Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

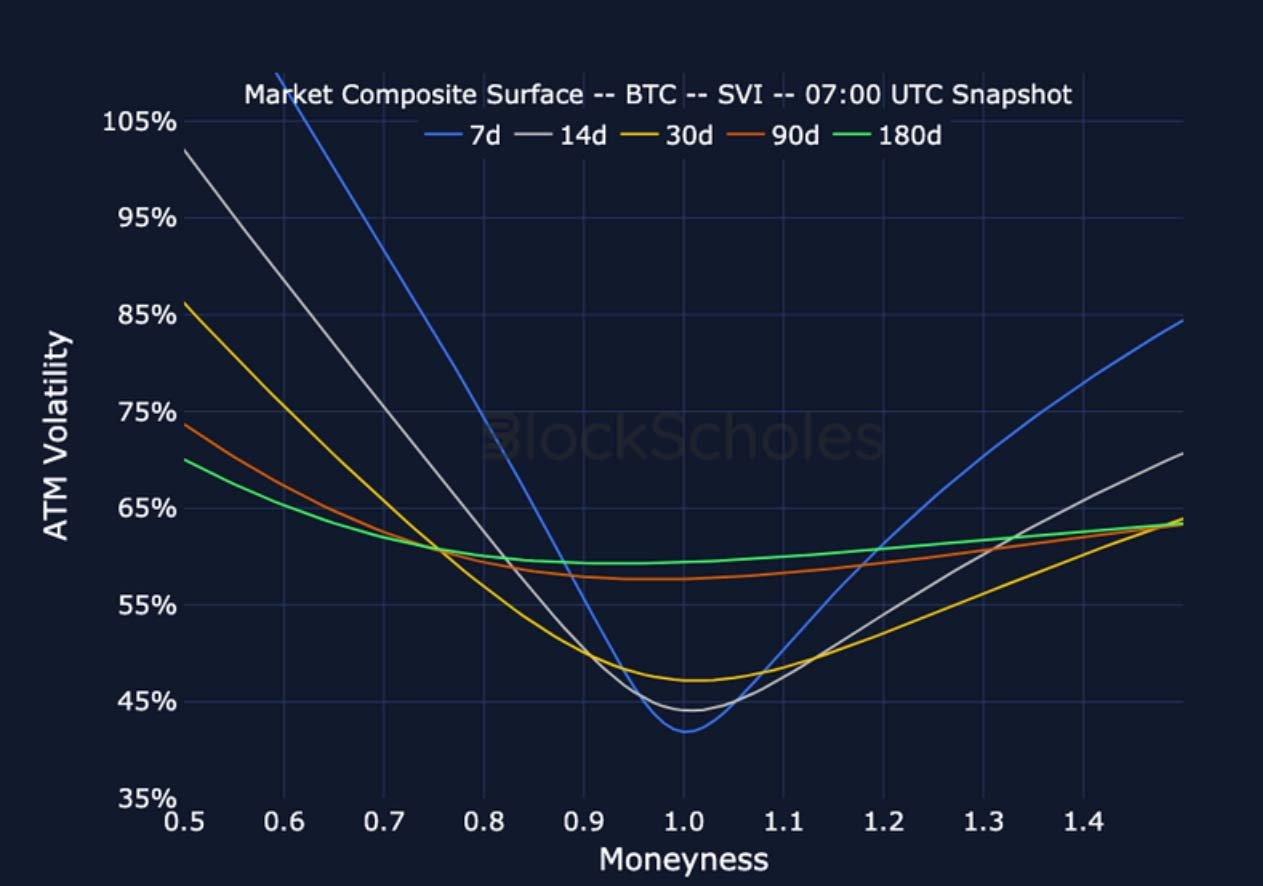

While volatility levels have been dropping consistently in the past week for short-tenors options in both majors, long-term levels have remained high. As the term structures have steepened even further, there are clear indications that options that expire after the US Presidential Election date present a volatility premium, with OTM calls being preferred for longer tenors, in contrast to the lingering put-skew at short tenors. This overall positive outlook for cryptocurrencies after the election date is confirmed by the steep futures term structure, as futures prices are trading higher above spot. The bearish sentiment for short term options has therefore weakened but long-term sentiment remains bullish.

