Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

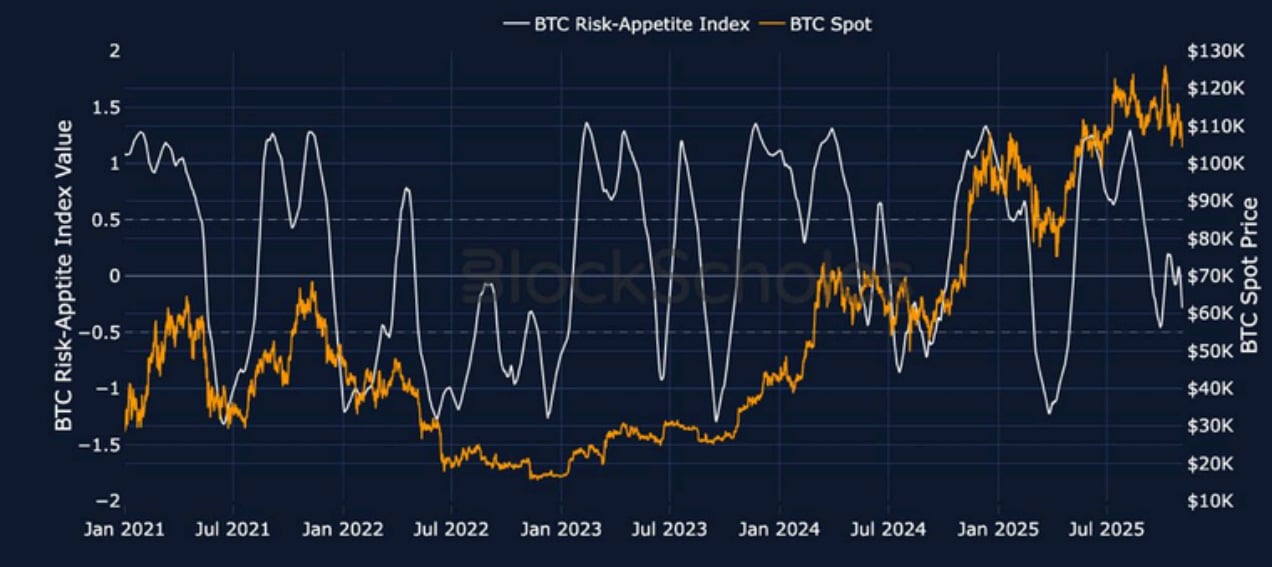

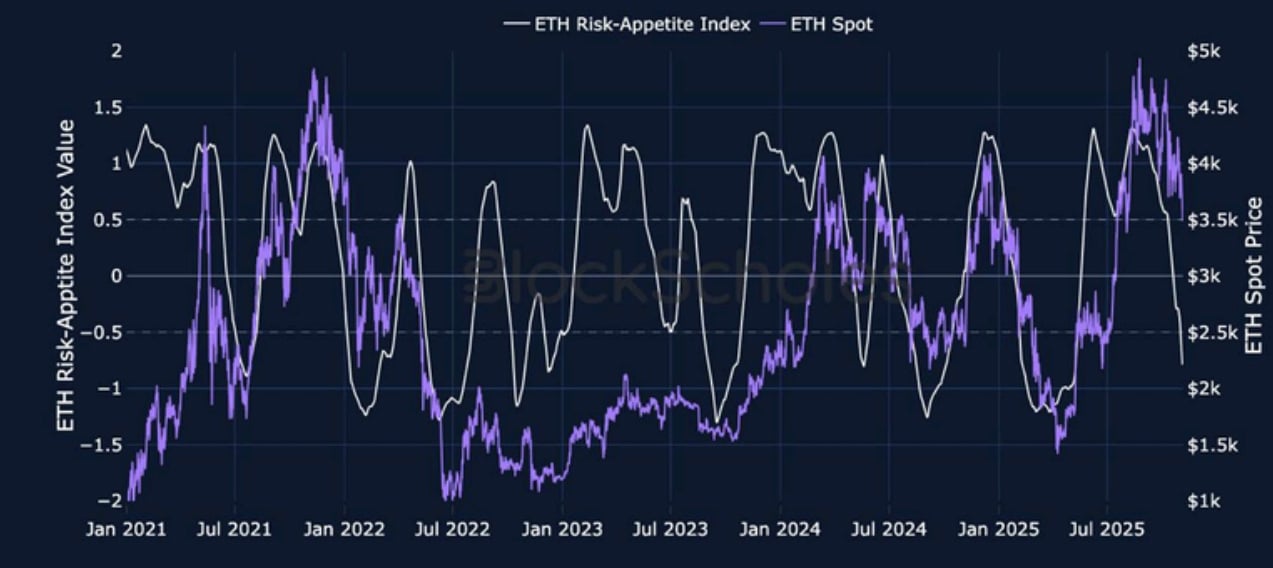

While US risk-on equities have held steady over the past week, crypto spot prices have continued to fall lower, souring sentiment further in derivatives markets. Since Oct 10, 2025, BTC has primarily traded between $105K and $115K. Earlier today, it broke below the $105K support level – that coincided with a further drop in our Risk- Appetite Index, designed to capture market sentiment. Funding rates on perpetual swap contracts have fallen to their lowest levels (-0.005% on an eight-hourly basis) since early August 2025, while volatility smiles have skewed further towards protection against more downside price action. Meanwhile, short-tenor options for both BTC and ETH have outperformed, suggesting traders are pricing in greater volatility expectations in the near-term. For ETH, that outperformance in short-tenor volatility has been enough to invert the volatility term structure. Zooming out to the broader macro picture, the past week saw a confirmed trade deal negotiated between President Trump and President Xi, as well as an interest rate cut from the Fed. While an October rate cut was expected, Chair Powell surprised markets with a more hawkish-than-expected outlook on the upcoming December meeting.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

