Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

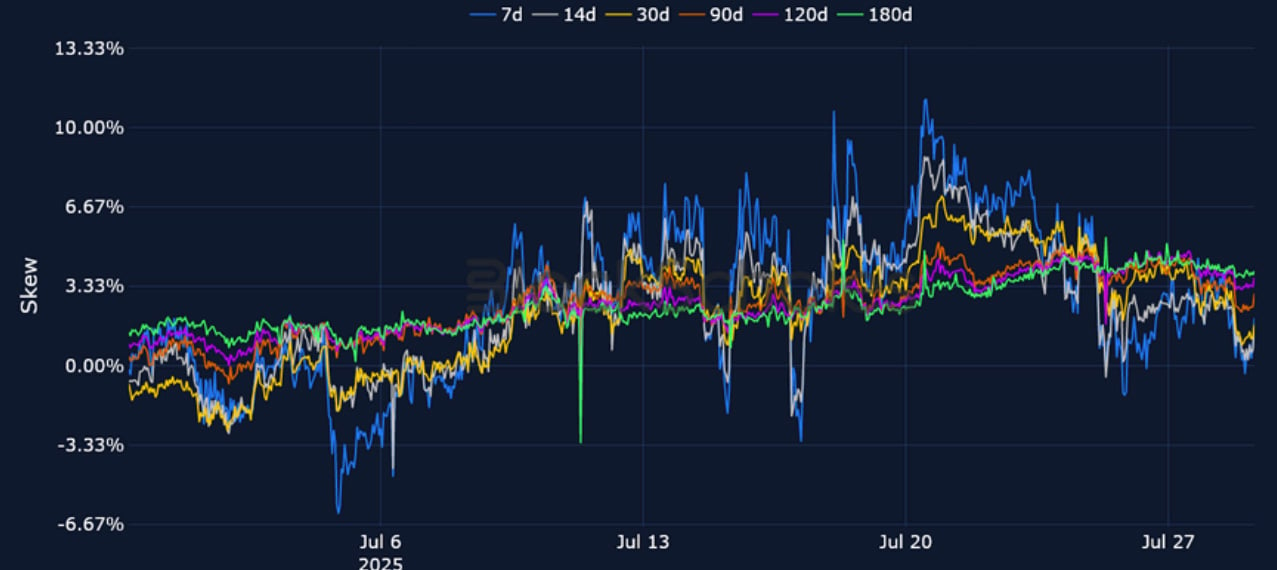

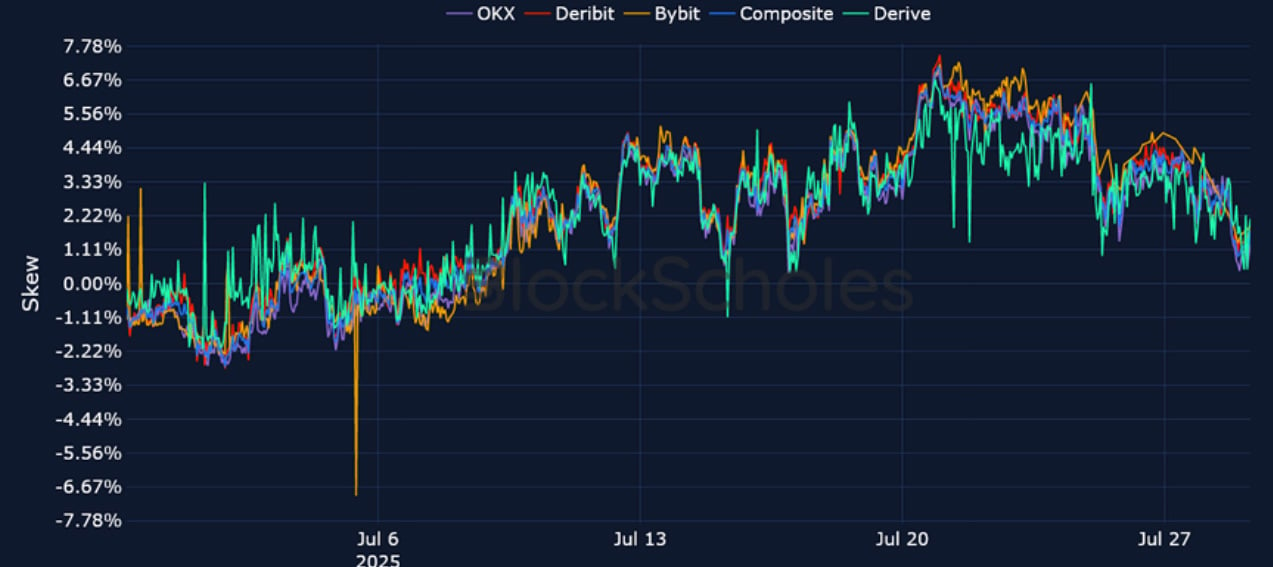

Two weeks ago BTC rallied to a new all-time high on the back of the exuberance affiliated with “Crypto Week”. Since then, it has traded sideways between $115K and $120K. That $115K low coincided with Galaxy Digital helping to facilitate the sale of 80,000 bitcoins for a “Satoshi-era investor”. While spot price recovered quickly from that local bottom, options markets still exhibit a skew towards OTM puts for short-tenor BTC options such as 7- and 14-day options. ETH on the other hand rallied past $3,900 for the first time since December 2024, with funding rates and skew supporting the rally. The past week has also been met with significant trade news. President Trump agreed deals with Japan, Philippines and the European Union, while also having a public disagreement with Fed Chair Jerome Powell.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

