Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

As spot prices trade at their lowest levels since early May, we see a stark divergence in the sentiment priced in by BTC and ETH options markets. ETH continues to trade with a 10-15 volatility premium across the term structure, and the most recent move lower in spot prices has seen BTC vol smile skew turned decidedly bearish at short tenors while ETH smiles skew neutral or towards calls at all tenors. While the fall in future-implied yields has recovered to last weeks levels, funding rates in the two majors have repeatedly charged short positions since the 9th June — a phenomenon that we observe across perpetual- swap markets.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

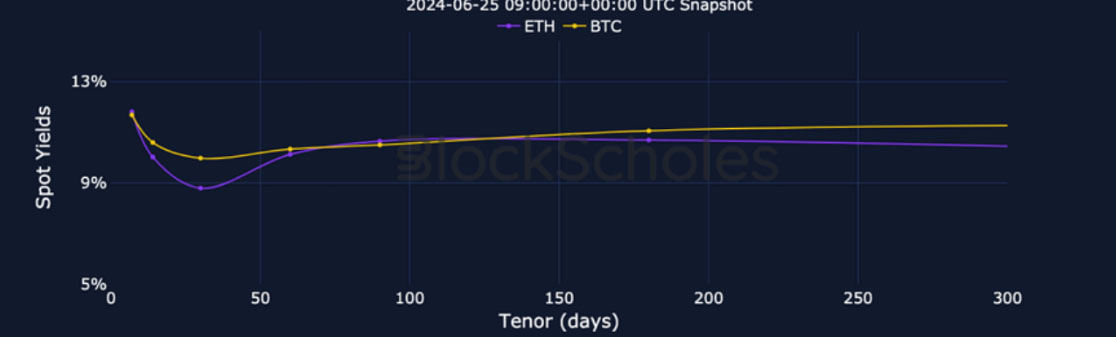

Futures

BTC ANNUALISED YIELDS – yields have recovered the levels they lost in the last 3 days with a pickup in short-dated futures.

ETH ANNUALISED YIELDS – trade in a tight range across the term structure between 9% and 13% at an annualised rate.

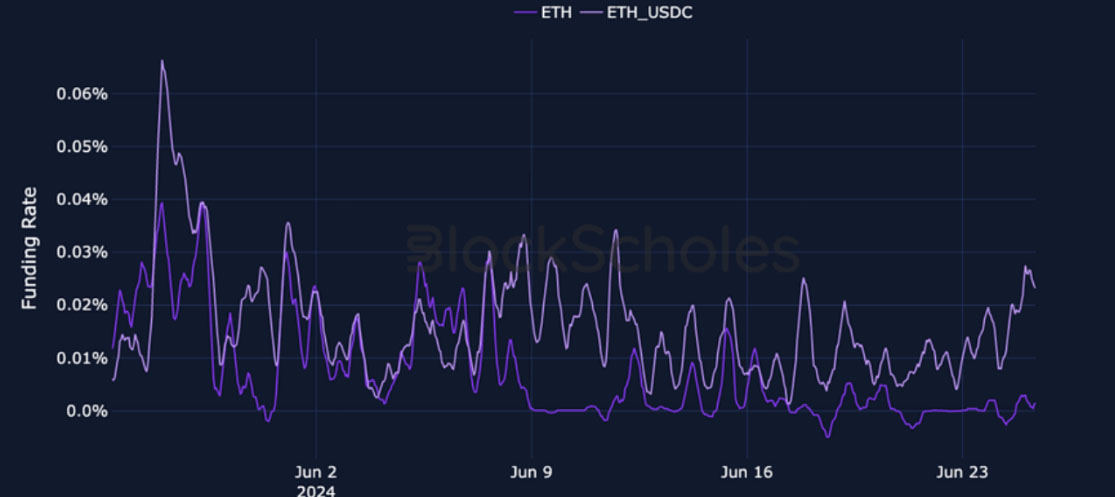

Perpetual Swap Funding Rate

BTC FUNDING RATE – funding rates continue to dip periodically negative after the fall in long leverage in perps on the 9th June.

