Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

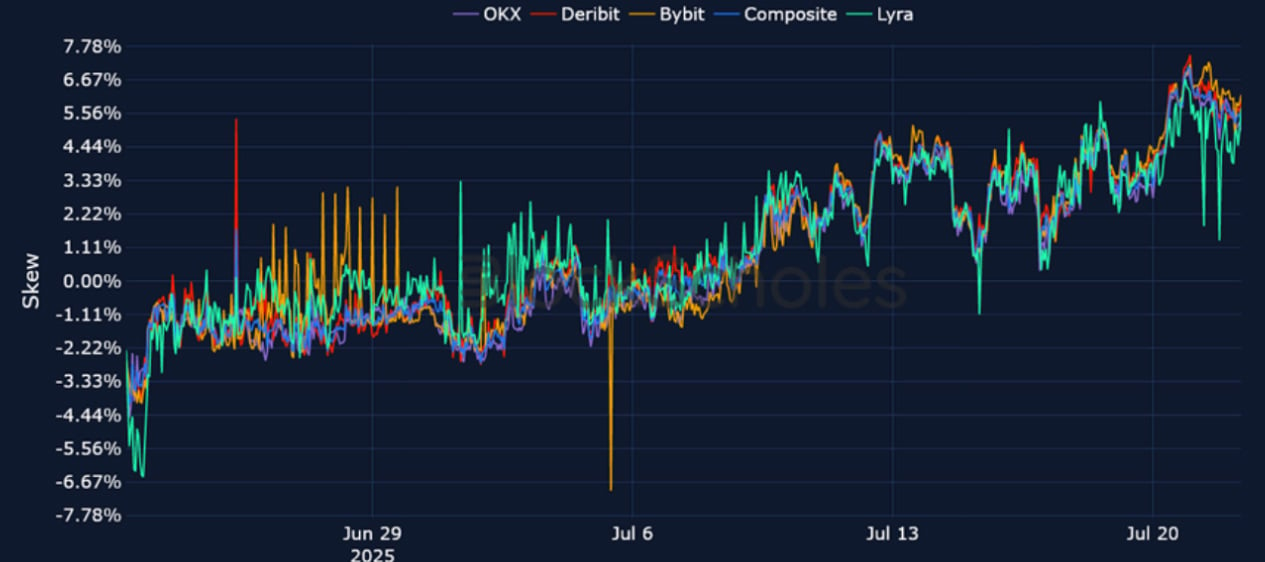

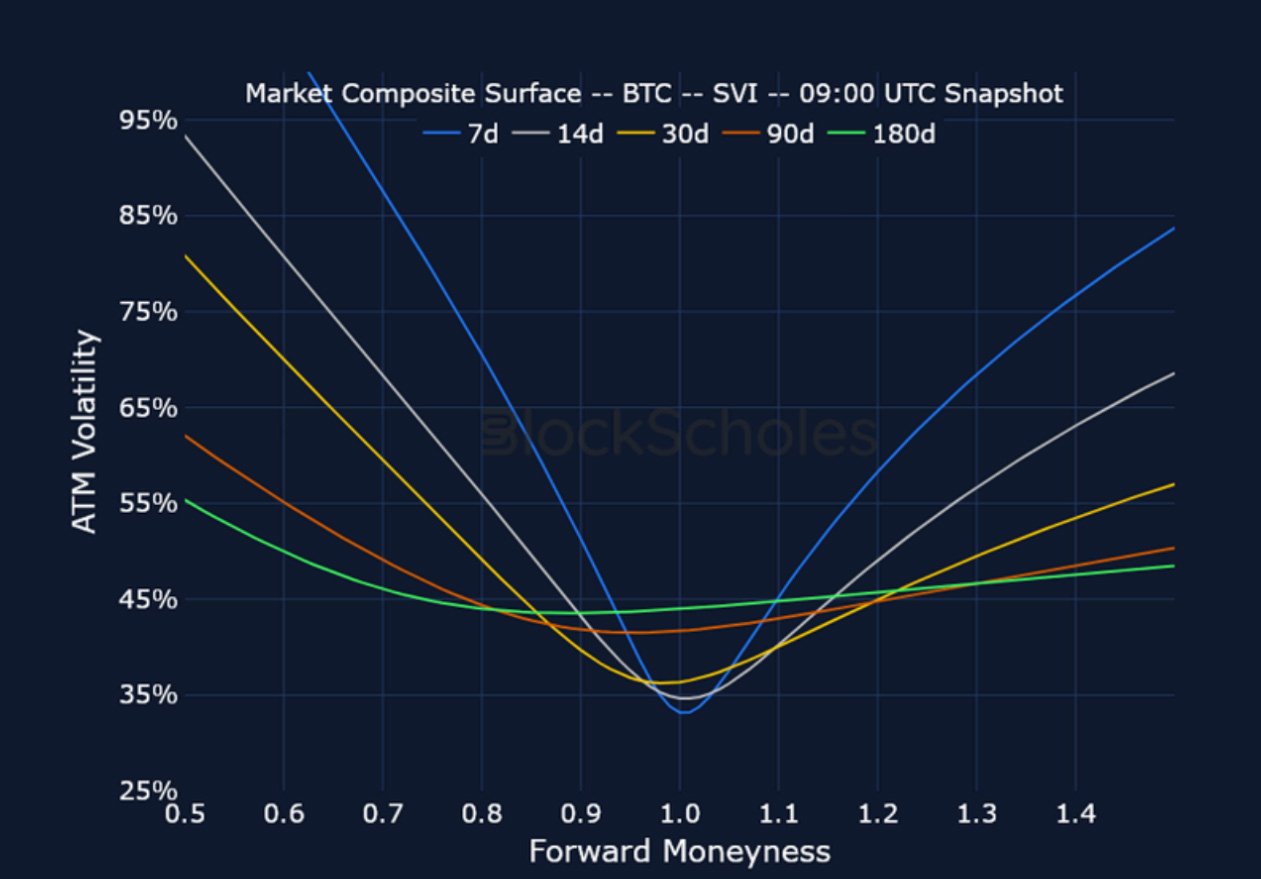

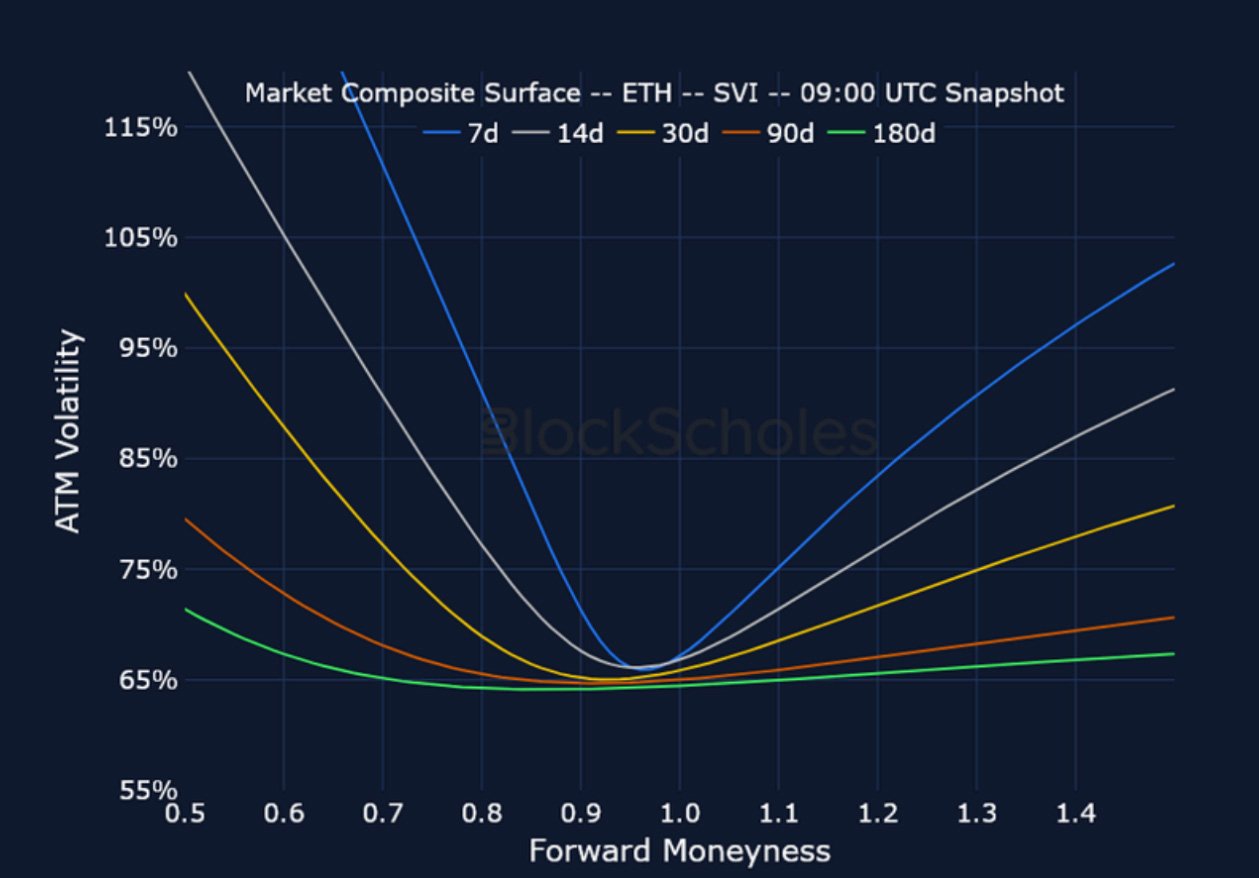

Following a new ATH to nearly $123K last week, the slowdown in BTC’s spot price has seen BTC’s options implied volatility term structure correct downward, with the front end falling 5%. Similarly, BTC perpetual futures funding rates have come down from their highs of 0.035% to under 0.010%. Short- tenor skew turned negative, despite spot trading only 0.36% lower over the past seven days. In contrast, the ETH’s spot outperformance continues and this bullish momentum is captured in skews which are heavily tilted positively especially for short tenors, with the 7-day showing highs of over 11%. The ETH term structure inversion grew stronger as implied volatility jumped up across the curve but similarly, more so for short tenors.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

