Weekly recap of the crypto derivatives markets by BlockScholes.

At a Glance

Key Insights:

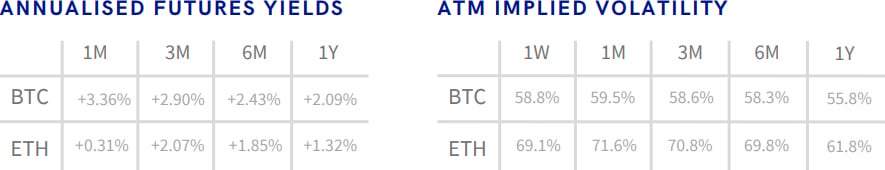

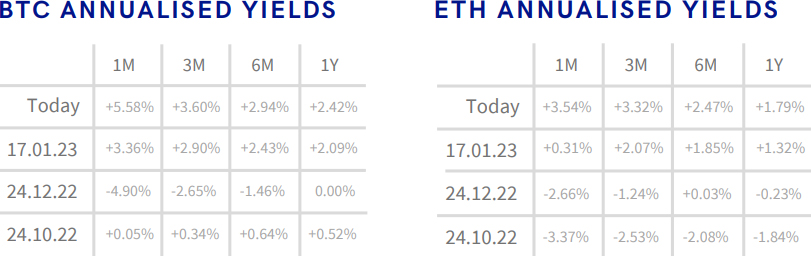

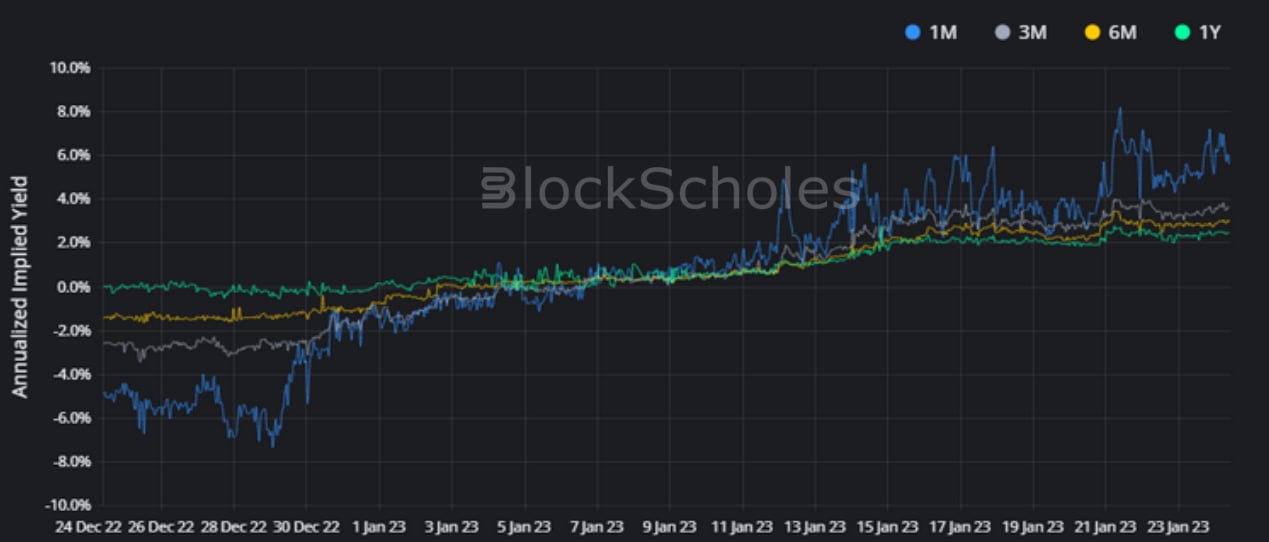

The second sharp leg up in spot prices in as many weeks sees short-dated ETH future-implied yields join BTC’s above zero. At-the-money implied volatility has returned to the levels seen this time last week for both assets, with a higher implied vol at the near side of the term structure. However, longer-dated ETH vol smiles remain slightly skewed towards OTM puts in contrast to BTC options with a similar tenor.

- BTC ANNUALISED YIELDS – futures prices continue their move above spot price.

