Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

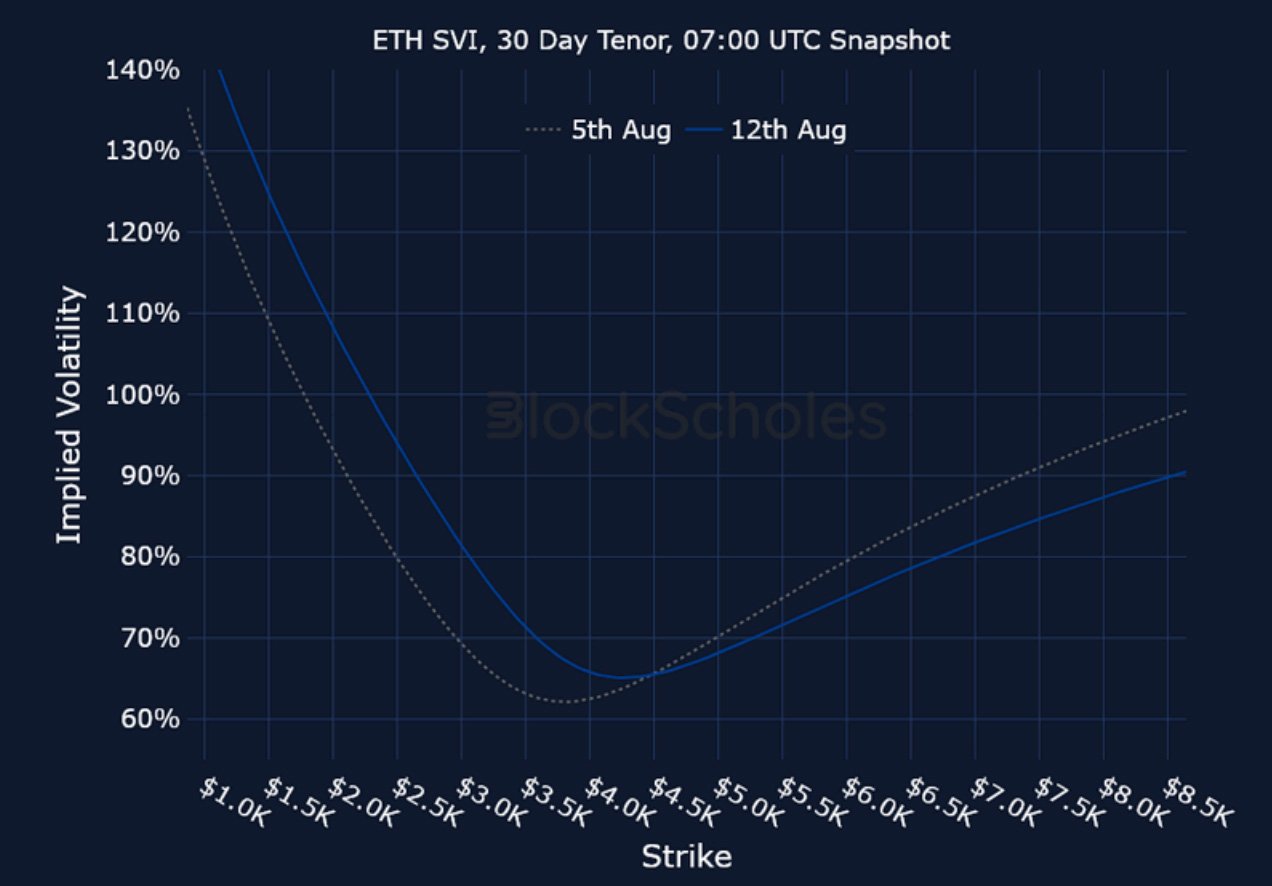

This week the spotlight has been on Ethereum as its native token trades more than 17% higher over the past seven days. Ether has been supported by a wave of buying via Spot ETH ETFs as well as institutional buying from the likes of BitMine and SharpLink Gaming. Spot ETFs saw their first ever $1B inflow day yesterday, while BitMine has become the largest corporate holder of ETH, amassing over 1M tokens. As such, derivatives markets are showing bullish signs. Volatility smiles are assigning a premium for call optionality, as 7-day options have a put-call skew close to 5%, while the futures-yields term structure has inverted, indicating a willingness from traders to pay a premium above the current spot price for upside ETH exposure. Over the weekend, ETH rallied past $4,000 for the first time since Dec 2024.

