Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The past three days has seen the US militarily join Israel in its conflict against Iran, bombing three key Iranian nuclear sites. That sent BTC below $100K for the first time since early-May, flattening its term structure of volatility as front-end volatility jumped to 45%. ETH spot price fell to its lowest intraday level since May 9, and short-tenor options led the move in implied volatility, resulting in a term structure inversion which has yet to be resolved fully. Iran retaliated yesterday afternoon which initially sent markets lower once more – though it was later revealed to be a de-escalatory reaction with advance notice to Washington. That then sent markets soaring, a rally extended further by President Trump announcing an official ceasefire between Iran and Israel. BTC now currently trades at $105K.

Futures Implied Yields

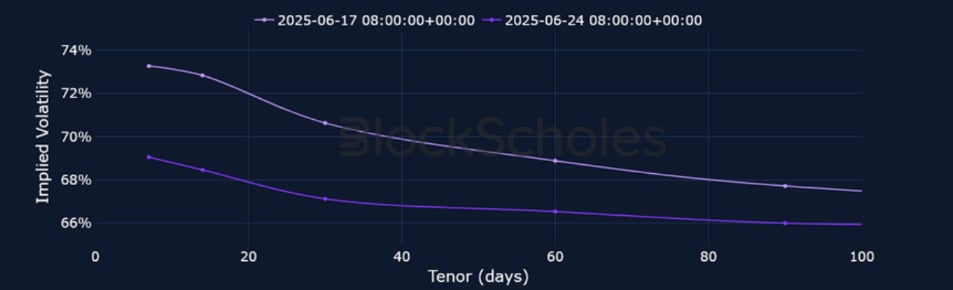

1-Month Tenor ATM Implied Volatility

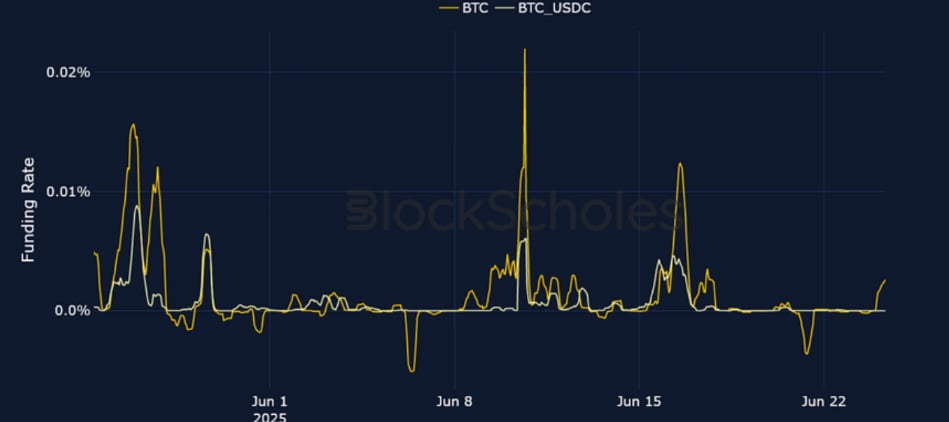

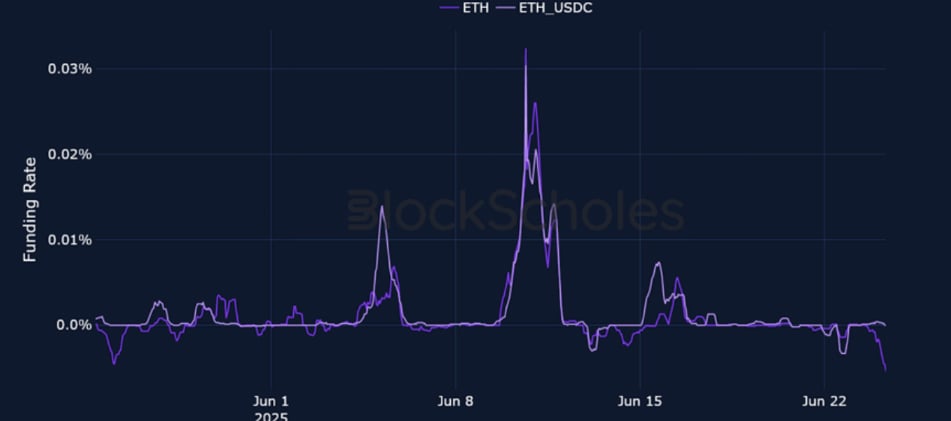

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding turns meaningfully positive for the first time since June 17, as BTC spot (now at $105K) recovers from a plunge to $98K.

