Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

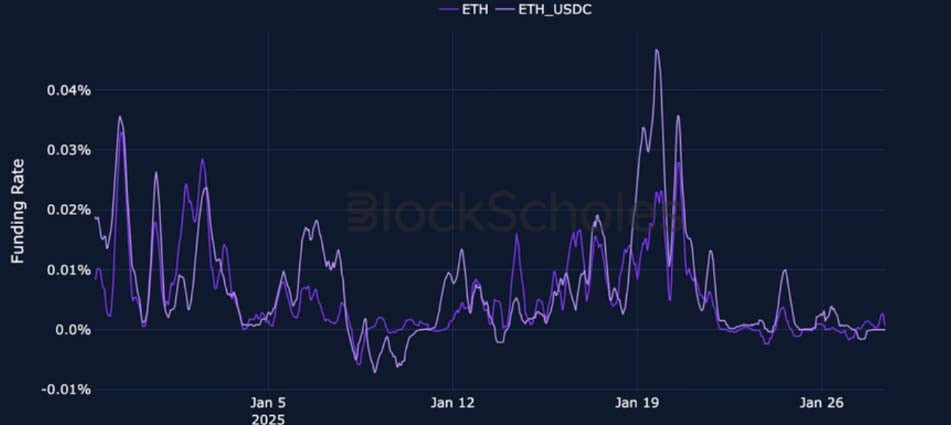

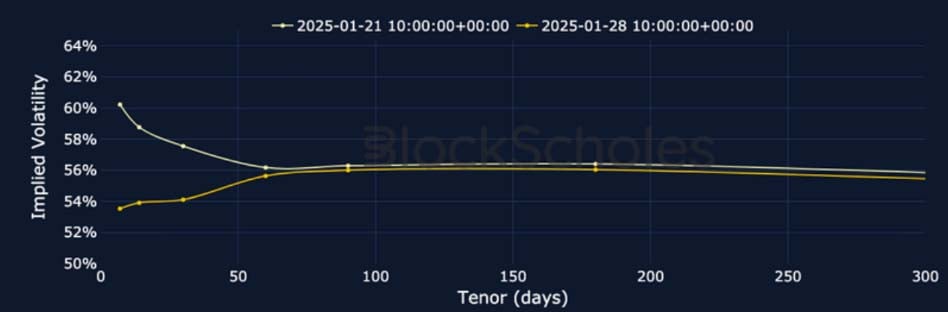

A revisit of sub-$100K levels for BTC has seen a miniature repeat of the pre-inauguration inversion of the term structure of at-the-money implied volatility. Despite the overnight recovery in crypto-assets, the move has left its mark on derivatives markets as volatility smiles retain their skew towards OTM puts. Longer-dated smiles, however, remain bullishly call-skewed as they have for much of the last month. ETH’s continued outperformance in spot relative to BTC (BTC / ETH has reported a return of +15.15% in 2025) is reflected in futures markets, by a lower basis, and in perpetual swaps, by an occasionally negative funding rate. However, short-tenor volatility smiles indicate a comparably bearish skew towards OTM puts in both assets.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

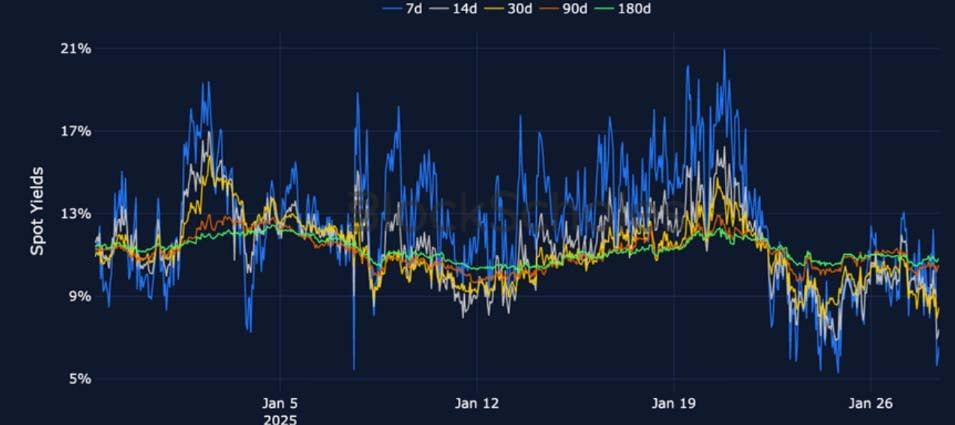

BTC ANNUALISED YIELDS – Futures yields trade at their lowest levels in over a month on the back of the pullback in spot.

