Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

BTC has whipsawed between a range of $101K and $107K over the past week, only 2% shy of the $109K all-time high it reached in mid-January. After a brief drop following the downgrade of US debt by credit agency Moody’s, BTC quickly recovered and has tested the upper bound of that range for two trading sessions in a row. That movement in spot price has resulted in higher short-term volatility expectations, which last week reached their lowest levels since June 2024. BTC derivatives markets continue to support a further move up: perpetual funding rates show a willingness for leveraged long exposure and BTC skew at all tenors maintains a stronger tilt towards OTM calls than ETH’s options markets.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

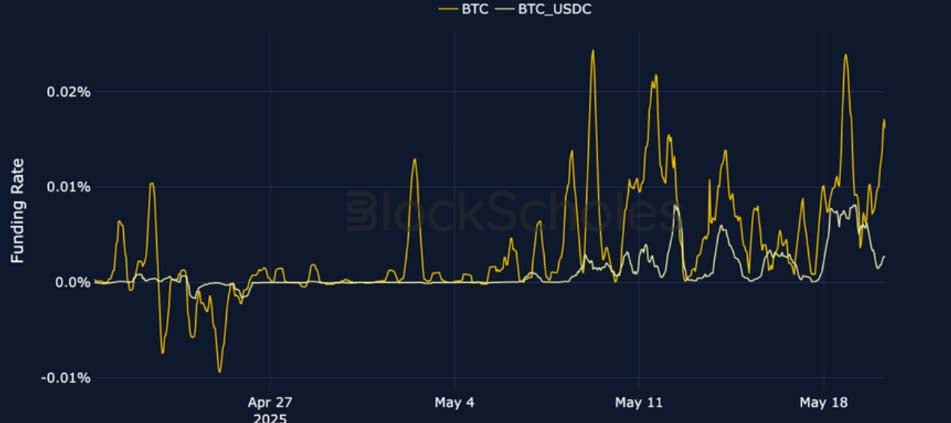

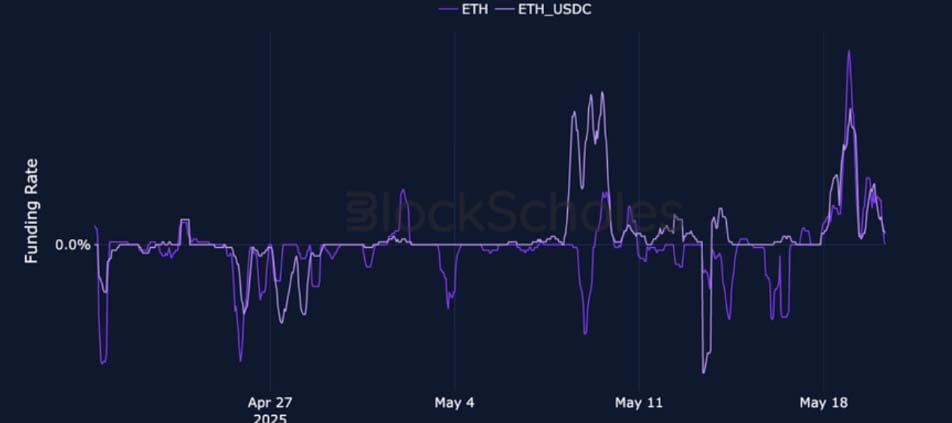

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC funding rates surged yesterday, towards highs for the month, in line with a rally that brought spot price inches away from $107K.

ETH FUNDING RATE – After intermittently dropping below zero over the past week, ETH funding rates briefly spiked at the same time as BTC funding rates.

