Weekly recap of the crypto derivatives markets by BlockScholes.

BTC

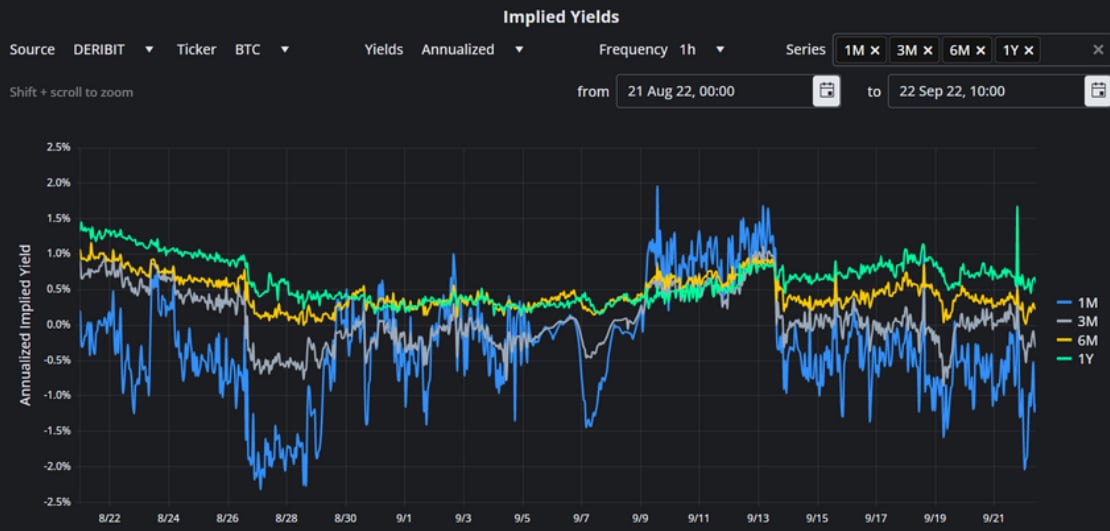

BTC’s annualised implied yields range between -1% and +1%, for tenors shorter than 1Y

BTC Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

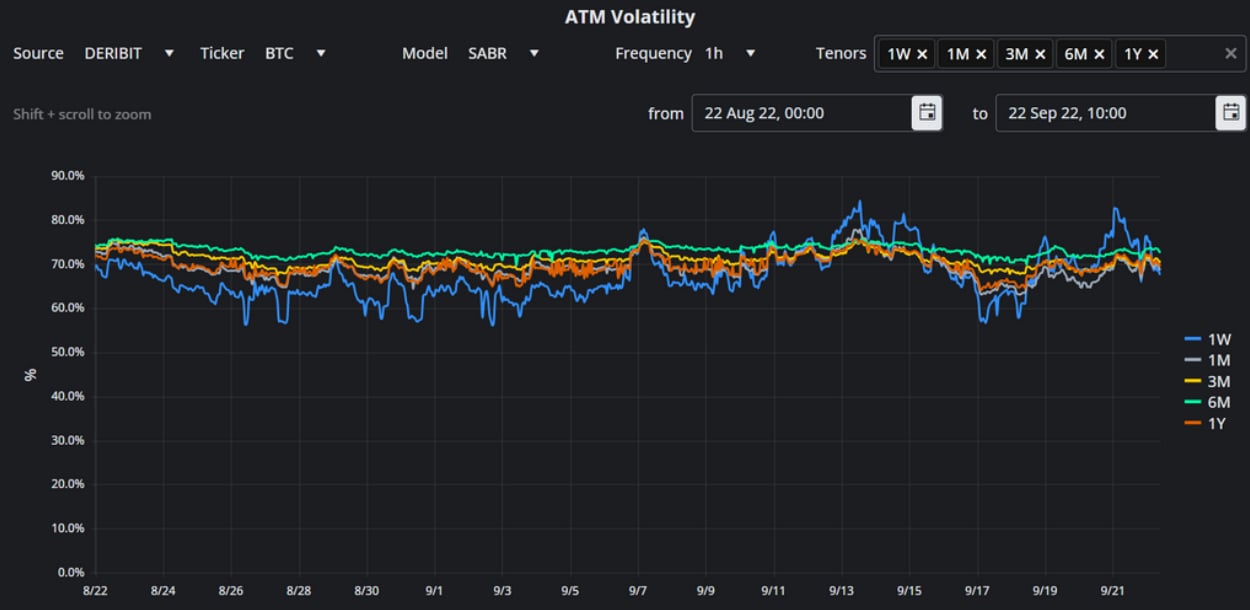

BTC’s ATM implied volatility is inverted, rising to local highs of 80% at a 1W tenor