ETH ANNUALISED YIELDS – ETH’s yields trade significantly below BTC’s, steepening strongly at the front end of the term structure.

Perpetual Swap Funding Rate

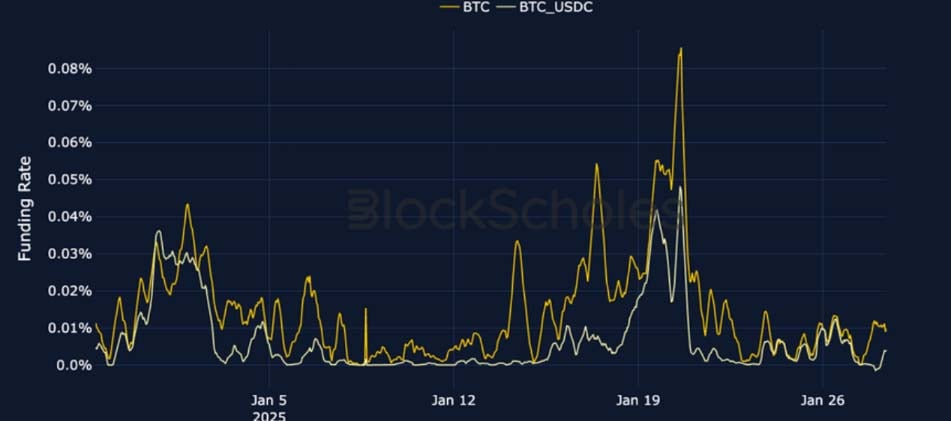

BTC FUNDING RATE – Despite the revisit below $100K, BTC’s funding rates have remained positive throughout at lower levels.

ETH FUNDING RATE – The relative behaviour in futures has been echoed by ETH’s funding rate, with an occasionally negative rate over the past month.

BTC Options

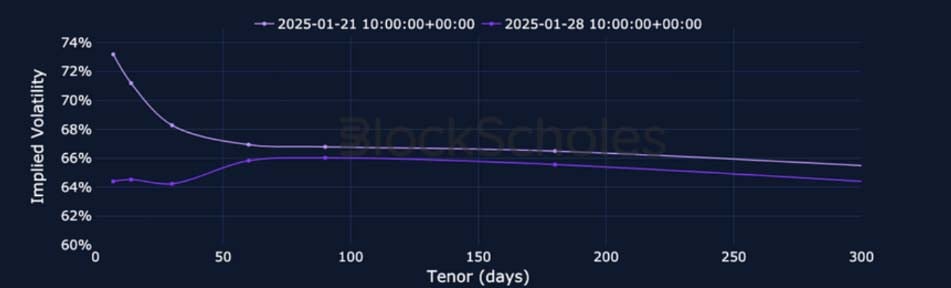

BTC SVI ATM IMPLIED VOLATILITY – Despite performing a miniature repeat of the inauguration inversion, the term structure is now flat.

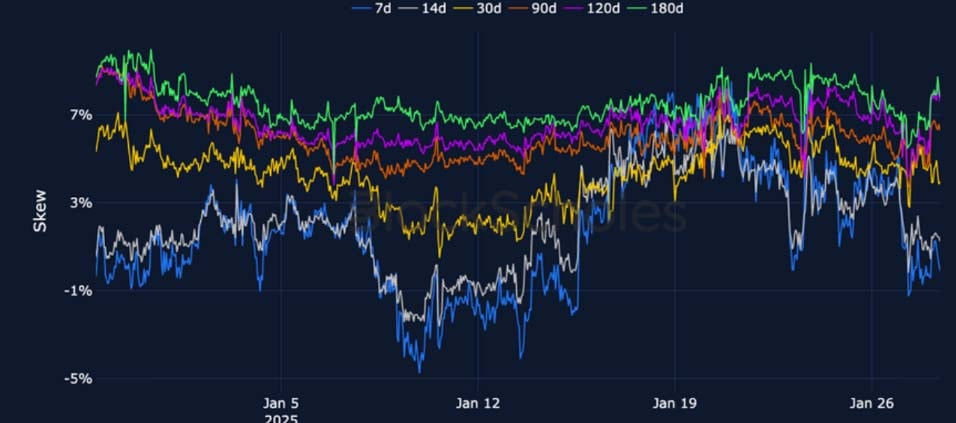

BTC 25-Delta Risk Reversal – Short-tenor smiles are skewed back towards OTM puts while longer-dated smiles retain a strong bullish tilt.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure has re-inverted and re-flattened on the back of the spot selloff and recovery.