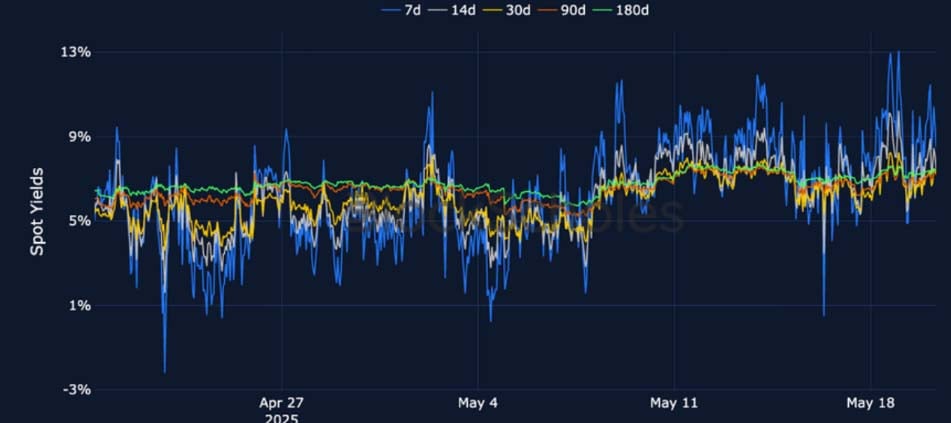

Futures Implied Yields

BTC Futures Implied Yields – BTC’s futures term structure remains inverted, as spot price has whipsawed between $101K and $107K.

ETH Futures Implied Yields – ETH futures yields briefly exceeded levels reached during last week’s 50% spot rally, despite ETH now trading lower.

