Weekly recap of the crypto derivatives markets by BlockScholes.

BTC Derivatives Analytics

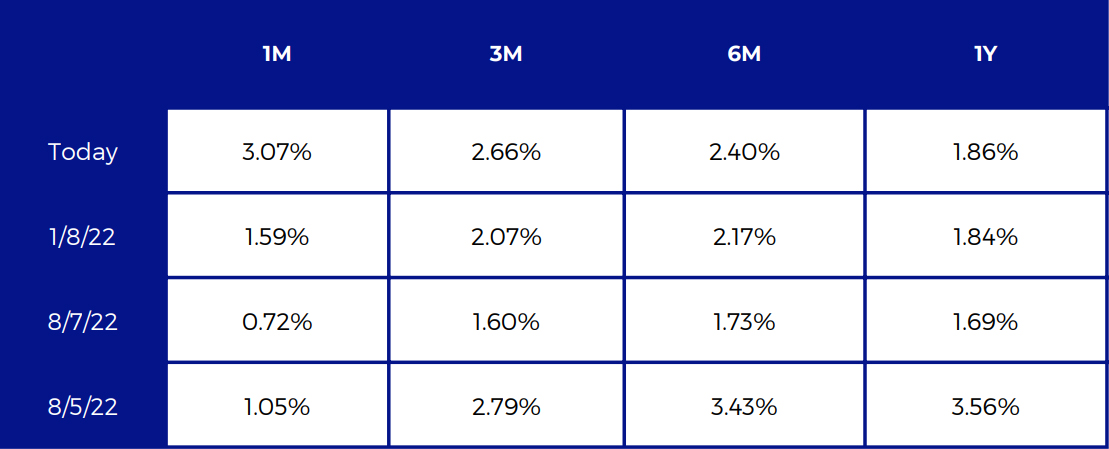

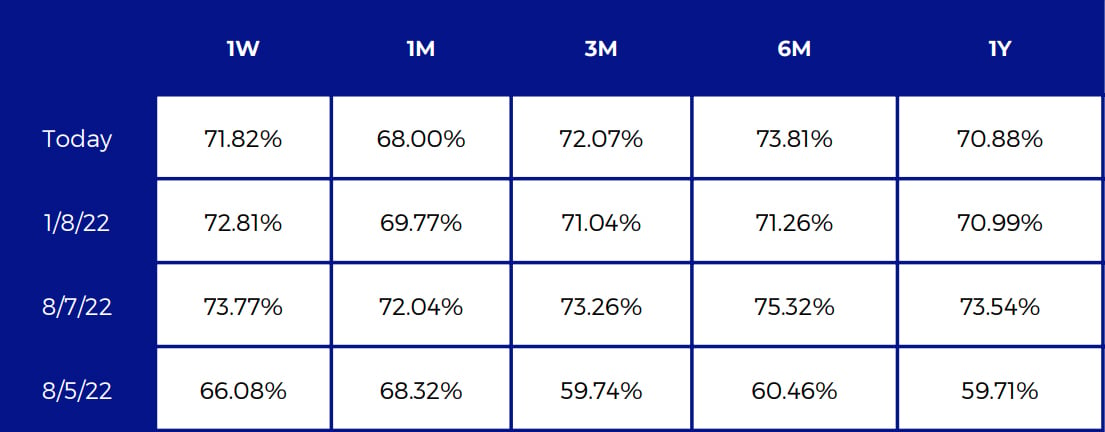

Annualised implied yields at all tenors have risen in response to the recent BTC spot rally

