Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

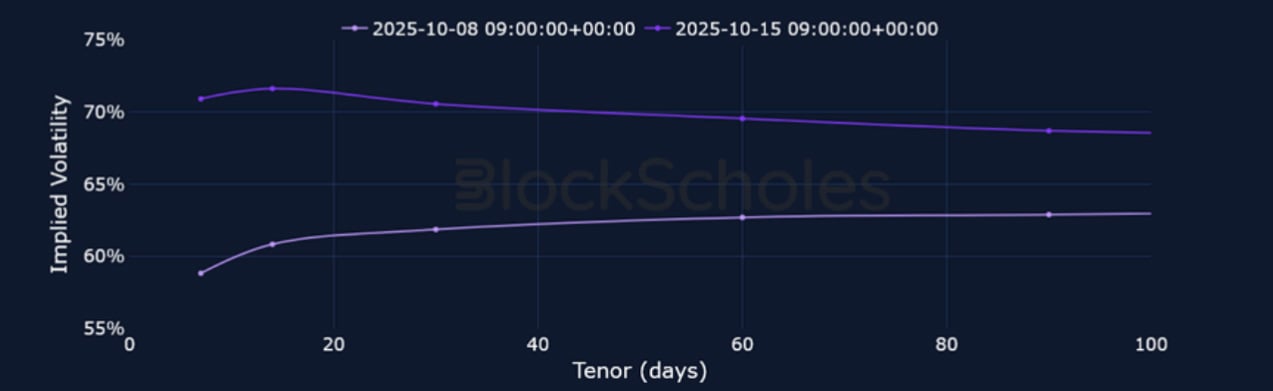

The past ten days has been a whirlwind for crypto asset spot markets and options markets. On Monday Oct 6, 2025, BTC broke out to a new all-time high of $126K, though options traders only marginally backed the rally, with volatility smiles modestly skewed towards calls. By Friday evening however (Oct 10, 2025), BTC had fallen to a low of $105K while ETH had fallen to $3,700 following a re-escalation of the tit-for-tat trade war between the US and China. President Trump announced a “Tariff of 100% on China, over and above any Tariff that they are currently paying” , in response to new export controls introduced by the Chinese government. That selloff then amalgamated into more than $19B worth of positions getting liquidated on Friday alone – by the far the largest in crypto history. ATM volatility levels increased across the whole term structure for BTC and ETH, with BTC’s structure experiencing a now rare inversion. Volatility smiles skewed towards puts significantly during the crash down; on Friday for BTC, that meant the lowest level of skew since the August selloff prior to Chair Powell’s Jackson Hole speech.