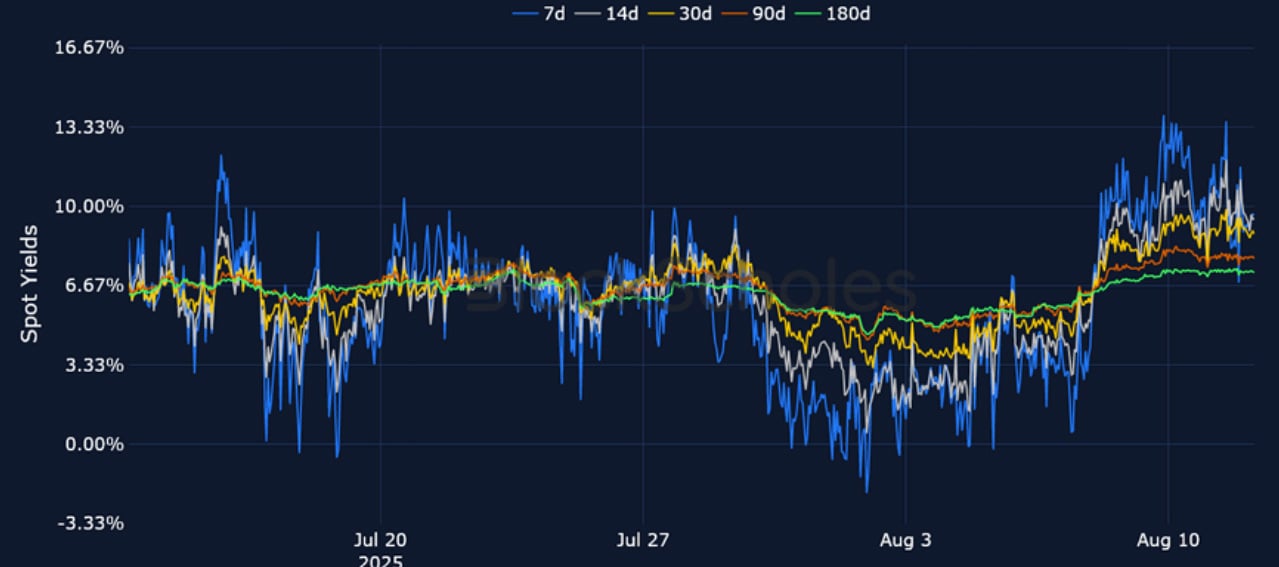

Futures Implied Yields

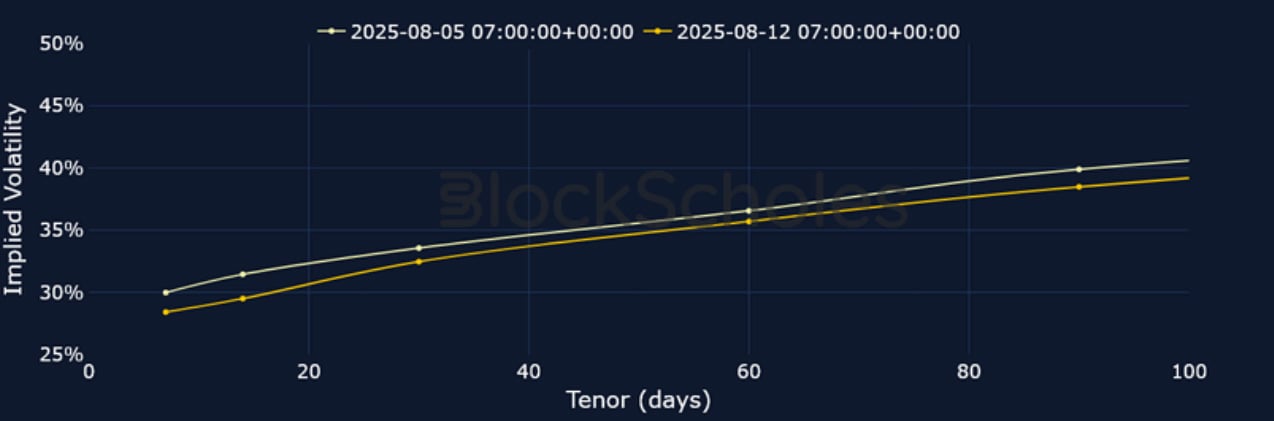

1-Month Tenor ATM Implied Volatility

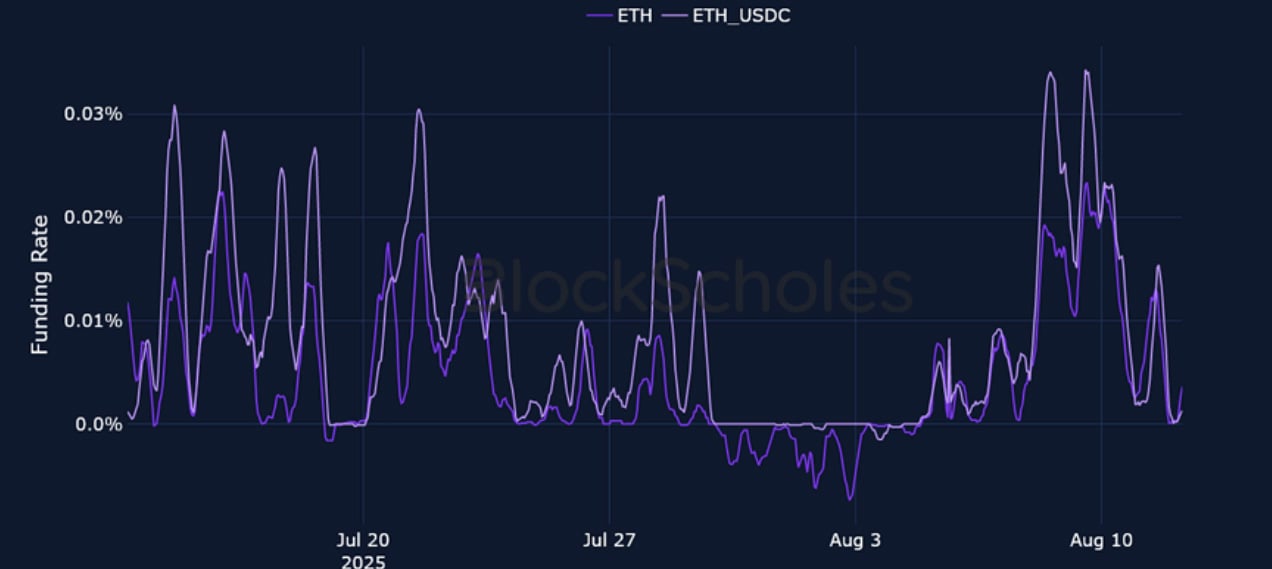

Perpetual Swap Funding Rate

BTC FUNDING RATE – As BTC neared its ATH of $123K yesterday, funding rates exceeded 0.02%, but a pullback in spot has caused the same in funding now.