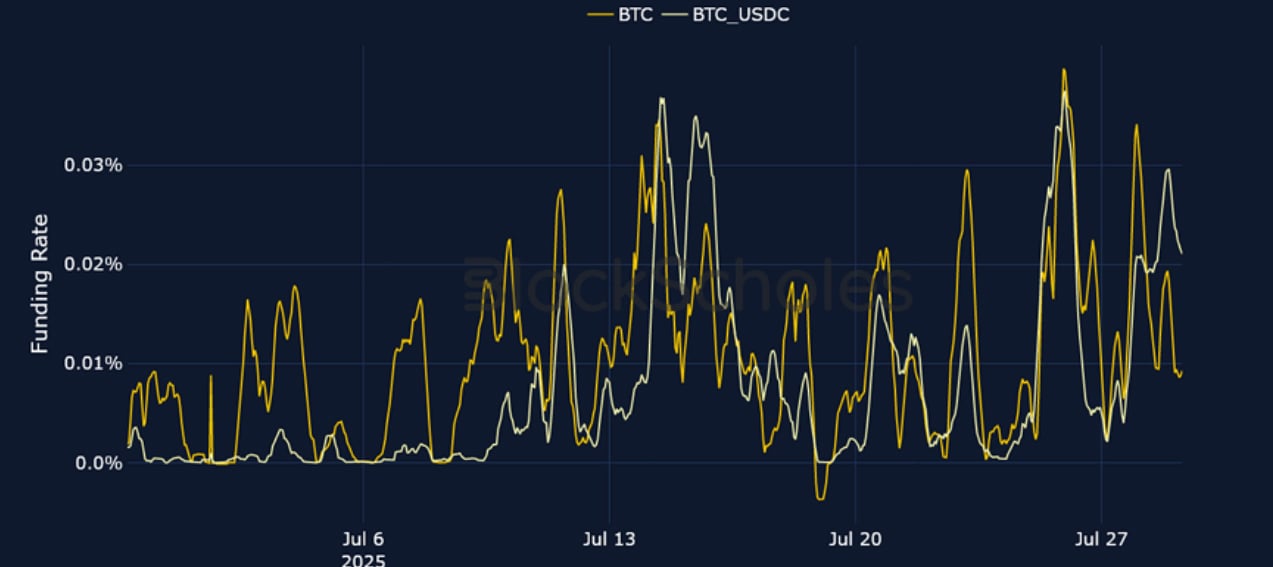

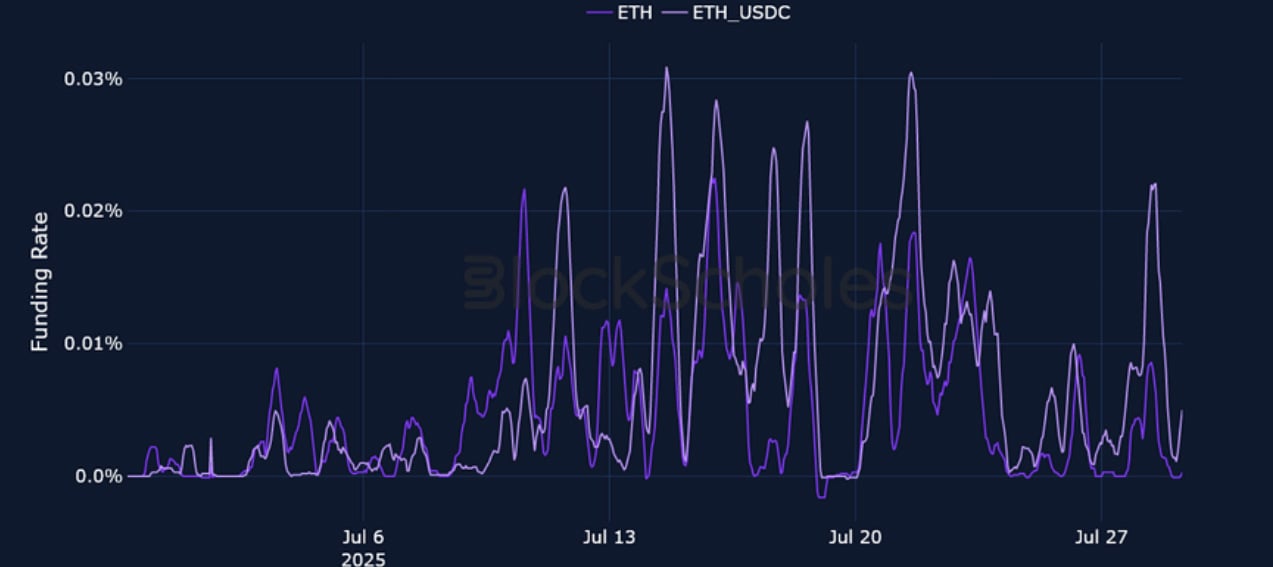

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates reached their highest over the past week on Friday evening, Jul 25, 2025, as BTC spot recovered from $115K to $118K.

ETH FUNDING RATE – Despite ETH reaching $3,900 for the first time since mid- December 2024 on Jul 28, 2025, funding rates failed to reach 0.03%.

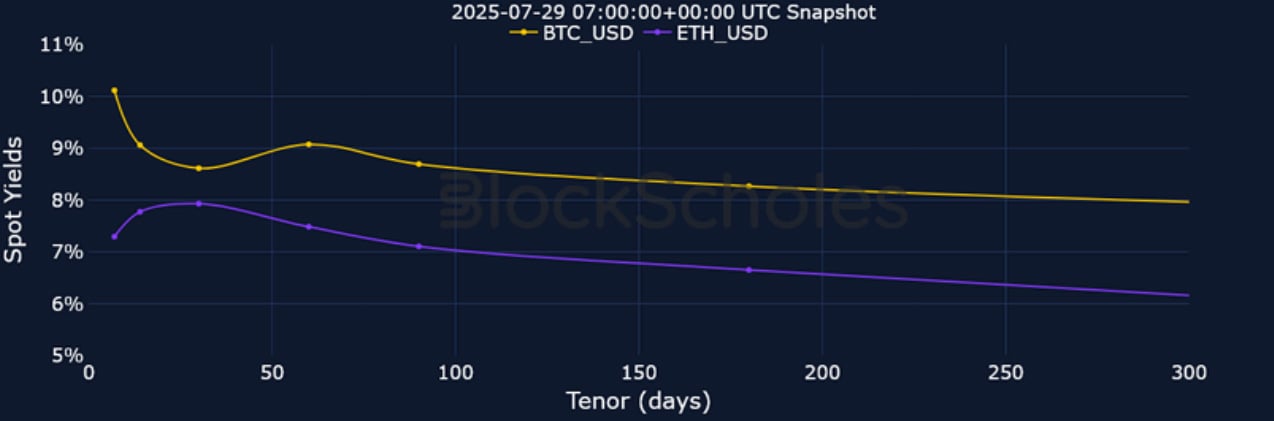

Futures Implied Yields

BTC Futures Implied Yields – BTC’s futures curve remains inverted with short term spot yields one percentage point higher than this time last week.

