Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

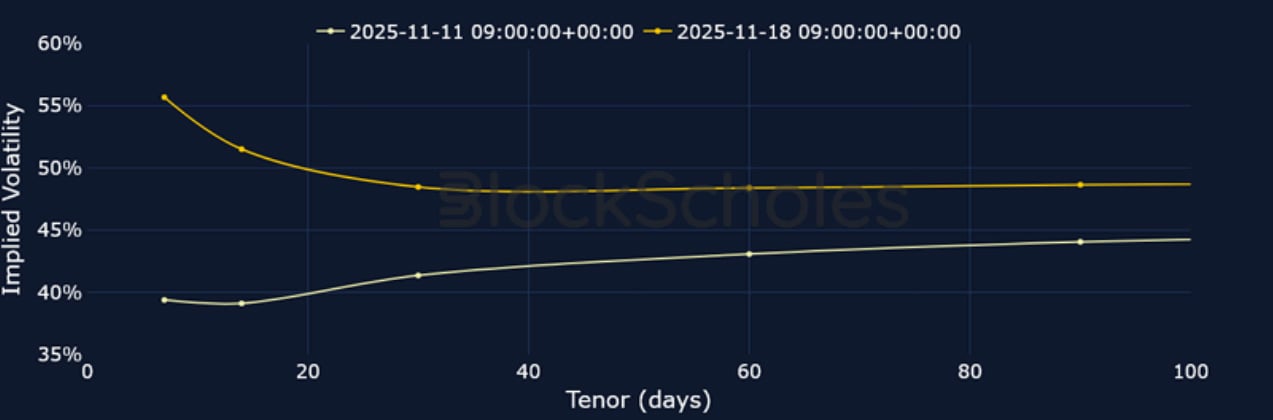

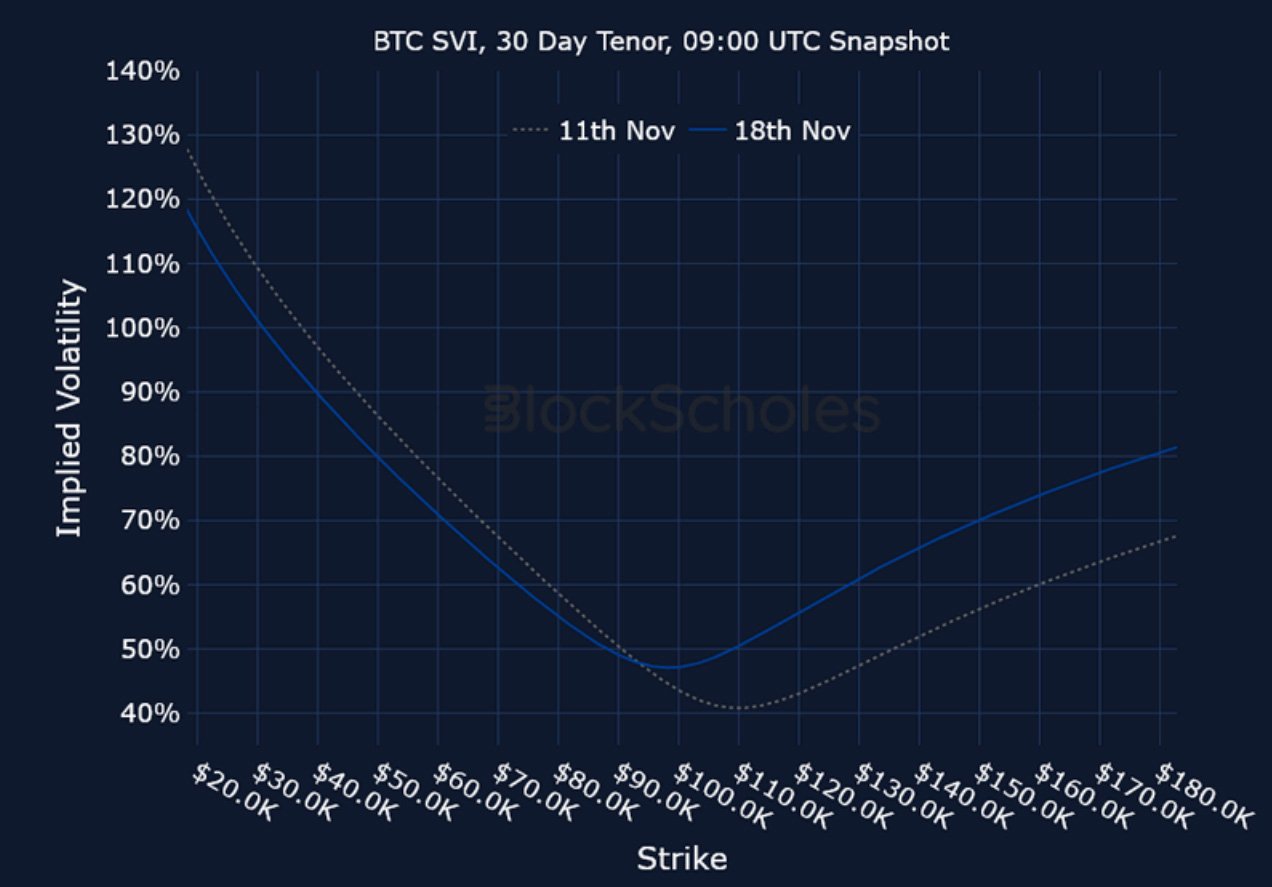

The past week has seen BTC hit a slew of new lows, with derivatives markets continuing to bet that the slide is far from finished. On Nov 14, 2025, BTC fell below $97K for the first time since early May 2025. That then extended to $93K – a level that meant BTC had erased all of its year-to-date gains – and then $89K. While the drop in crypto asset prices is part of a broader risk-off move amidst growing speculation over a potential AI bubble and Fed talk indicating a possible December rate pause, it is nonetheless crypto tokens that have been hit the hardest. As a result, implied volatility levels in both BTC and ETH options remain elevated, while volatility smiles have maintained a persistent skew towards downside protection. For ETH, the expectation of elevated volatility, particularly in the short-term, has meant an inverted term structure of volatility that has shown little signs of abating. In another sign of bearish sentiment, short-dated BTC and ETH exposure in futures markets show futures prices trading below spot prices, indicating that markets are willing to accept a lower price when shorting compared to the spot price.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