ETH FUNDING RATE – Funding rates surged as high as 0.03%, in line with a spot price that has rallied 17% over the past seven days.

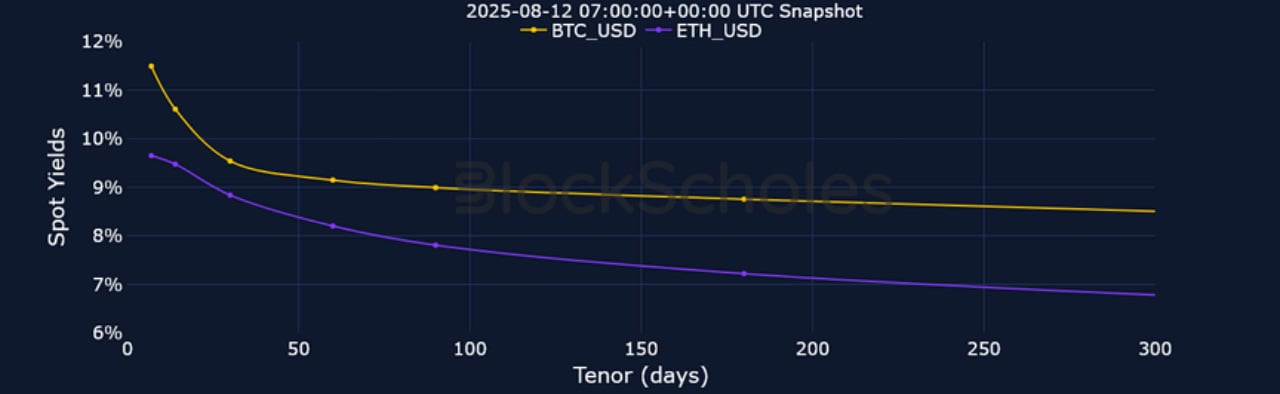

Futures Implied Yields

BTC Futures Implied Yields – While BTC spot has underperformed ETH this week, futures yields remain higher across the term structure relative to ETH.

ETH Futures Implied Yields – Markets show a strong willingness to pay a premium above ETH’s spot price for long exposure as 7-day yields are at 9.7%.