ETH Futures Implied Yields – Comparatively, ETH’s futures term structure has flattened at slightly higher outright levels than one week ago.

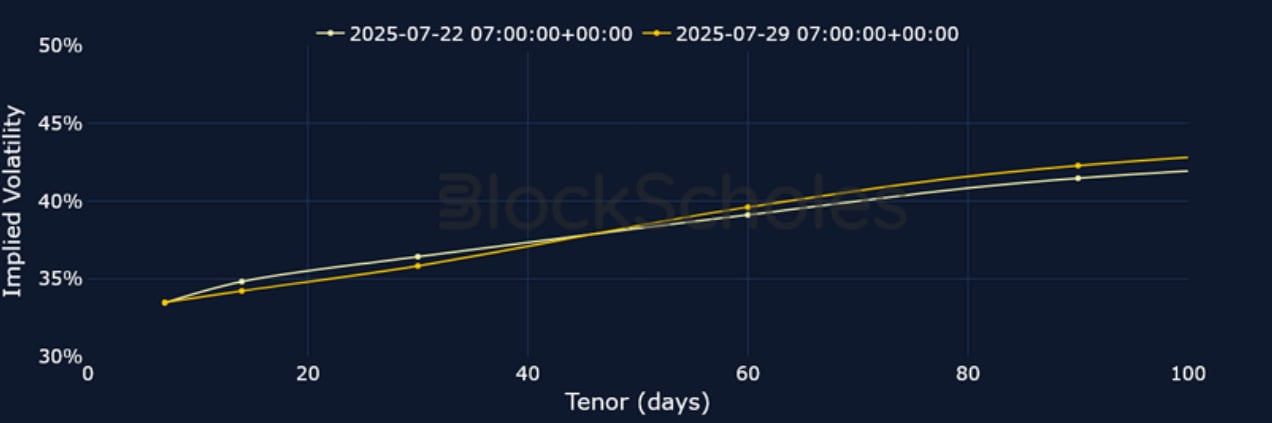

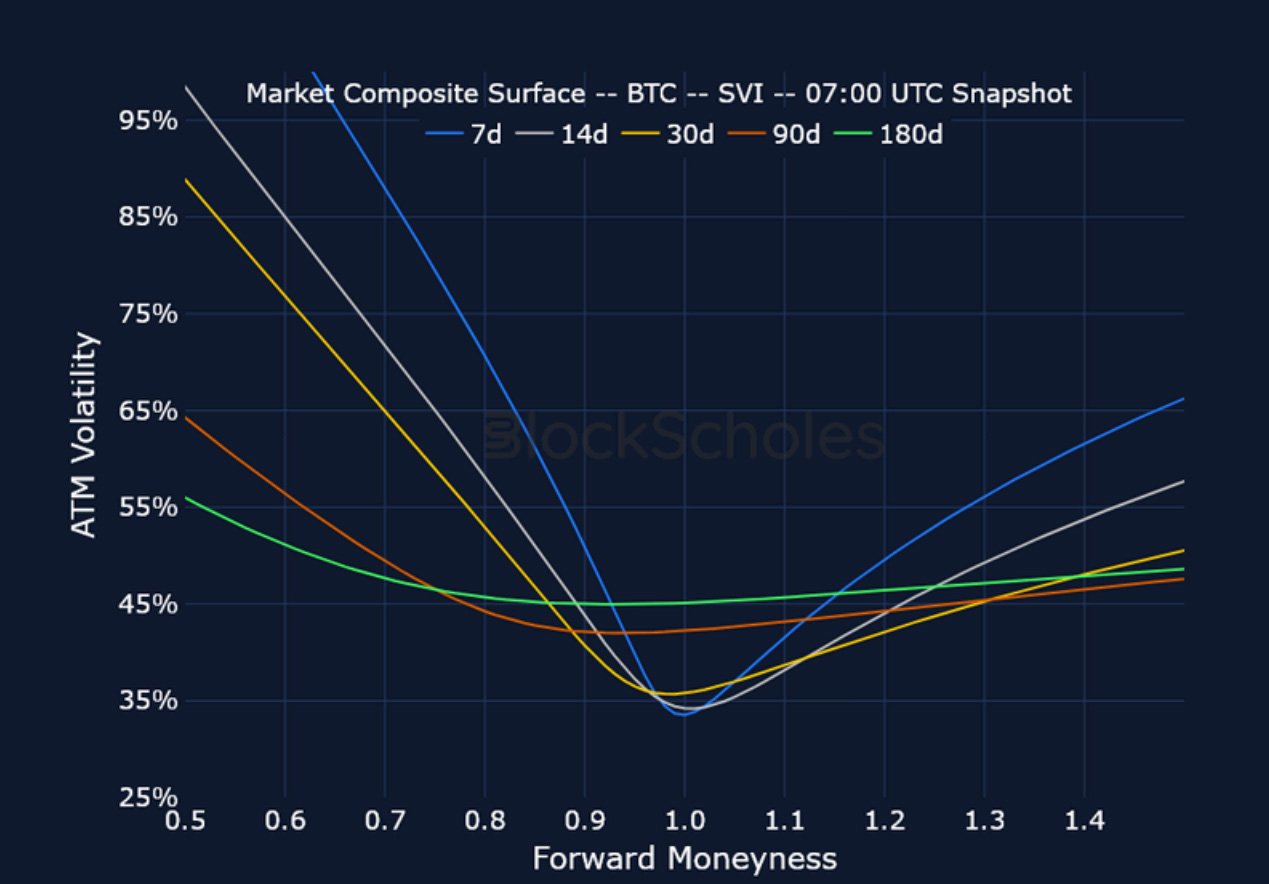

BTC Options

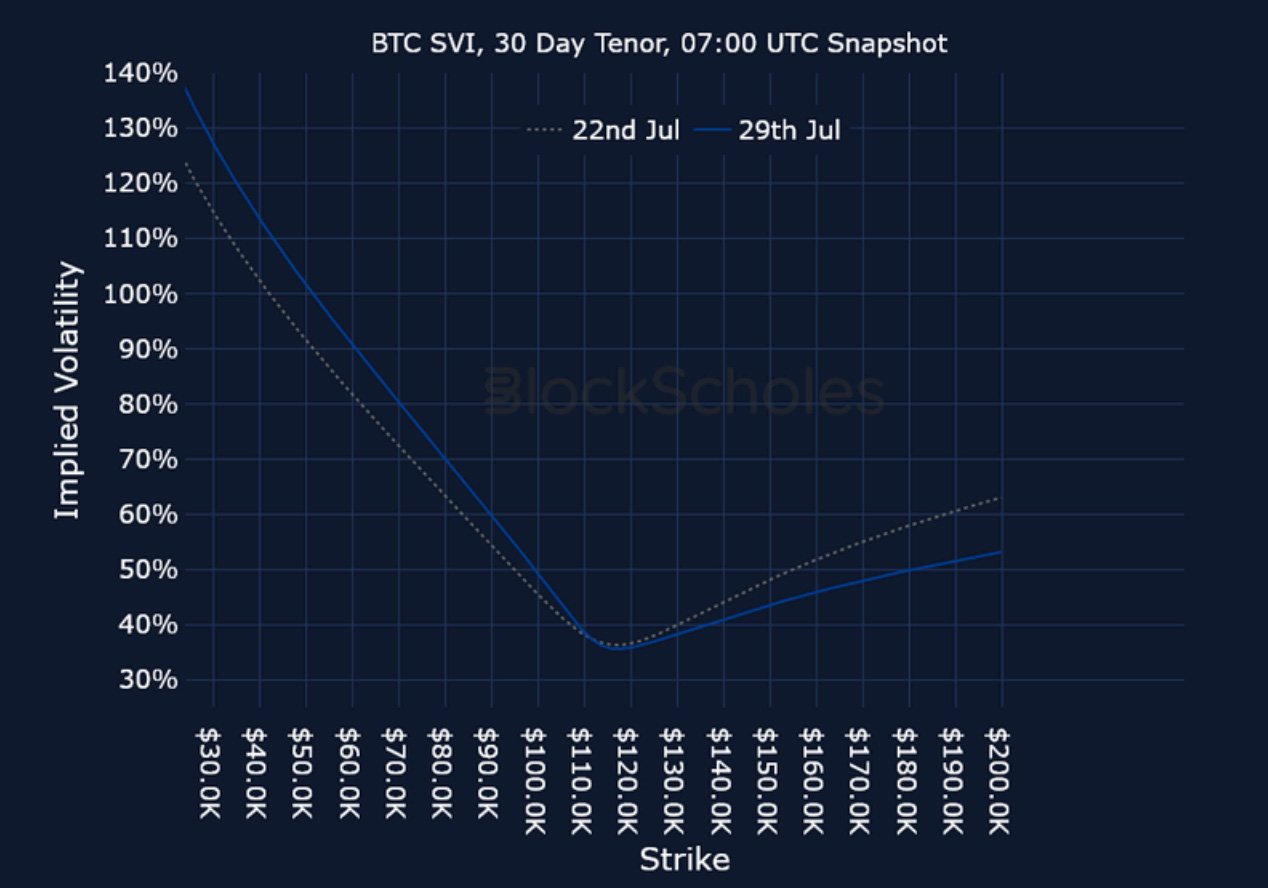

BTC SVI ATM IMPLIED VOLATILITY – The implied volatility on BTC options has traded between a low of 30% and a high of 38% over the last seven days.

BTC 25-Delta Risk Reversal – With a sideways spot price of $115K and $120K, short-tenor options have mostly been skewed towards OTM puts this week.

