Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

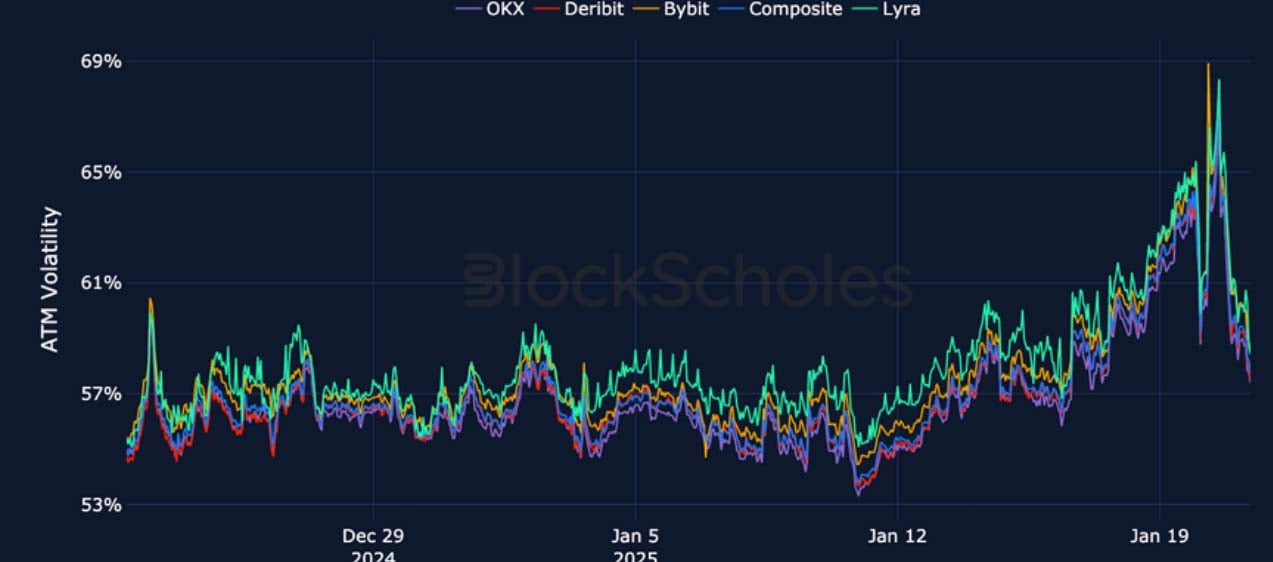

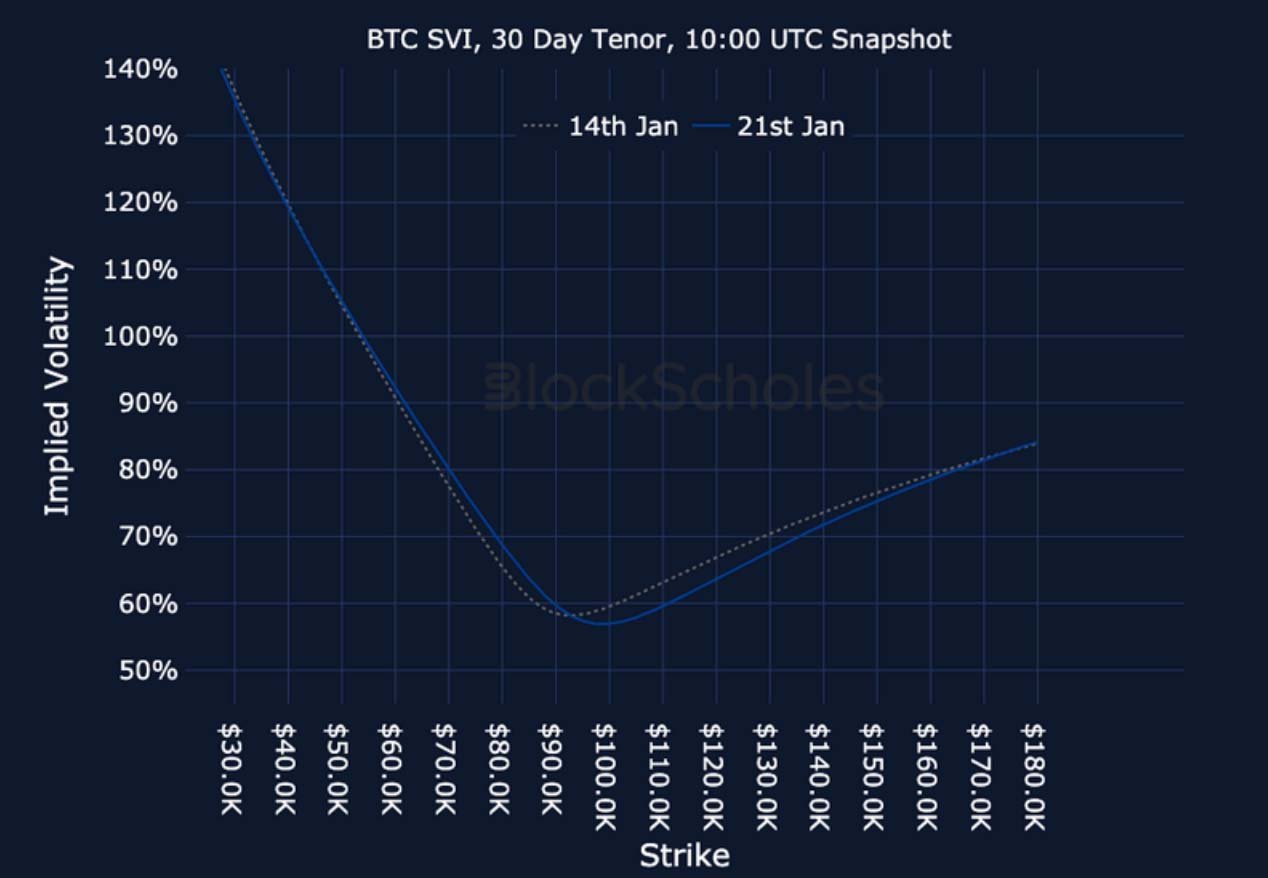

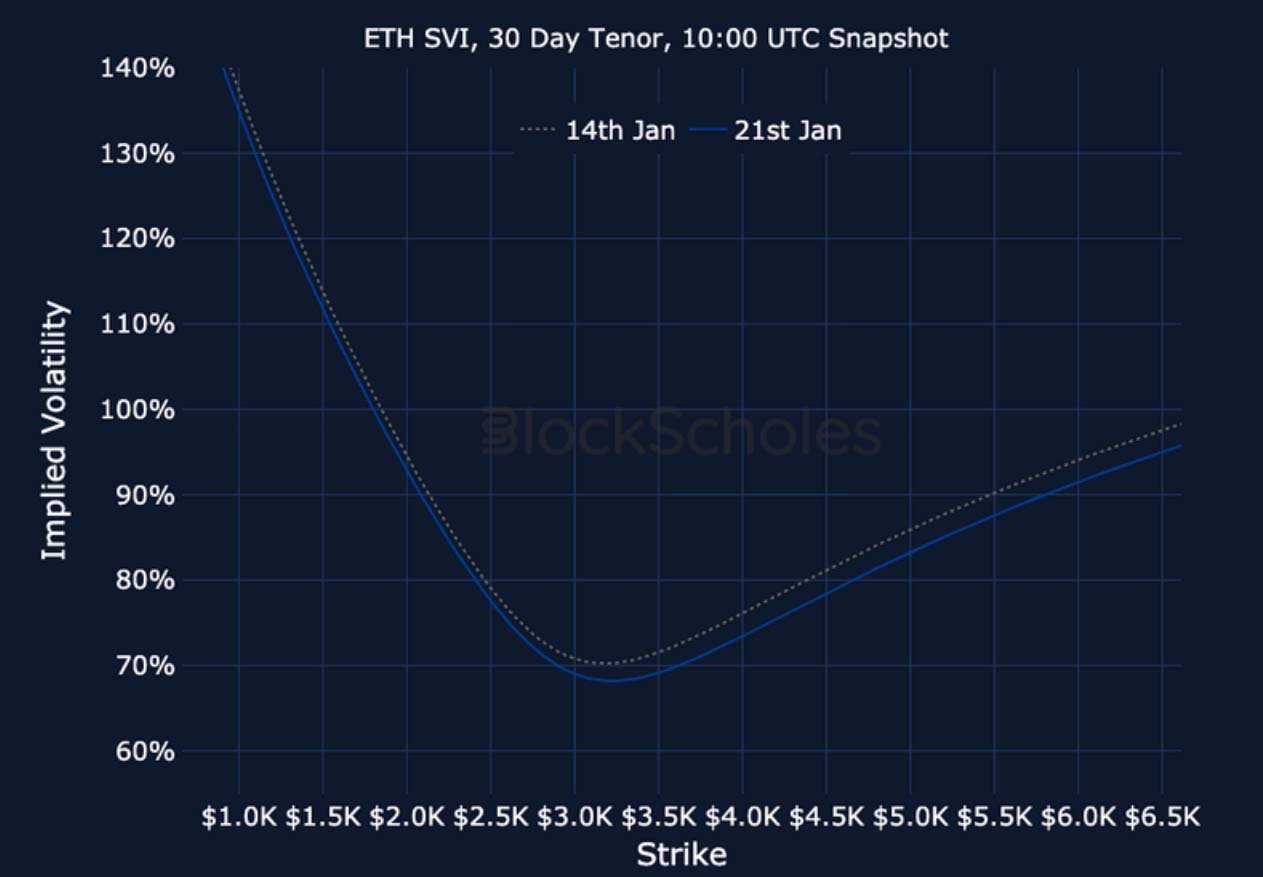

The prelude to President Trump’s inauguration on Jan 20, 2025 saw derivatives markets price in a healthy expectation of ‘day-one’ executive orders, including speculation of the announcement of a Strategic Bitcoin Reserve. Monday’s event followed the launch of two Trump family meme tokens, which themselves drew billions in market cap within hours. However, the inversions of the volatility term structure, the soaring perpetual swap funding rate, as well as the high premium assigned to short-tenor futures contracts have all resolved following a disappointing lack of announcements by the incoming President. Though while at-the-money implied volatility has largely returned to its early Jan levels, the skew towards OTM calls remains strong across the term structure for BTC’s markets.