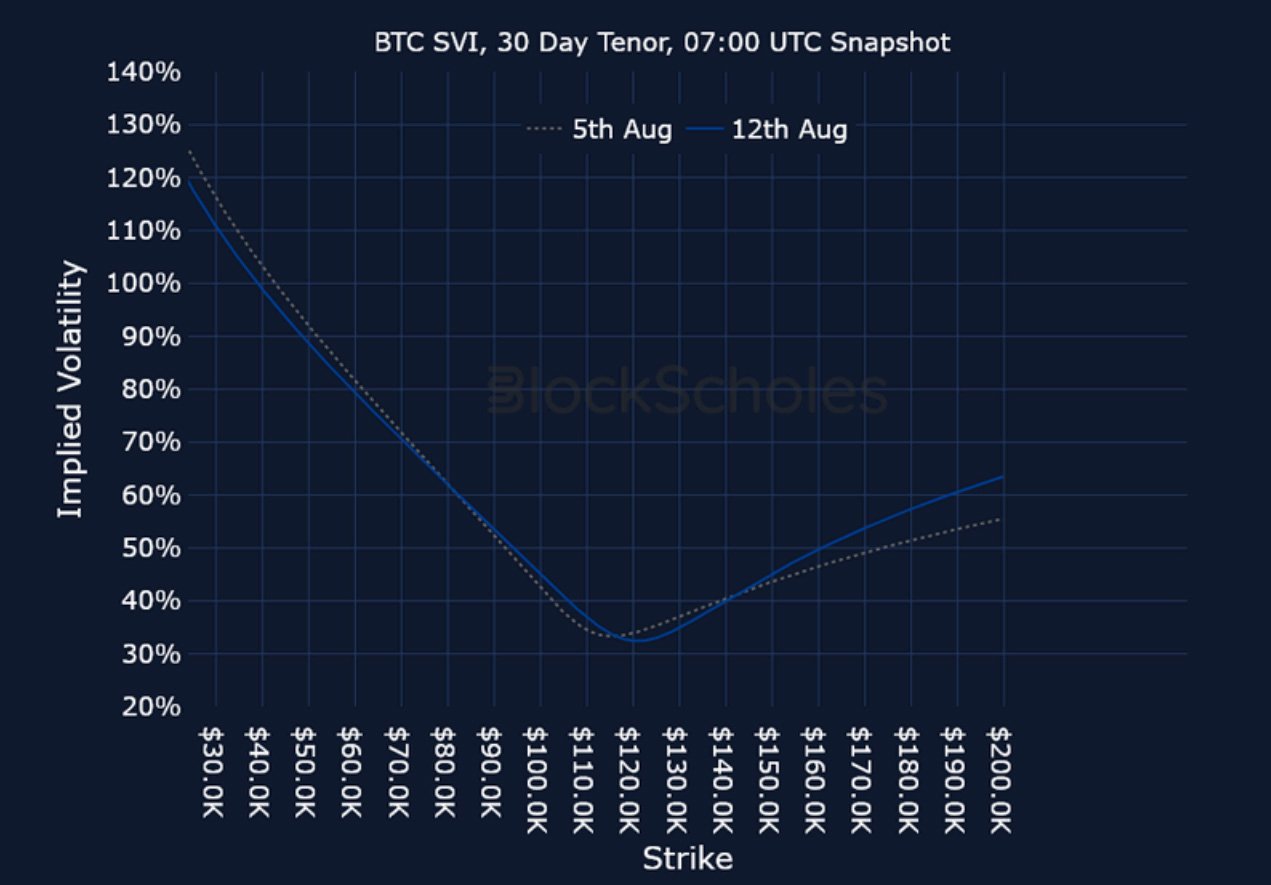

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor volatility fell below 25% on Aug 8, as BTC spot price traded sideways at $116K.

BTC 25-Delta Risk Reversal – Despite trading close to ATH’s, short tenor BTC volatility smiles suggest traders are pricing for downside action, as put-call skew is tilted towards OTM puts in contrast to longer tenors.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – After a brief inversion on Aug 10, ETH’s term structure has now flattened close to 65%.

ETH 25-Delta Risk Reversal – ETH has been bolstered by rampant Spot ETF demand and digital asset treasury purchases. As such, OTM call options trade with a near 5% premium to out-of-the-money put options.

