Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

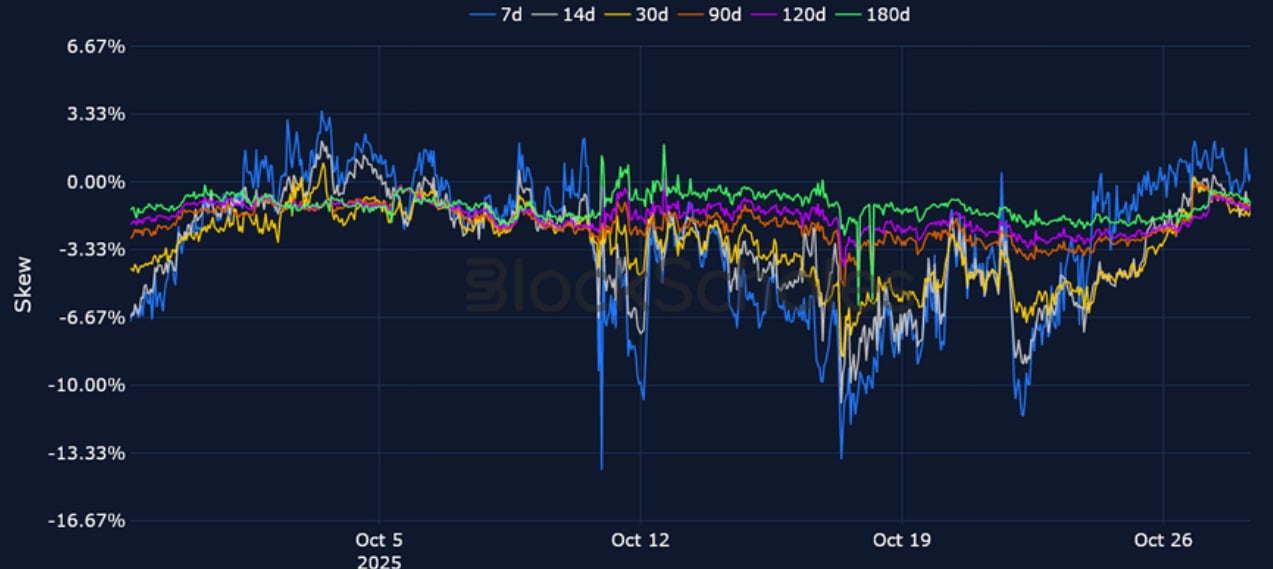

The past week has been characterised by a modest recovery in risk-on appetite as BTC and ETH trade 5% and 6% higher, respectively. That has encouraged a slight pick up in derivatives market, where sentiment is not excessively euphoric, though far less bearish than earlier in the month. BTC and ETH’s short-tenor volatility smile skew has steepened to the upside, with much of the bearish sentiment being priced out over the past week. ETH’s 7-day put-call skew still trades with a slight put bias, though skew for similar-dated BTC options is modestly positive. ATM implied volatility levels remain elevated relative to pre-October 10 levels, indicating continued demand for options exposure. The recent rebound in risk sentiment came amidst signs of reduced trade tensions between the two largest economies in the world – the US and China. Trade negotiators from both sides reached a preliminary consensus and “a very positive framework” for President Trump and President Xi to discuss in their Thursday face-to-face meeting later this week.

