Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

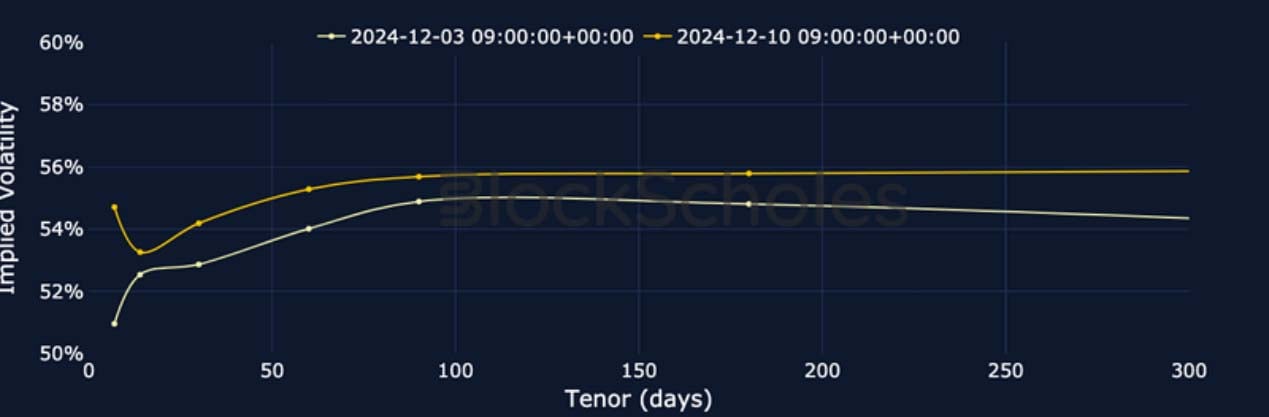

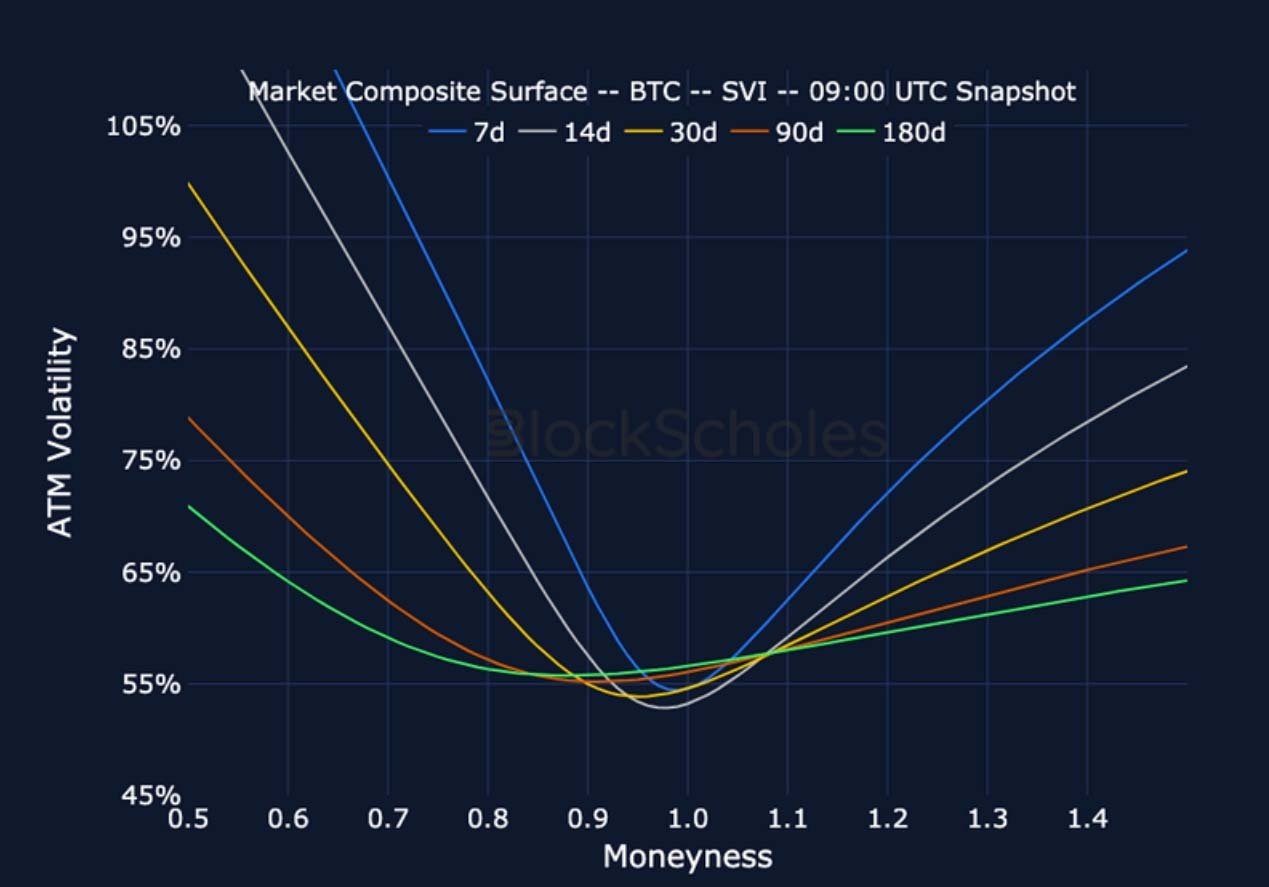

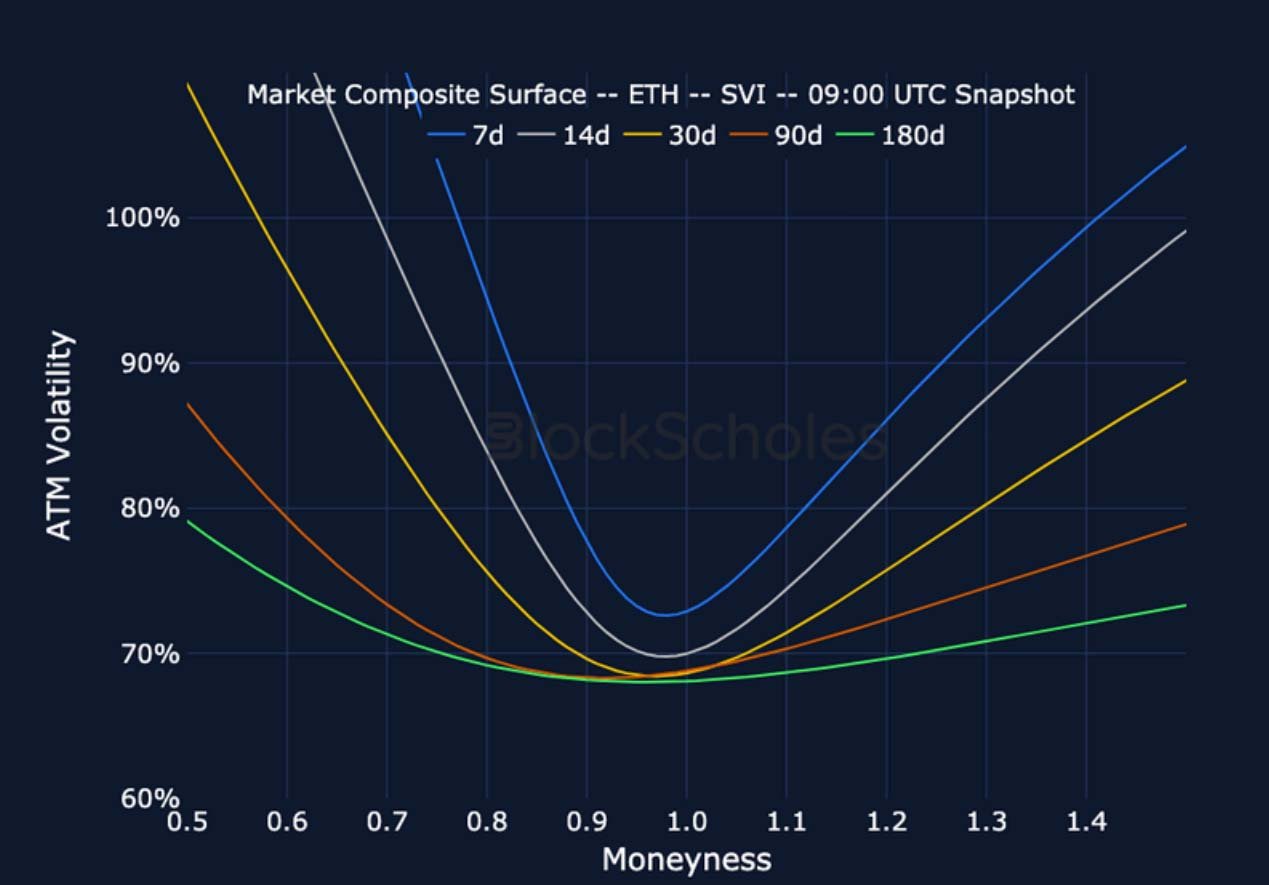

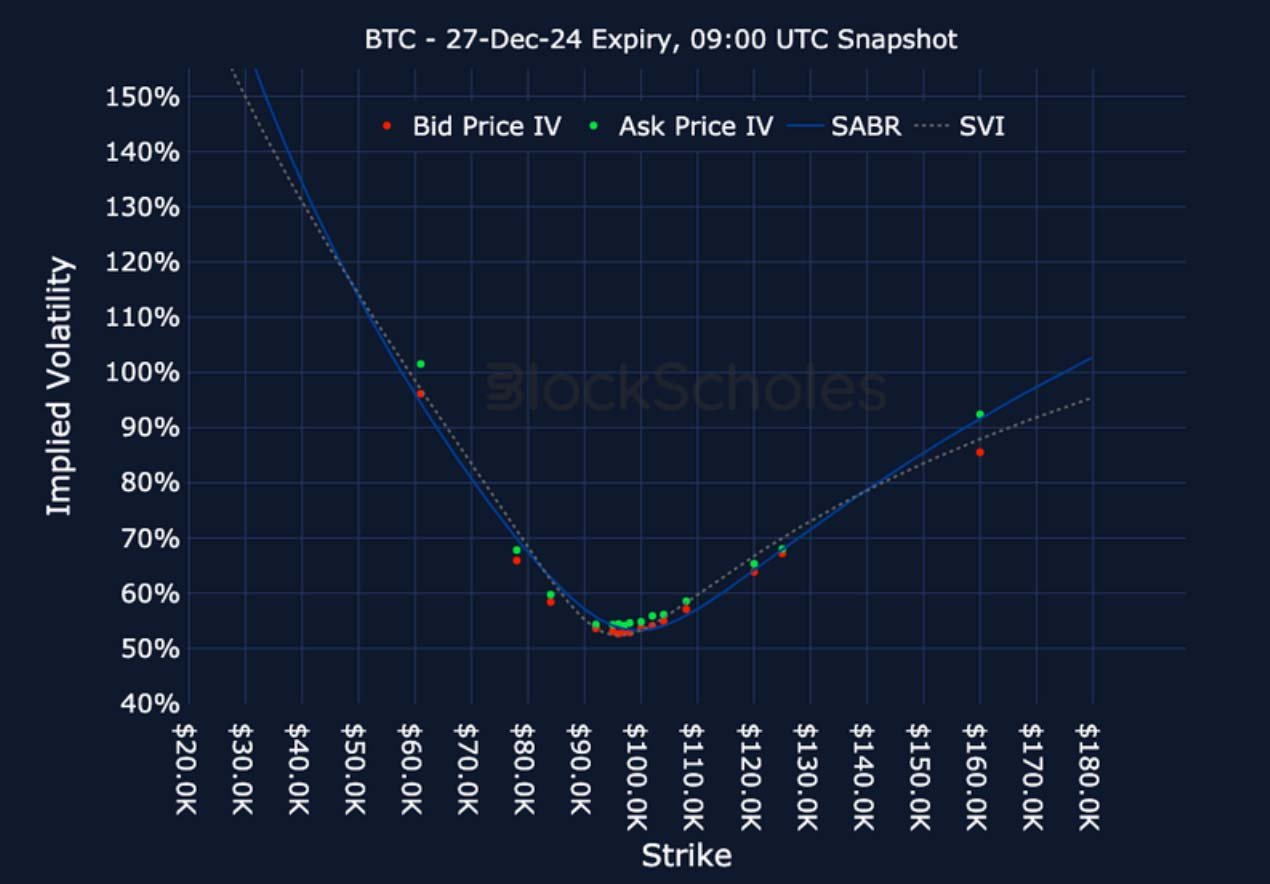

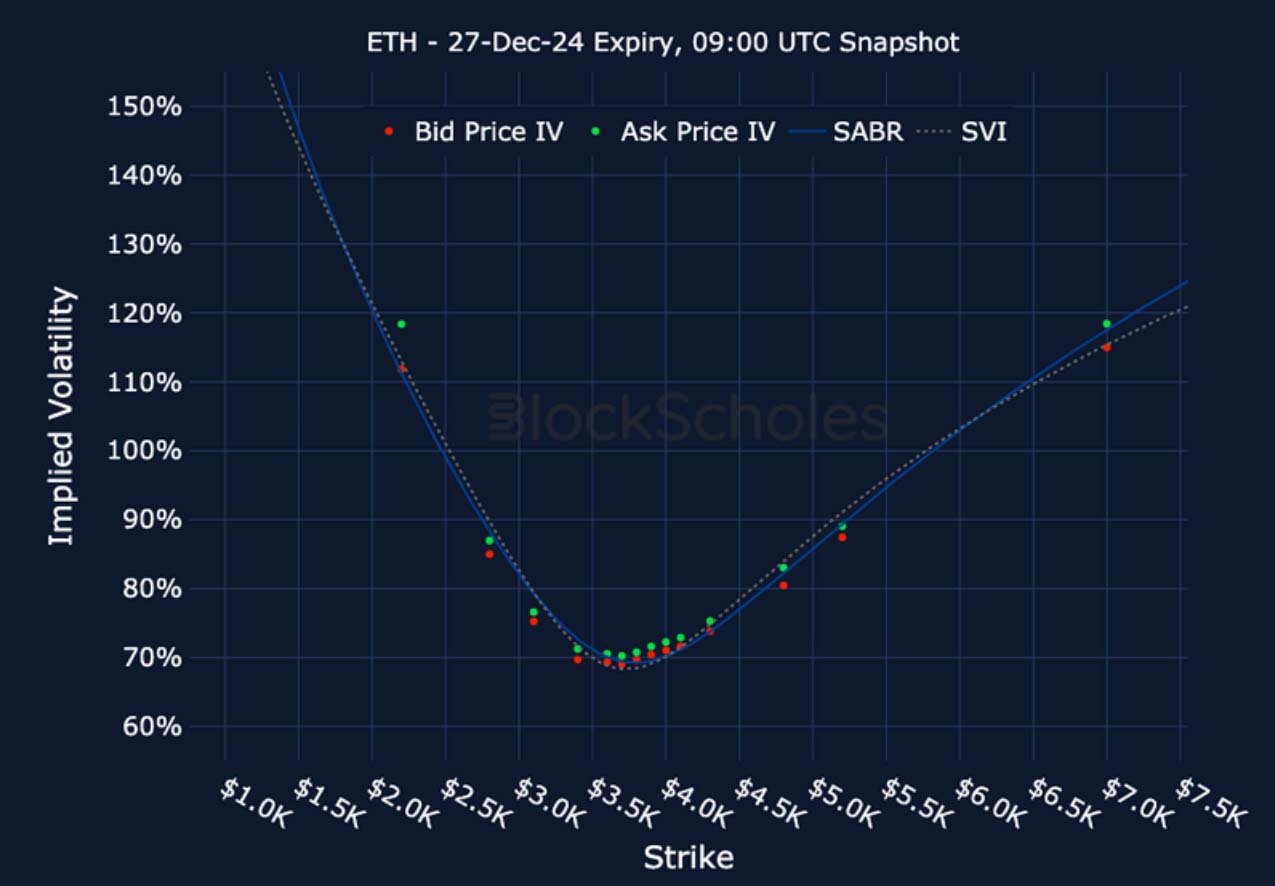