Futures Implied Yields

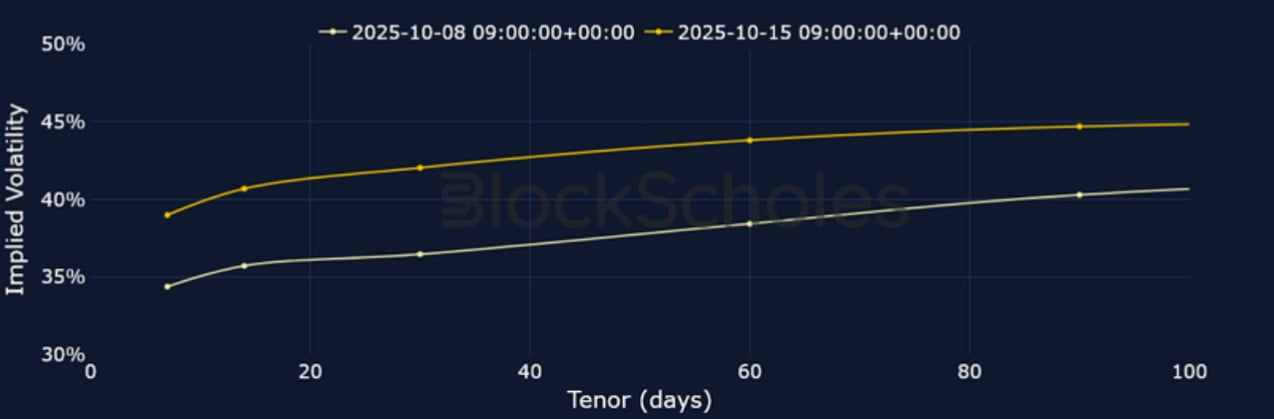

1-Month Tenor ATM Implied Volatility

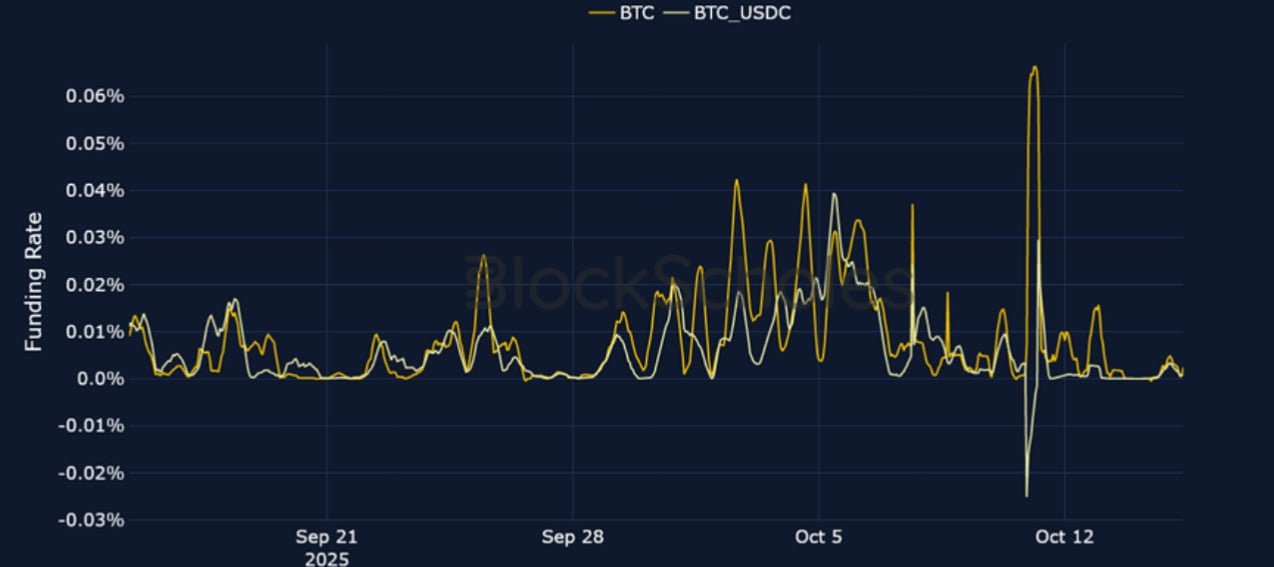

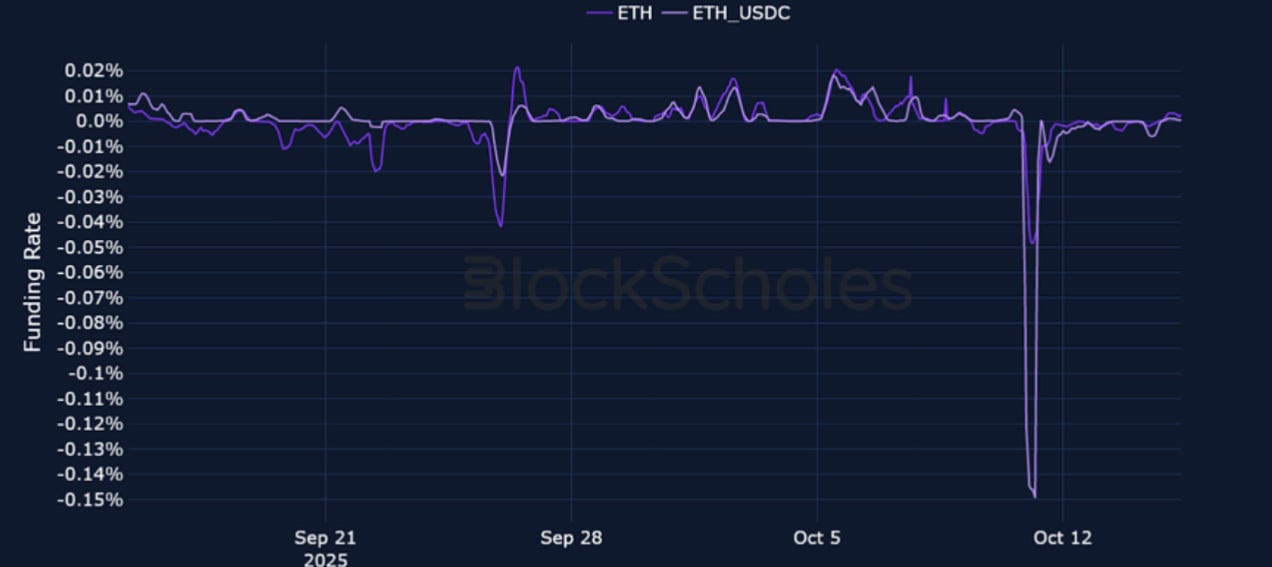

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates in the BTC contract remained positive throughout the Friday selloff and rose to 0.06% on the following day.

ETH FUNDING RATE – As ETH’s spot price plunged more than 20% lower, funding rates fell to their lowest levels all year before rebounding.