BTC Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

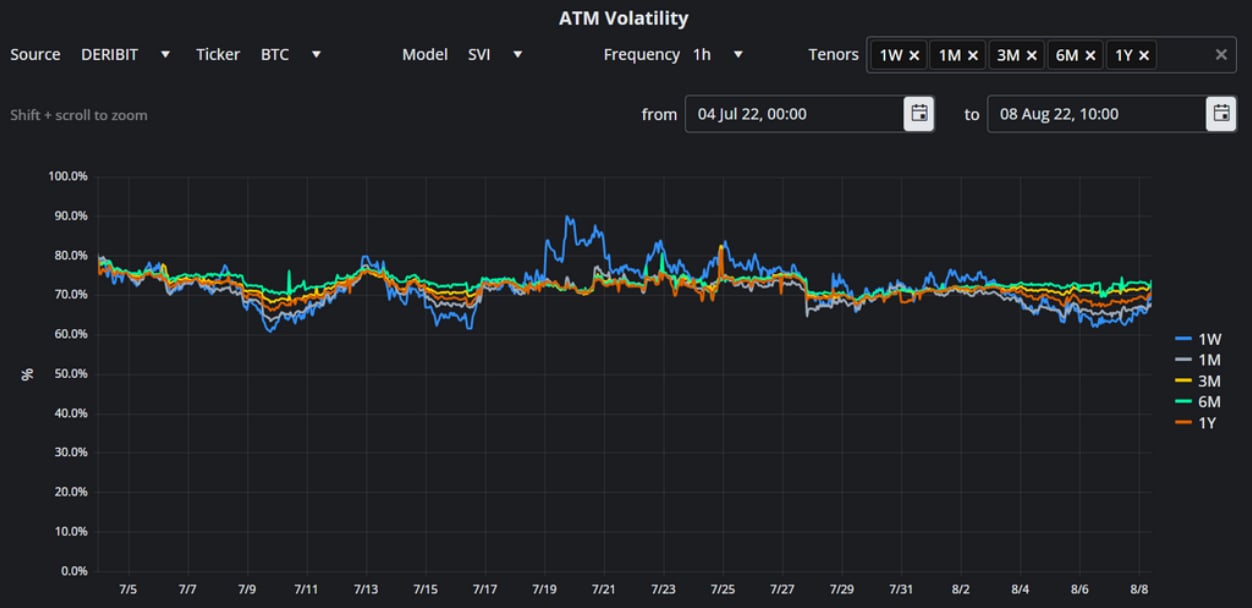

BTC’s ATM implied volatility is now no longer inverted and is rising for short-dated expiries