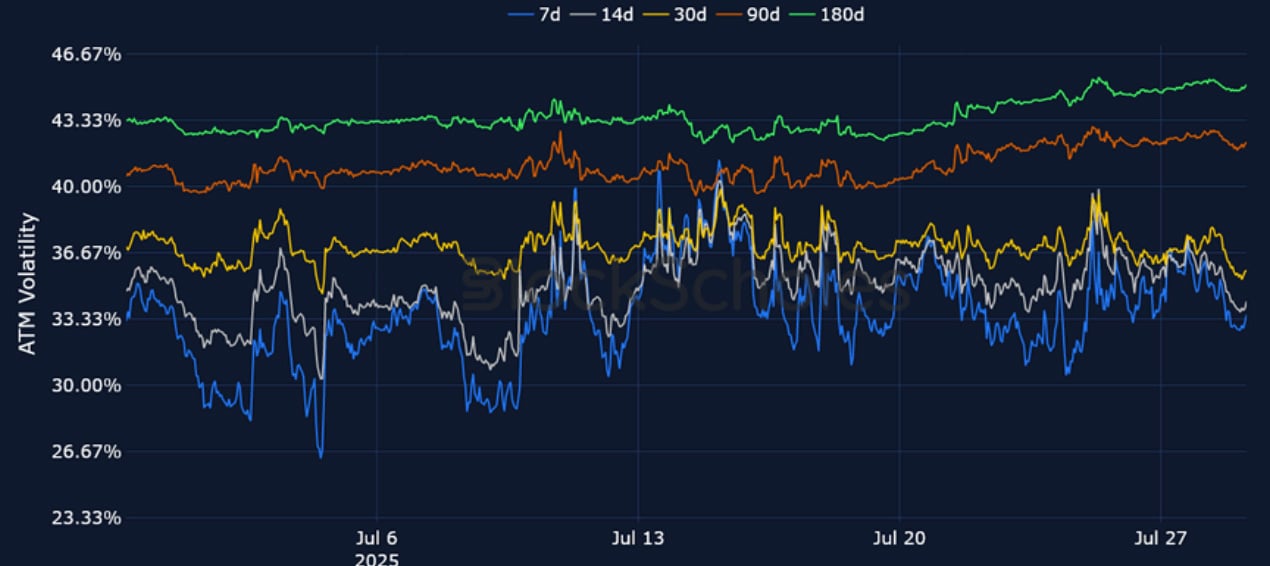

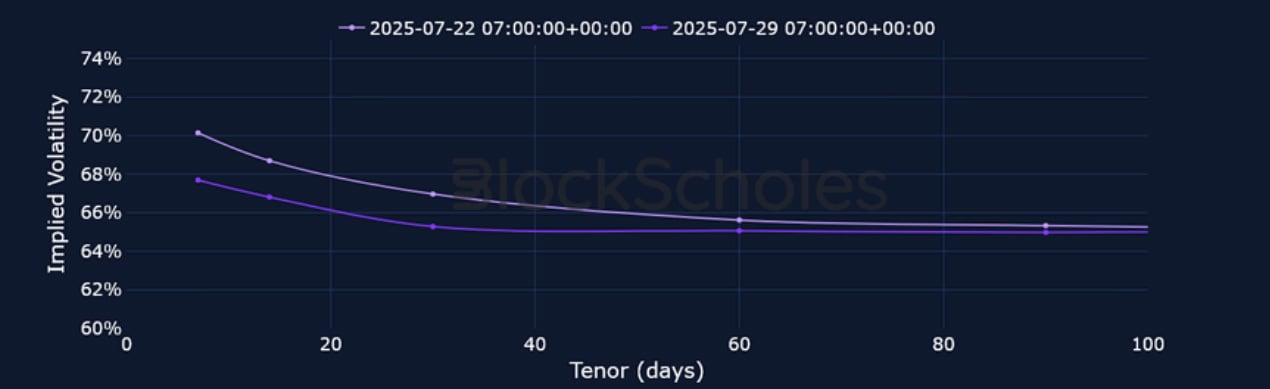

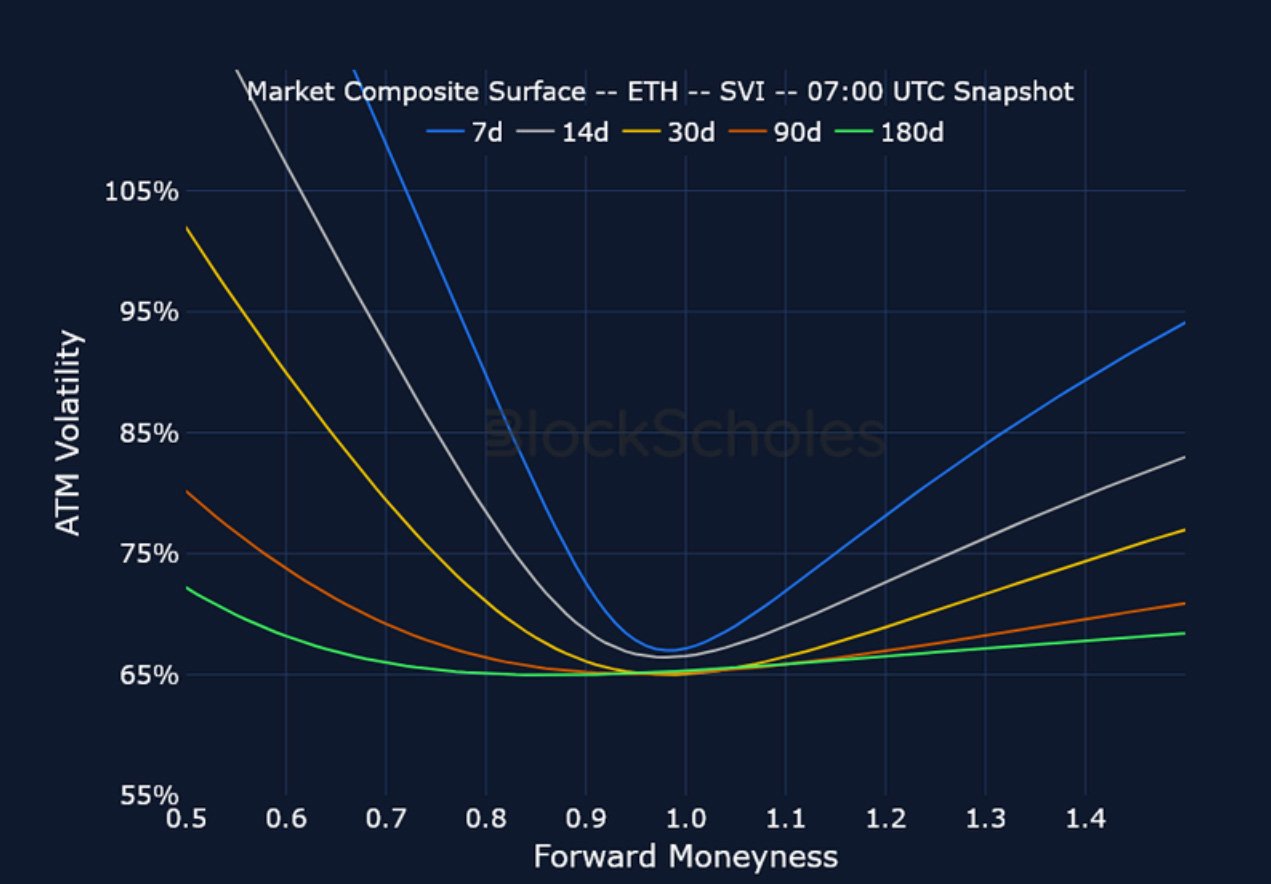

ETH Options

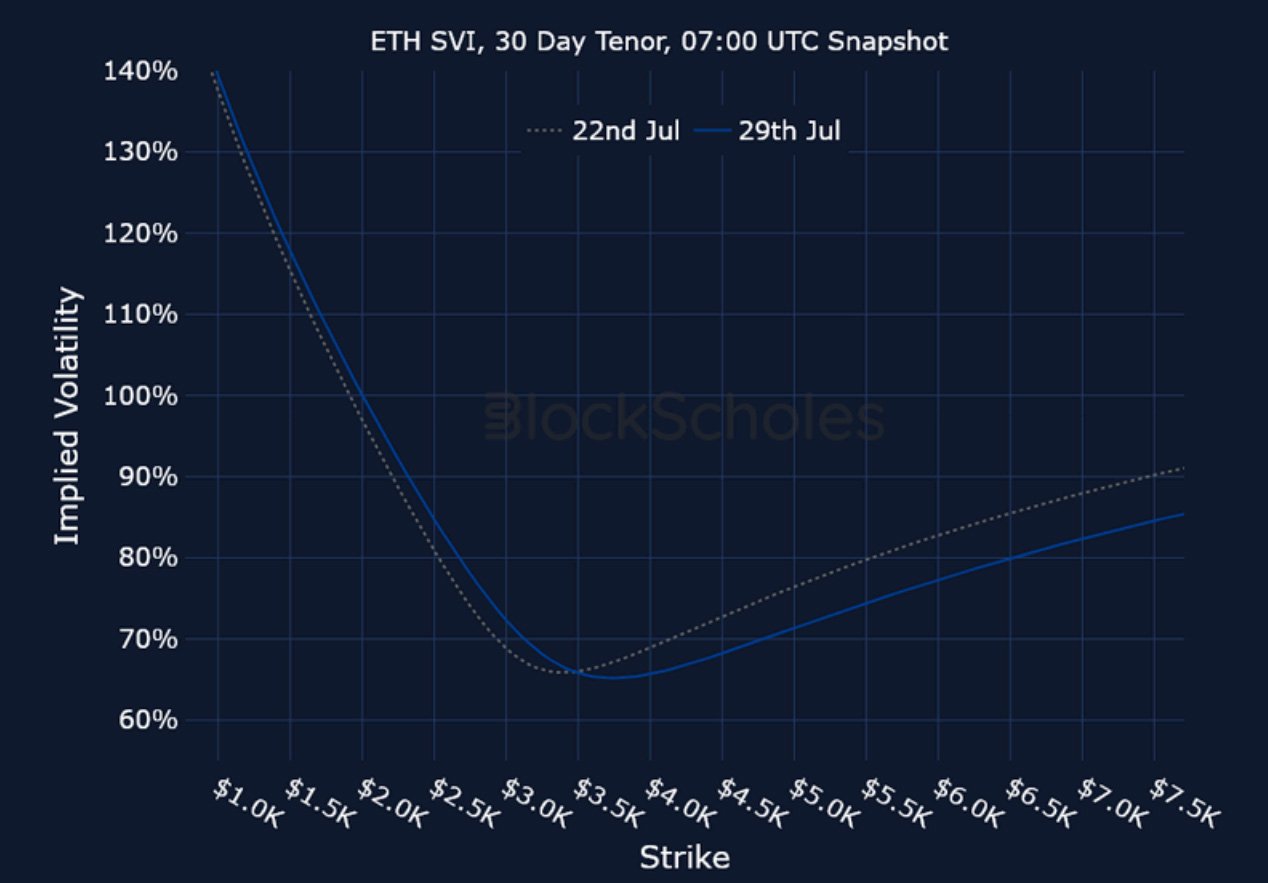

ETH SVI ATM IMPLIED VOLATILITY – Unlike BTC, ETH’s term structure of volatility inverted as its spot price trades 6% higher since Jul 22, 2025.

ETH 25-Delta Risk Reversal – ETH skew across the term structure only briefly fell below 0% this week and has mostly been tilted towards OTM call options. However, that skew has abated significantly from its 11% highs earlier in July.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