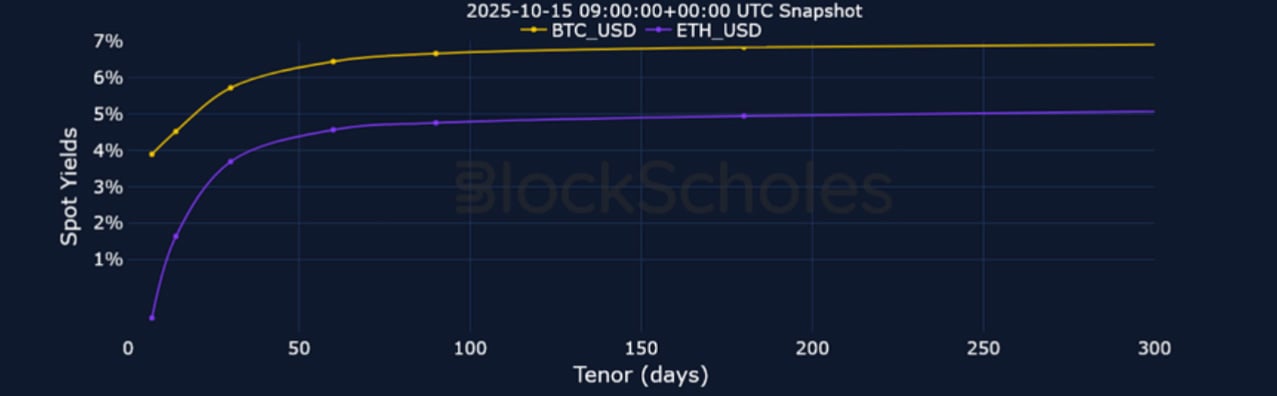

Futures Implied Yields

BTC Futures Implied Yields – In a sign of bearish positioning, futures yields fell to -5.3%, indicating futures prices traded significantly cheaper than spot.

ETH Futures Implied Yields – Matching a similar major move lower in perpetual swap contract funding rates, the futures yield for short-tenor contracts fell sharply as $19B of positions were liquidated.

BTC Options

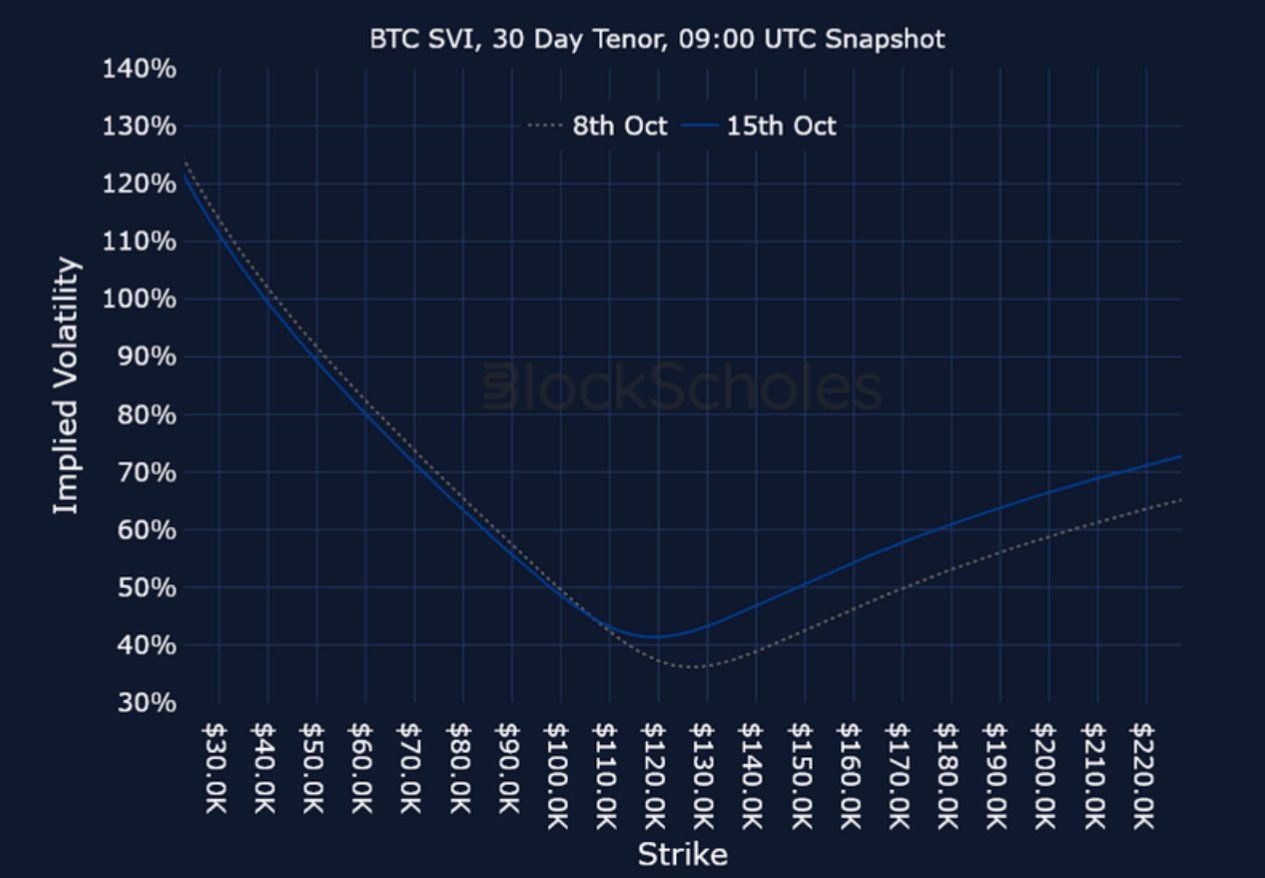

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor volatility massively outperformed over the weekend, inverting the vol term structure.

BTC 25-Delta Risk Reversal – The demand for protection against further downside moves were on full display as 1-week OTM puts traded with a significant premium over call optionality.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure of volatility also inverted, though unlike BTC, short-tenor vol remains far higher.

ETH 25-Delta Risk Reversal – After initially trading near parity, short-tenor smiles plunged in favour of put contracts and still remain negatively skewed.