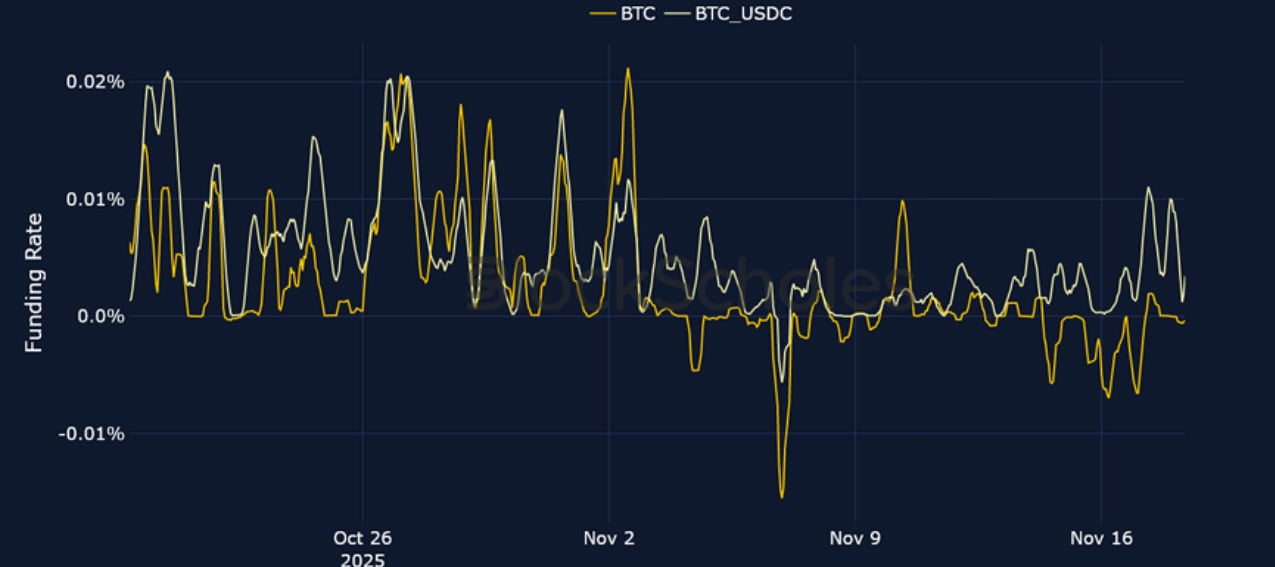

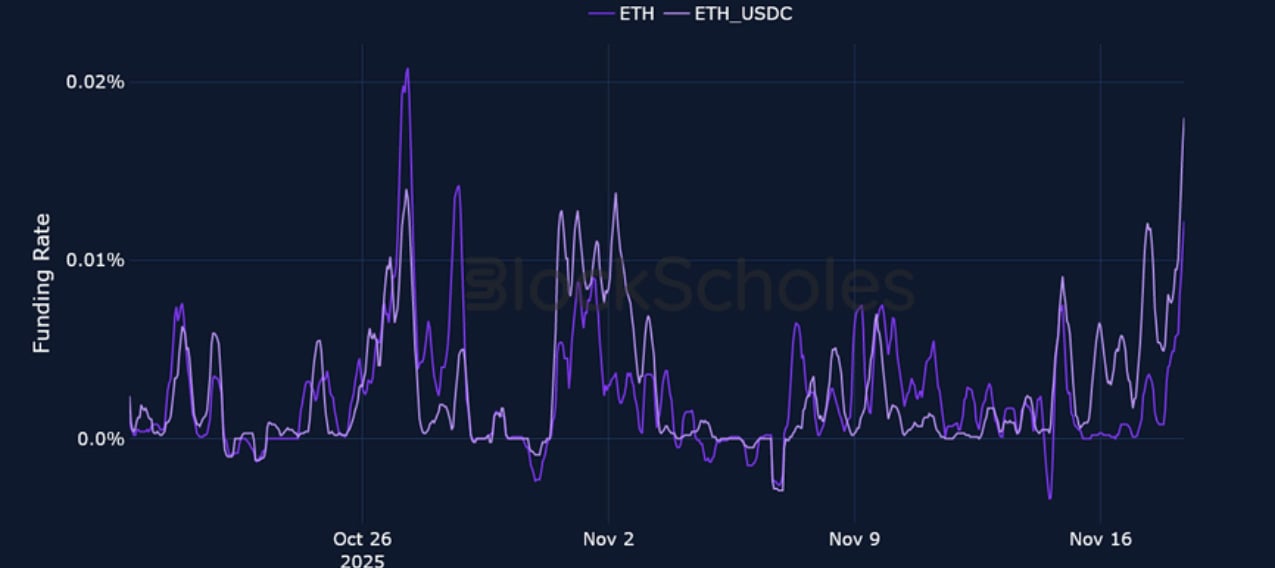

Perpetual Swap Funding Rate

BTC FUNDING RATE – While Deribit’s inverse BTC contract has persistently traded with a negative funding rate, the linear contract (USDC) shows some signs of traders willing to take bullish bets.

ETH FUNDING RATE – Despite trading 38% below ATH levels, funding rates in ETH contracts show a bullish picture, in stark contrast to its options markets.

Futures Implied Yields

BTC Futures Implied Yields – Short-dated BTC futures (7-day) trade below spot price, suggesting a strong demand for short positions.

ETH Futures Implied Yields – Short-dated ETH exposure also shows futures prices below spot, though not to the same bearish degree as seen in BTC.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Multiple drops below $100K and a year- to-date wipe out of gains has set the stage for an inverted vol term structure.

BTC 25-Delta Risk Reversal – Traders are not quite willing to bet that the most recent drop to $89K marks the local floor as skew is firmly towards puts.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – As we expect, ETH options have reacted more sensitively to the selloff, with short-dated IV surging past 80%.

ETH 25-Delta Risk Reversal – The lack of a meaningful spot recovery means vol smiles are skewed towards puts at all short-to-mid dated tenors.