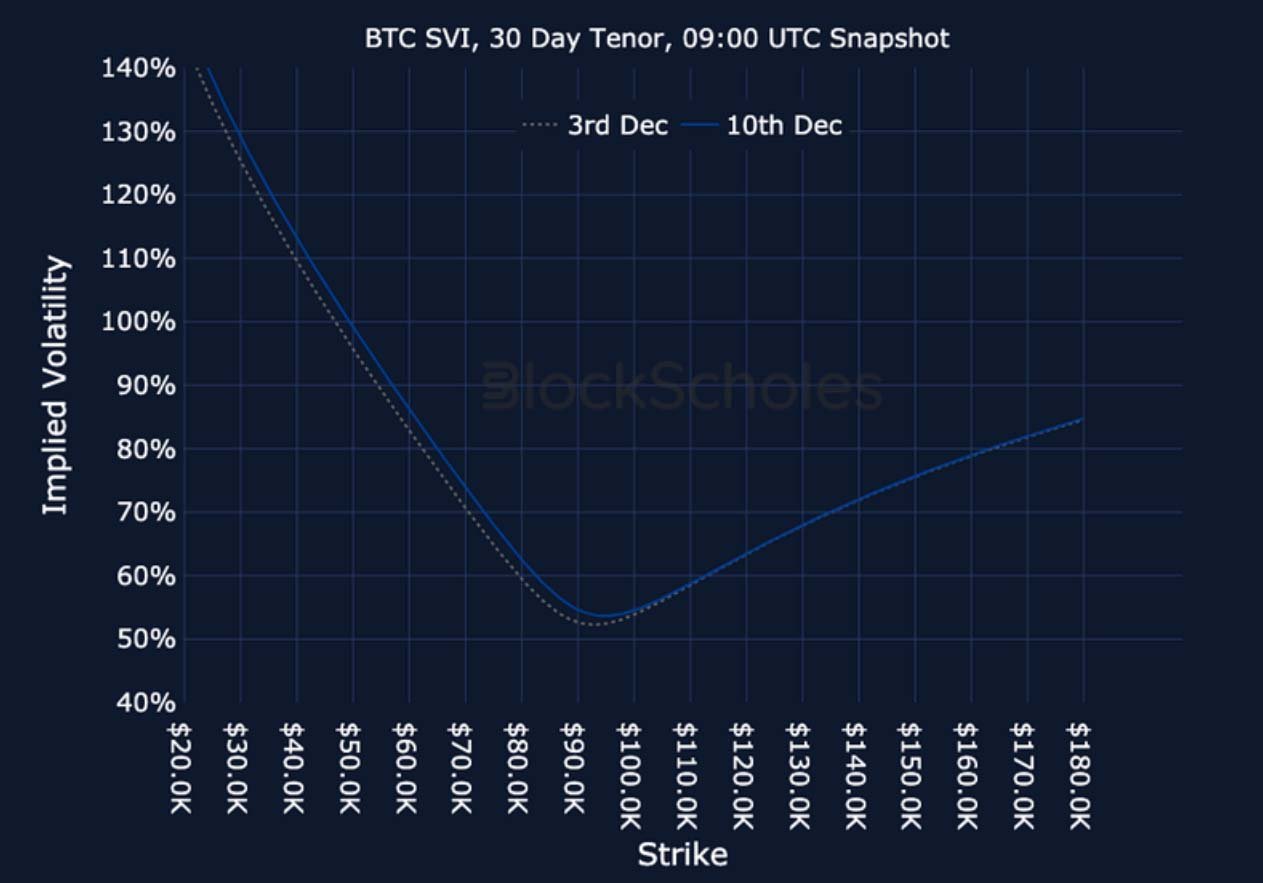

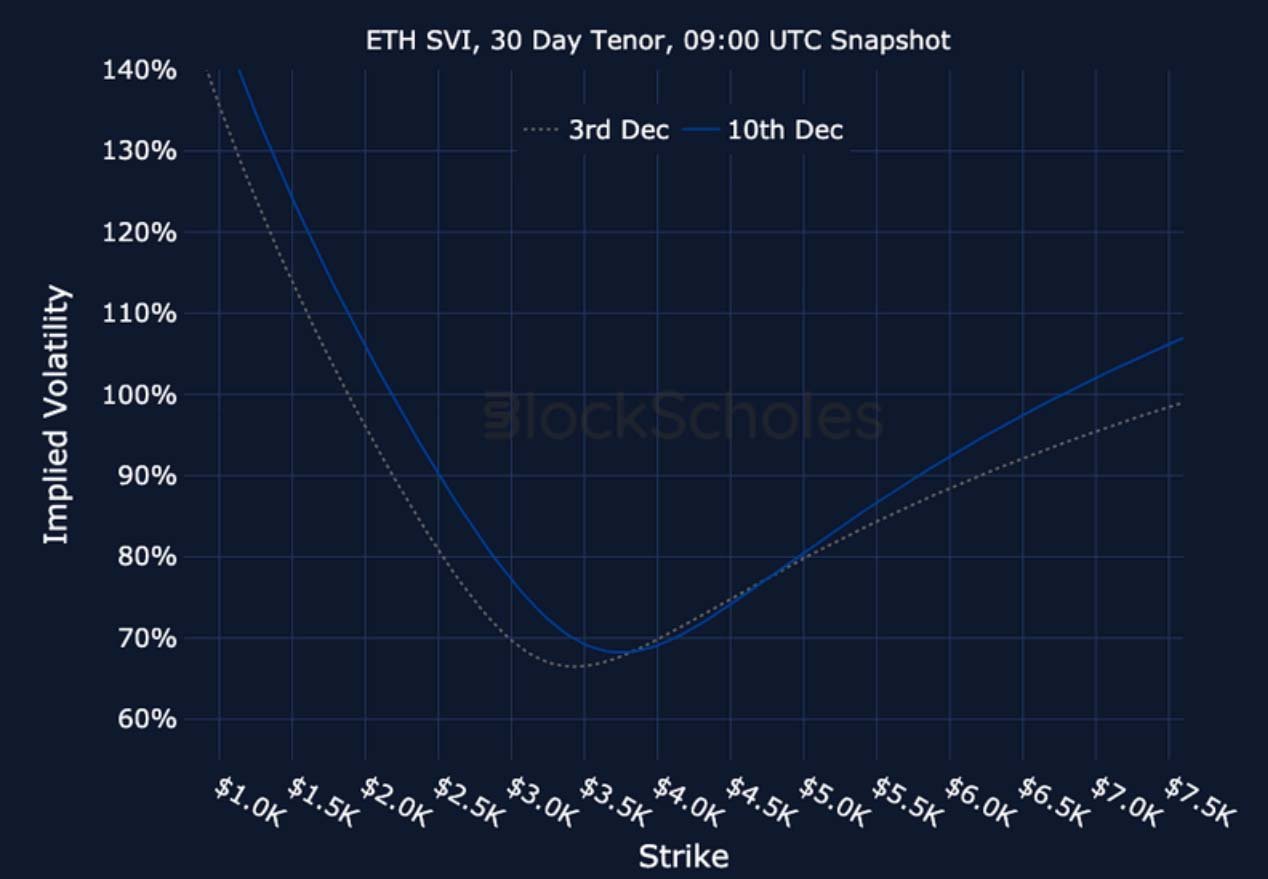

Spot levels retraced once more from the top of their recent range in a move that has seen BTC regain some of the market cap dominance it had leaked over the previous two weeks. BTC’s term structure of at-the-money implied volatility is not as inverted as ETH’s, whose implied volatility levels trade close to 15 vol points higher. Short-dated volatility smiles lost much of the skew towards OTM calls that they had been carrying during the selloff, but neither market reported a significant skew towards OTM puts, nor did we see a significant impact in longer-dated expiries. The relatively resilient sentiment was matched in futures and perpetual swaps markets, which still carry a healthy basis above spot and positive funding rates respectively despite a spate of liquidations that saw a reset in leverage levels earlier this week.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