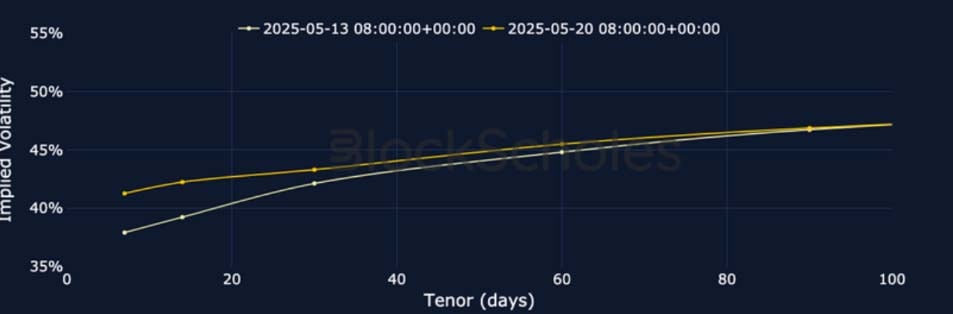

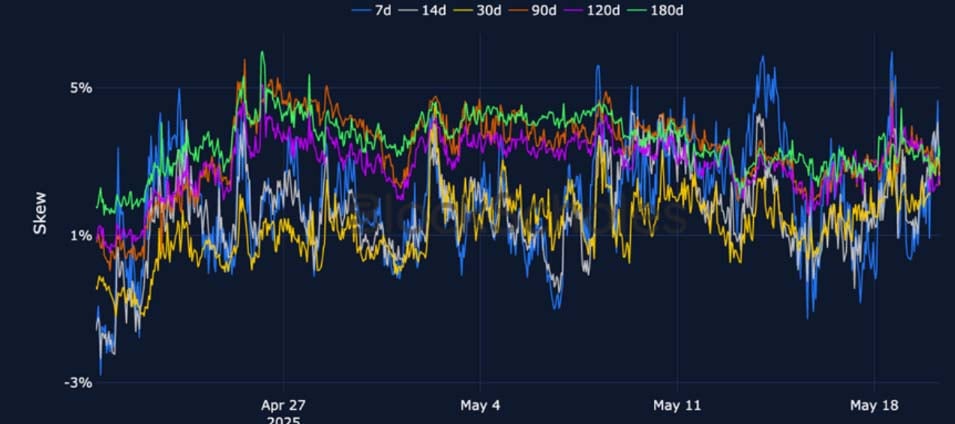

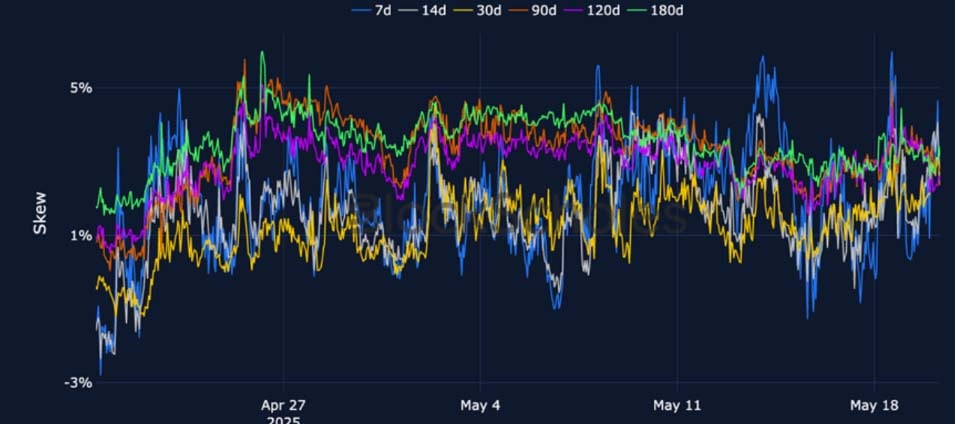

BTC Options

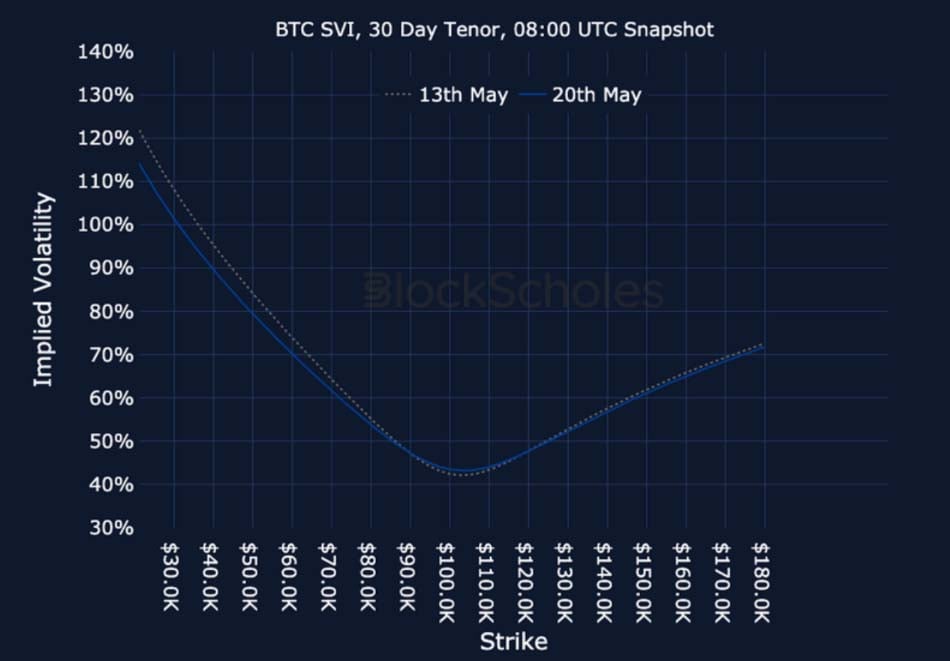

BTC SVI ATM IMPLIED VOLATILITY – Short-term volatility expectations have increased over the past seven days, as BTC spot trades 2% away from ATHs.

BTC 25-Delta Risk Reversal – Short-tenor smiles now have a stronger skew towards towards OTM calls than ETH options at a similar tenor.

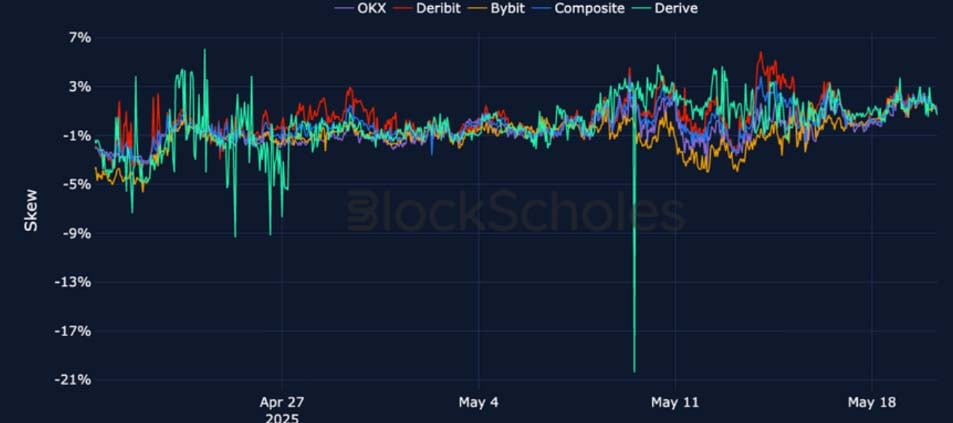

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Volatility expectations remain elevated even after last week’s rally in ETH has slowed down.

