Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

A large increase in realised volatility as a result of the SEC’s lawsuits against Coinbase and Binance did not see an inspired increase in ATM implied volatility for either BTC or ETH. The options markets of both assets continue to price volatility near to the lower bound of their historic range. The consistently high rate paid from long to short holds of perpetual swaps indicates that traders are, in aggregate, still willing to pay for long exposure to the two largest crypto-assets.

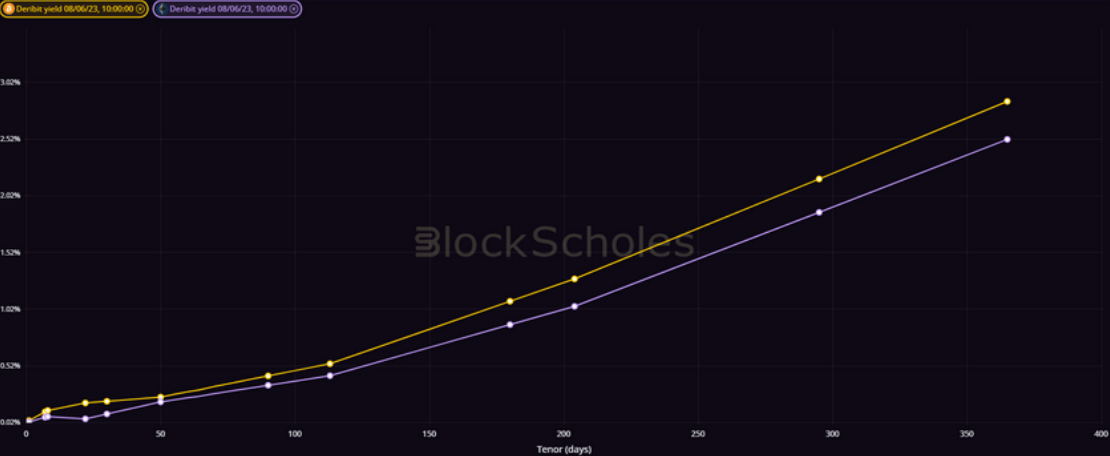

FUTURES IMPLIED YIELD TERM STRUCTURE.

