Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

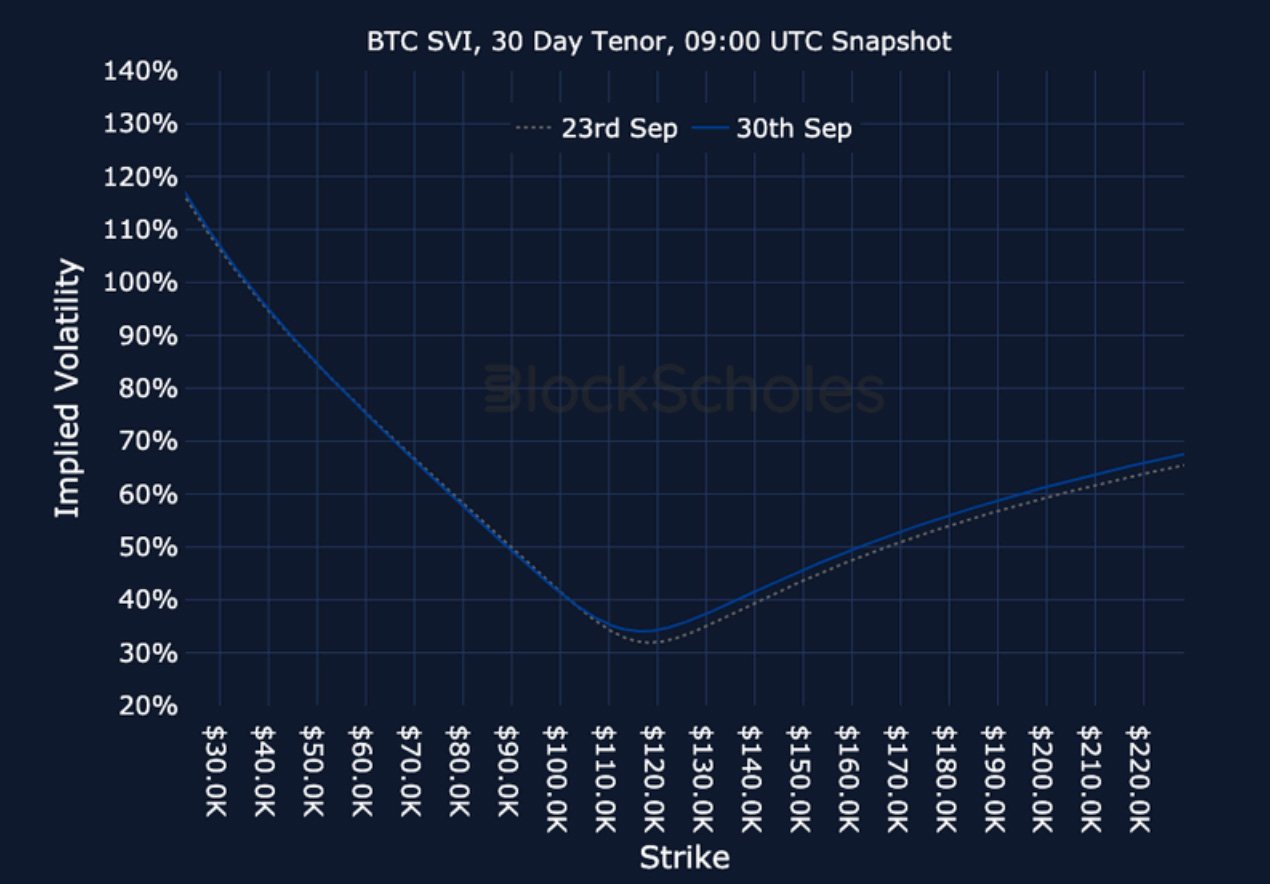

The past week began with the largest long liquidation event of the year, as more than $1.5B in long positions was liquidated on Monday Sep 22, 2025. Both BTC and ETH subsequently fell below key support levels of $110K and $4,000, respectively. That pullback in spot price was also exacerbated by continued outflows from Spot Bitcoin and Ethereum ETFs. ATM implied volatility levels shot up higher during the liquidation event, before settling back down, and volatility smiles for most of the second half of September (post-FOMC) progressively skewed further towards OTM puts with each spot price selloff. However, the rally this week in crypto-asset spot prices, which began over the weekend, has pushed BTC back to $116K and Ether to $4,300. Volatility smiles have also eroded much of their negative skew towards puts over the past few days, with smiles for short-tenor BTC and ETH options now close to neutral. That has also been supported by major inflows into Spot ETFs – Bitcoin ETFs purchased $518.0M of bitcoins yesterday, while ETH Spot ETFs outperformed with inflows of $546.9M.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