ETH FUNDING RATE – does not show the same negative bias that we see in BTC perps, with the less liquid USDC-margined token trending higher close to 0.03%.

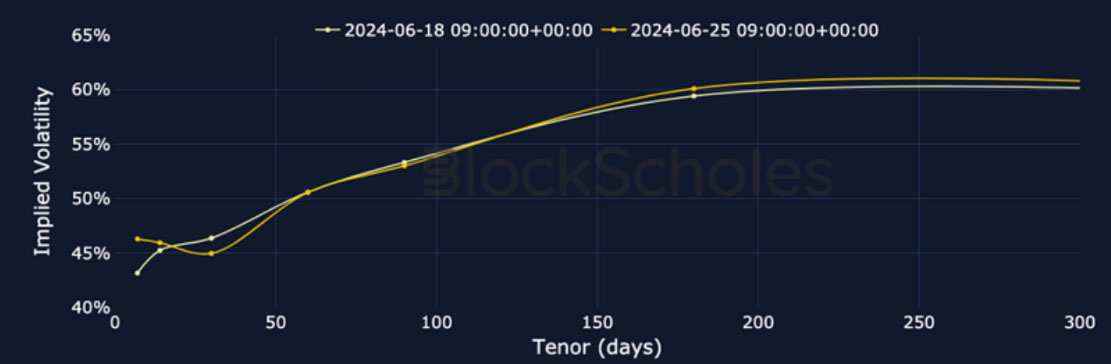

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – we see a strong rally in front-end volatility, resulting in a flattening in the vol term structure.

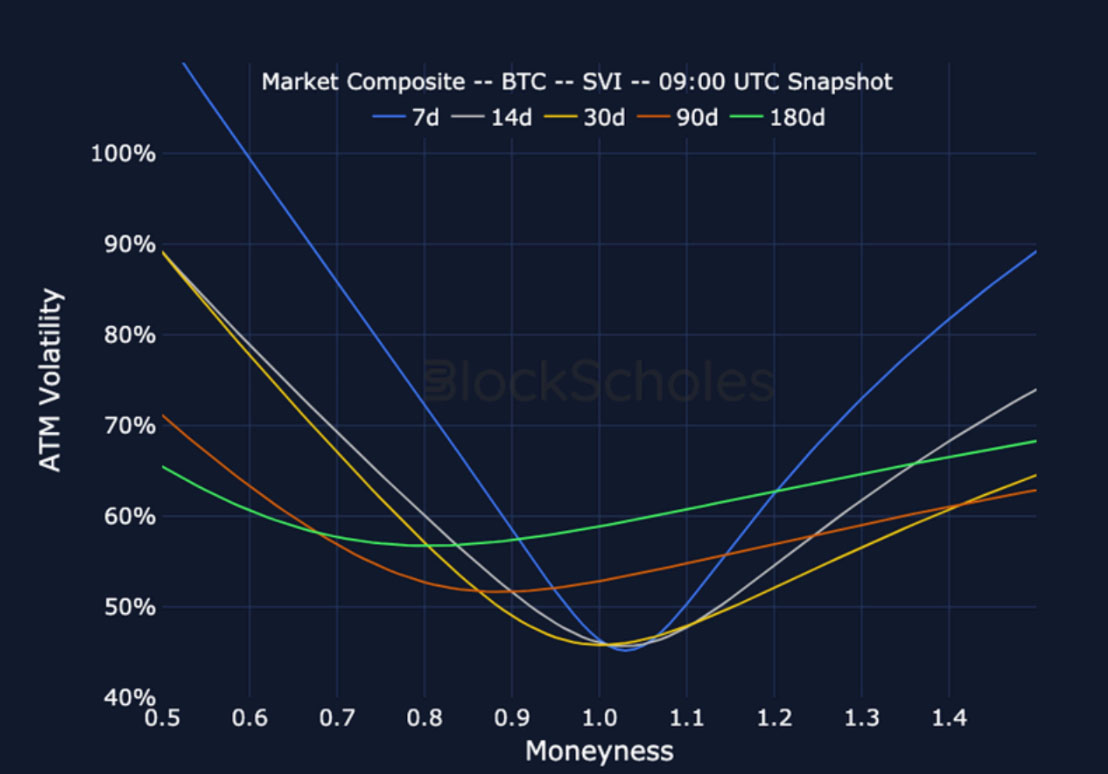

BTC 25-Delta Risk Reversal – short tenor vol smiles has skewed towards OTM calls while tenors longer than 30 days retain their bullish skew.