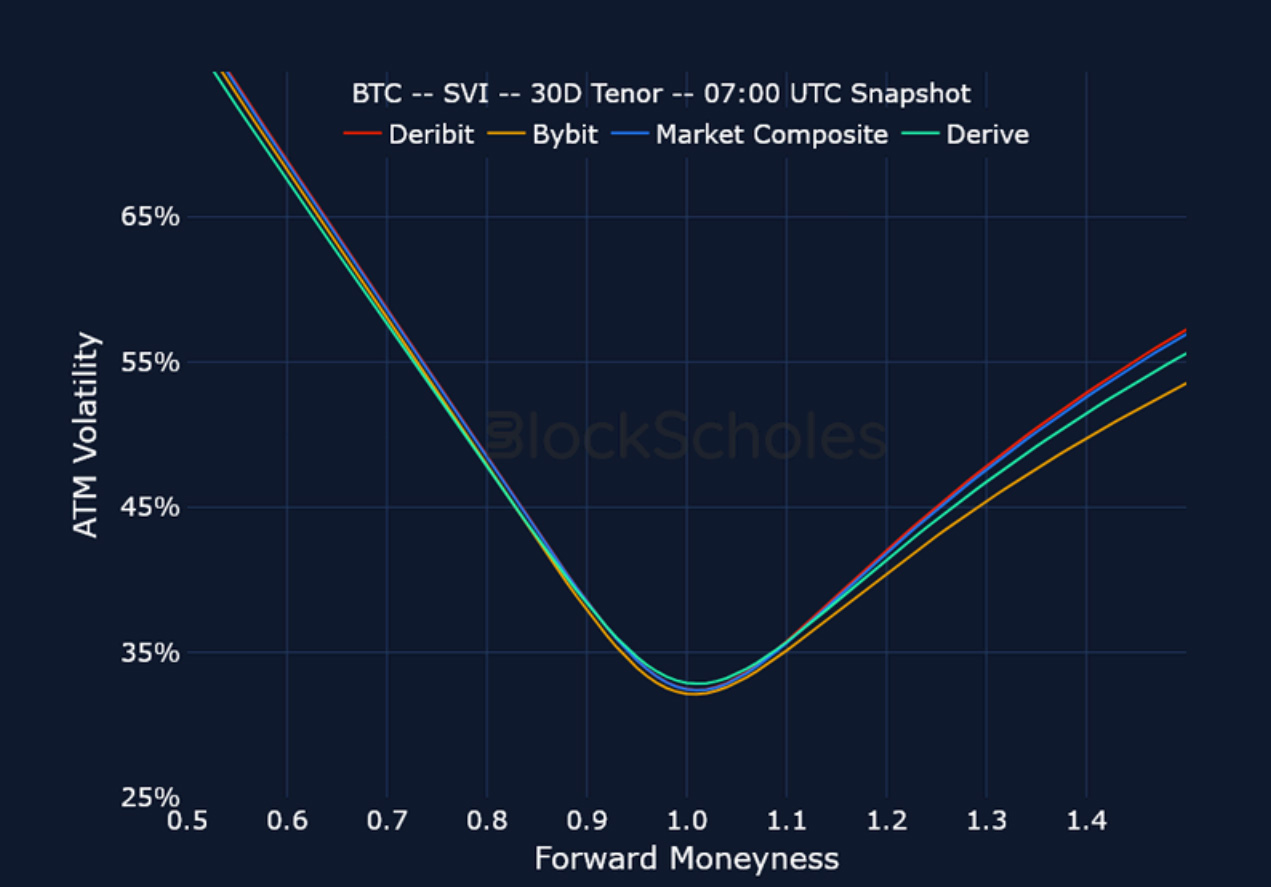

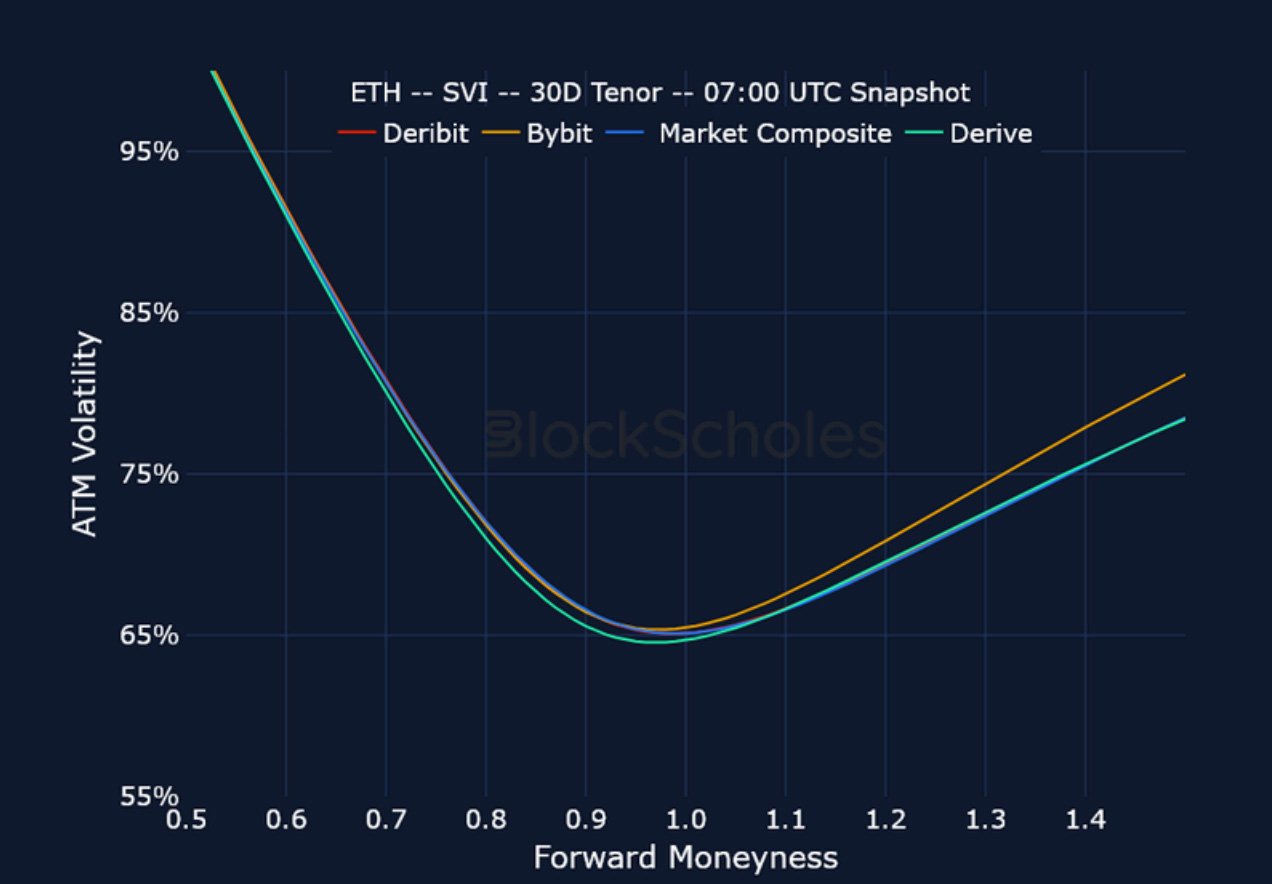

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