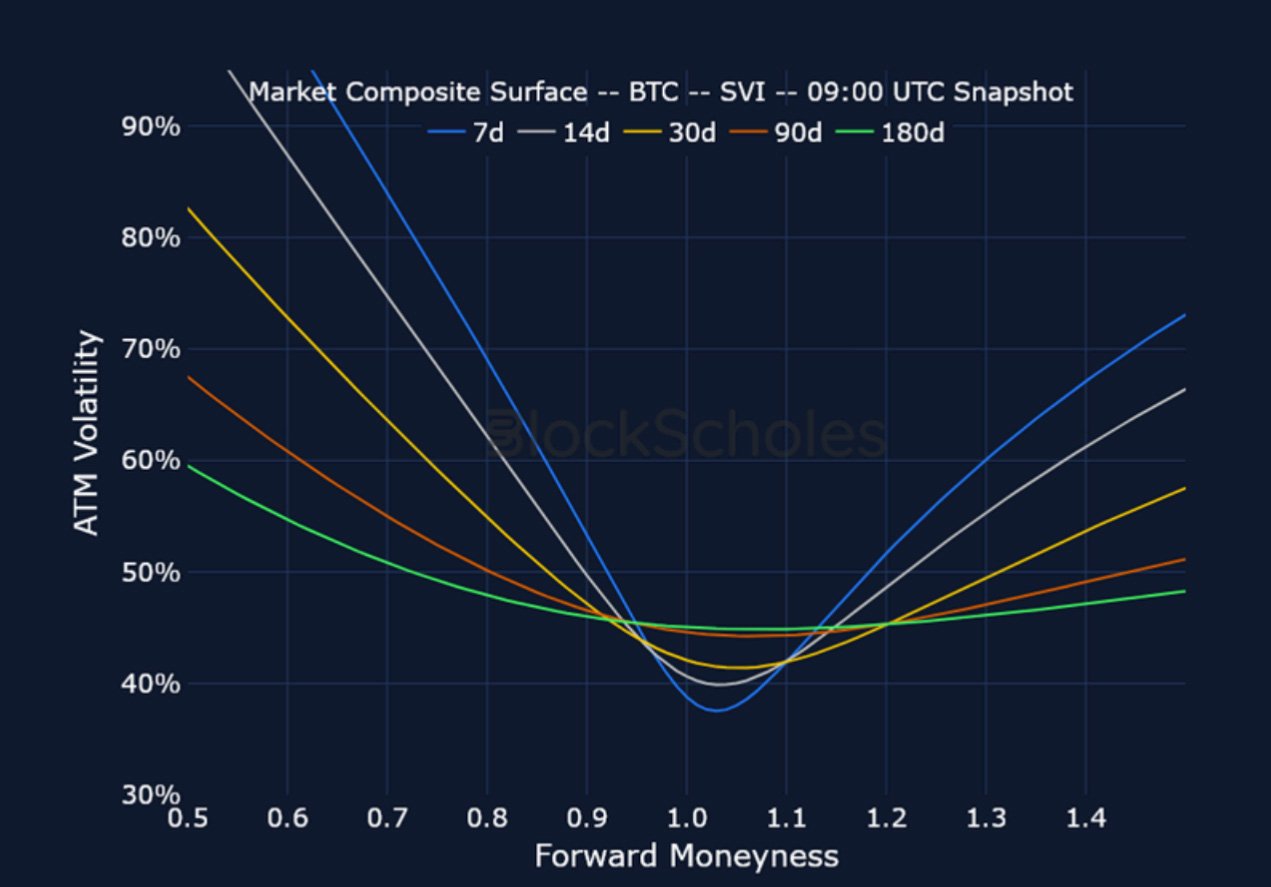

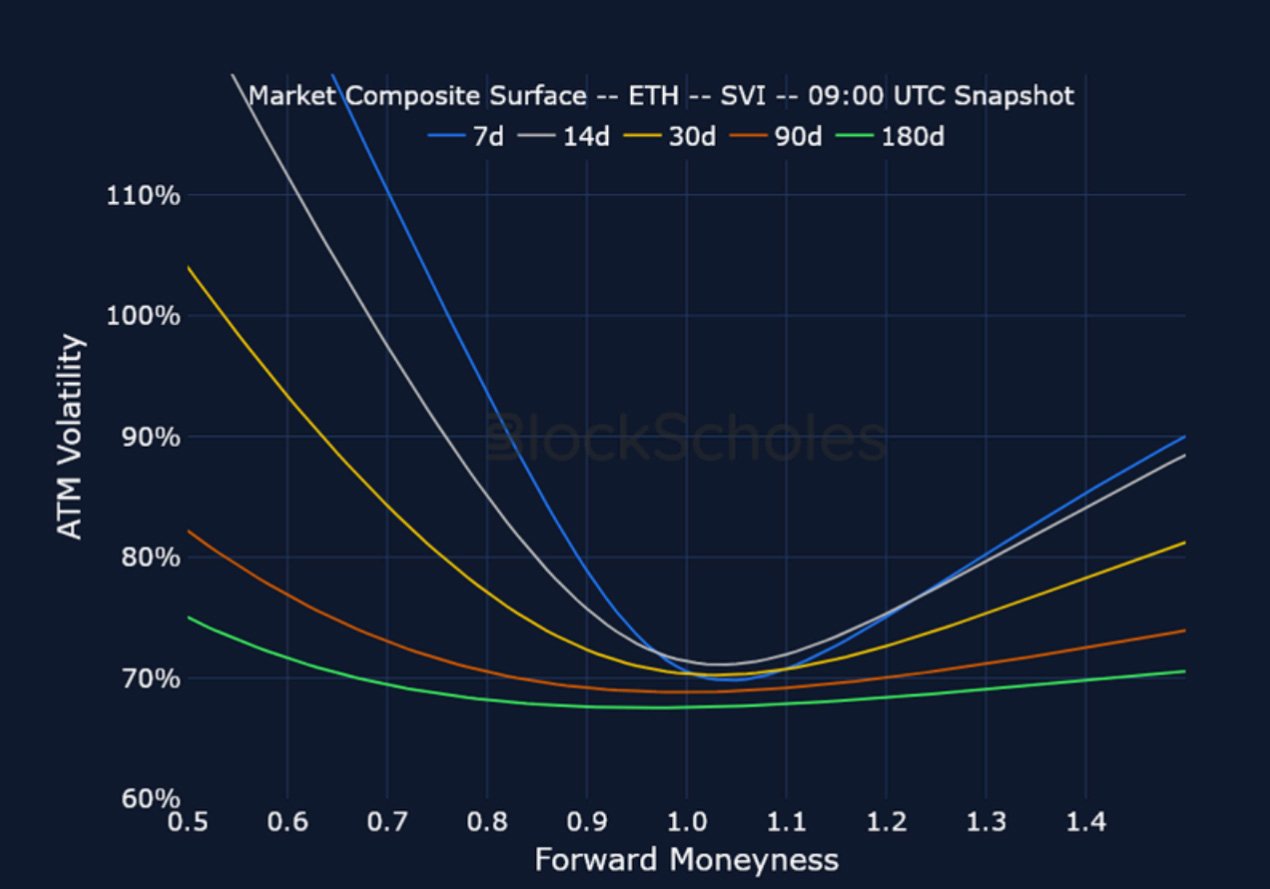

Market Composite Volatility Surface