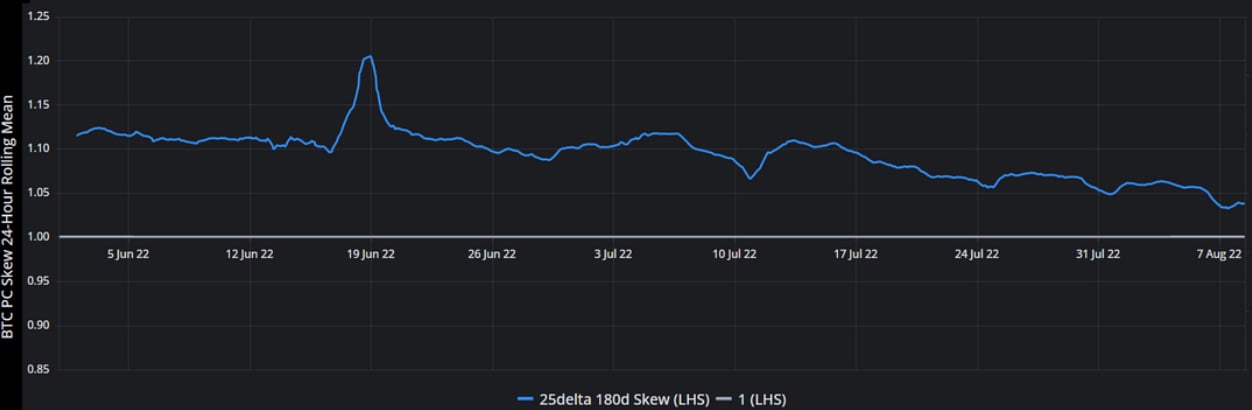

BTC’s 25-delta put-call skew continues to trend downwards

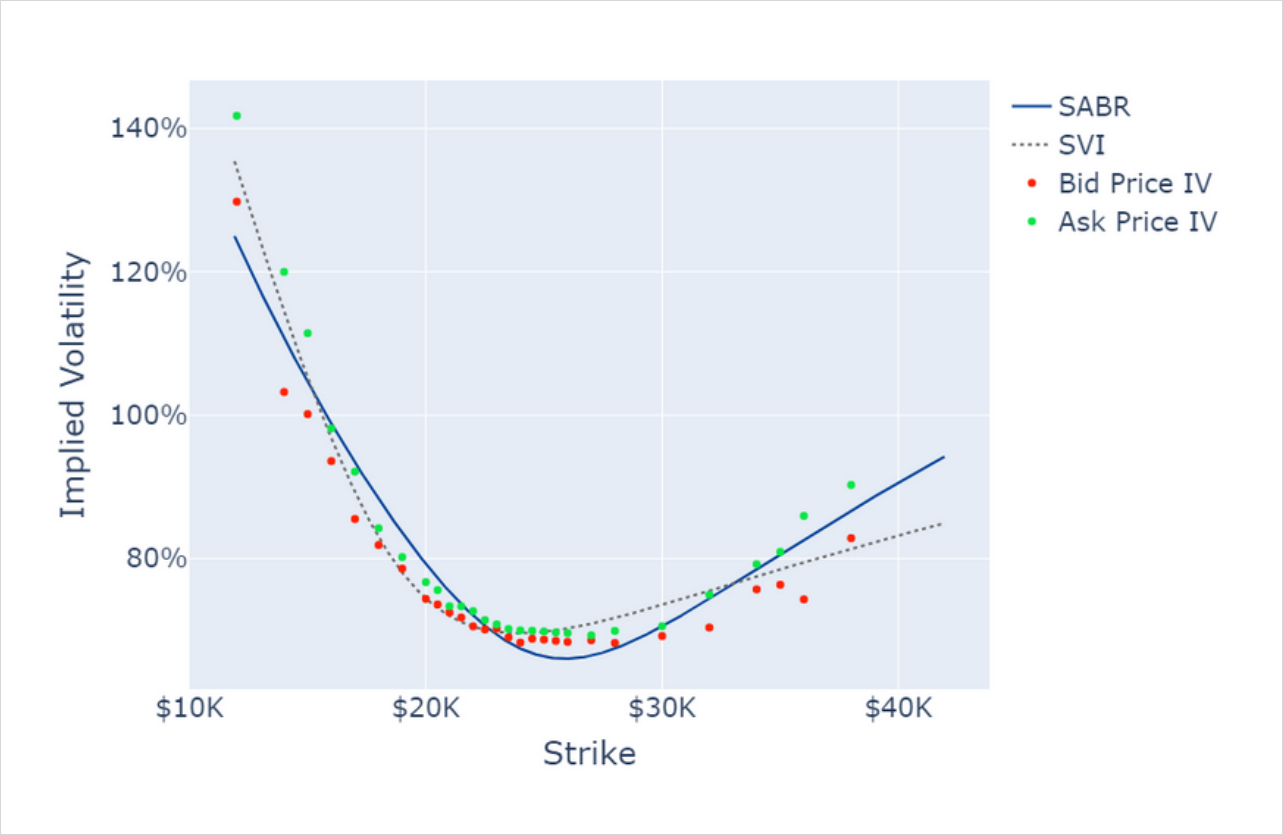

SABR Smile Calibration

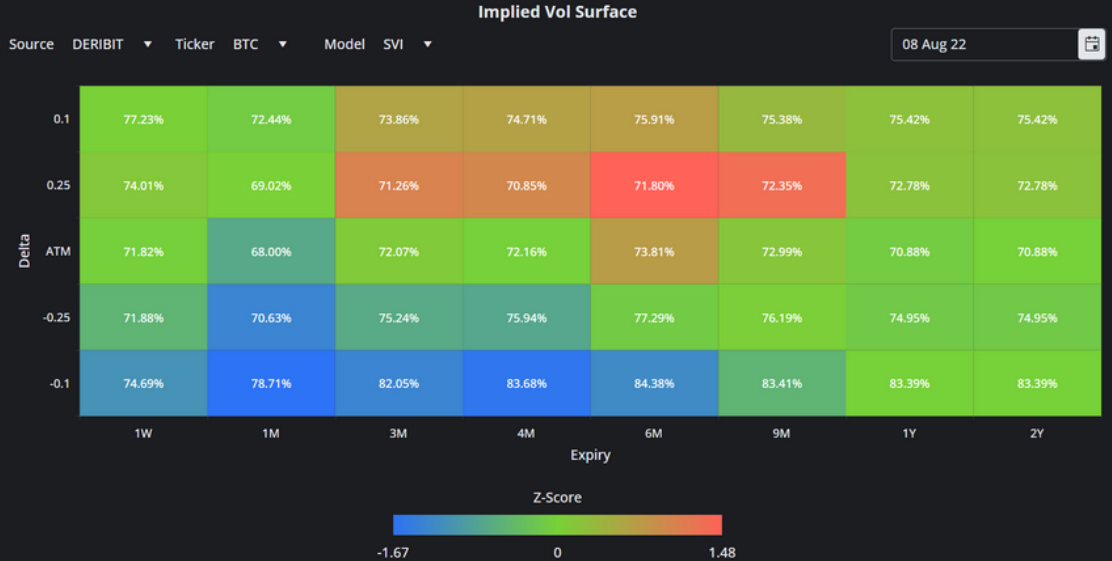

The IV of short-dated BTC calls has cooled as 6M OTM puts have outperformed the rest of the volatility surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 26th August Expiry