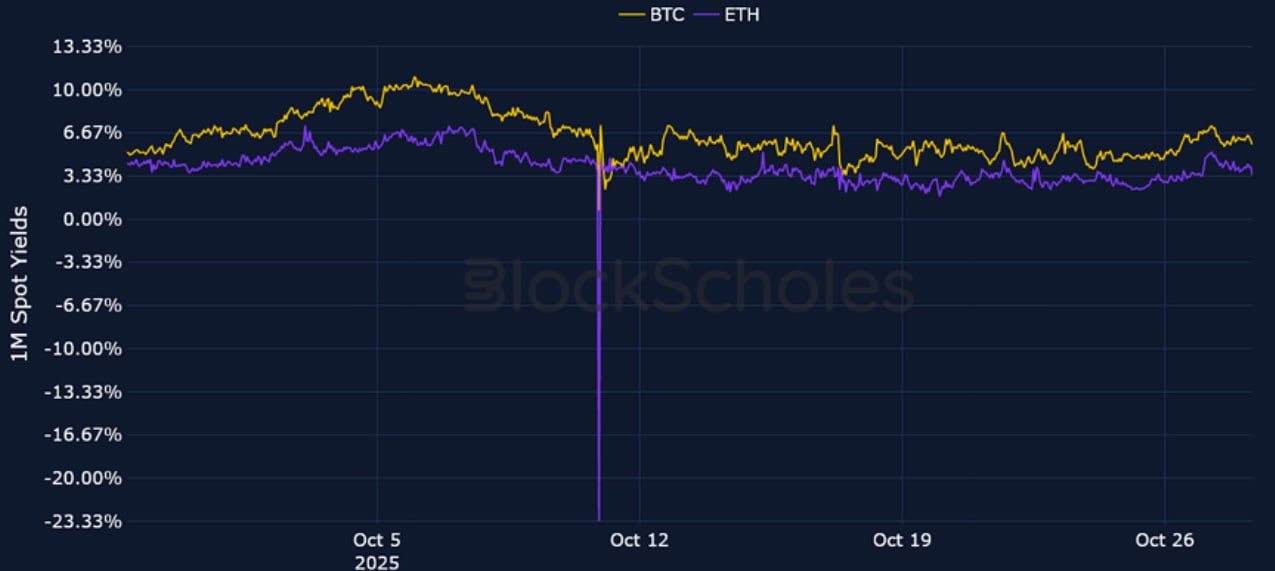

Futures Implied Yields

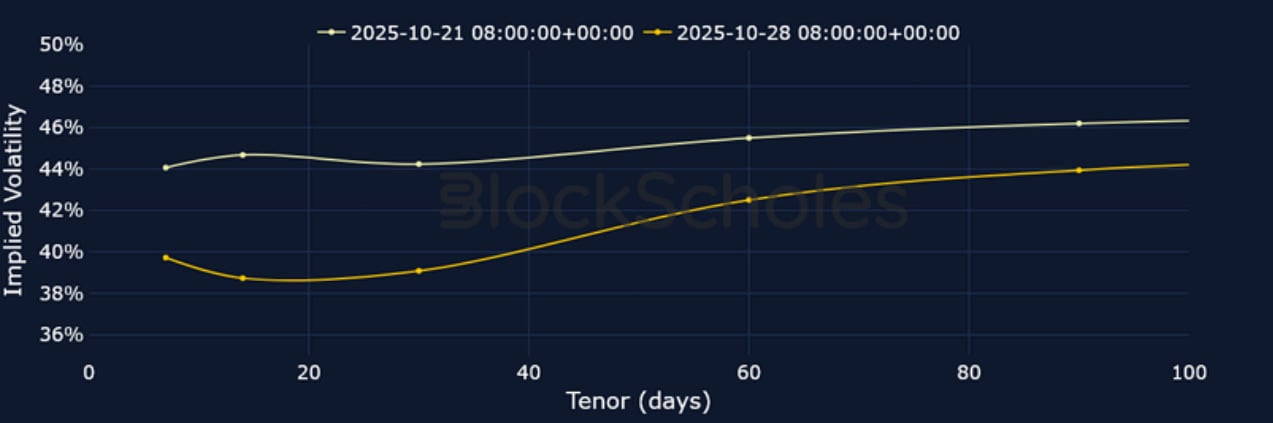

1-Month Tenor ATM Implied Volatility

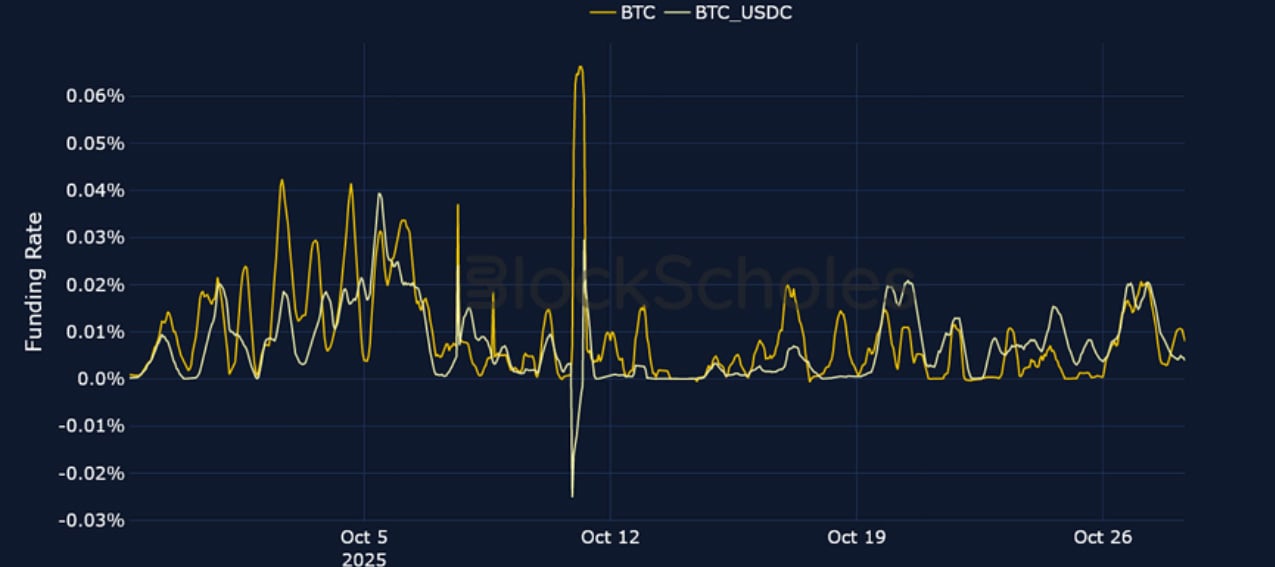

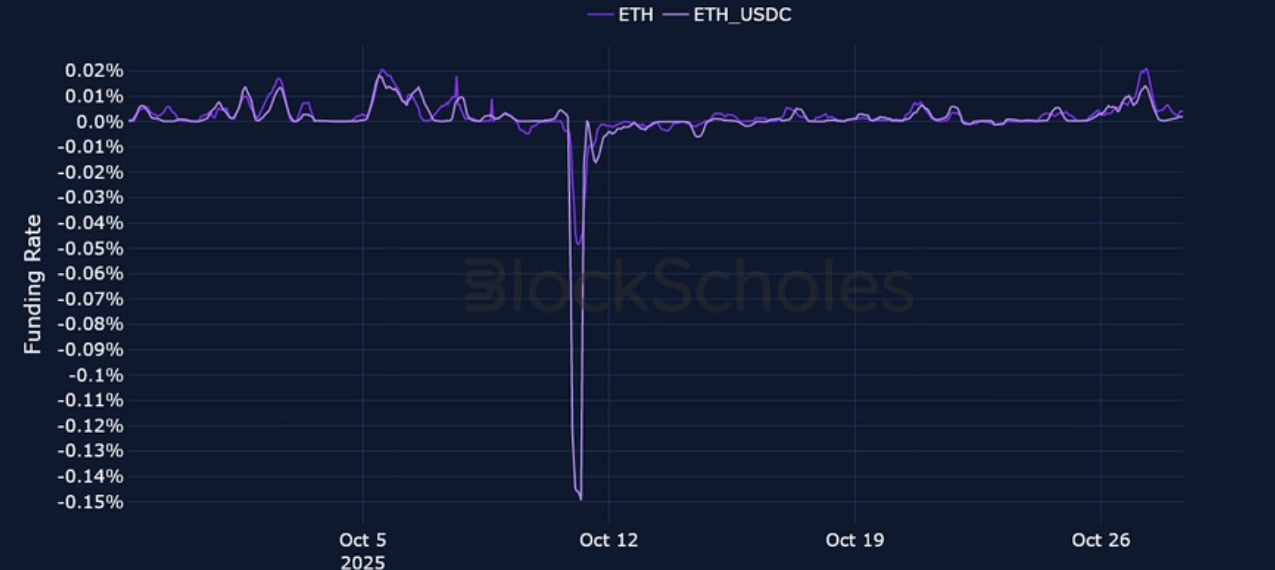

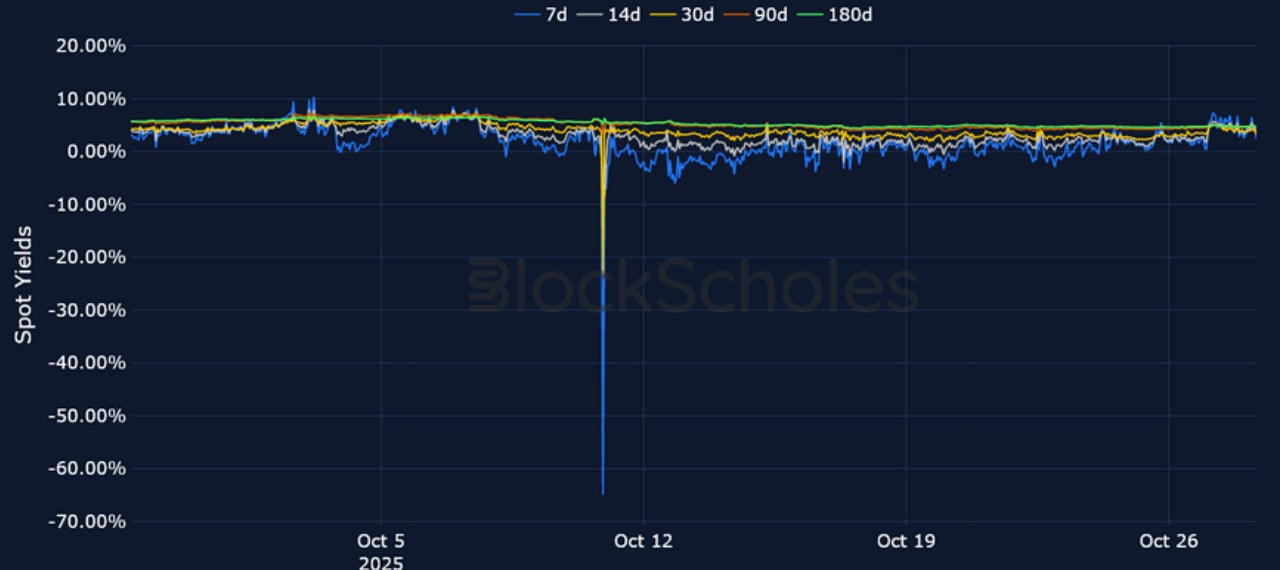

Perpetual Swap Funding Rate

BTC FUNDING RATE – Perpetual swap funding rates show a slight preference for leveraged upside exposure, matching the similarly modest skew seen in short-tenor BTC volatility smiles.

