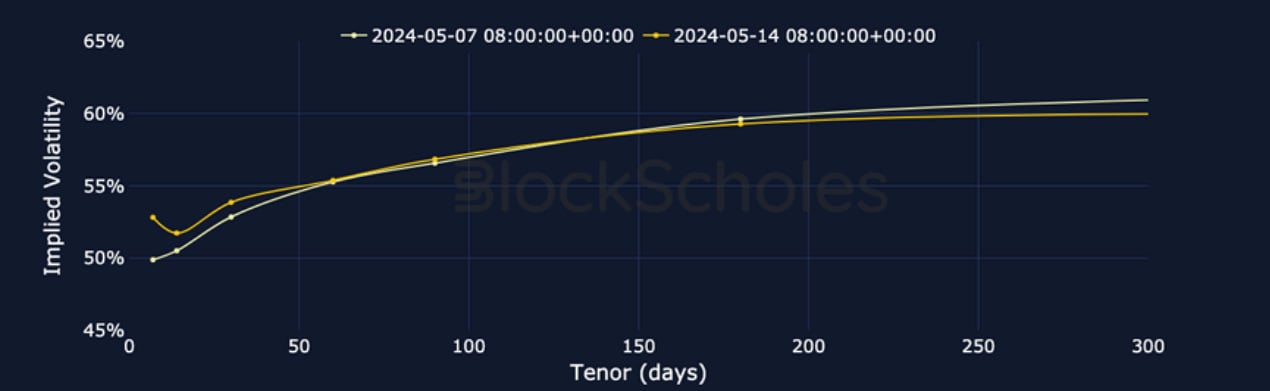

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – has followed a similar pattern to BTC, but still trades 5-7 vols higher across the compressed term structure.

ETH 25-Delta Risk Reversal – is slightly more bearish at shorter-dated tenors, but nothing like the bearishness observed at the beginning of the month.