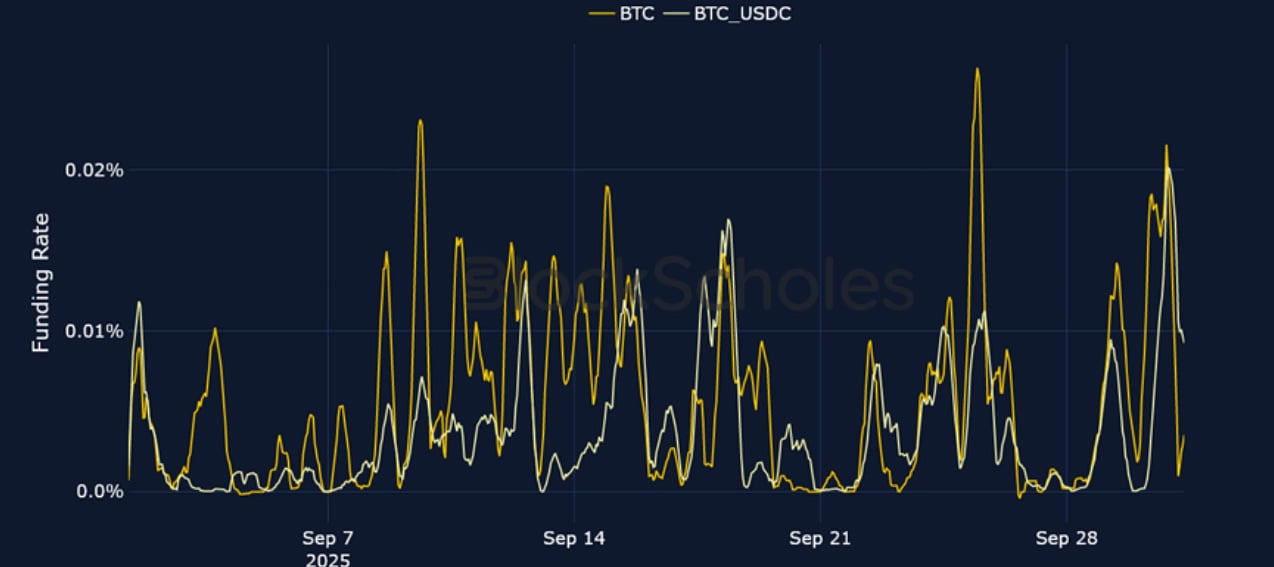

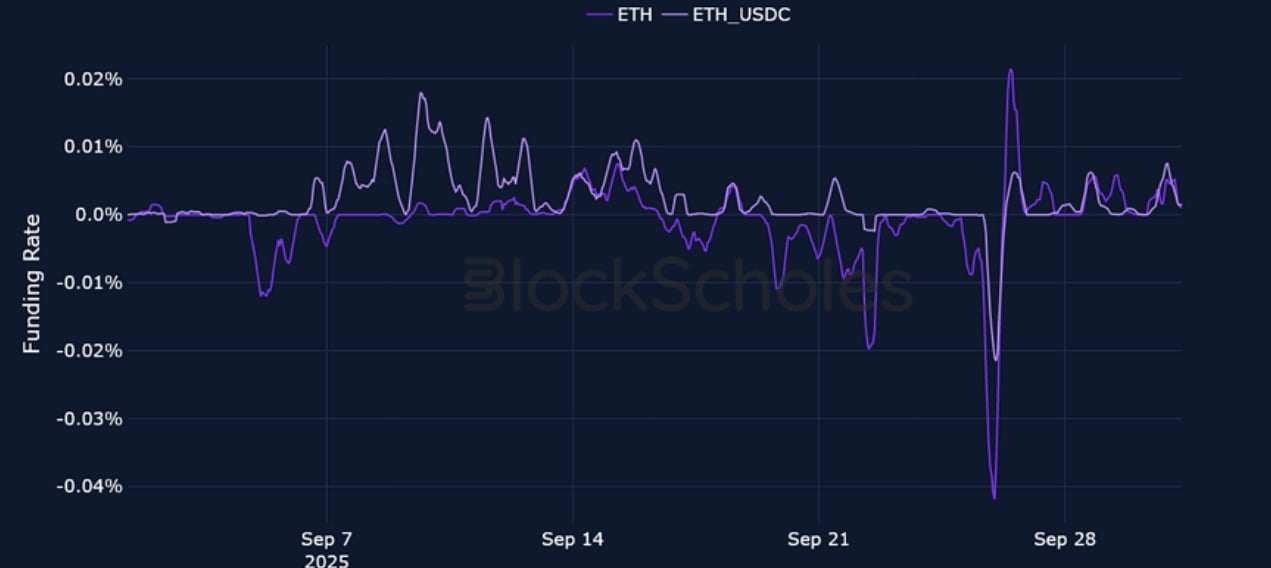

Perpetual Swap Funding Rate

BTC FUNDING RATE – As has been the case throughout the month, funding rates have stayed positive, despite options markets remaining fearful.

ETH FUNDING RATE – A large drop in Ether’s spot price has meant that funding rates are currently subdued and close to neutral, following a sharp negative spike earlier last week.