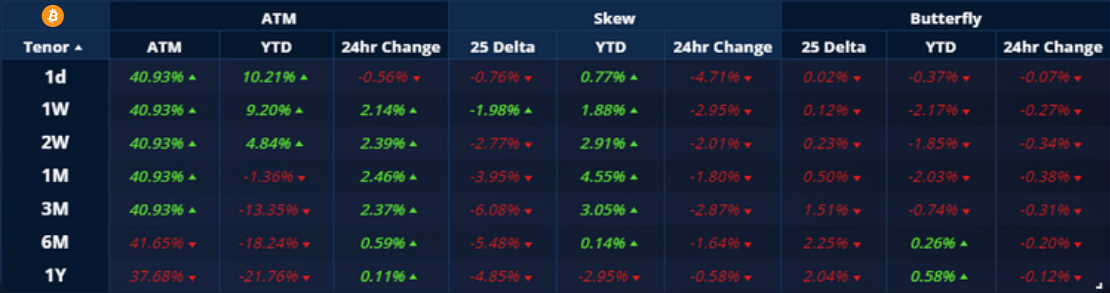

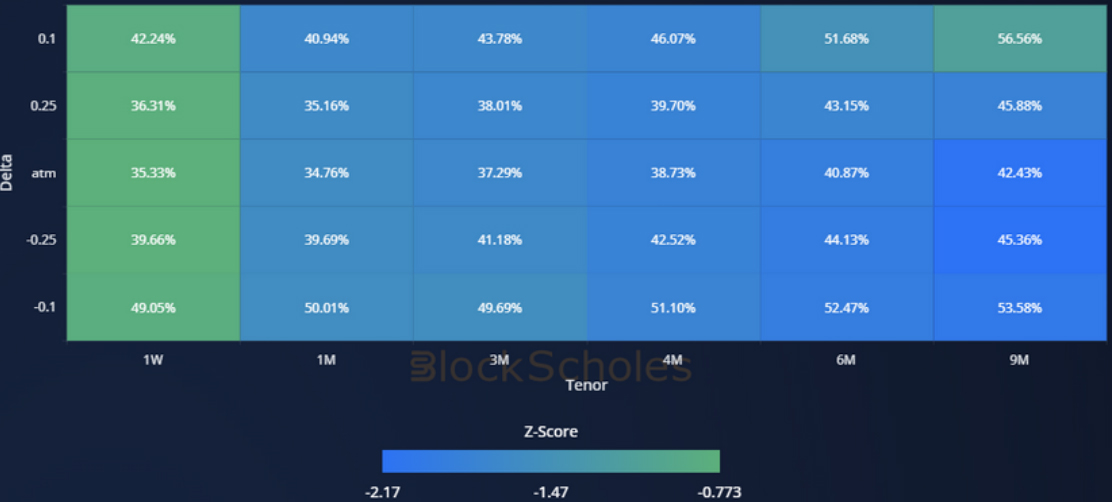

VOLATILITY SURFACE METRICS.

All data in tables are recorded at a 10:00 UTC snapshot unless otherwise stated.

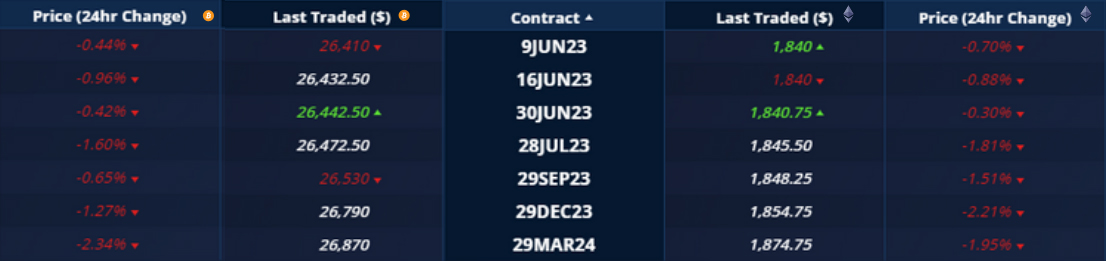

Futures

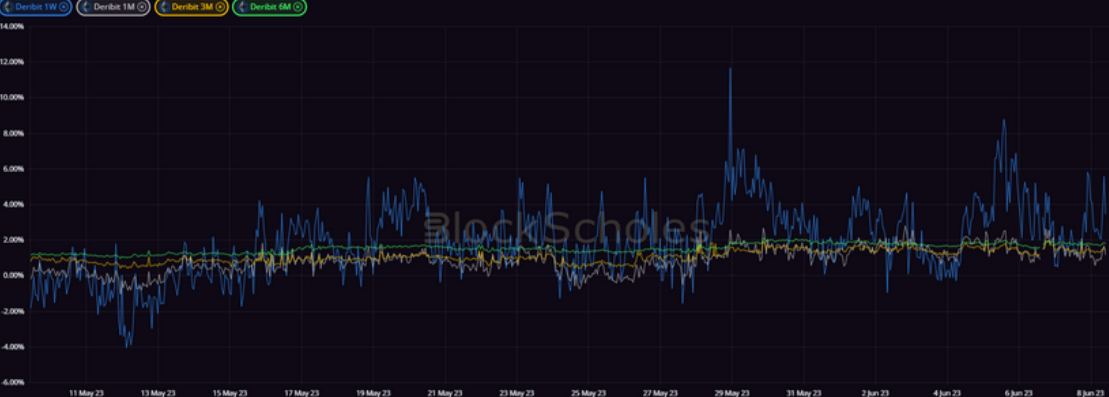

BTC ANNUALISED YIELDS – last week’s positive spike for yields at short tenors continued, expressing a continuation of bullish sentiment.

ETH ANNUALISED YIELDS – have traded positively at short tenors with higher volatility than BTC’s.