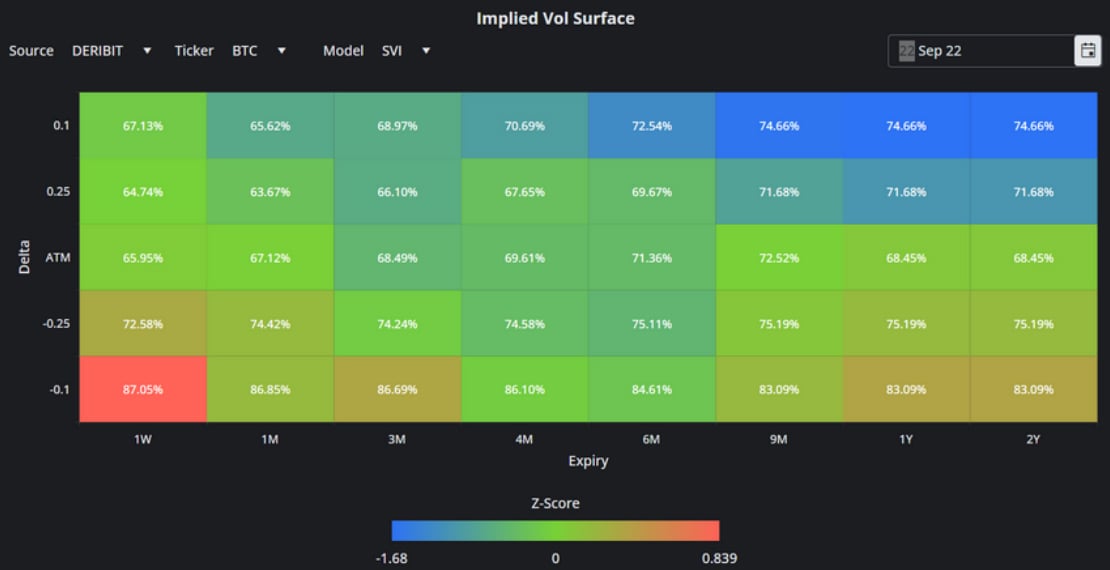

BTC’s 25-delta vol smile continues its skew towards OTM puts

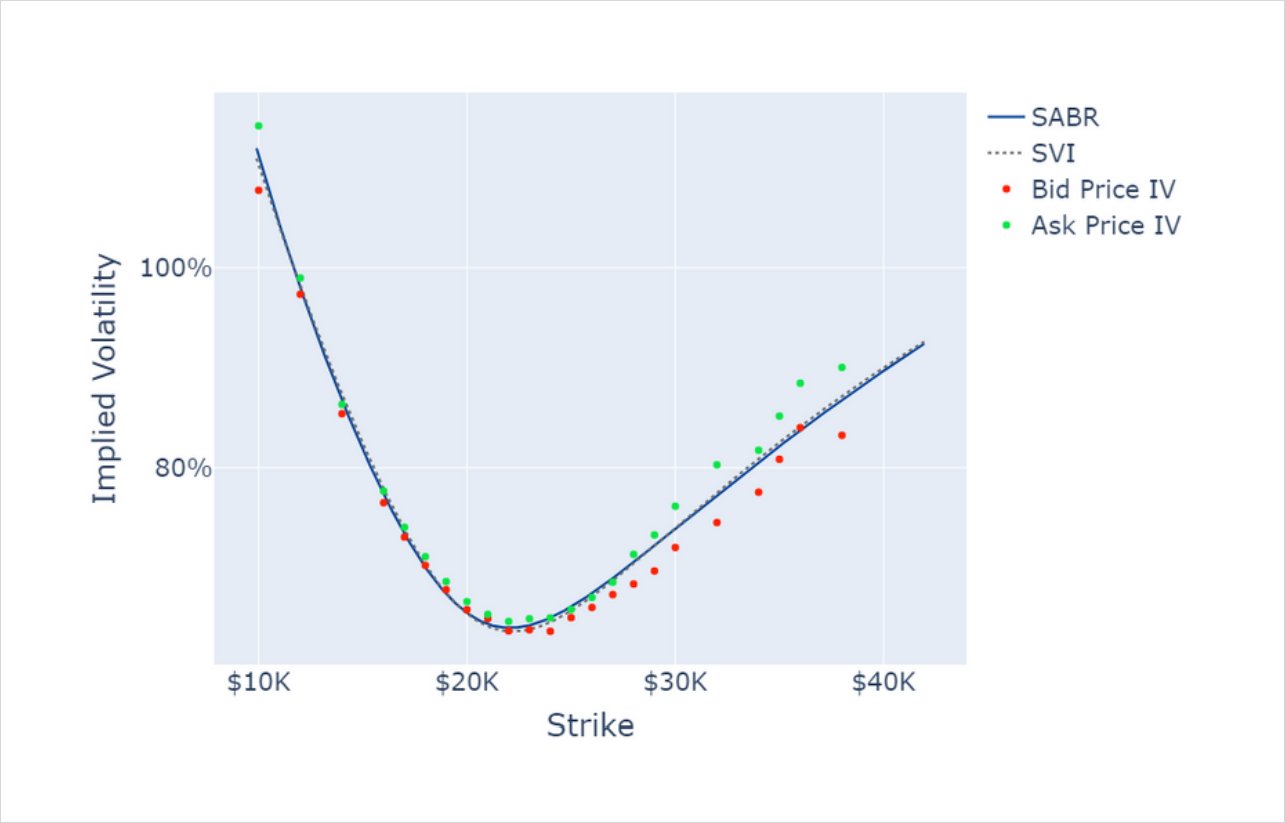

SABR Smile Calibration

Short-dated OTM puts outperform the rest of the smile as the IV of long-dated OTM calls cools to 75%

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 28th October Expiry

BTC’s 30d tenor vol smile remains largely consistent with last week’s smile, with IVs falling slightly across all strikes

BTC 1 Month SABR Implied Vol Smile.

