Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

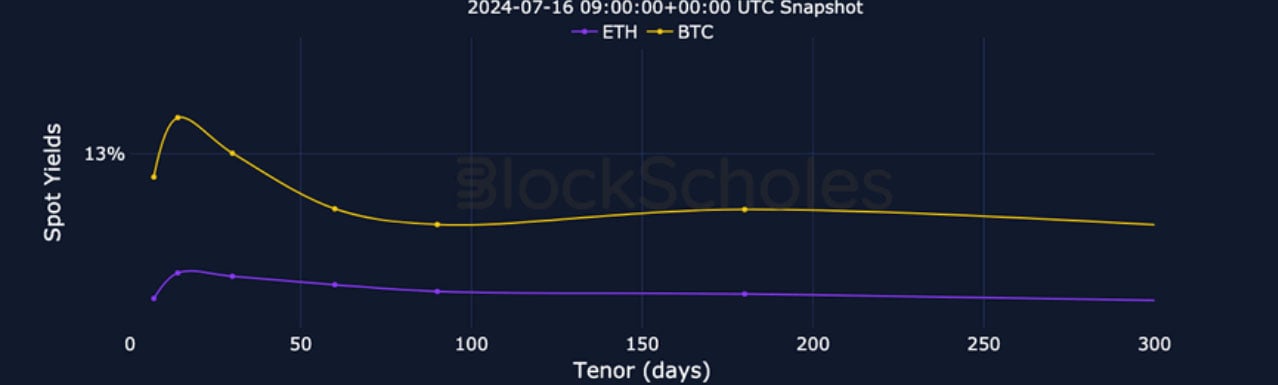

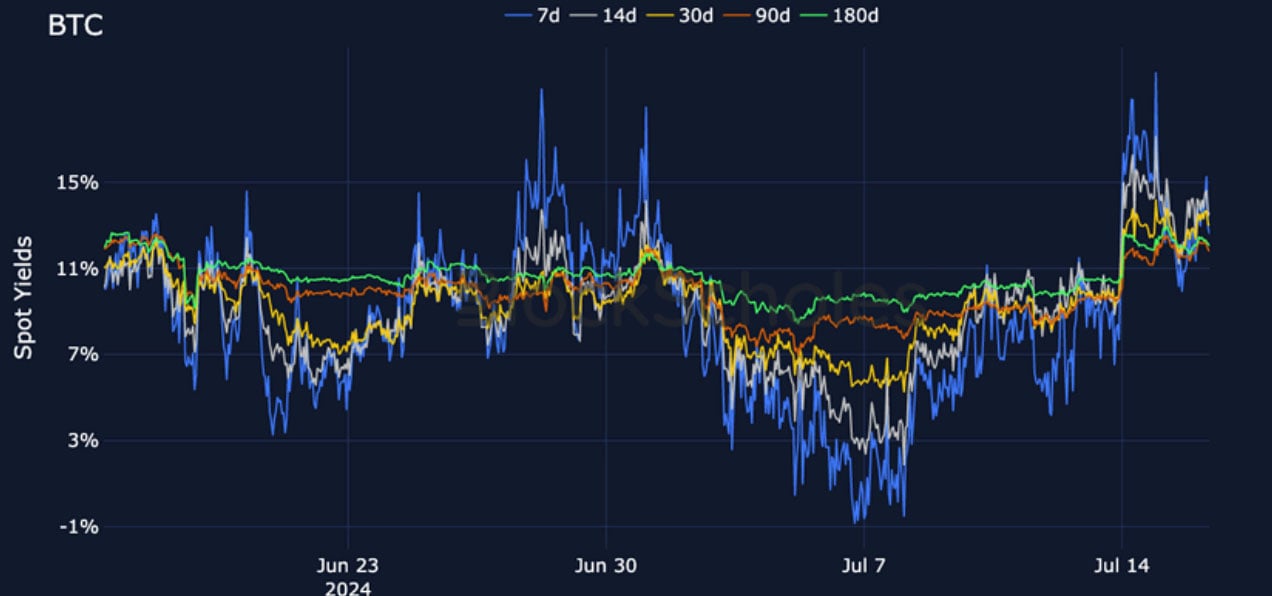

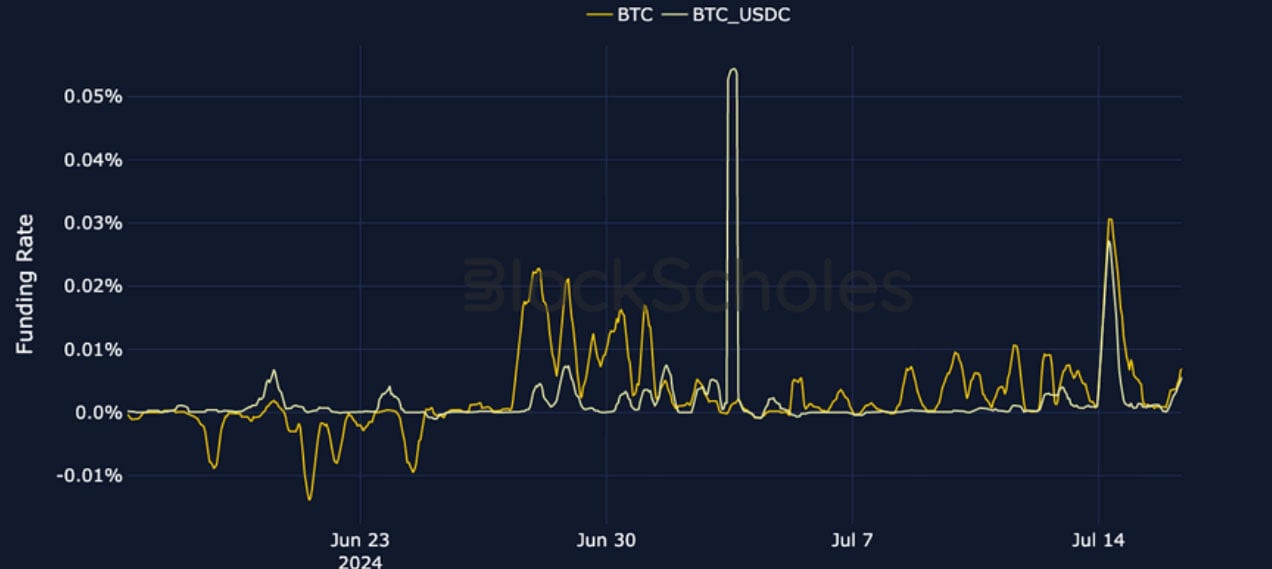

Spot prices have performed a significant recovery since bouncing off the lower bound of their recent range almost one week ago. As a result, delivered volatility has stayed at its highs and has materially increased implied volatility at short-tenor options and inverted the term structure. The recovery has inspired a return to double digit yields implied by both BTC and ETH futures markets, but only the former asset sees a similar sentiment expressed by its perpetual swap funding rates. ETH still has its months-long-held volatility premium over BTC of around 10 points, but its short-tenors did not push as close to the levels at the back end of the term structure leaving its term structure slightly steeper.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