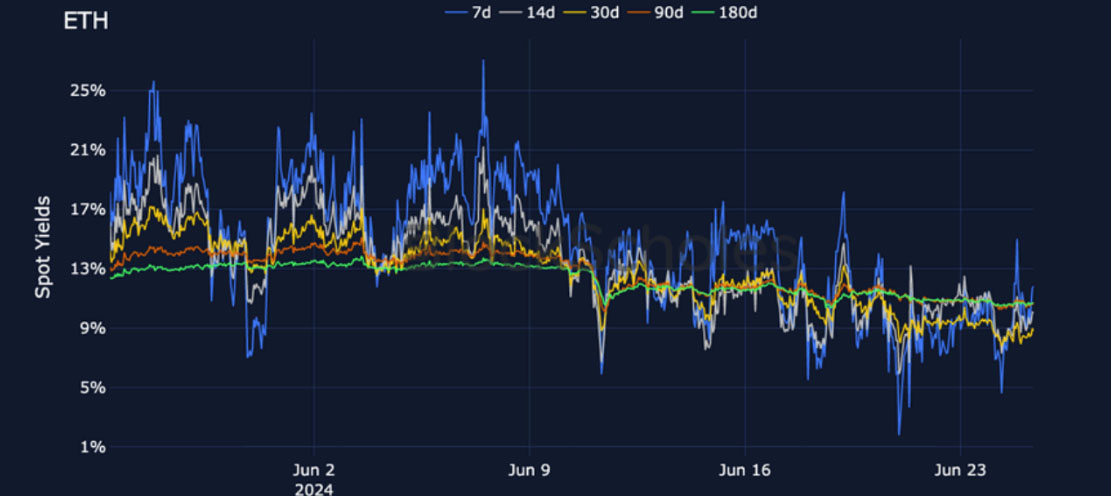

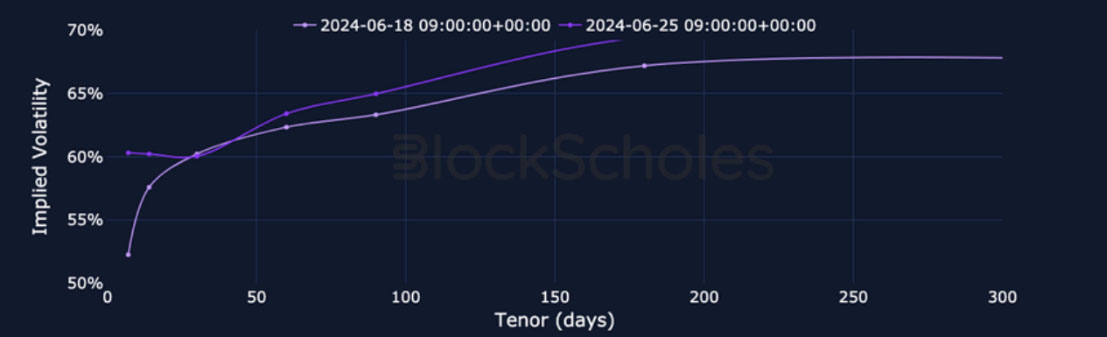

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH sees the same increase in short- dated volatility as BTC, while trading at a 10-15 point premium.