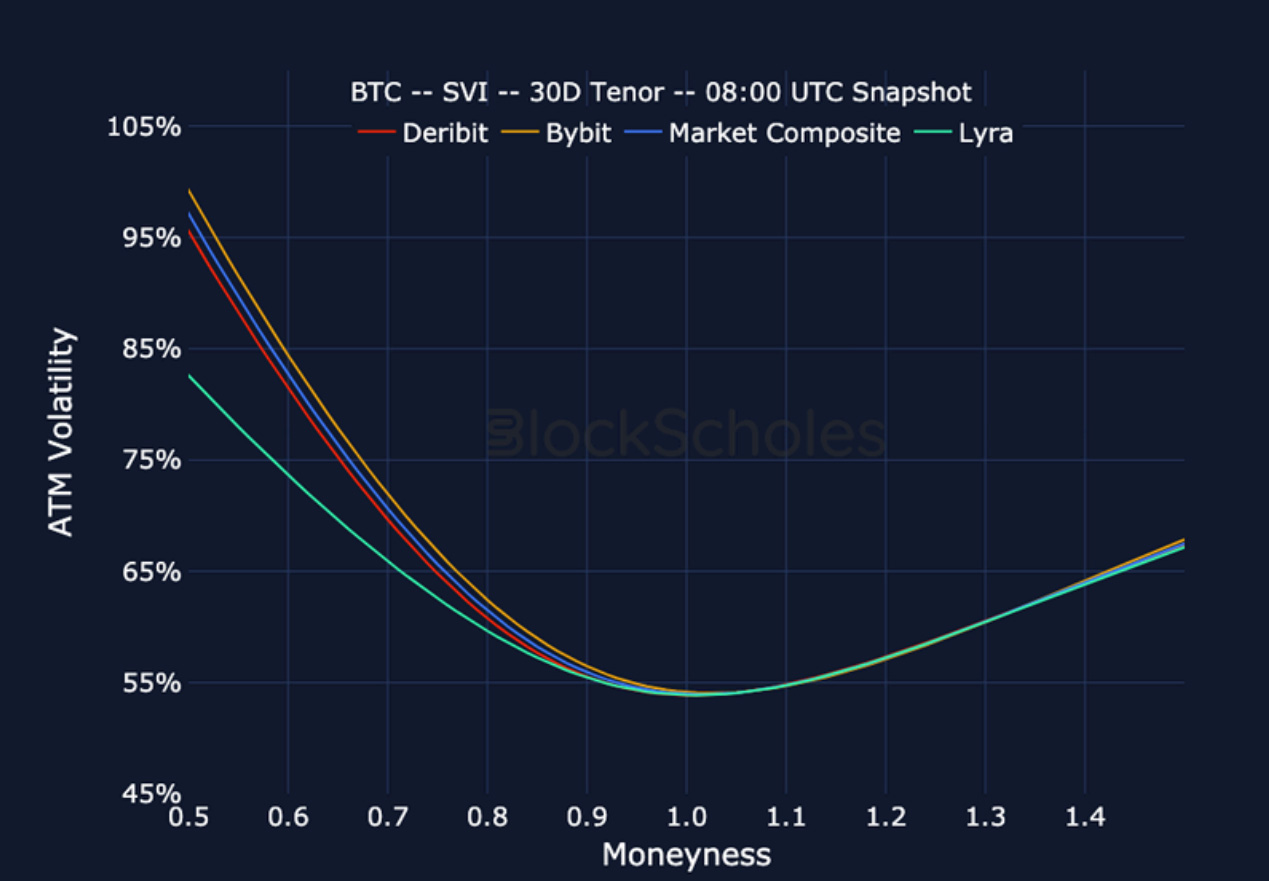

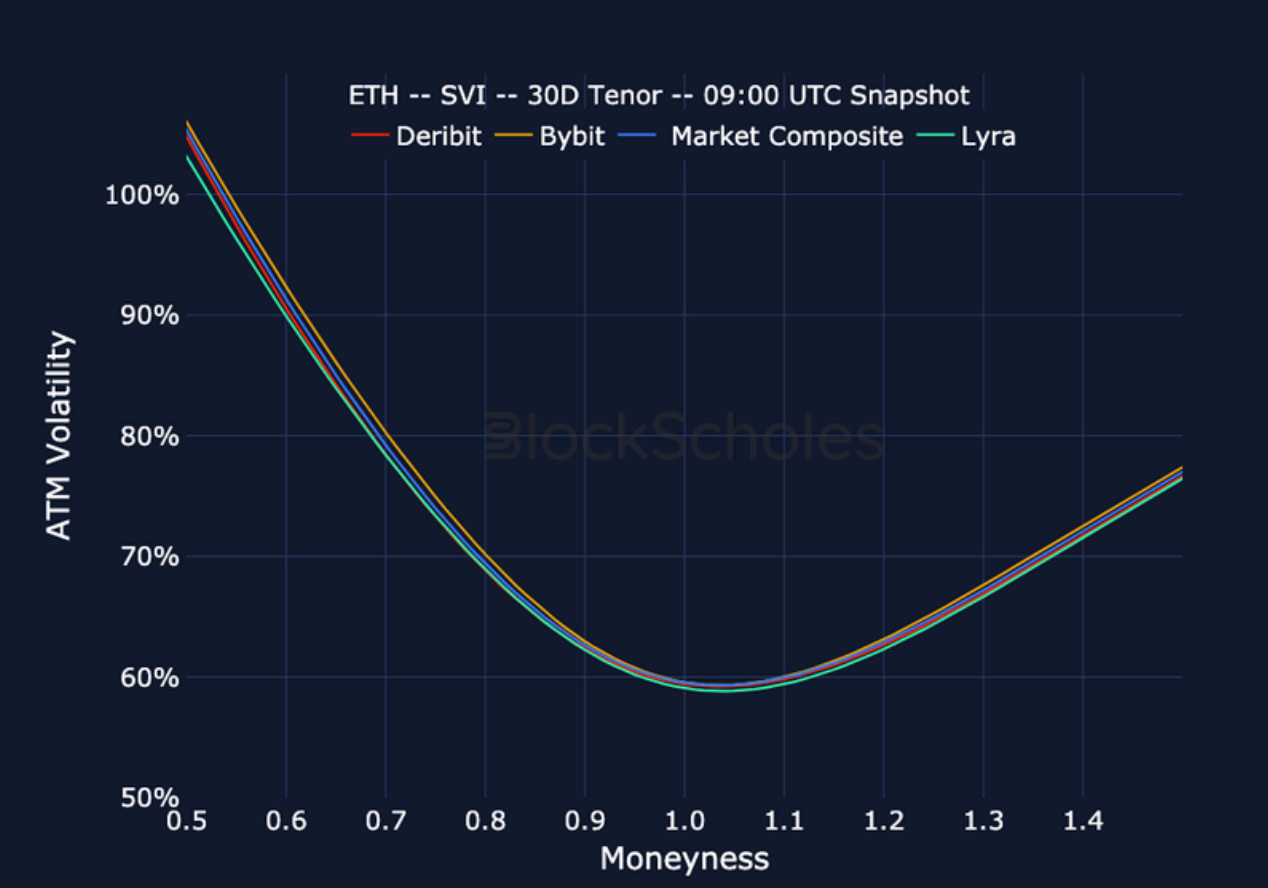

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