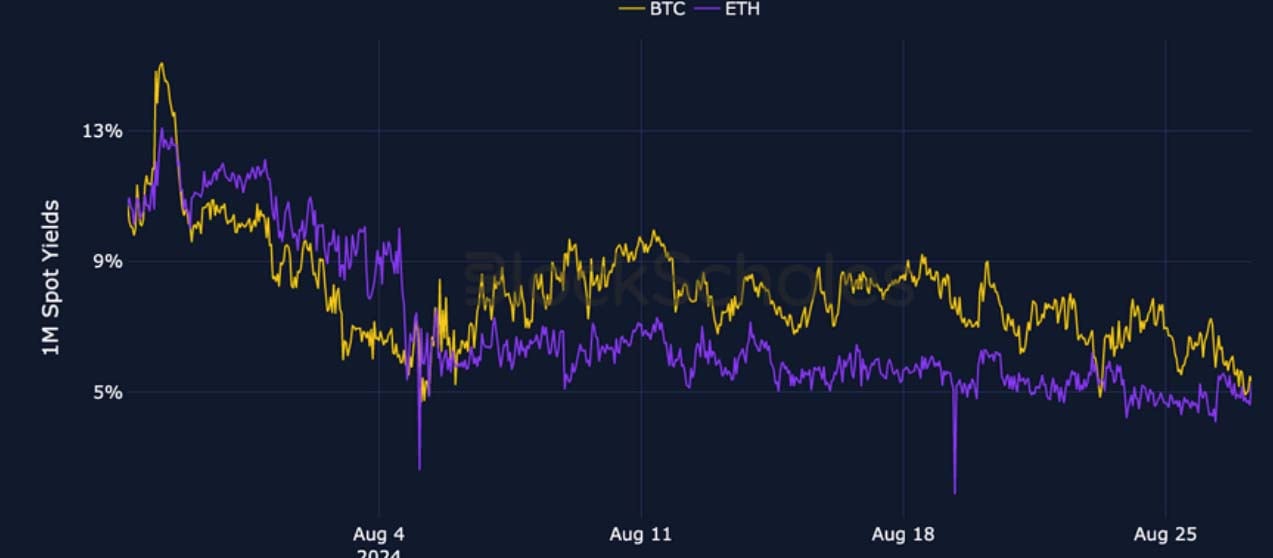

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

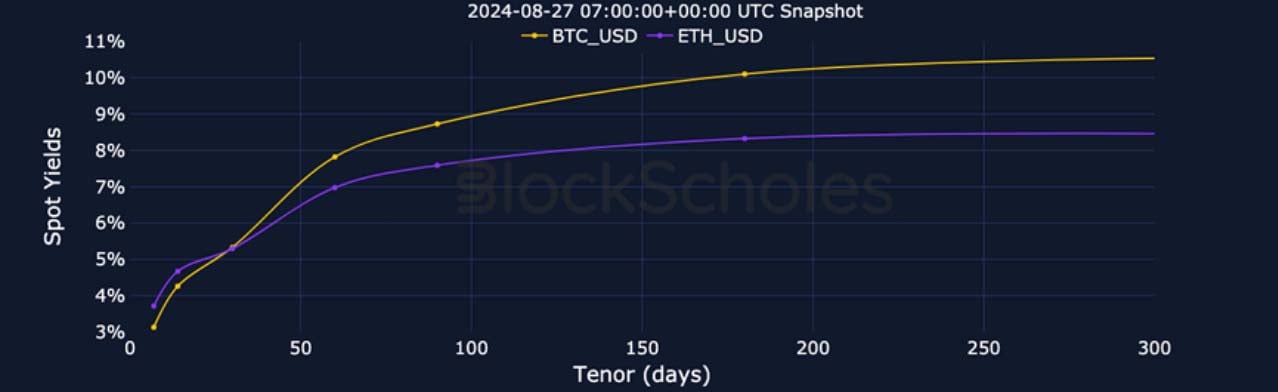

BTC ANNUALISED YIELDS – Show a steep term structure, with prices trading at 8-11% above spot for tenors after the election.

ETH ANNUALISED YIELDS – ETH yields show the same structure as BTC, but slightly lower levels for tenors longer than 30 days.

