ETH Momentum Builds, but Macro Winds Strongly Favor Bitcoin

Ethereum is pushing toward $4K as spot‑ETF inflows outpace Bitcoin for seven straight days. With a smaller market cap, ETH is easier to move and is riding narrative tailwinds and renewed institutional interest—though positioning looks stretched.

Bitcoin remains resilient. Despite slower ETF inflows and an 80K BTC sale late last week, price held firm, signaling strong demand and a growing long‑term holder base. BTC dominance sits near 60%, reinforcing its ‘digital gold’ role even as ETH and other majors gain some share.

Macro and policy winds are turning in Bitcoin’s favour: the Fed has shifted to an easing bias, global liquidity is accelerating, and the U.S. has pivoted from hostility to support—reopening banking rails and green‑lighting the fastest‑growing ETF in history. Treasury‑style corporates are accumulating BTC, tightening float and priming an upside flywheel.

Many analysts expect a ‘right‑translated’ cycle in BTC, with peak returns later. With institutional rails built and capital returning, a stretch toward $150K–$200K in the next 6–12 months remains plausible. Near‑term chop aside, institutions are here, supply is thinning, and the bull cycle may still be early. We’ll stay pragmatic and position accordingly.

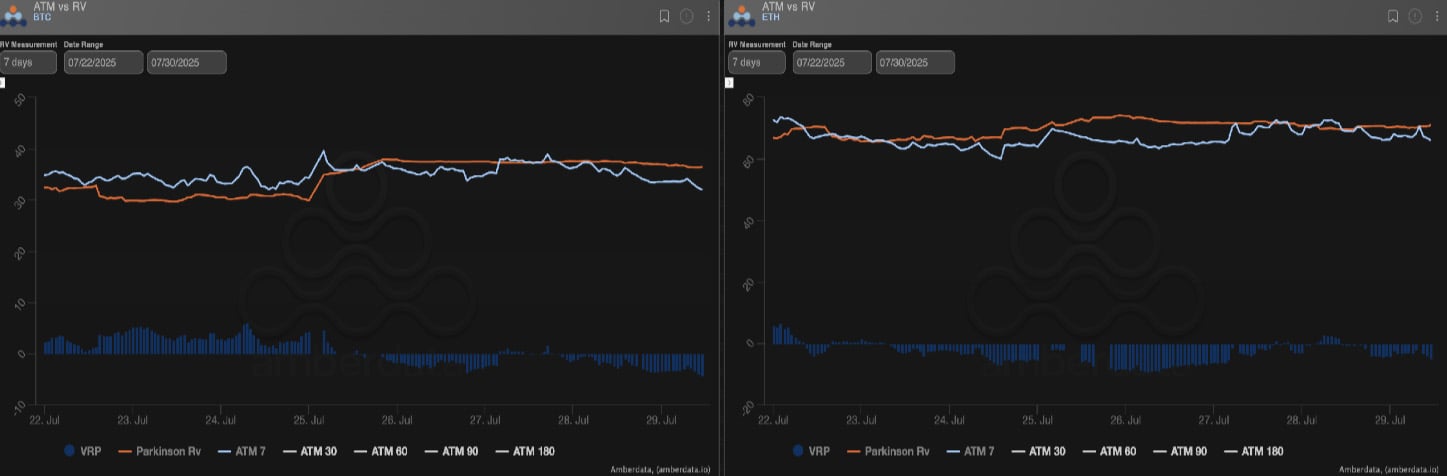

Realized Vol Holds Steady as Implied Softens

Realized vol is steady: BTC ~35, ETH ~70;

- Front‑end vols eased after an initial spike: BTC −3 vols, ETH −1.5, following a +5‑vol pop on the move higher.

- Carry is negative as implied fell below realized; if spot holds, realized should drift lower.

- Implied ranges on OHLC were respected most of the week; both assets traded range‑bound.

