Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

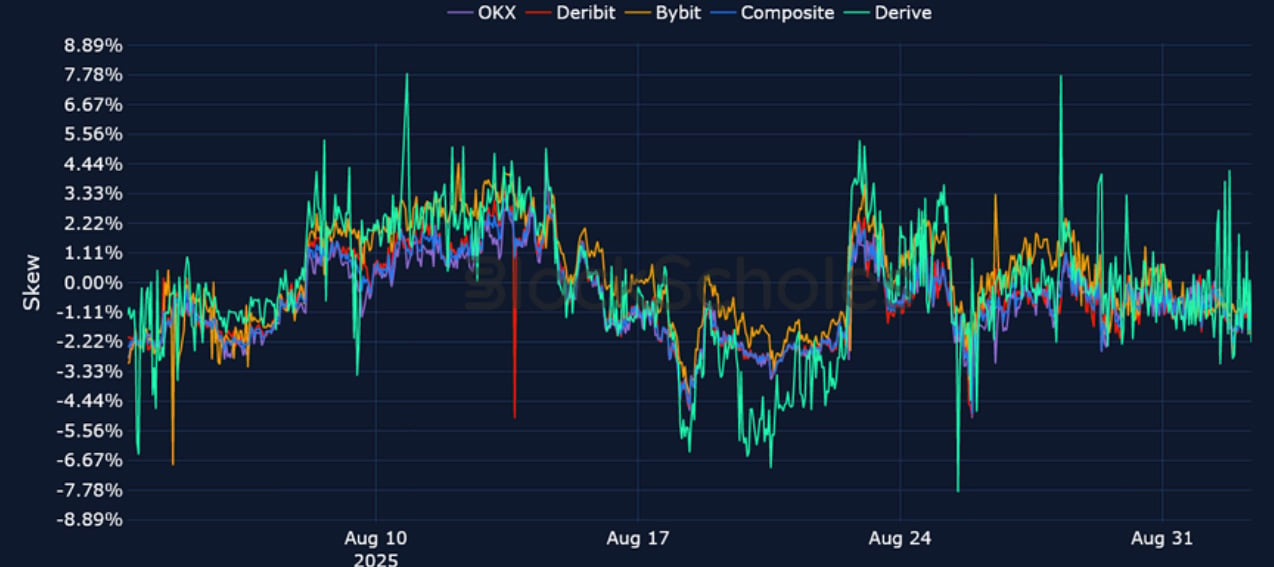

After a mid-August rally to an ATH of $123K, BTC’s spot price has trended downward, reaching a local bottom of $107K earlier this week. Over the past month, it is down 4% relative to a 25% rally in ETH which has held up far better. However, both assets options markets are nonetheless still painting a bearish picture of further downward price movements. Volatility smile skews for BTC have traded with a premium towards OTM puts of as much as 6%, compared to a smaller 4% premium over calls for OTM ETH puts. Perpetual swap funding rates, on the other hand, suggest a slightly more negative sentiment in ETH than BTC. Funding rates for ETH turned negative earlier in the week, falling towards -0.02%. In macro, PCE inflation in the US came in exactly as expected (core PCE rose to 2.9%) though the reading did very little to change market-implied odds for a September rate cut – which currently sits at 89.7%.