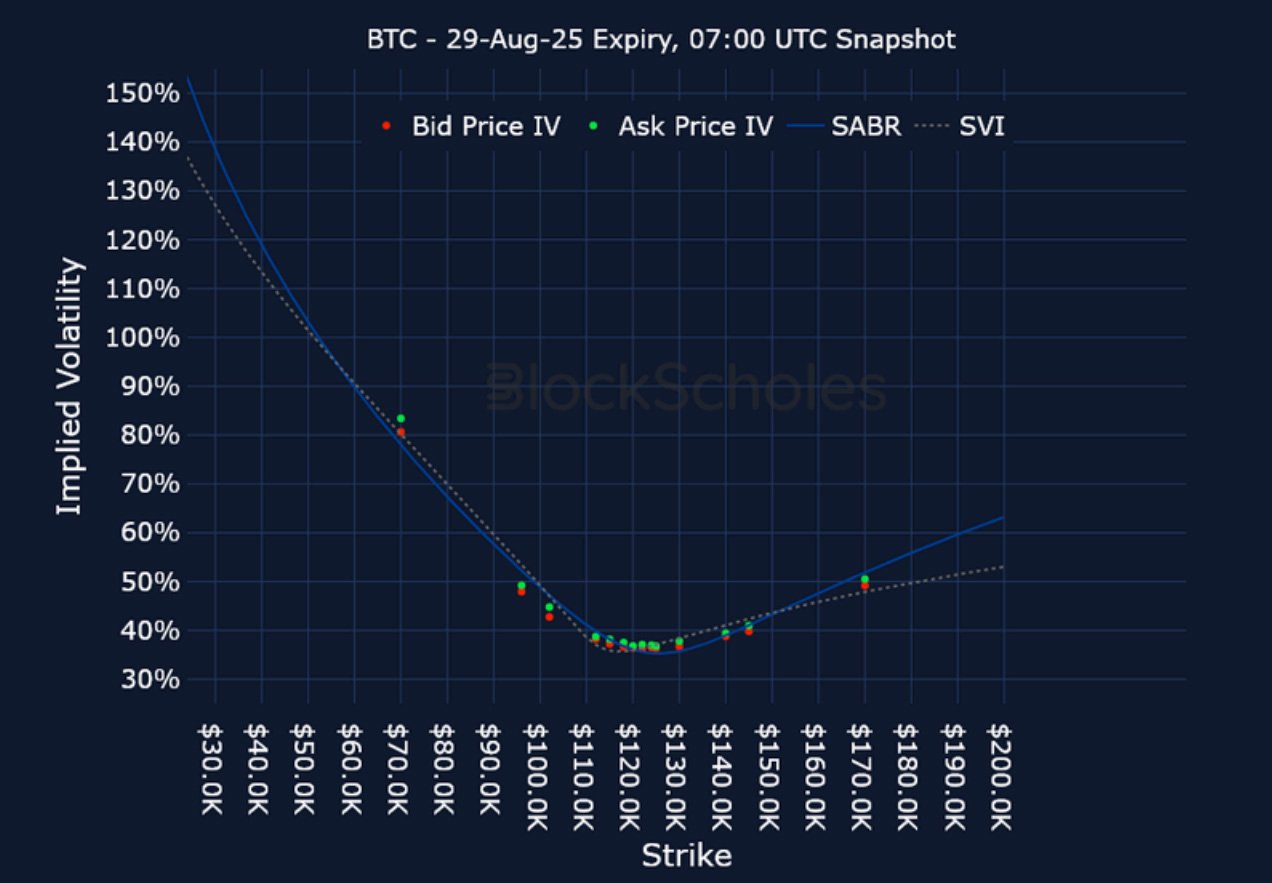

Listed Expiry Volatility Smiles

BTC 29-AUG EXPIRY – 9:00 UTC Snapshot.