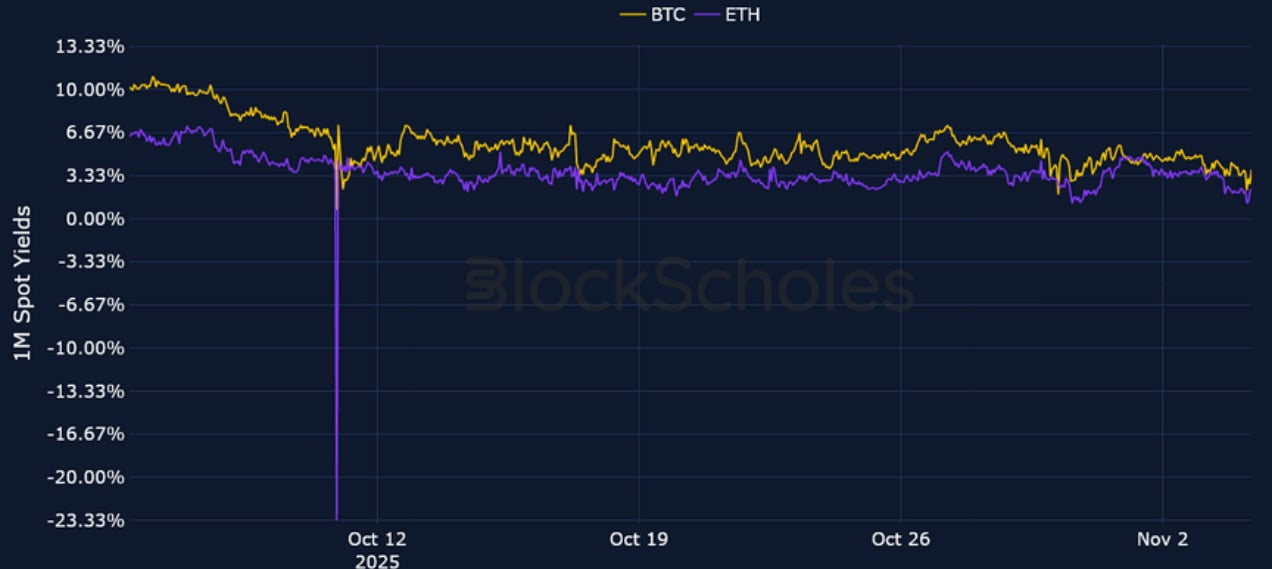

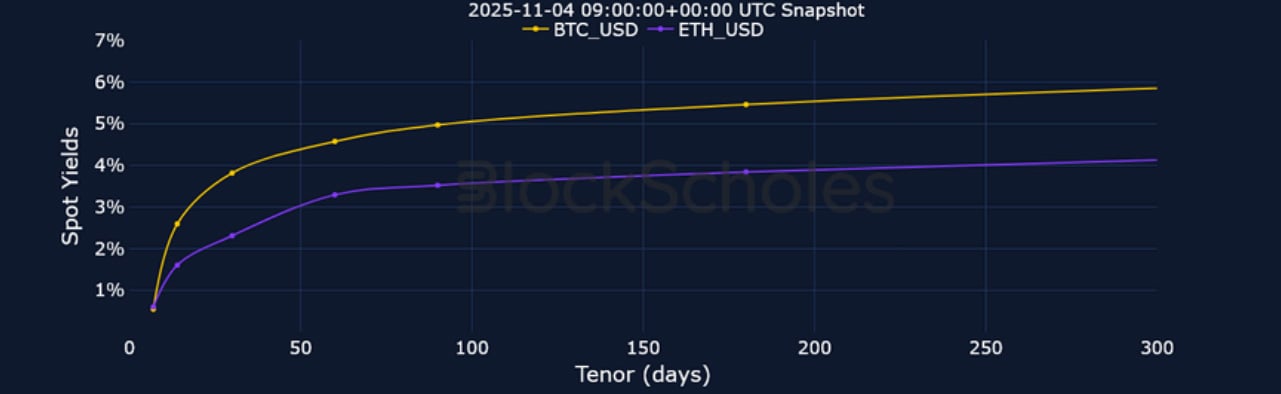

Futures Implied Yields

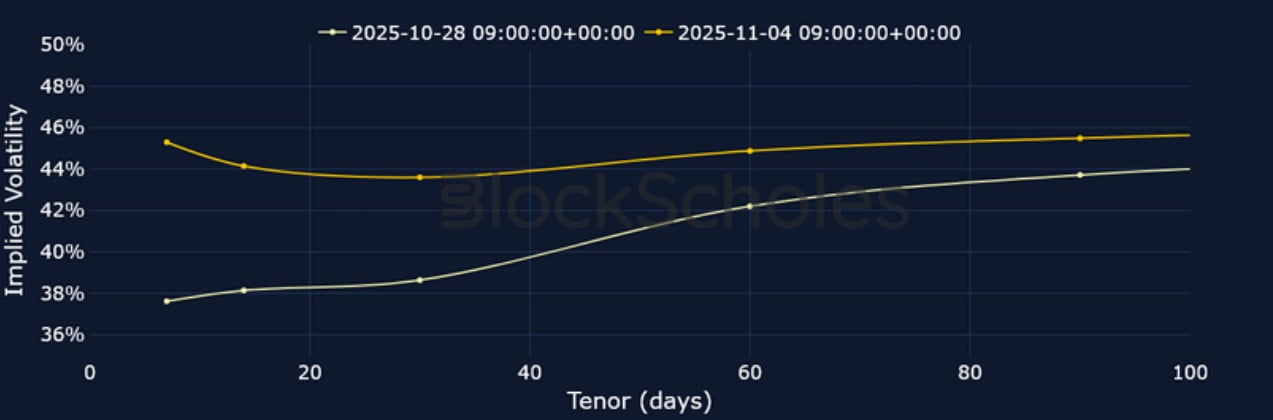

1-Month Tenor ATM Implied Volatility

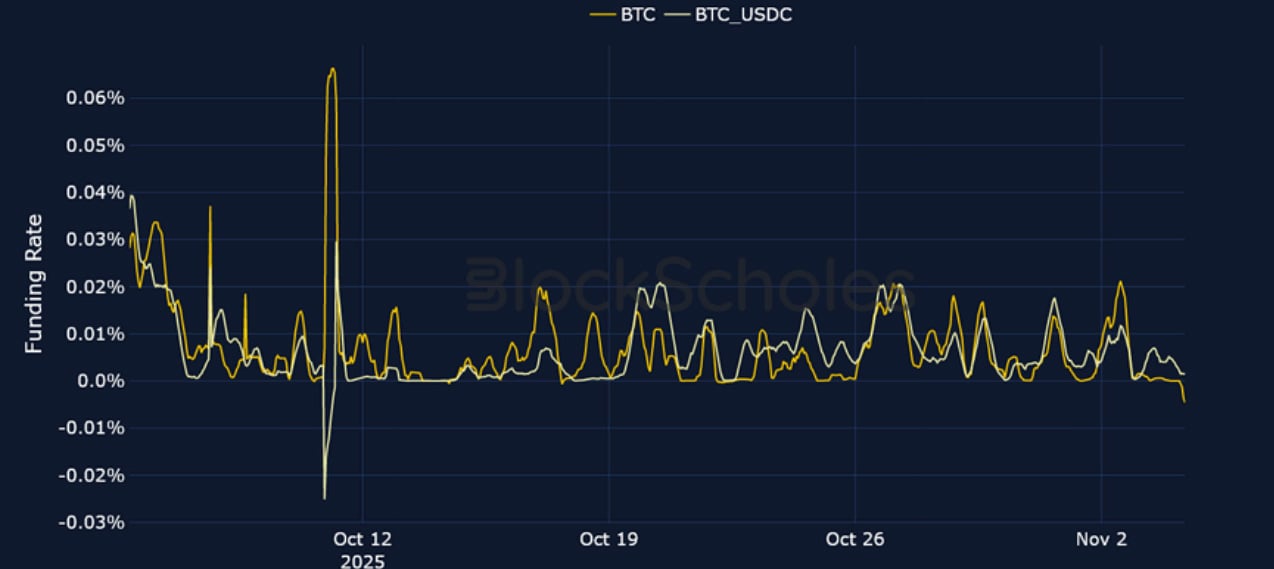

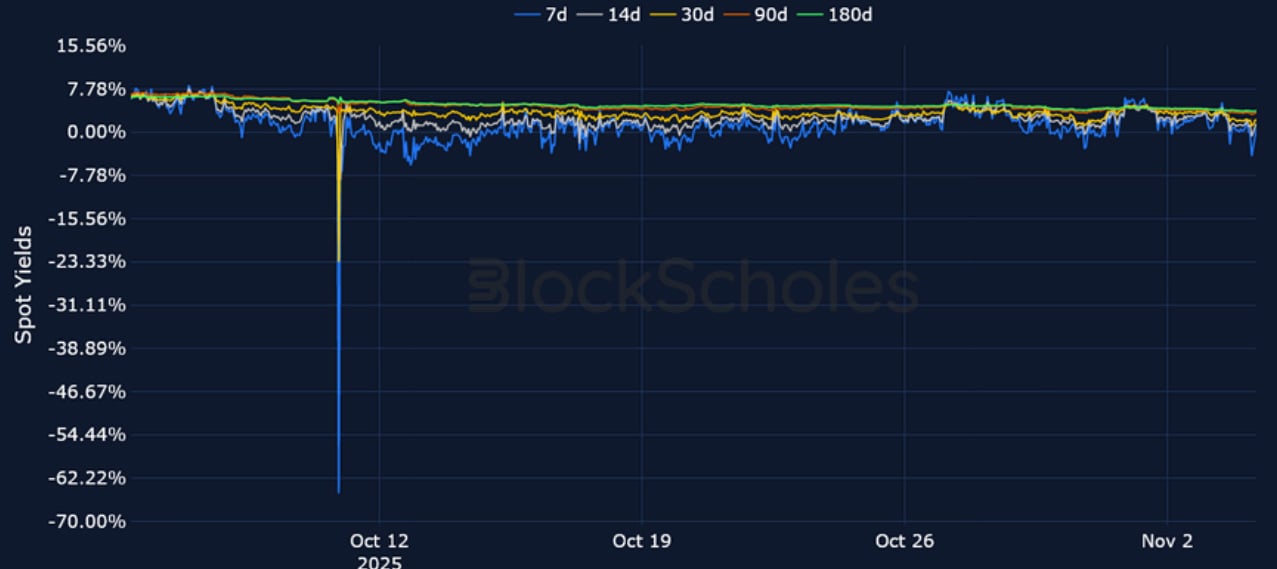

Perpetual Swap Funding Rate

BTC FUNDING RATE – Deribit’s inverse BTC contract currently trades with the most negative funding rate since early August 2025, a sign that traders are willing to pay a premium to maintain their bearish stance on BTC spot price.