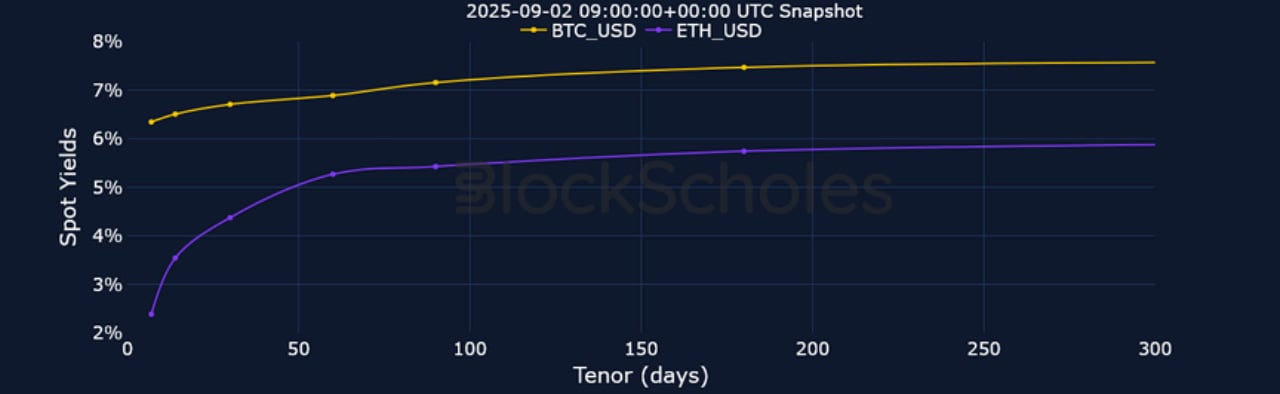

Futures Implied Yields

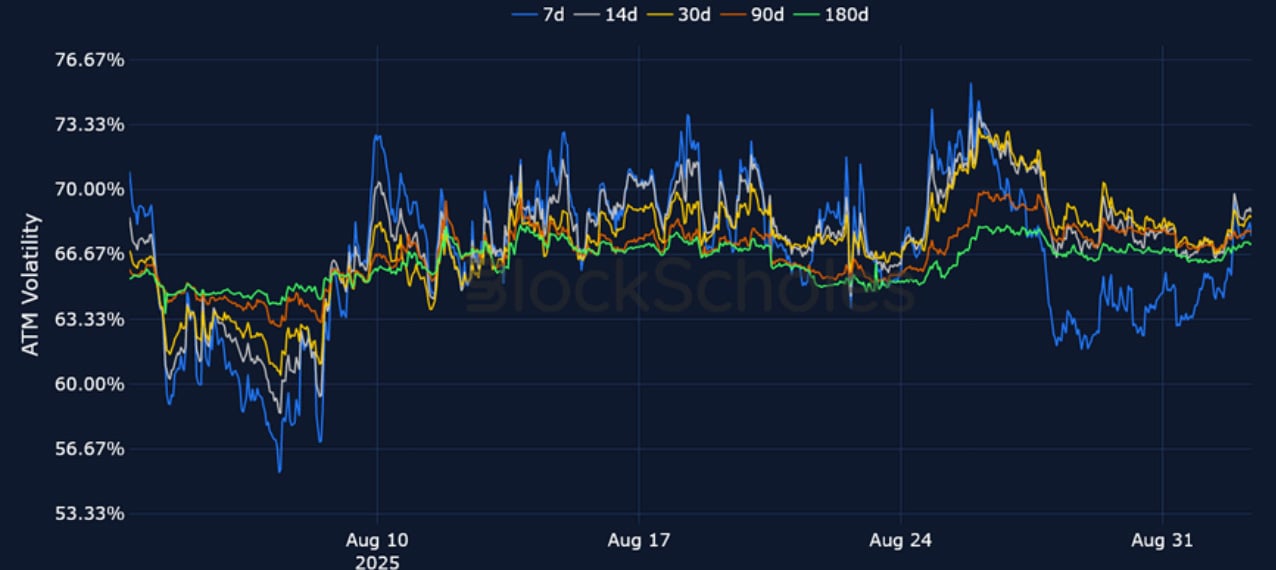

1-Month Tenor ATM Implied Volatility

Perpetual Swap Funding Rate

BTC FUNDING RATE – In line with other measures of derivatives sentiment, BTC funding rates have fallen from their highs earlier in the month.

ETH FUNDING RATE – ETH funding rates turned even more bearish over the past week, despite a stronger spot performance in ETH than BTC over the same period of time.

Futures Implied Yields

BTC Futures Implied Yields – Annualised BTC yields have settled between 6 and 7%, resulting in a flat term structure.

ETH Futures Implied Yields – In contrast to the flat futures term structure for BTC, ETH’s term structure exhibits an upward positive slope. That’s a major shift from its inversion last week during its spot ATH.