ETH

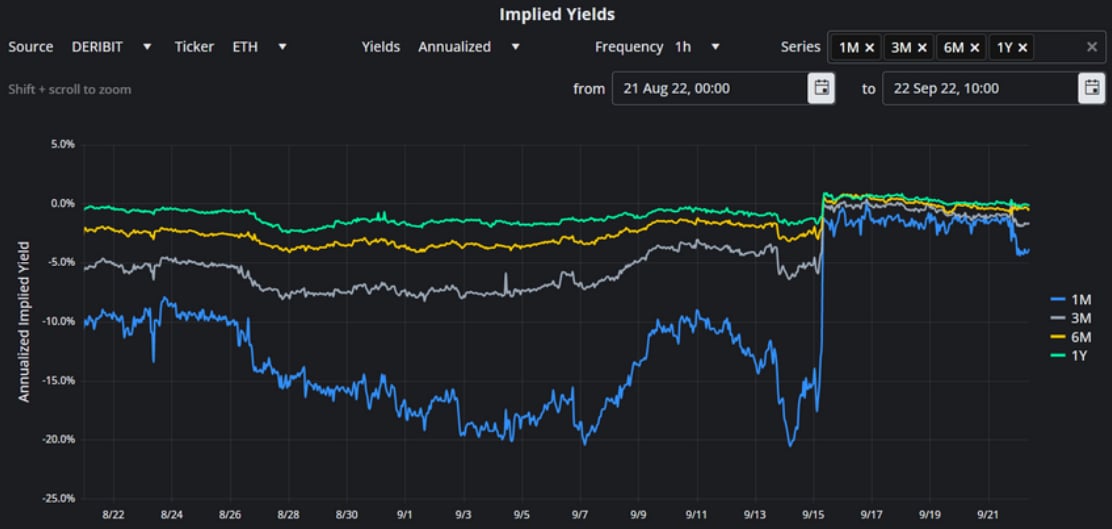

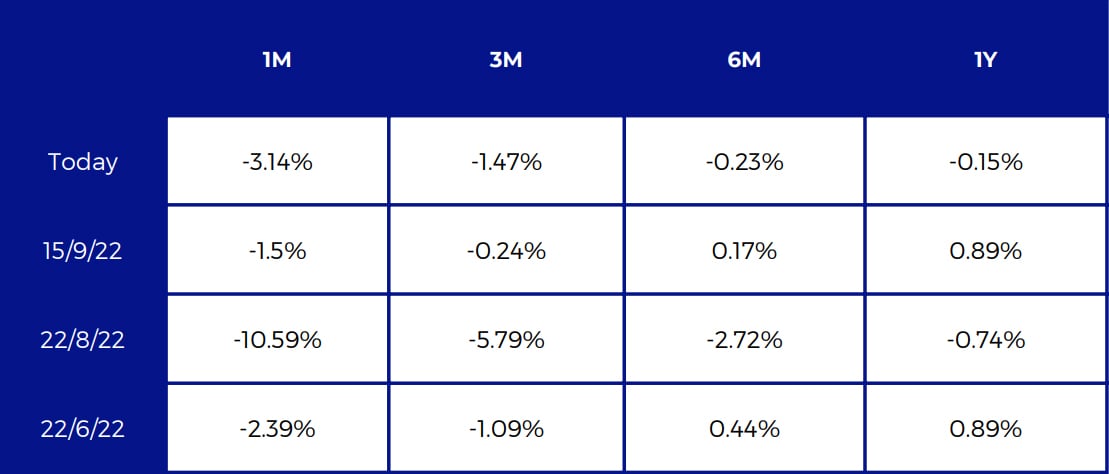

ETH’s yields recover sharply follow the Merge as traders unwind the hedge that allowed them to collect an ETH POW token without exposure to ETH’s price risk