ETH FUNDING RATE – Despite an 8% drop in Ether’s spot price in the past five days, funding rates trade at neutral levels.

Futures Implied Yields

BTC Futures Implied Yields – After temporarily trading below spot price, short-dated futures are now only marginally higher than BTC’s spot price.

ETH Futures Implied Yields – 7D futures yields fell to -5%, a sign that traders were willing to accept a lower price when shorting relative to spot price.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor volatility has jumped 10 percentage points in the past two days, flattening the term structure.

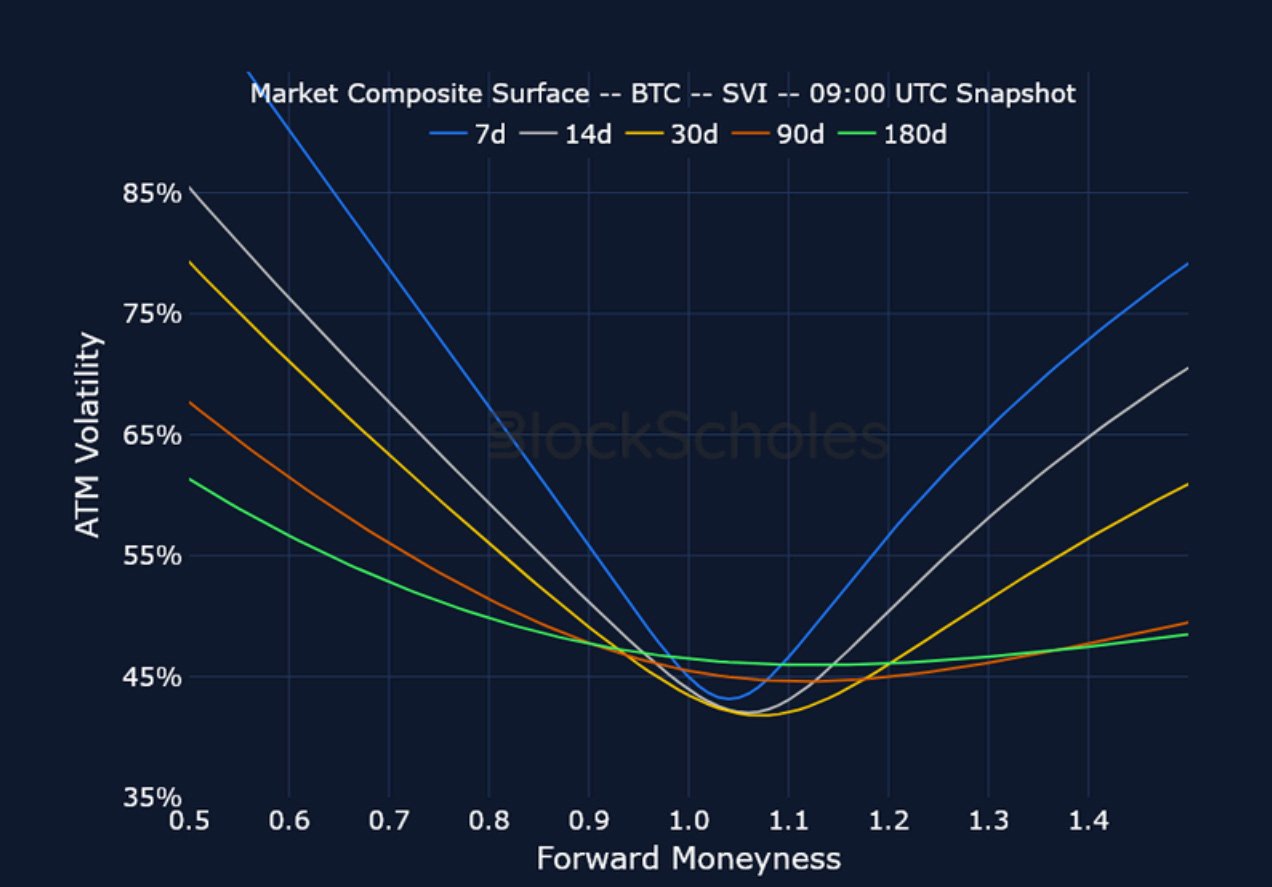

BTC 25-Delta Risk Reversal – The heightened vol expectations coincide with a further weakening in sentiment as all tenors trade with negative skew.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Similar to BTC, front end volatility has broken out, though for ETH it has jumped enough to invert the term structure.

ETH 25-Delta Risk Reversal – While short expiry options have tilted further towards puts, 120- and 180-day contracts remain marginally bullish.