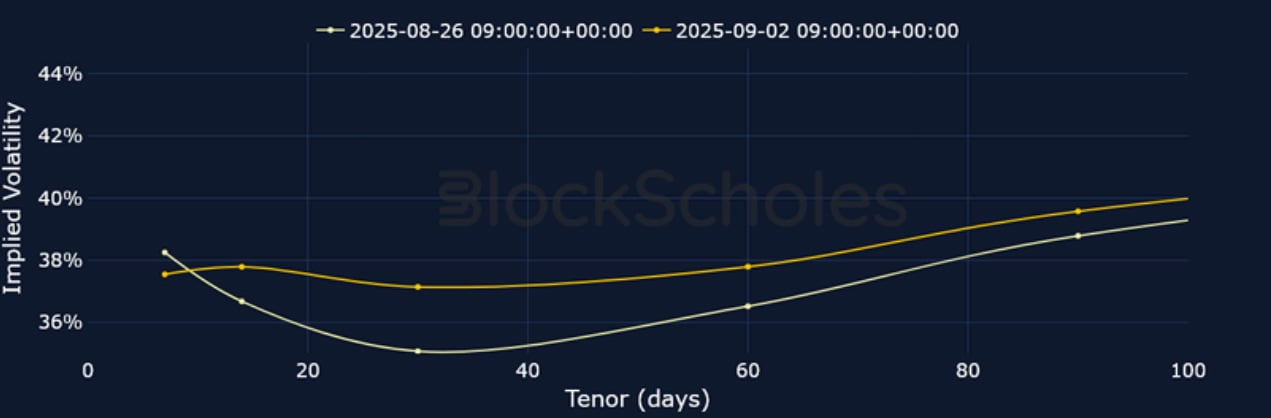

BTC Options

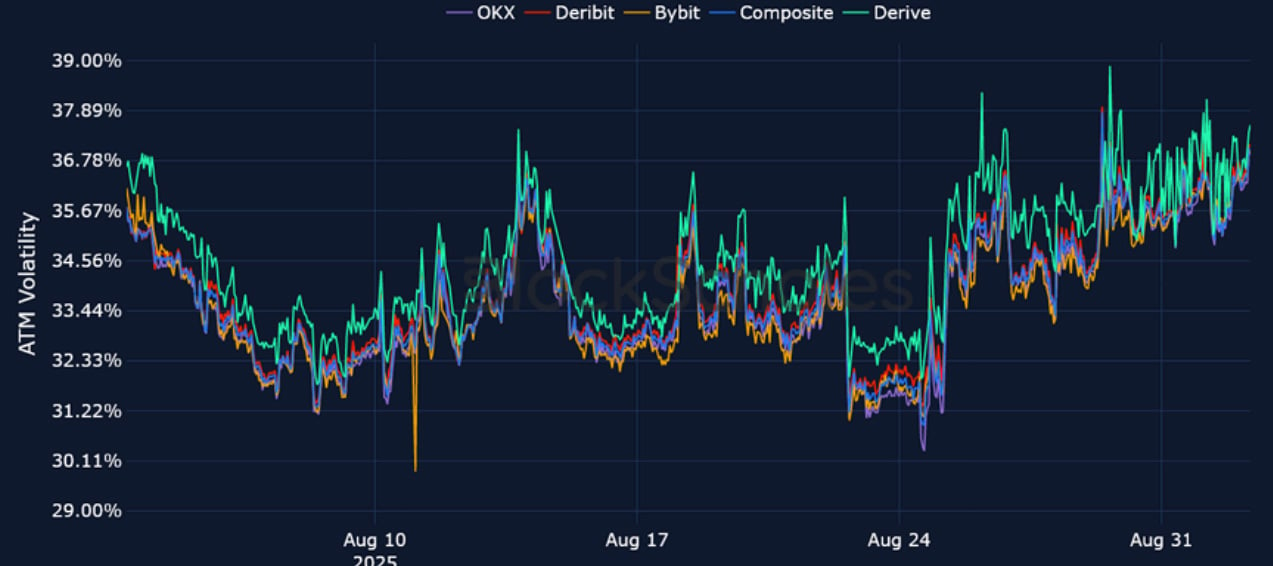

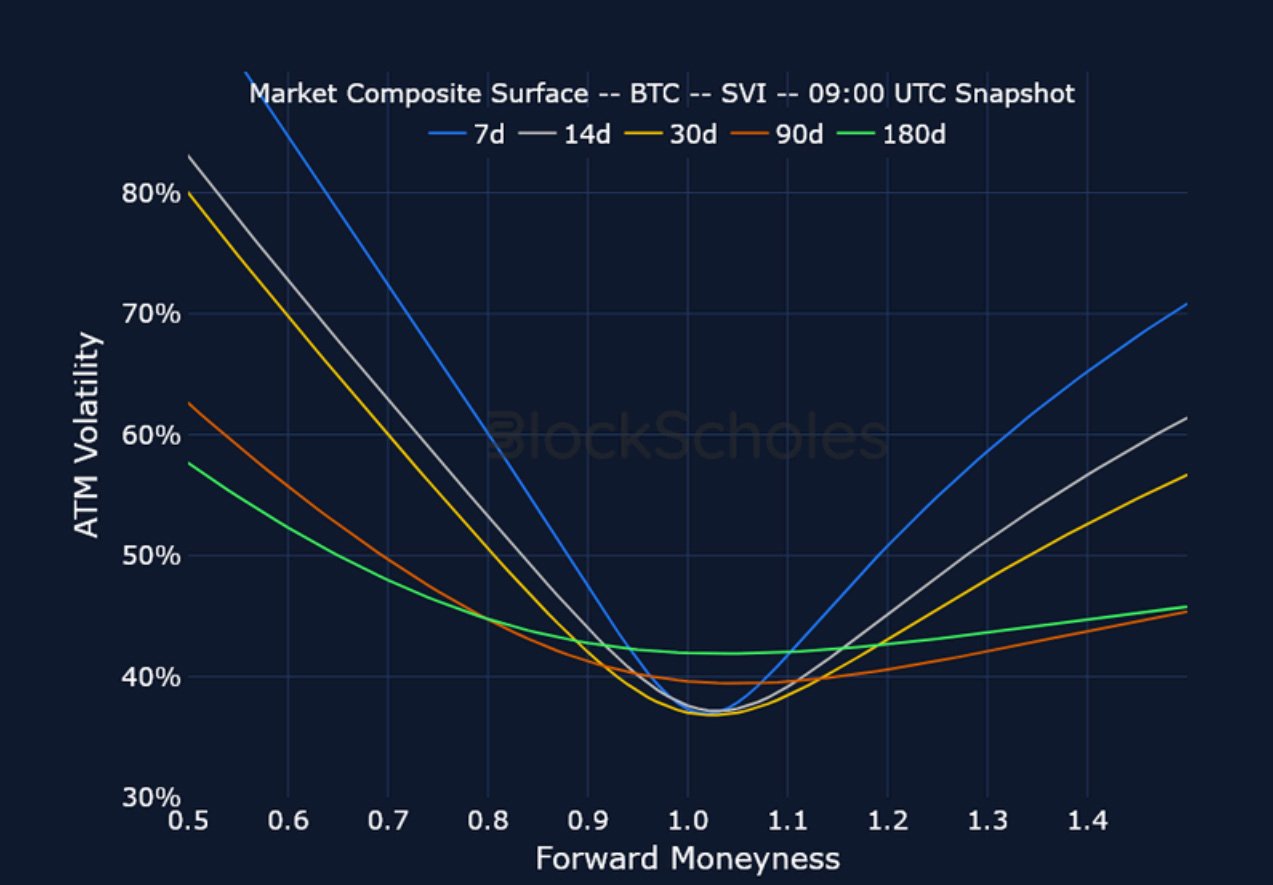

BTC SVI ATM IMPLIED VOLATILITY – Short-to-mid dated tenors have jumped from 30% to 37%, as BTC’s spot price fell from $113K to a low of $107K.

BTC 25-Delta Risk Reversal – Skew across the term structure for BTC has remained bearish over the past week with traders bracing for further downside moves.

