Summary: During the last 30 days, we have seen $+4.5 billion of fiat being deployed into crypto markets – liquidity lifting prices higher and igniting a rally in altcoins. A US government shutdown could occur on Friday, November 17, and might last a month. Then, work finalizing a Bitcoin ETF might be pushed out beyond January 2024 due to the Christmas holidays. The result could be a sharp decline in implied volatility as any near-term rally in Bitcoin prices would become unlikely in the case of a government shutdown. Selling Dec ’23 expiry calls and puts with 40,000 and 32,000 strike prices could generate a +7.1% return at year’s end.

Analysis

During the last month, Tether’s market capitalization increased by $+3.5 billion, while crypto-related investment products saw $+1 billion after seven consecutive weeks of net inflows. This shows that new liquidity is entering the crypto space, and it is tough to argue why Bitcoin would see a material sell-off at year’s end. Instead, Bitcoin might be trapped in a range if some macro risk events materialize. We will know shortly. With options, traders can also make attractive products in various trading markets.

U.S. House Speaker Mike Johnson proposed a compromise temporary funding plan without insisting on deep spending cuts (Stopgap). A government shutdown could last a month, and then work finalizing a Bitcoin ETF might even be pushed out beyond January 2024.

There is a non-zero risk that the U.S. government will shut down by Friday, November 17. In that case, all federal agencies must cease all non-essential functions until Congress acts. This would include the Securities and Exchange Commission (SEC), which could approve a Bitcoin ETF at any moment. During the last ten years, we had three government shutdowns, lasting from 3 days (January 2018) to 16 days (September 2013) to 34 days (December 2018) – or 17 days on average. This would make any potential Bitcoin ETF approval challenging before the Christmas holidays. Subsequently, any preliminary work before a possible Bitcoin ETF approval in January 2024 would also be challenging.

U.S. House Speaker Mike Johnson is proposing a compromise for a temporary funding plan without insisting on deep spending cuts (Stopgap). But a shutdown could have significant implications for us crypto traders.