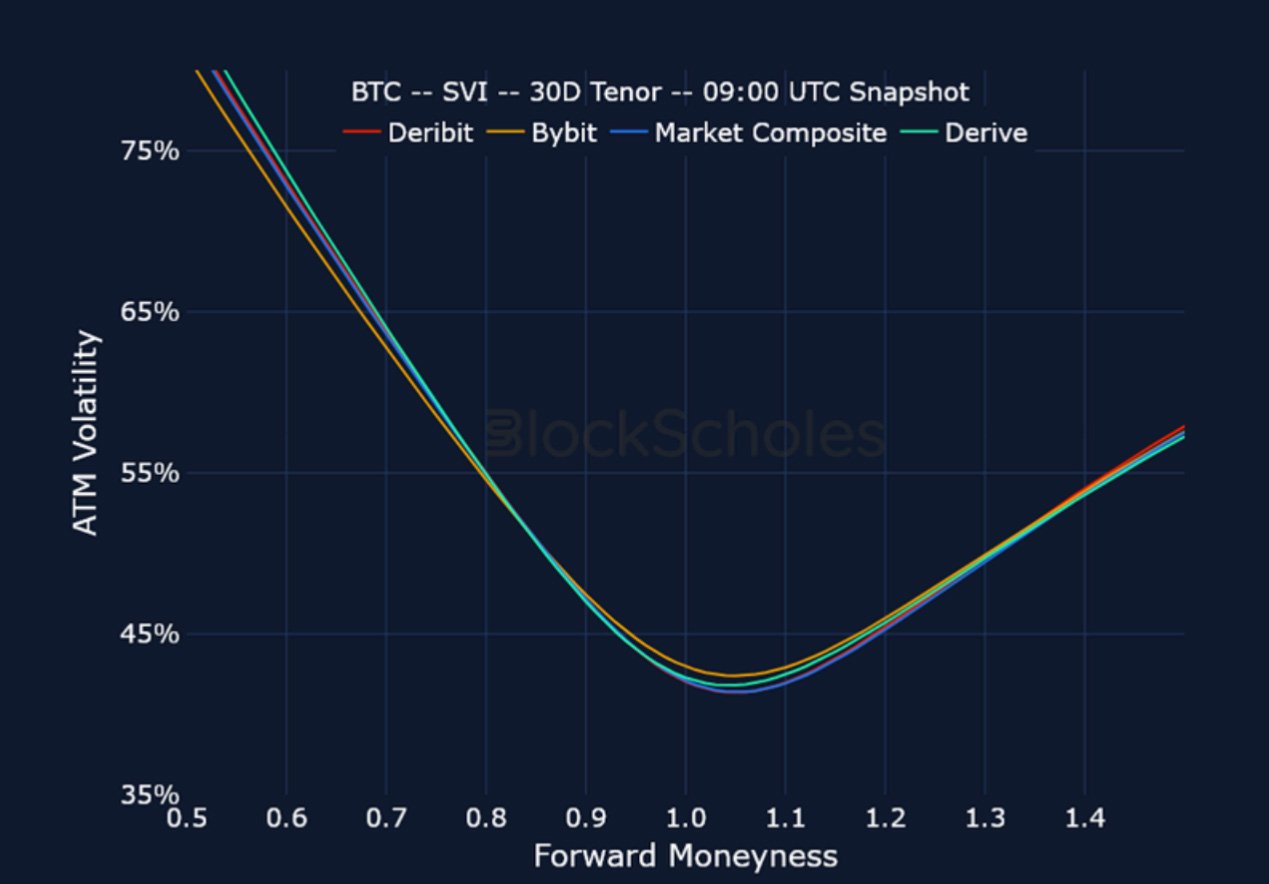

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