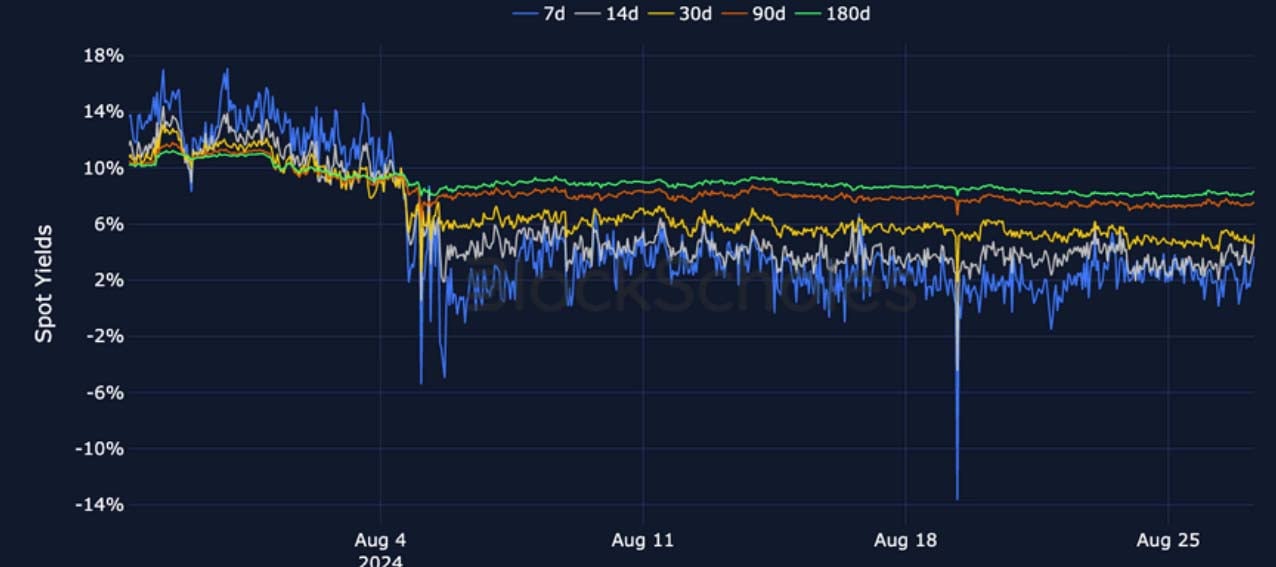

Perpetual Swap Funding Rate

BTC FUNDING RATE – rates keep oscillating between positive and neutral, showing quick sentiment movements for long positions.

ETH FUNDING RATE – has continued to trade intermittently negative over the past three weeks.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – short-dated volatility has fallen further to ~42%, while volatility levels after the election date have remained constant.

BTC 25-Delta Risk Reversal – skew has quickly moved towards calls for short tenors in the last week, but has now returned to previous levels of put-skew.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – shows the same steepening in the term structure as last week but has moved downwards, more so for short tenors.

ETH 25-Delta Risk Reversal – skew movements have been similar to BTC, with a swift move towards calls for short tenors, but now reverted back to puts.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 7:00 UTC Snapshot.