BTC ANNUALISED YIELDS – yields rally across the term structure as short- tenors out perform, inverting the term structure.

ETH ANNUALISED YIELDS – have also recovered to the top of their monthly range with short tenors out performing.

Perpetual Swap Funding Rate

BTC FUNDING RATE – has seen a consistently positive rate paid from longs to shorts over the past week, spiking during the spot recovery.

ETH FUNDING RATE – remains much flatter than BTC’s despite ETH’s outperformance in the spot recovery.

BTC Options

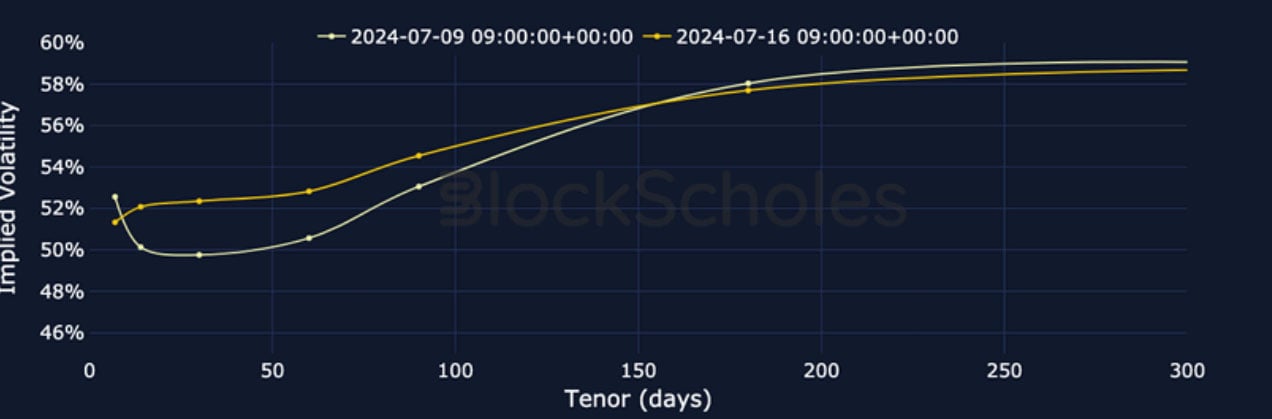

BTC SVI ATM IMPLIED VOLATILITY – the term structure has flattened significantly as short-tenor optionality has rallied back above 50%.

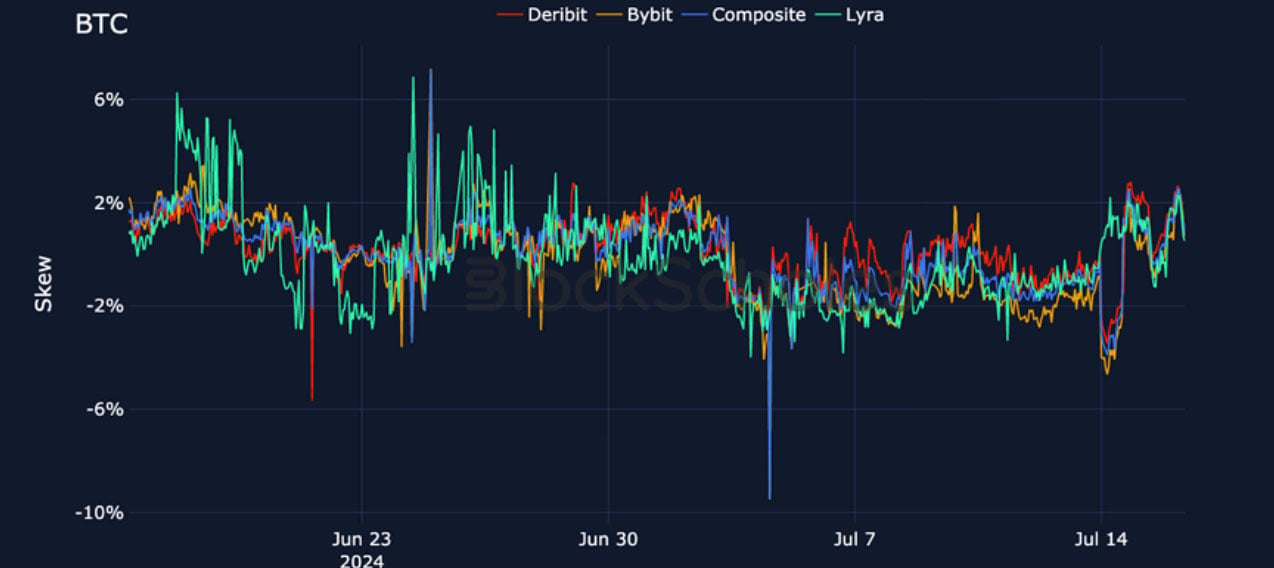

BTC 25-Delta Risk Reversal – the changing directions of spot price movements are reflected in the change in skew from towards puts to calls.