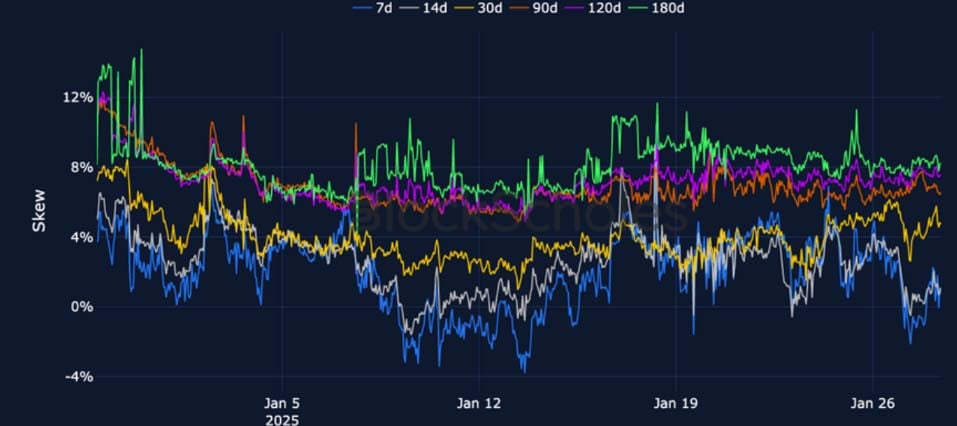

ETH 25-Delta Risk Reversal – Despite futures and funding rates suggesting otherwise, ETH’s short-tenor skews are not far more bearish than BTC’s.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