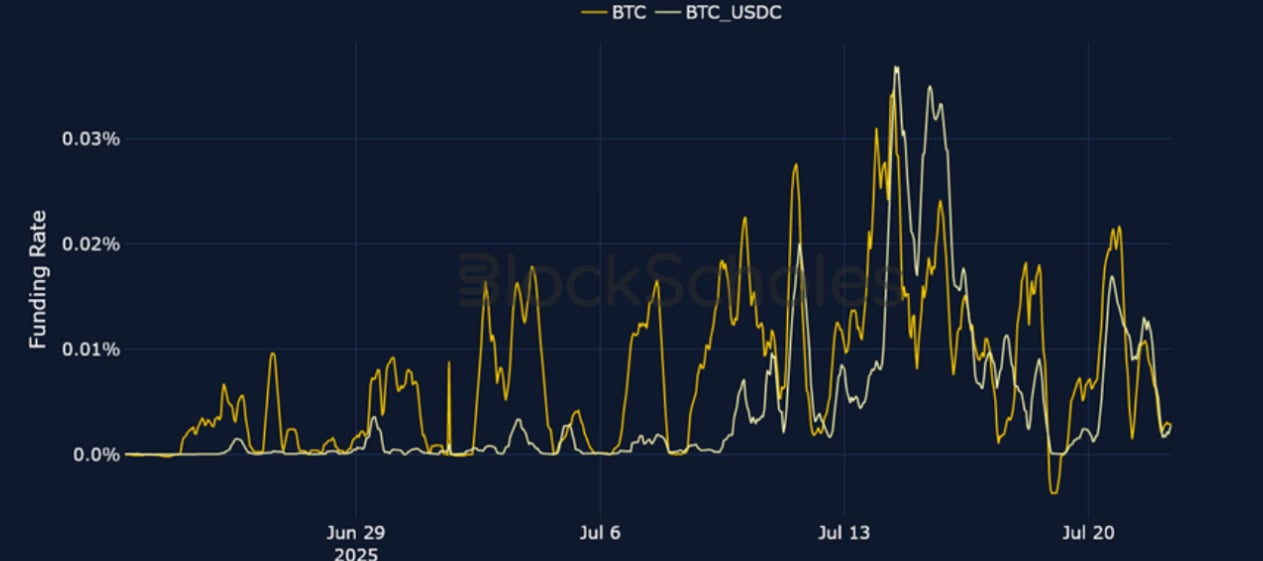

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates remain positive but have generally trended downwards since Jul 14th’s ATH.

ETH FUNDING RATE – ETH funding rates have similarly spiked positively yet remain elevated compared to BTC’s funding rates as ETH spot outperforms.

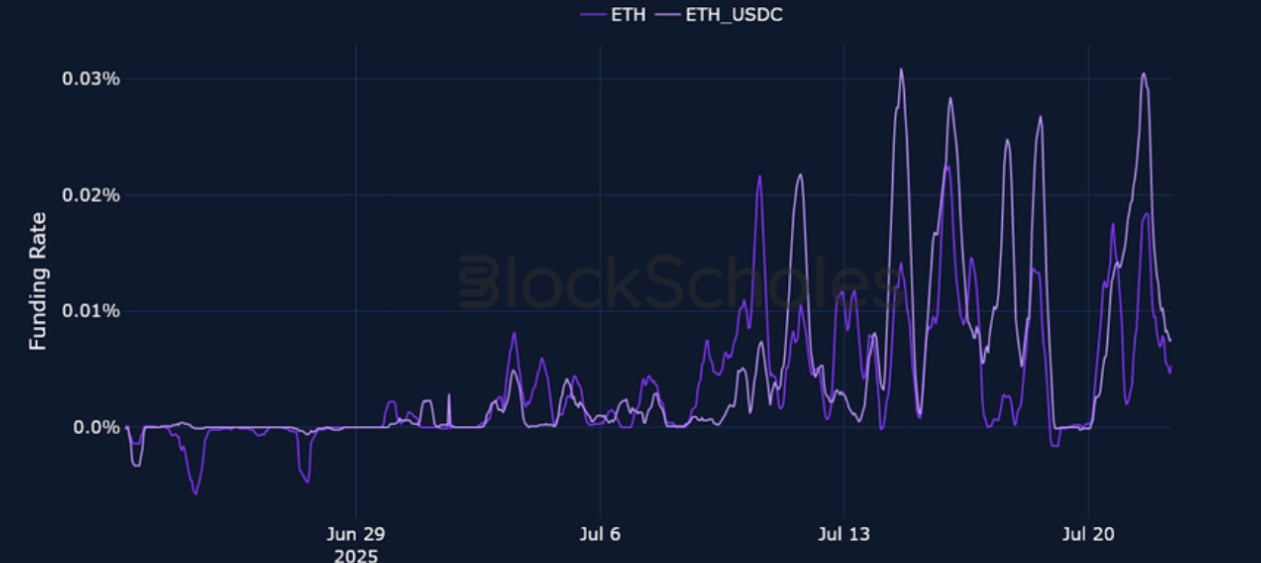

Futures Implied Yields

BTC Futures Implied Yields – The futures curve experienced a strong inversion which looks to be correcting as short term spot yields drop lower.

ETH Futures Implied Yields – Also inverted, ETH’s temporary disinversion created an asymmetry to BTC yields which remained inverted throughout.