ETH Options

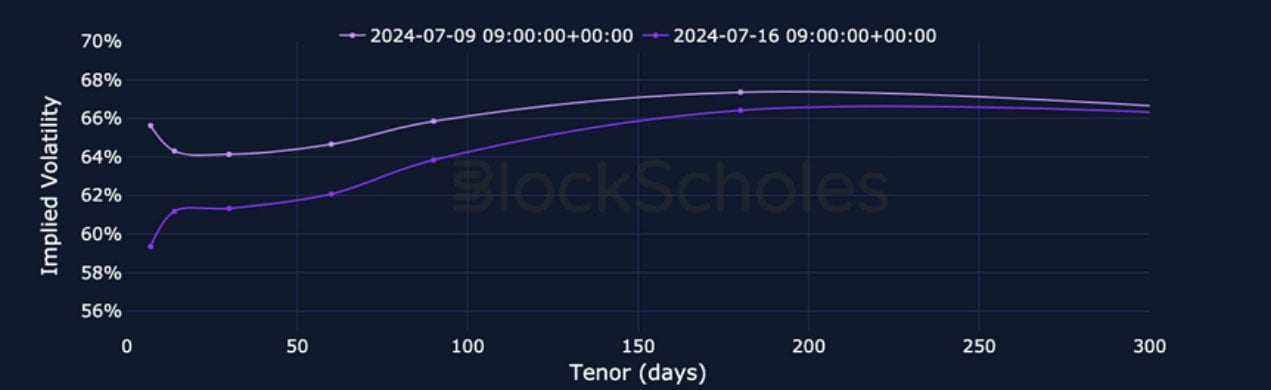

ETH SVI ATM IMPLIED VOLATILITY – ETH volatility remains above BTC’s across the term structure but front-end vols did not rally as hard.

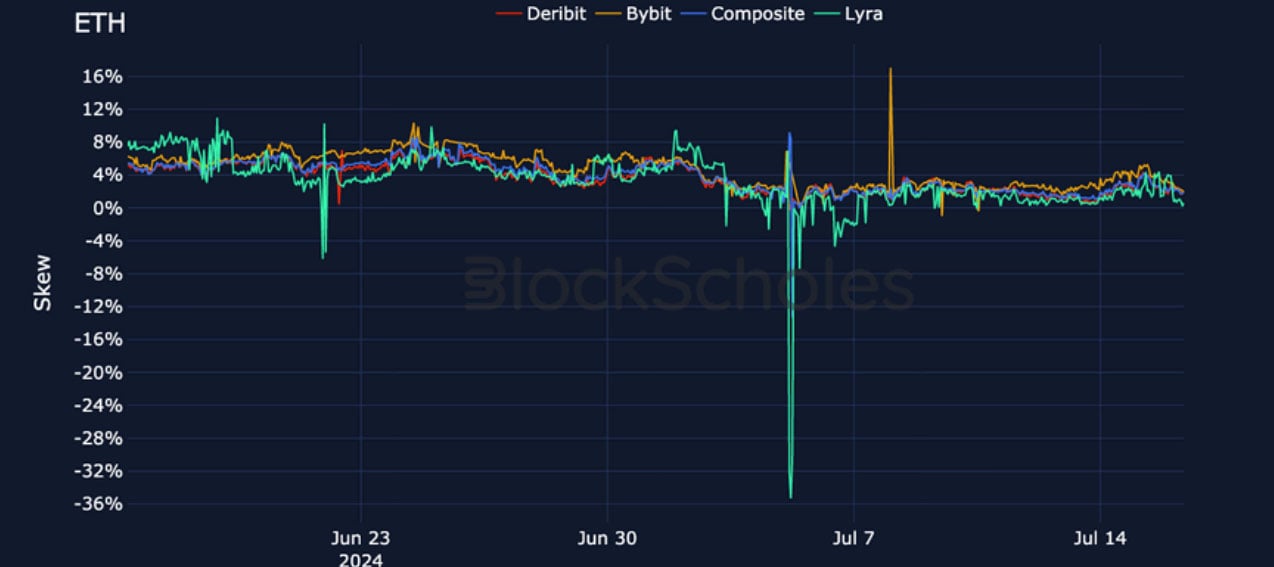

ETH 25-Delta Risk Reversal – like BTC, ETH’s markets are skewed slightly towards OTM calls but have not seen the same extremes in the last week.