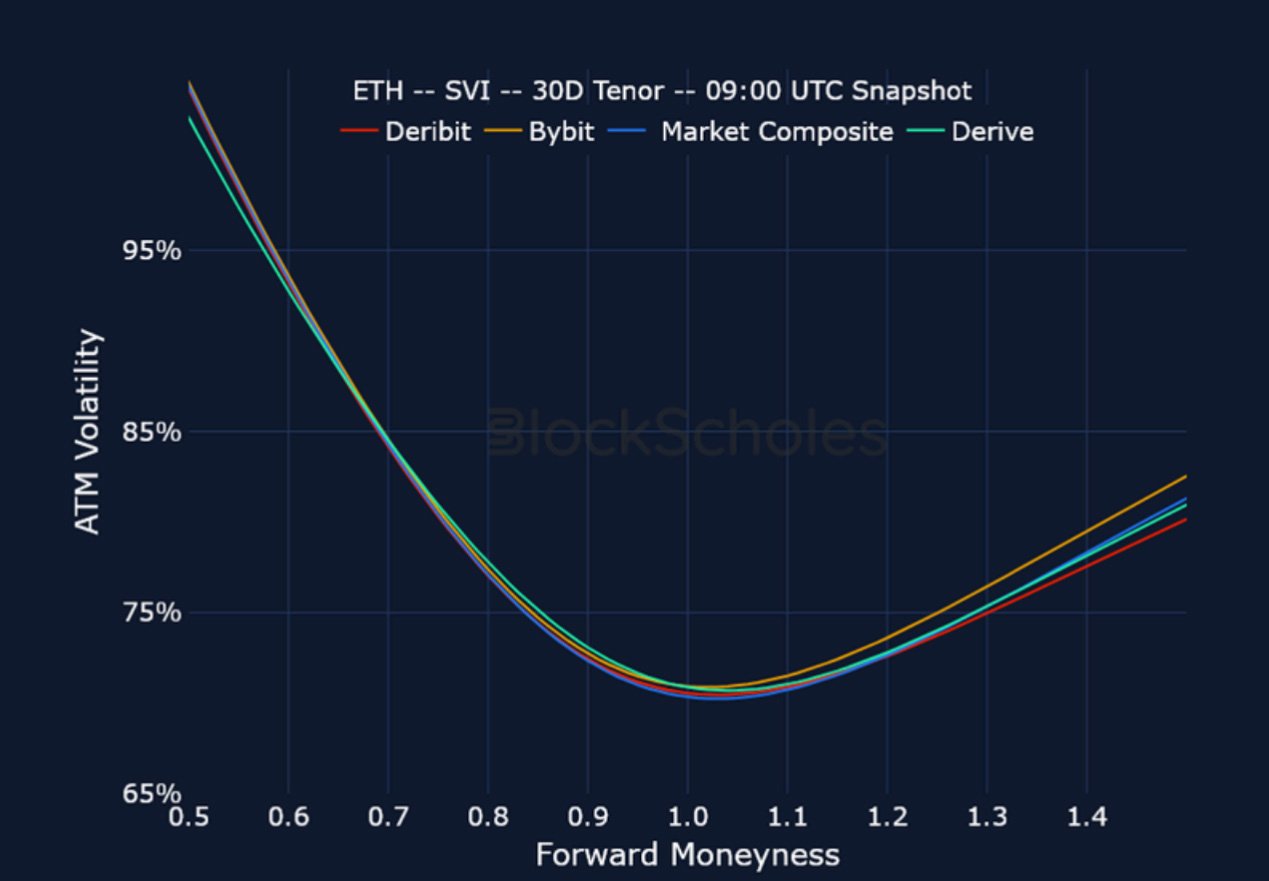

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