- ETH ANNUALISED YIELDS – join BTC’s in moving above zero at short tenors over the last week.

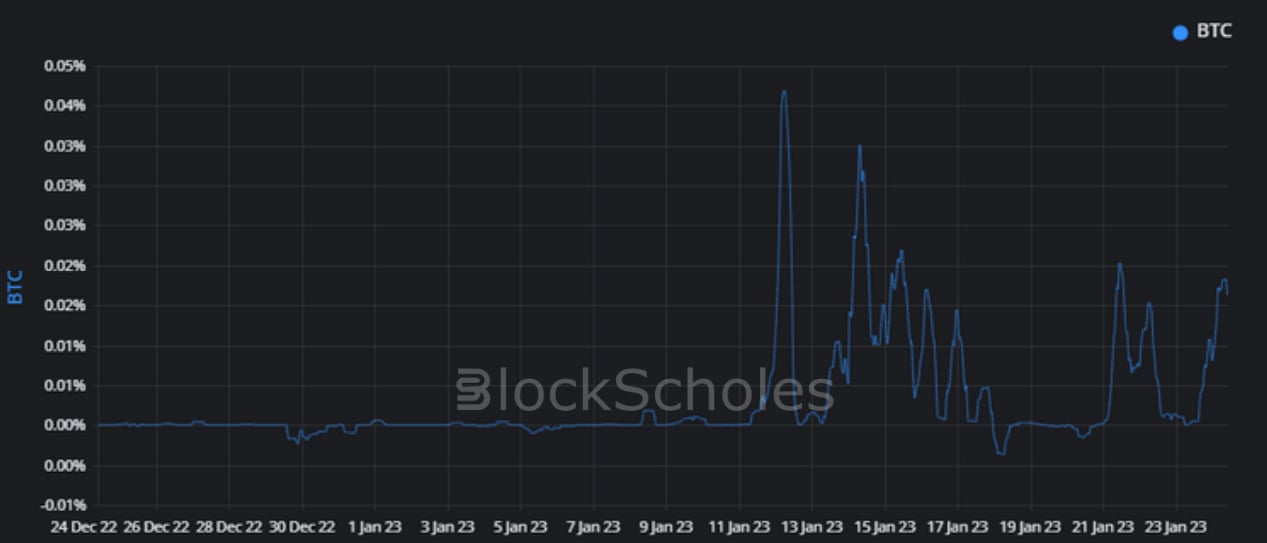

- BTC FUNDING RATE – remains positive, reflecting the demand for long perpetual swap exposure during BTC’s move upwards in spot price.