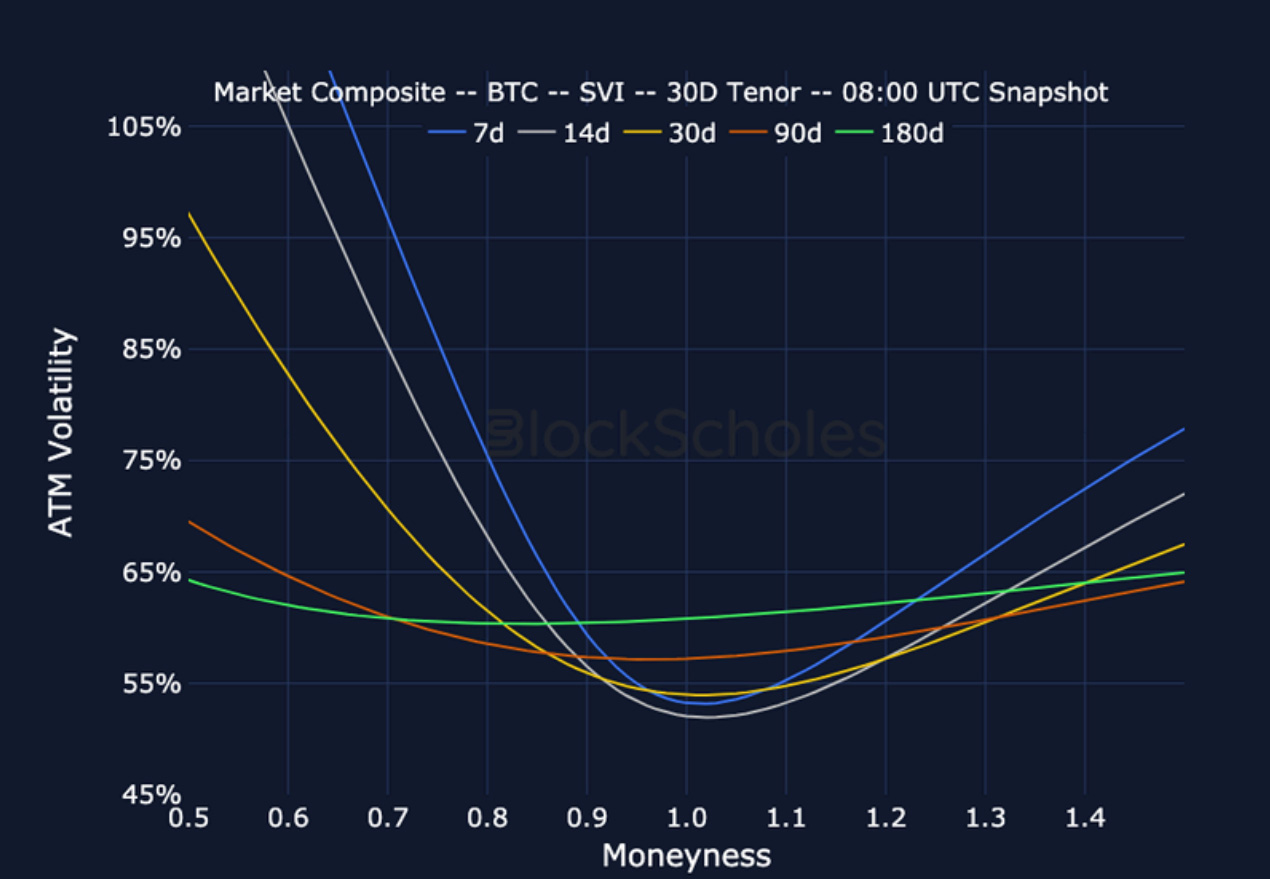

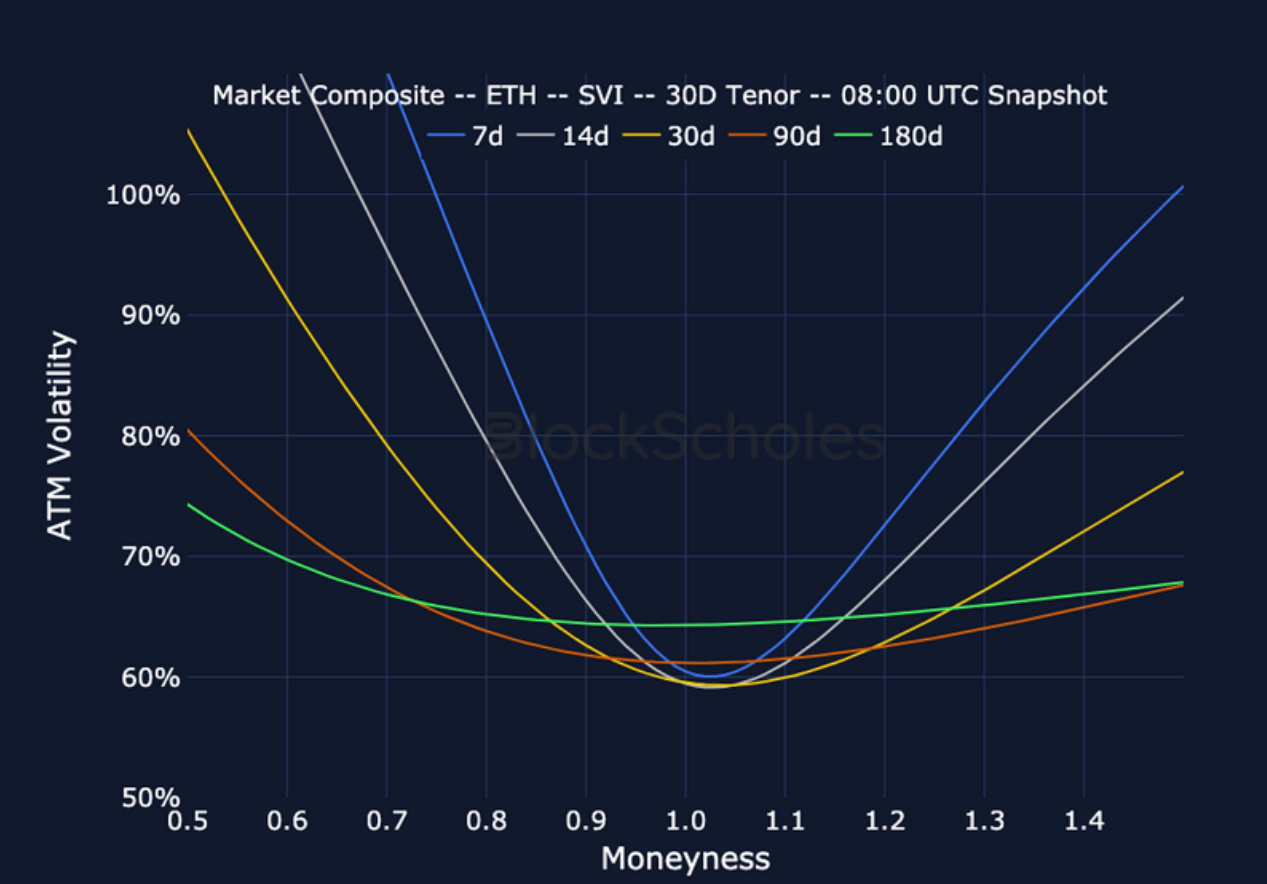

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 8:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 8:00 UTC Snapshot.