Perpetual Swap Funding Rate

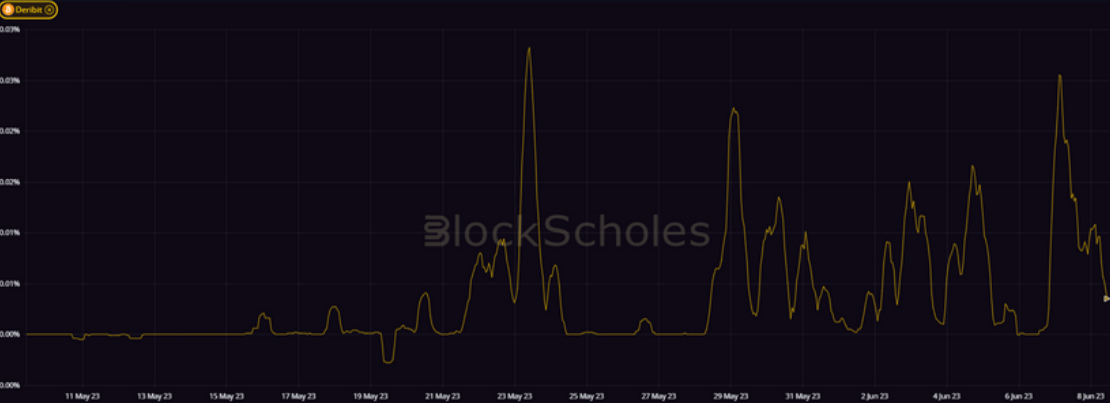

BTC FUNDING RATE – remains positive, indicating that long positions are still willing to pay for their long exposure via the perpetual swap.

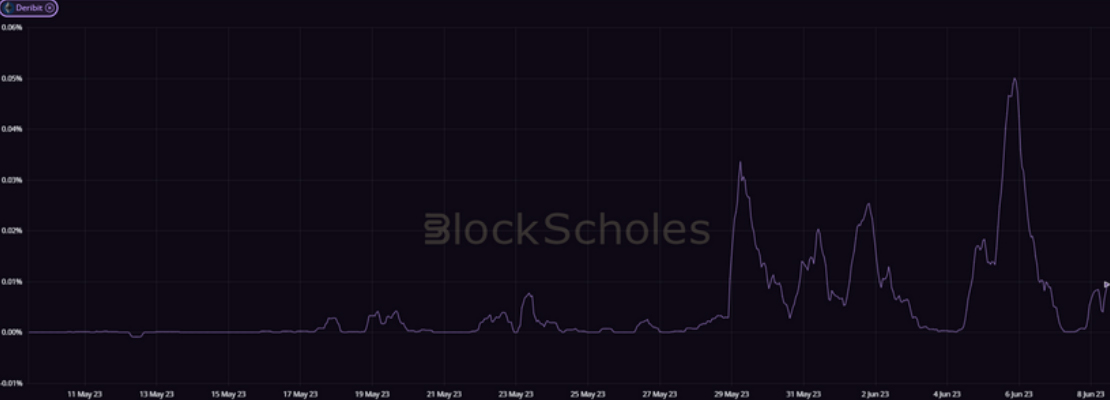

ETH FUNDING RATE – reflects a similar demand for long exposure through the swap contract that has trended lower in recent days.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has trended upwards over the last week of high realised volatility, but remains at historically low levels.

BTC 25-Delta Risk Reversal – have reversed a brief trend towards a neutral volatility smile to settle at a distinct skew towards OTM puts.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – remains near historically low levels despite increased realised volatility over the last week.

ETH 25-Delta Risk Reversal – remains negative across the term structure, reflecting a distinct preference for downside protection.