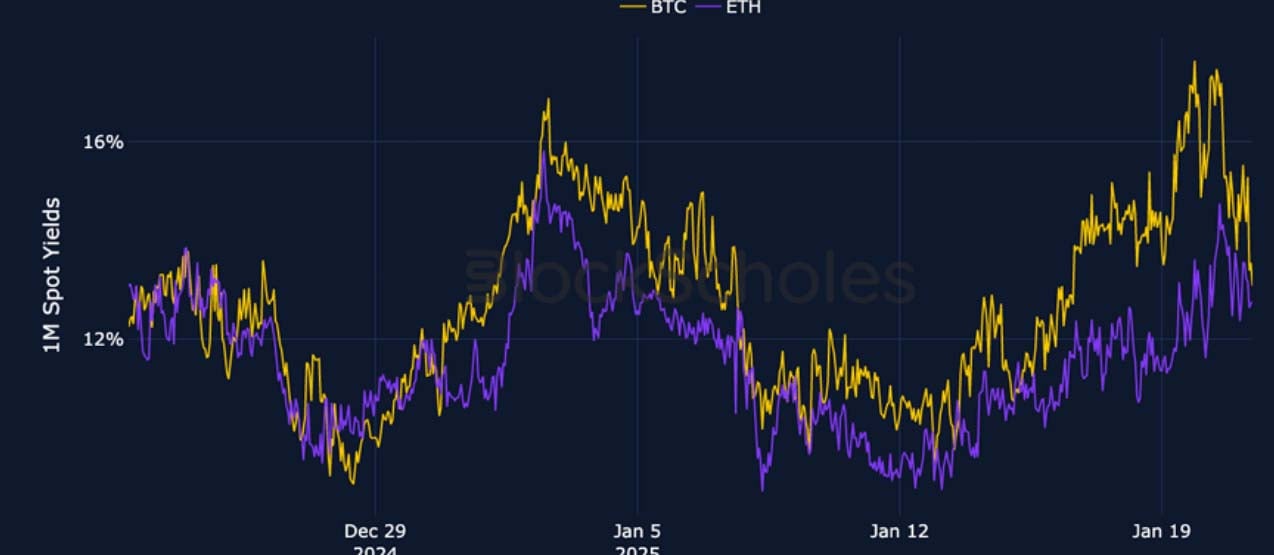

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

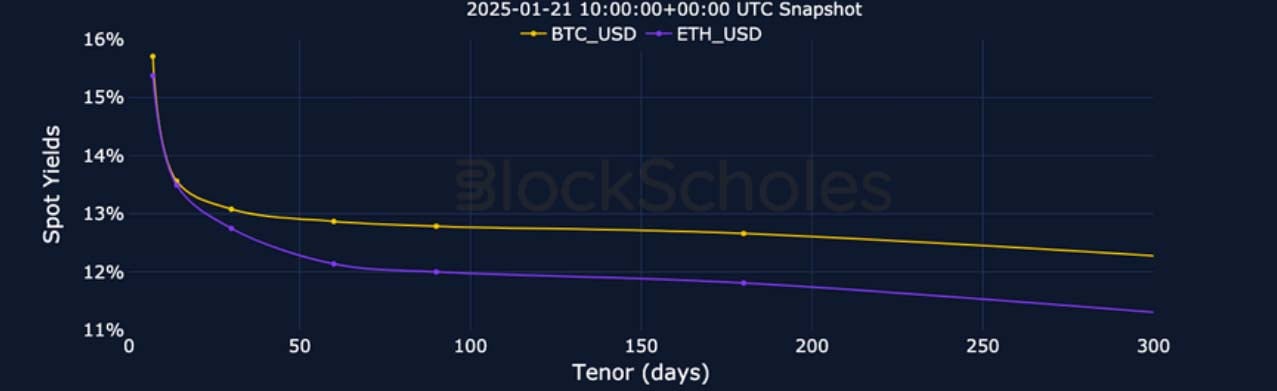

BTC ANNUALISED YIELDS – The strong pre-inauguration inversion of yields has moderated slightly, without short tenors returning below longer tenors.

ETH ANNUALISED YIELDS – Despite levels broadly trending sideways over the last month, the term structure remains inverted.

Perpetual Swap Funding Rate

BTC FUNDING RATE – Spiked to its highest value since December, before a disappointing lack of inaugural announcements returned it to flat.

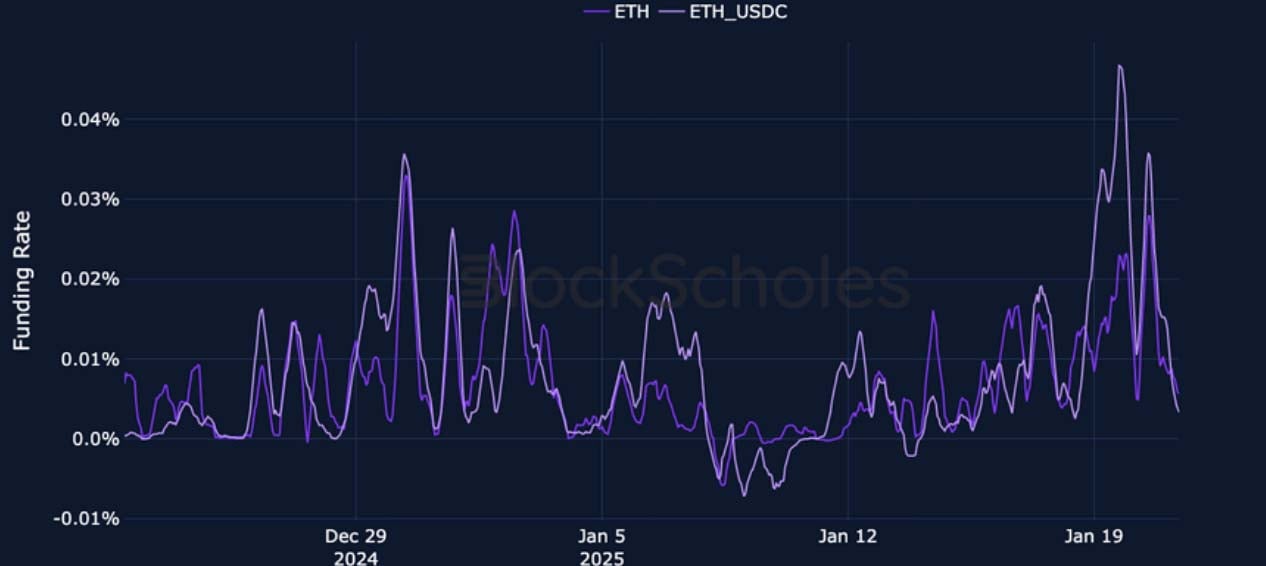

ETH FUNDING RATE – ETH’s funding rate did not spike as high as BTC’s, continuing the bullish-but-less-bullish positioning we’ve observed.