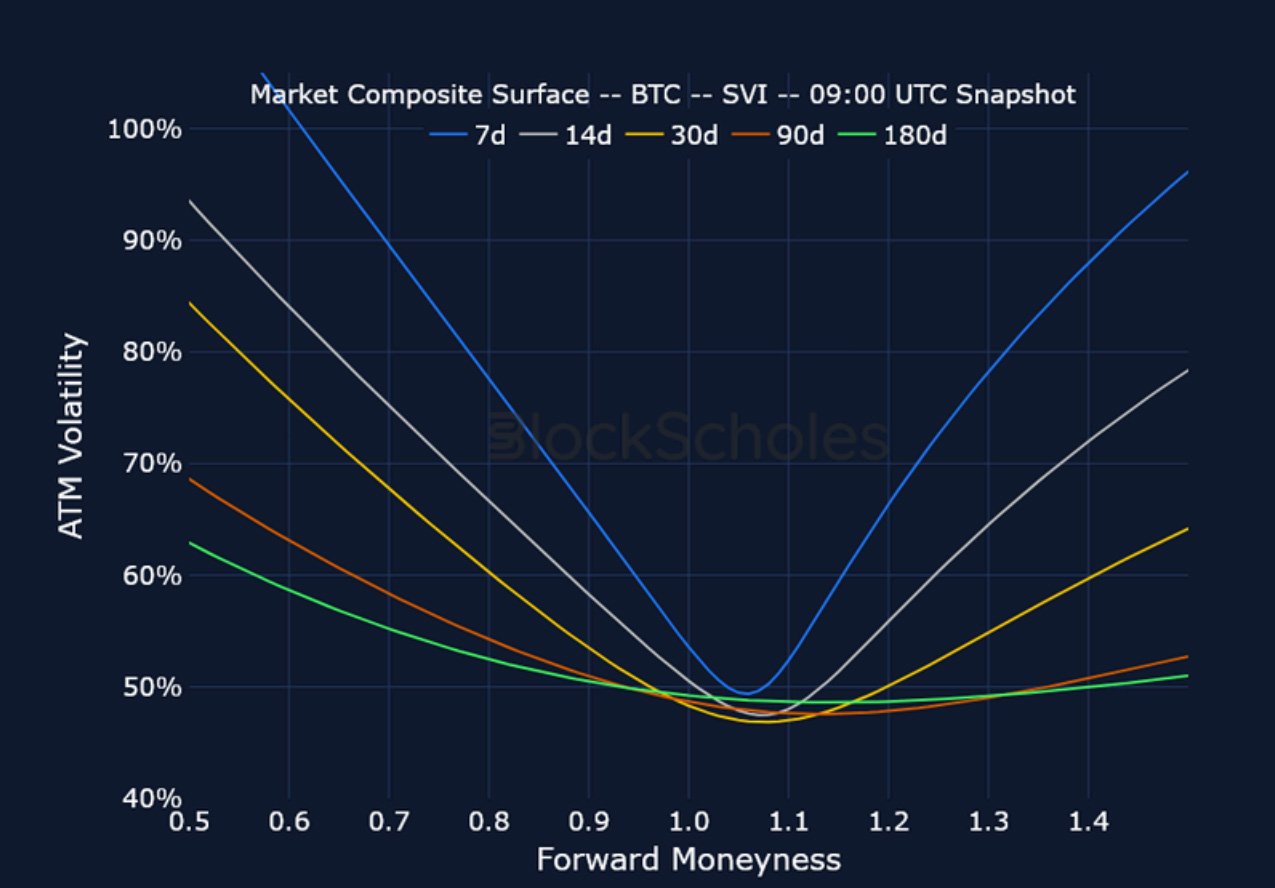

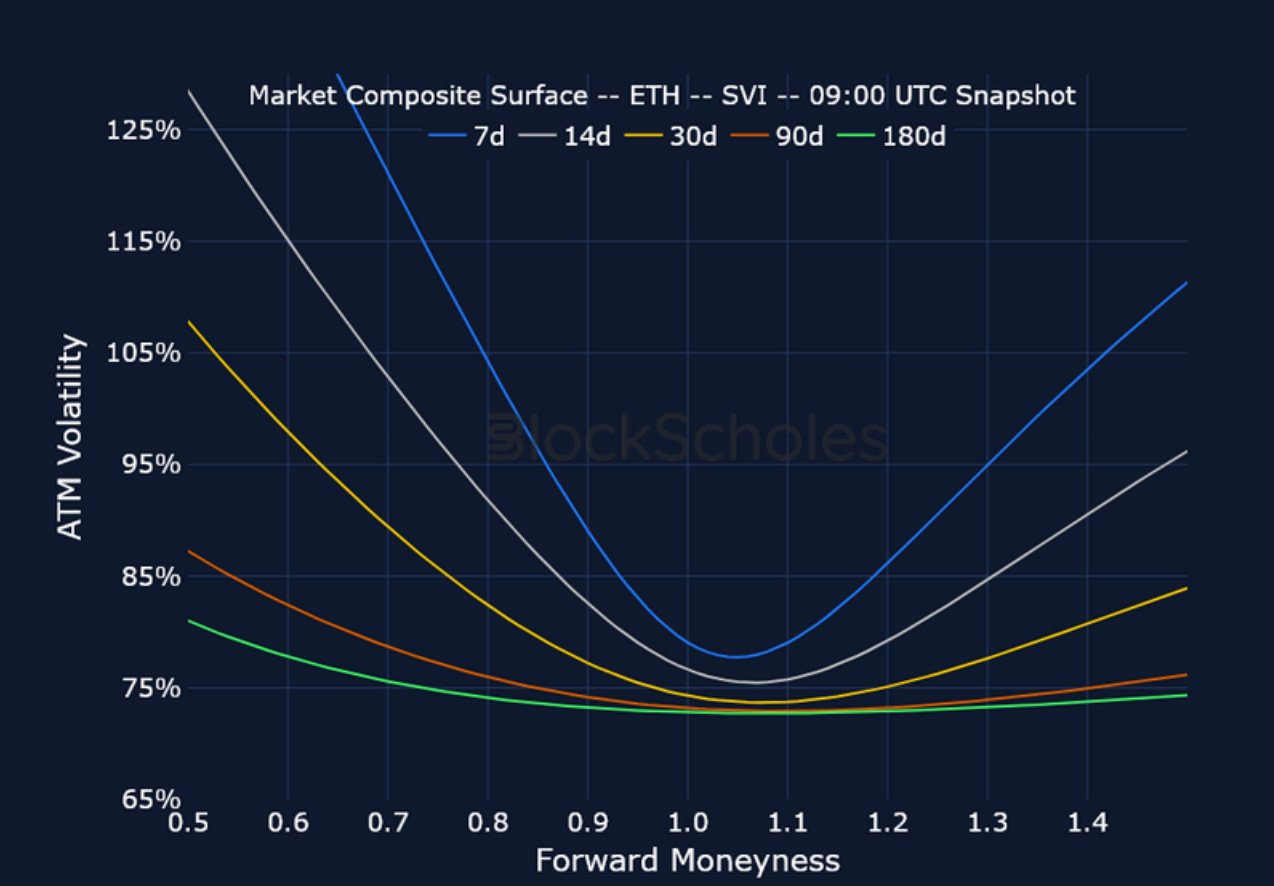

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