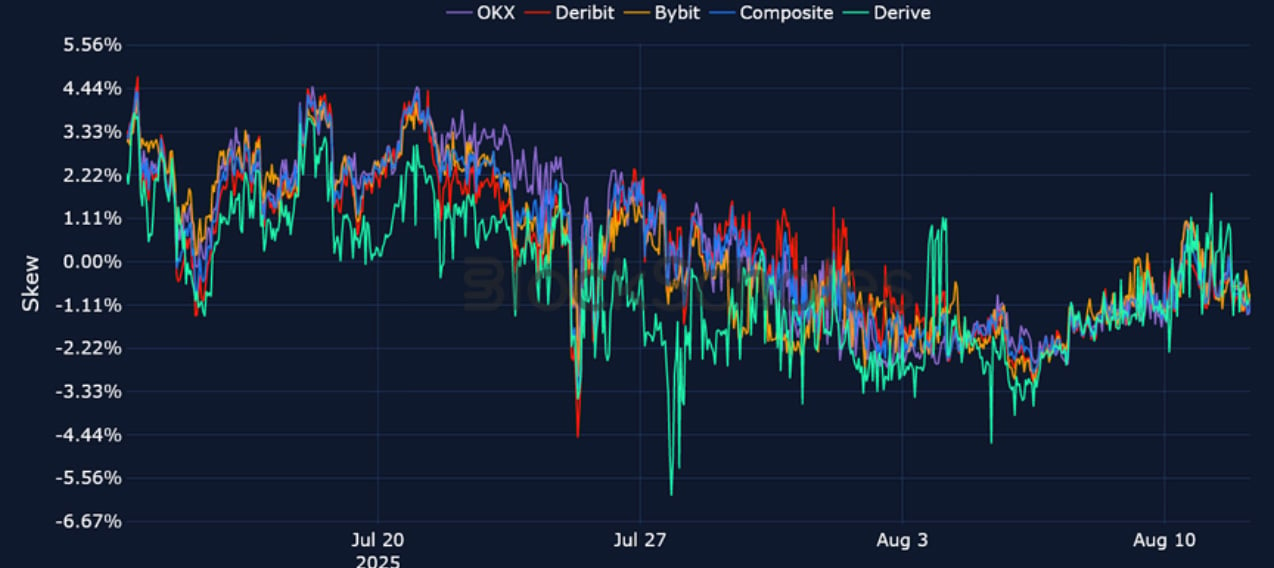

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

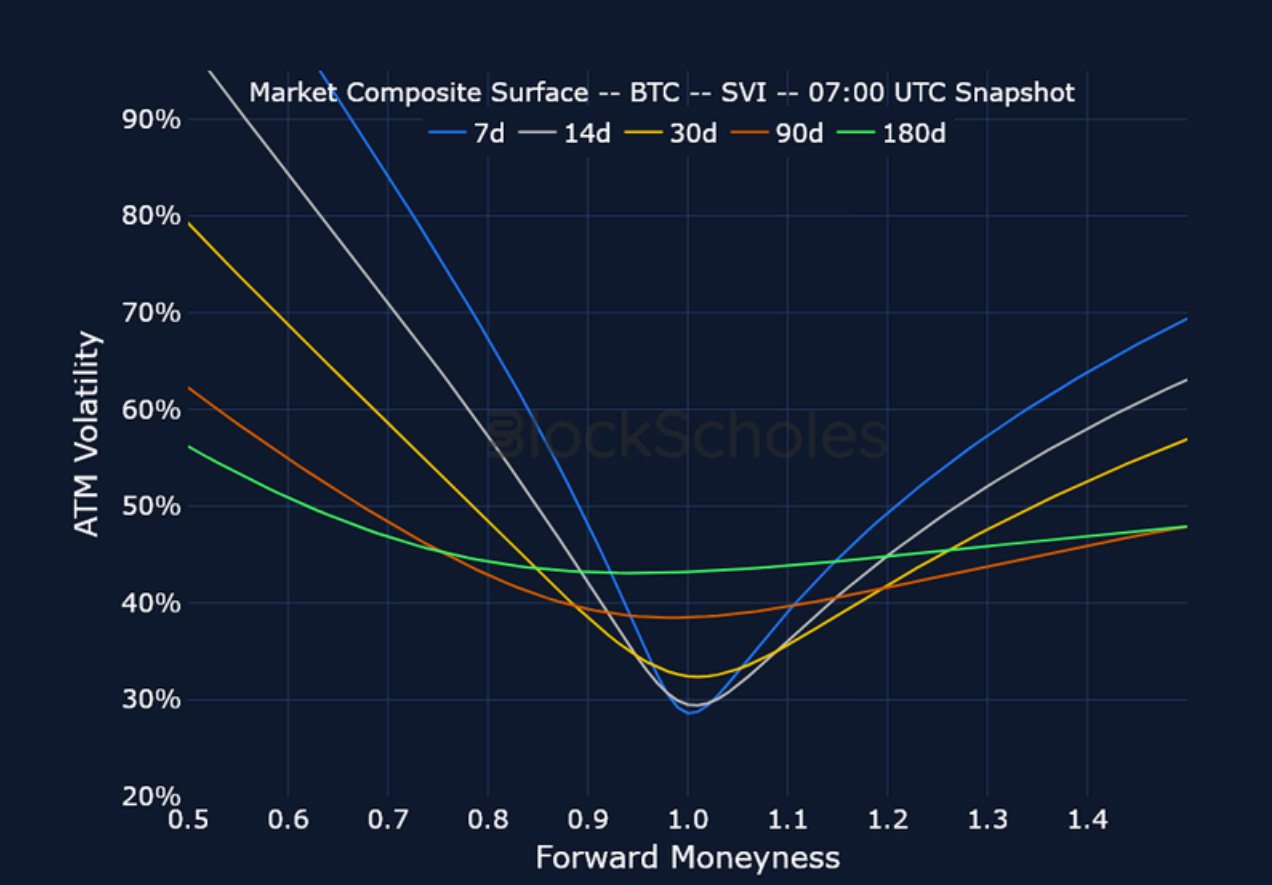