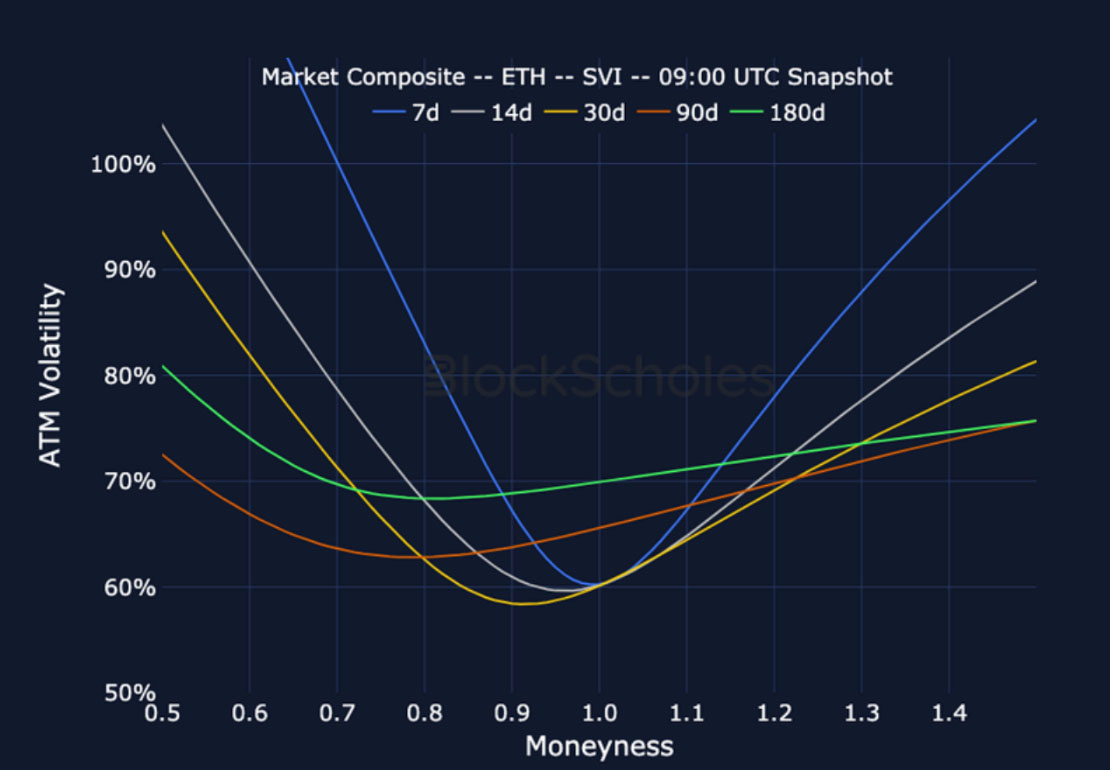

ETH 25-Delta Risk Reversal – ETH smiles trade with a skew towards OTM calls at all tenors in contrast to the bearish positioning we have seen develop over the last three days in BTC’s markets.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