ETH FUNDING RATE – The more bearish sentiment in ETH options is also apparent in perp funding rates, which have dropped to -0.005%.

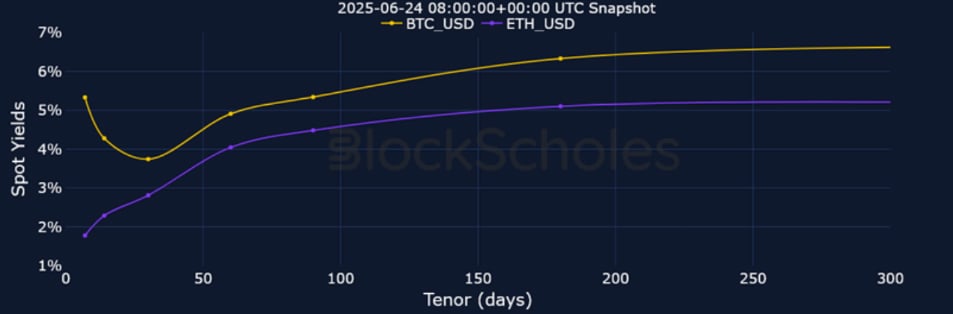

Futures Implied Yields

BTC Futures Implied Yields – 7-day BTC futures yields are more than 3x higher than the equivalent tenor ETH yield, which is at 1.77%.

ETH Futures Implied Yields – ETH futures-implied yields did not drop significantly negative despite Iran’s retaliatory strikes against the US.

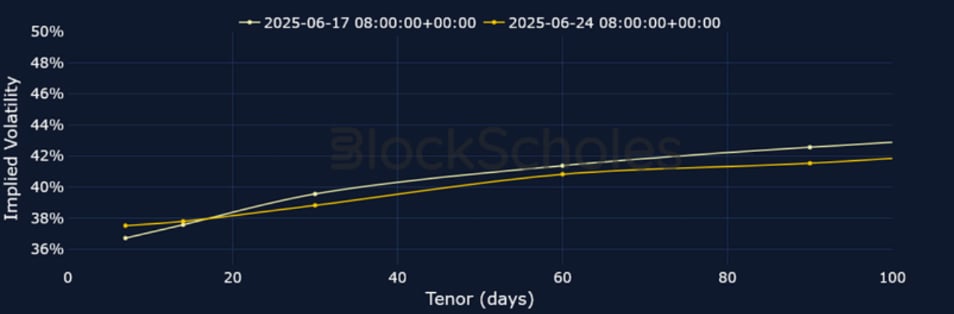

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – After a brief flattening of the term structure yesterday, the volatility curve is once more upward sloping.

BTC 25-Delta Risk Reversal – With the recovery back above $100K, BTC front- end skew has abated most of its bearish preference for OTM puts.