BTC Options

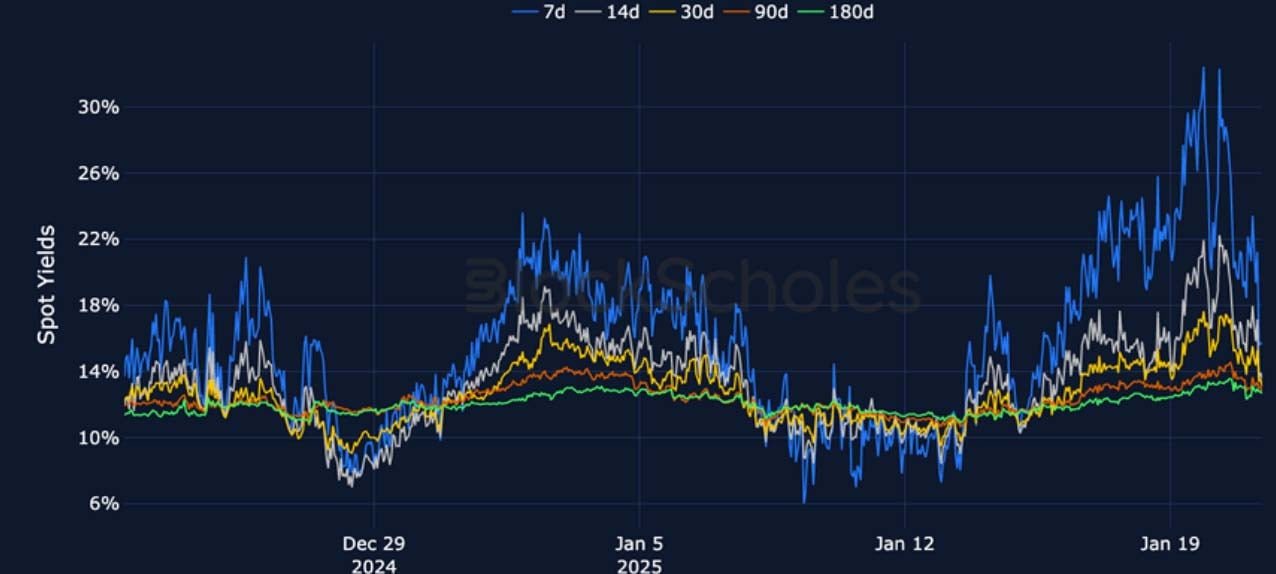

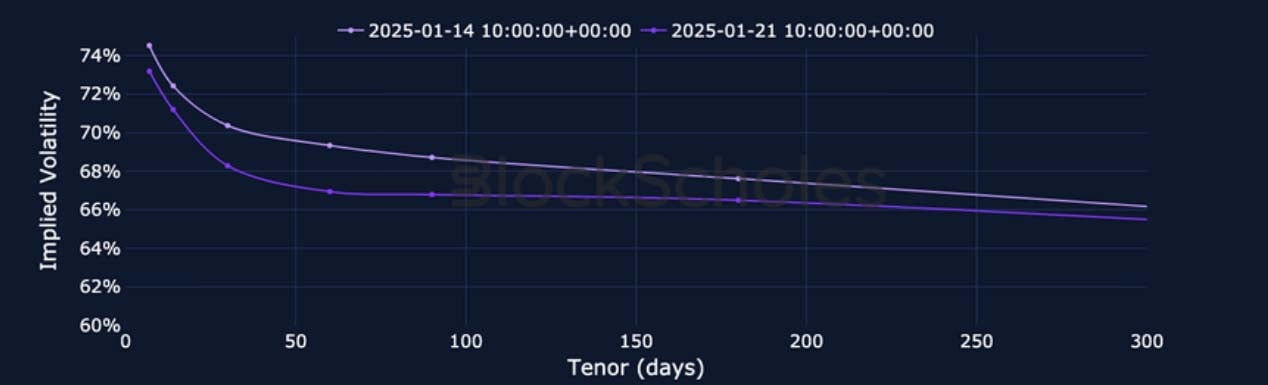

BTC SVI ATM IMPLIED VOLATILITY – Trump’s inauguration saw the largest inversion of the term structure since the U.S. election in November.

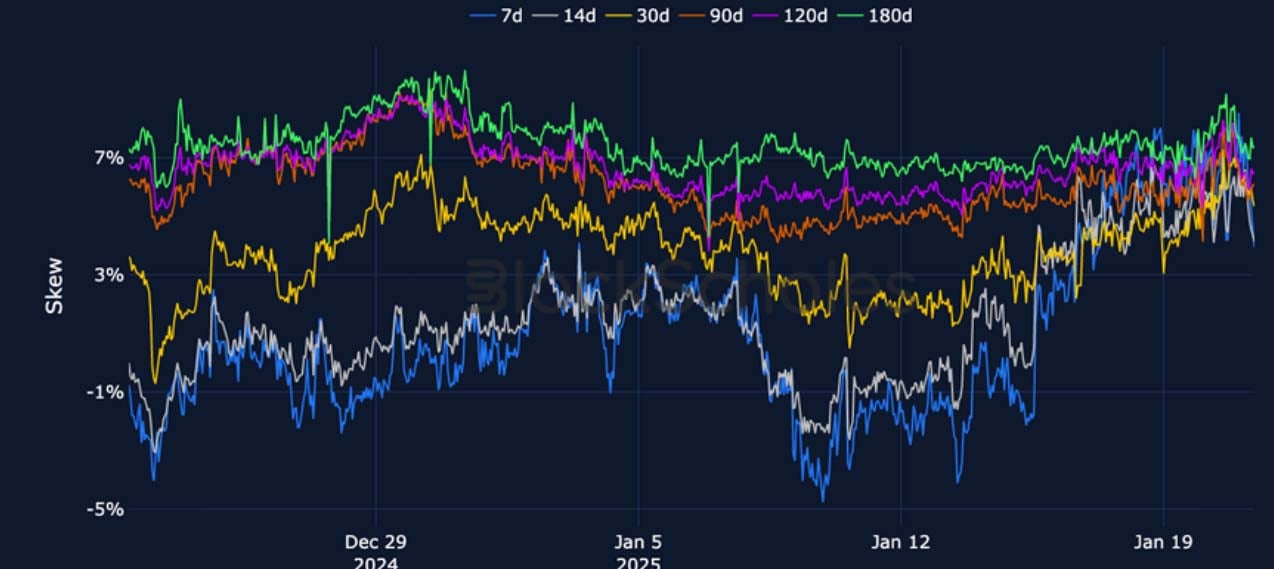

BTC 25-Delta Risk Reversal – While less bearish than yesterday, short-tenor smiles remain slightly skewed toward OTM puts despite the rally in the spot.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Like BTC, ETH’s term structure of volatility inverted strongly before flattening in the aftermath of Jan 20, 2025.