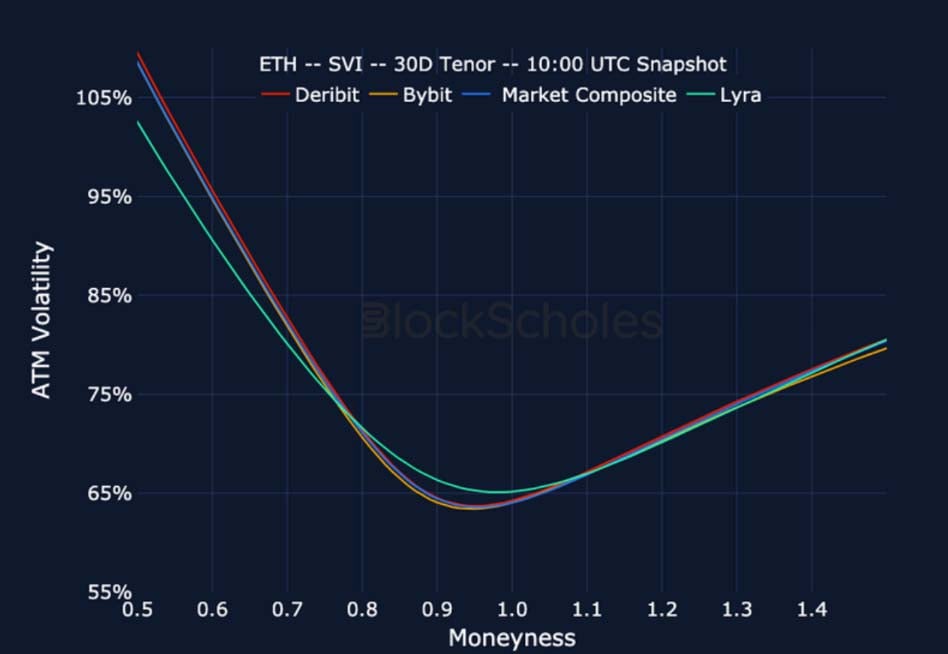

ETH, 1-MONTH TENOR, SVI CALIBRATION

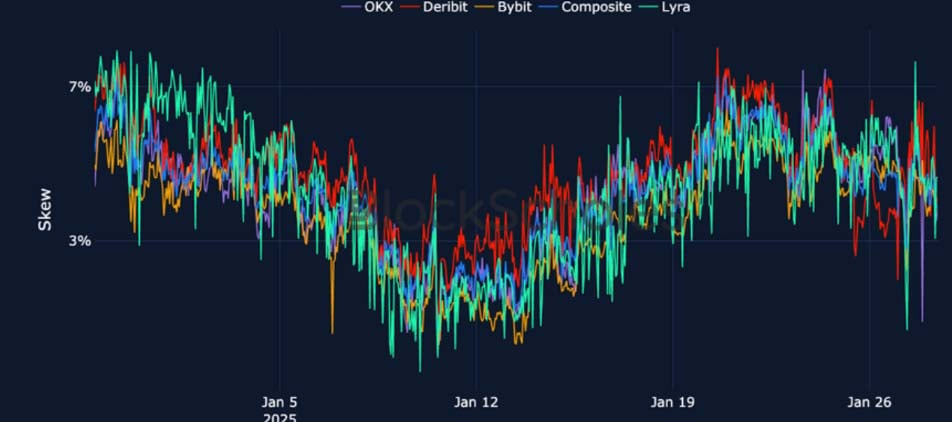

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

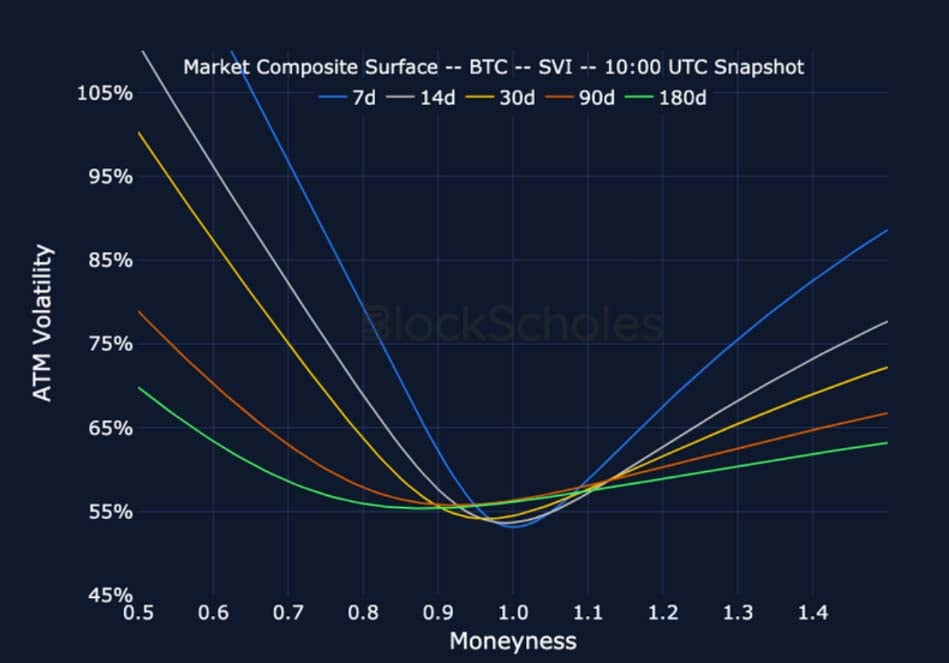

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