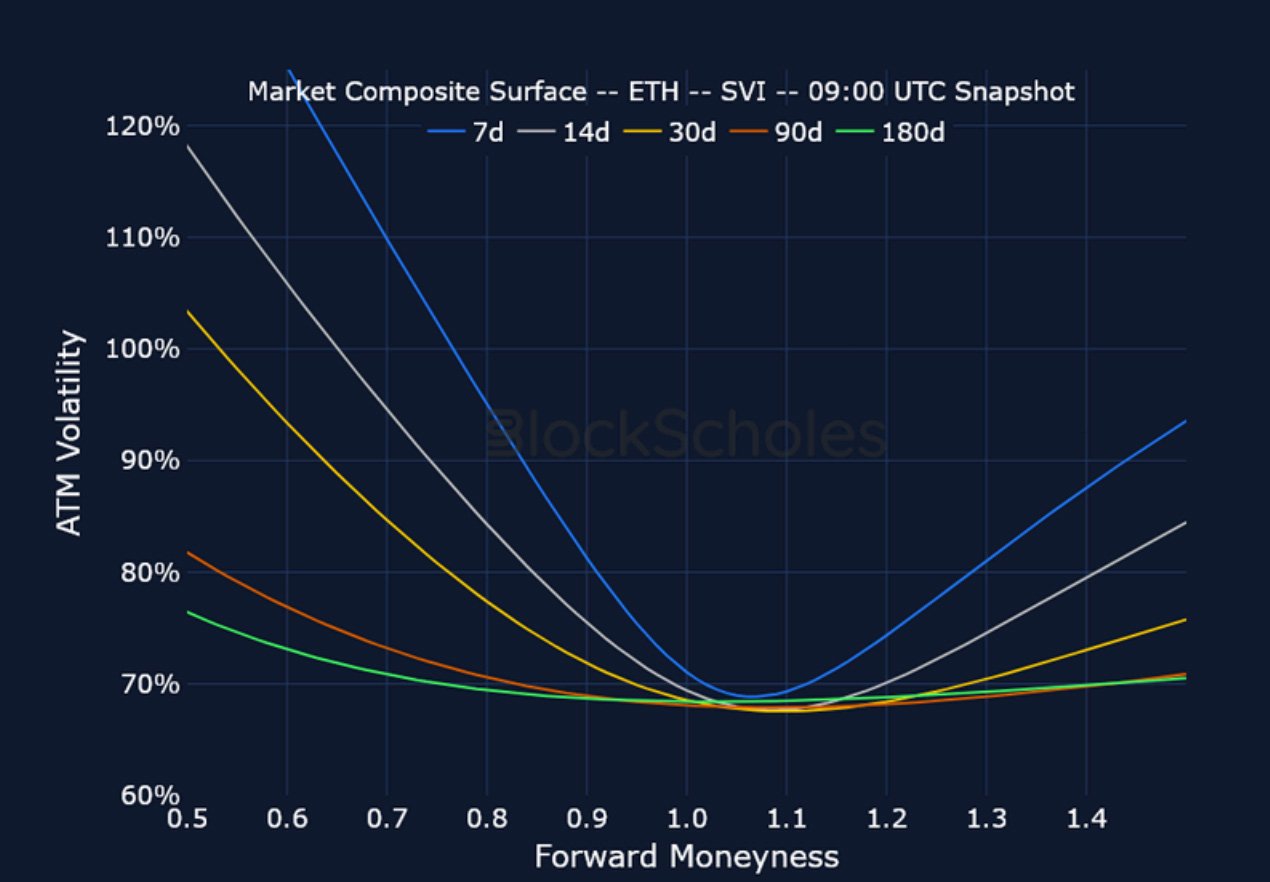

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

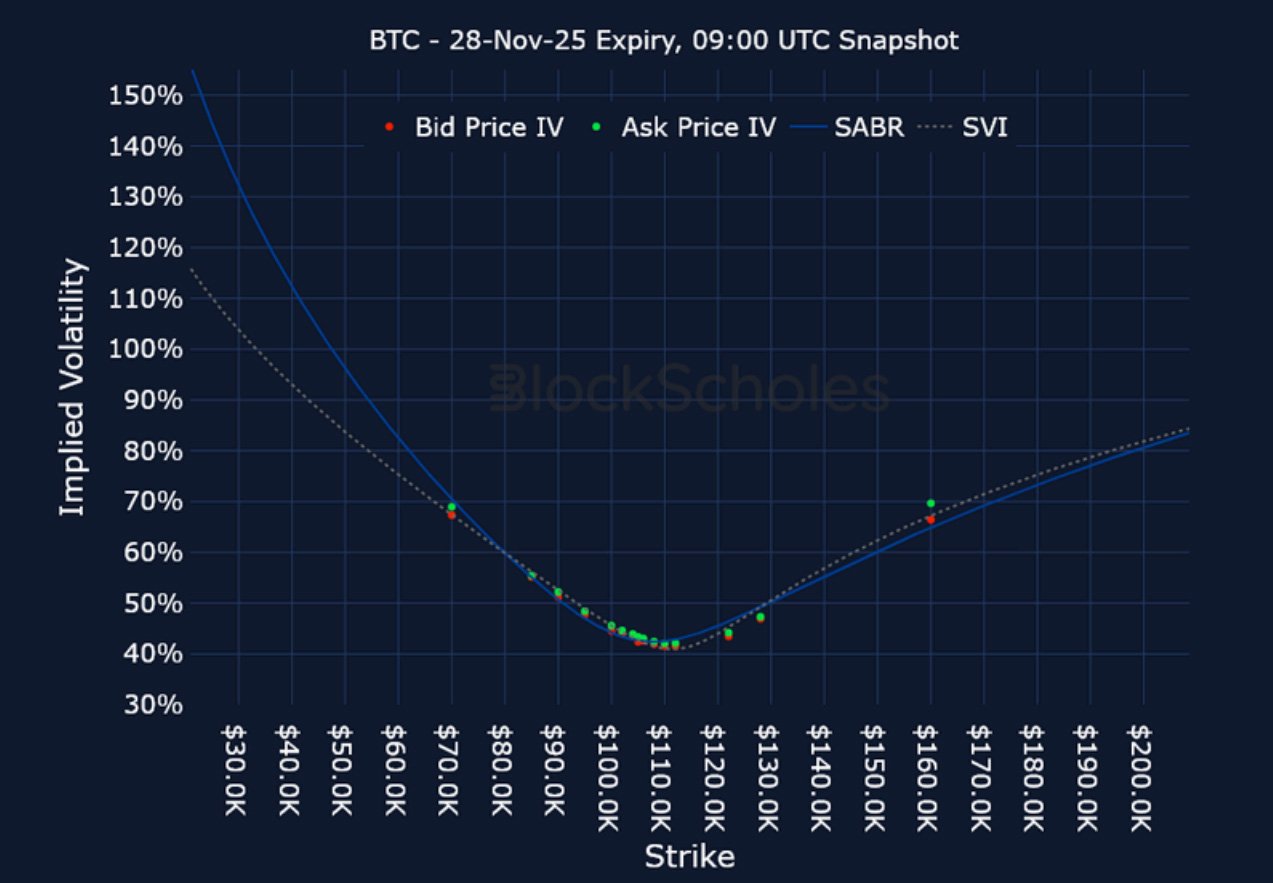

Listed Expiry Volatility Smiles

BTC 28-NOV EXPIRY – 9:00 UTC Snapshot.

ETH 28-NOV EXPIRY – 9:00 UTC Snapshot.