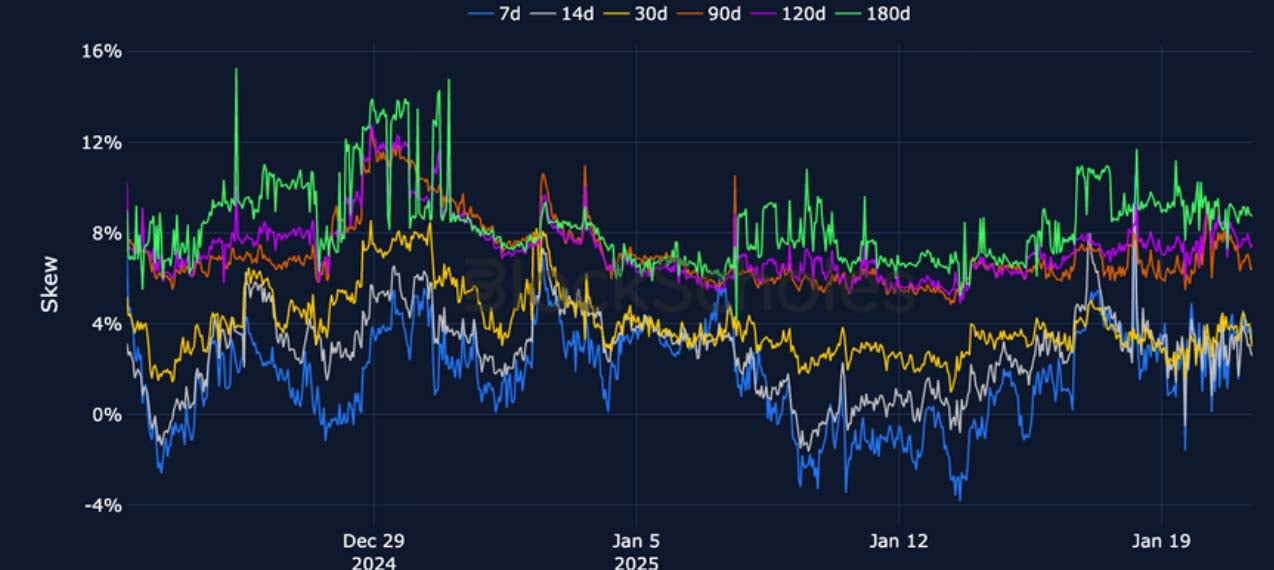

ETH 25-Delta Risk Reversal – ETH’s skew sees none of the increased bullishness at short tenors that BTC did in the prelude to the inauguration.