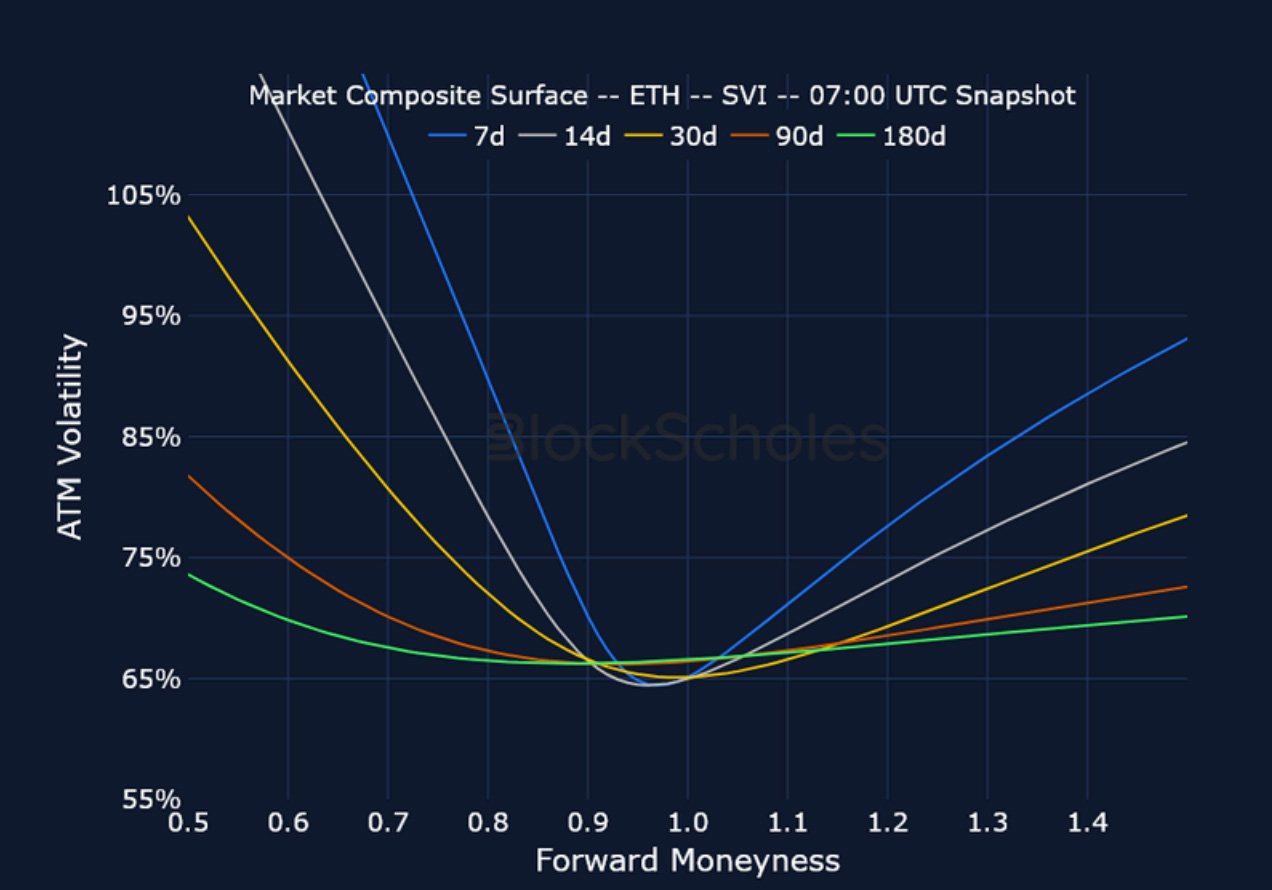

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

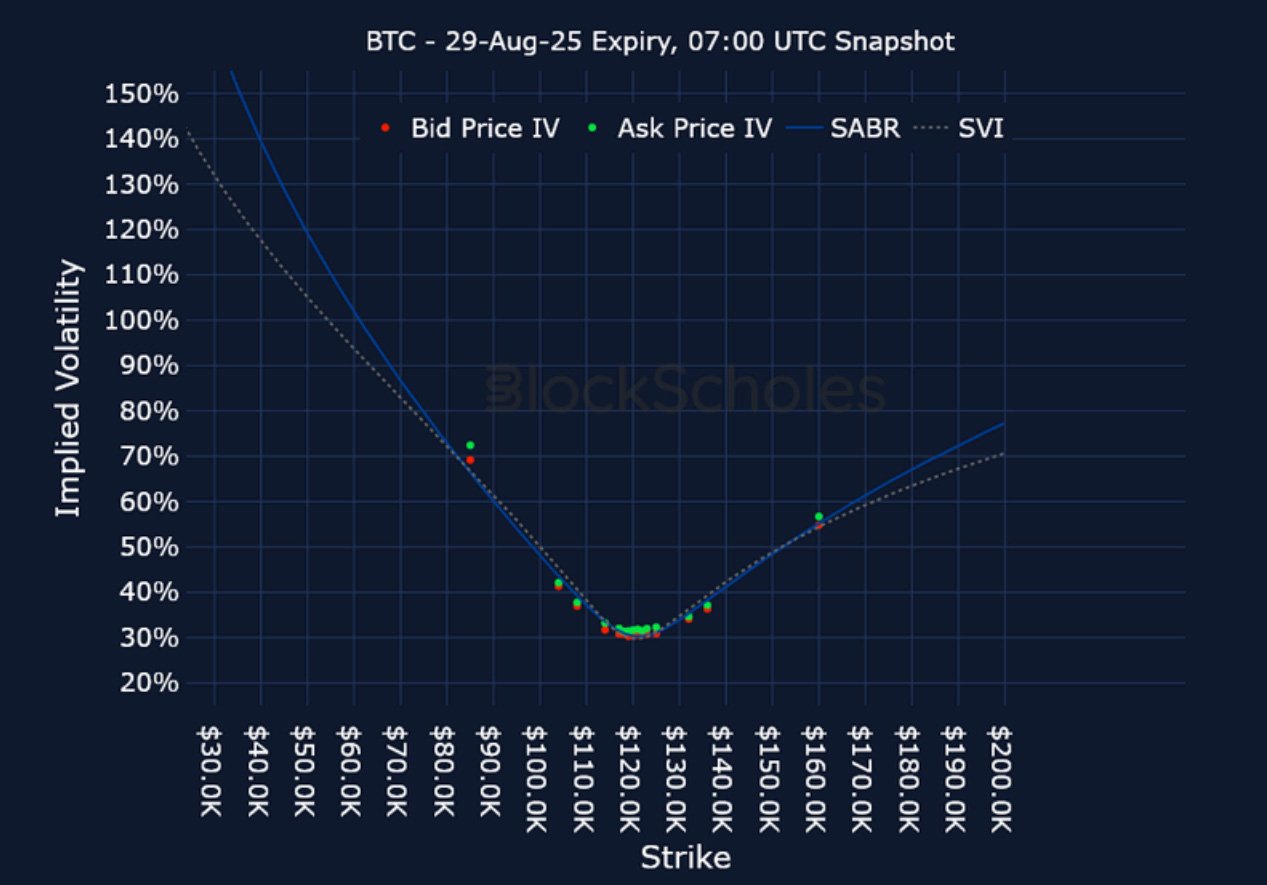

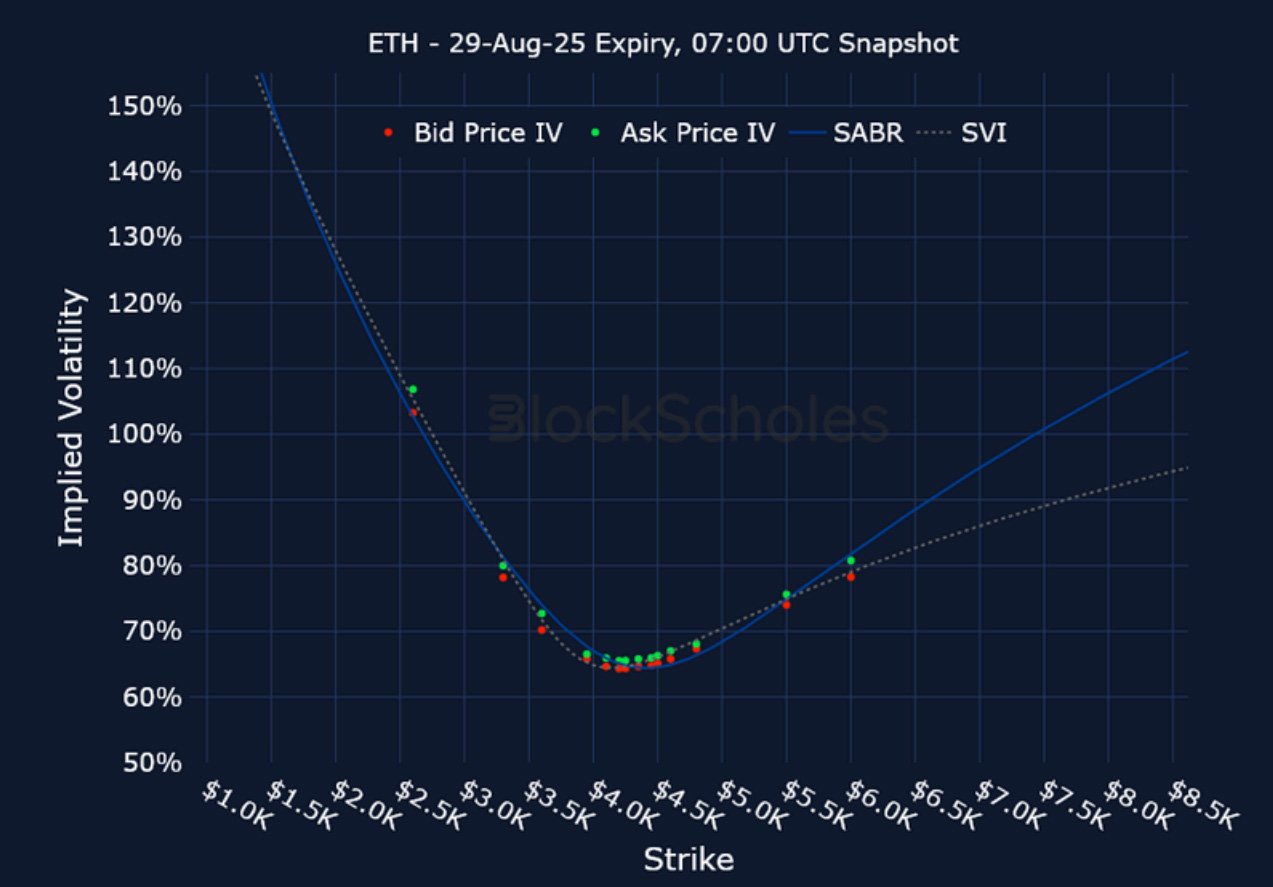

Listed Expiry Volatility Smiles

BTC 29-AUG EXPIRY – 9:00 UTC Snapshot.

ETH 29-AUG EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)