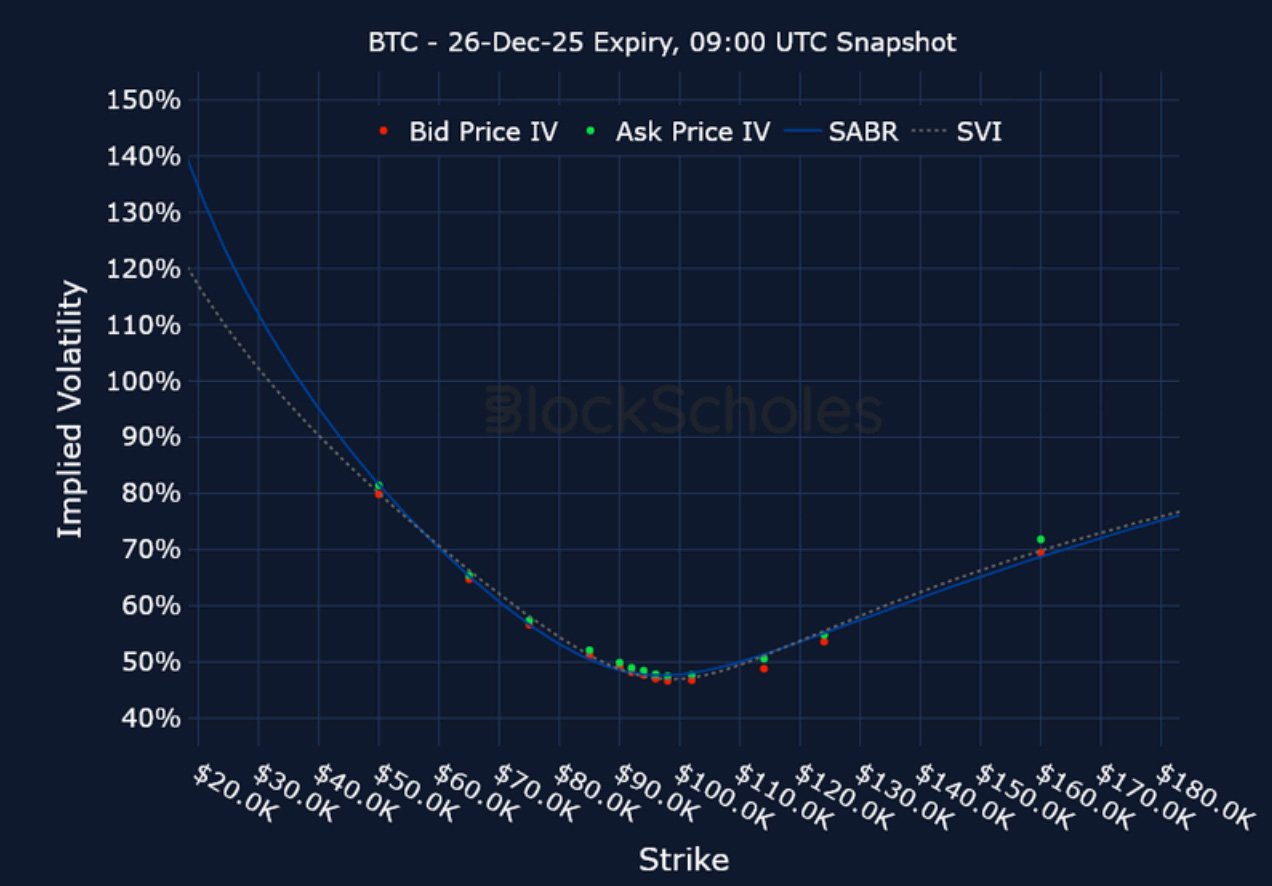

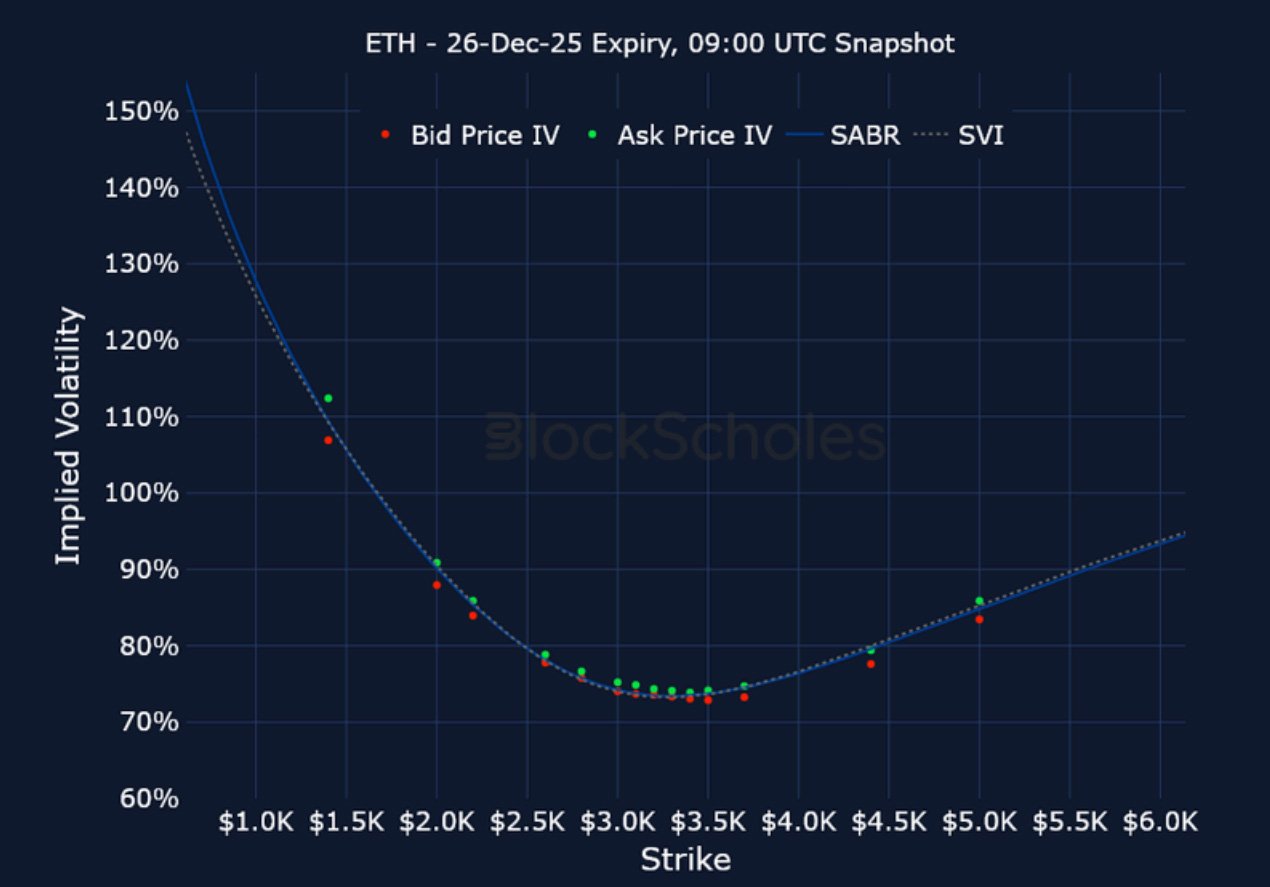

Listed Expiry Volatility Smiles

BTC 26-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 26-DEC EXPIRY – 9:00 UTC Snapshot.