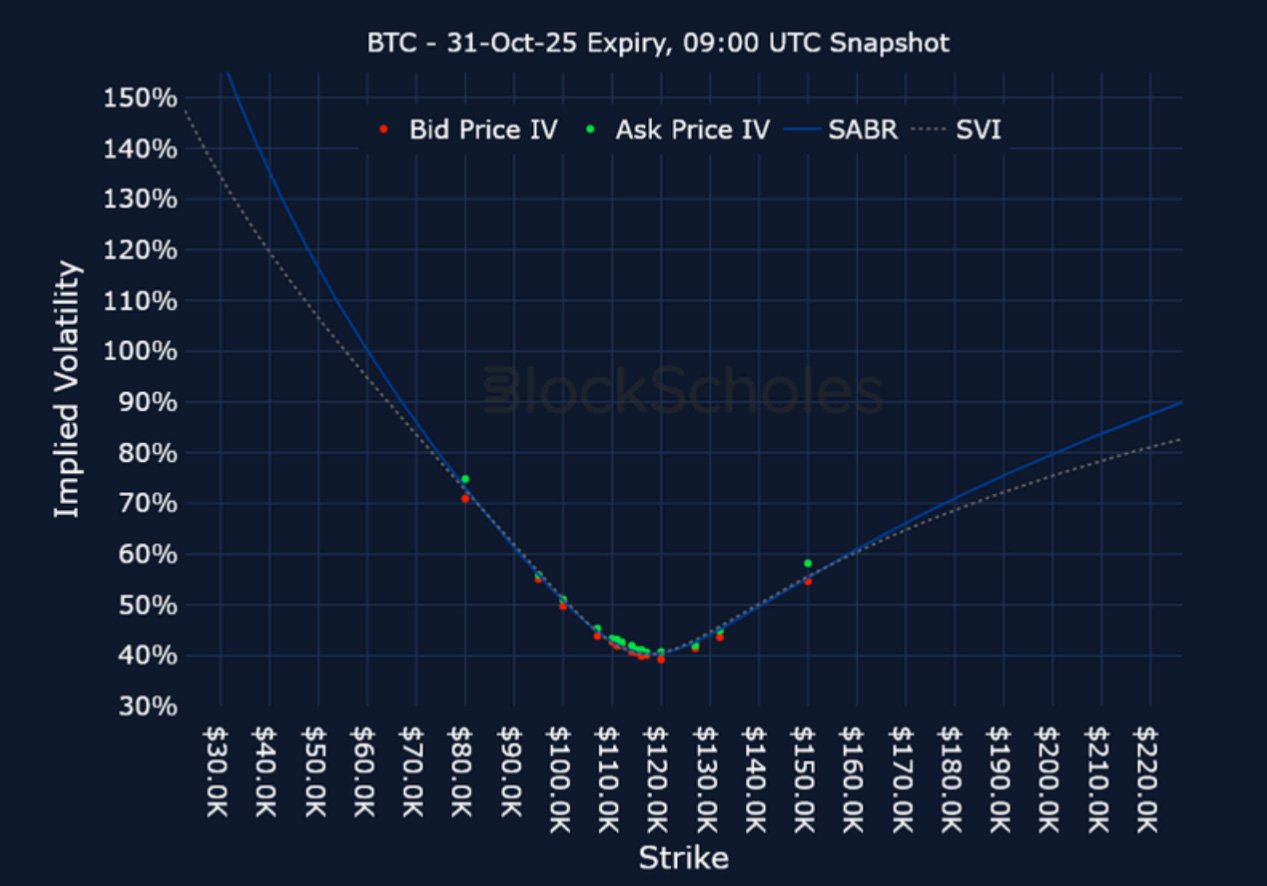

Listed Expiry Volatility Smiles

BTC 31-OCT EXPIRY – 9:00 UTC Snapshot.

