Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

More bullish action in the spot prices of both majors overnight sees future-implied spot-yields and perpetual swap funding rates climb back to last week’s highs. As in their futures markets, ETH’s volatility markets continue to price for lower levels than BTC’s, despite a definitive pickup that has been enjoyed by all tenors on the term structure. The divergence between the two assets is visible in the skew of their respective smiles towards calls at longer tenors, with BTC enjoying the stronger of the two tilts.

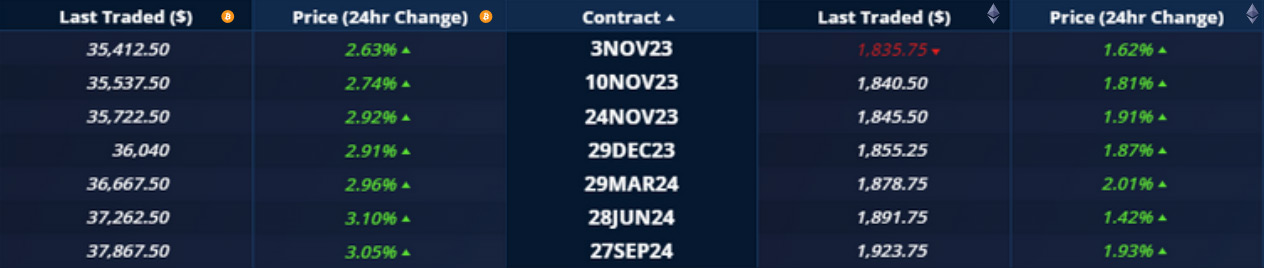

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – have trended back to the highs recorded last week, with the 1-tenor back at 20%.

ETH ANNUALISED YIELDS – have risen above last week’s levels to highs of 15% at a 1-week tenor, with longer dated tenors each above 5%.