ETH Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

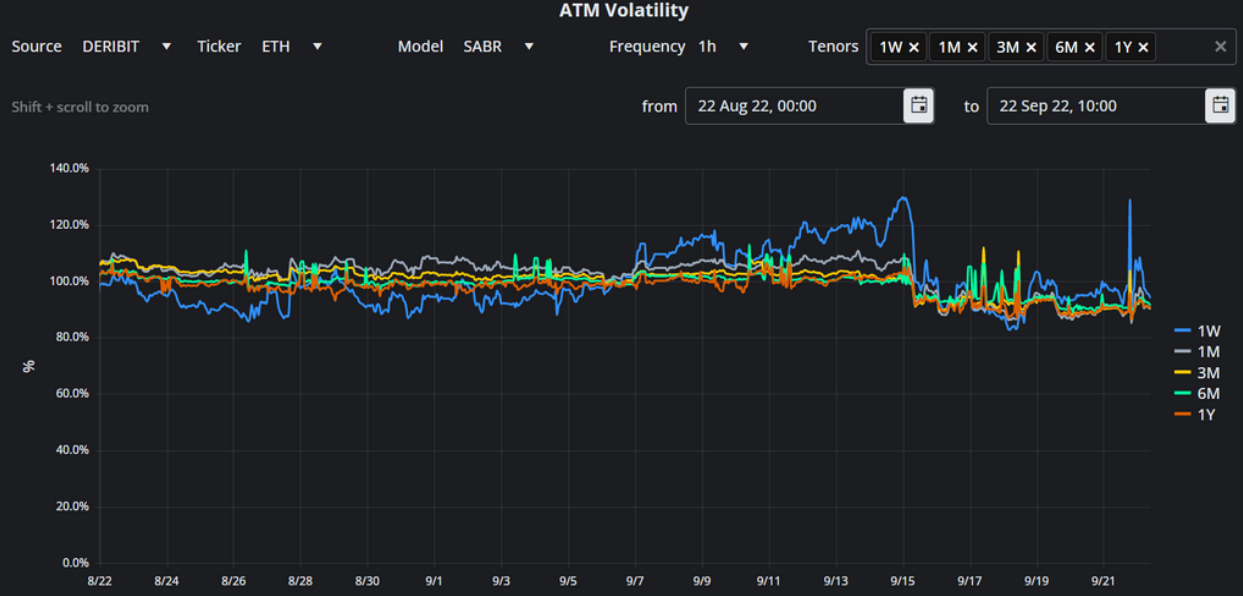

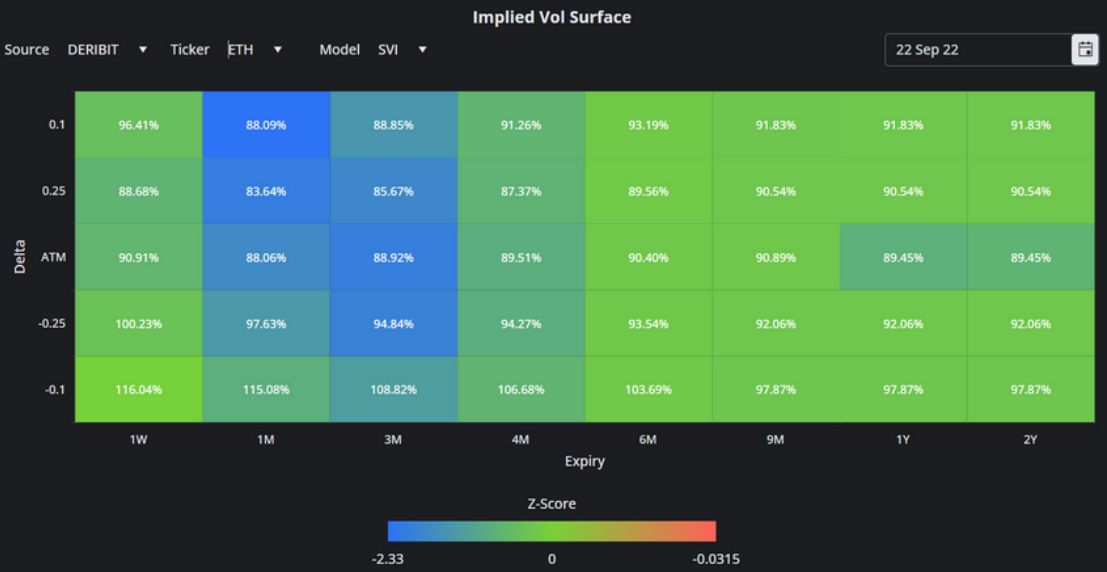

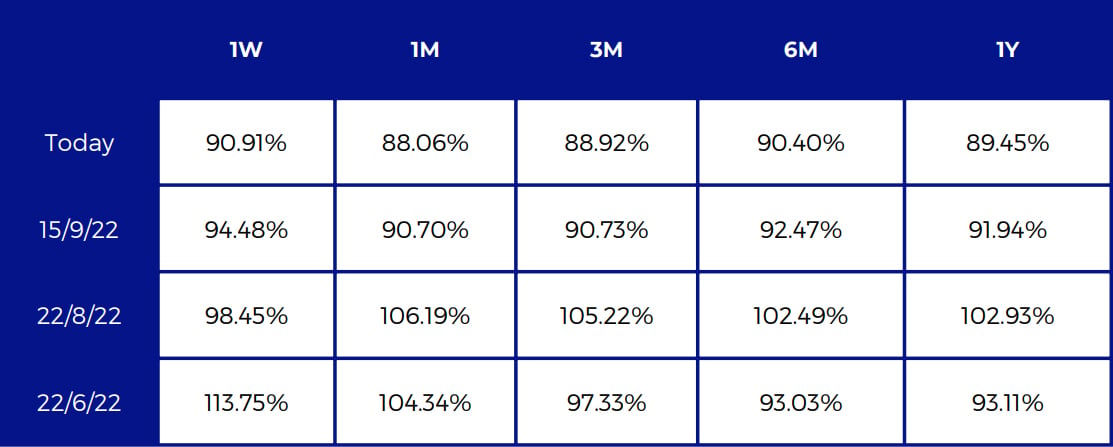

ETH’s ATM volatility falls sharply