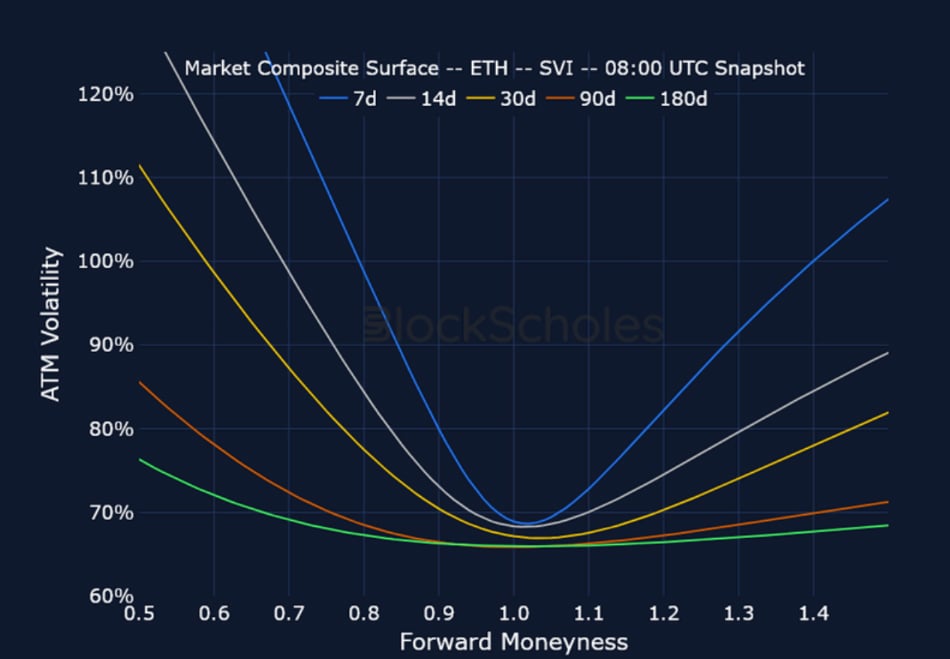

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure still contrasts that of BTC – inverted, though at lower outright levels than last week.

ETH 25-Delta Risk Reversal – ETH short-tenor smiles skewed as much as 15% towards OTM puts when Trump announced US strikes on three key Iranian nuclear sites – though that has now abated to a 3% skew towards OTM puts.