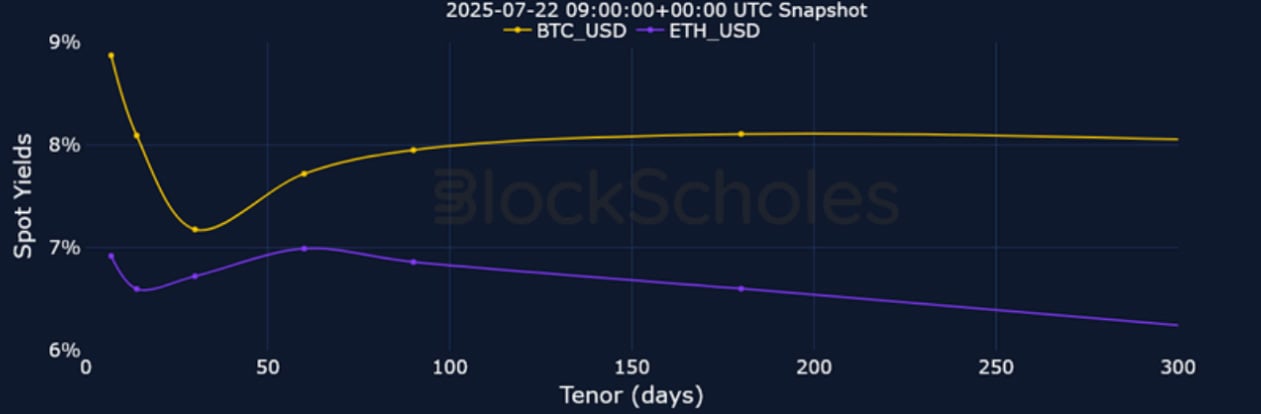

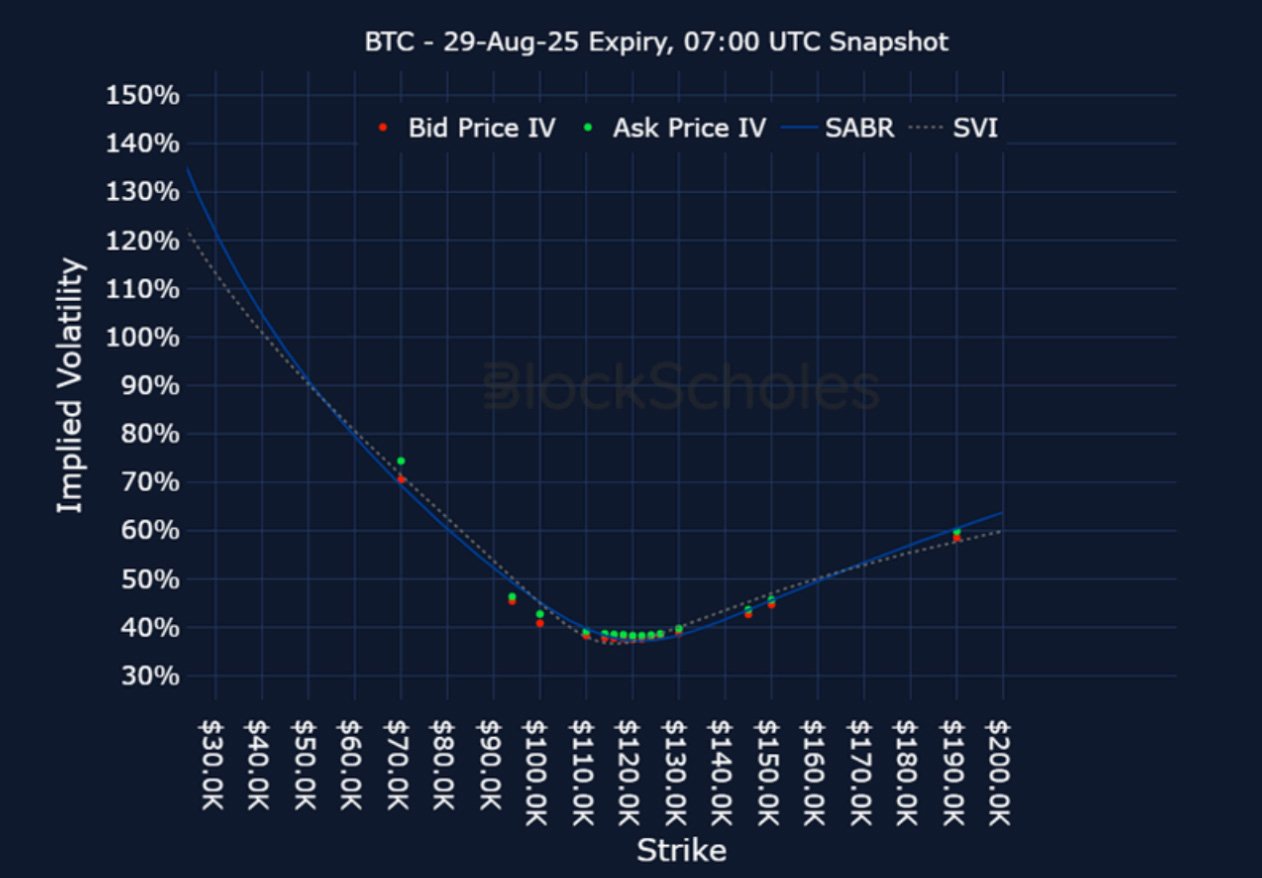

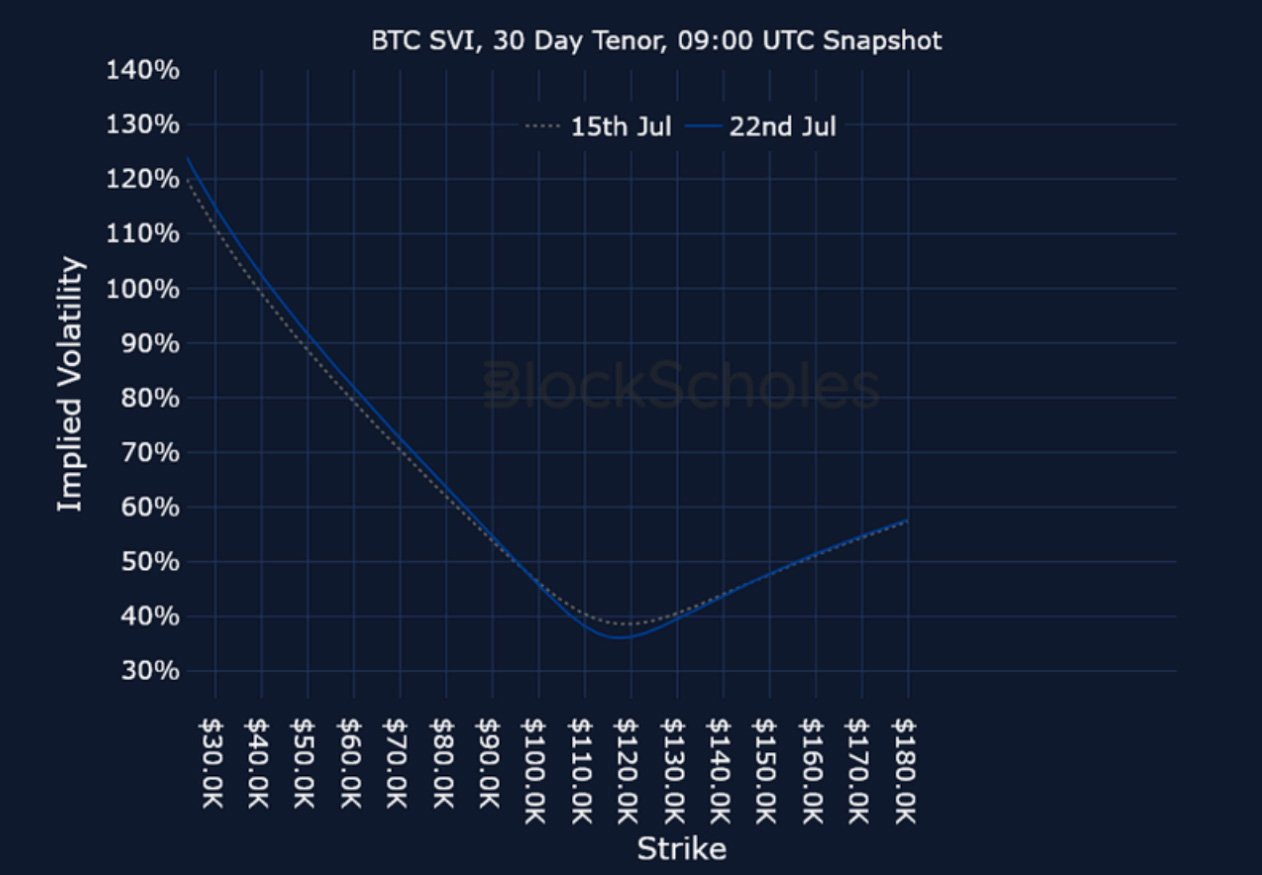

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-term vol expectations have continued their decline since last week, alongside cooling BTC spot price.