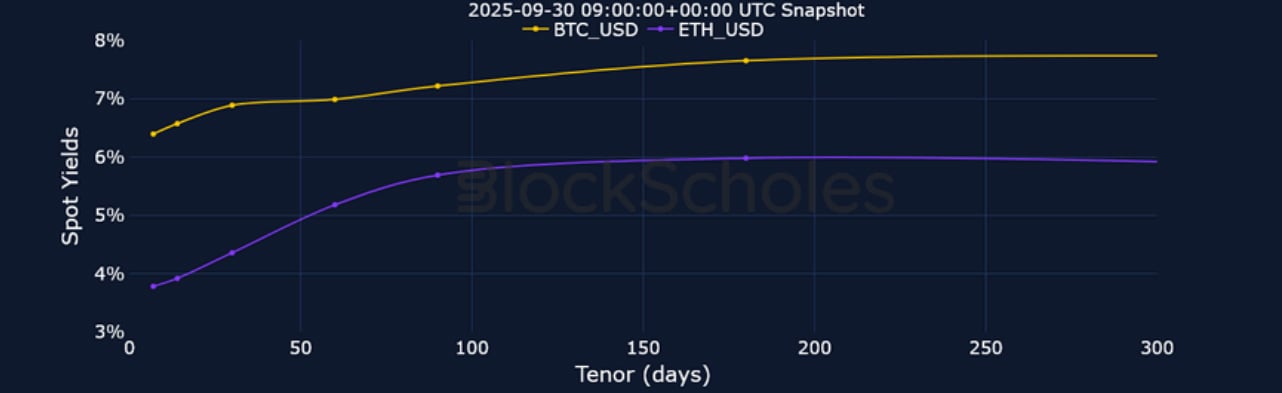

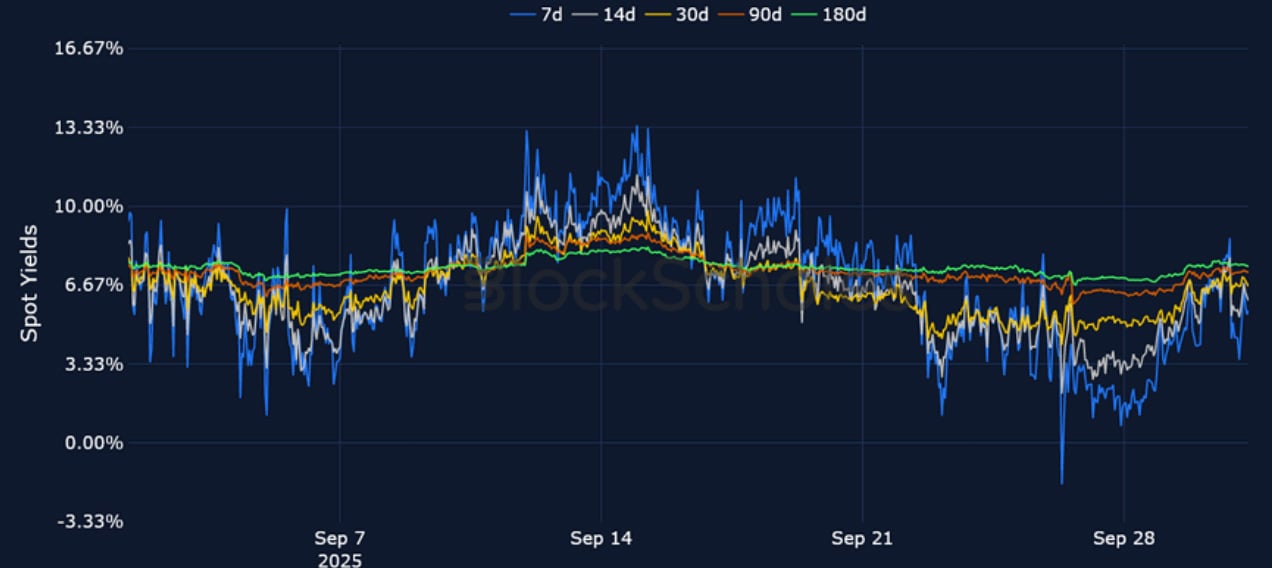

Futures Implied Yields

BTC Futures Implied Yields – BTC’s term structure of spot yields is upward sloped, marking a divergence to last week’s inverted structure.

ETH Futures Implied Yields – Both funding rates and spot yields dipped sharply negative on Sept 25, 2025 when Ether fell to $3,800, a local bottom over the past month.

BTC Options

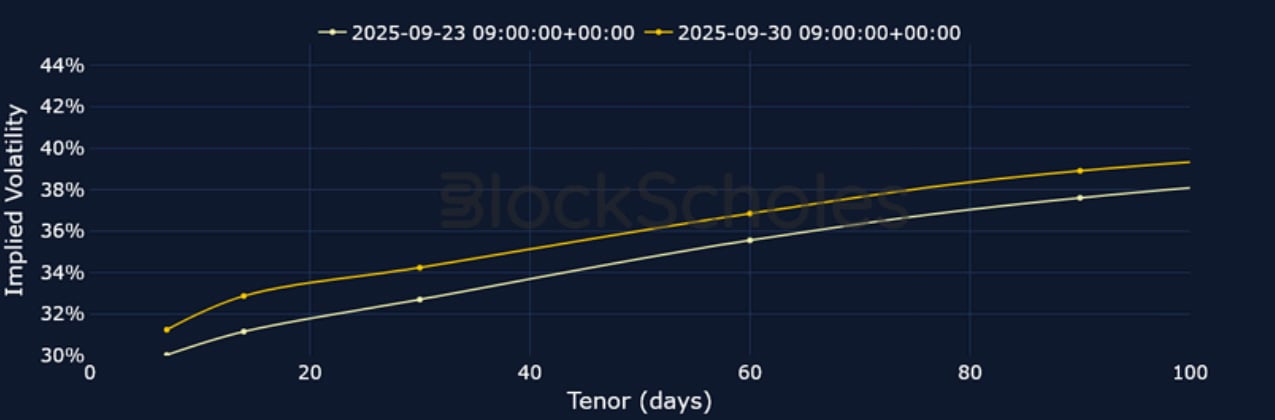

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor ATM IV levels shot past 30% during the liquidation event last week, though have since traded sideways.