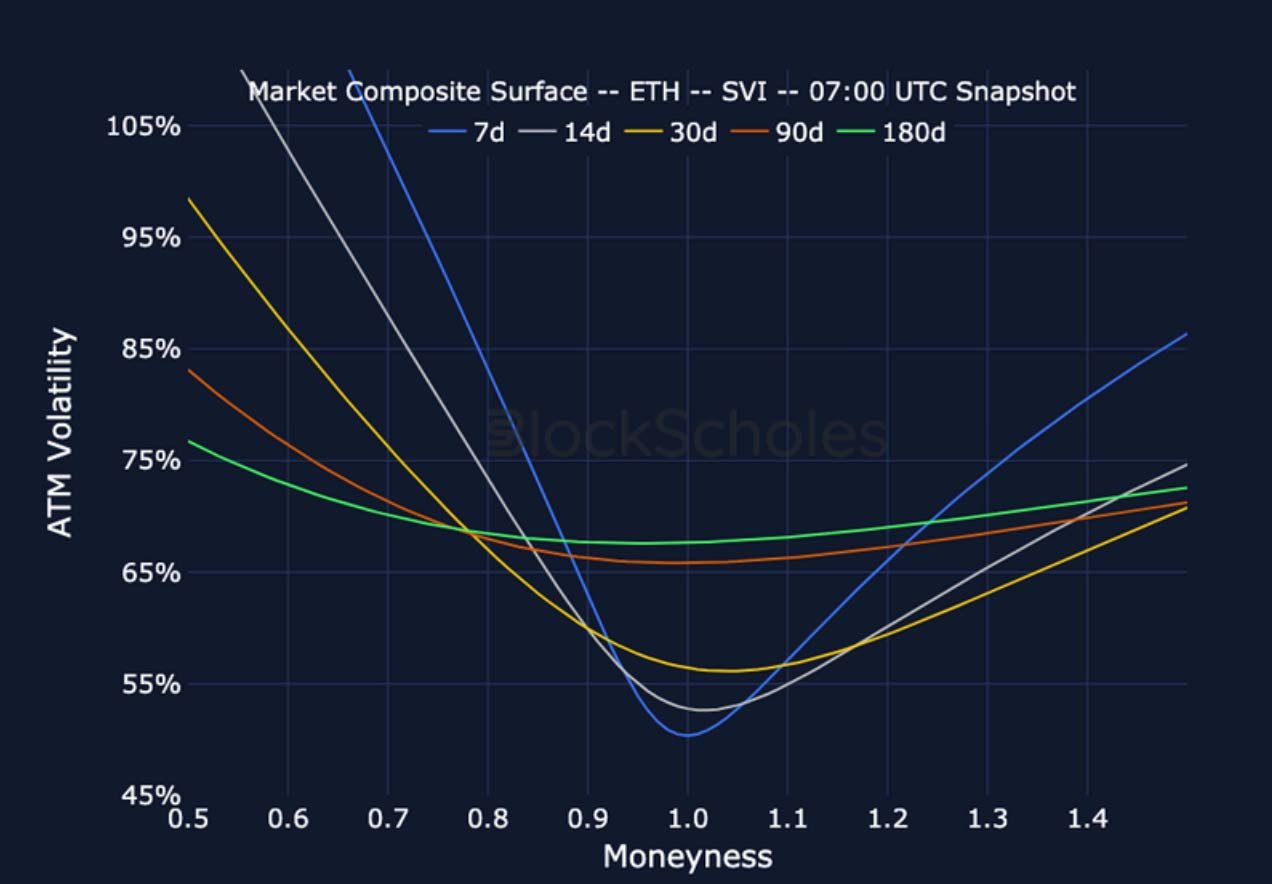

CeFi COMPOSITE – ETH SVI – 7:00 UTC Snapshot.