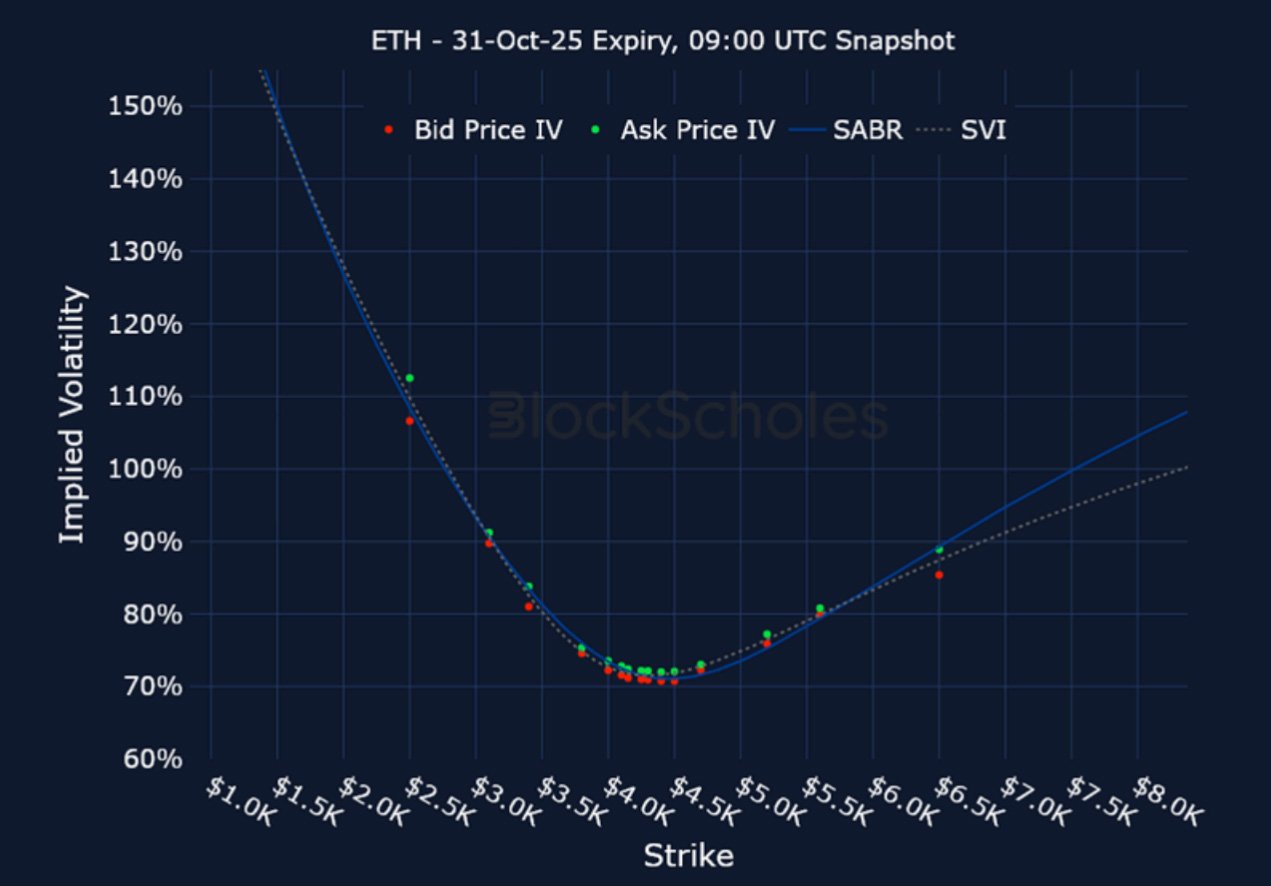

ETH 31-OCT EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

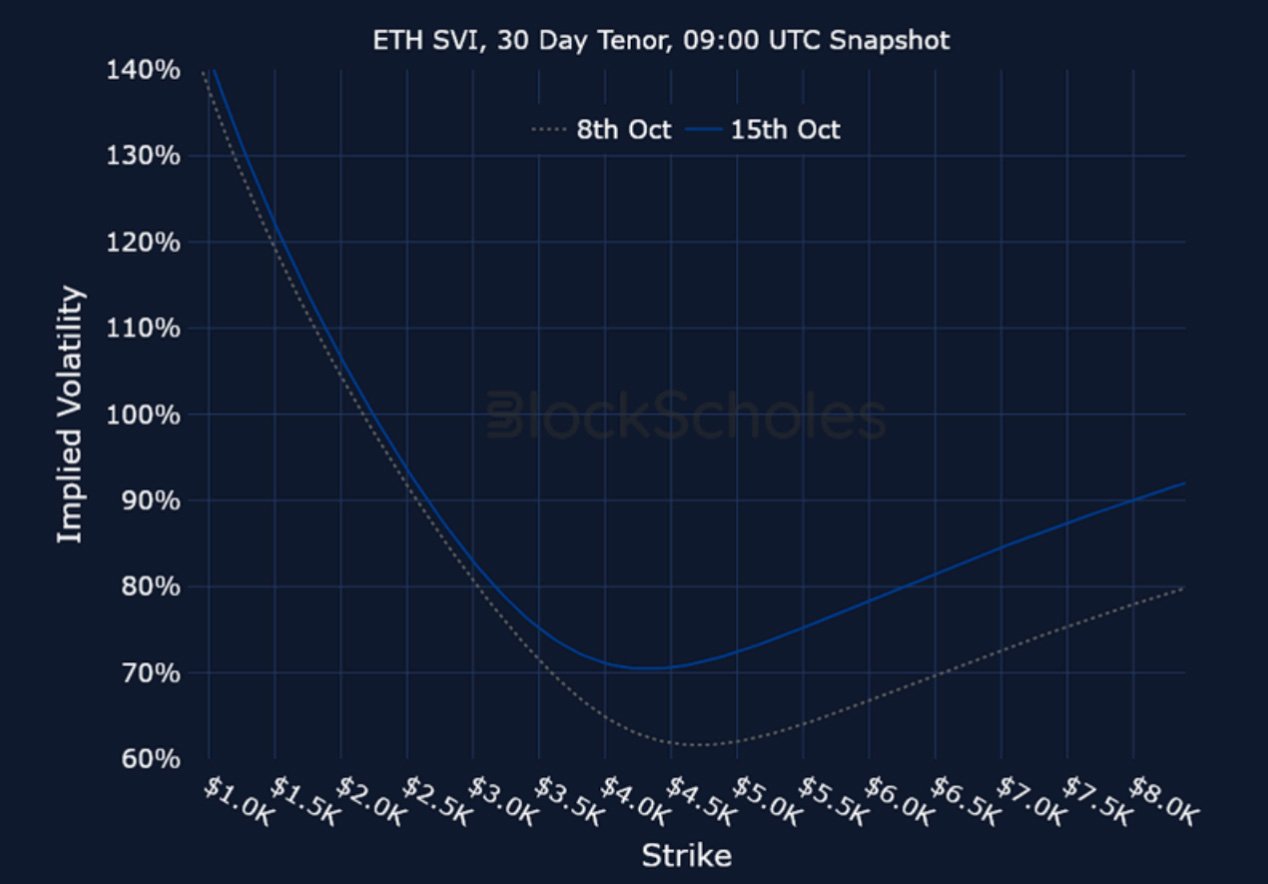

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)