BTC 25-Delta Risk Reversal – Despite spot trading only 0.36% lower over the past seven days, short-tenor options continue to favour OTM puts.

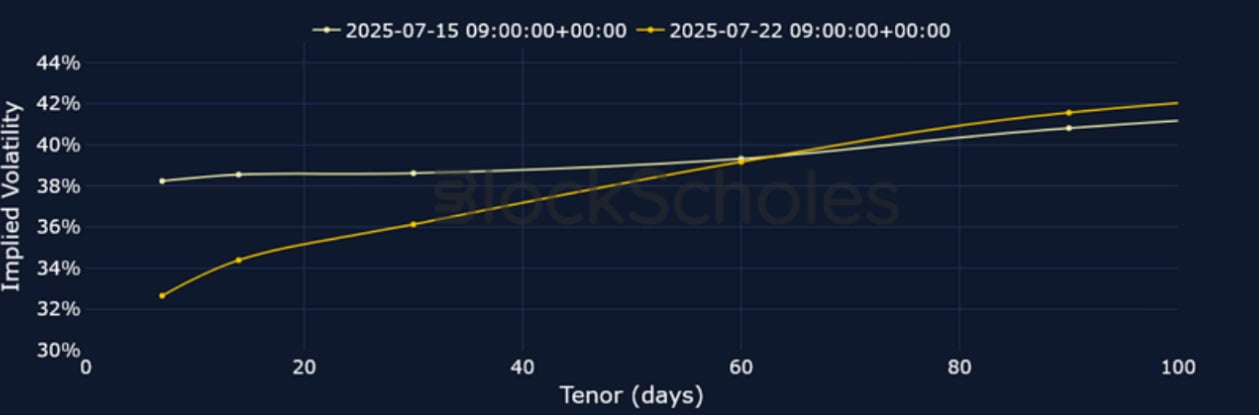

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – With spot price rallying more than 22% this week, short-dated IV has risen, inverting the volatility curve.