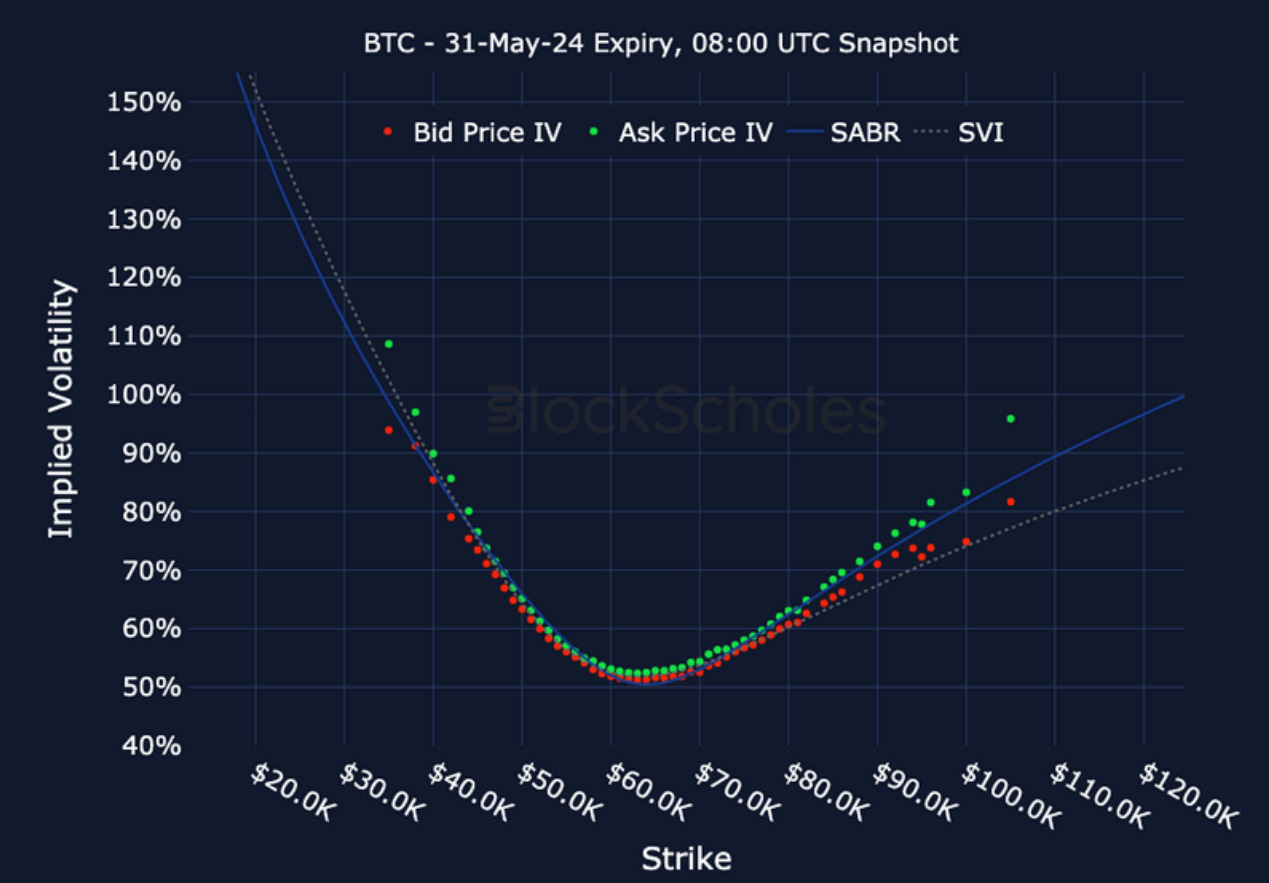

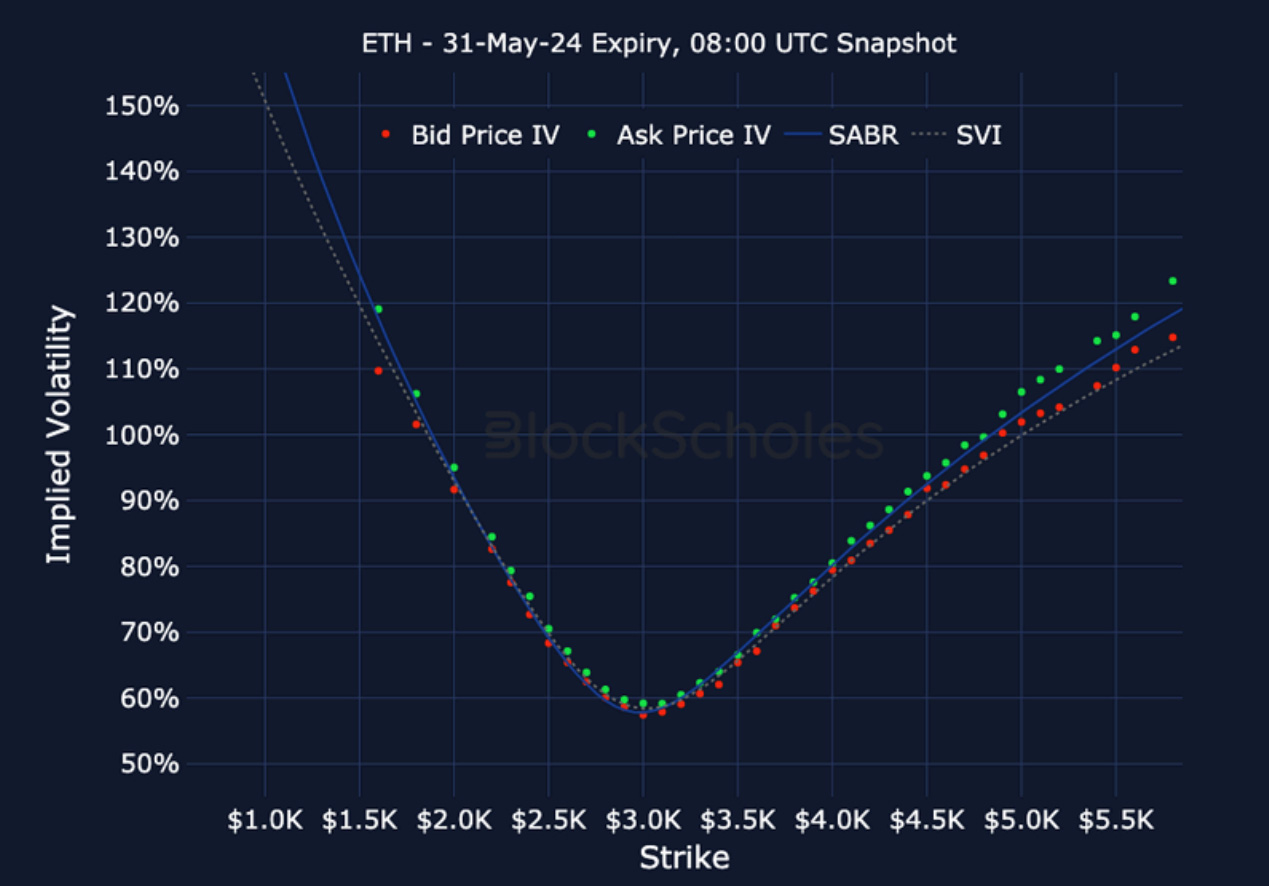

Listed Expiry Volatility Smiles

BTC 31-MAY EXPIRY– 8:00 UTC Snapshot.