ETH FUNDING RATE – ETH funding rates jumped to their highest levels since the start of the month earlier this week, as spot price rallied past $4,200.

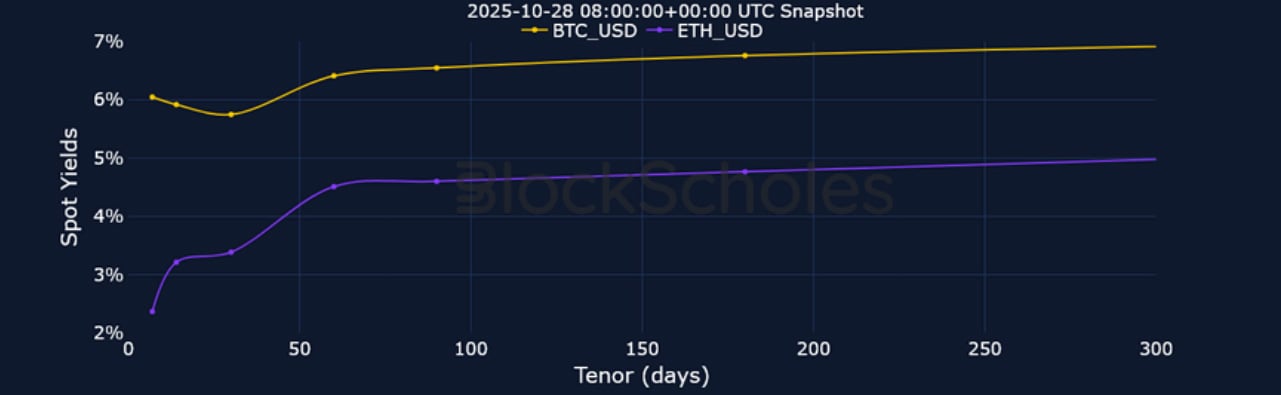

Futures Implied Yields

BTC Futures Implied Yields – Short-dated futures contracts no longer trade below spot price as was the case last week; a signal of recovering sentiment.

ETH Futures Implied Yields – ETH futures traders are not currently willing to pay as high a premium for leveraged upside exposure as BTC traders.