ETH 25-Delta Risk Reversal – ETH 7-day skew eased from above 11% to just over 6%, but still favours calls, indicating continued bullish interest. This contrasts with BTC’s short-tenor negative skew.

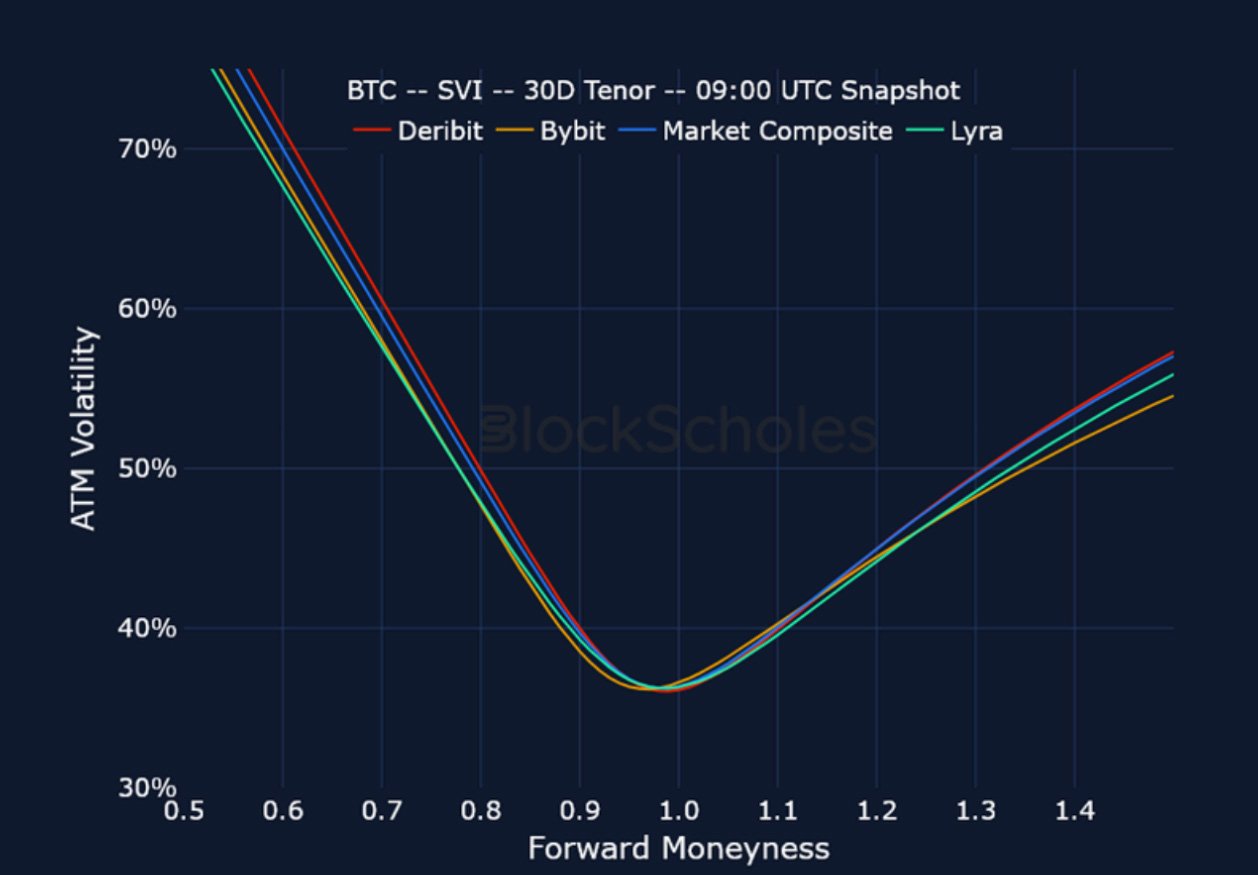

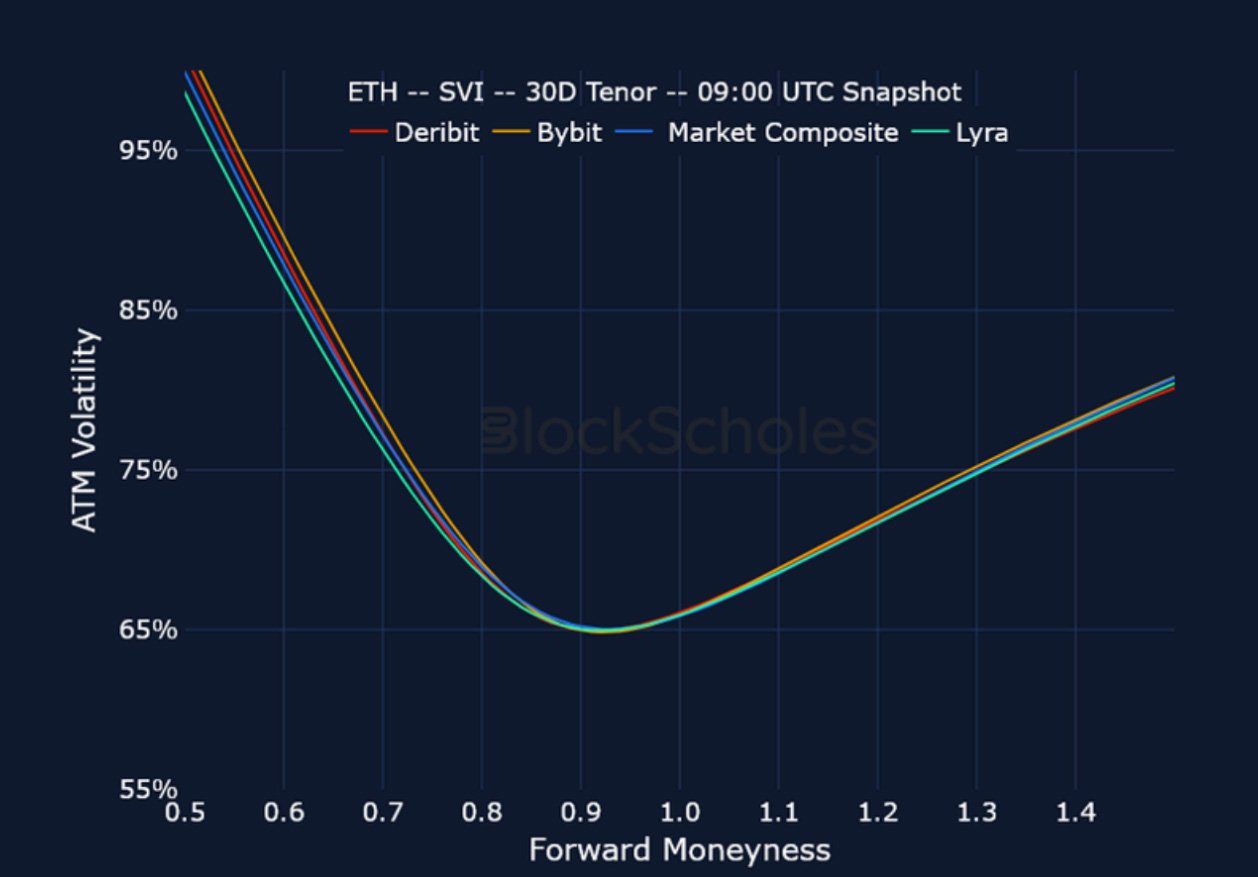

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

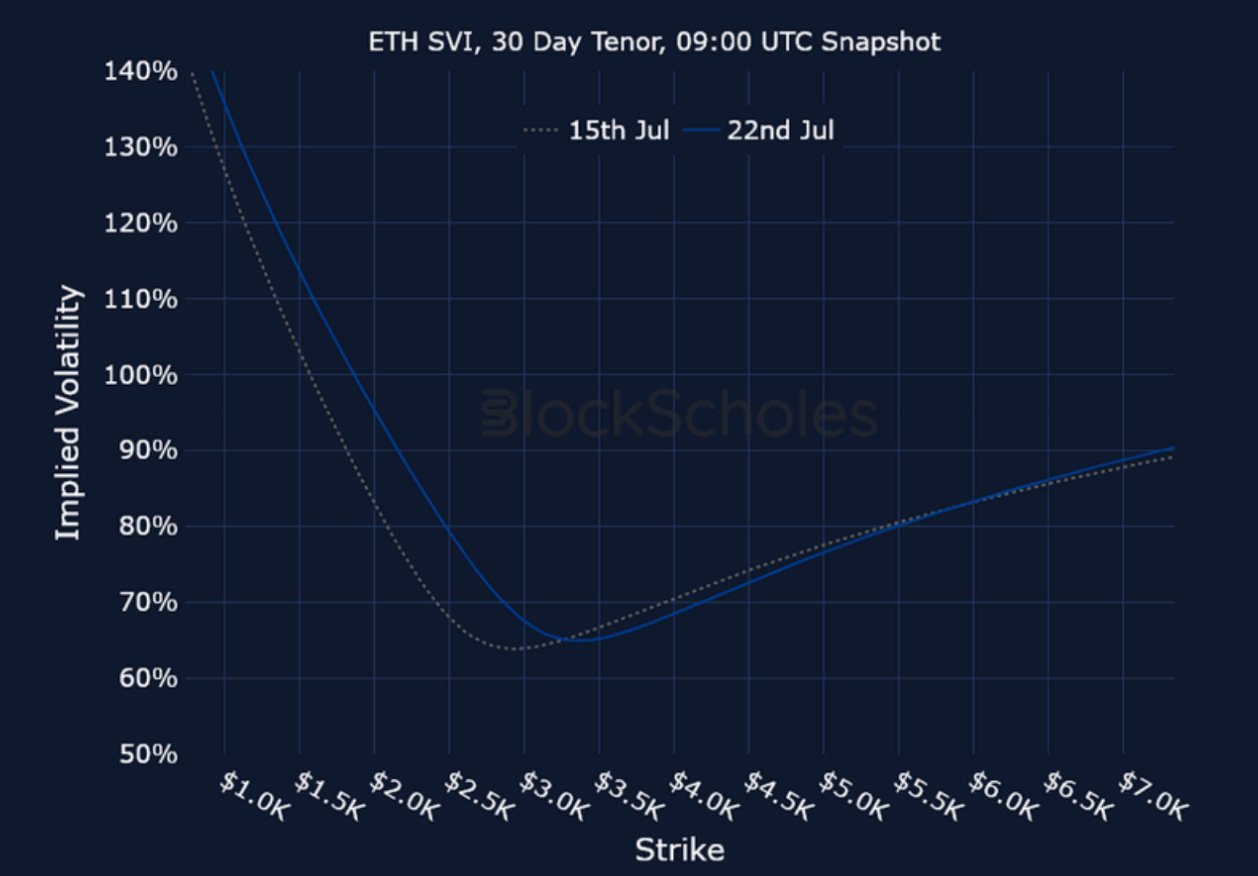

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