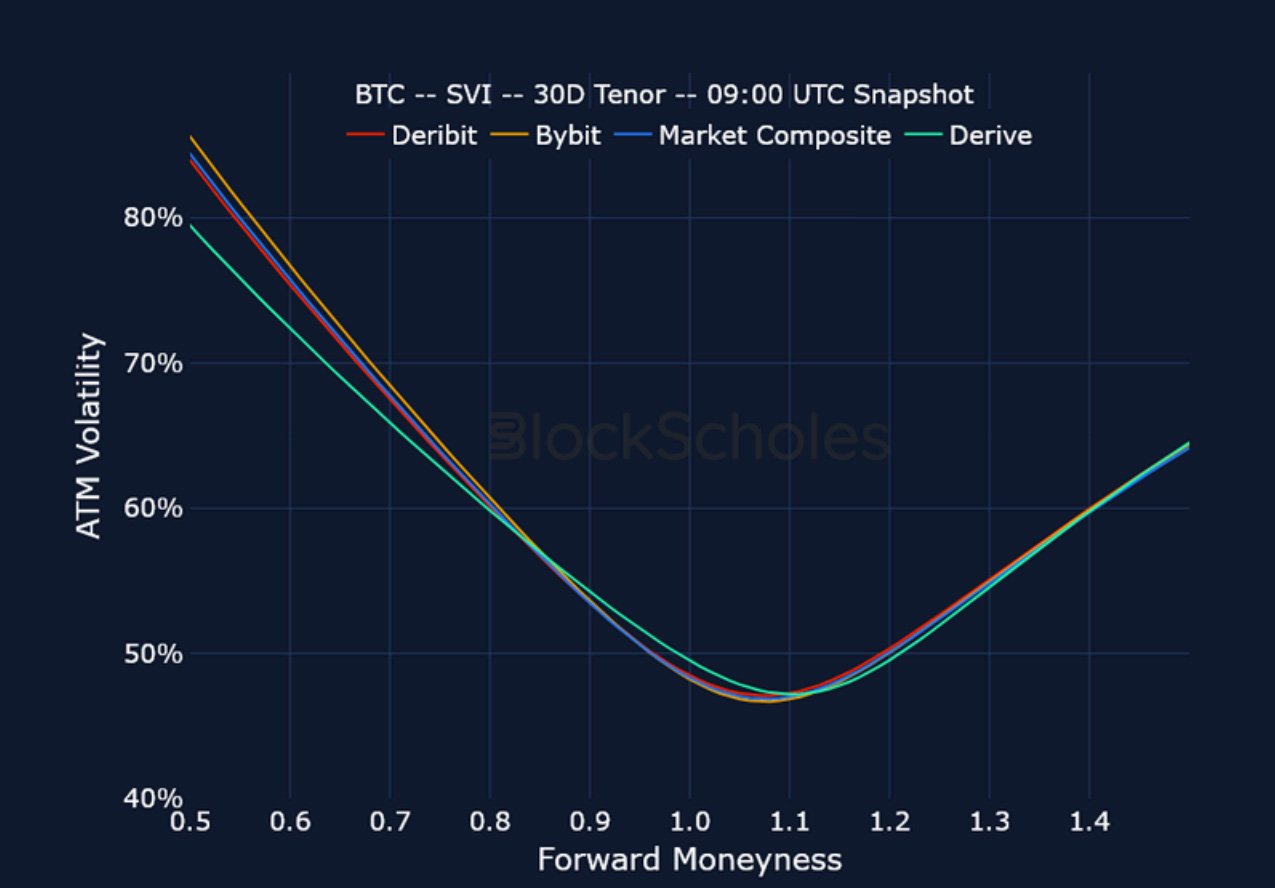

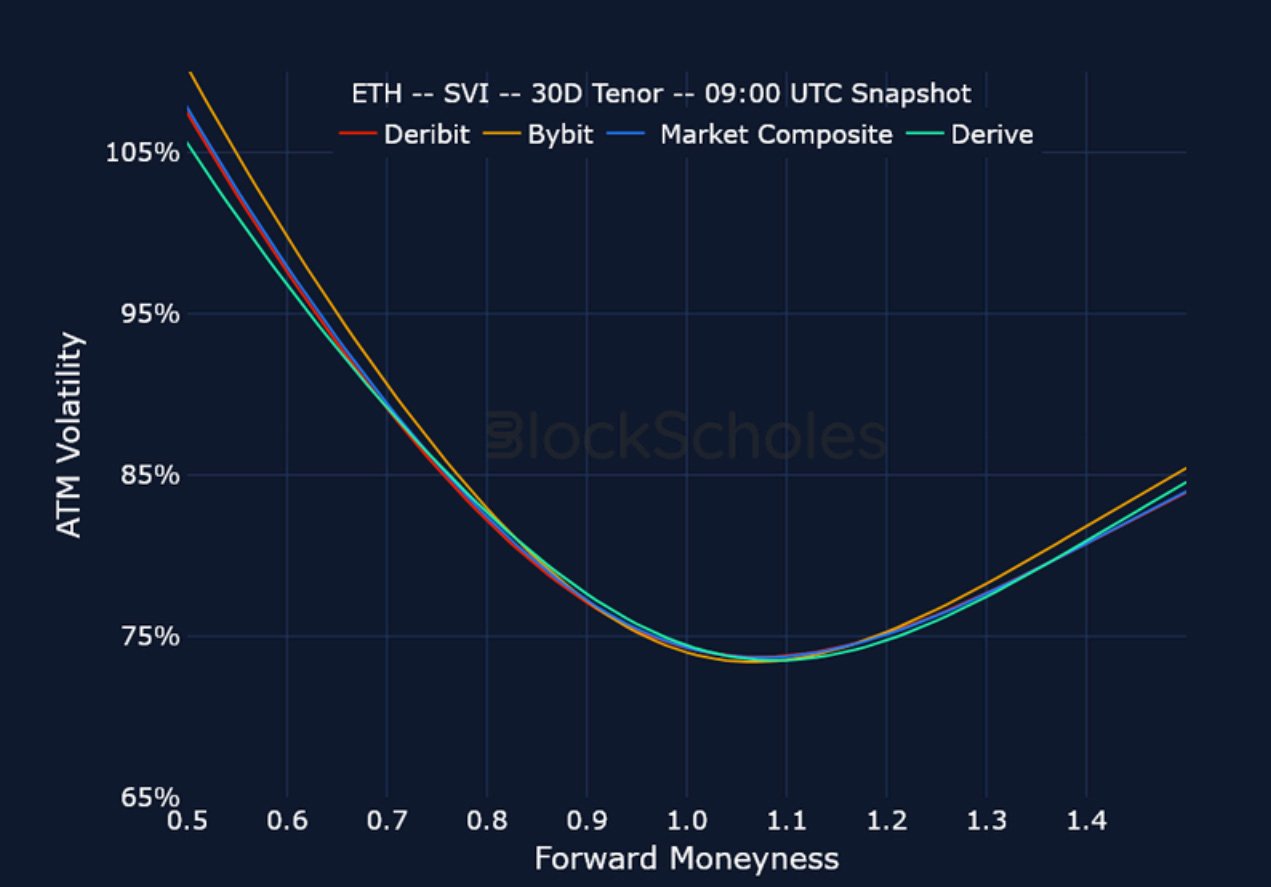

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)