ETH 25-Delta Risk Reversal – ETH’s 25-delta risk reversal has relented significantly from a strong bullish tilt for call optionality to levels closer to neutral.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

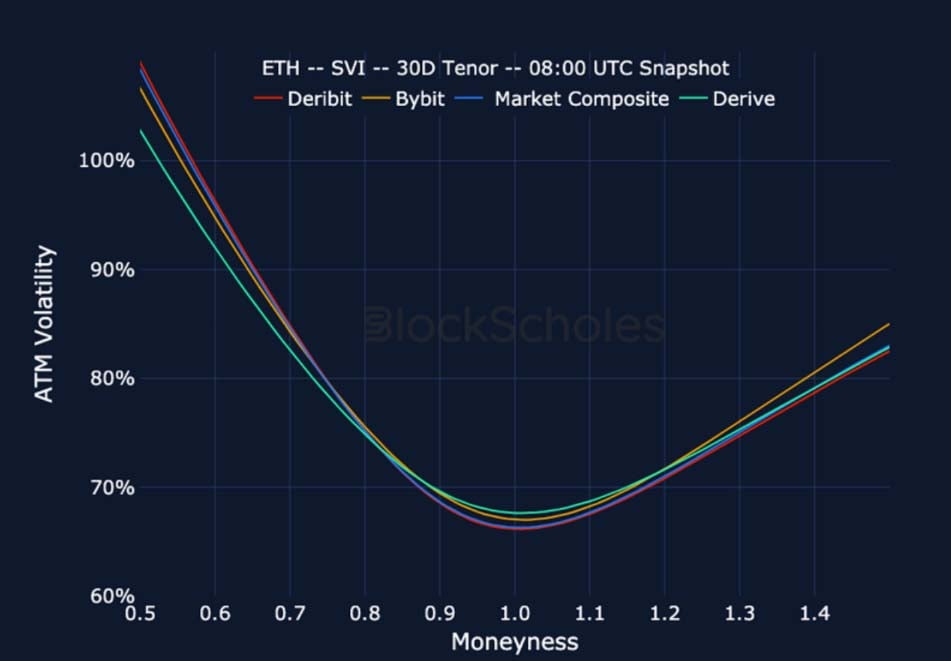