BTC 25-Delta Risk Reversal – Skew levels across the term structure have been tilted towards OTM puts for most of September, however short-tenor skews are showing signs of recovery heading into October.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – The term structure of volatility briefly inverted during last week’s spot price shakeout to below $4,000.

ETH 25-Delta Risk Reversal – Similar to BTC volatility smiles, the drift in skew to OTM puts over the month has reversed over the past few days. Short-tenor smiles are now trading close to neutral levels.

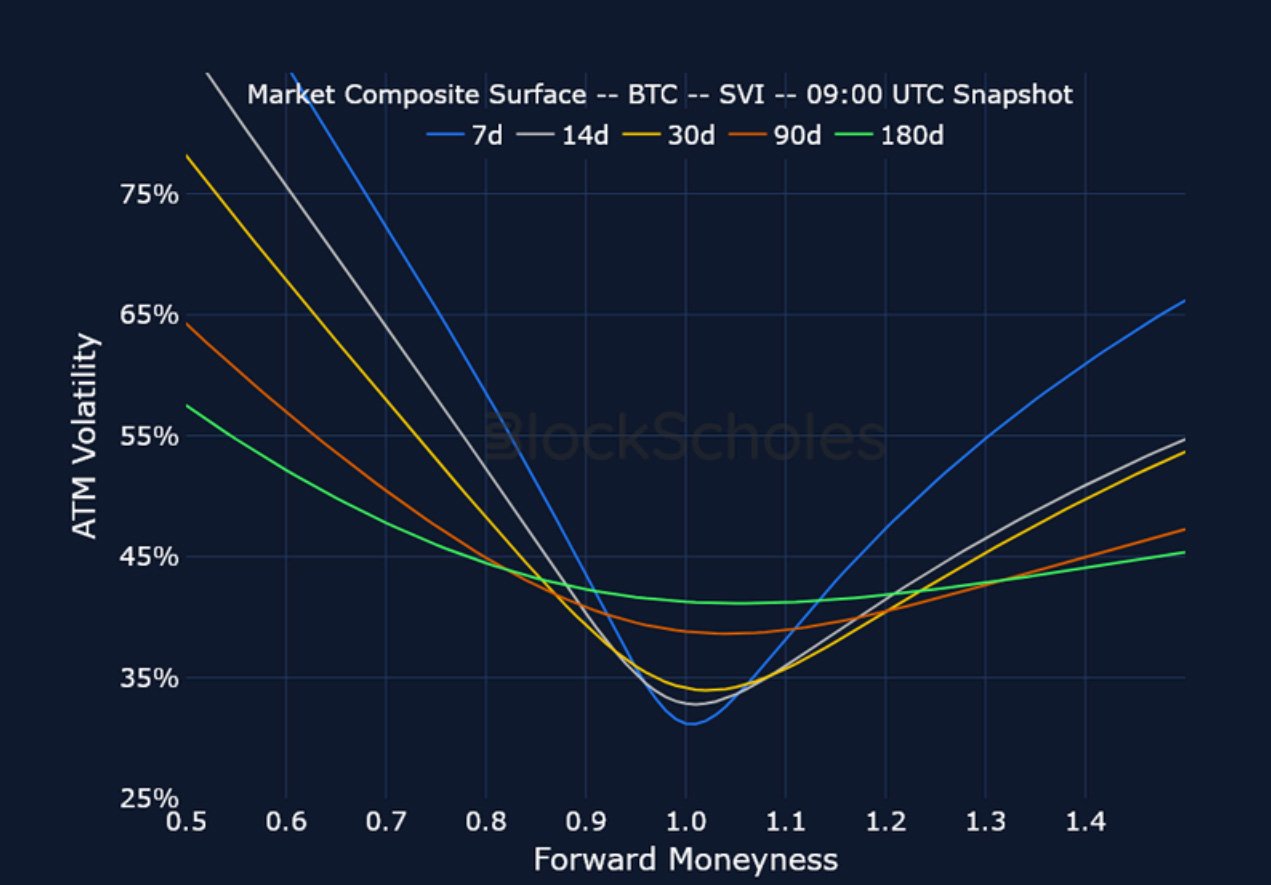

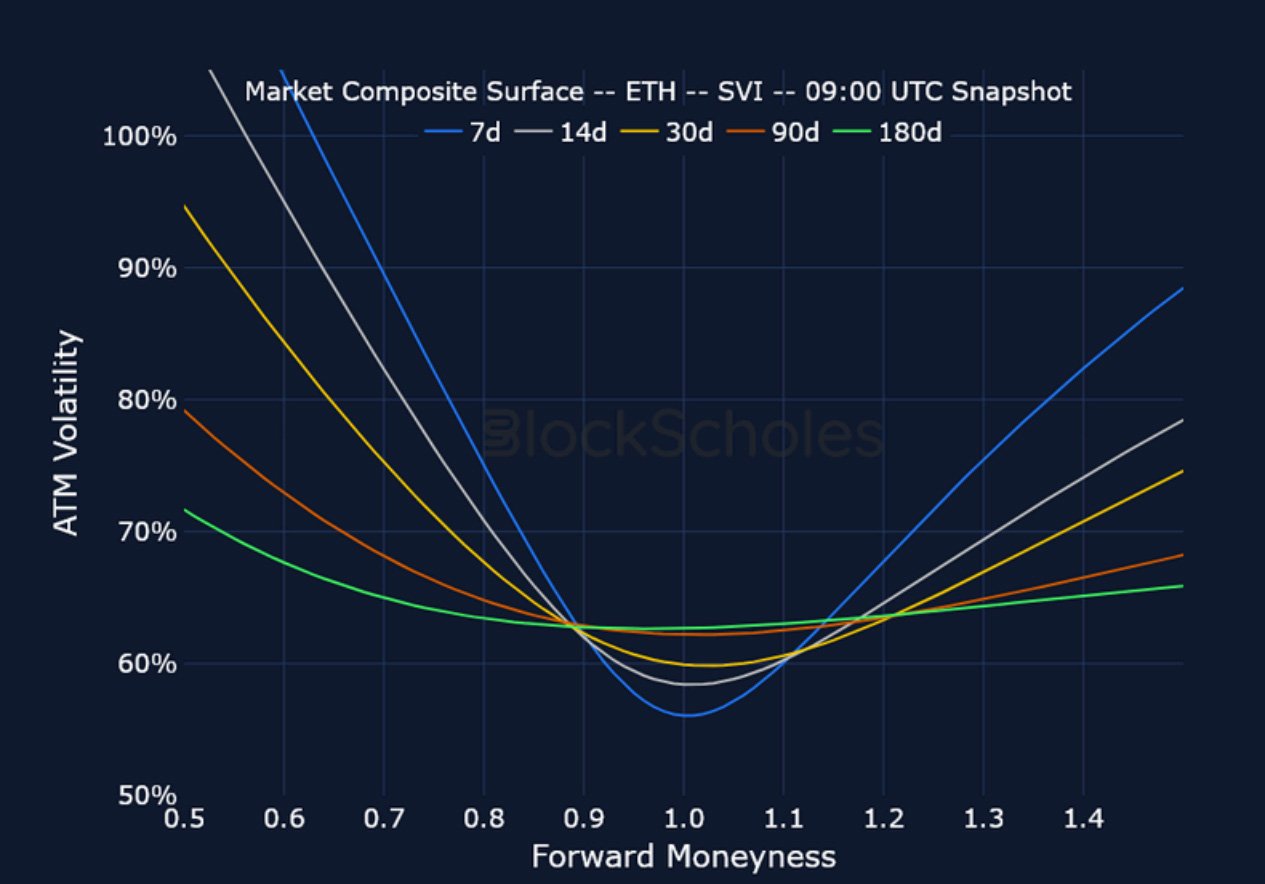

Market Composite Volatility Surface

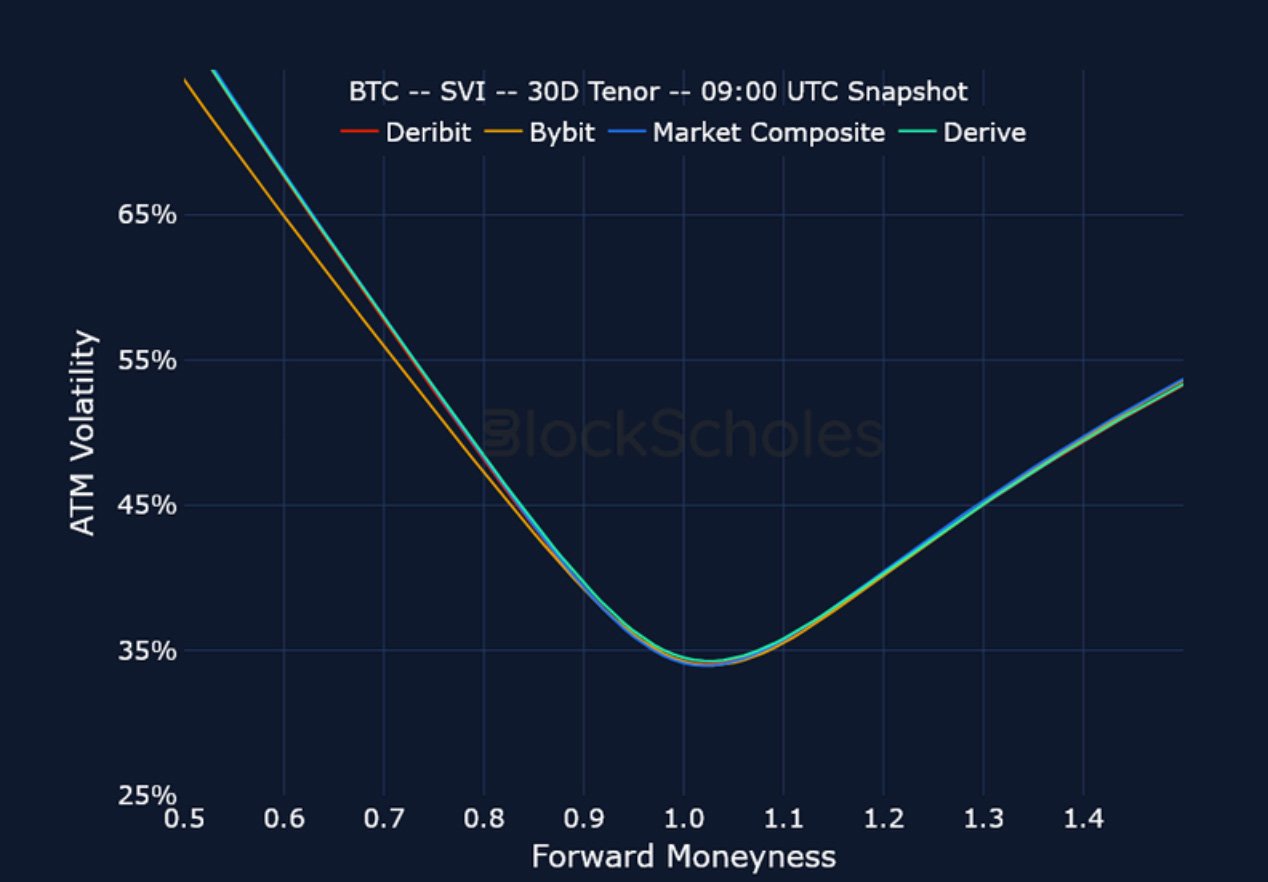