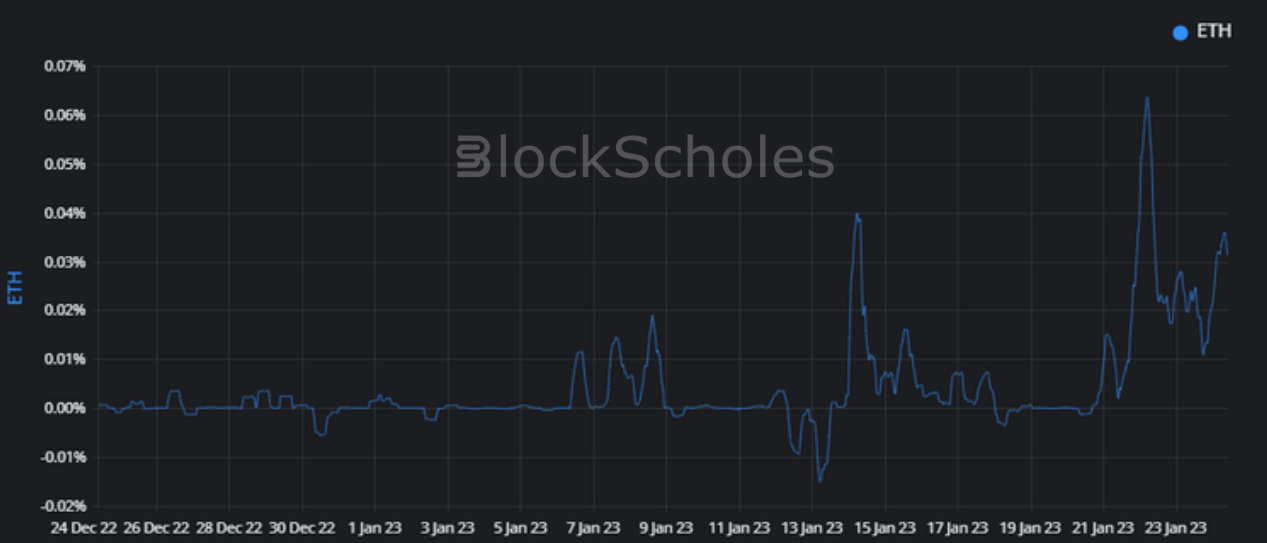

- ETH FUNDING RATE – indicates a more dramatic demand for long exposure during the second weekend rally of the year than for the first.

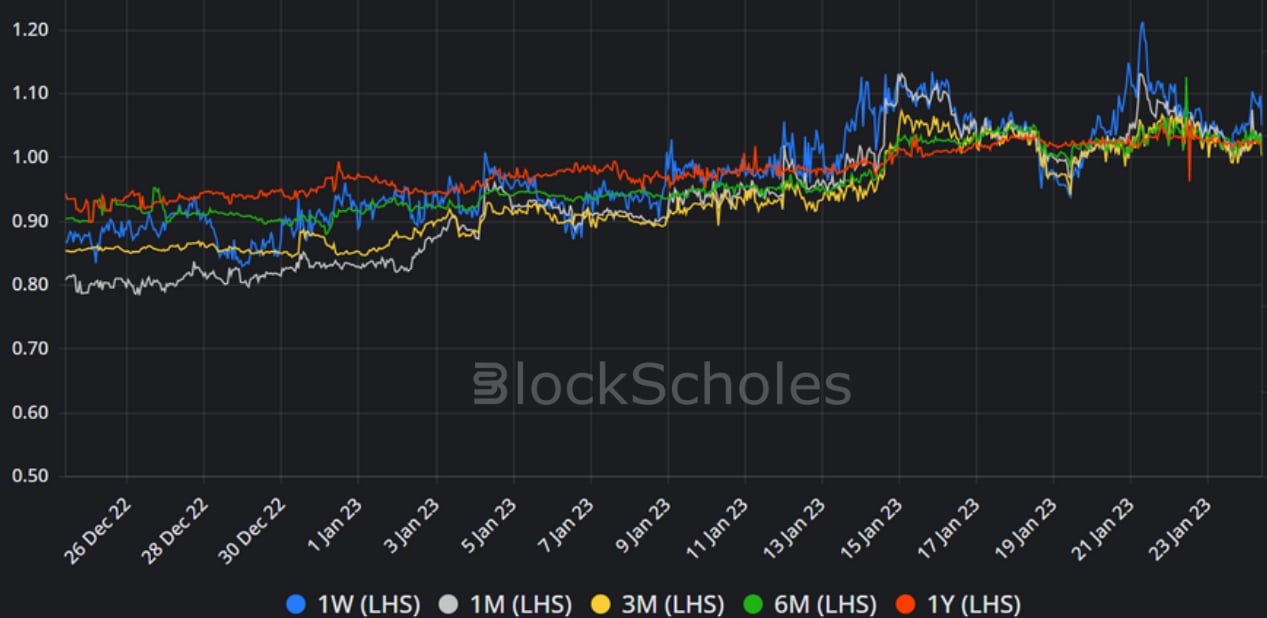

- BTC SABR ATM IMPLIED VOLATILITY – continues at similar levels to last week, up from the low levels observed over December.