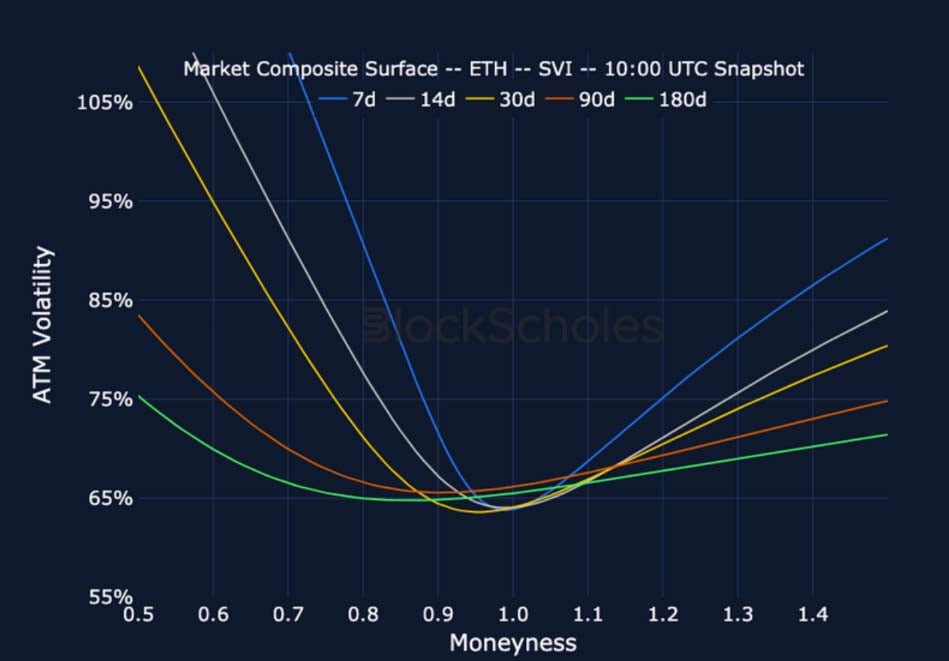

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

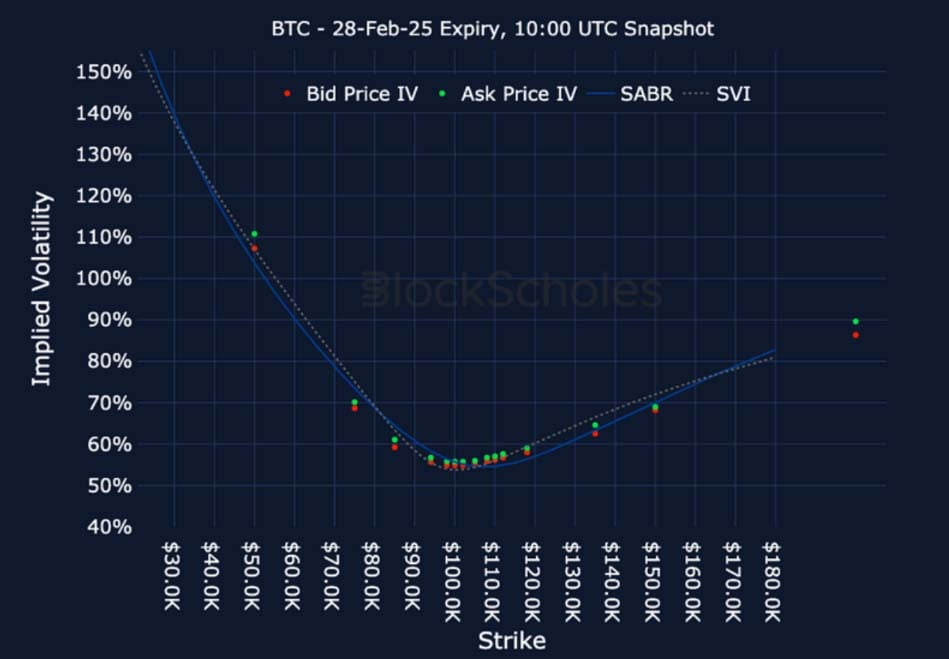

Listed Expiry Volatility Smiles

BTC 28-FEB EXPIRY – 9:00 UTC Snapshot.

ETH 28-FEB EXPIRY – 9:00 UTC Snapshot.