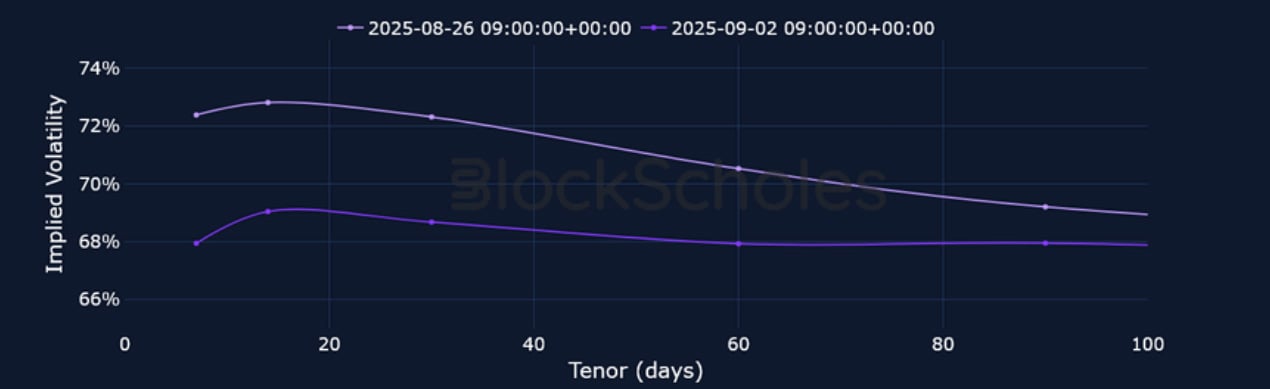

ETH Options

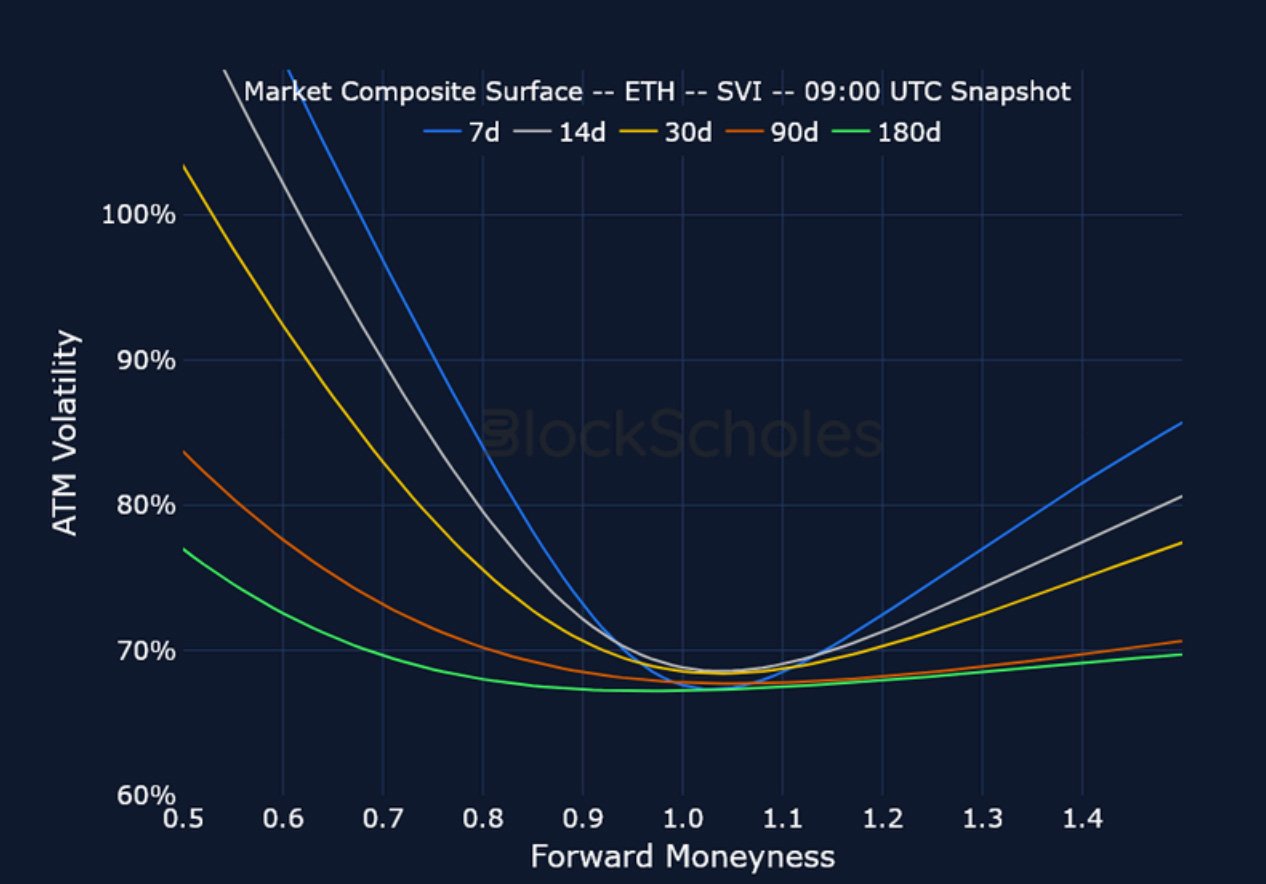

ETH SVI ATM IMPLIED VOLATILITY – ETH’s vol term structure has a slight inversion, with 7-day options at 72%, while longer-tenor options trade at 69%.