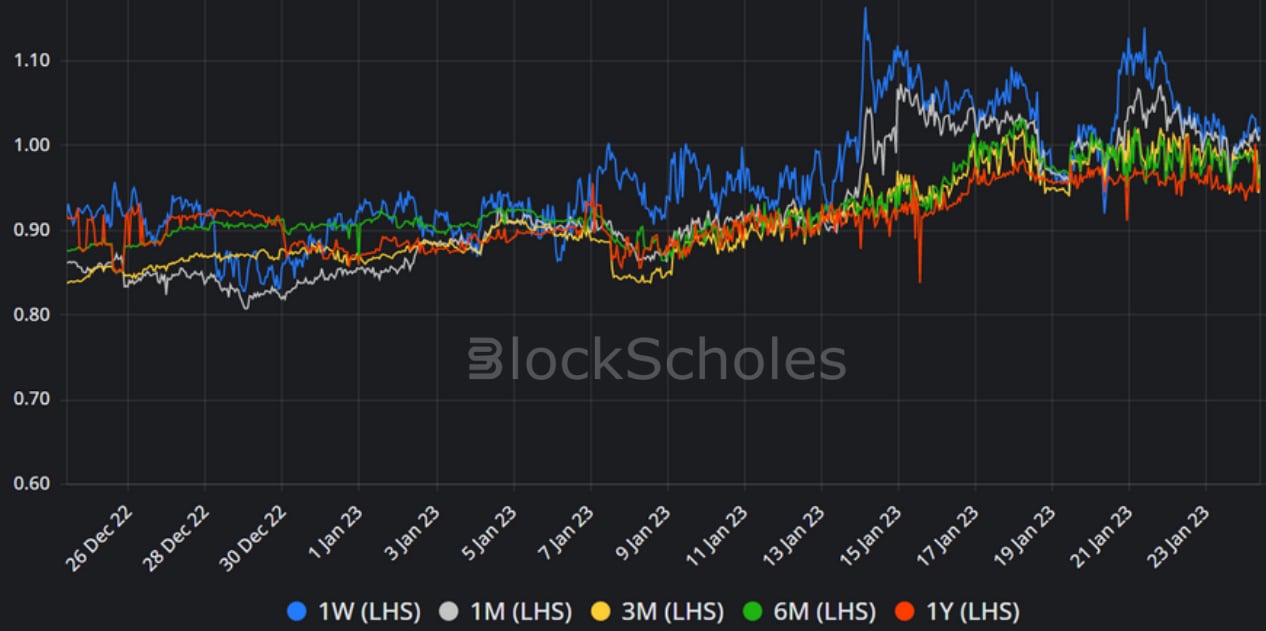

- ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s return to last week’s levels.

- BTC IMPLIED VOL SURFACE – displays that the strongest increase in implied volatility is in options with a 1W or 1M tenor.

- ETH IMPLIED VOL SURFACE – shows similarly high implied vol and a small skew towards OTM calls at shorter tenors only.

- BTC 25 DELTA PC SKEW – shows that the vol smile is mostly neutral with a small skew towards OTM calls at all tenors shorter than 1Y.

- ETH 25 DELTA PC SKEW – shows a slight preference for OTM puts at longer tenors, in contrast to the skew of BTC’s volatility surface.

Futures

BTC ANNUALISED YIELDS – futures prices continue their move above spot price.

ETH ANNUALISED YIELDS – join BTC’s in moving above zero at short tenors over the last week.

Perpetual Swap Funding Rate

BTC FUNDING RATE – remains positive, reflecting the demand for long perpetual swap exposure during BTC’s move upwards in spot price.

ETH FUNDING RATE – indicates a more dramatic demand for long exposure during the second weekend rally of the year than for the first.

Options

BTC SABR ATM IMPLIED VOLATILITY – continues at similar levels to last week, up from the low levels observed over December.

ETH SABR ATM IMPLIED VOLATILITY – mirrors BTC’s return to last week’s levels.

Volatility Surface

BTC IMPLIED VOL SURFACE – displays that the strongest increase in implied volatility is in options with a 1W or 1M tenor.

ETH IMPLIED VOL SURFACE – shows similarly high implied vol and a small skew towards OTM calls at shorter tenors only.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC.

Put-Call Skew

BTC 25 DELTA PC SKEW – shows that the vol smile is mostly neutral with a small skew towards OTM calls at all tenors shorter than 1Y.

ETH 25 DELTA PC SKEW – shows a slight preference for OTM puts at longer tenors, in contrast to the skew of BTC’s volatility surface.