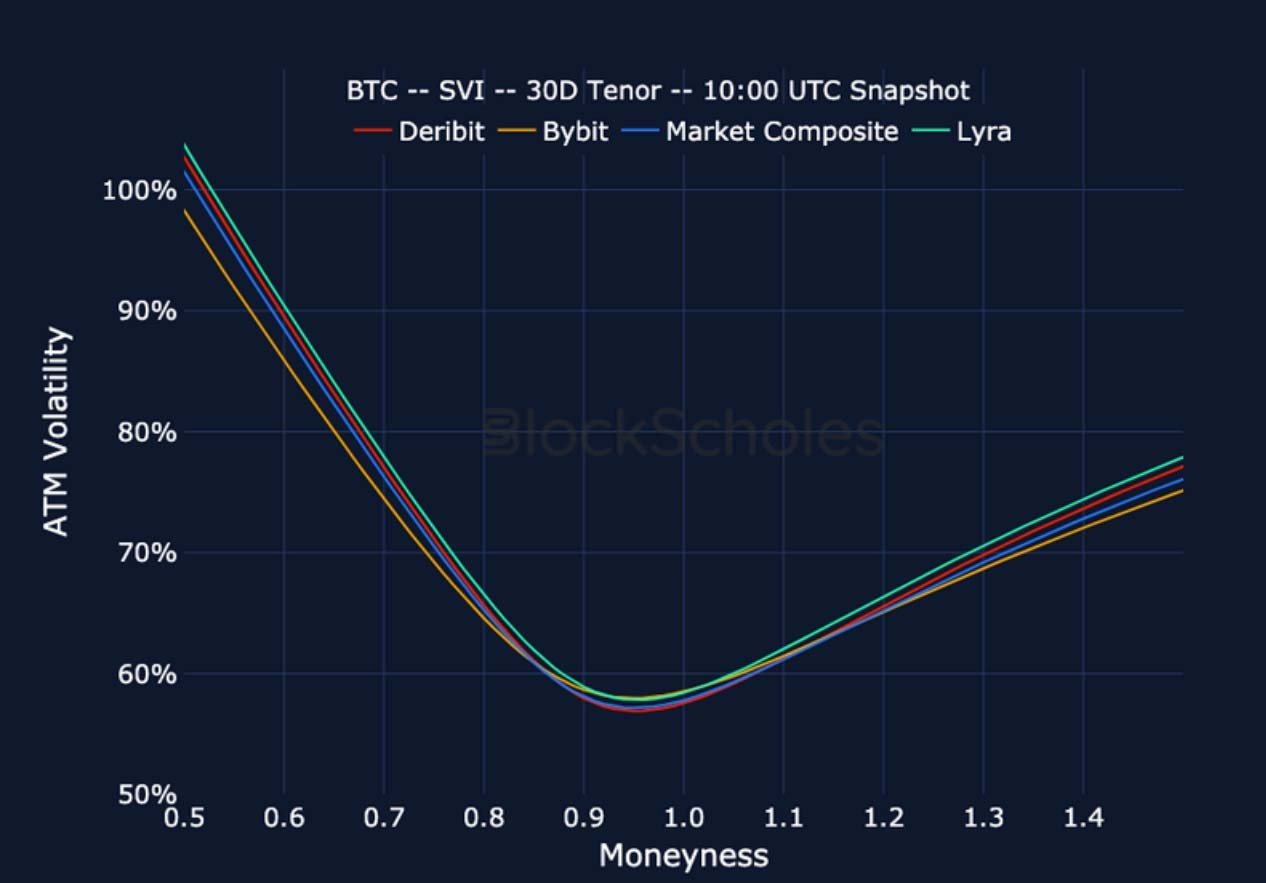

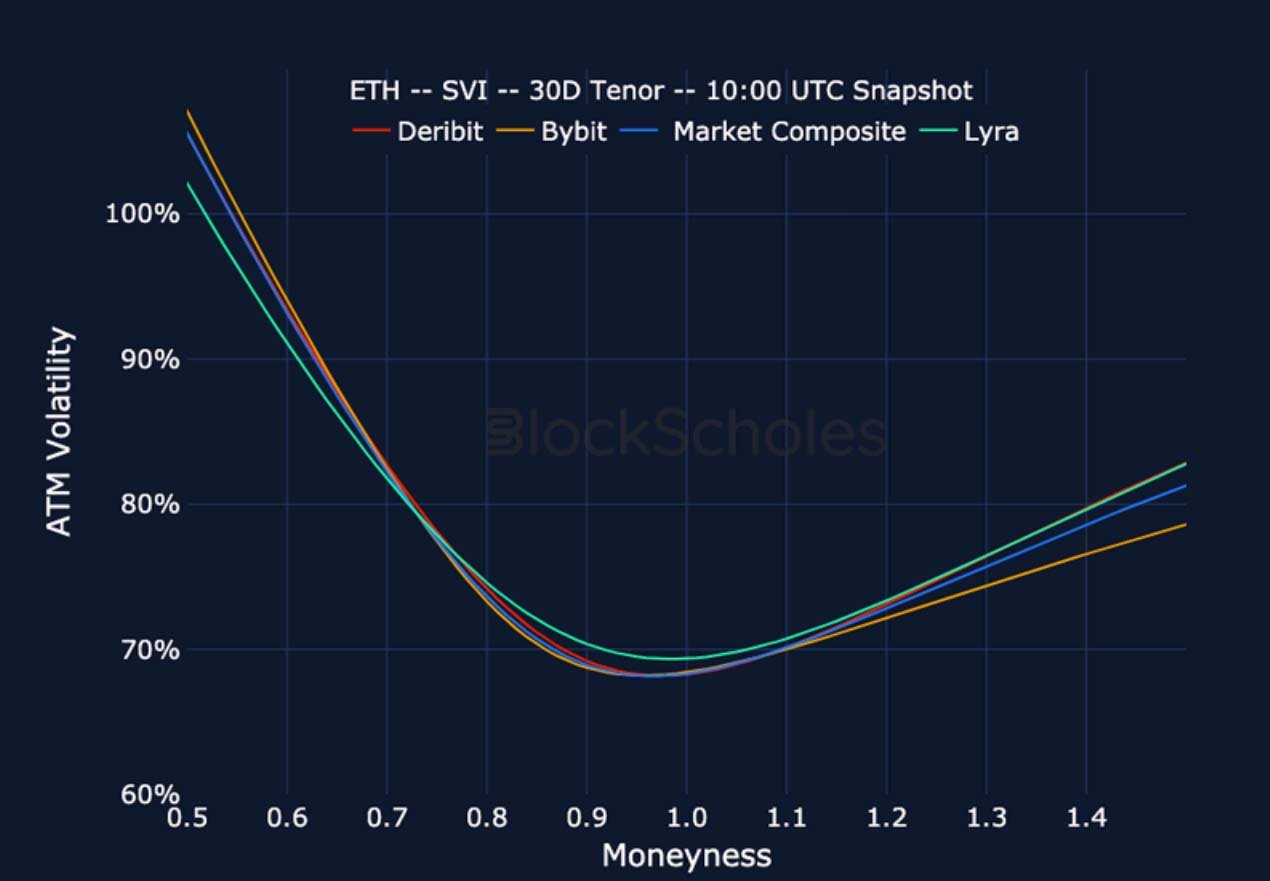

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

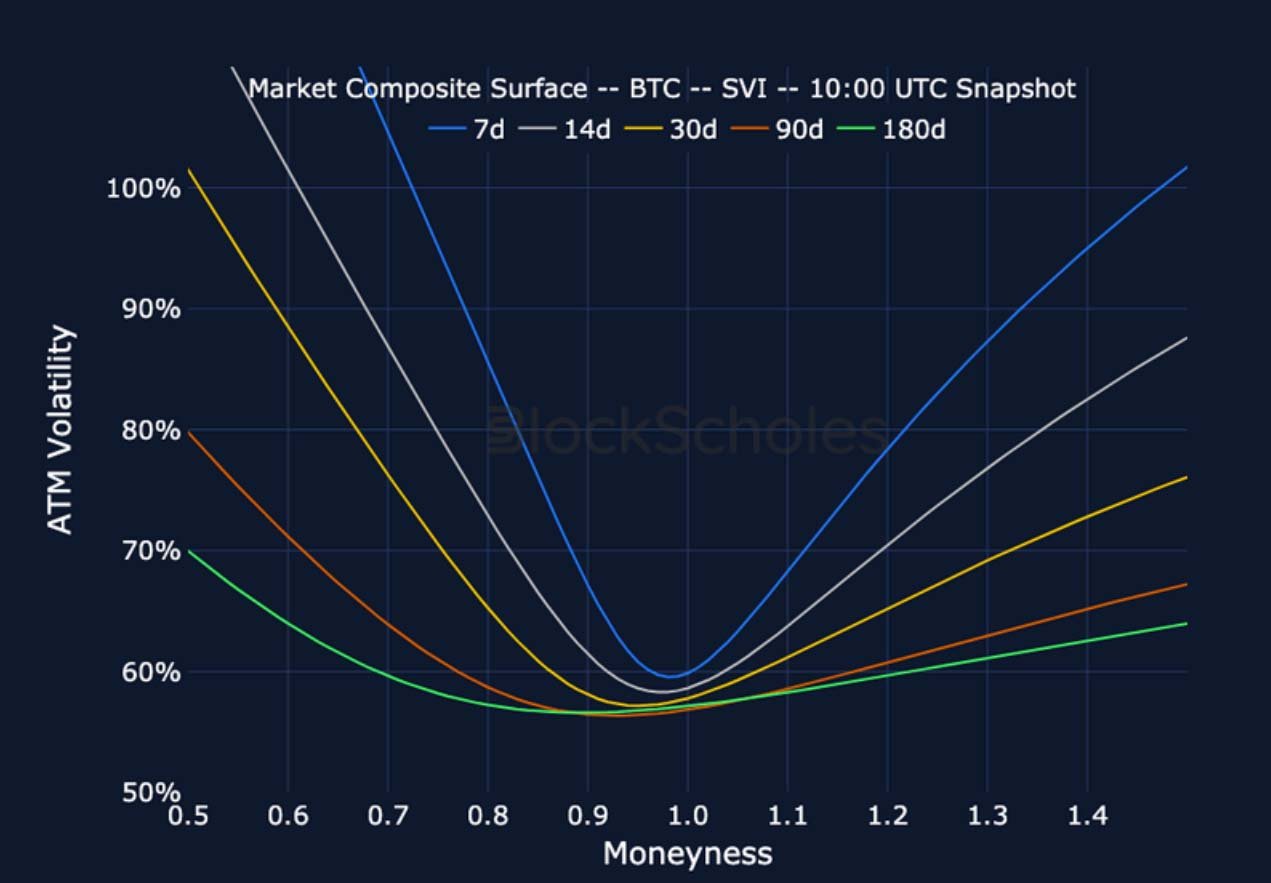