following the date of the Merge on the 15th of September to trade below 100% at all tenors

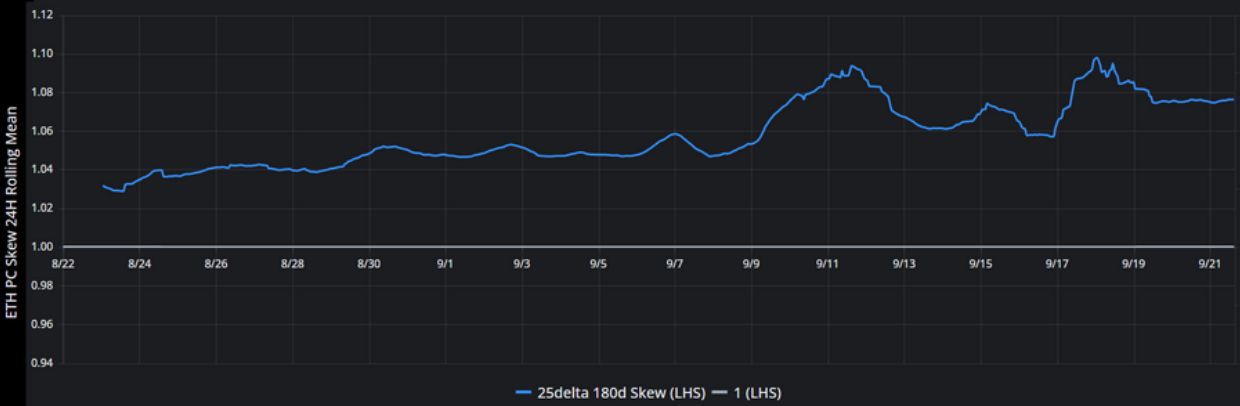

ETH’s 180d volatility smile is skewed heavily towards puts in the days following the Merge