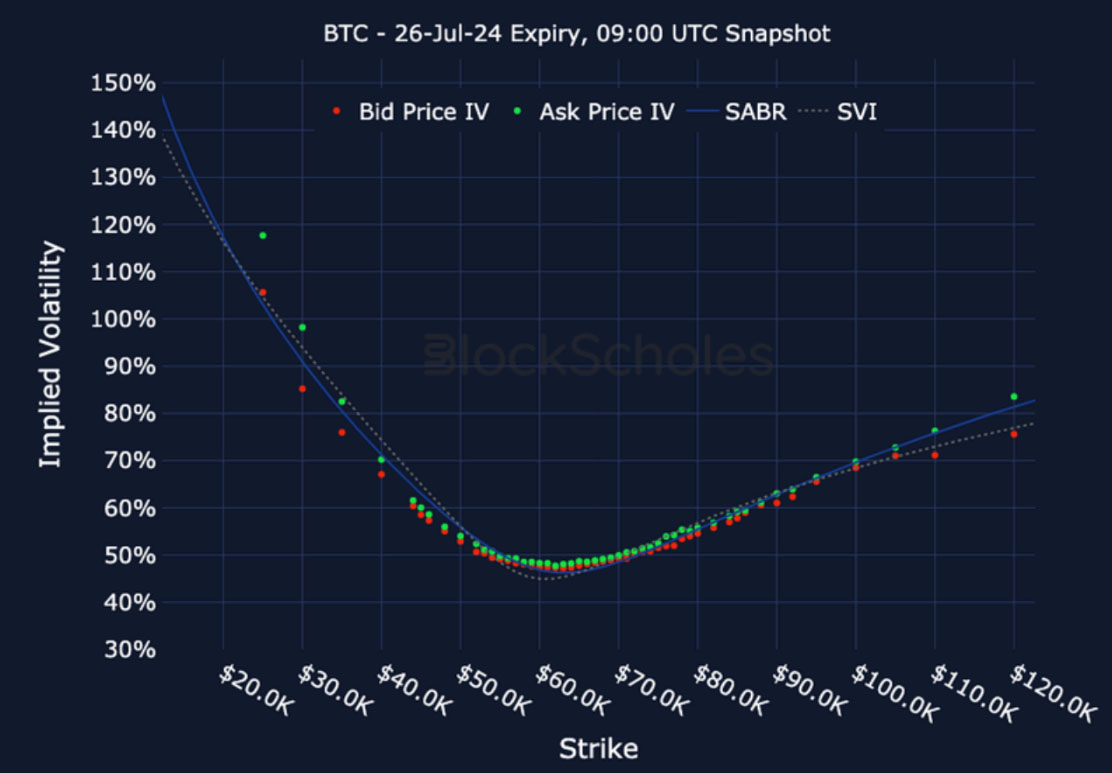

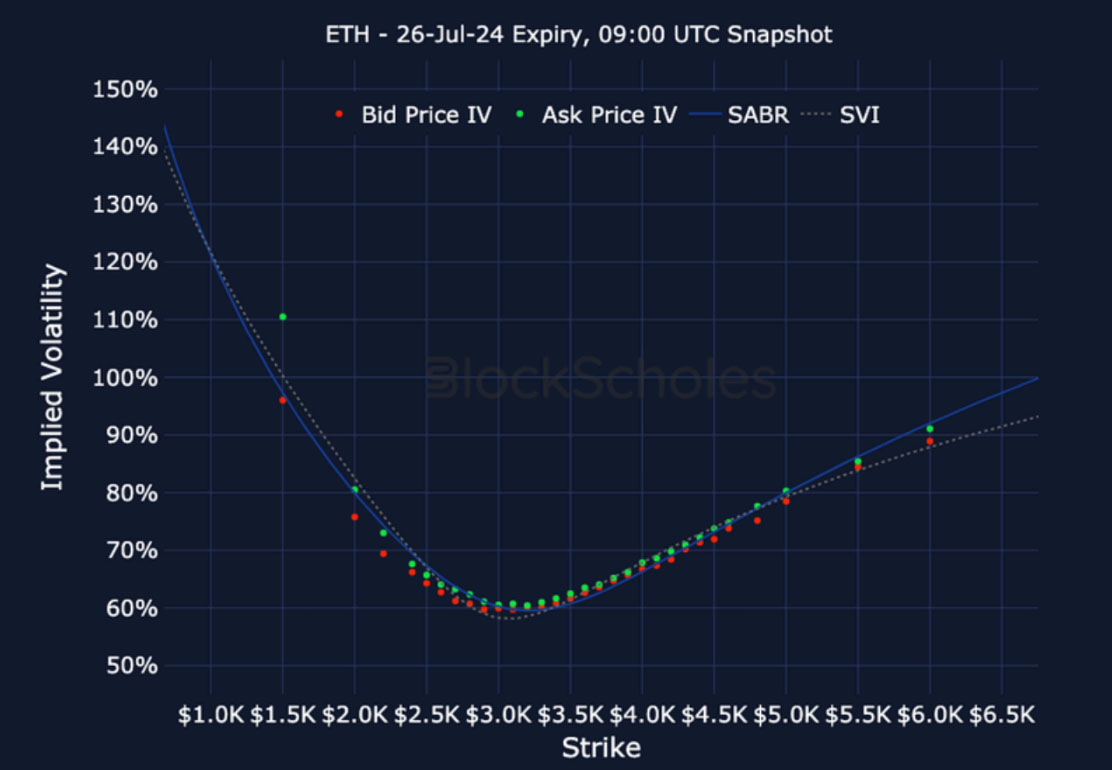

Listed Expiry Volatility Smiles

BTC 26-JUL EXPIRY– 9:00 UTC Snapshot.