ETH 25-Delta Risk Reversal – Unlike perpetual swap funding rates which have shown more bearishness in ETH than BTC, smile skews for ETH are less bearish than they are for BTC. Nonetheless, 7-day OTM puts trade with a 2% premium to calls.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

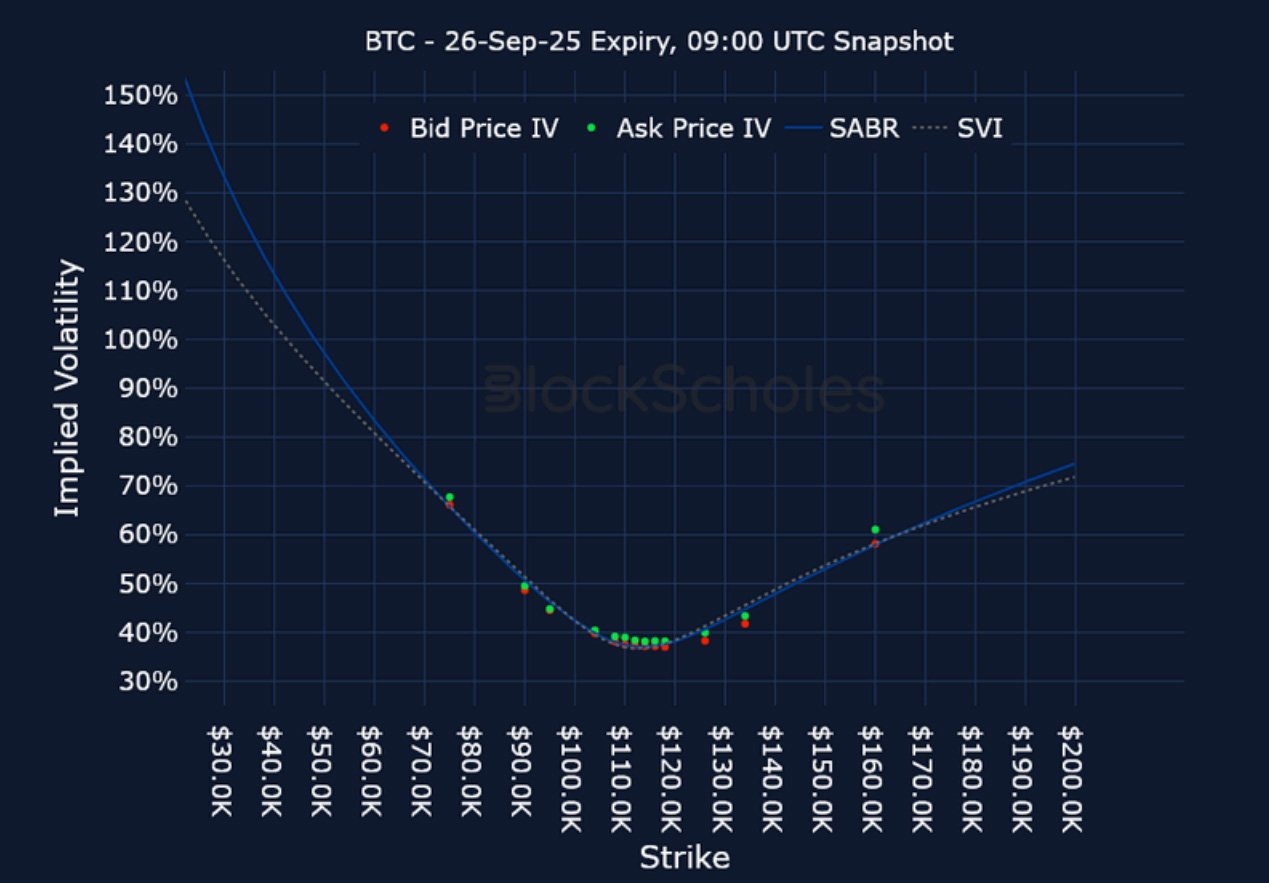

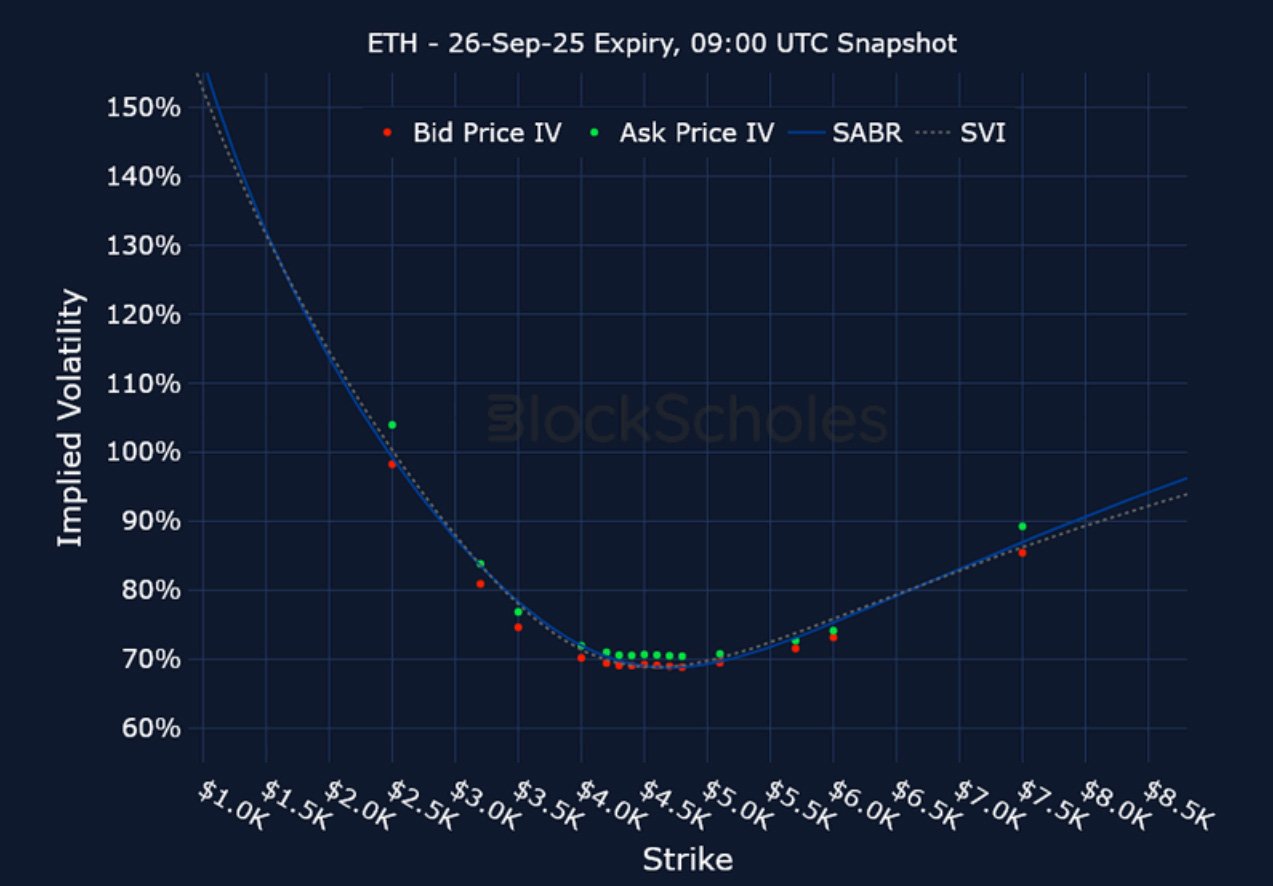

Listed Expiry Volatility Smiles

BTC 26-SEP EXPIRY – 9:00 UTC Snapshot.

ETH 26-SEP EXPIRY – 9:00 UTC Snapshot.