Volatility Surface

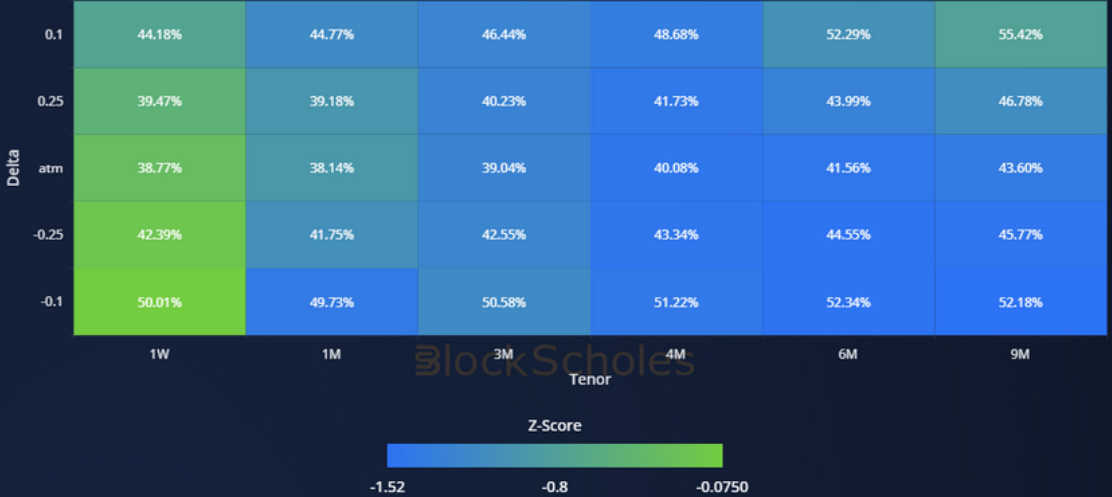

BTC IMPLIED VOL SURFACE – despite the short-lived increase in implied volatility, levels are still historically low across the surface.

ETH IMPLIED VOL SURFACE – reflects the strong downwards momentum of volatility that we have observed for some months.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