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

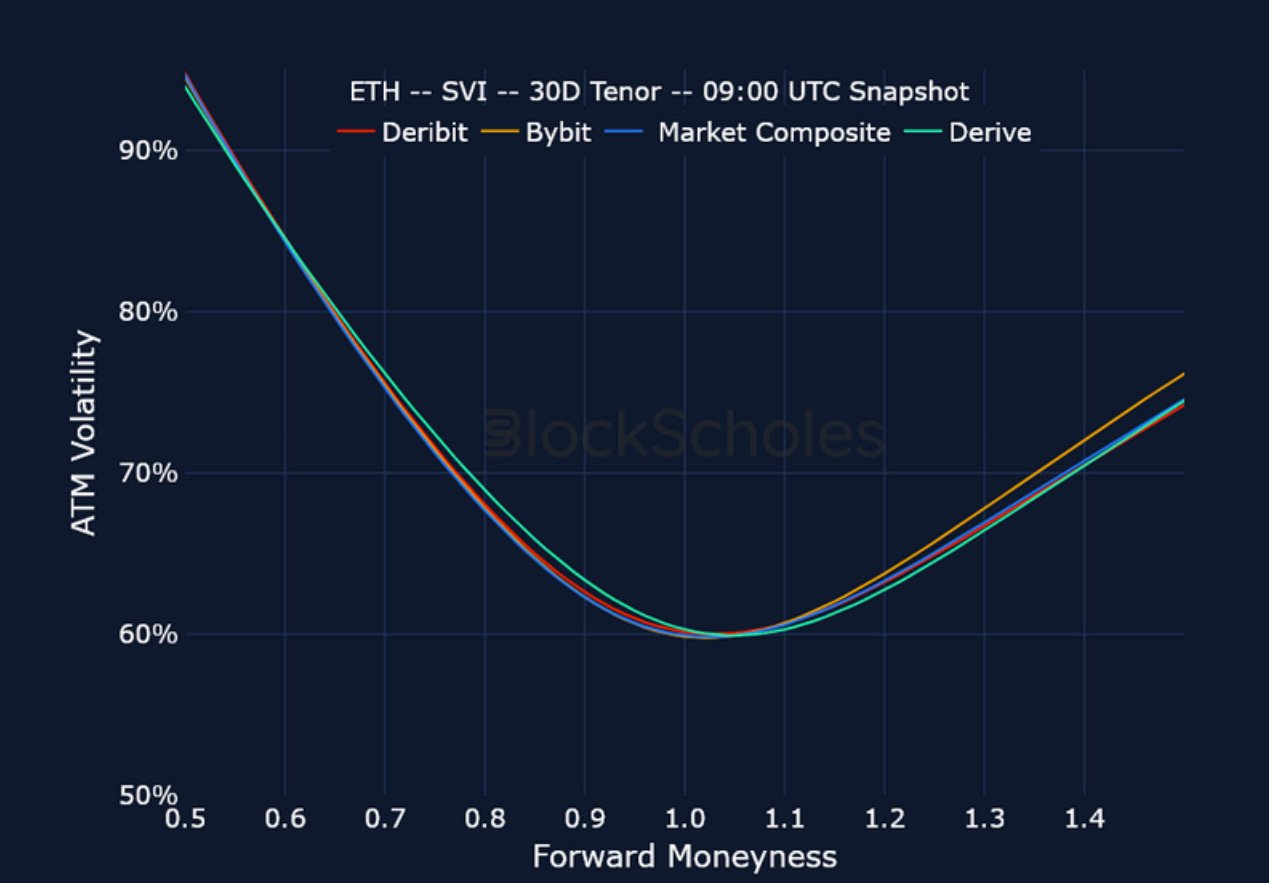

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

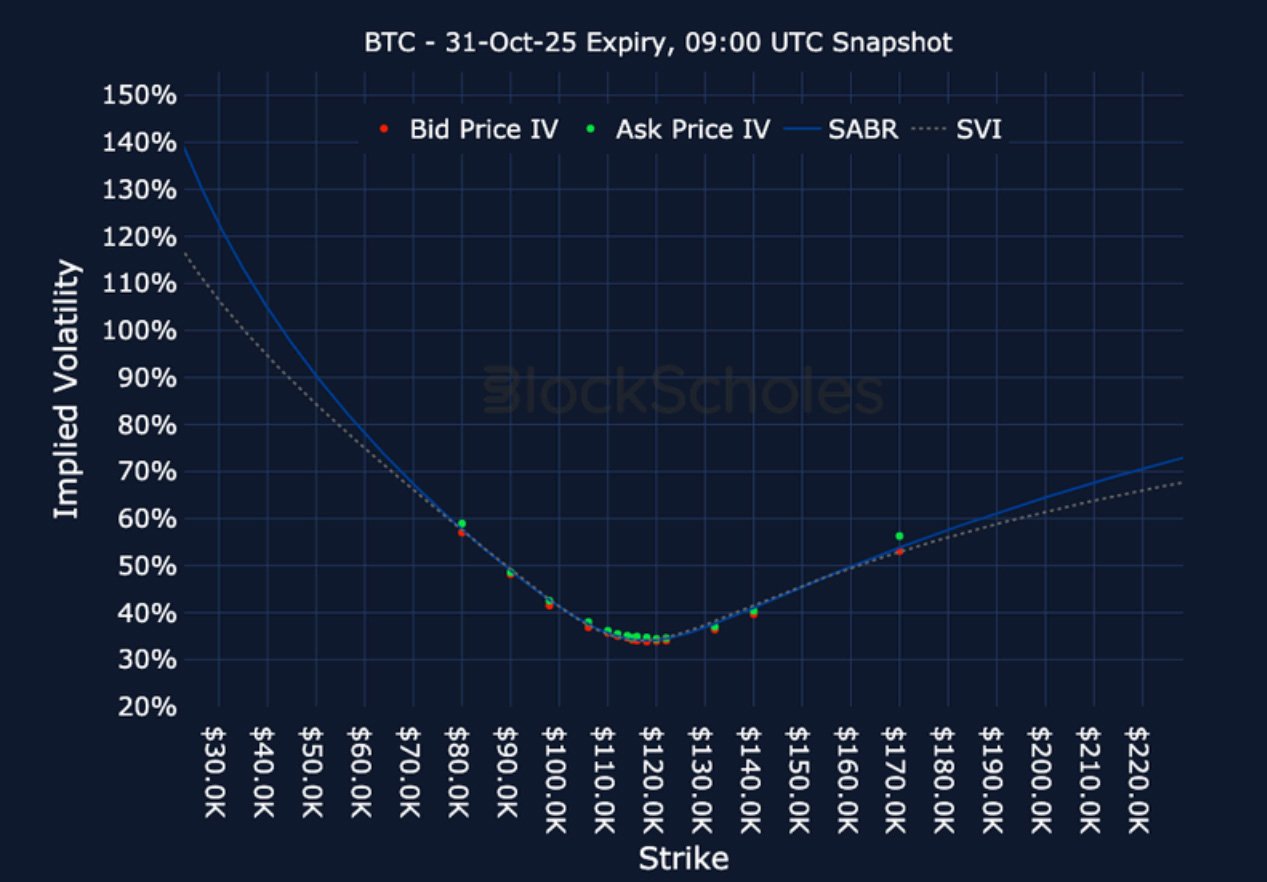

Listed Expiry Volatility Smiles

BTC 31-OCT EXPIRY – 9:00 UTC Snapshot.