BTC Options

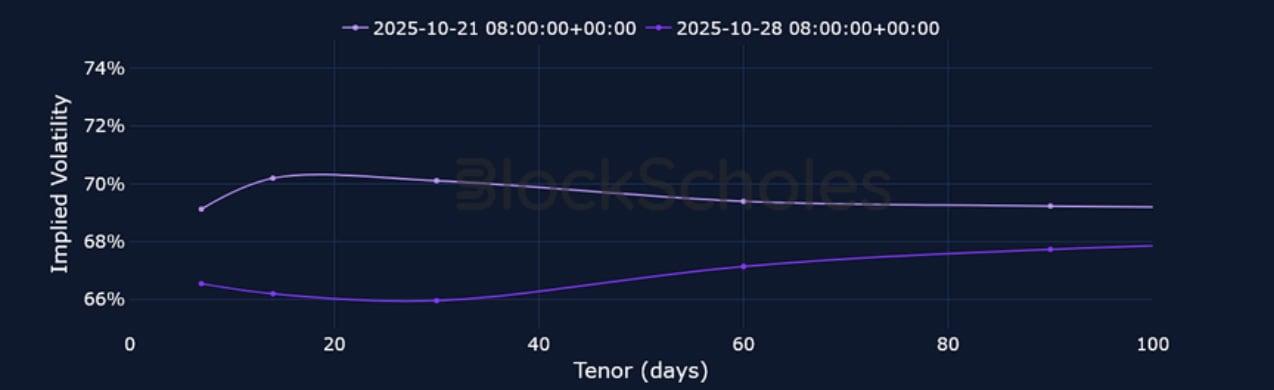

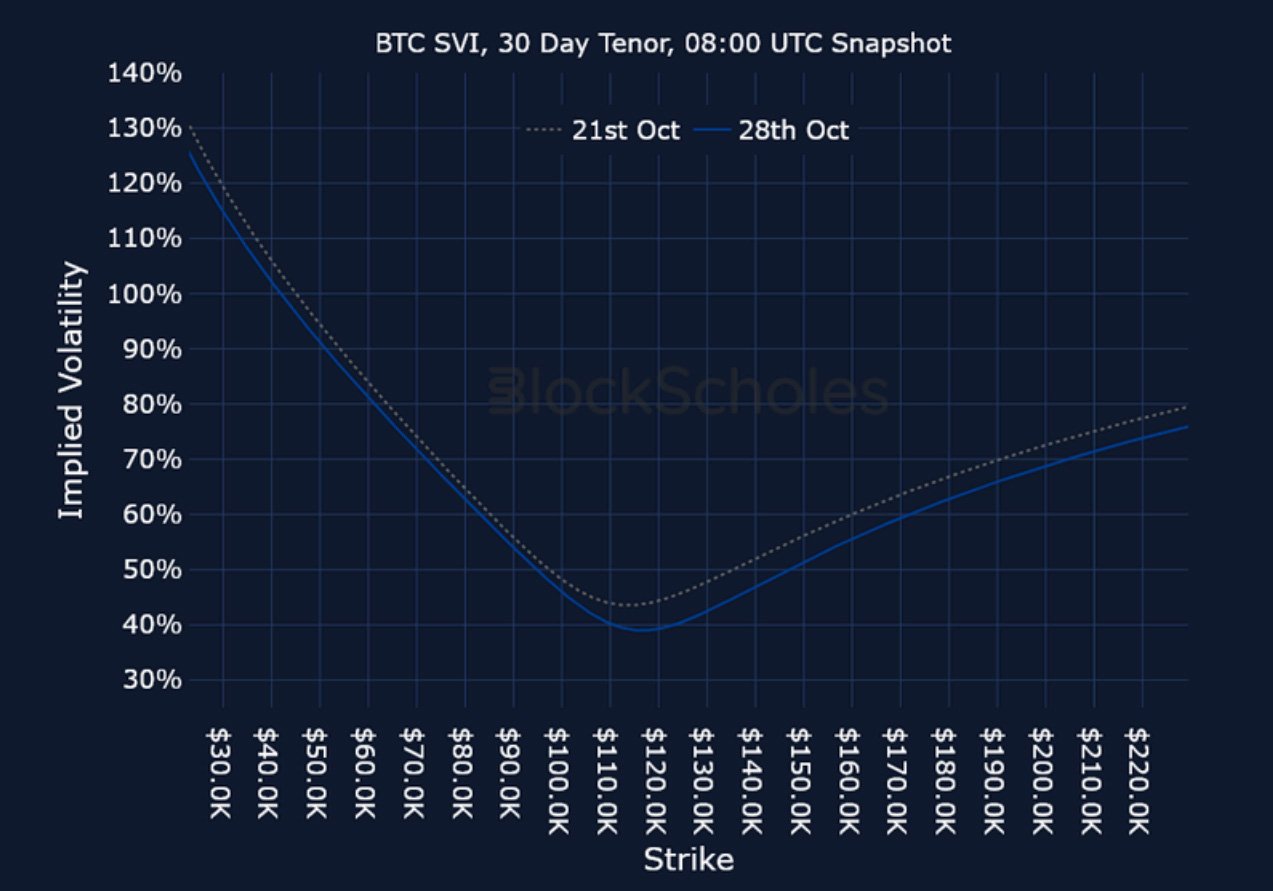

BTC SVI ATM IMPLIED VOLATILITY – Demand for optionality still remains elevated above pre-October 10 levels where ATM vol traded closer to 30%.

BTC 25-Delta Risk Reversal – Short-tenor smile skews have steepened to the upside over the past week and trade at modestly positive-to-neutral levels.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – After two major inversions in the month, ETH ATM vol currently trades between 65-68%.

ETH 25-Delta Risk Reversal – Longer dated ETH options maintain their bias towards calls, though ETH traders expect more downside in the short-term.