Volatility by Exchange

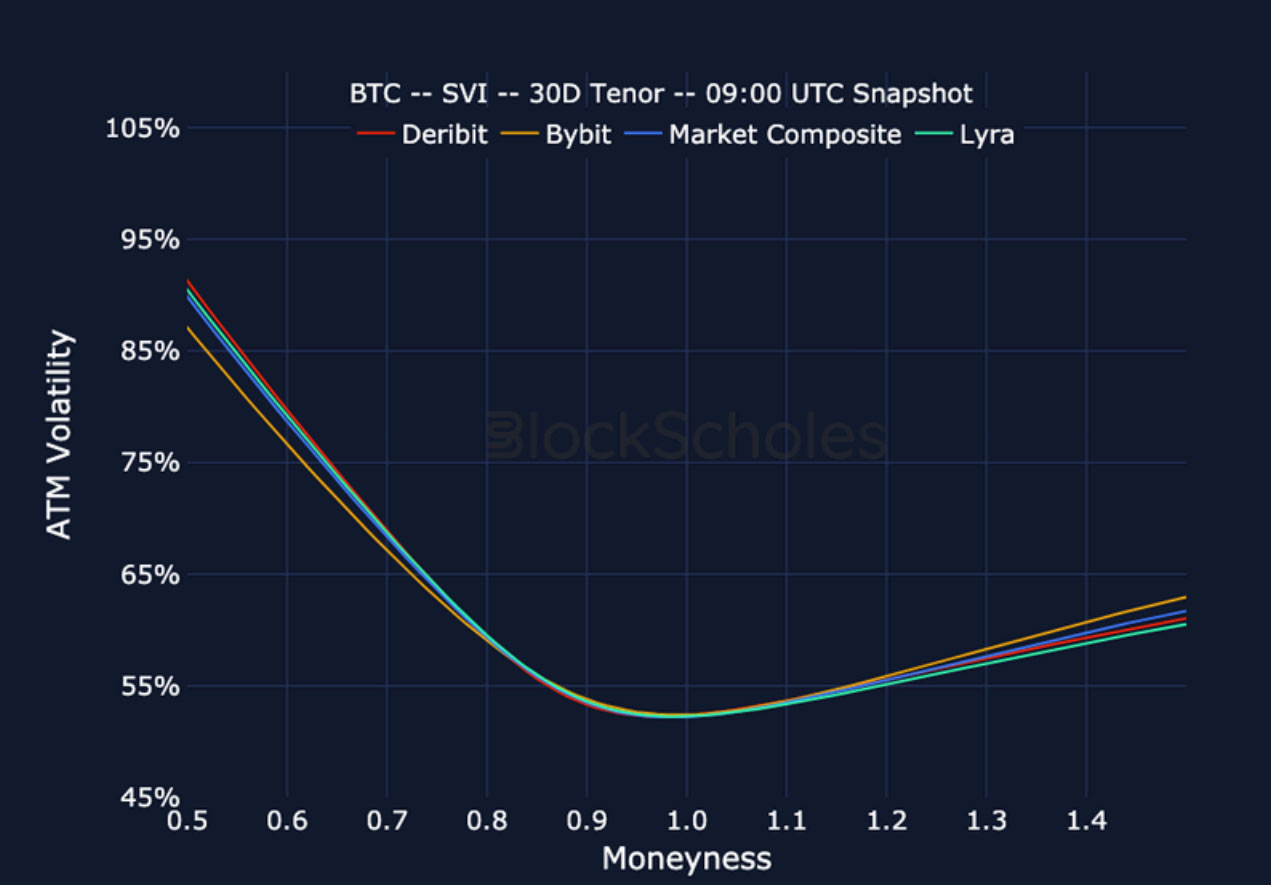

BTC, 1-MONTH TENOR, SVI CALIBRATION

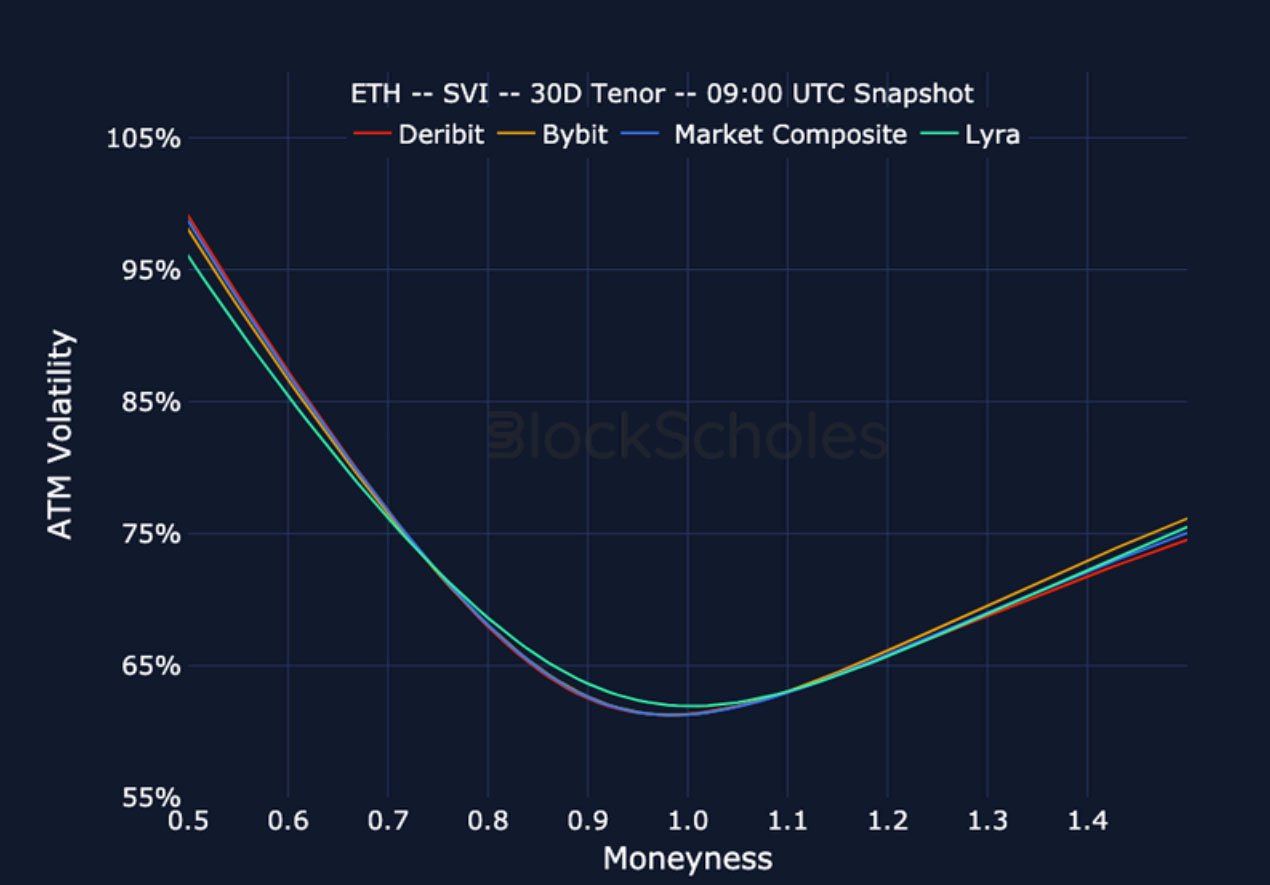