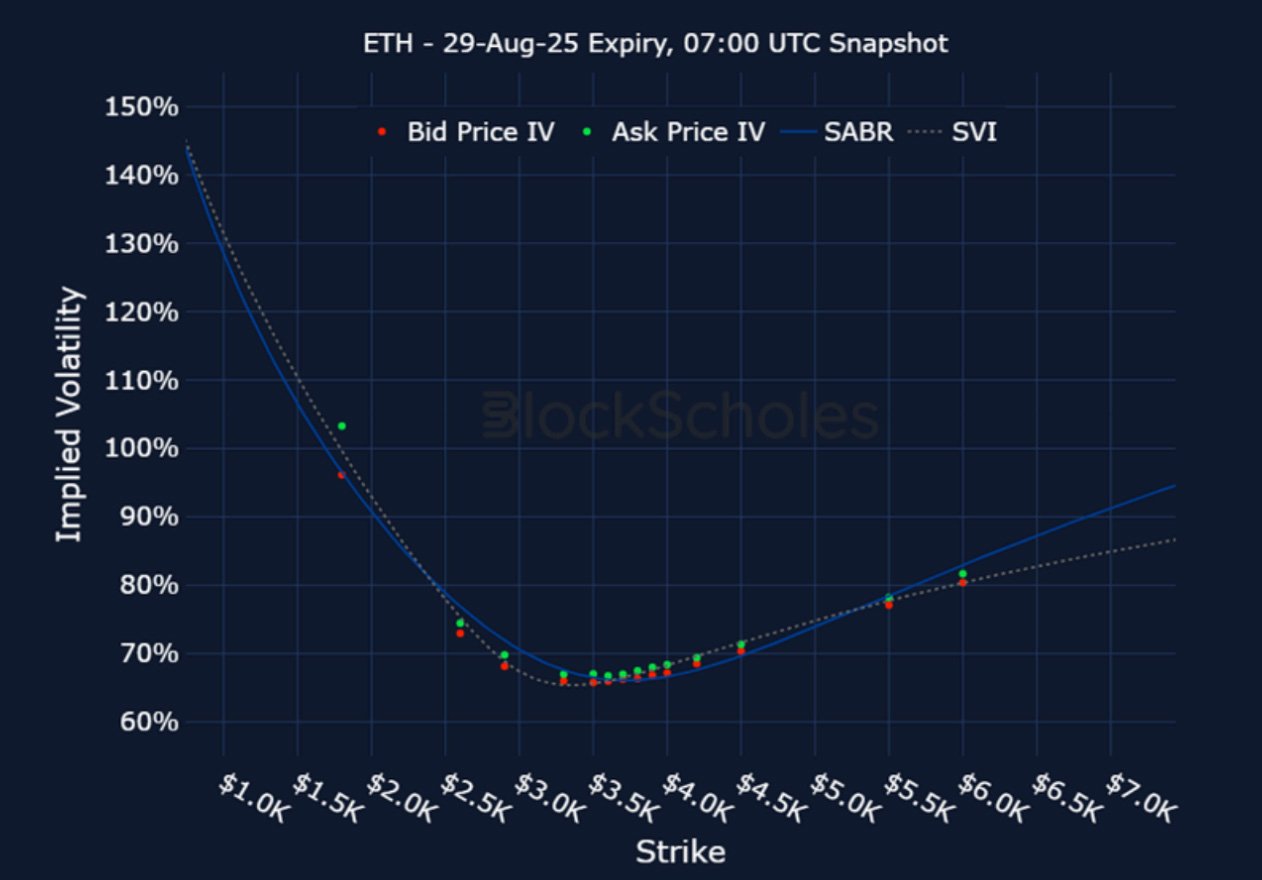

Listed Expiry Volatility Smiles

BTC 29-AUG EXPIRY – 9:00 UTC Snapshot.

ETH 29-AUG EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)