Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Whilst risk-reversals have recovered from their plummet at the beginning of the 7 day period to price up- and down-side protection at more neutral levels, the outright level of implied volatility has continued to drift lower. This trend was exacerbated by the release of US CPI data on Wednesday, which has repeatedly resulted in a lower level of volatility throughout this inflationary cycle. Both yields and perpetual swap funding rates continue to suggest positive sentiment in contrast to the 25-delta RRs.

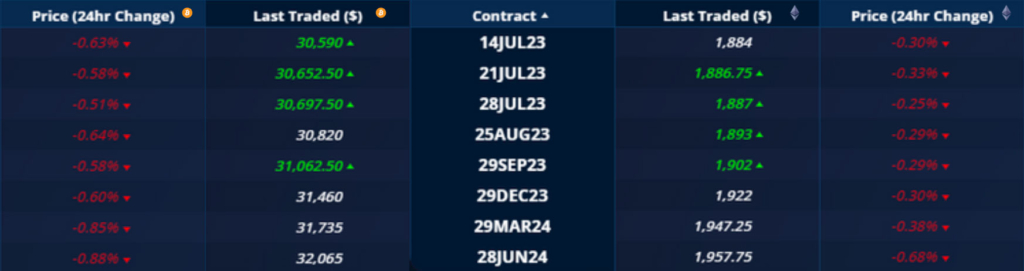

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – The term structure of annualised yields remains inverted as short tenors report a higher yield than longer tenors.

ETH ANNUALISED YIELDS – Show the same inversion, with lower volatility and at a lower outright yield.

Perpetual Swap Funding Rate

BTC FUNDING RATE – has reported a lower payment to shorts throughout the last week, with an increased interest in long exposure near to the CPI release on wednesday.

ETH FUNDING RATE – remains positive throughout the last month, indicating that traders are still willing to pay for long exposure.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has steepend across the term structure, with the vol of short tenor options drifting lower throughout the week.

BTC 25-Delta Risk Reversal – recovered from a strong tilt towards downside protection 7 days ago.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – short tenor options widened their spread to the implied volatility of options with longer tenors, reaching back into the low 30s.

ETH 25-Delta Risk Reversal – has also recovered from a spike downwards, settling at a level slightly lower than BTC’s RR.

Volatility Surface

BTC IMPLIED VOL SURFACE – reports a surface-wide fall in implied volatility that is more extreme in mid-tenor OTM puts.

ETH IMPLIED VOL SURFACE – similarly reports a fall in implied volatility at short tenors, with more action in the 9M tenor, ATM.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

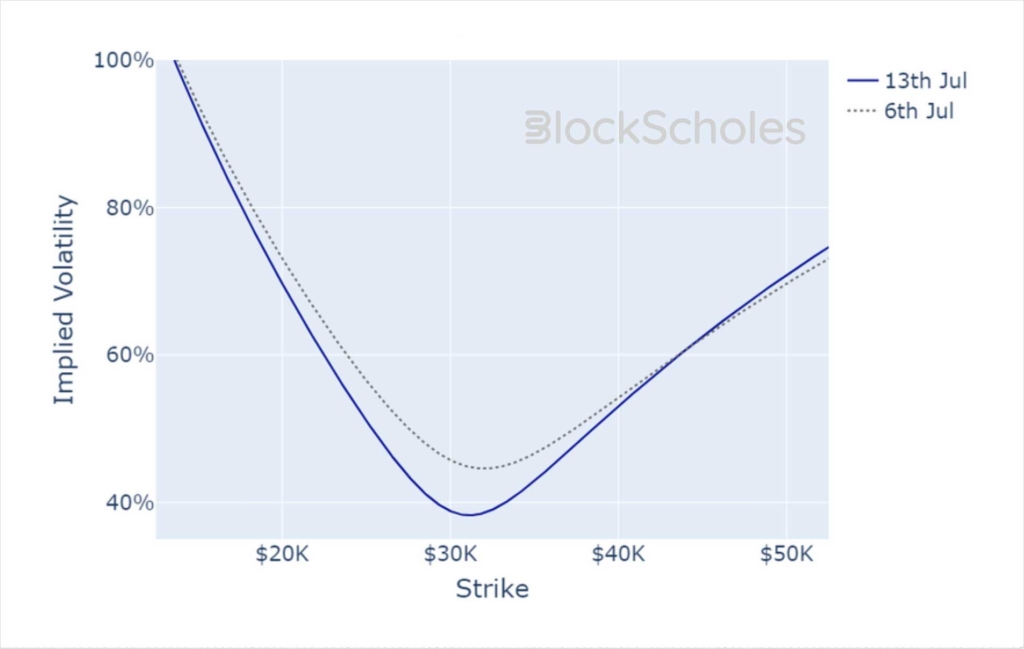

Volatility Smiles

BTC SMILE CALIBRATIONS – 28-Jul-2023 Expiry, 10:00 UTC Snapshot,

ETH SMILE CALIBRATIONS – 28-Jul-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)