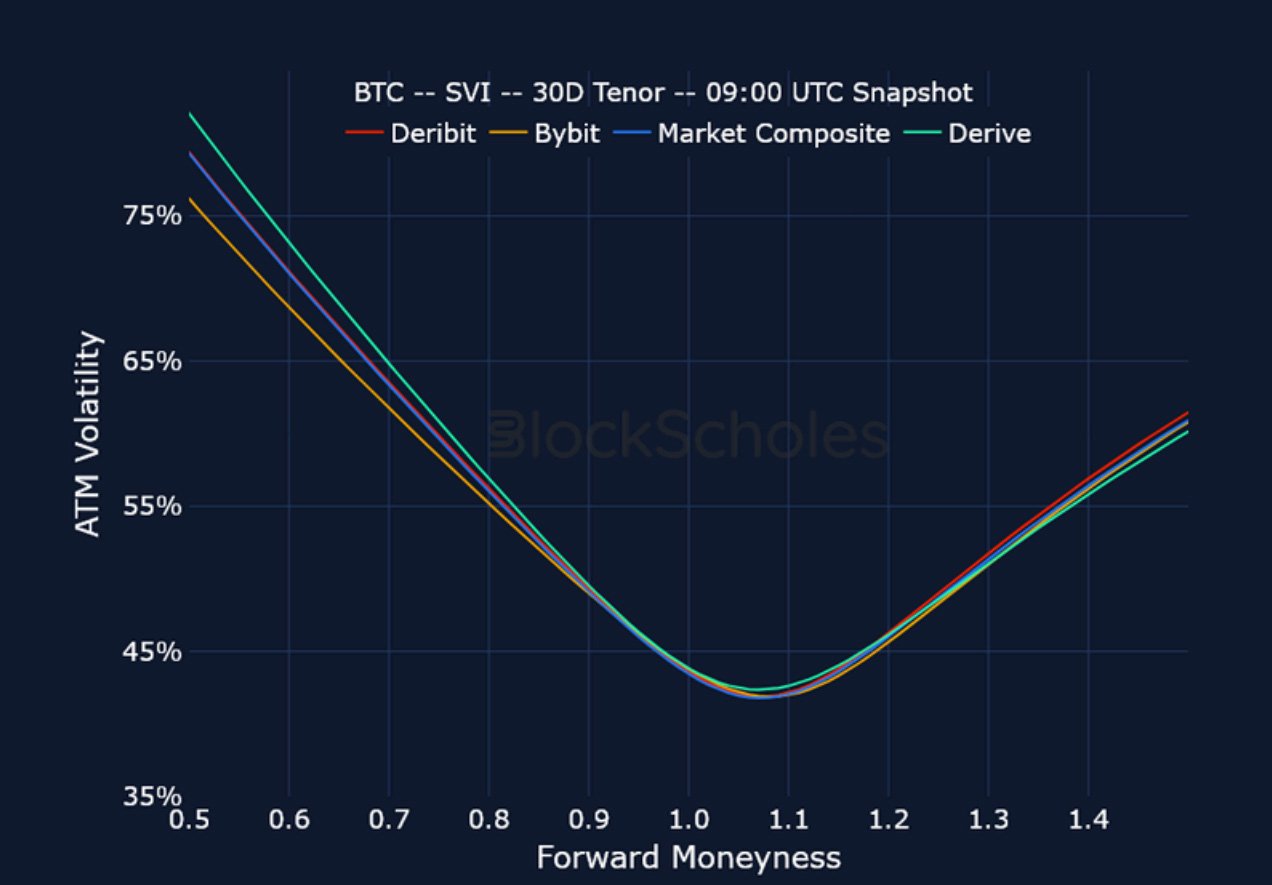

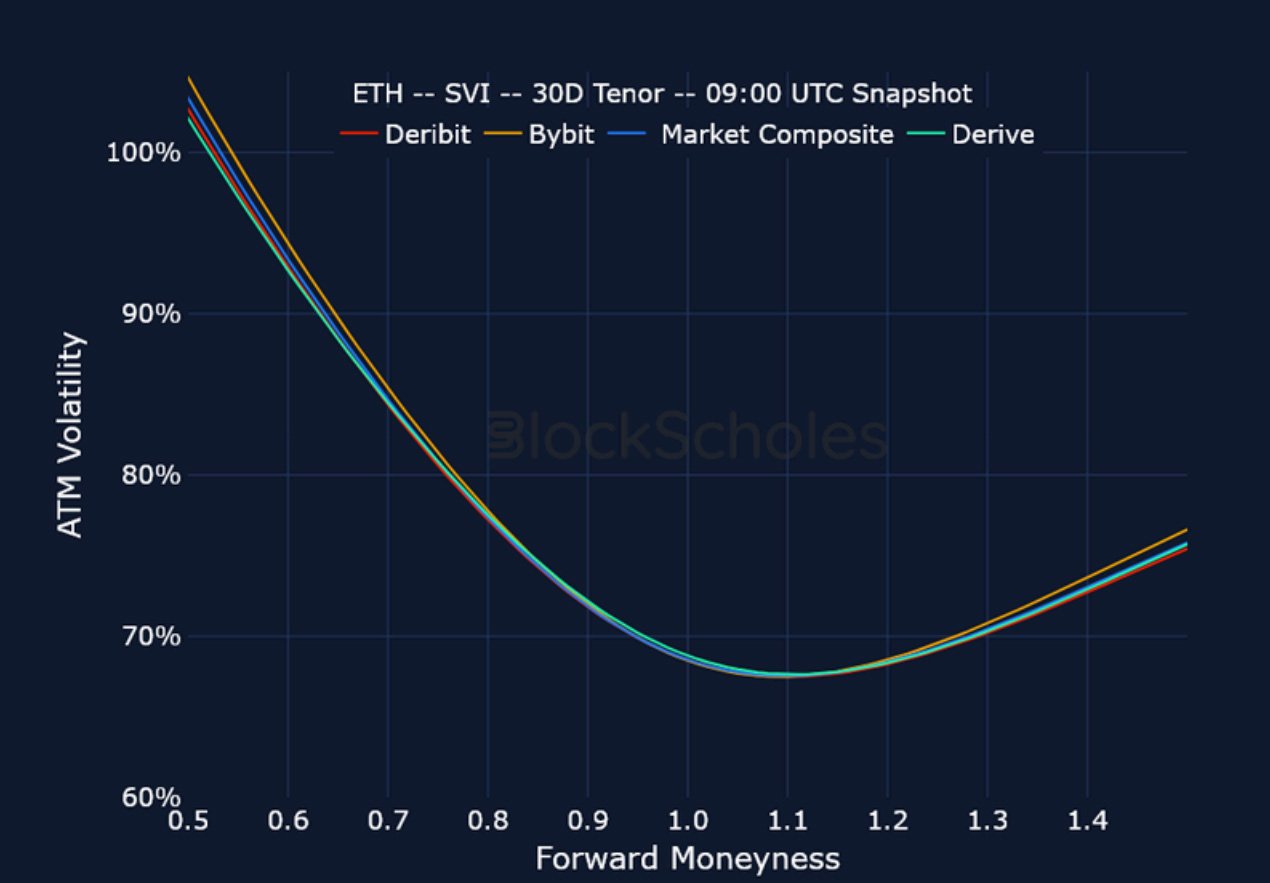

Cross-Exchange Volatility Smiles