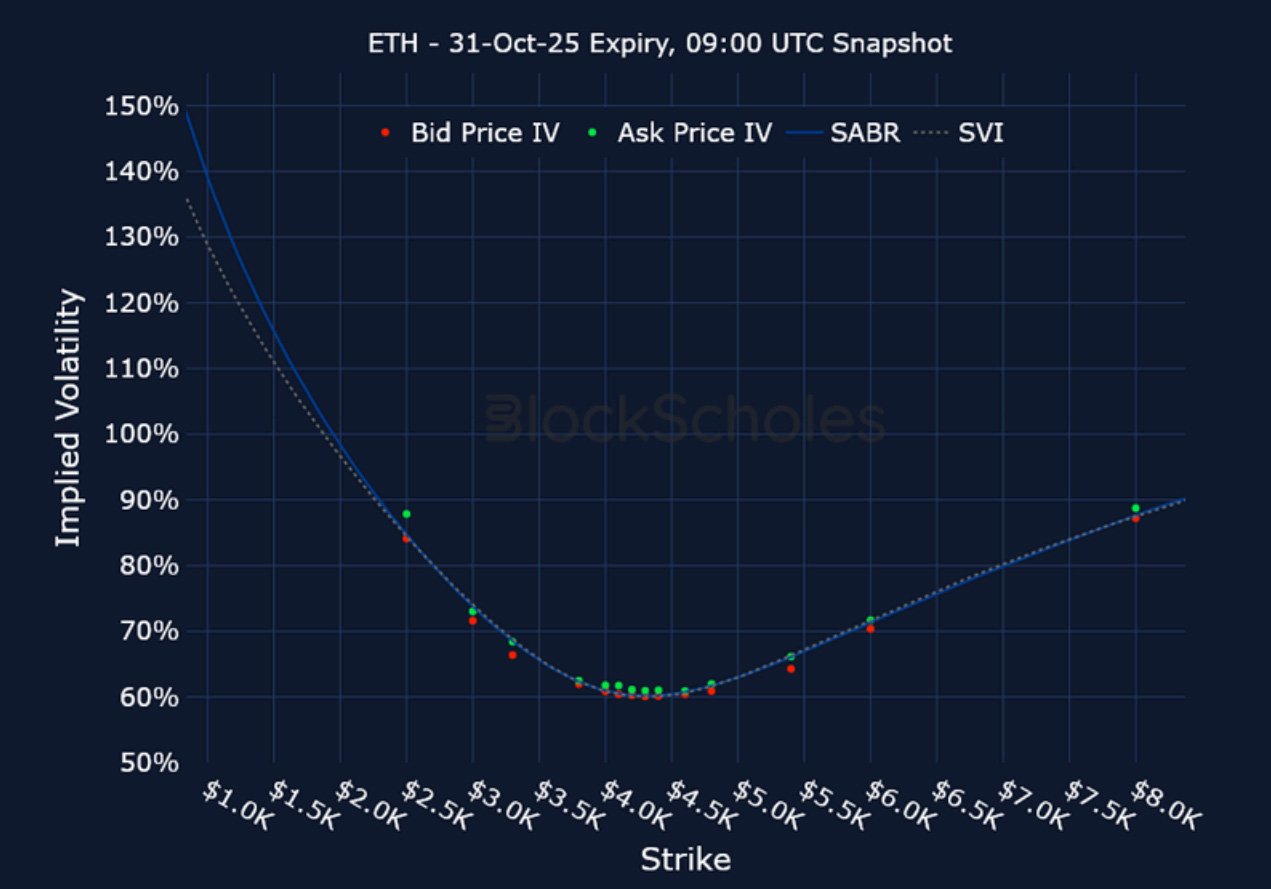

ETH 31-OCT EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

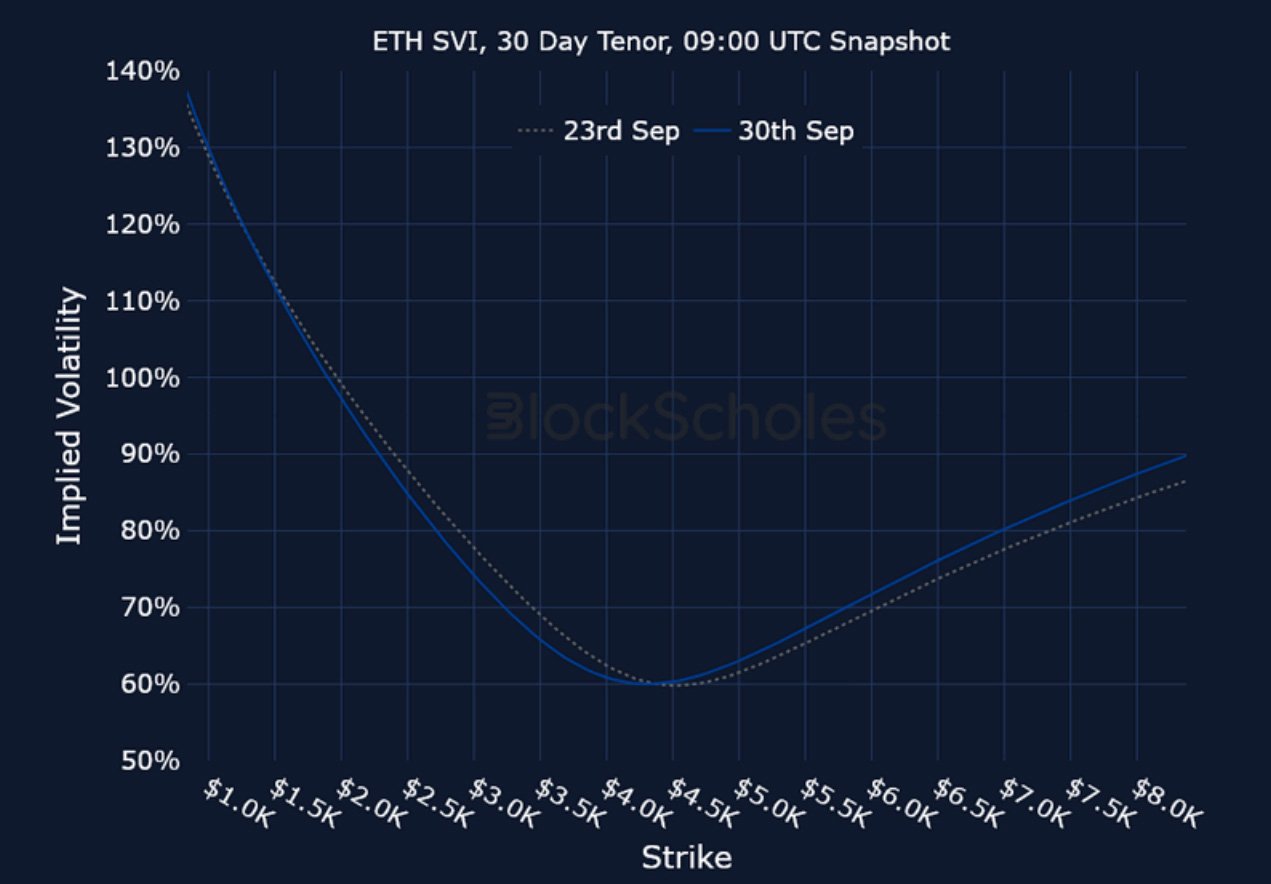

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)