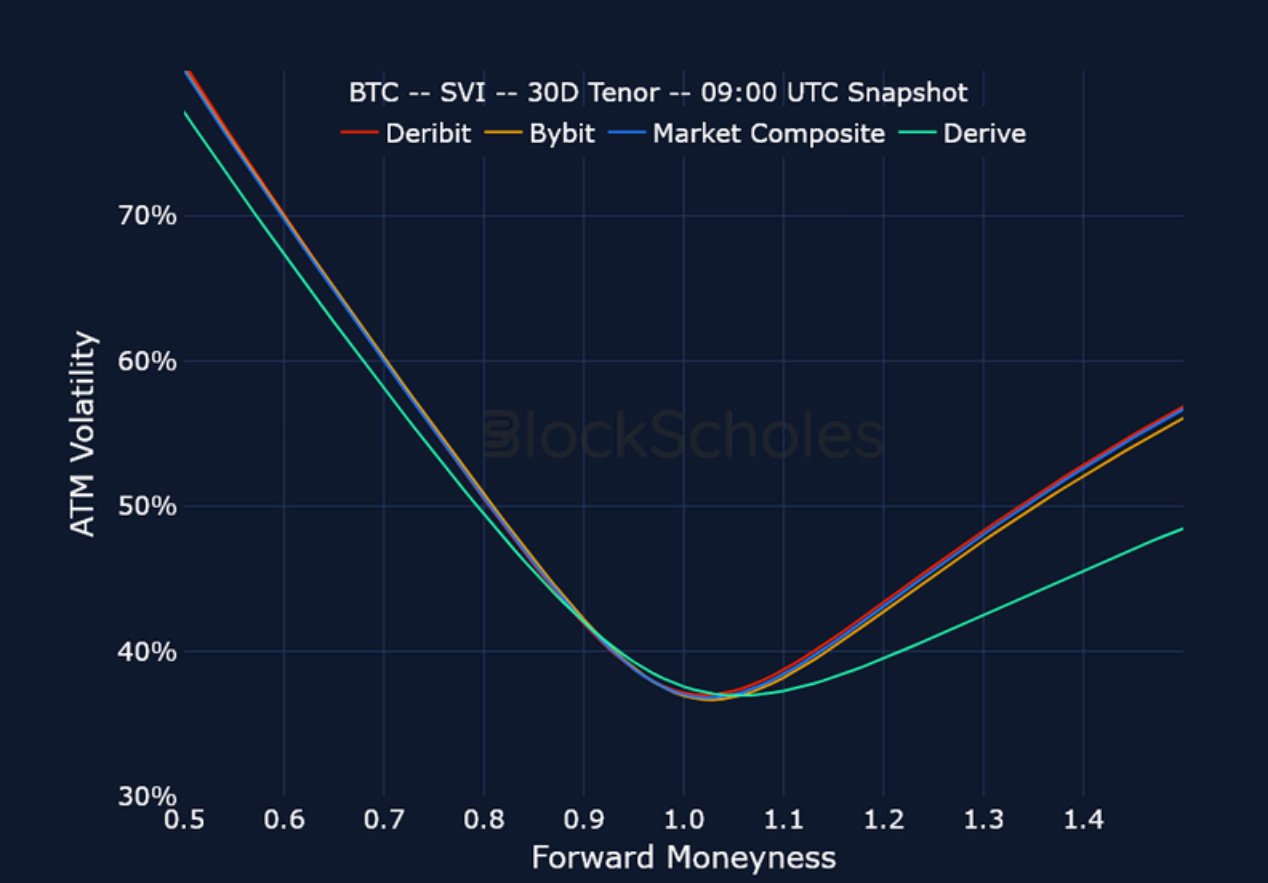

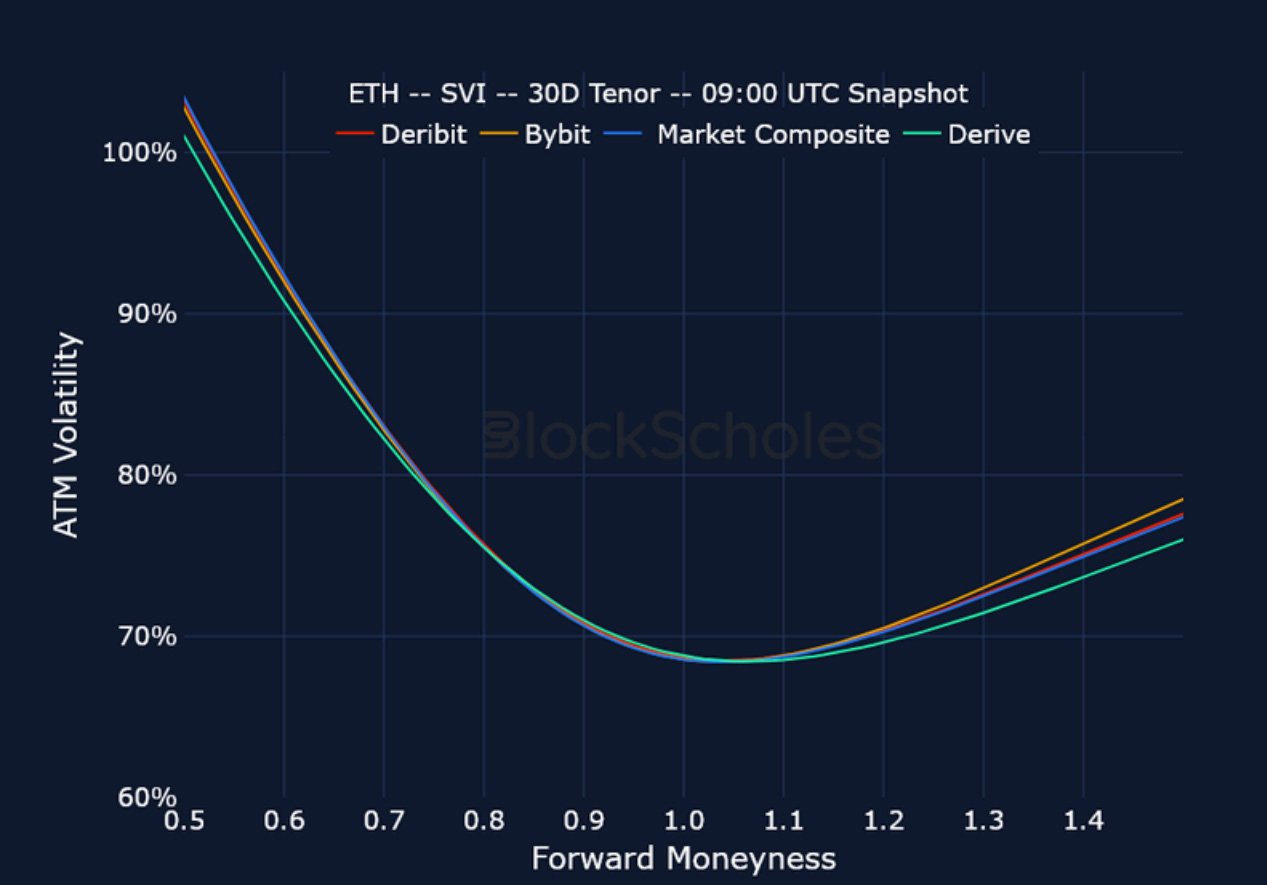

Cross-Exchange Volatility Smiles