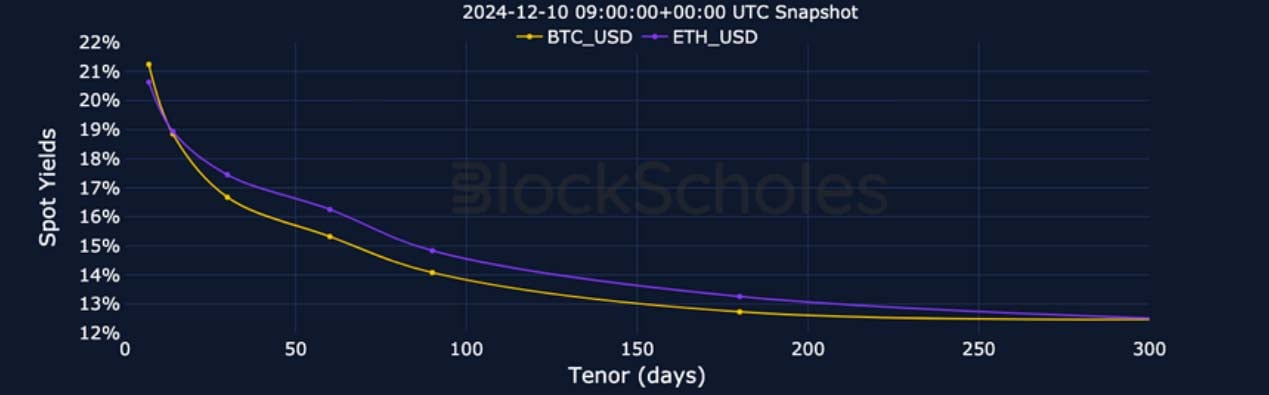

BTC ANNUALISED YIELDS – Longer-dated futures are trading closer to spot while the front-end of the term structure has climbed higher.

ETH ANNUALISED YIELDS – The selloff in spot prices has not dis-inverted ETH’s yield term structure, but merely moderated their levels’ growth higher.

Perpetual Swap Funding Rate

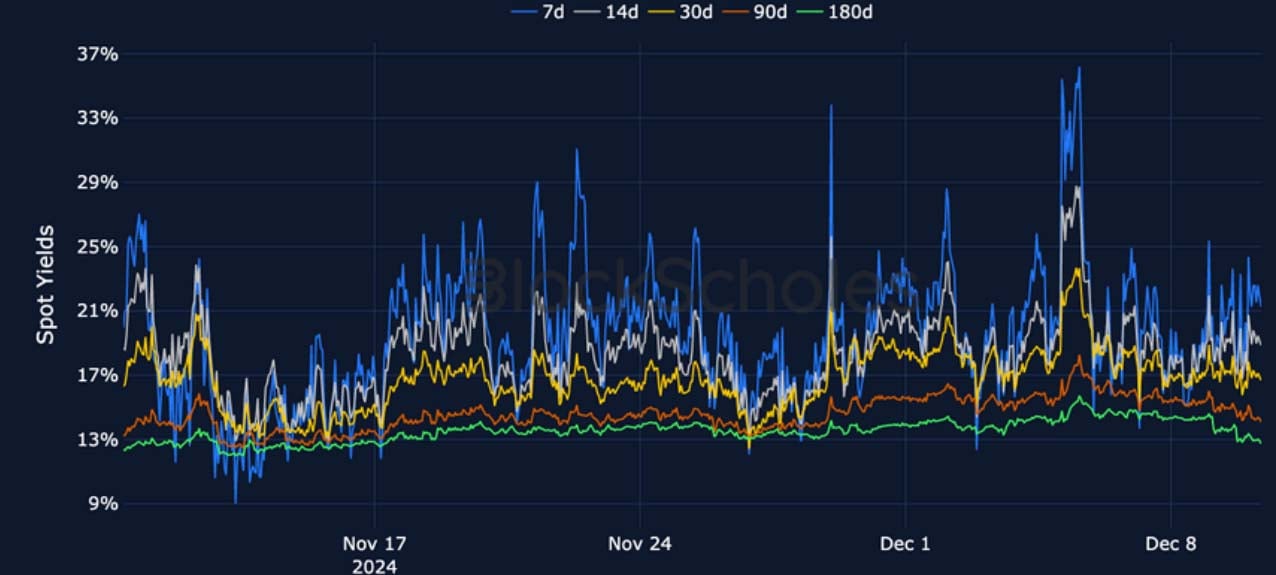

BTC FUNDING RATE – The reset in leverage levels earlier this week has kept funding rates below their exuberant highs, but still at positive levels.

ETH FUNDING RATE – The large reset in BTC funding rates was not as drastic in ETH’s, whose market reports a consistently bullish tilt.