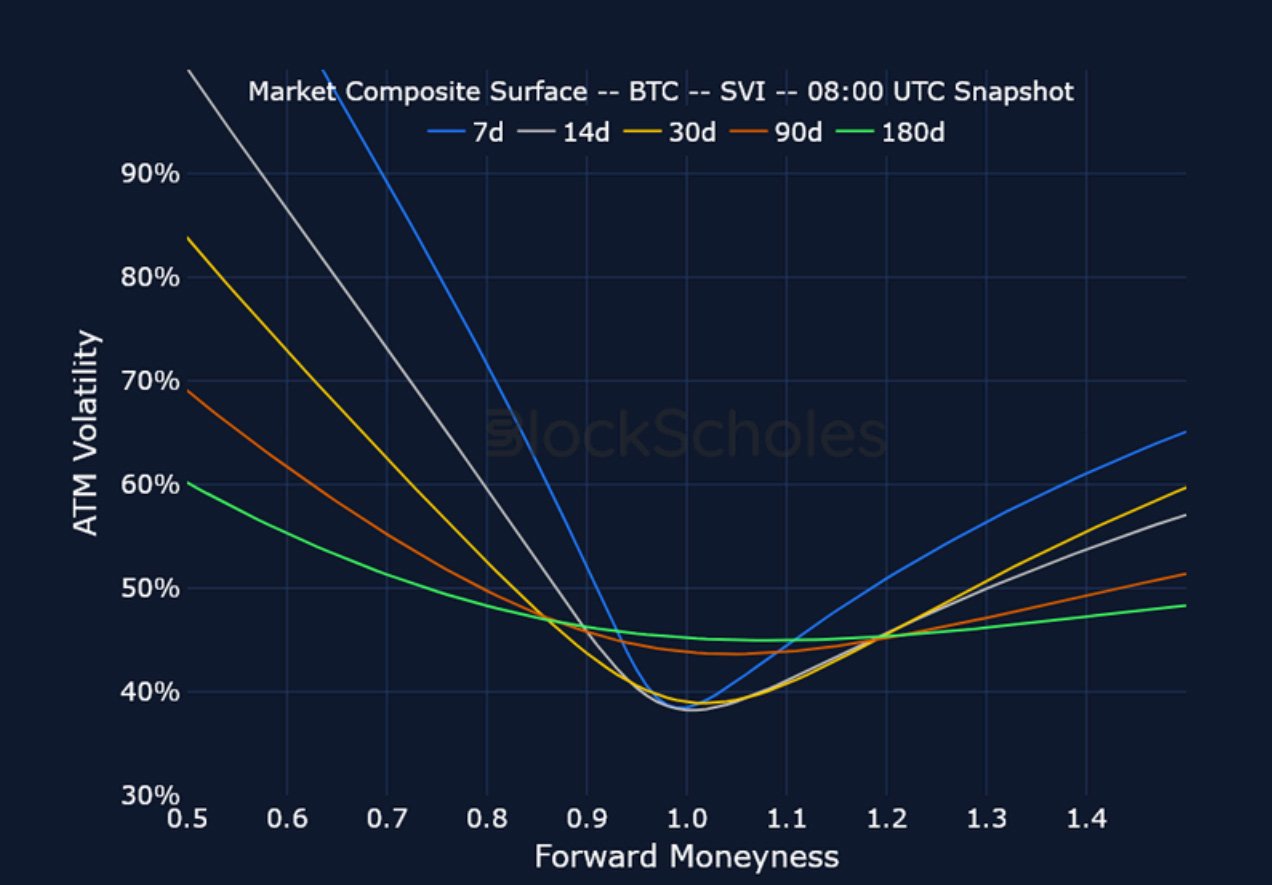

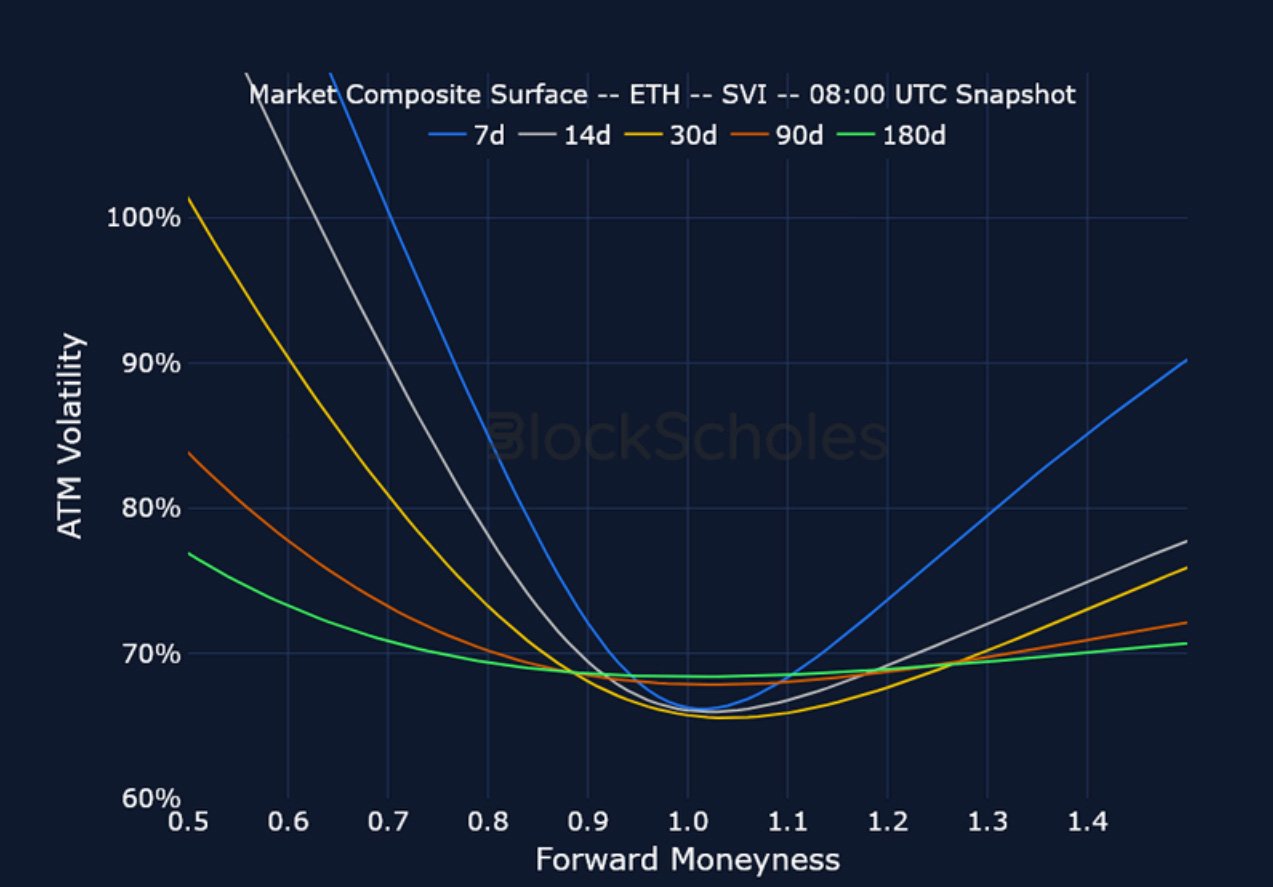

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