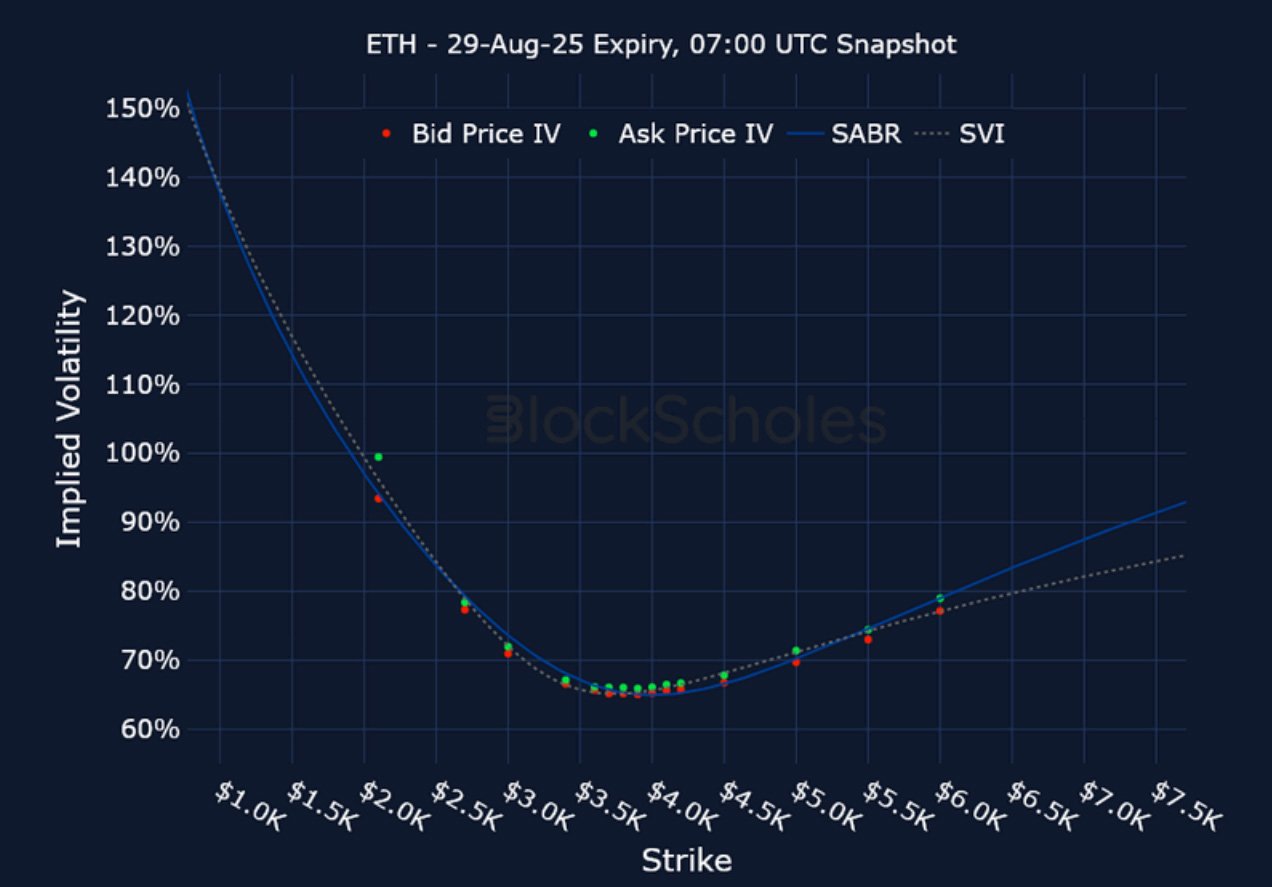

ETH 29-AUG EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

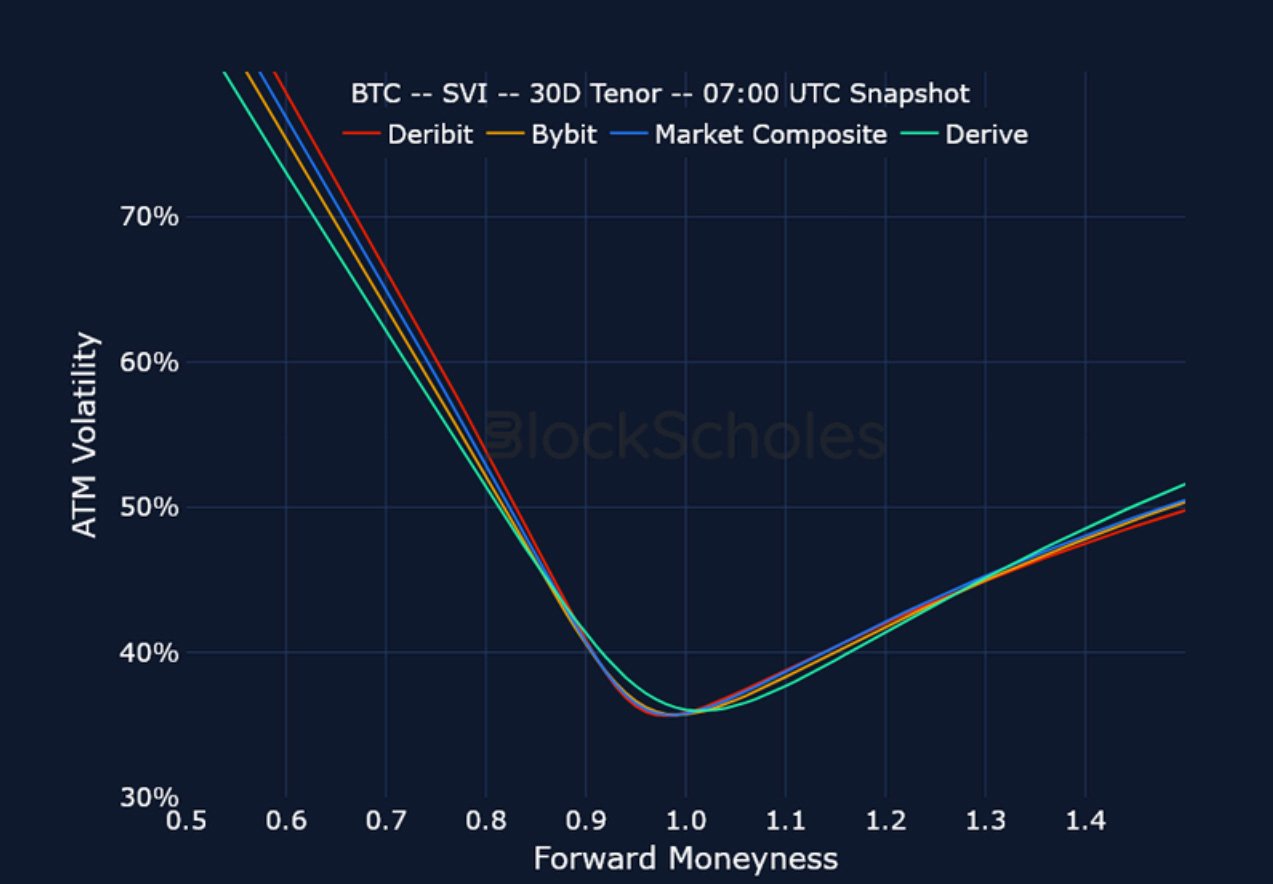