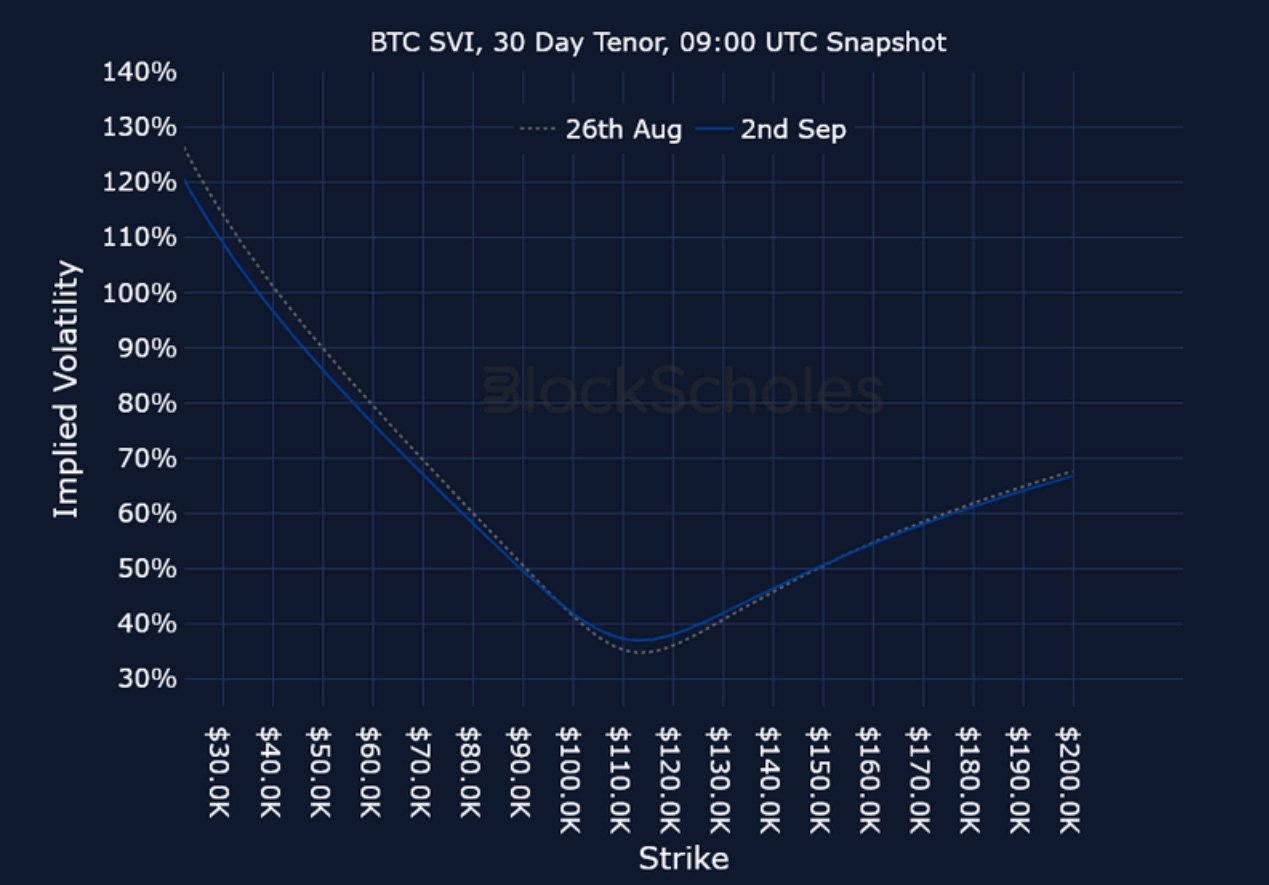

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

