Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Despite a small pick-up that was strongest in shorter dated tenors, implied volatility remains close to the lower bound of its historical range. There is positive sentiment for both BTC and ETH expressed by their high, positive futures-implied yields and a willingness to pay positive funding rates for long exposure via the perpetual swap contracts. However, whilst the skew of BTC’s volatility smile remains neutral, ETH’s options market expresses a distinct preference for protection against downside moves.

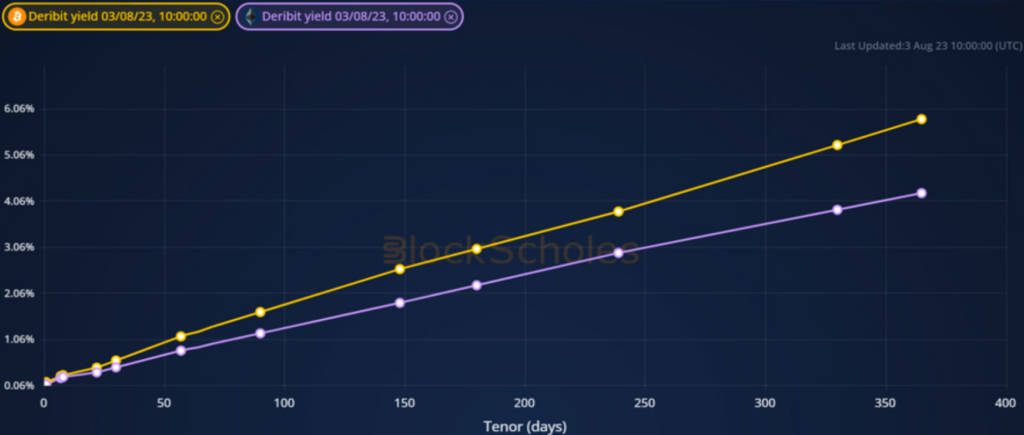

Futures implied yield term structure.

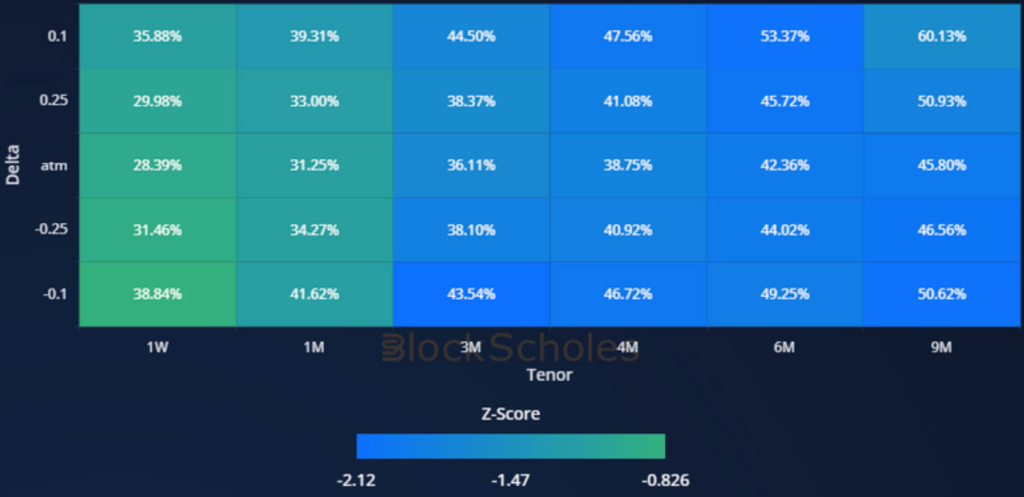

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – Have peaked as high as 15% for futures with a 7-day tenor, and remained high in the days after.

ETH ANNUALISED YIELDS – Peak as high as 12% for 7-day maturity futures and remain elevated across the term structure.

Perpetual Swap Funding Rate

BTC FUNDING RATE – Returns to the high rate paid from long positions to short positions for exposure to movements in the underlying.

ETH FUNDING RATE – Enjoys a similarly high and persistent rate to BTC’s perpetual swap contract as long positions continue to pay for exposure.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – Slides further along its downwards trend, with a small pickup at shorter tenors in the middle of the last week.

BTC 25-Delta Risk Reversal – Has fallen somewhat in the last week to price up- and down-side protection at similar levels.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – Briefly reversed its almost monotonic slide downwards, with short tenor options rising some 5 points.

ETH 25-Delta Risk Reversal – Has not yet fully reversed its move to skew away from OTM calls with all tenors expressing a preference for OTM puts.

Volatility Surface

BTC IMPLIED VOL SURFACE – The downwards trend in volatility has continued across the volatility surface, with each cell lower than its 30- day average.