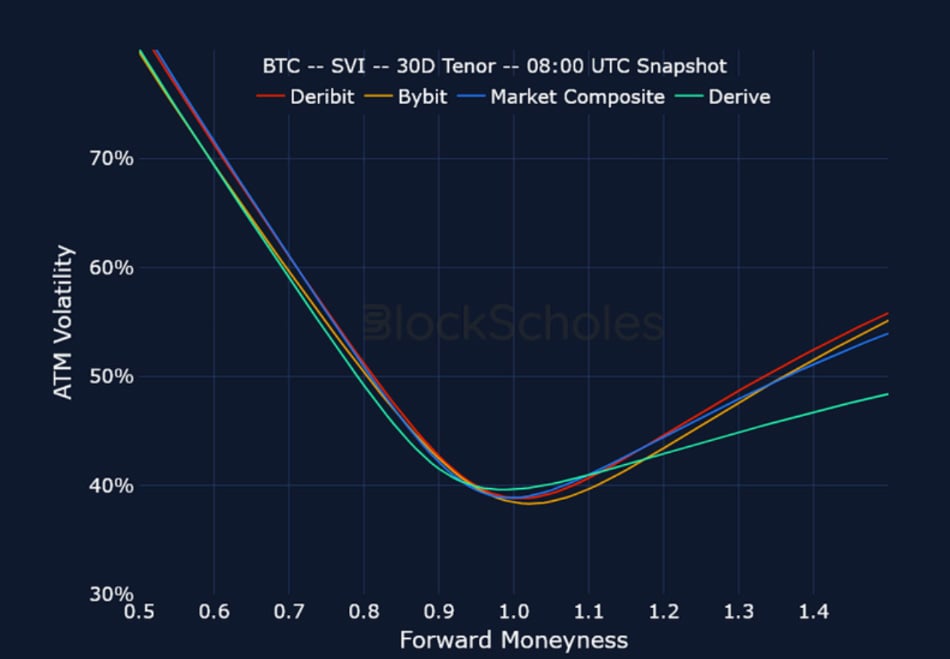

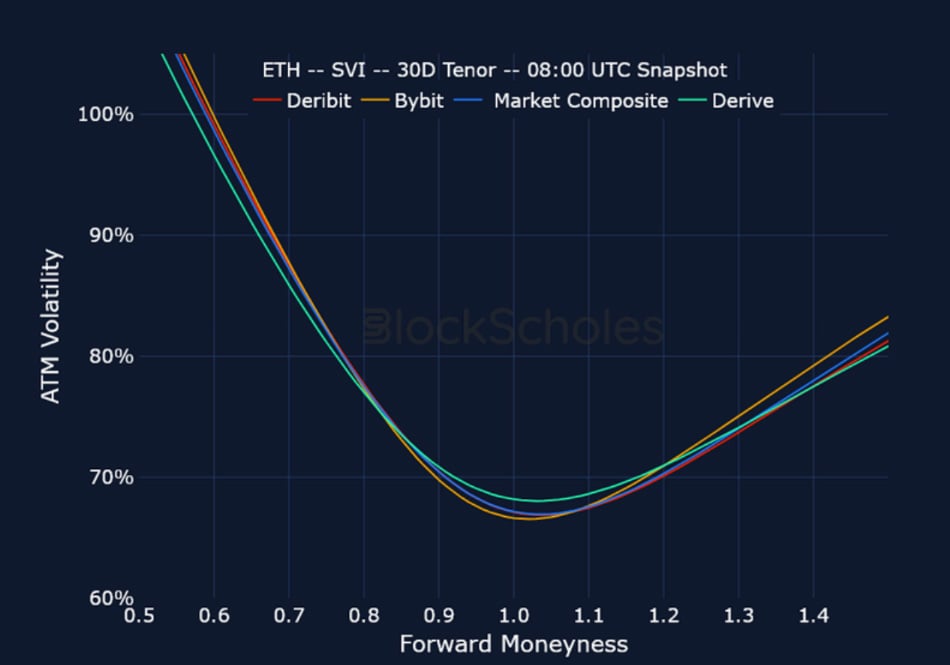

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

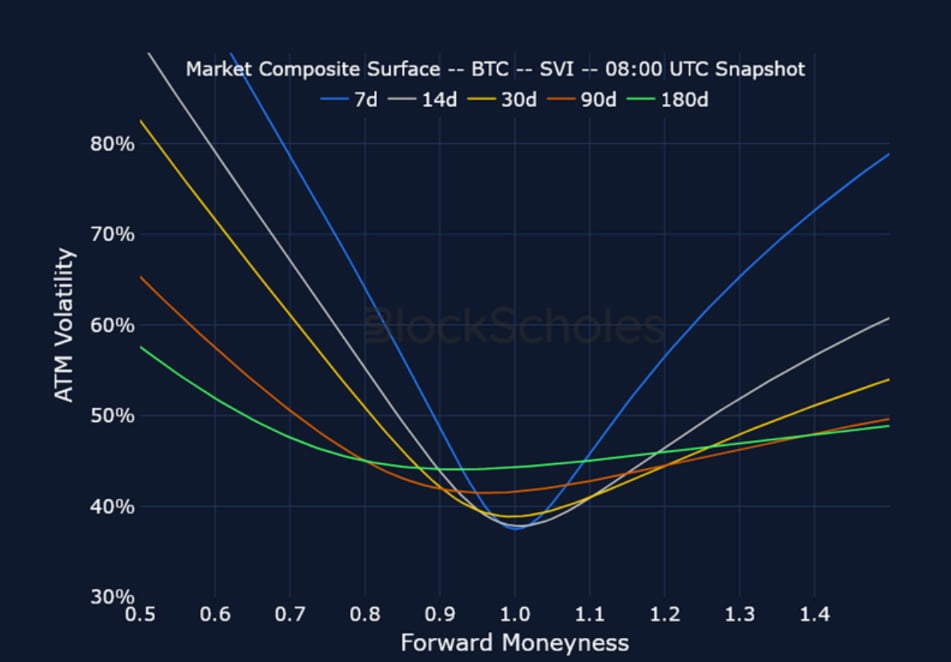

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