ETH 26-JUL EXPIRY – 9:00 UTC Snapshot.

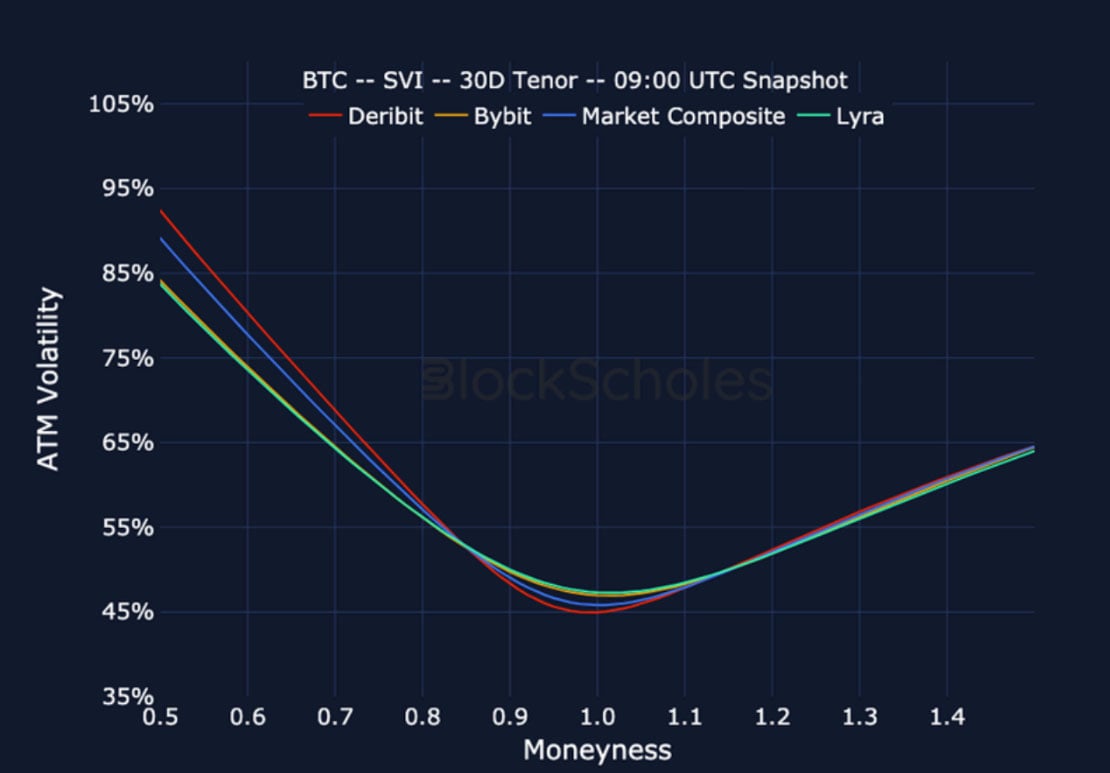

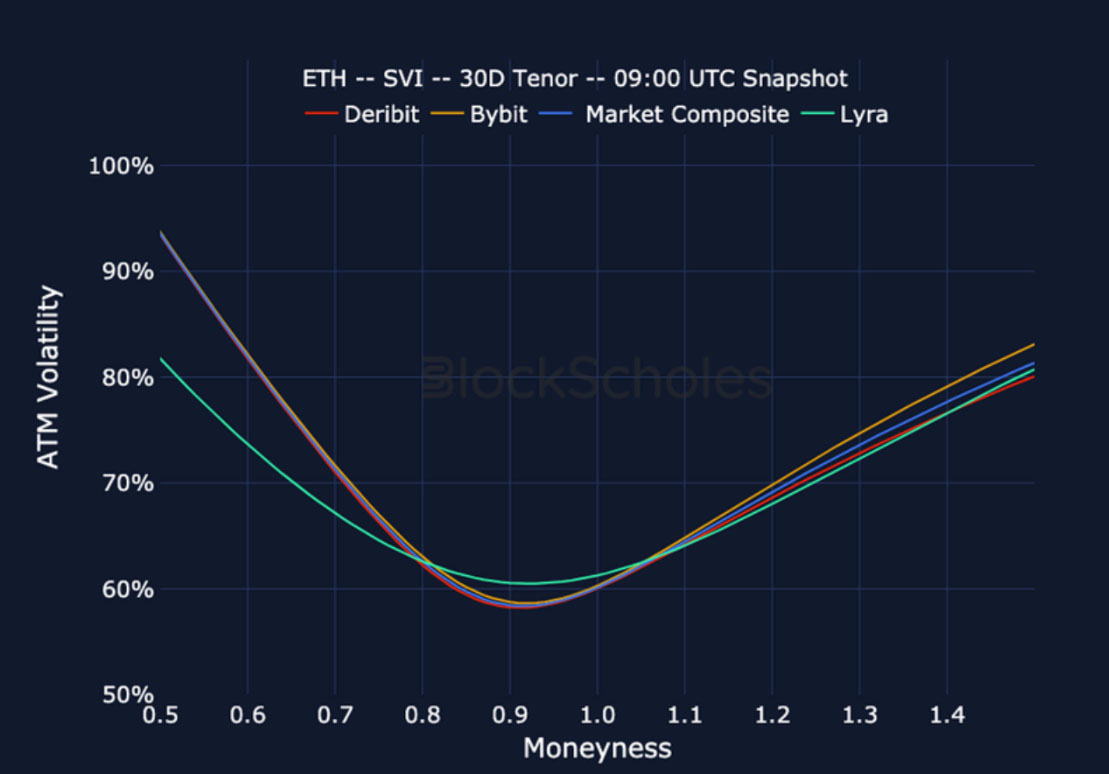