ETH, 1-MONTH TENOR, SVI CALIBRATION

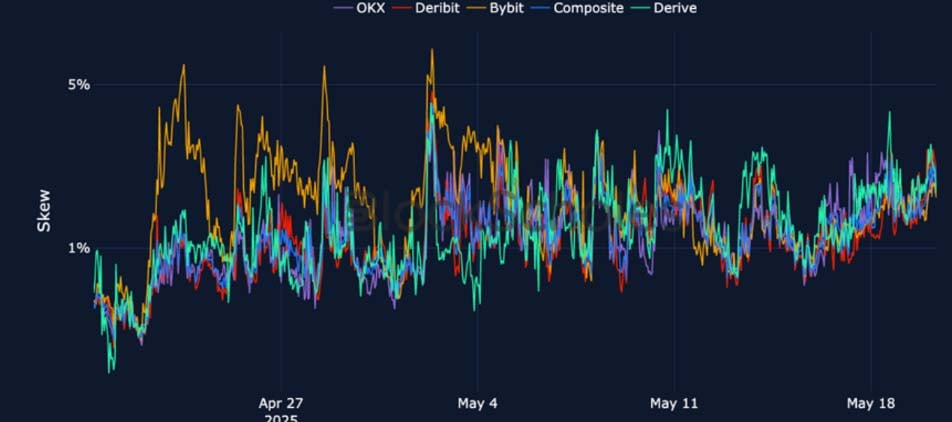

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

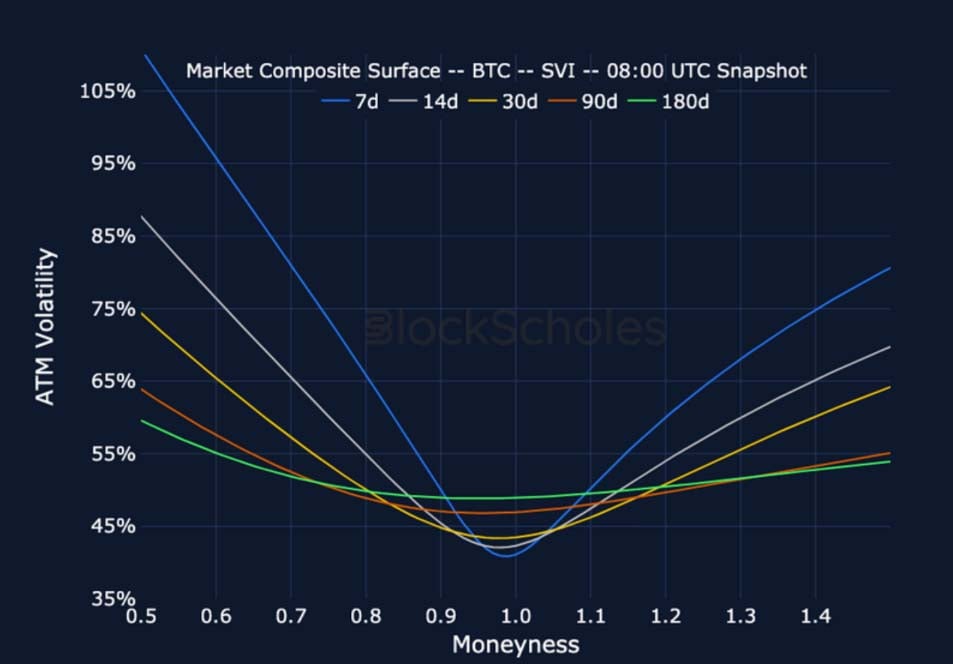

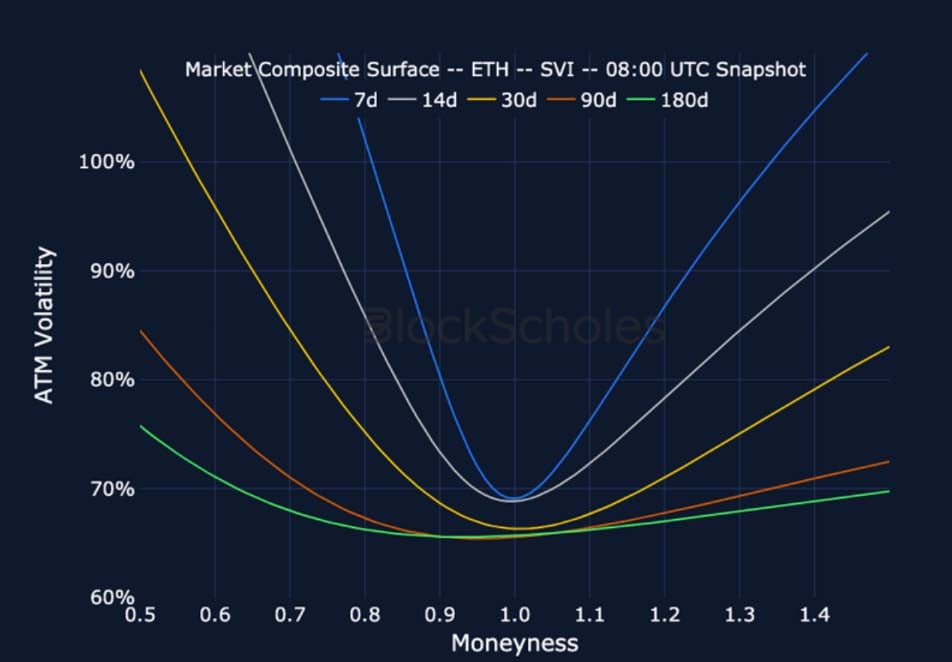