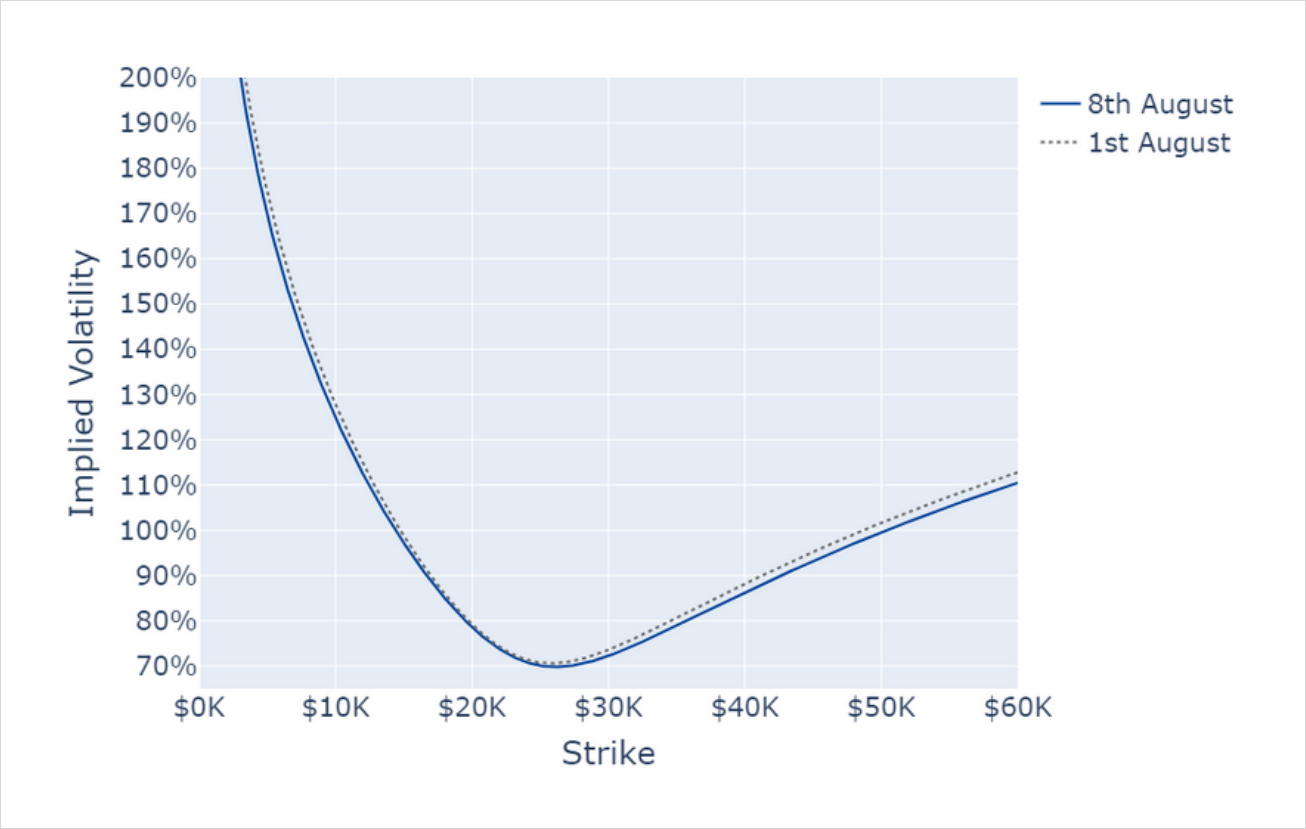

BTC’s volatility smile remains skewed towards OTM puts and at similar overall levels to 7 days ago

BTC 1 Month SABR Implied Vol Smile.

ETH Derivatives Analytics

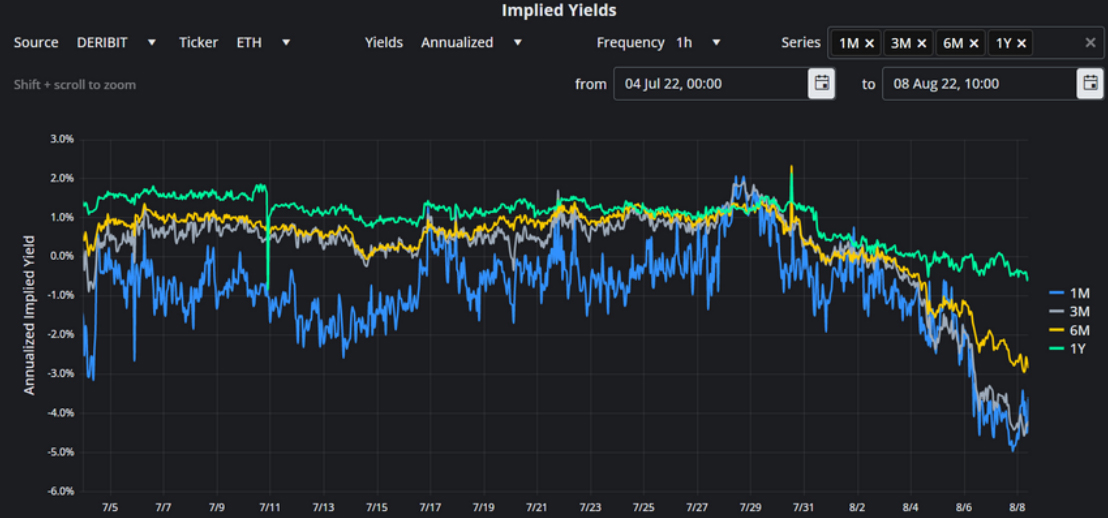

Unlike BTC’s, ETH’s annualised yields are significantly below zero, in spite of the spot rally over the past month

Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

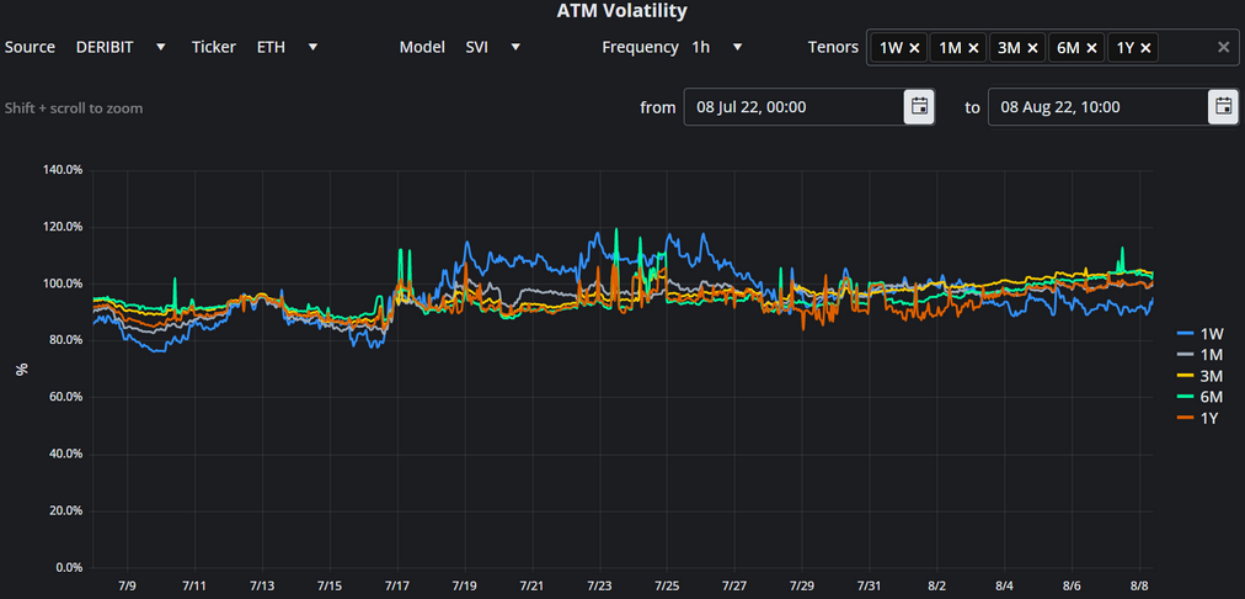

ETH’s short-term ATM implied vols are stable as the implied vol of longer-date options pushes higher