Cross-Exchange Volatility Smiles

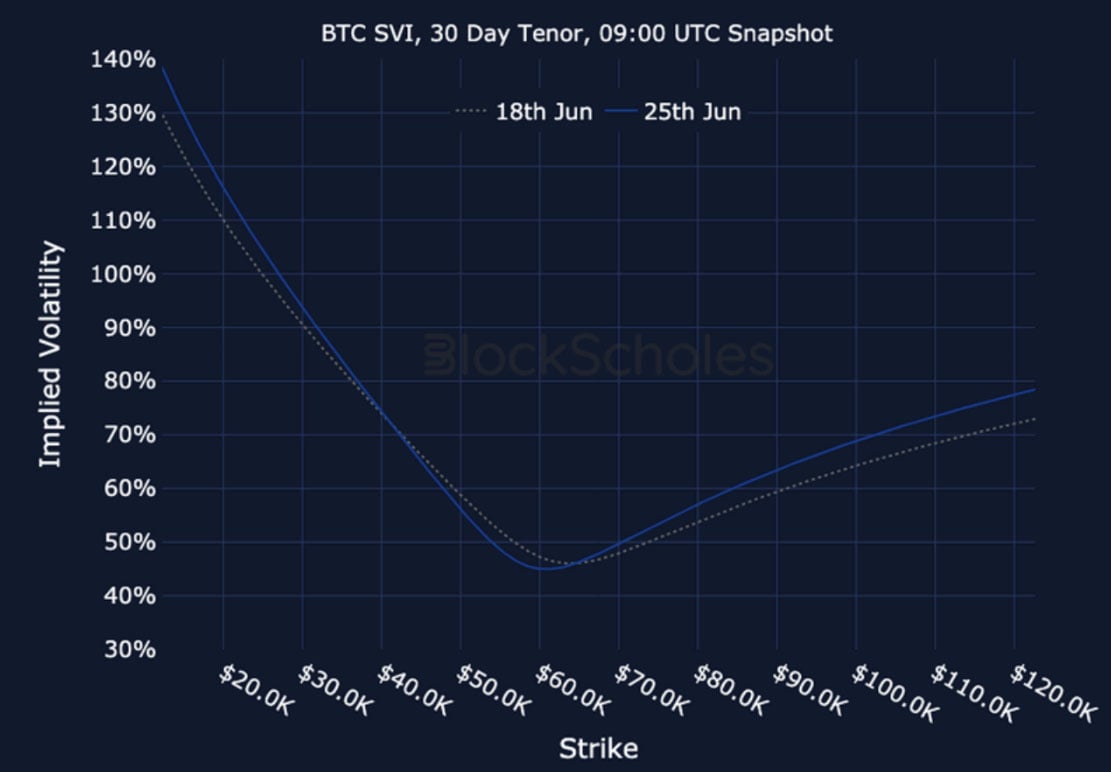

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