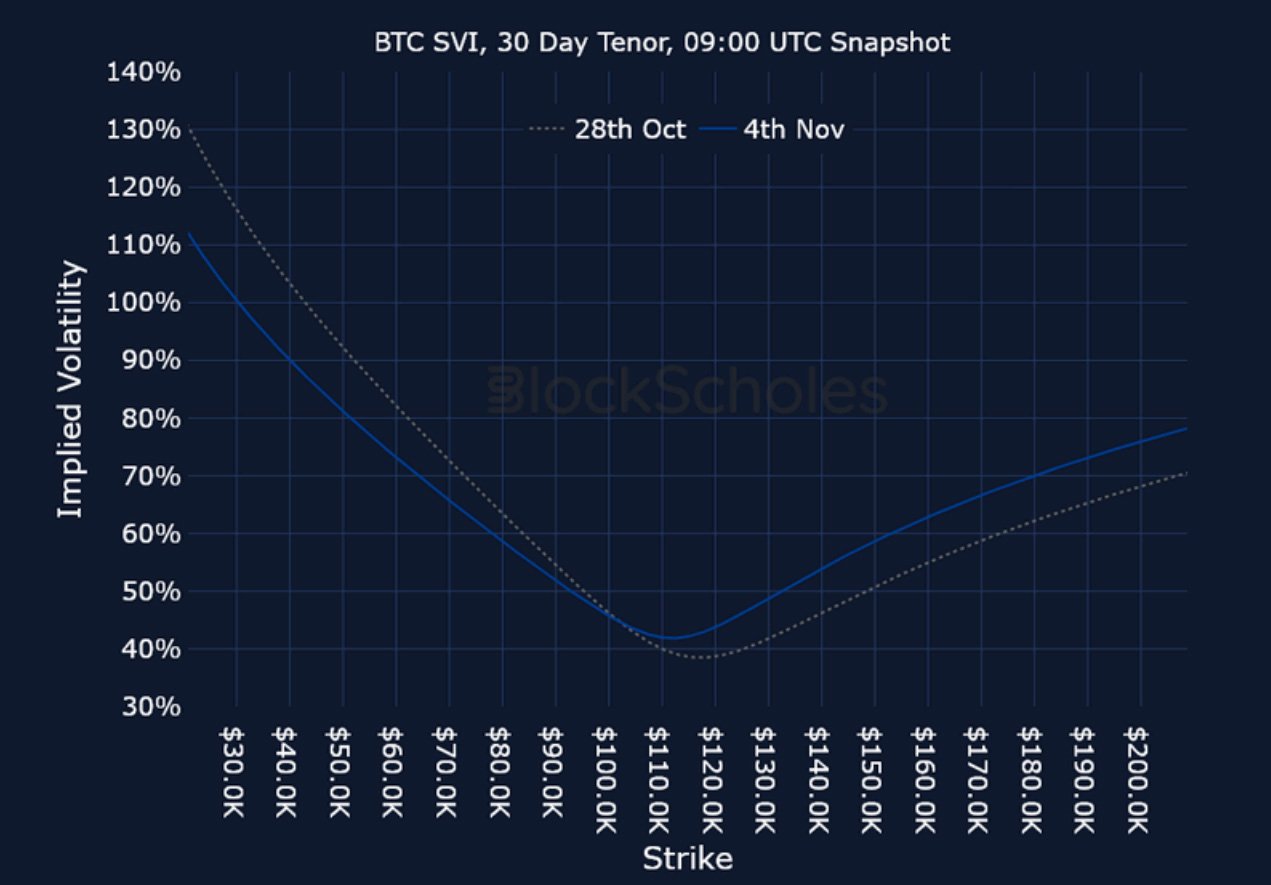

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