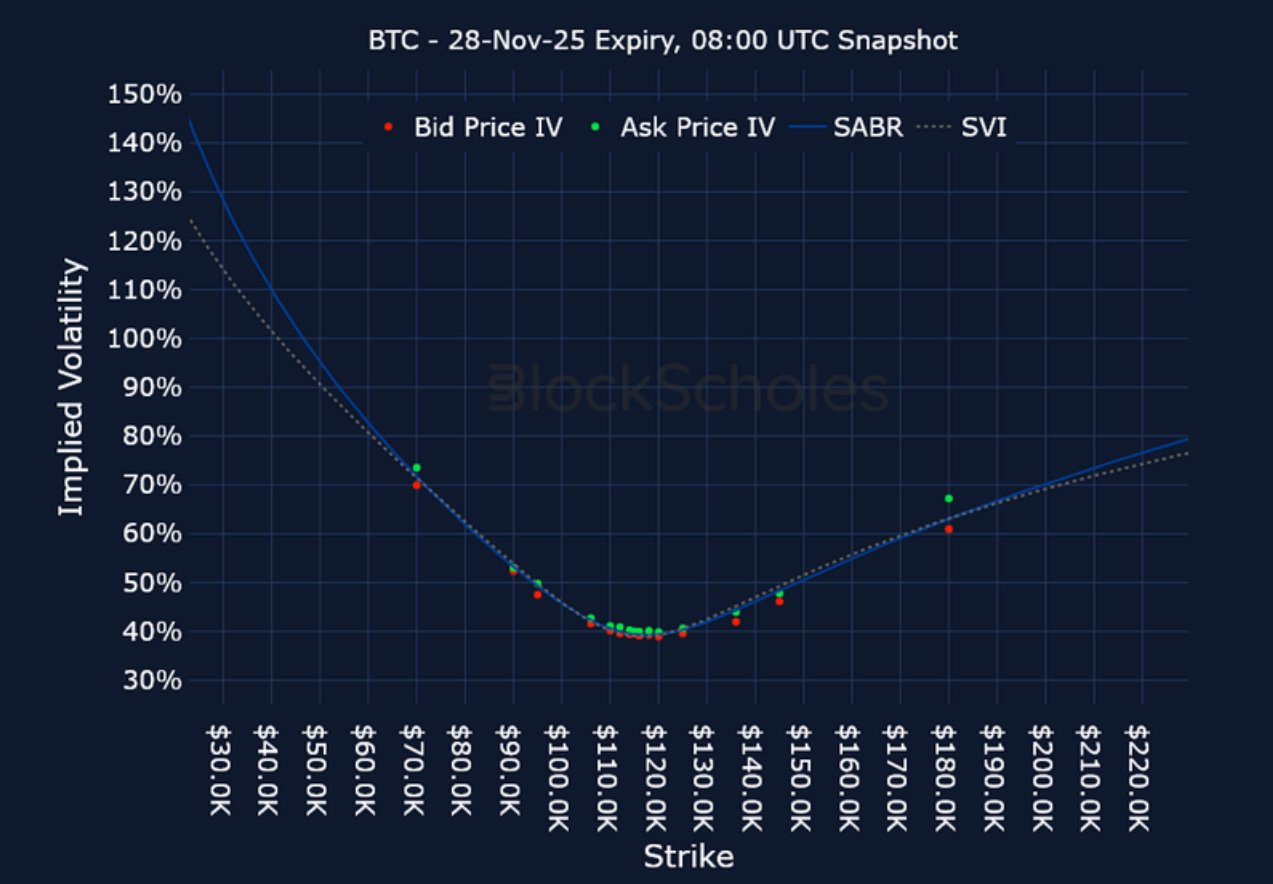

Listed Expiry Volatility Smiles

BTC 28-NOV EXPIRY – 9:00 UTC Snapshot.