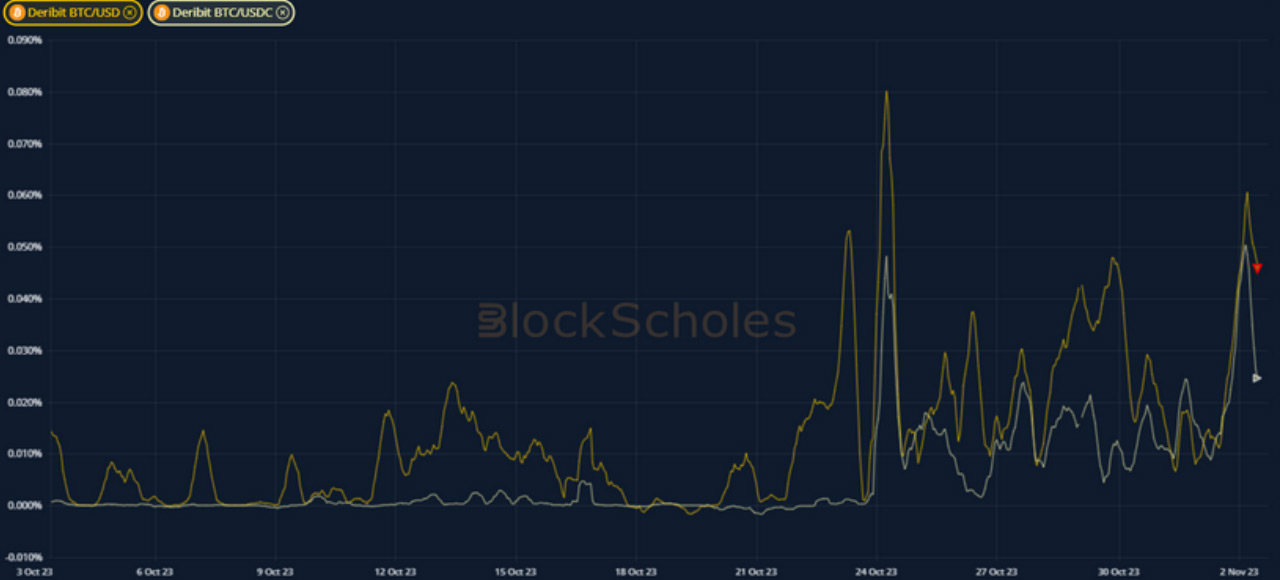

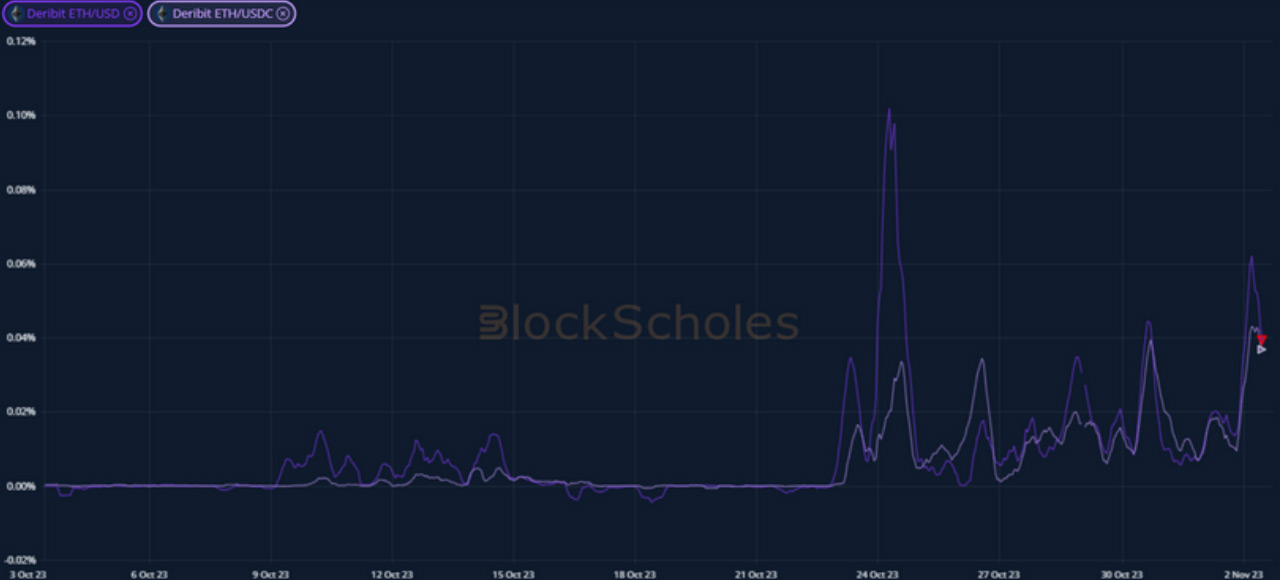

Perpetual Swap Funding Rate

BTC FUNDING RATE – continues to enjoy strong positive rates paid from long positions to shorts.

ETH FUNDING RATE – rises alongside BTC’s during the latest period of bullish spot price action.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has drifted back to last week’s levels, comfortably in the 50%-60% range across the term structure.