BTC Options

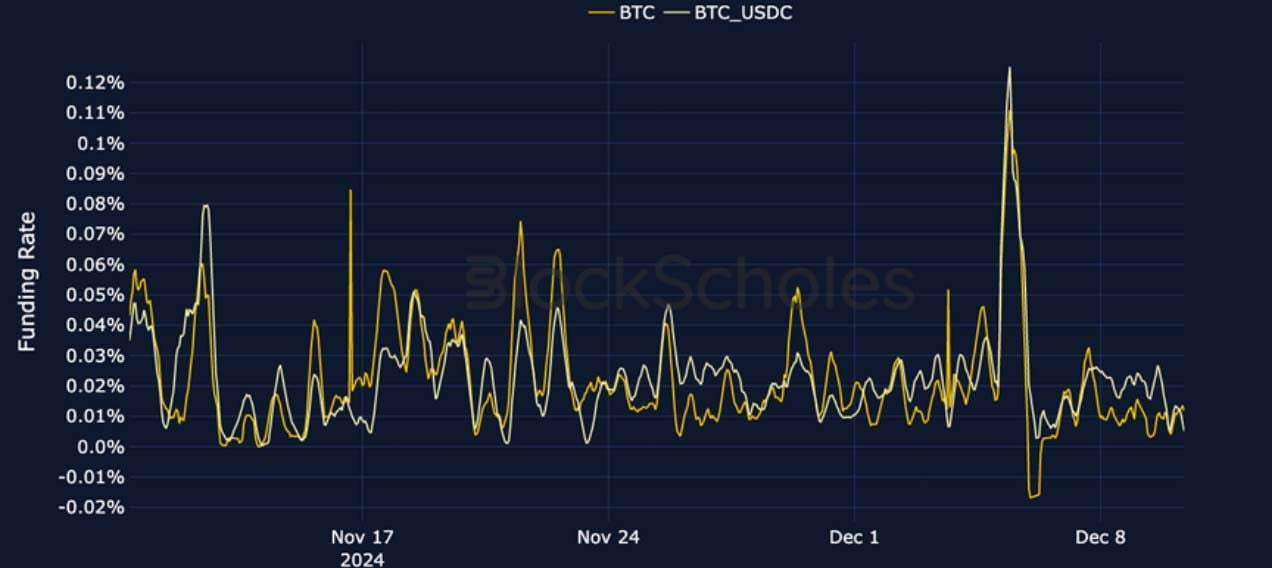

BTC SVI ATM IMPLIED VOLATILITY – BTC’s implied volatility is lower and far less inverted than ETH’s, trading between 50% and 55% at all tenors.

BTC 25-Delta Risk Reversal – Short tenors did not skew towards OTM puts during the selloff, and longer-dated expiries remain bullish.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Short tenor implied volatility continues to trade higher than longer-dated expiries, resulting in a strong inversion.

ETH 25-Delta Risk Reversal – Short tenor skews briefly turned negative during the overnight selloff but quickly recovered.