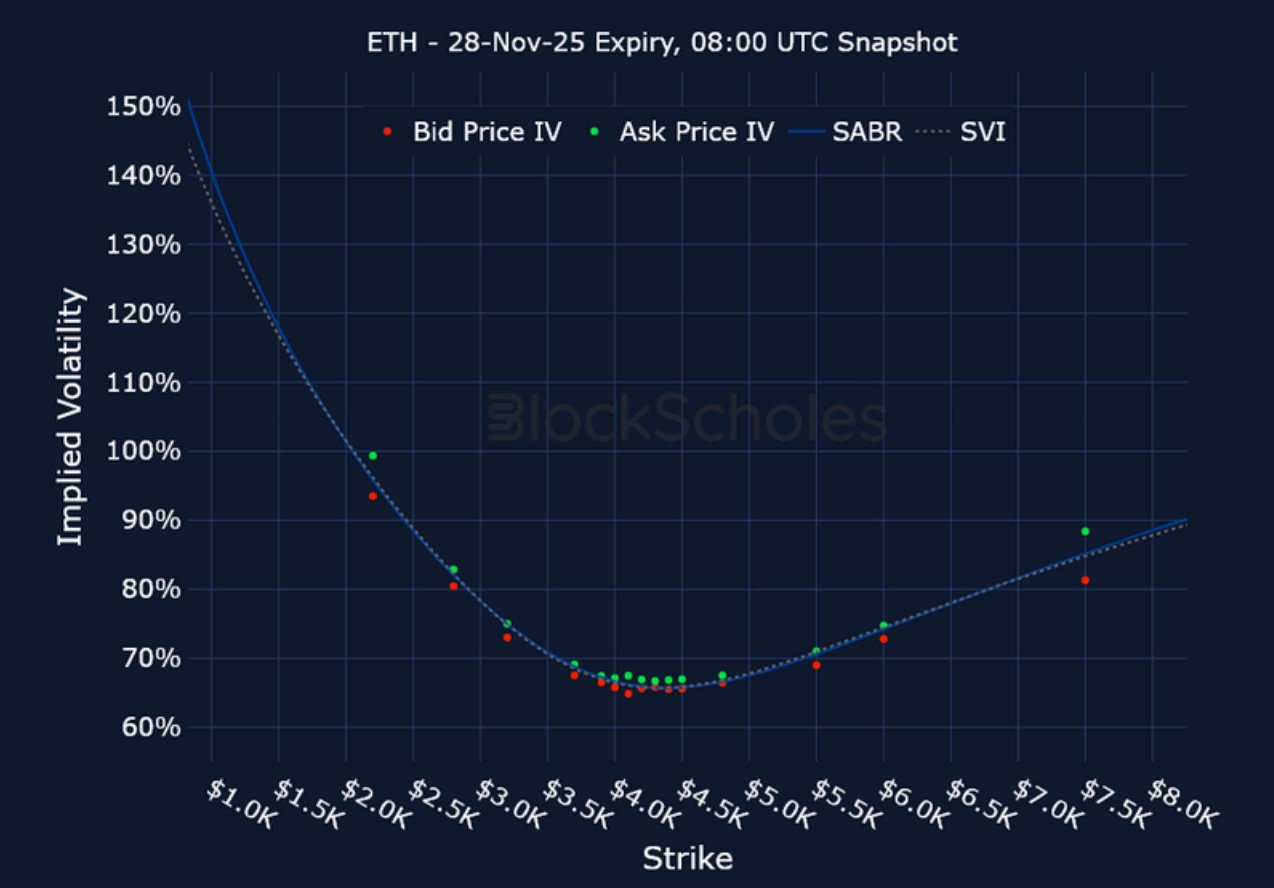

ETH 28-NOV EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

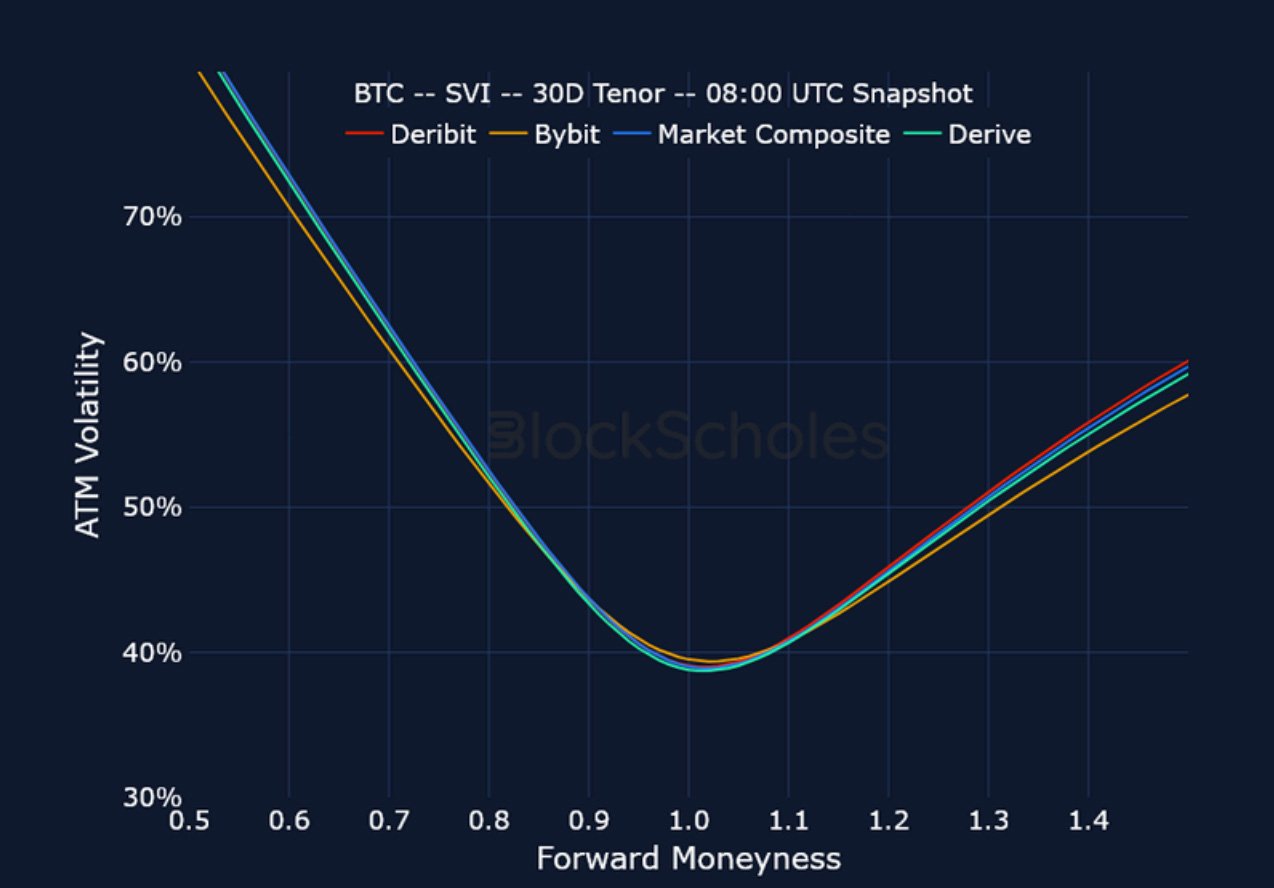