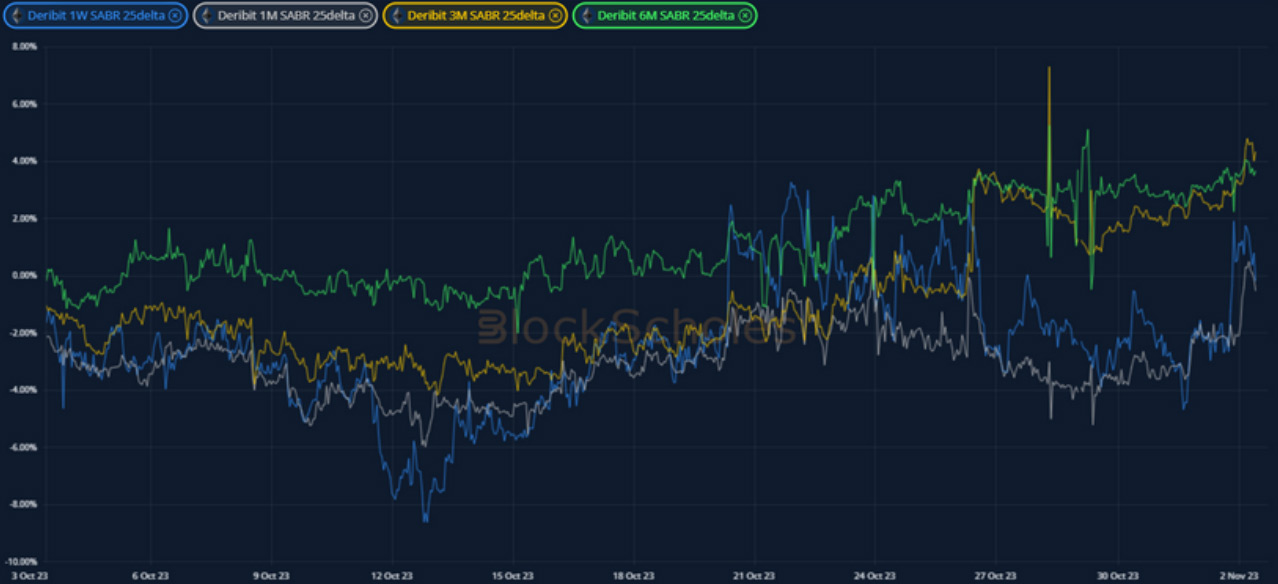

BTC 25-Delta Risk Reversal – 3M and 6M tenors report a decisive tilt towards OTM calls with shorter-dated options pricing a more neutral smile.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – has risen once again to levels slightly below those of BTC’s at each tenor.

ETH 25-Delta Risk Reversal – shows a similar preference for OTM calls at longer dated tenors as BTC’s, but at a lower level of conviction.

Volatility Surface

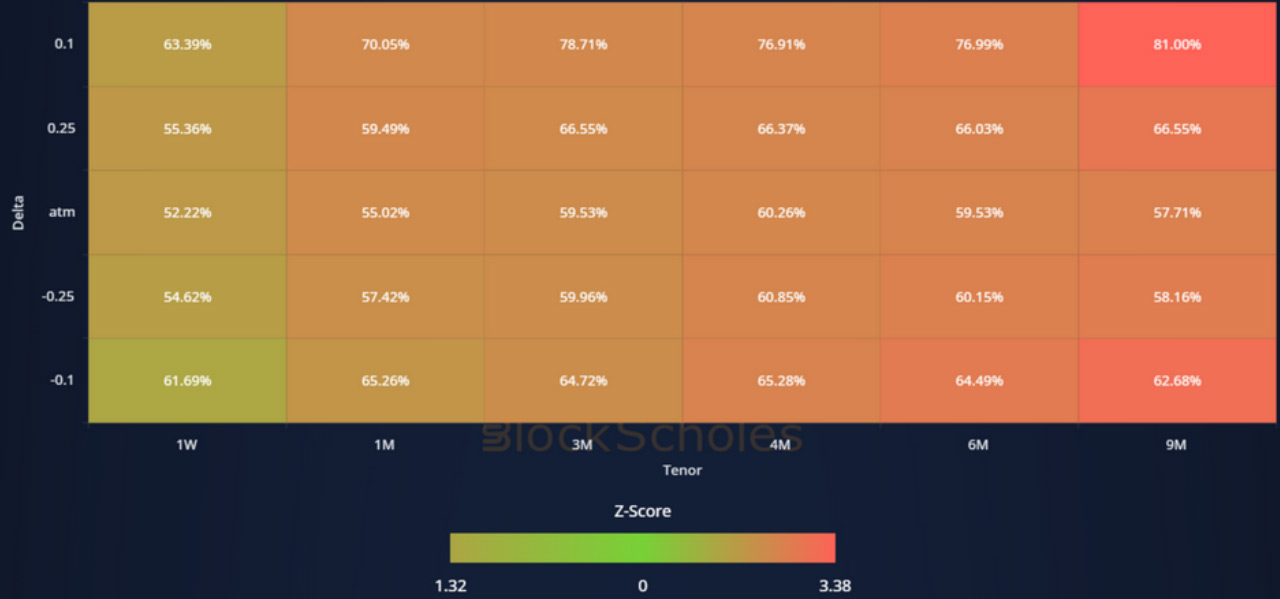

BTC IMPLIED VOL SURFACE – like last week, we see a surface-wide increase in vol that is stronger at longer dated tenors.