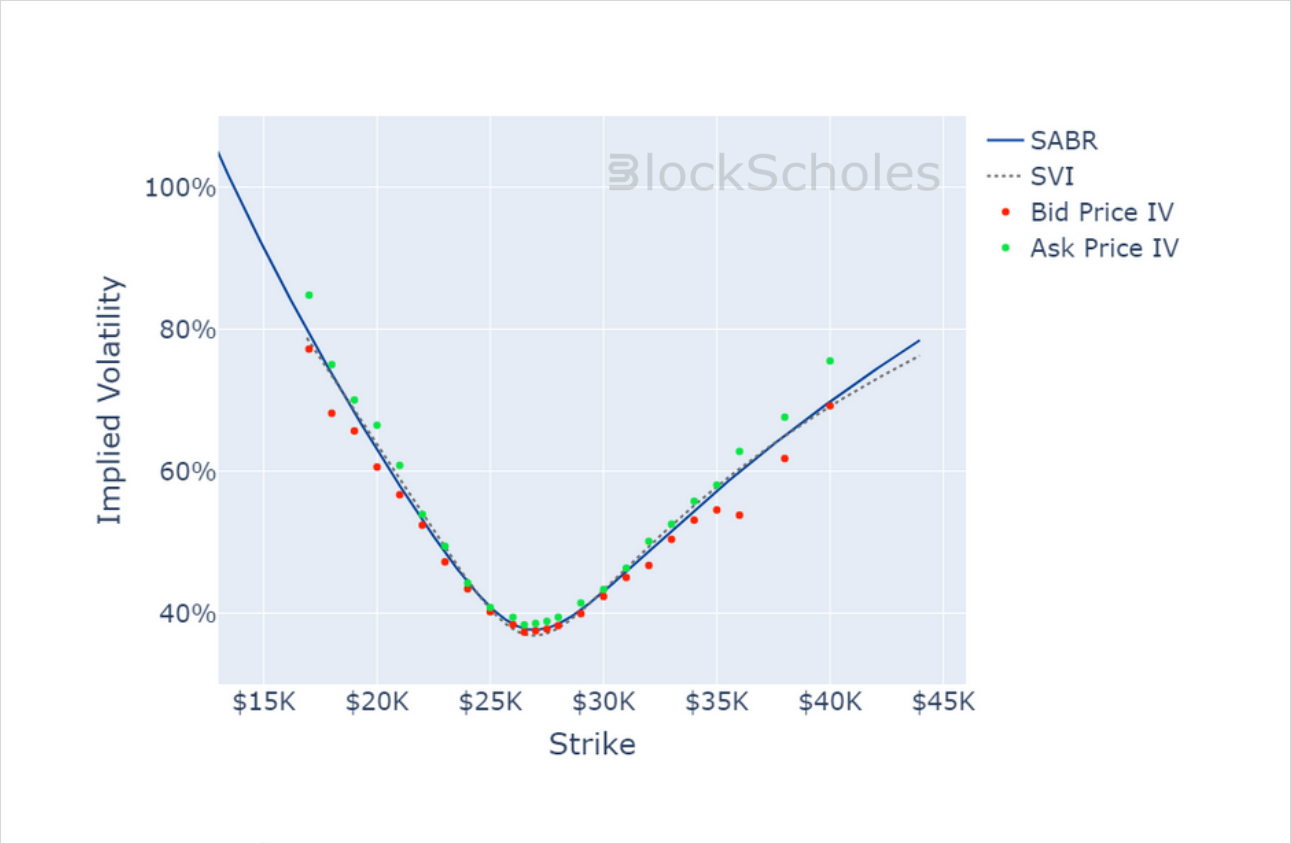

Volatility Smiles

BTC SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