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

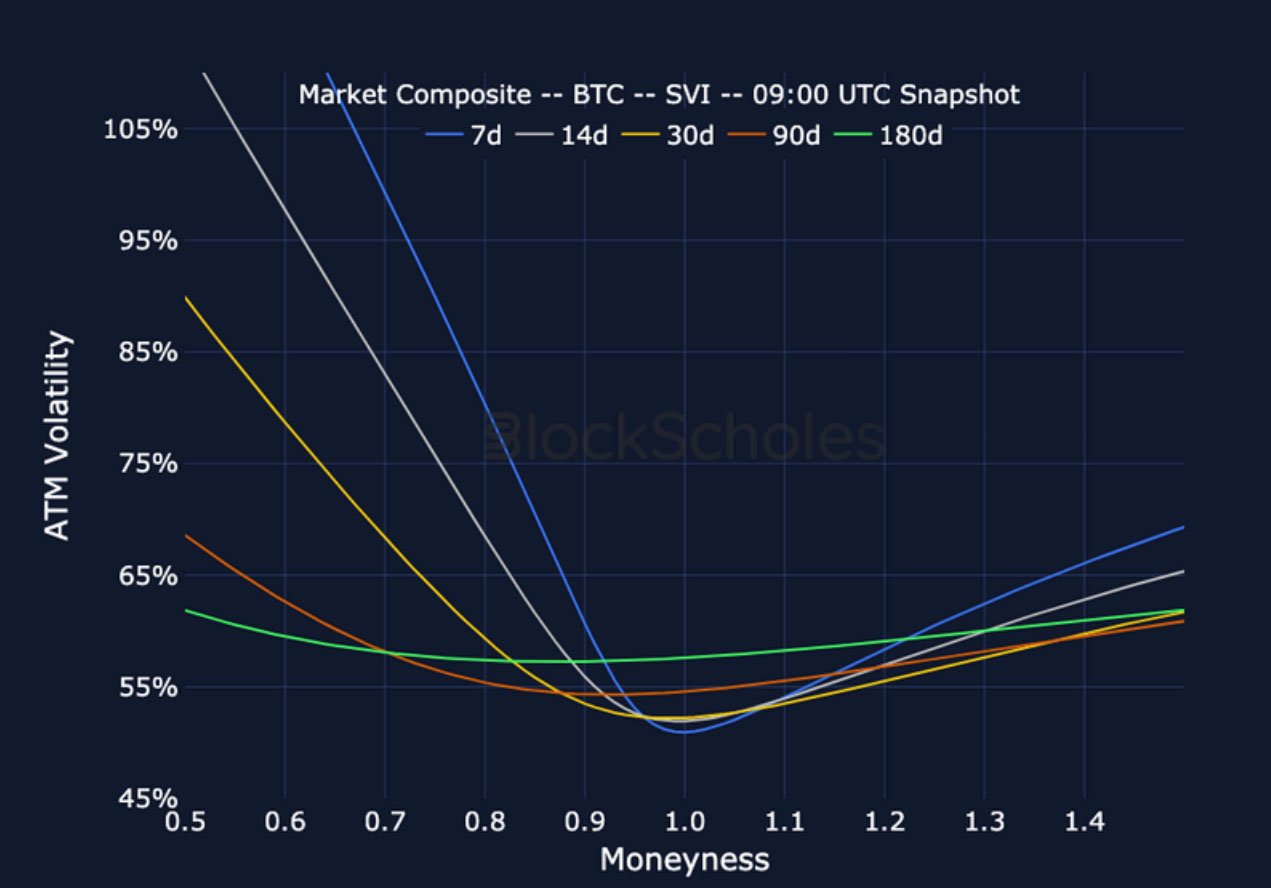

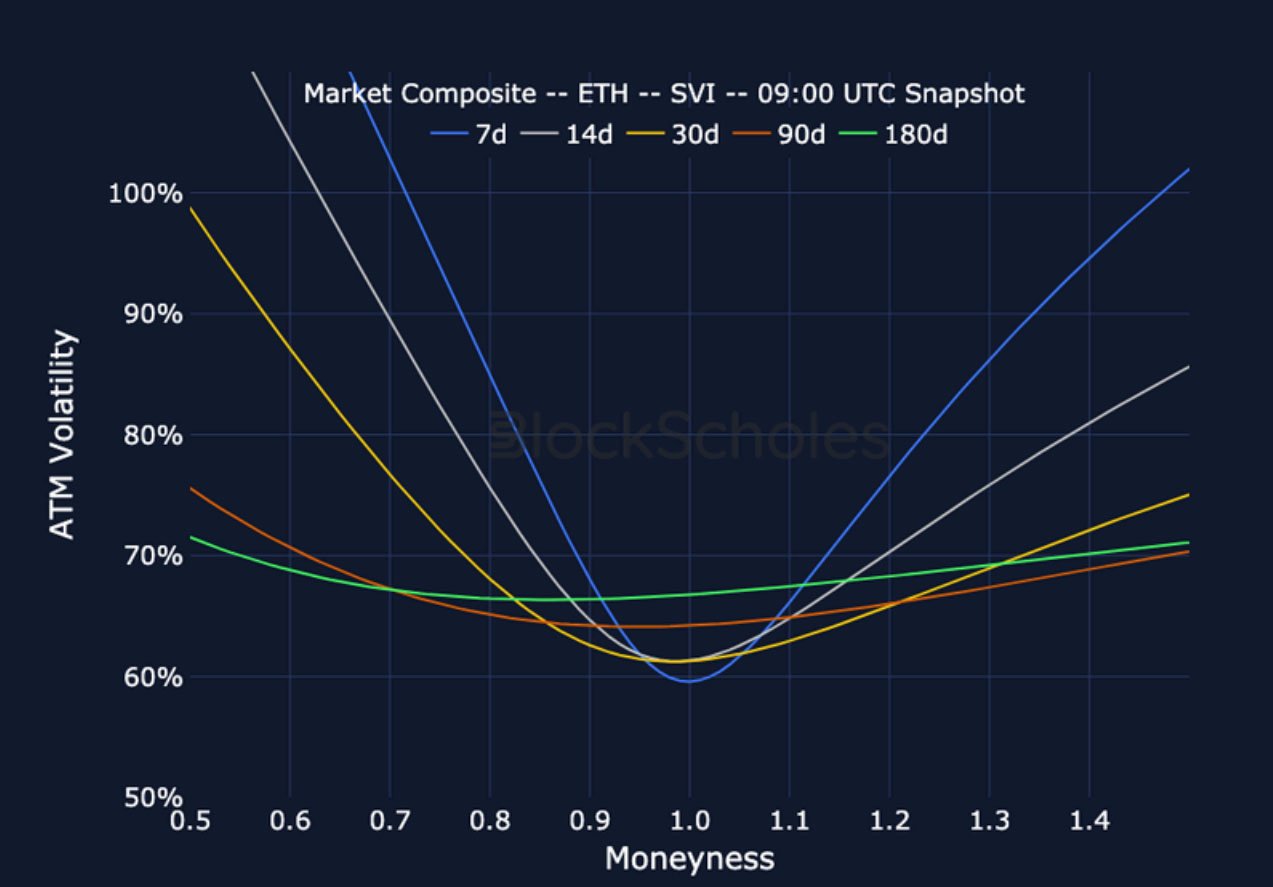