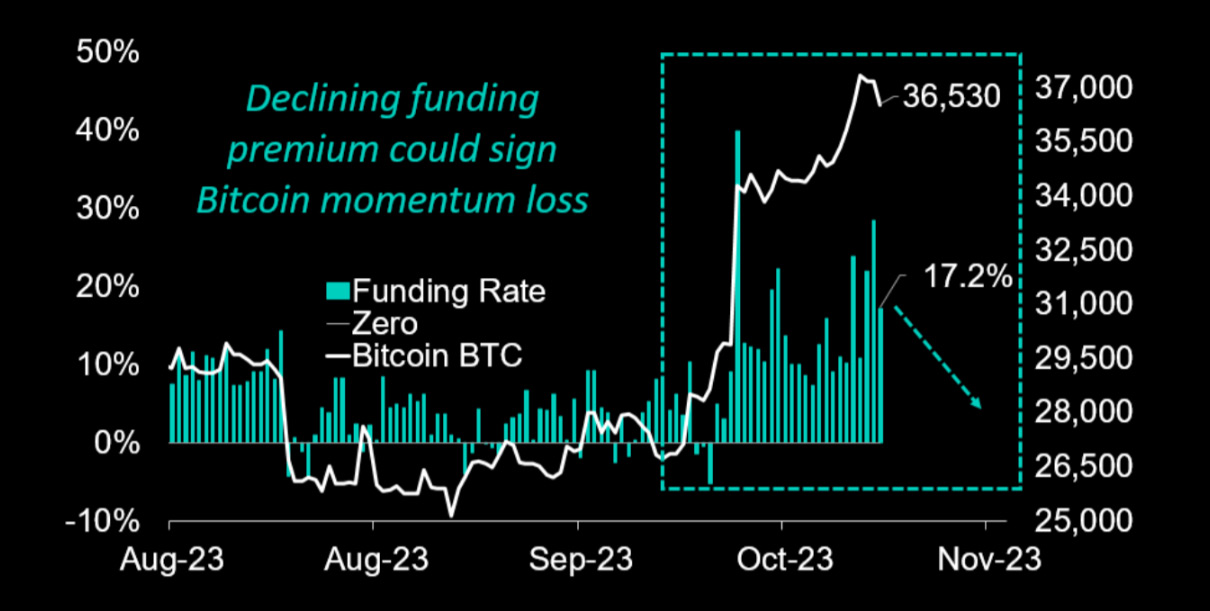

Bitcoin’s funding premium is already shrinking, and this could be a leading signal that the upside is capped for now as directional players harvest the +17% annualized funding spread rather than have directional long exposure.

The result could be a sharp decline in implied volatility as any near-term rally in Bitcoin prices would become unlikely in the case of a government shutdown. This could keep Bitcoin prices in a tight range until January and cause implied volatility to fall significantly. Traders could sell the December 29, 2023, put with a strike price of 32,000 and the 40,000 strike call. The latter call trades with an implied volatility of 55% and could be sold for $1,844, while the 32,000 put trades with a 54% implied volatility and could be sold for $800. Therefore, $2,644 could be generated through this strangle or roughly 7.1% until year-end.

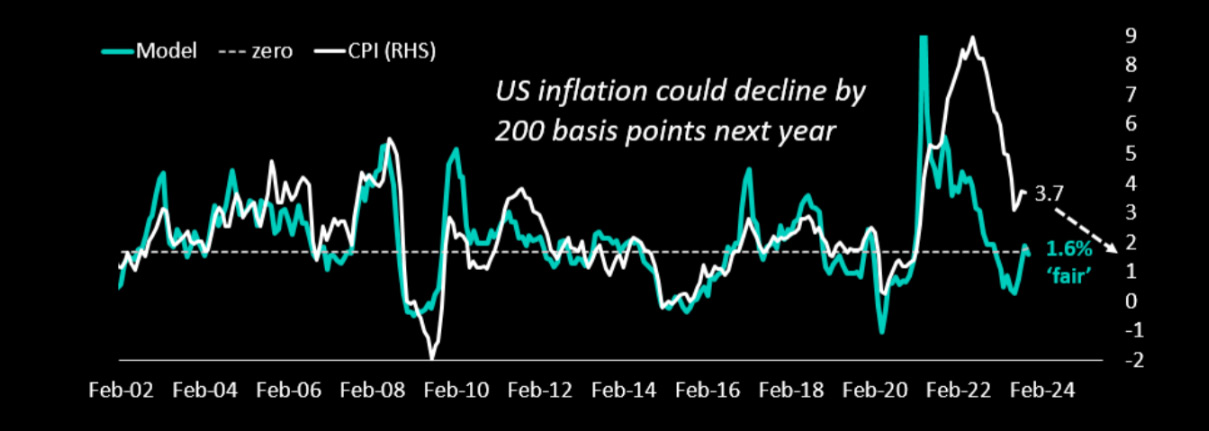

A potential government shutdown would also pause any macroeconomic data releases the US agencies collect. For example, the inflation data that the Fed uses for its interest rate projection could fail to be reported, and central bankers and traders would fly blind without reliable data. A year ago, we became big Bitcoin bulls as we expected a sharp decline in US CPI – which has indeed materialized.

In line with the recent rally in crude oil prices, US inflation rebounded slightly, but today’s CPI report could be the start of another decline in US inflation. This would continue to provide tailwinds for risk assets, and we would suggest accumulating upside exposure for 2024 if we see any dip in Bitcoin prices. Our inflation model implies that US CPI YoY would decline from 3.7% to 1.6% in 2024 – this will be bullish for risk assets (tech stocks and crypto) – hence we remain bullish into next year.

From a short-term trading perspective, we could see a decline in Bitcoin prices towards 35,800, but unless today’s inflation report sets off the fireworks – which we do not expect – Bitcoin might trade in a broad sideways range of 32,000 to 40,000 until the year-end.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)