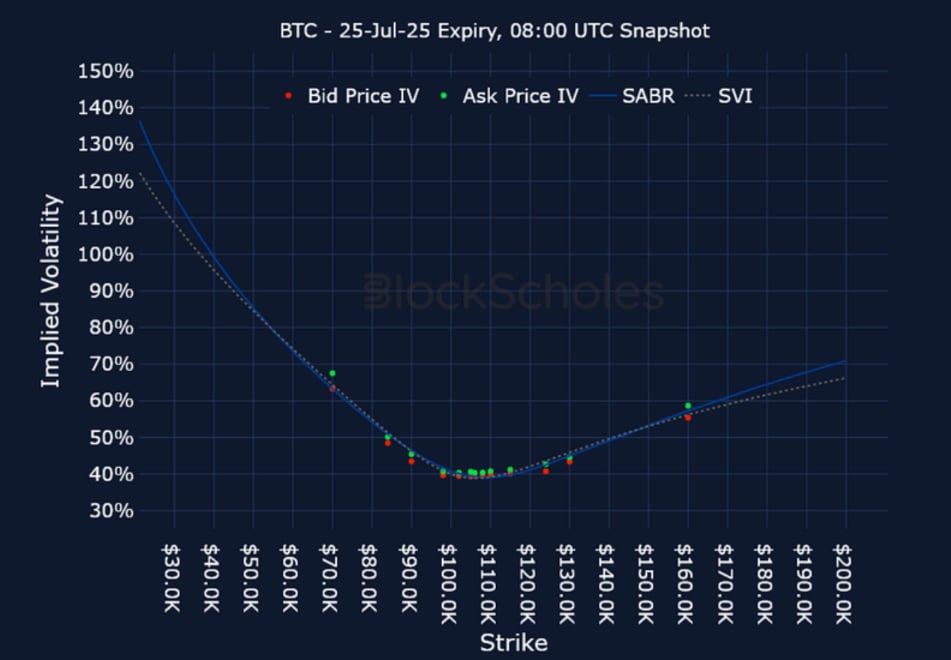

Listed Expiry Volatility Smiles

BTC 25-JUL EXPIRY – 9:00 UTC Snapshot.

ETH 25-JUL EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

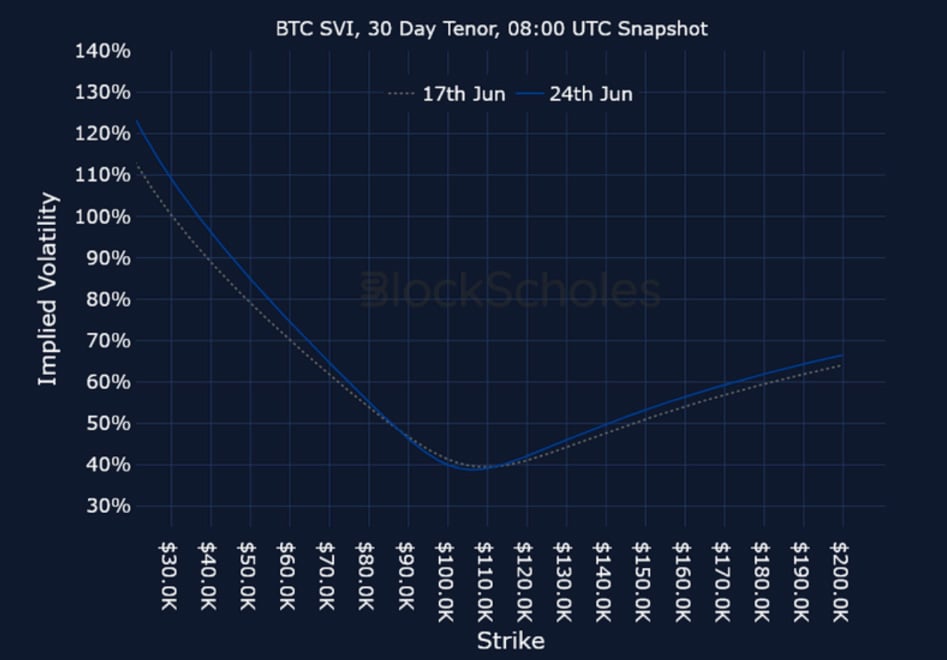

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)