ETH 31-MAY EXPIRY – 8:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

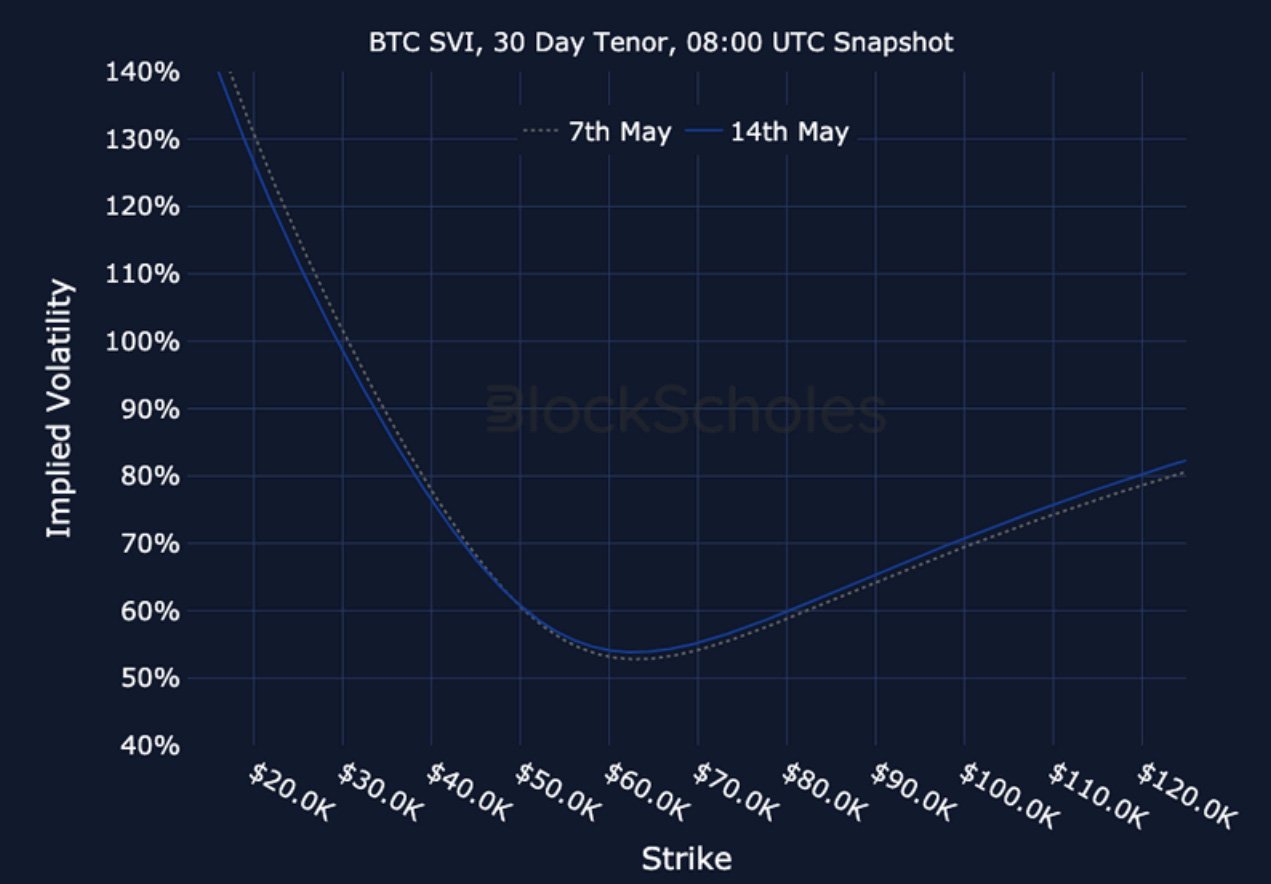