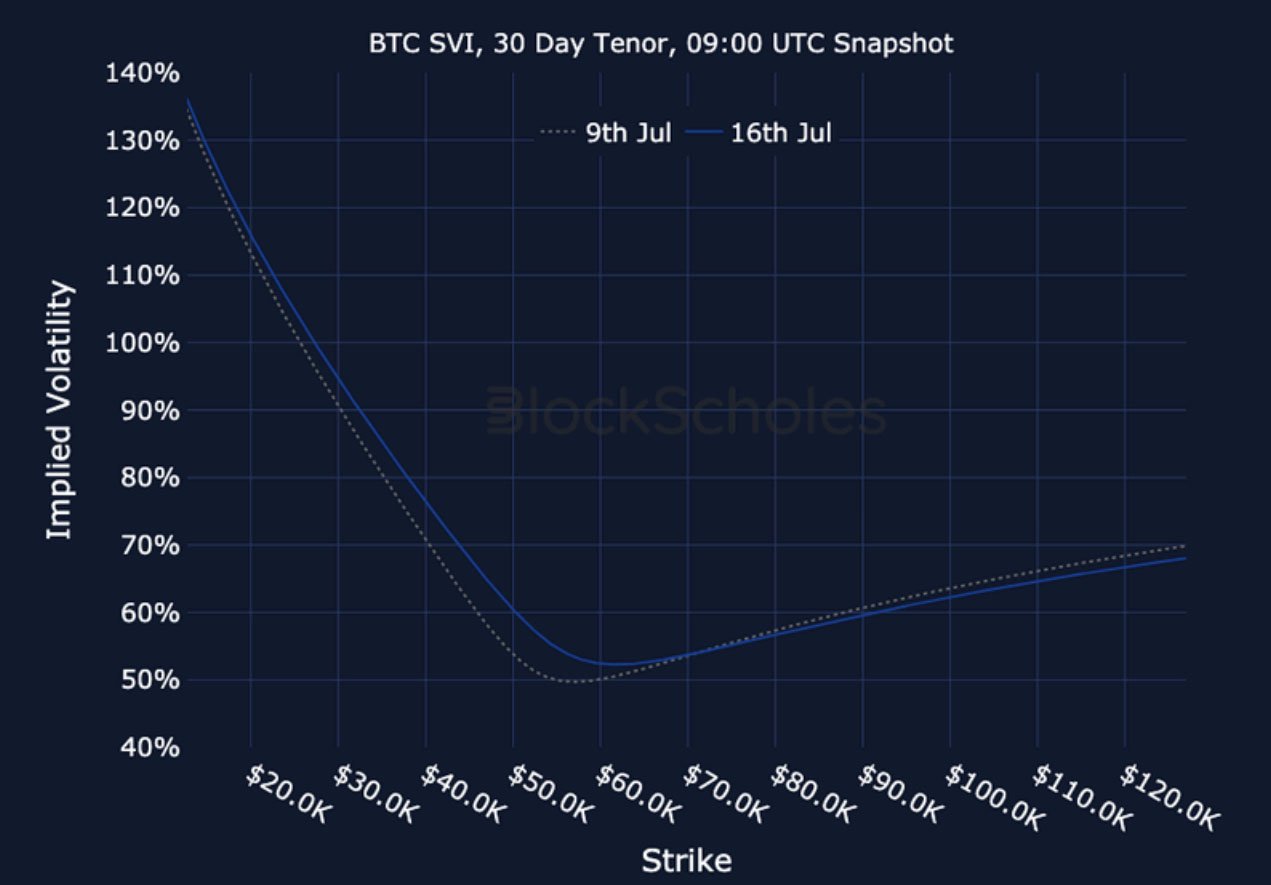

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

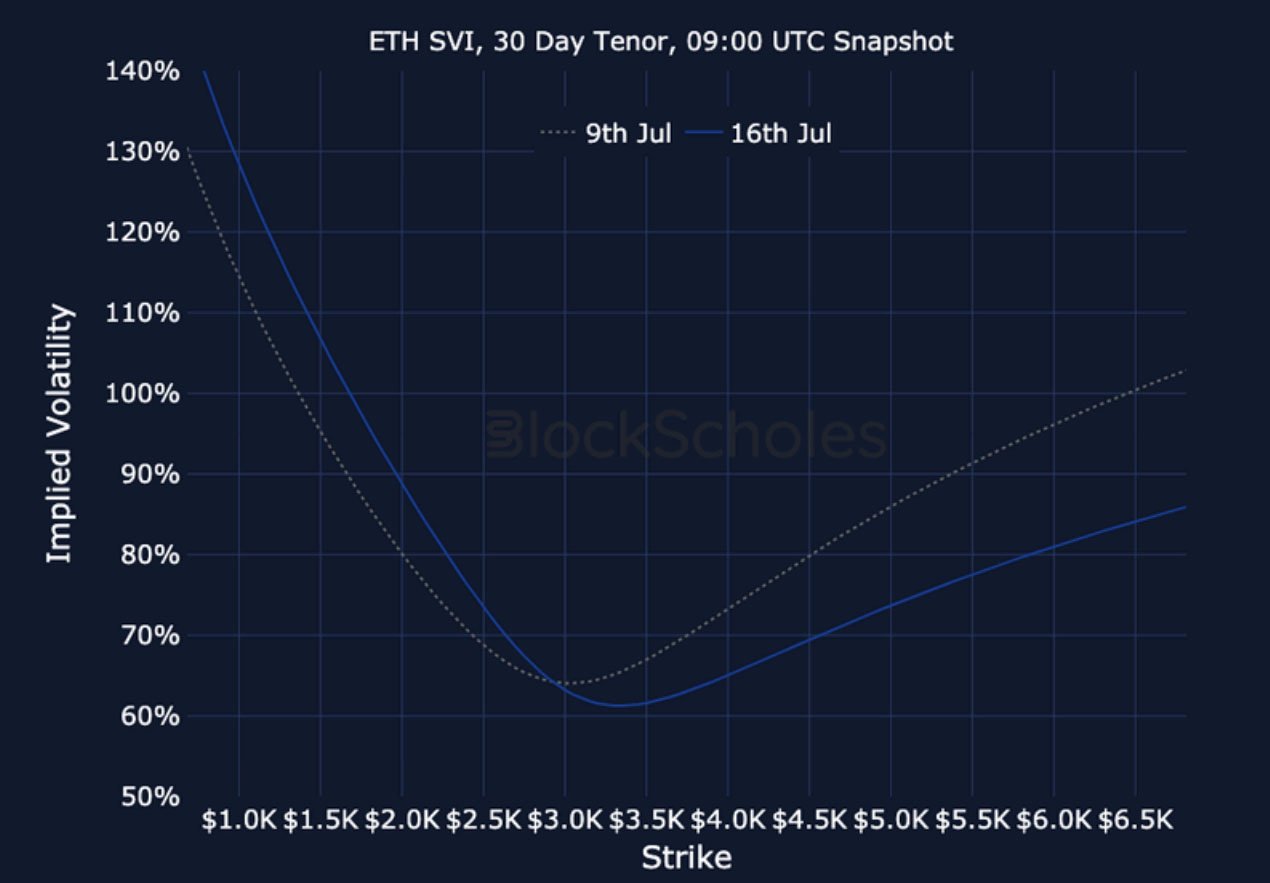