ETH IMPLIED VOL SURFACE – shows that the entire vol surface has risen during the most recent spot price rally.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

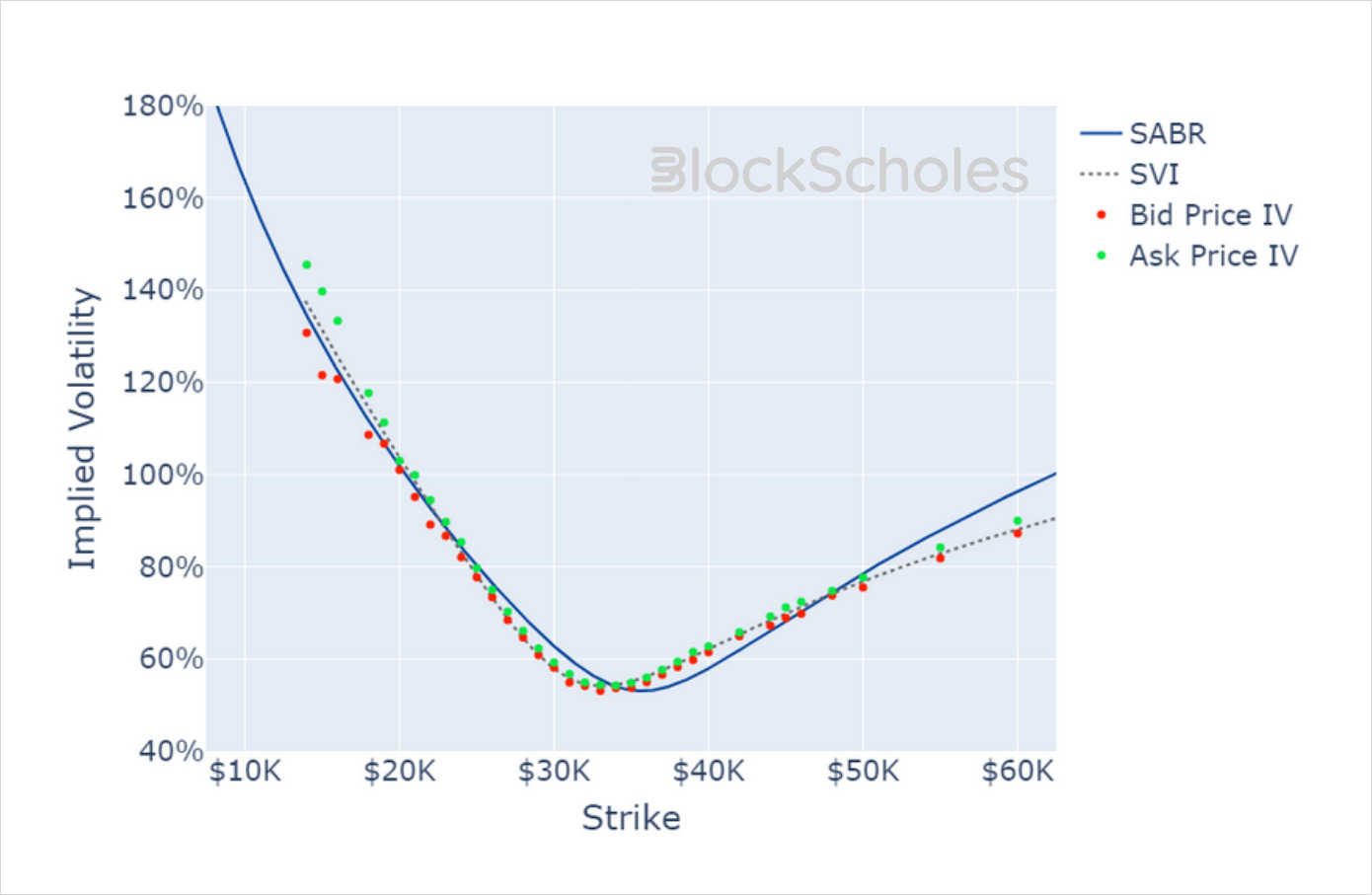

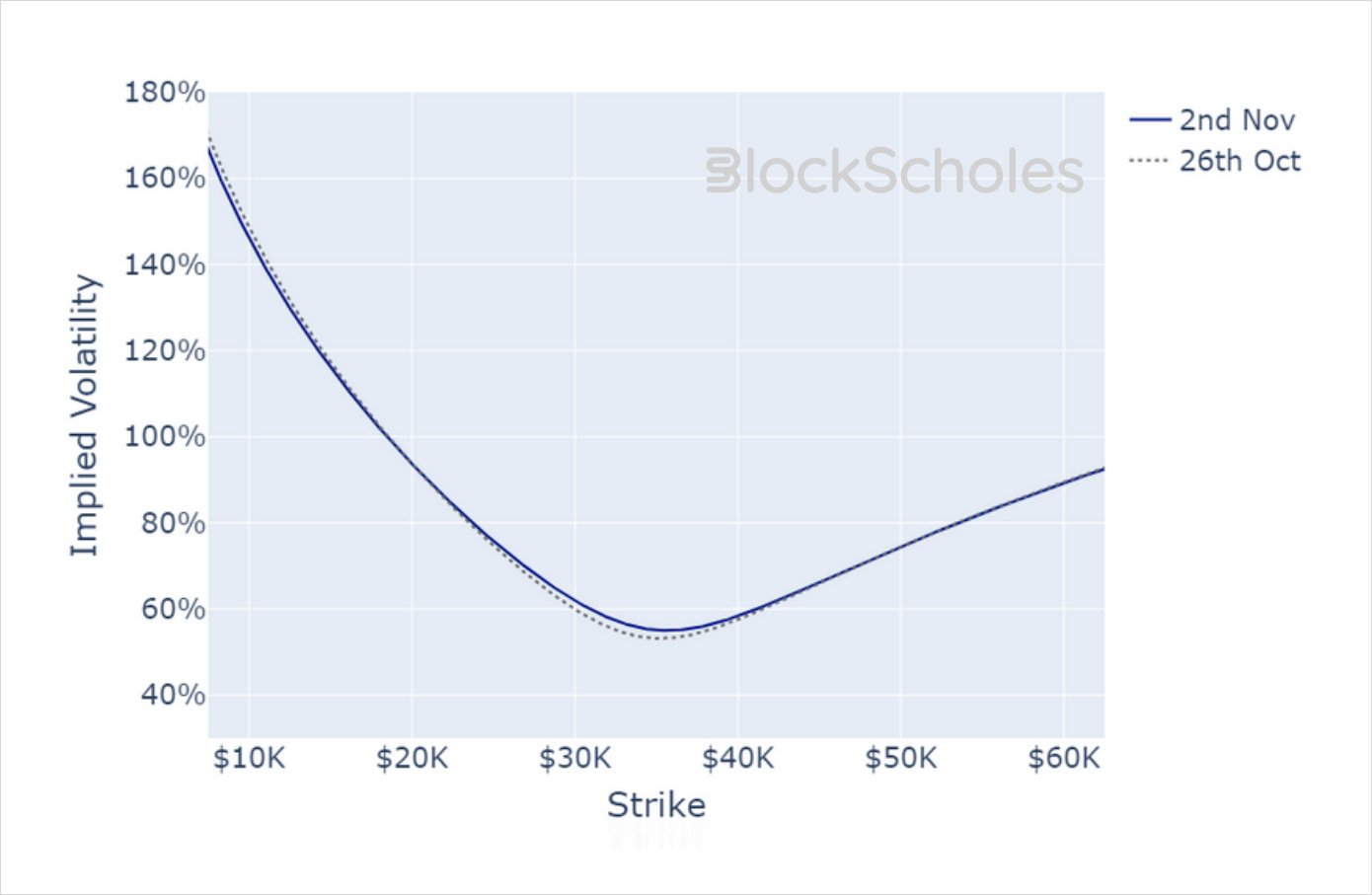