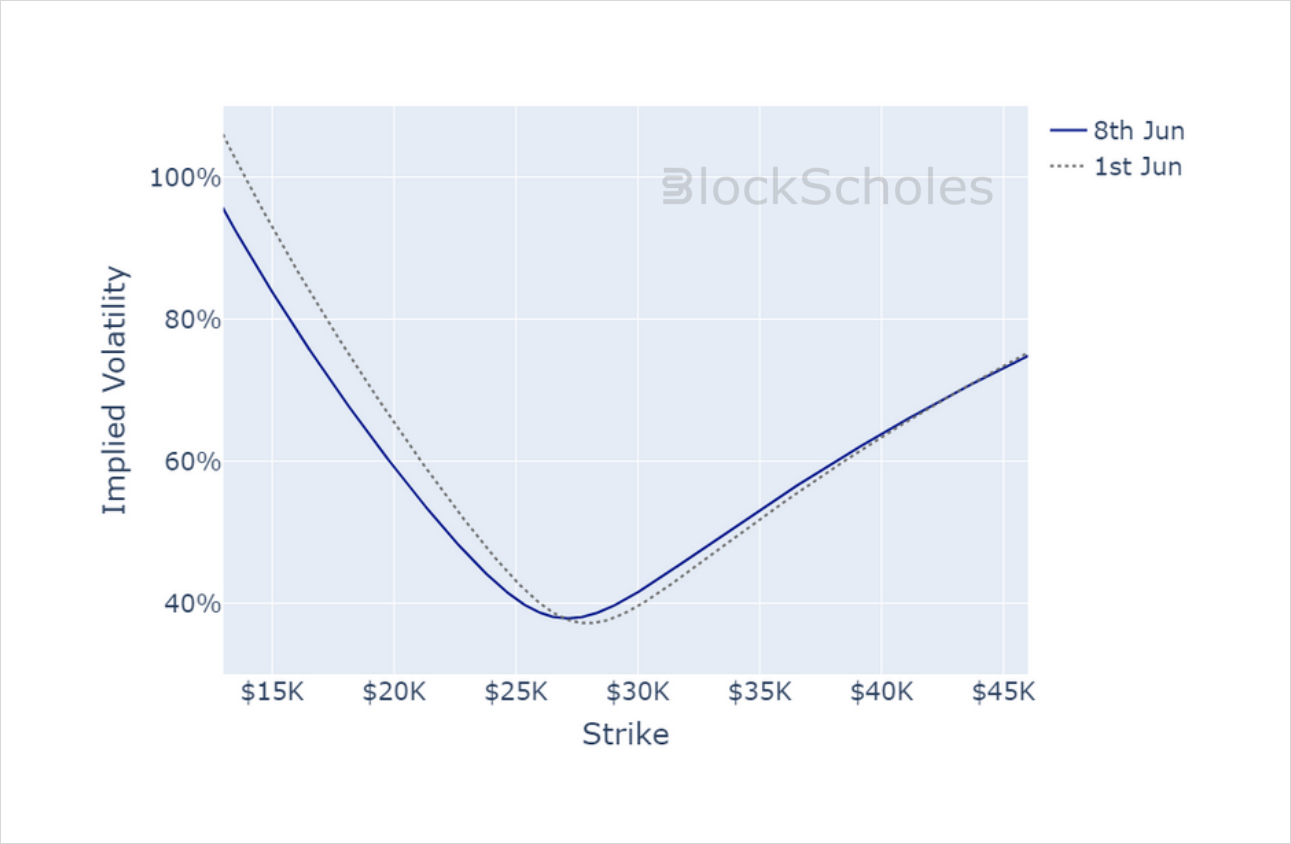

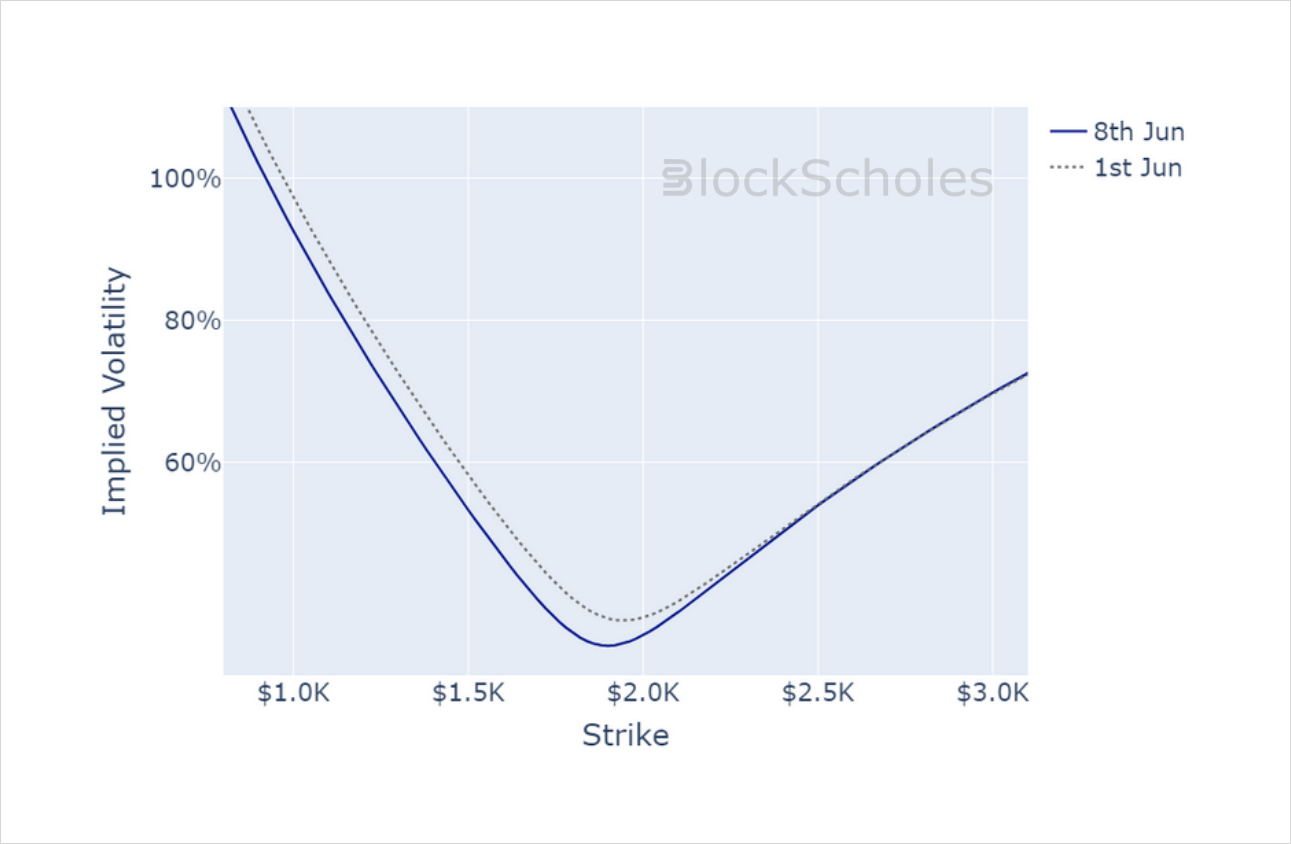

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)