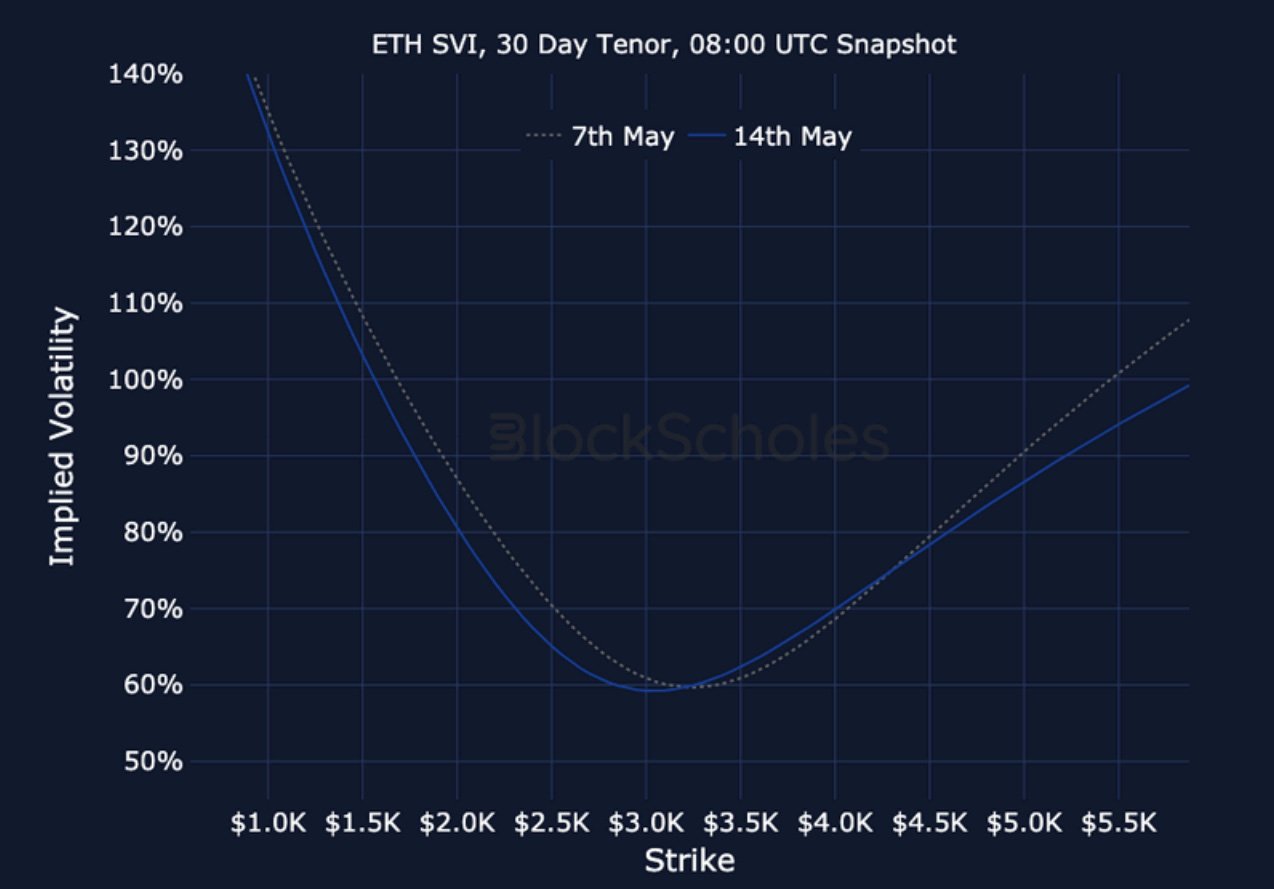

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

AUTHOR(S)