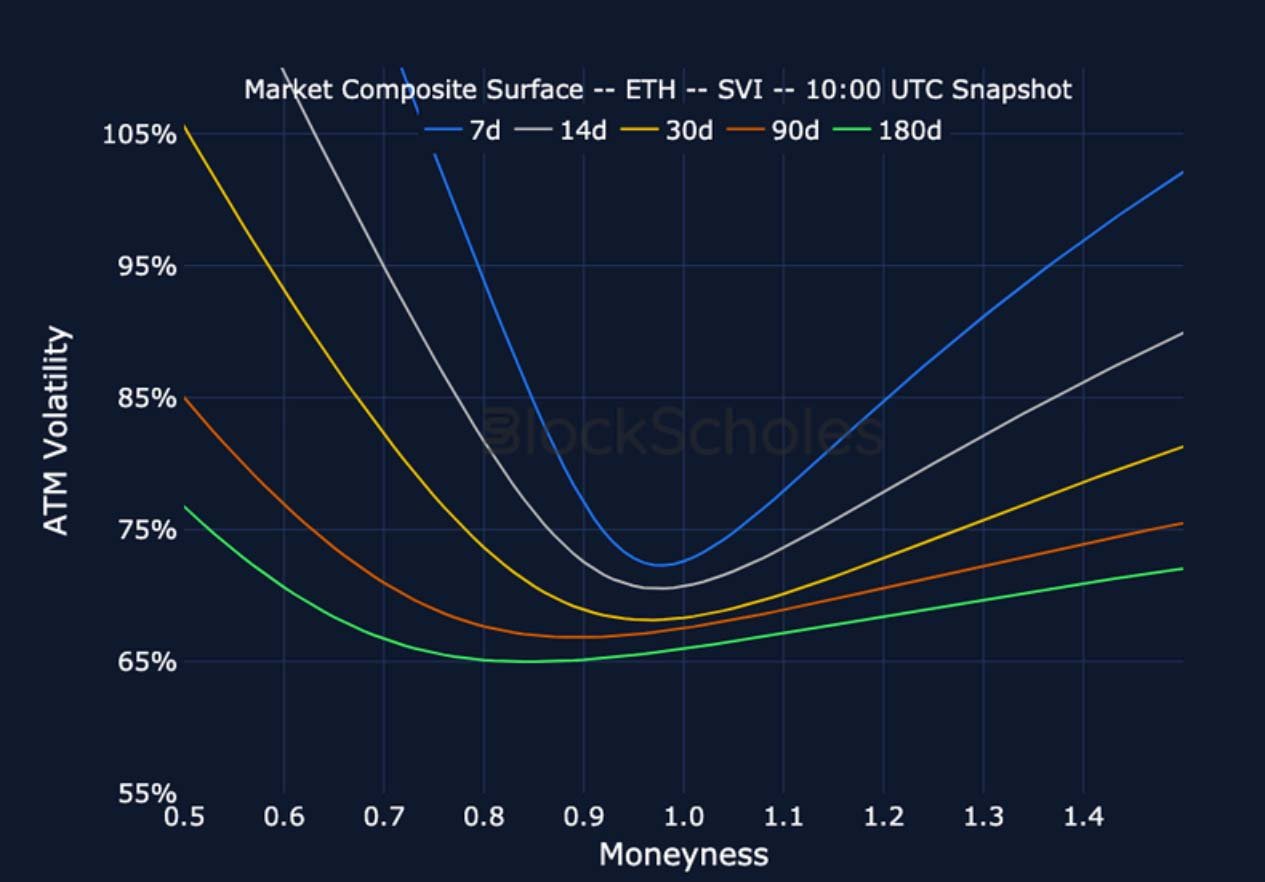

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

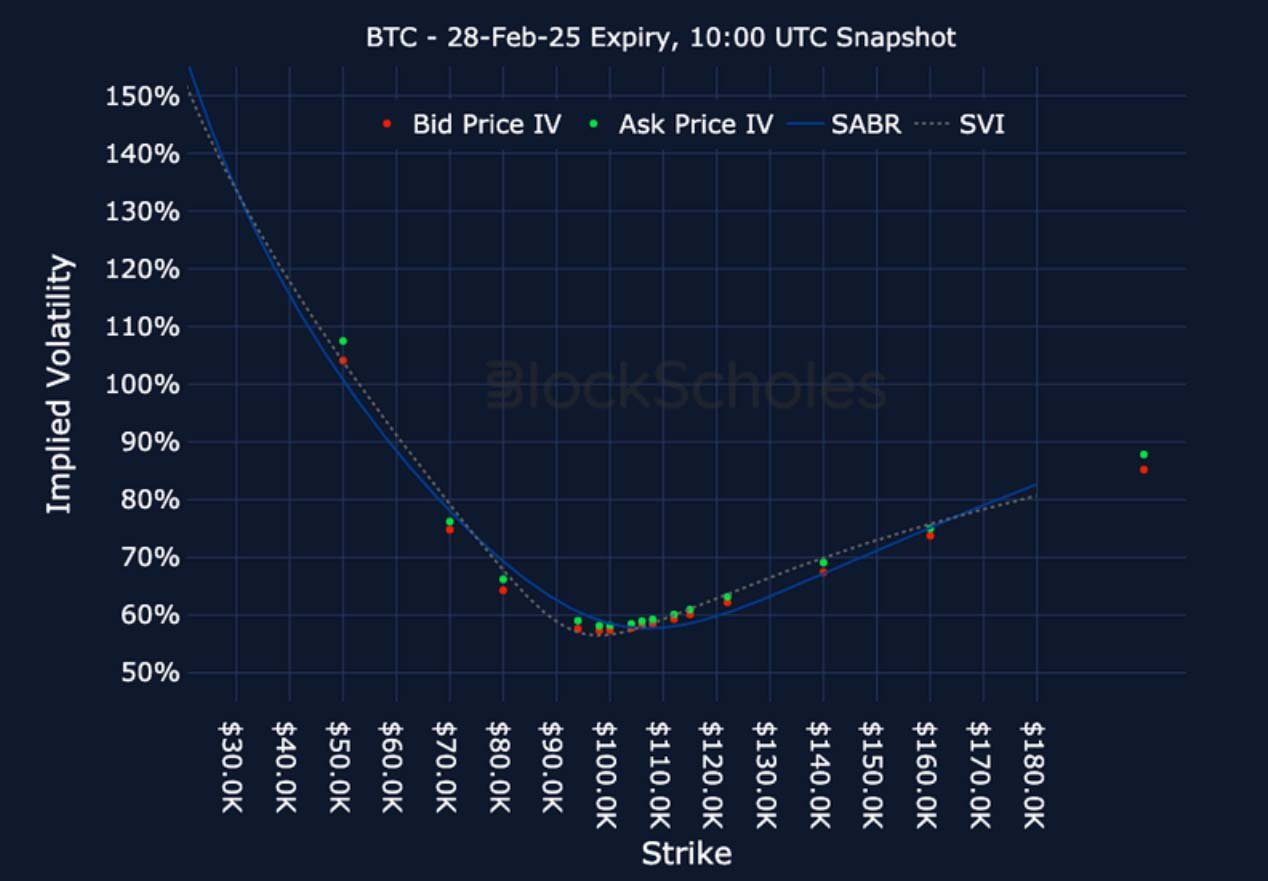