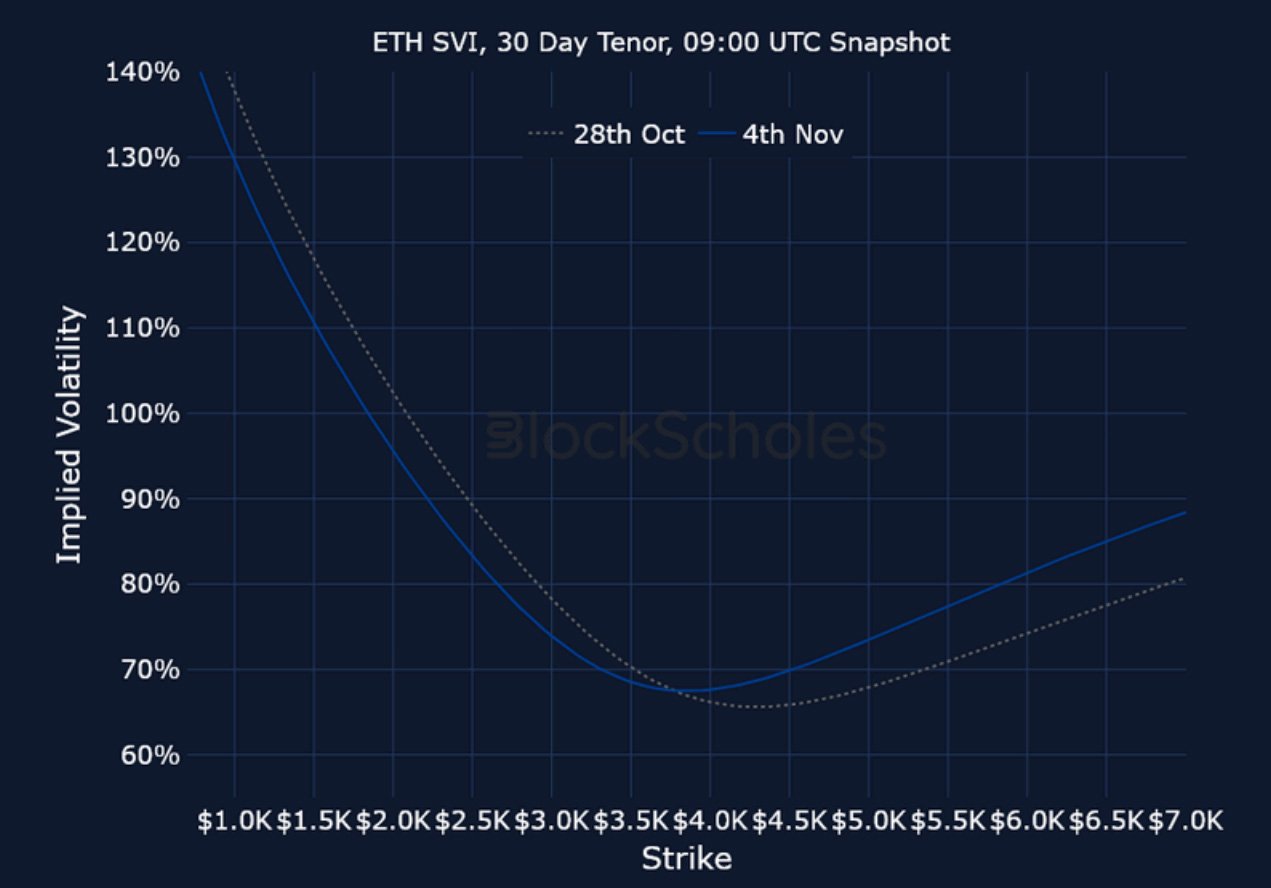

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)