Volatility by Exchange

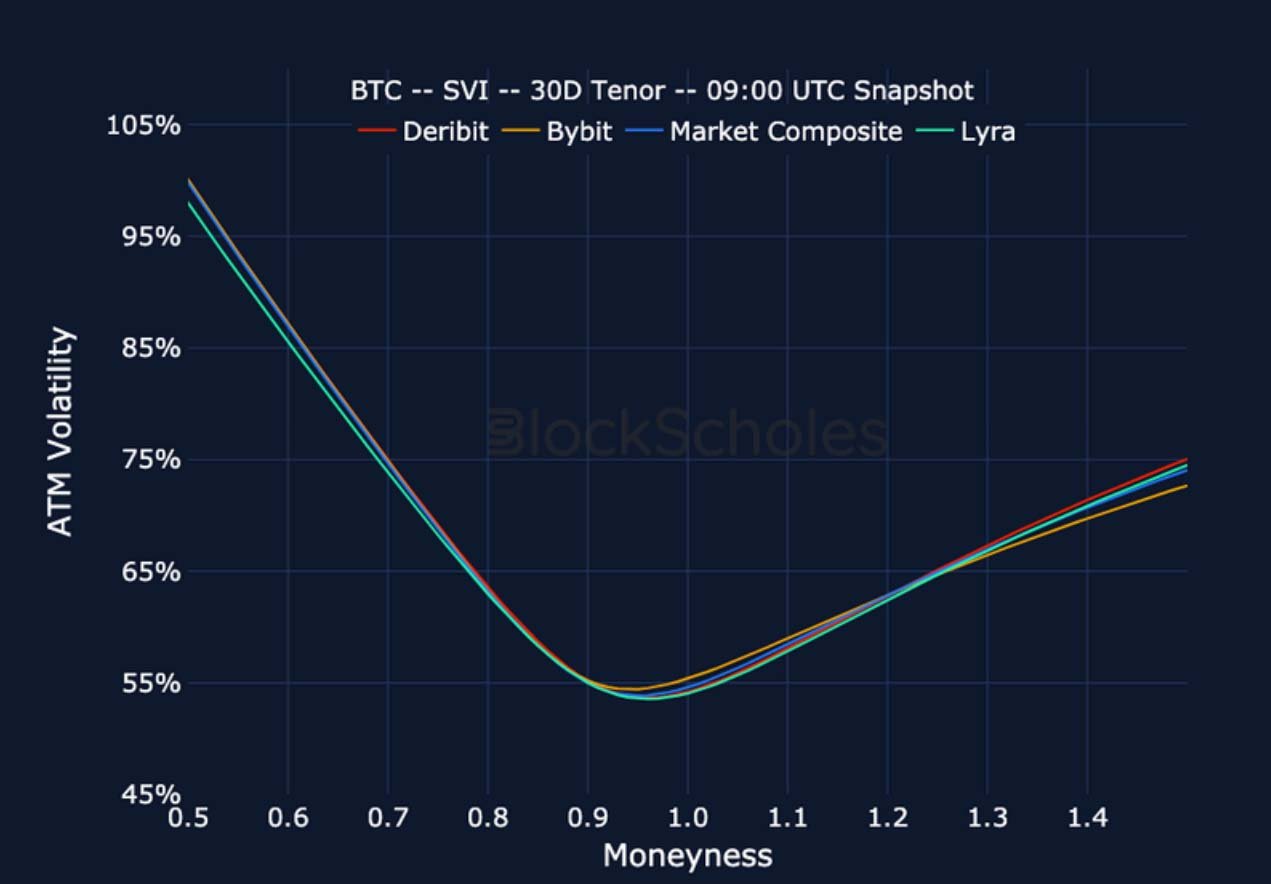

BTC, 1-MONTH TENOR, SVI CALIBRATION

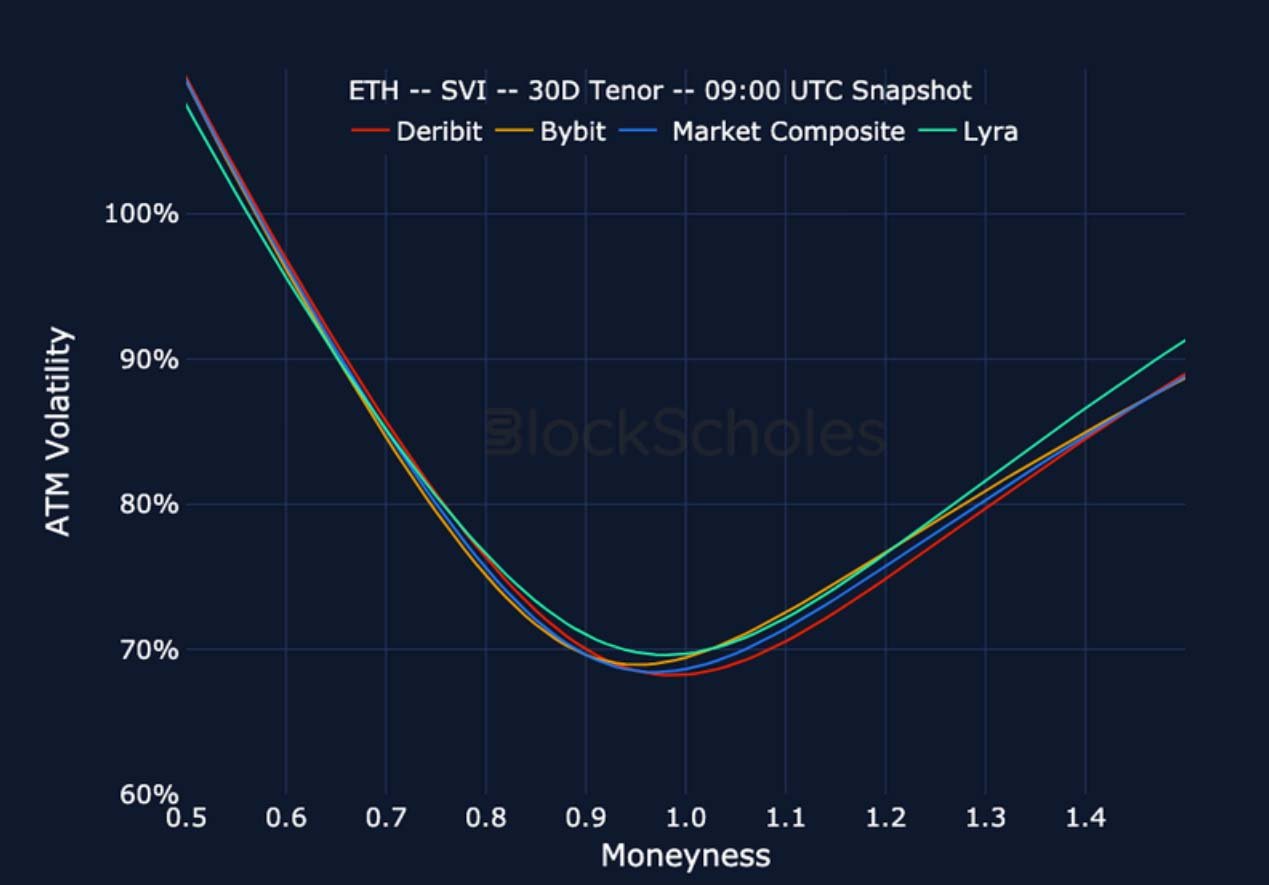

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

Listed Expiry Volatility Smiles

BTC 27-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 27-DEC EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)