SABR Smile Calibration

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

ETH ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 28th October Expiry

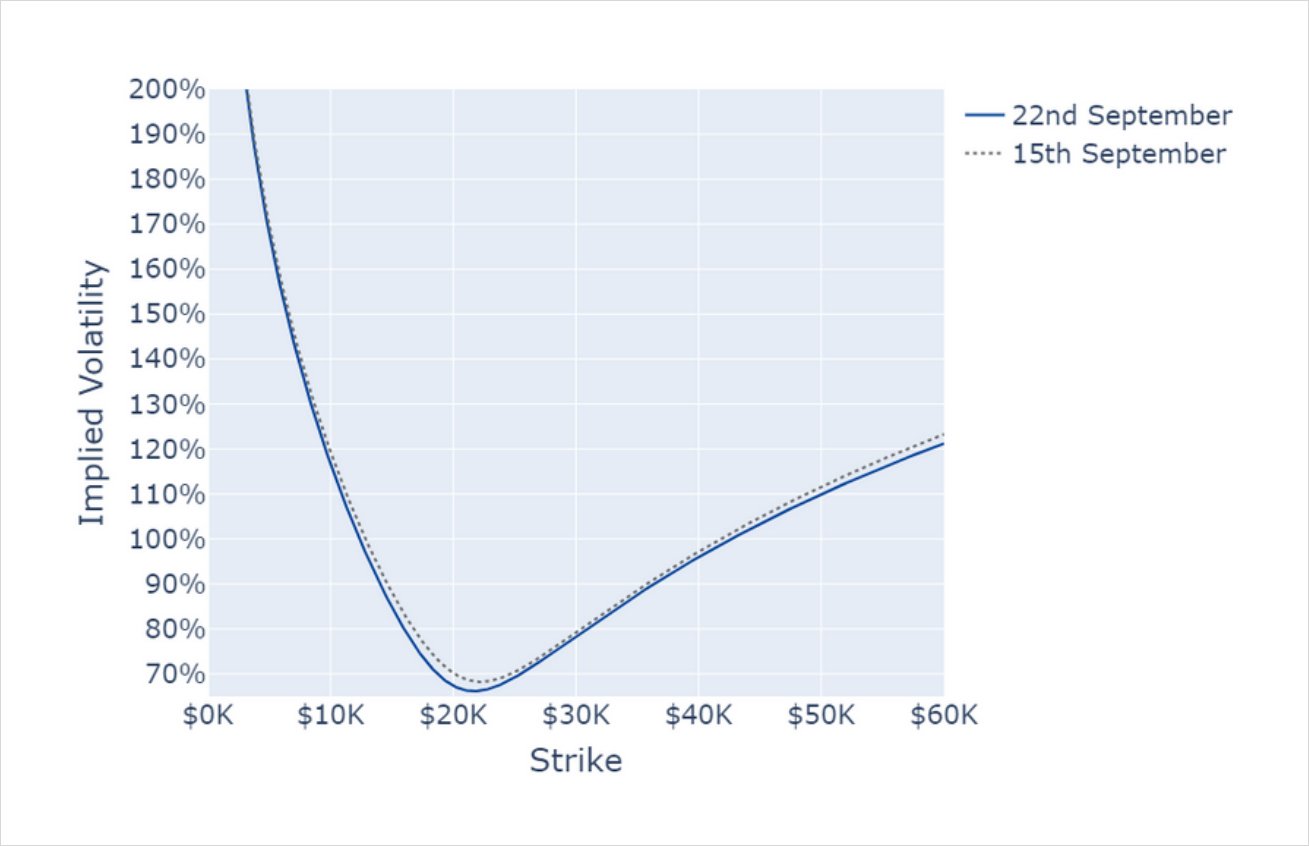

ETH’s vol smile sees a small rise in the IV of OTM calls, with similar IVs for OTM puts to 7 days ago

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)