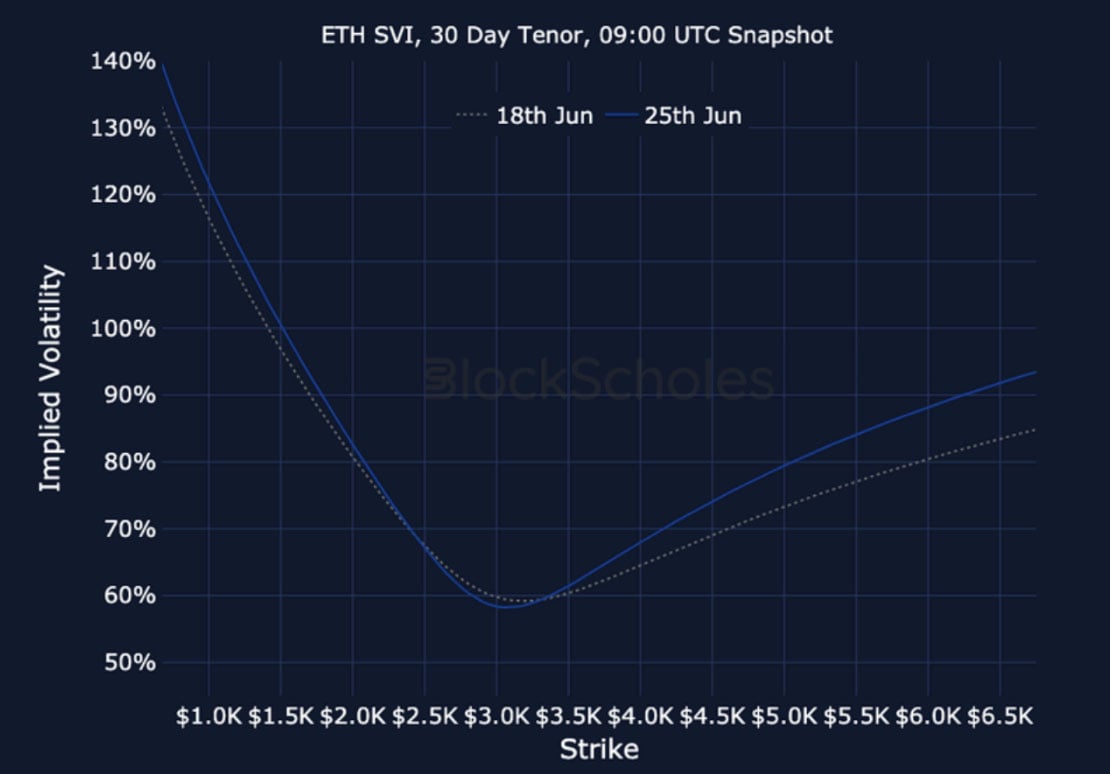

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)