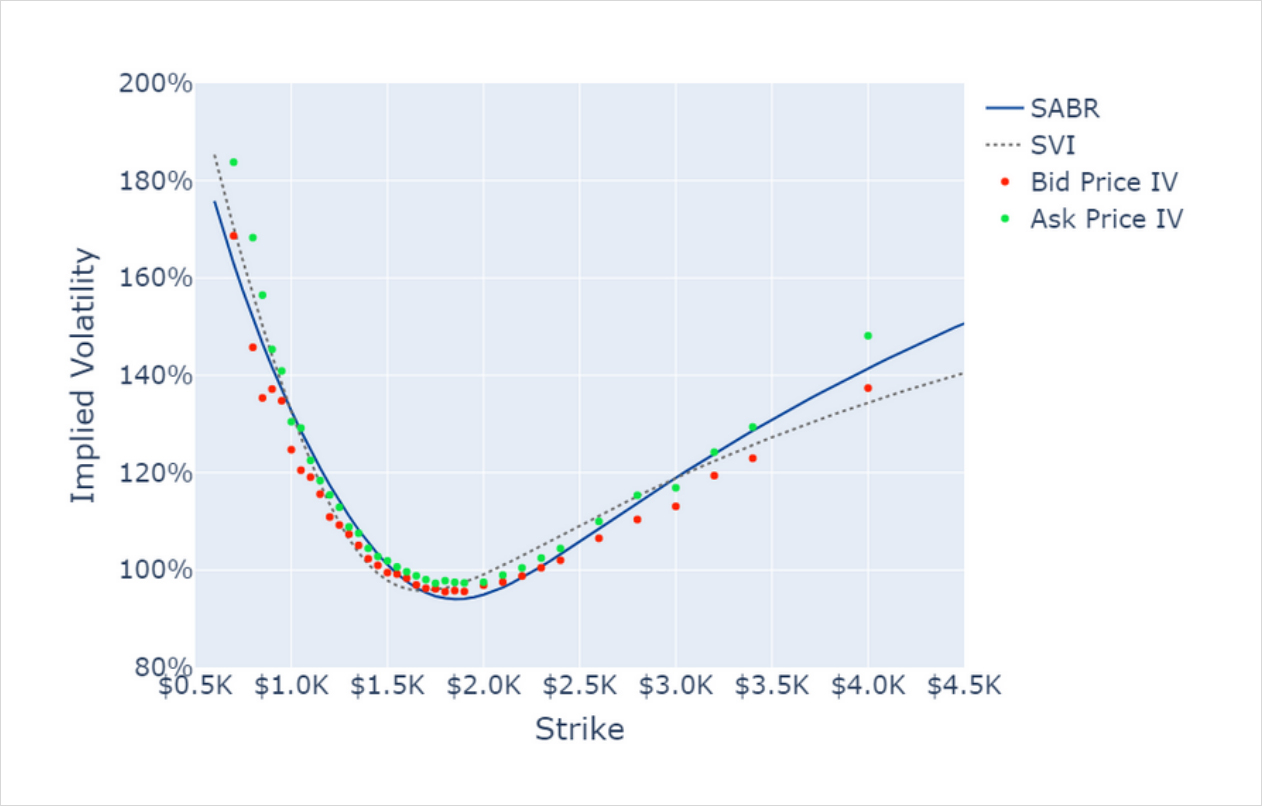

Whilst ETH’s 180d volatility smile has skewed back towards puts, the phenomenon has weakened over the past week

SABR Smile Calibration

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

ETH ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

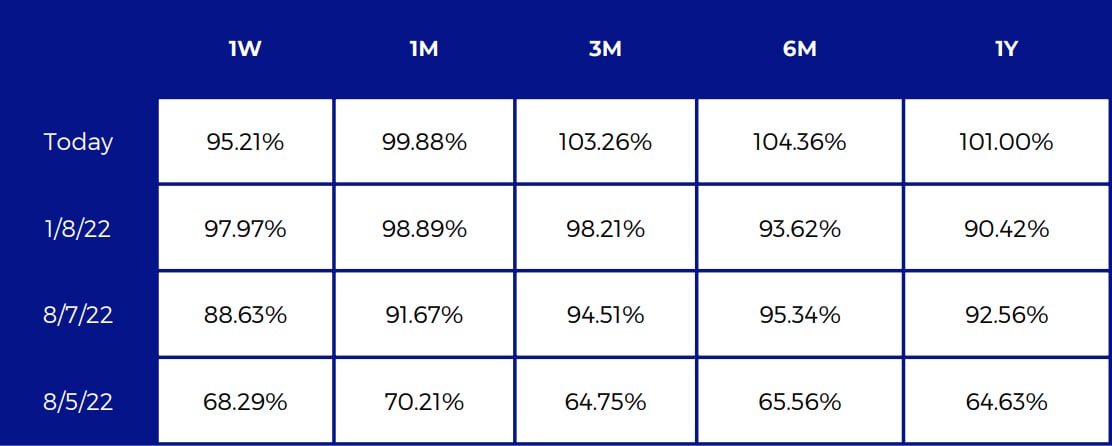

SABR and SVI Smile Calibrations, 26th August Expiry

The smile’s wings are less steep and the vol of both OTM puts and calls has dropped from last week’s levels

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)