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

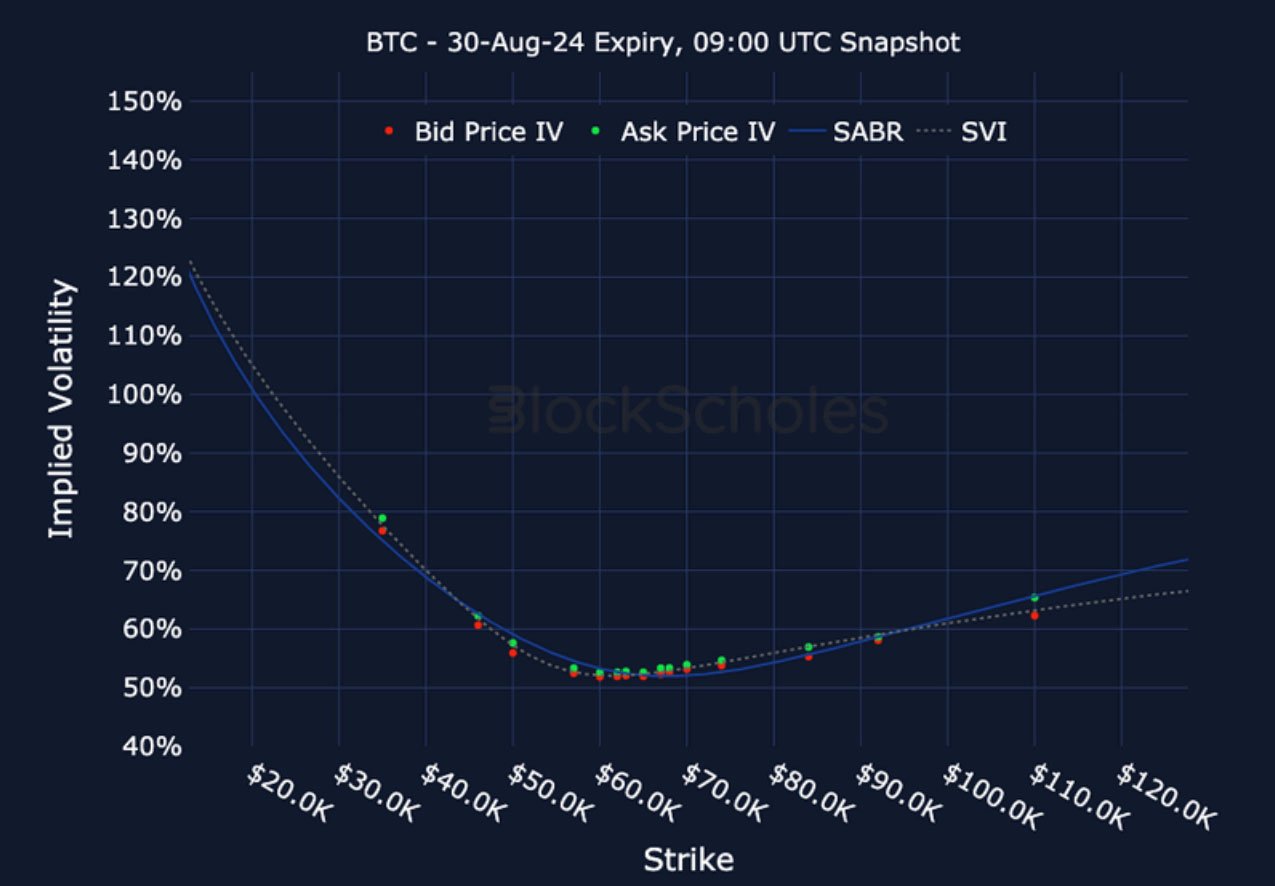

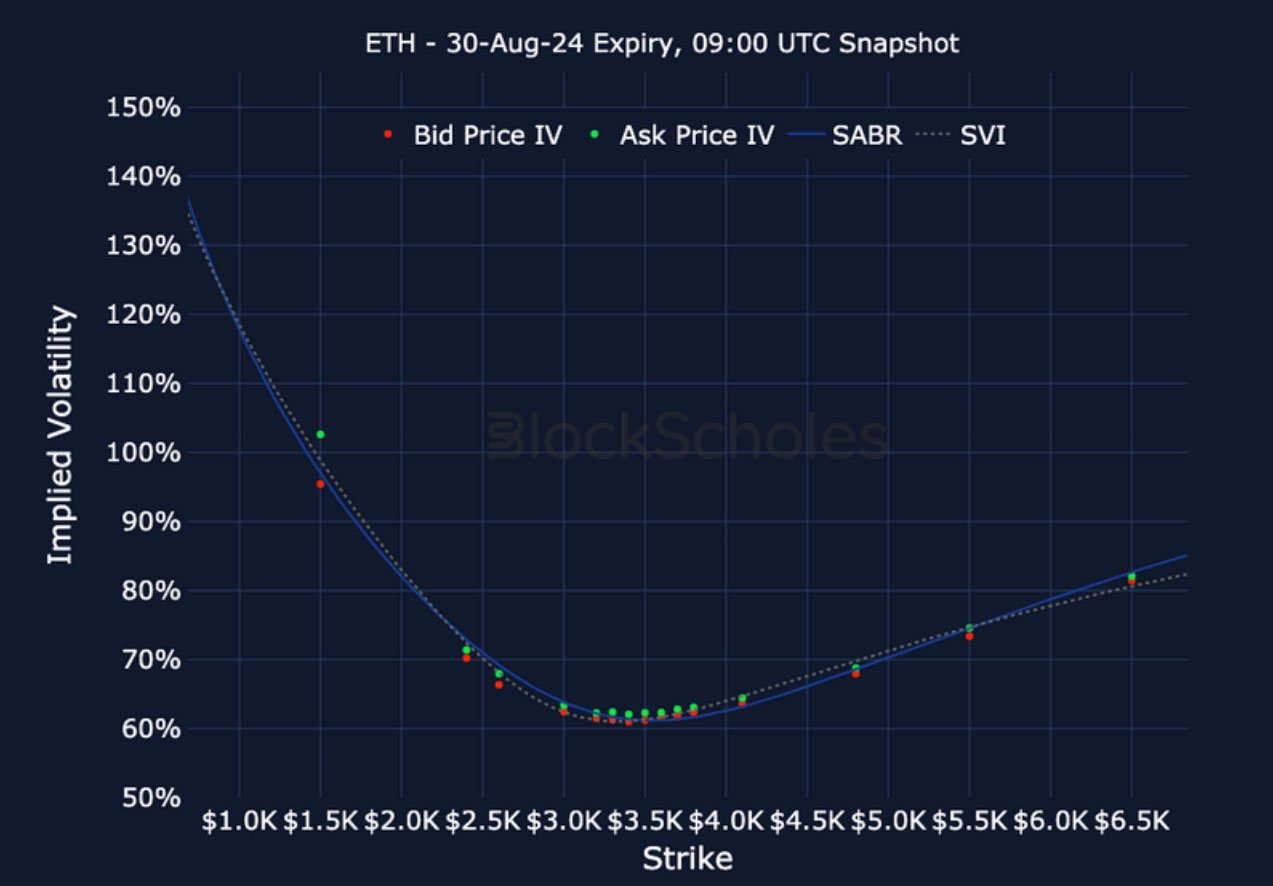

Listed Expiry Volatility Smiles

BTC 30-AUG EXPIRY– 9:00 UTC Snapshot.

ETH 30-AUG EXPIRY– 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)