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

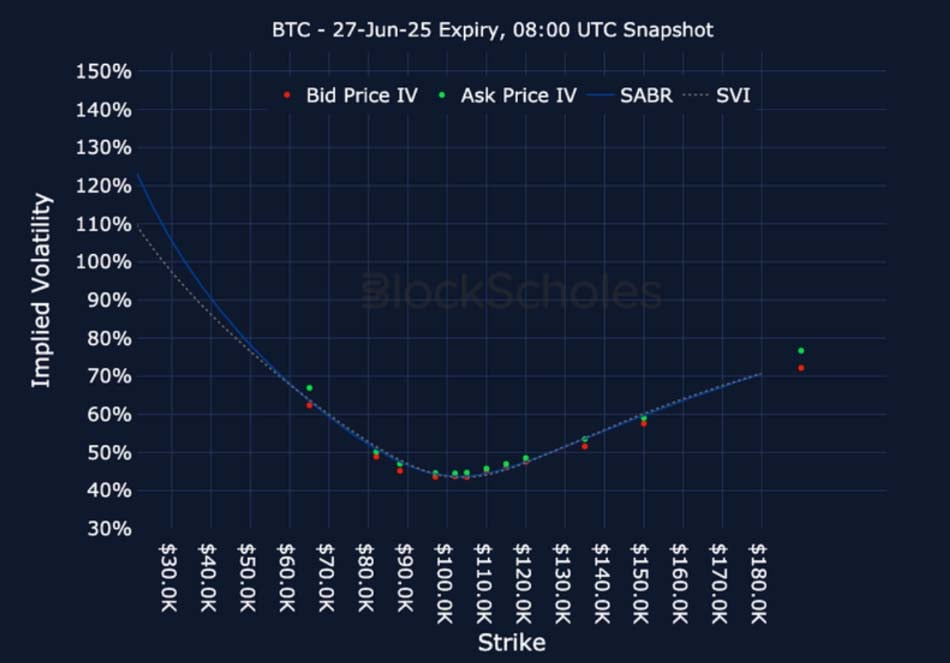

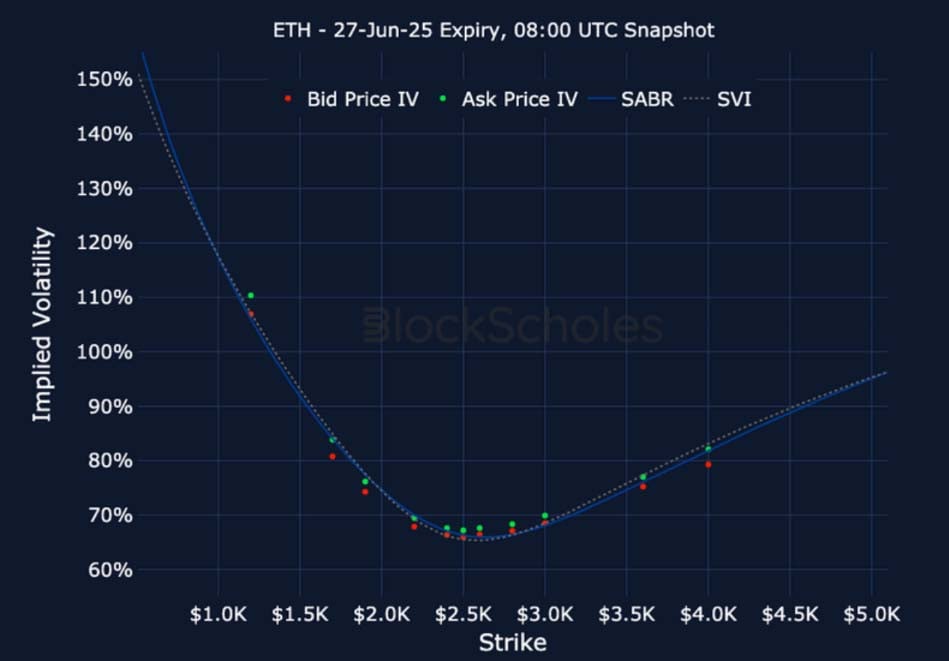

Listed Expiry Volatility Smiles

BTC 27-JUN EXPIRY – 9:00 UTC Snapshot.

ETH 27-JUN EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)