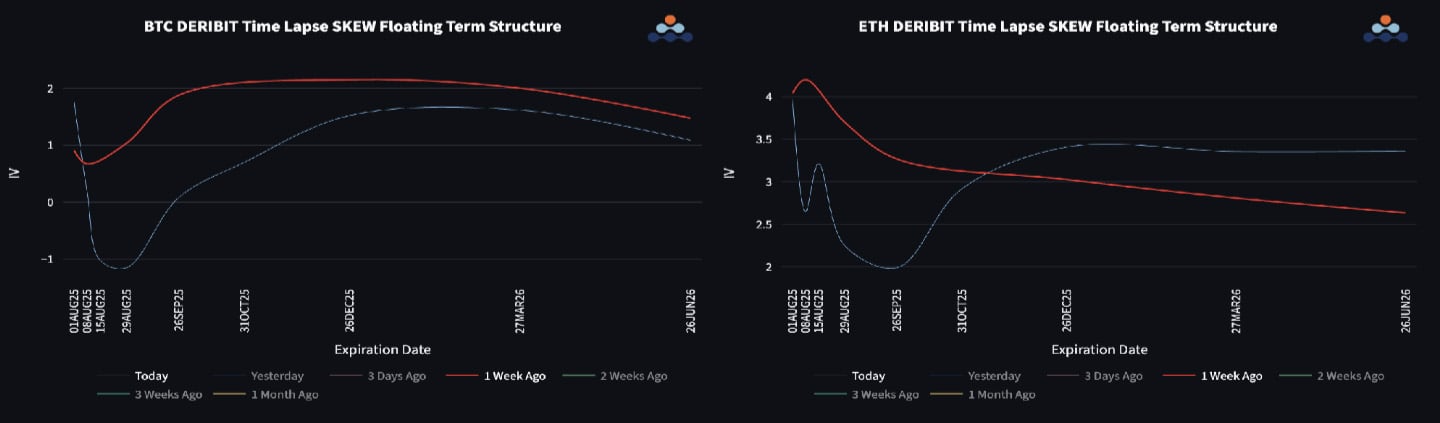

BTC Skew Flips to Put Premium: Large Block Distorts Front End

BTC’s skew repriced lower in the 1‑month, flipping to a put premium. The rest of the curve remains in call premium but is shifting down;

- ETH has given back some call skew yet still holds a call premium across the curve, with a dip in the 1‑month.

- A large block in 08‑Aug 110K puts (~$600M notional; >$5M premium) likely distorted front‑end skew.

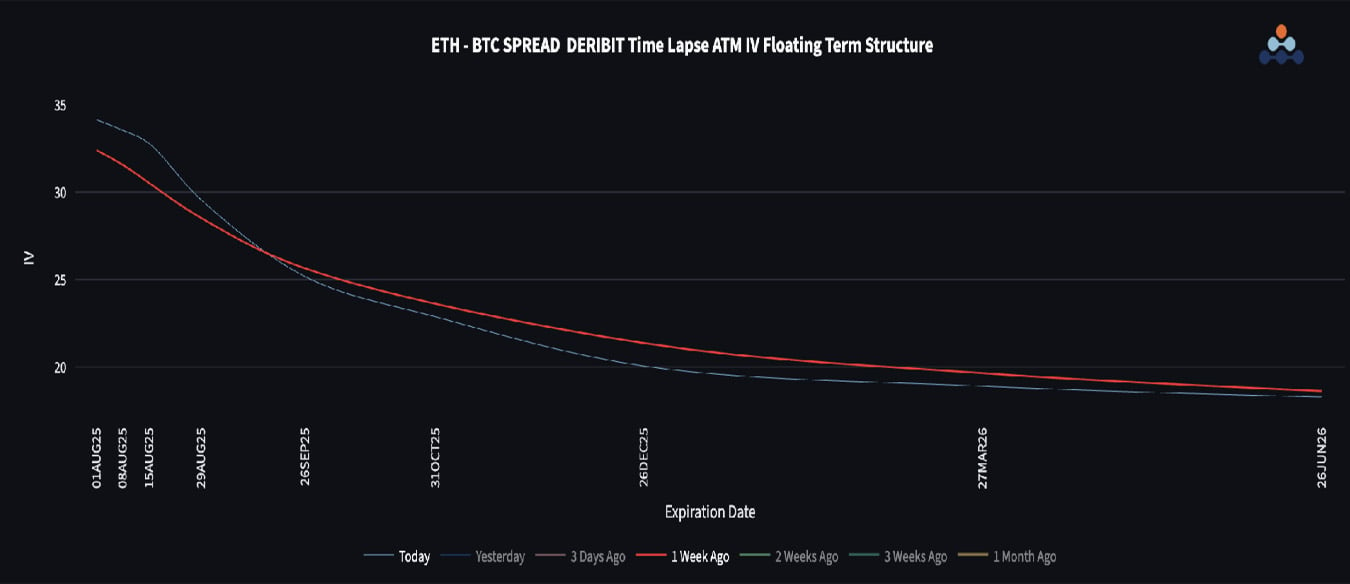

ETH/BTC Holds Breakout as Vol Spread Compresses

ETH/BTC has held its breakout gains and remains firm.;

- Front‑end vol spread is ~35, consistent with the realized differential.

- Back‑end vol spread is grinding below 20 as VEGA demand appears in BTC Dec call spreads.

- The RV skew curve shows a clear, ETH‑bullish bias across tenors.

- My Dec‑25 ETH/BTC VEGA spread is recovering P&L as spot stabilizes and back‑end vol spreads compress.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)