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

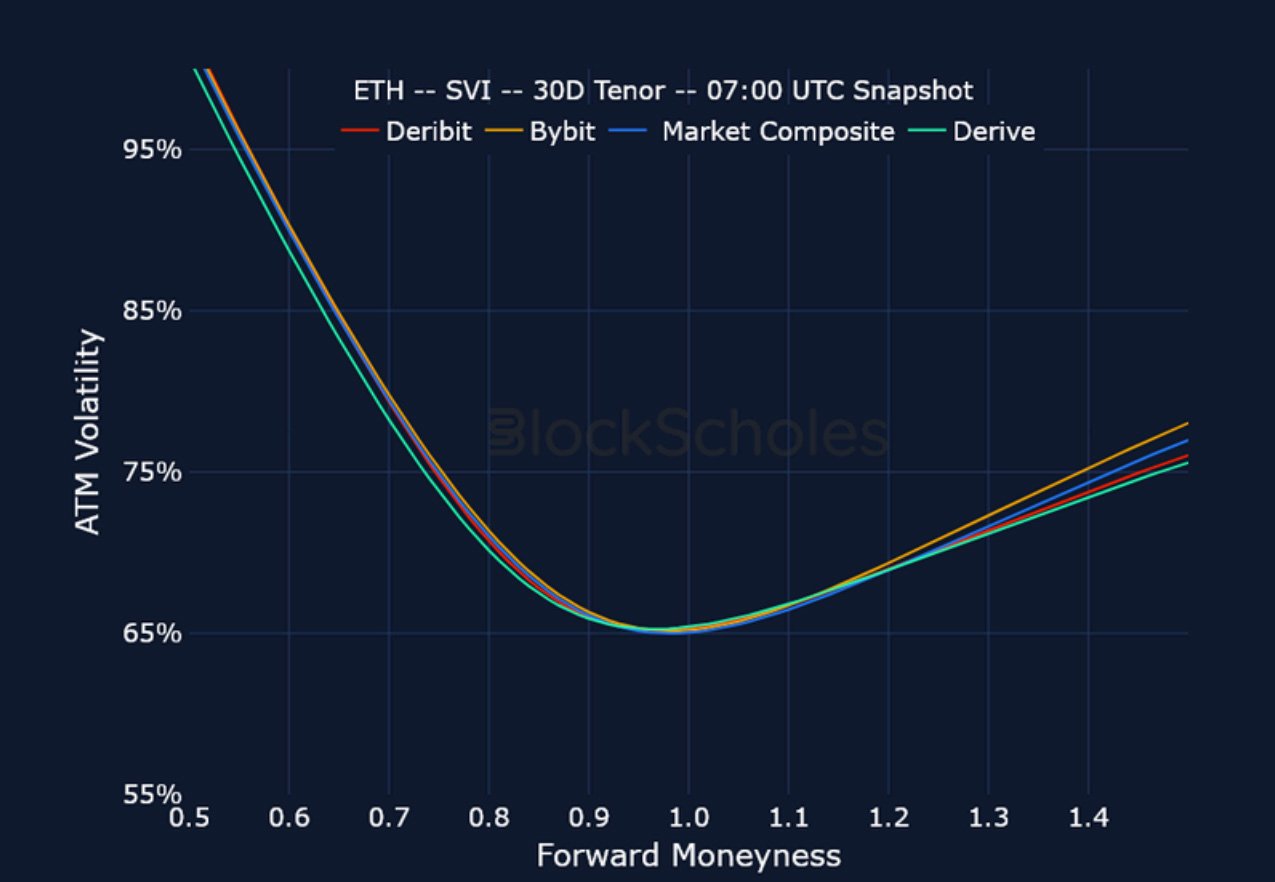

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)