ETH IMPLIED VOL SURFACE – Also sees a surface-wide fall in implied volatility that is most extreme in the 4-6M tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

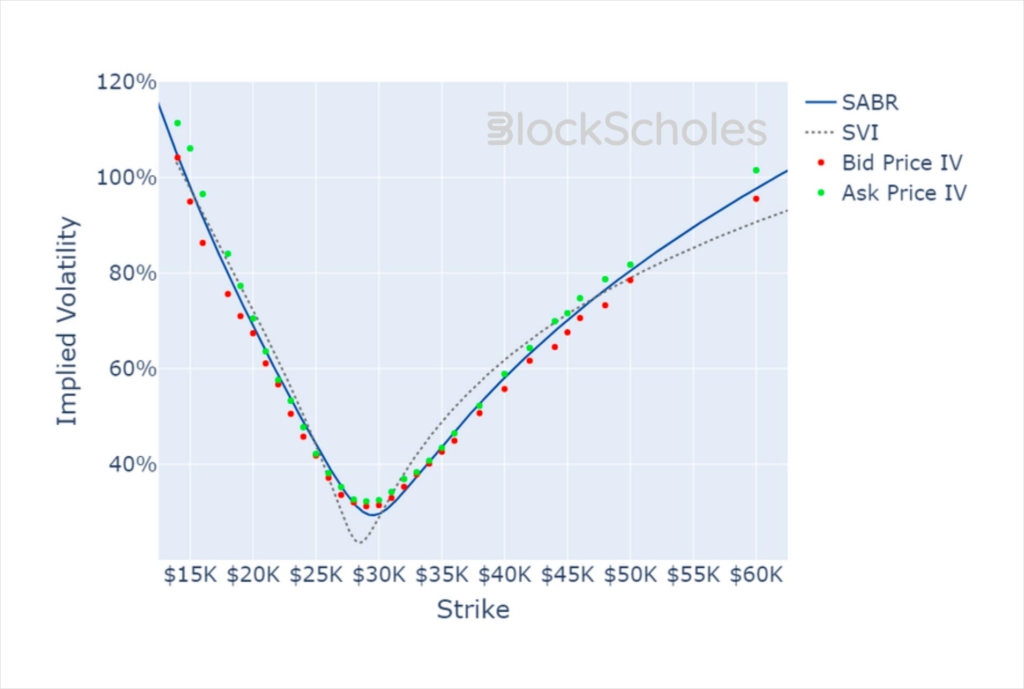

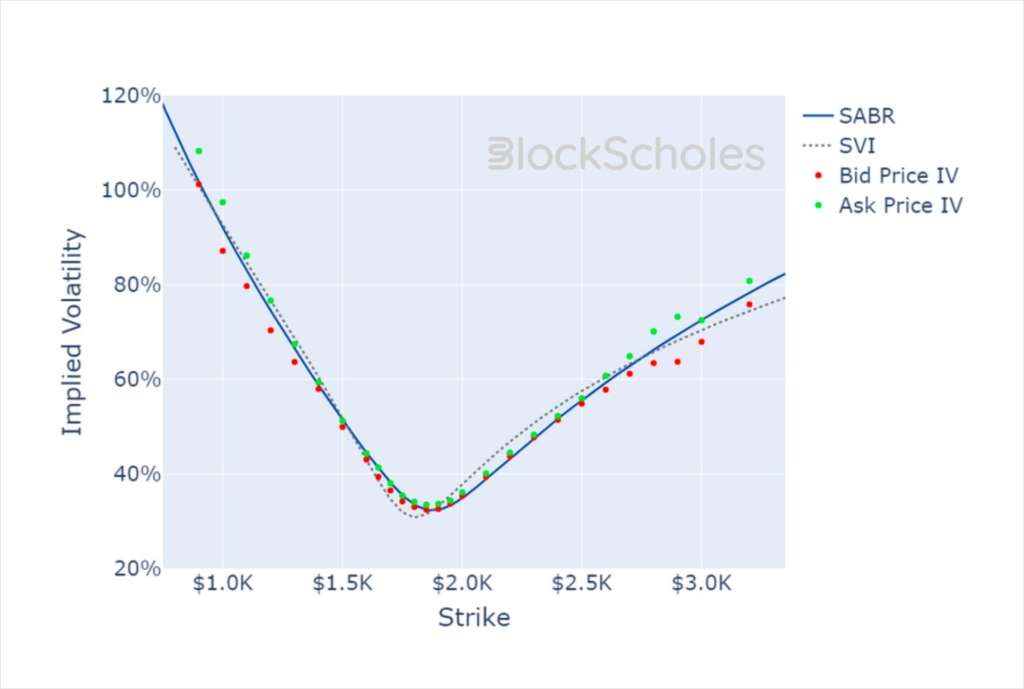

Volatility Smiles

BTC SMILE CALIBRATIONS – 25-Aug-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 25-Aug-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)