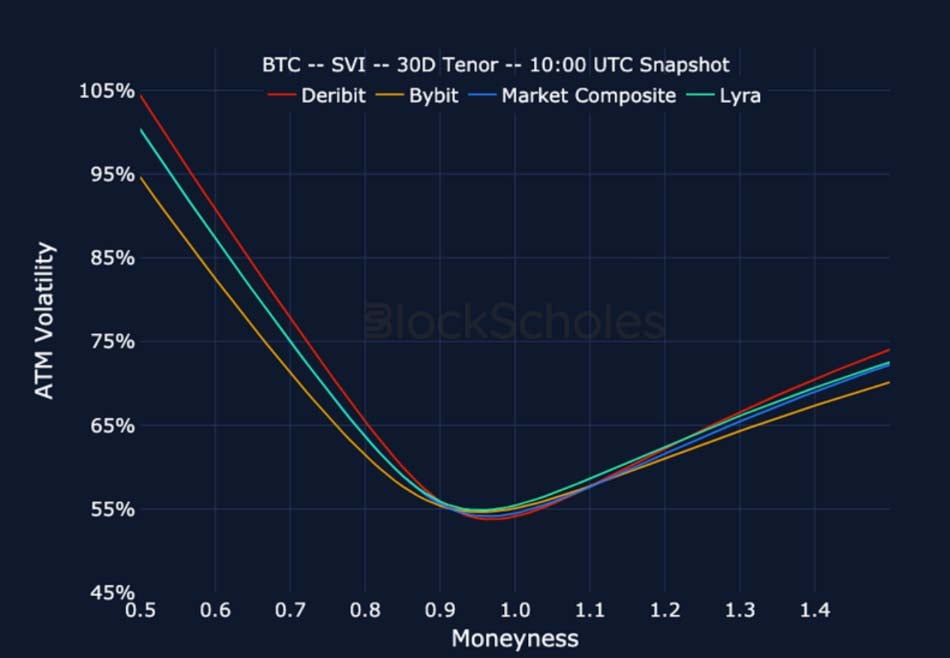

Cross-Exchange Volatility Smiles

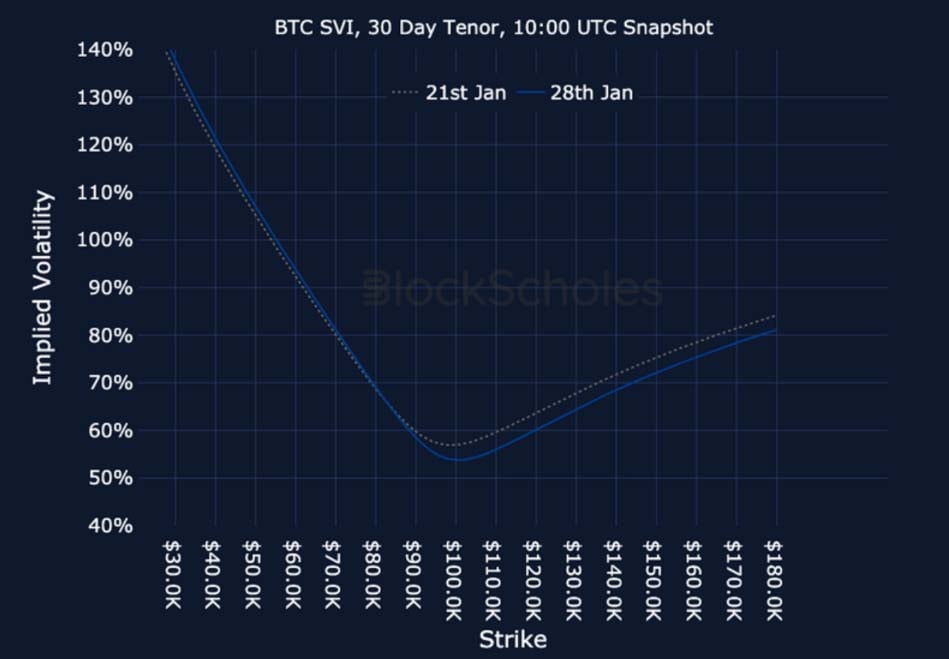

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

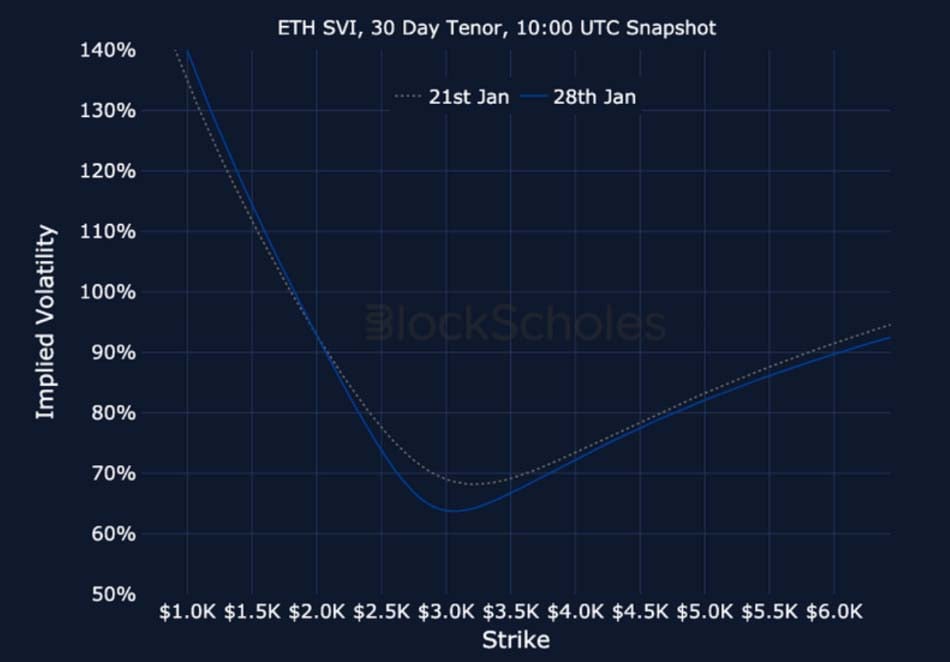

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)