Listed Expiry Volatility Smiles

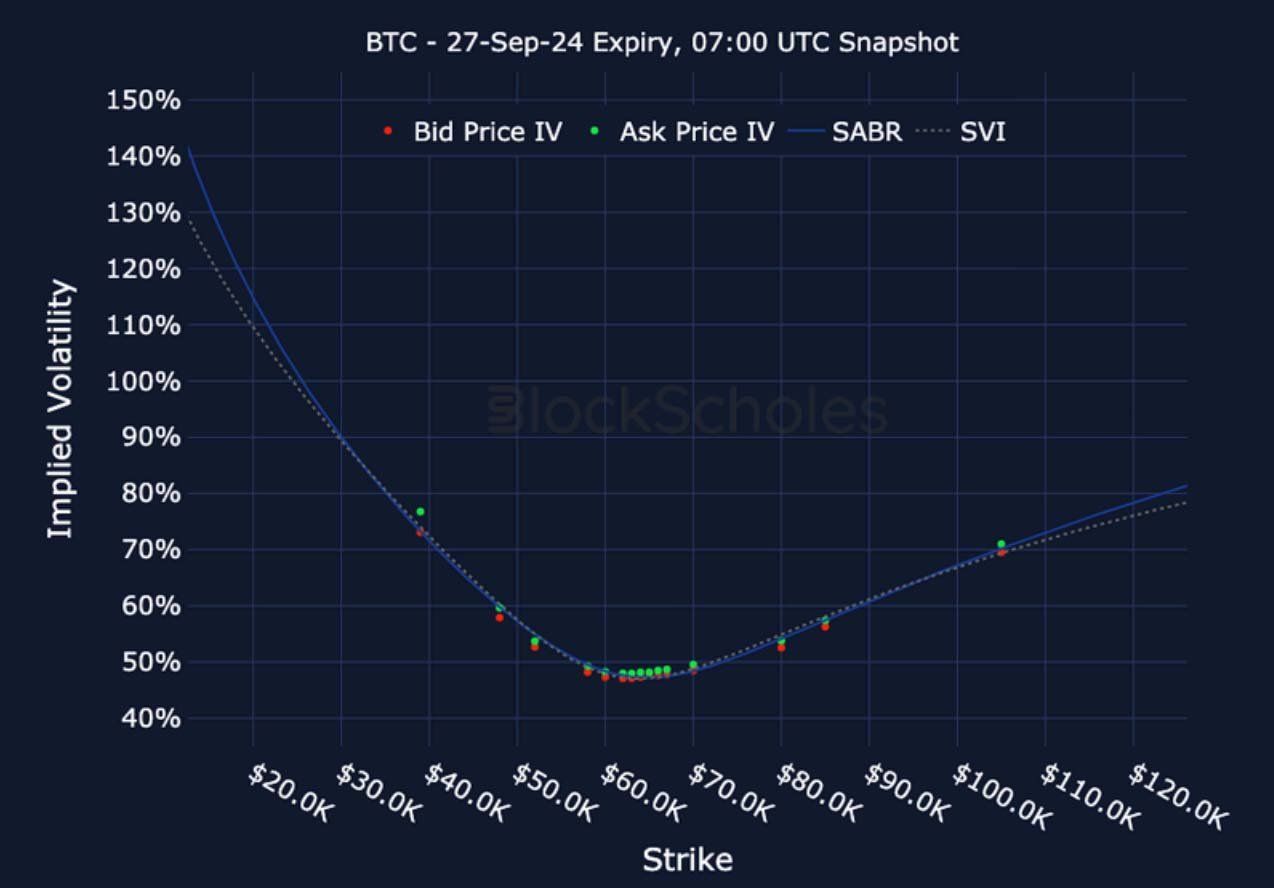

BTC 27-SEP EXPIRY– 7:00 UTC Snapshot.