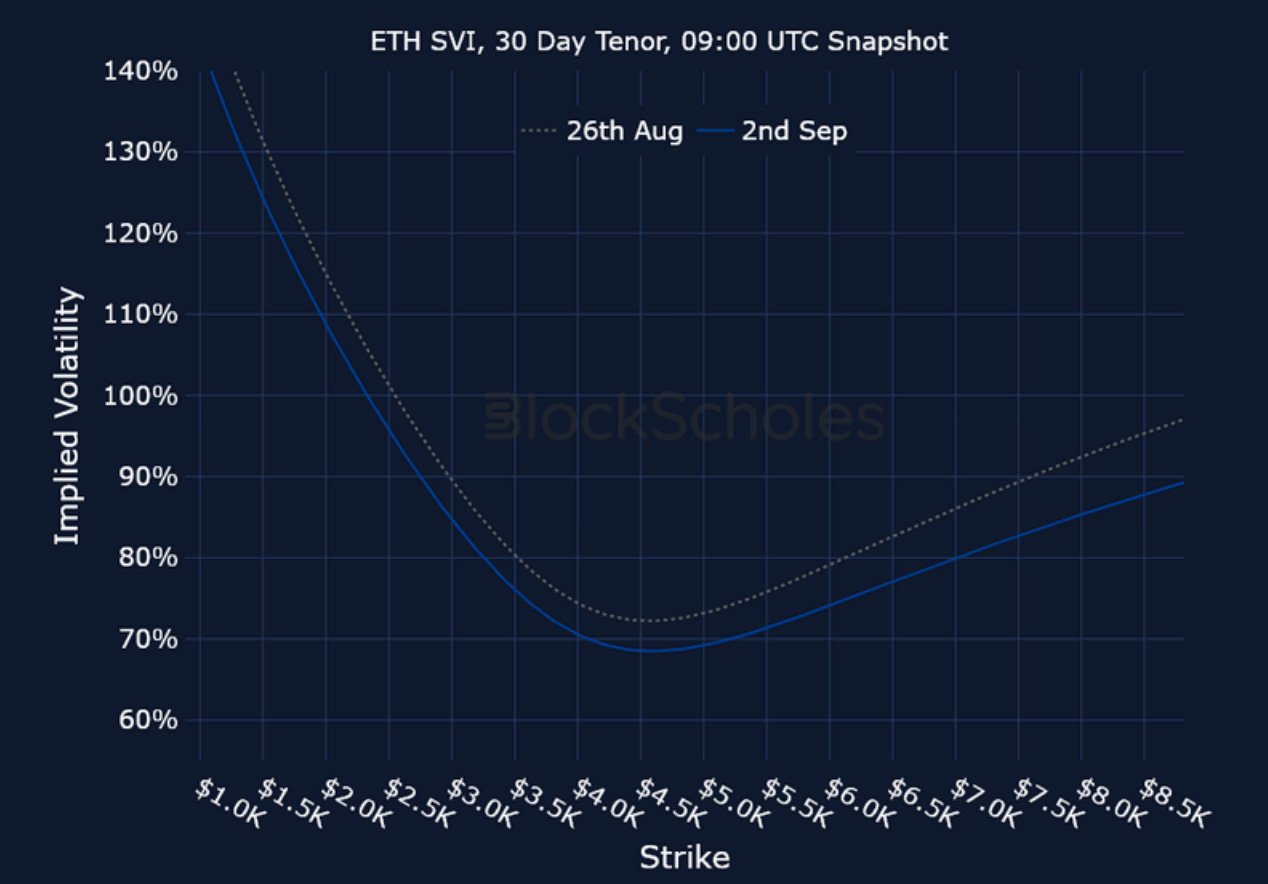

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)