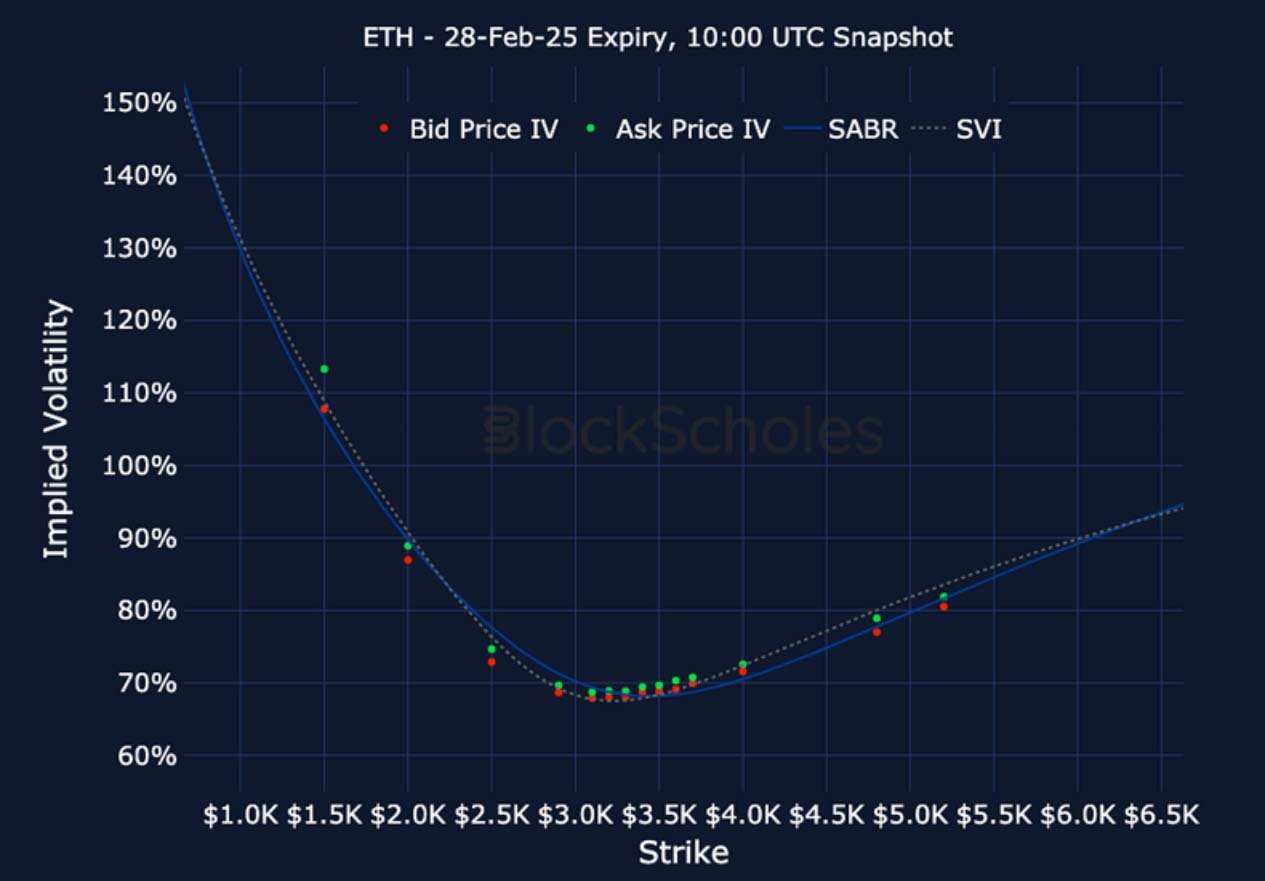

Listed Expiry Volatility Smiles

BTC 28-FEB EXPIRY – 9:00 UTC Snapshot.

ETH 28-FEB EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)