ETH 27-SEP EXPIRY– 7:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

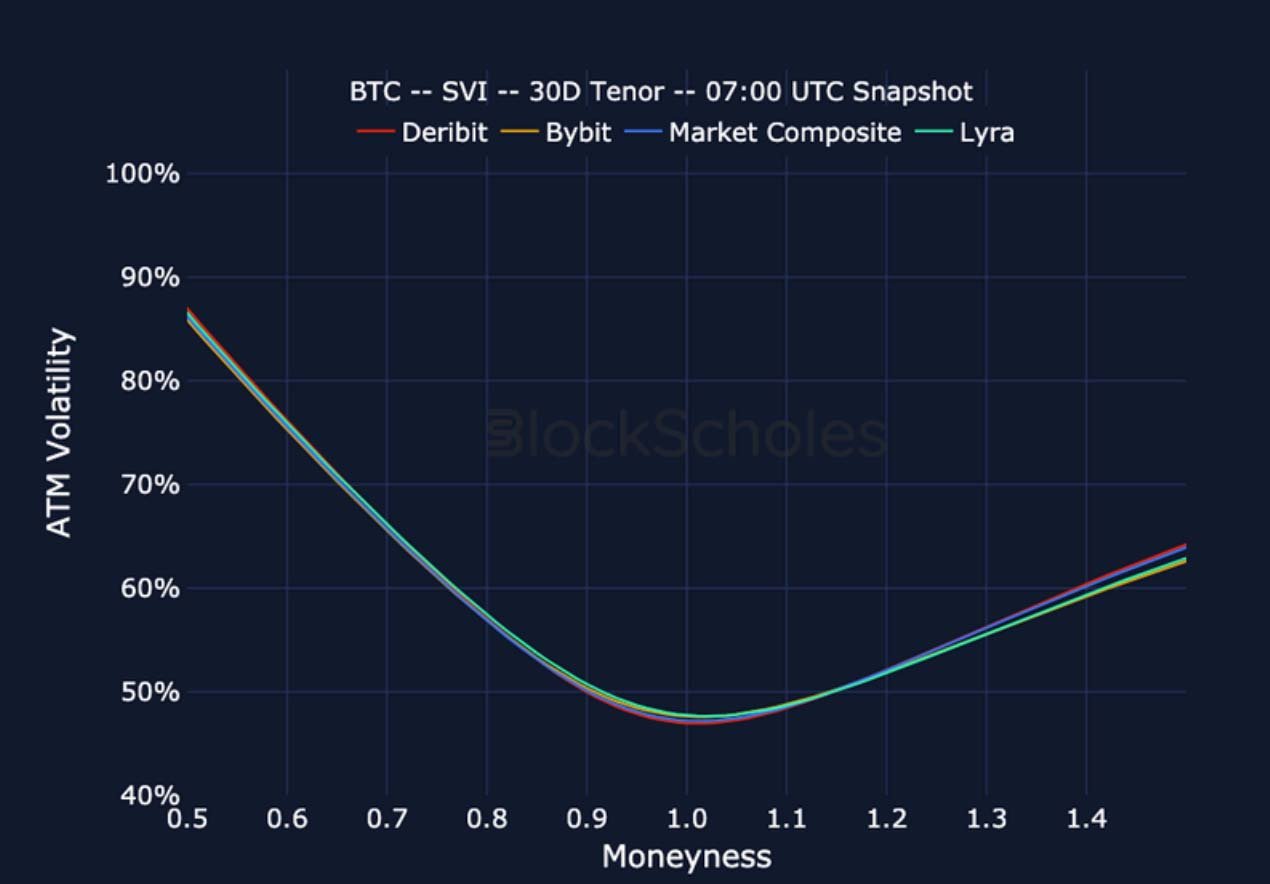

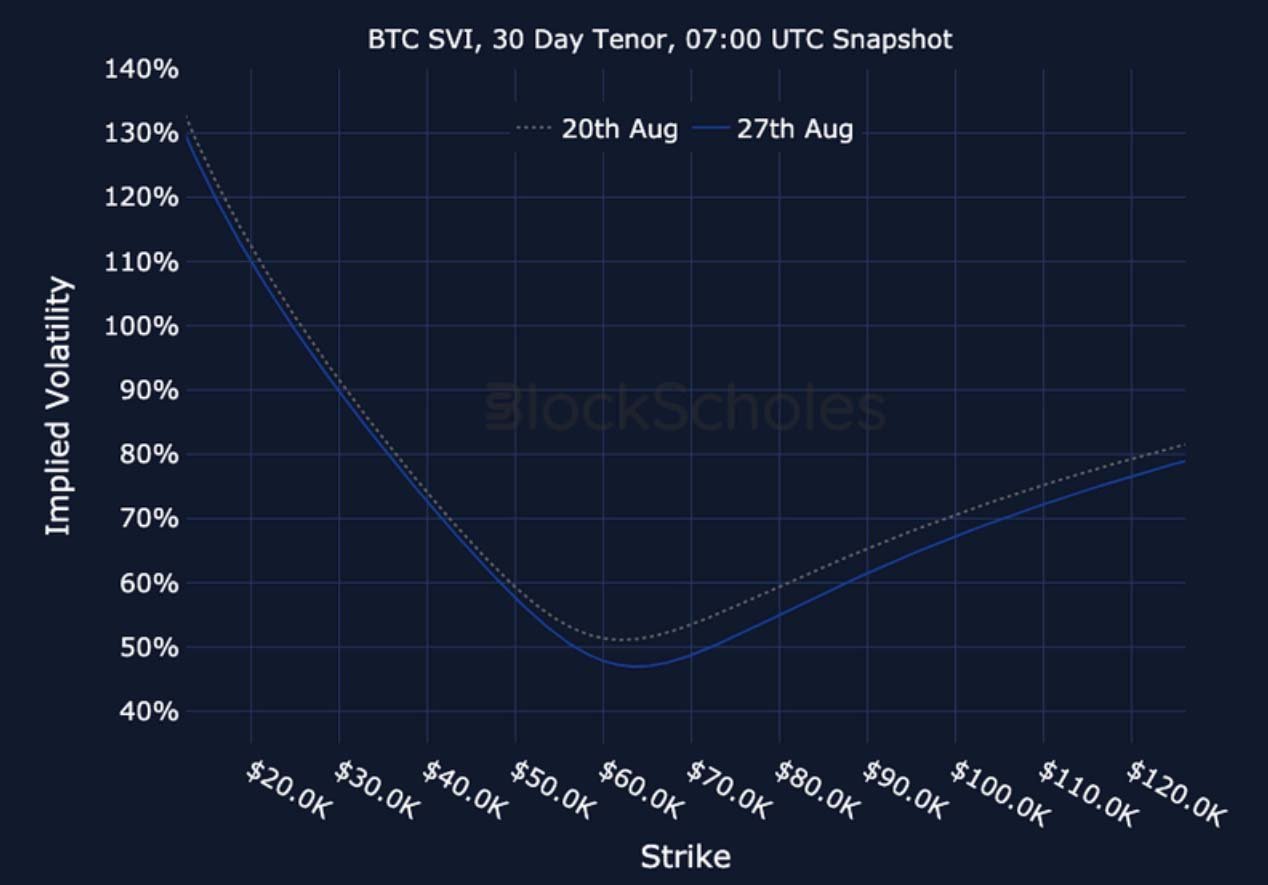

BTC SVI, 30D TENOR – 7:00 UTC Snapshot.