BTC SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

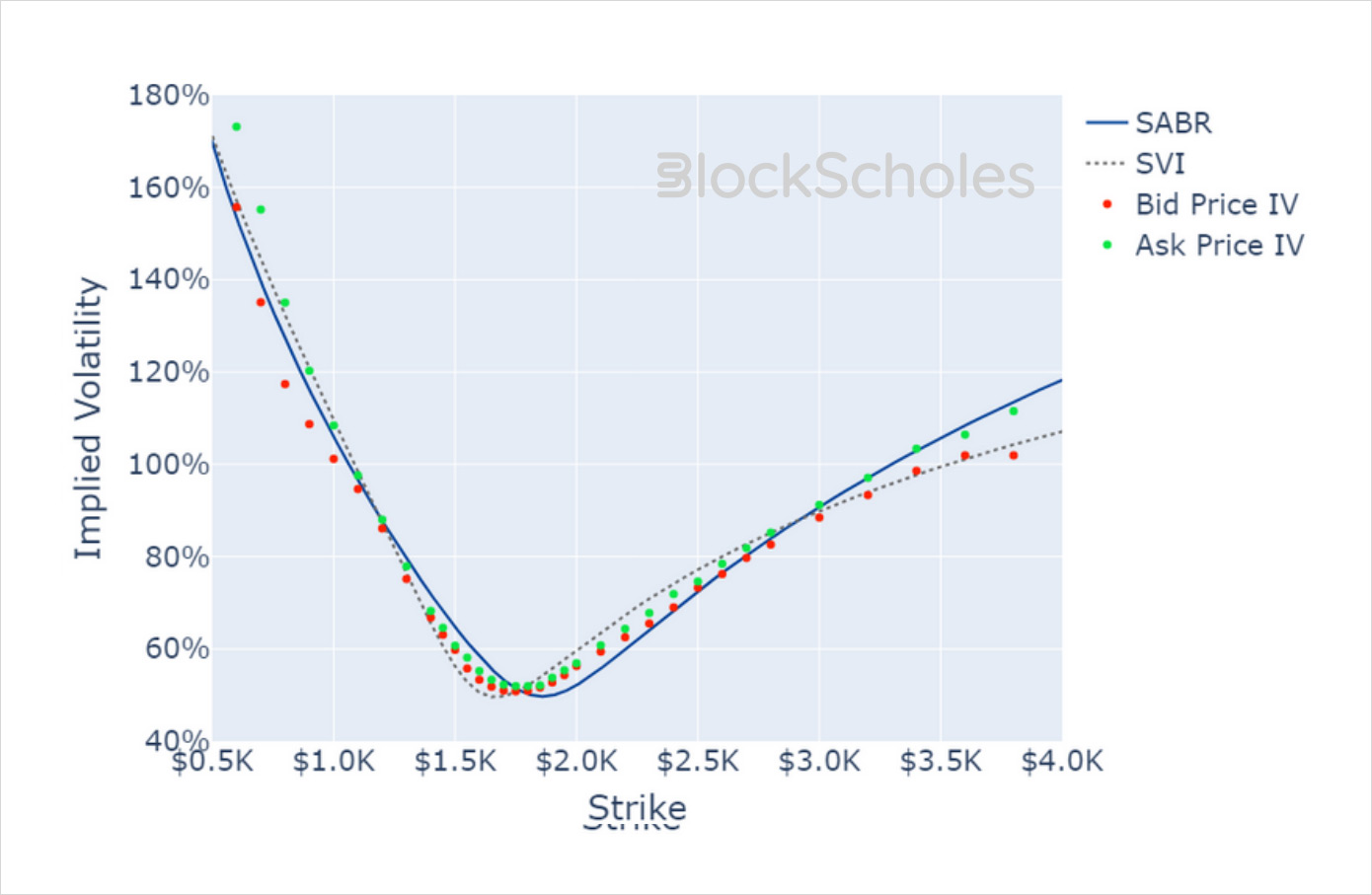