Volatility Smiles

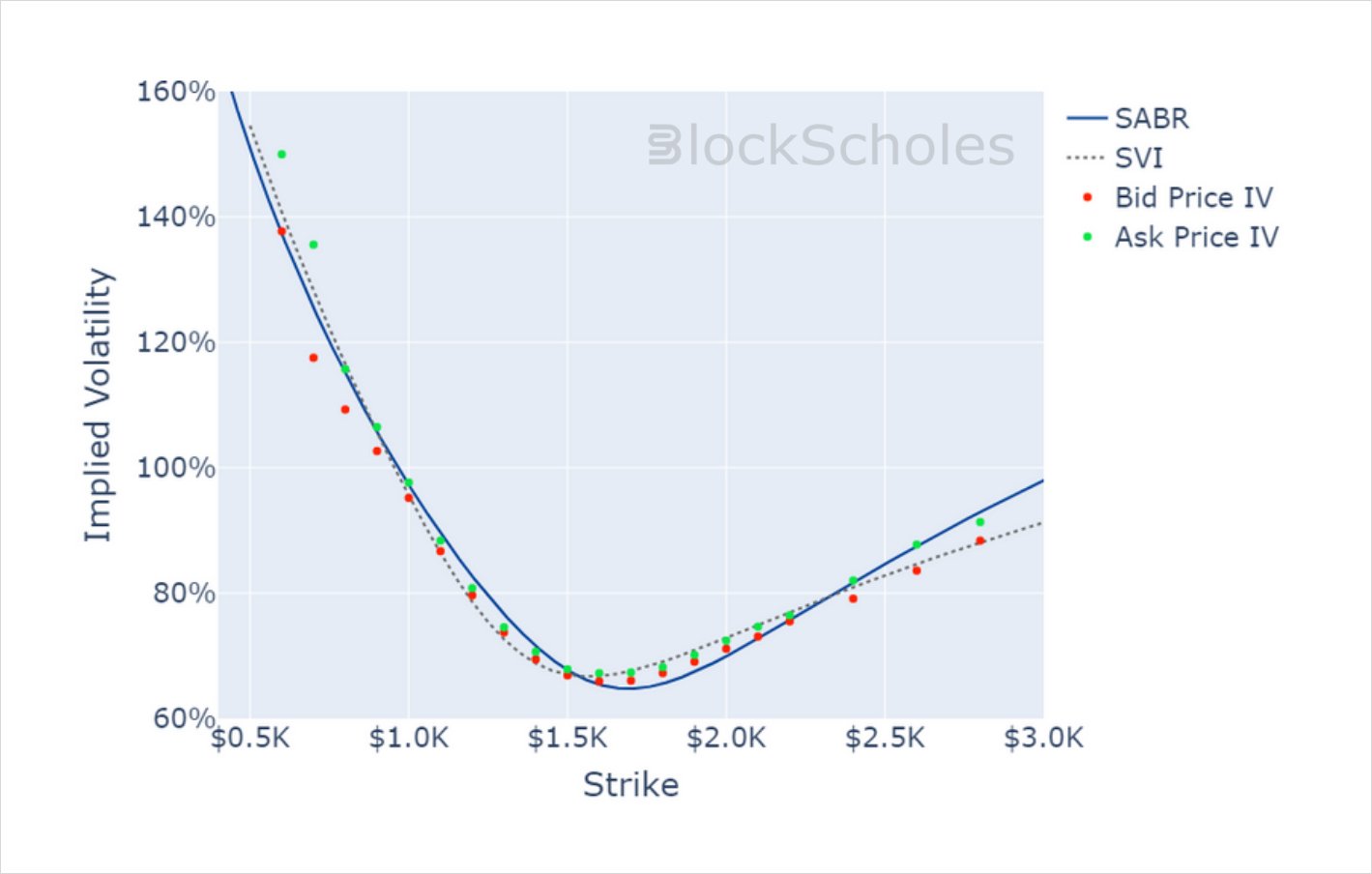

BTC SMILE CALIBRATIONS – 24-Feb-2023 Expiry, 14:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 24-Feb-2023 Expiry, 14:00 UTC Snapshot.