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

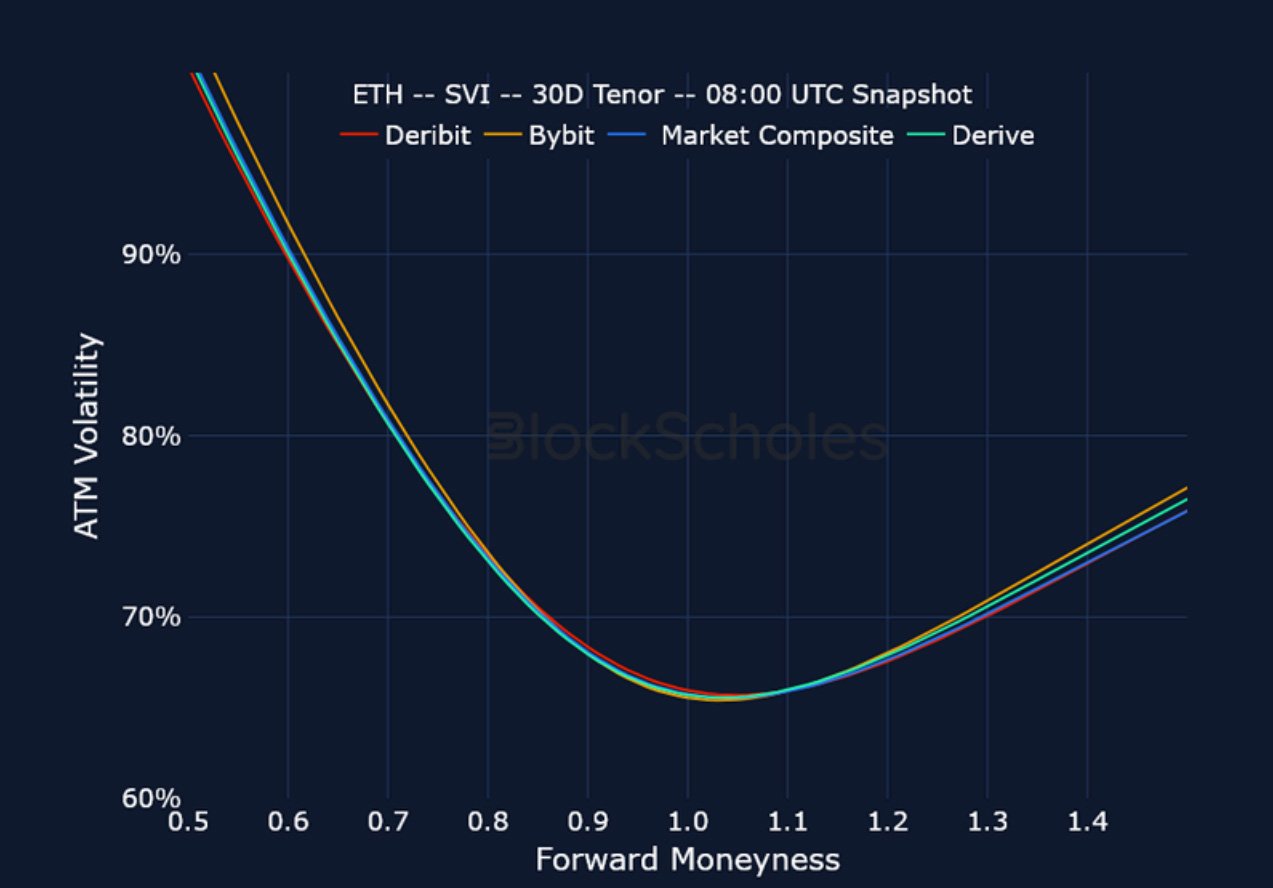

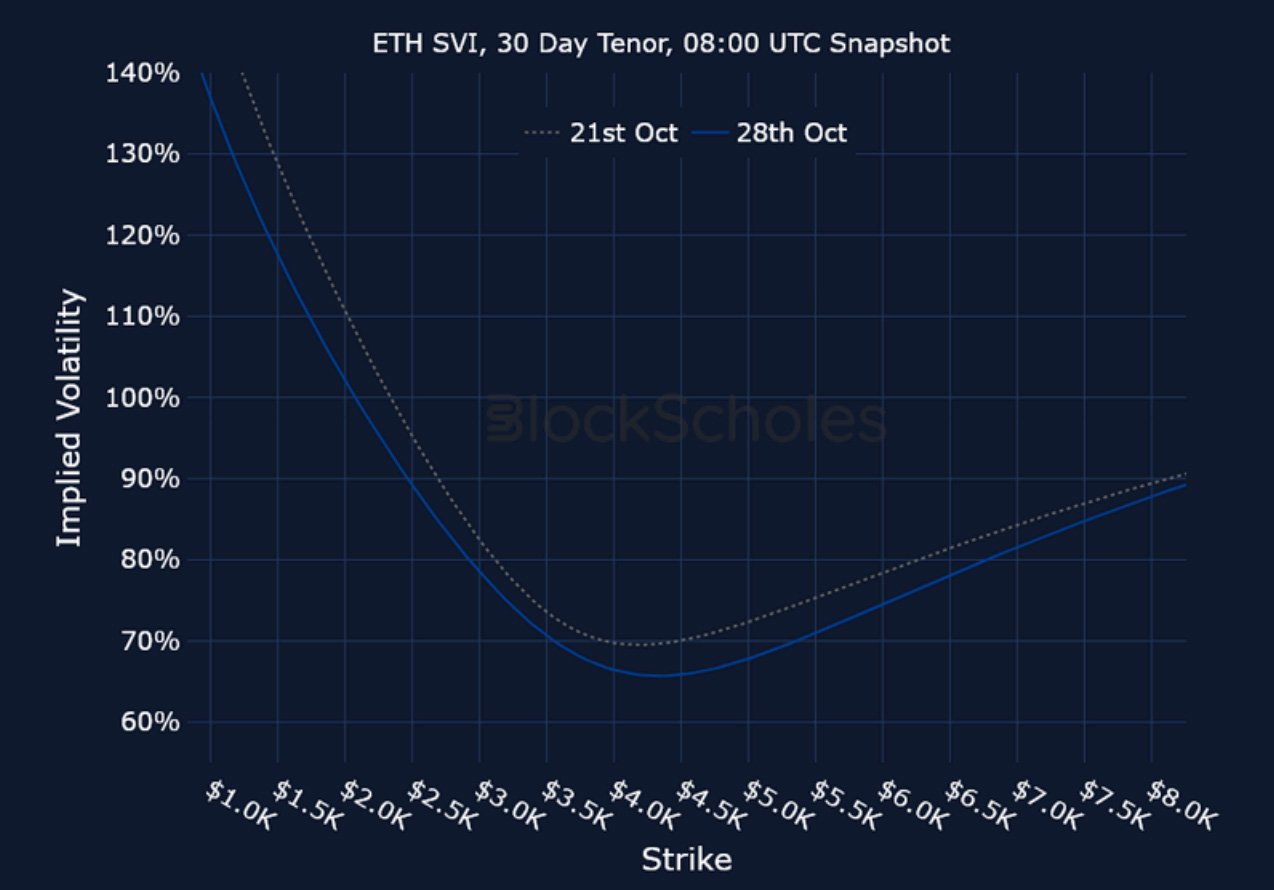

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)