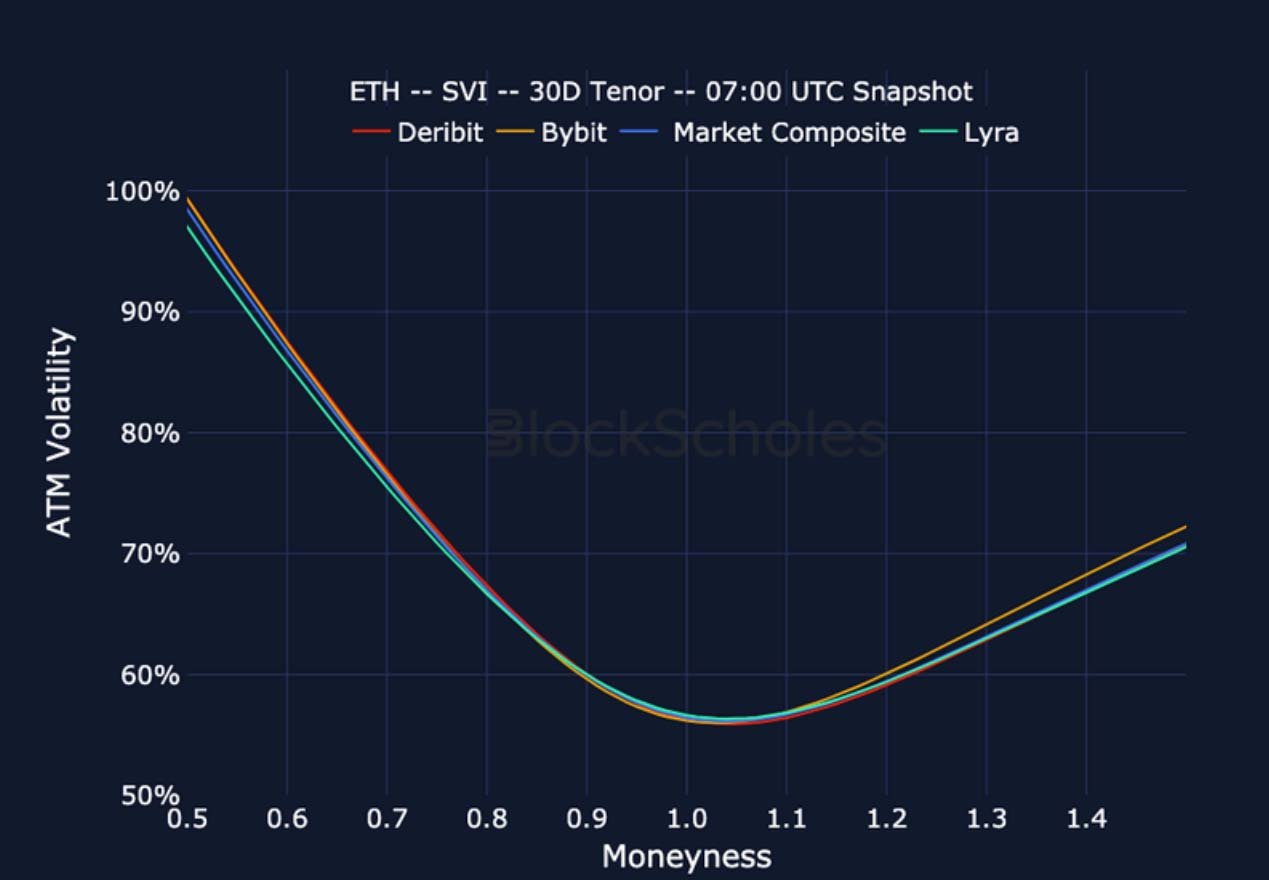

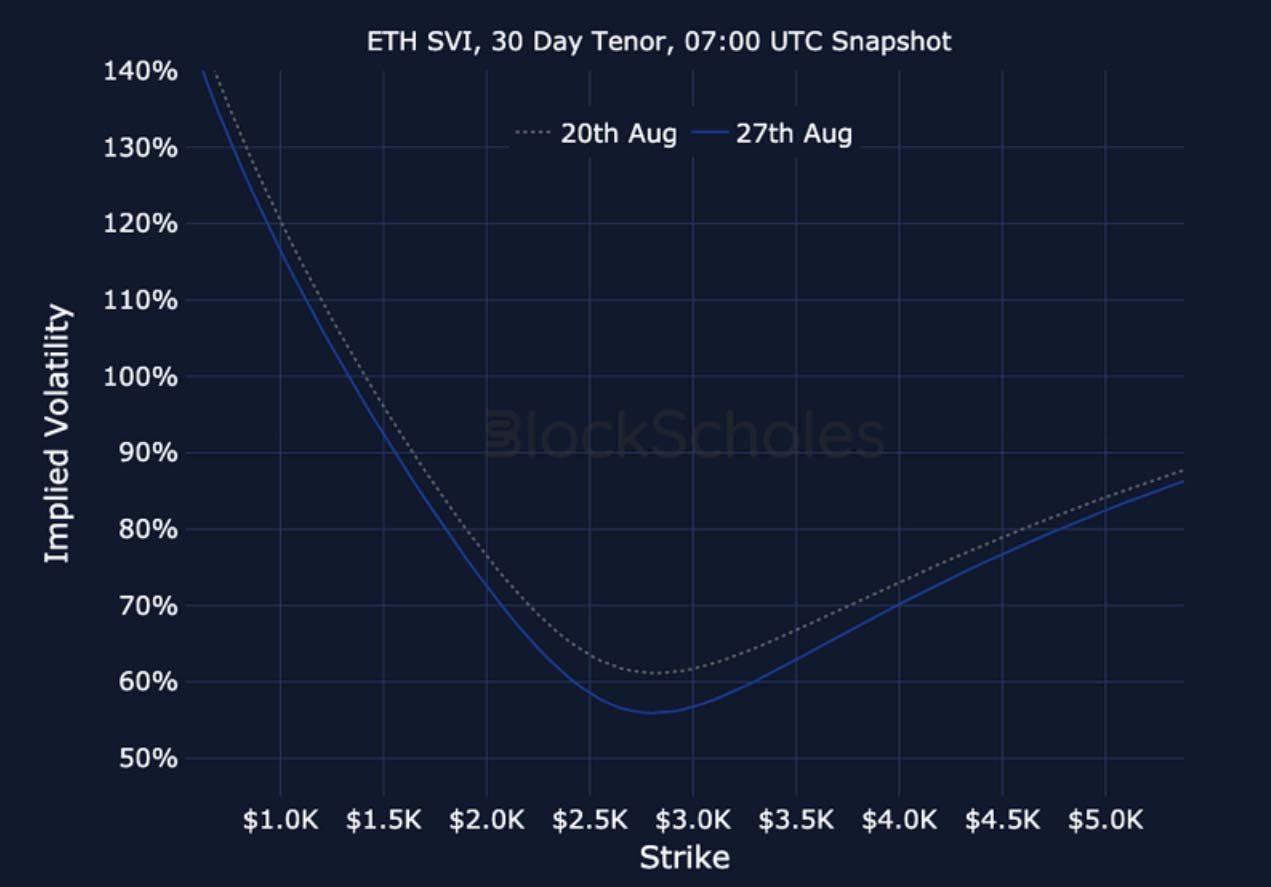

ETH SVI, 30D TENOR – 7:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 7:00 UTC Snapshot.

ETH SVI, 30D TENOR – 7:00 UTC Snapshot.

AUTHOR(S)