Historical SABR Volatility Smiles

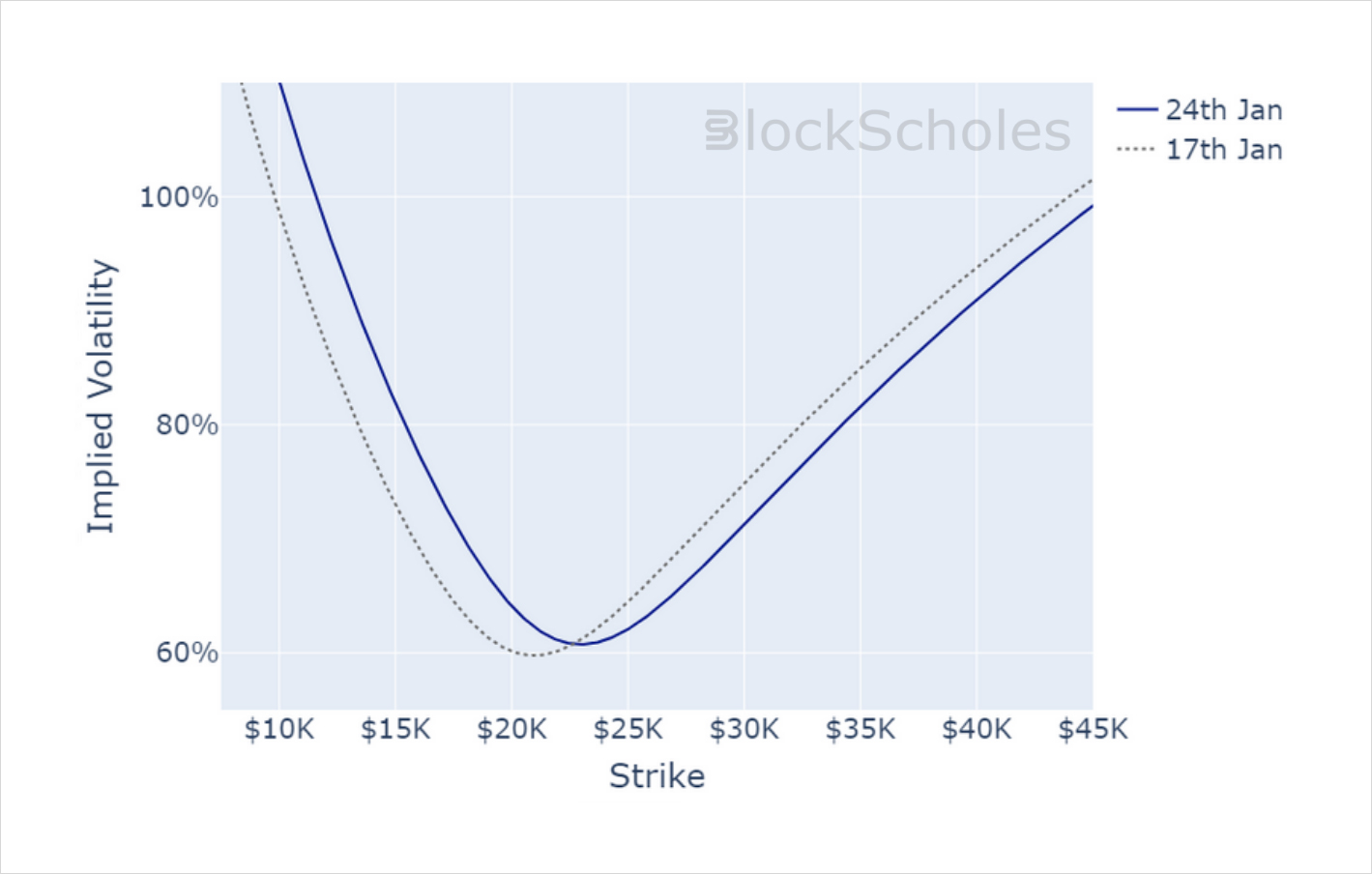

BTC SABR CALIBRATION – 30 Day Tenor, 14:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 14:00 UTC Snapshot.

AUTHOR(S)