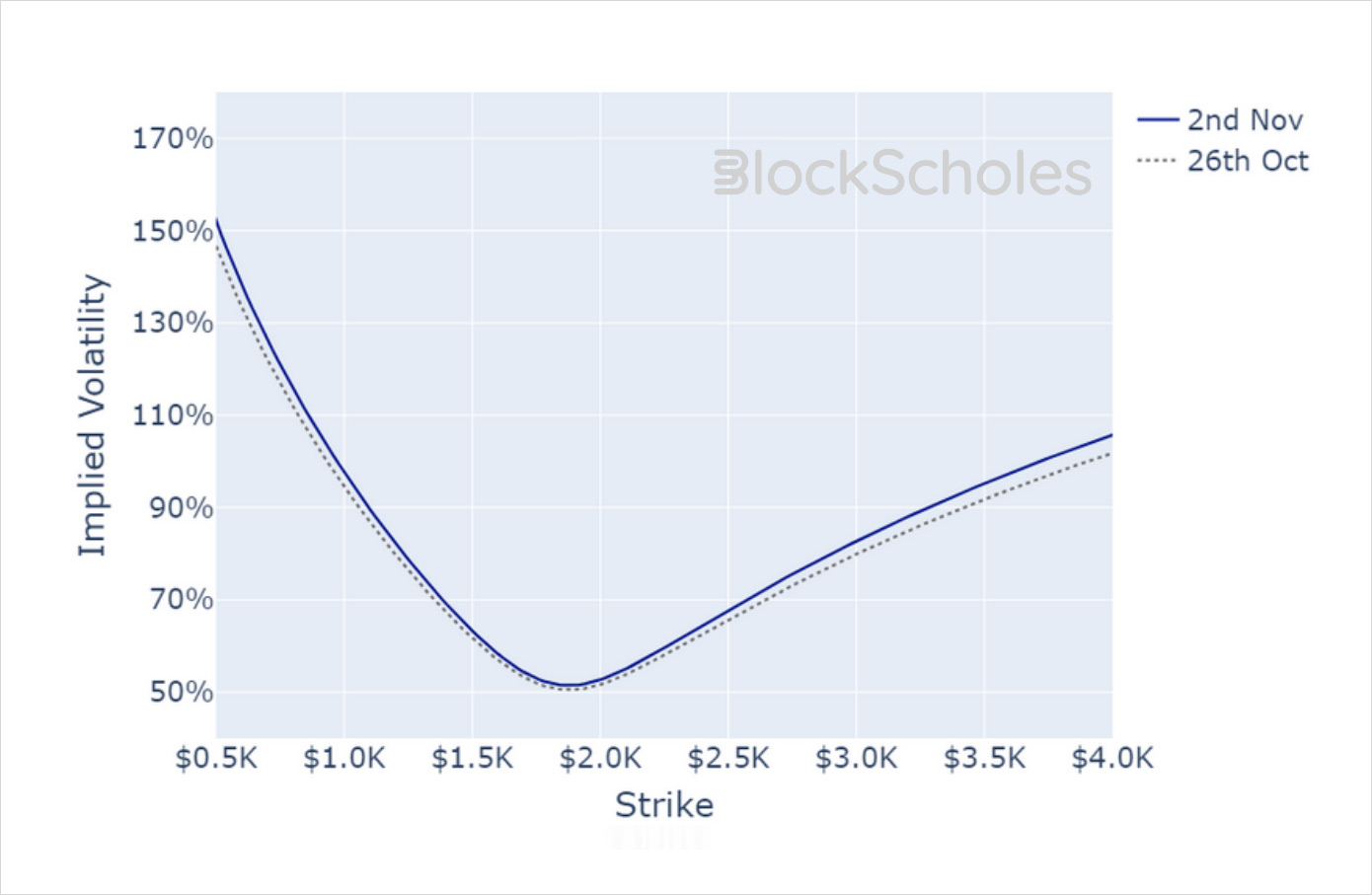

ETH SMILE CALIBRATIONS – 24-Nov-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)