Crypto Rising on Macro Tailwinds

Bitcoin has surged over the past week, with Ethereum showing even stronger growth after lagging behind. Highlights include:

- $250 million flowed into BTC ETFs in just two days, with ETH also seeing strong inflows.

- The Fed cut rates by 50 basis points and plans further cuts this year and in 2025. While Powell’s guidance was vague, attention now shifts to labor data.

- Kamala Harris pledged support for crypto growth, adding to endorsements from industry advocates.

With no major events until Friday's PCE report, traders may take profits as Bitcoin approaches the $65k resistance. Improving funding rates and more attractive yields could bring fresh capital into the crypto market.

Crypto Vol Stays Stable

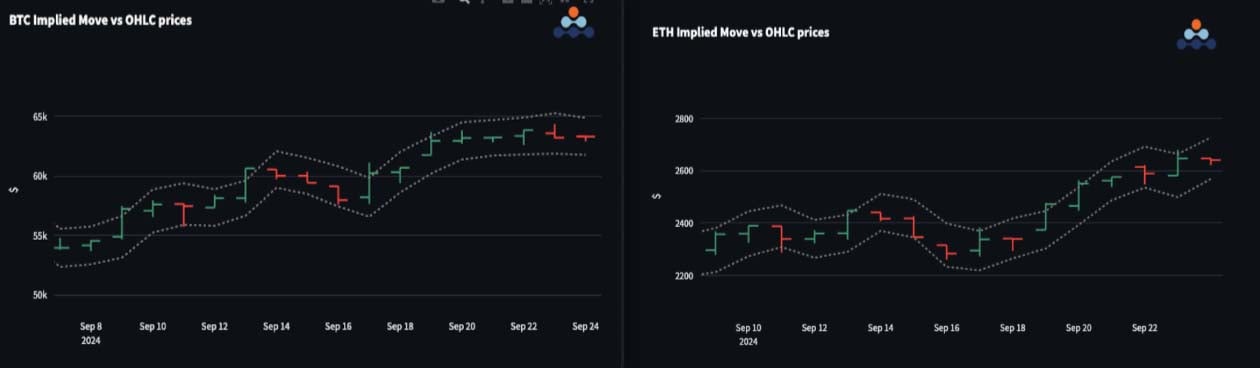

Crypto volatility remains stable in the 40s, with implied vols trending down. Key points:

- Volatility settled after the FOMC meeting, reducing positive carry to around 5 vols.

- Selling BTC gamma has been straightforward, with prices staying within implied ranges.

- ETH tested the upper limit of its implied range a few times this week.

- The only major macro event this week is Friday’s PCE report, with some midweek Fed speakers.

China’s stimulus efforts may grab headlines, but they haven’t sparked a crypto breakout yet.

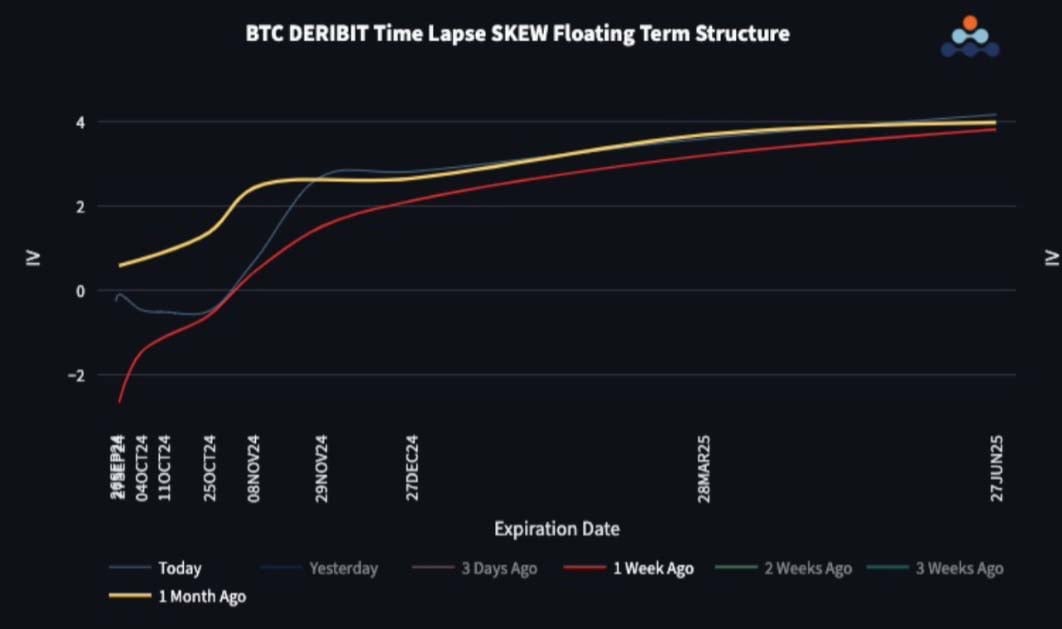

Front-End Skew Loses Put Premium

This week, the skew’s contango term structure shifted into more of a step pattern:

- Front-end skew lost its put premium as sentiment improved with the recent spot price bounce.

- The upcoming US election is a key turning point, where we move from mild put skew to call skew. Traders expect the election to be a bullish event for crypto.

ETH/BTC Spots Bounces Strongly

ETH/BTC had a solid rebound from oversold levels as altcoin speculation returned, aided by improved liquidity from the FOMC and China’s actions.

- ETH volatility picked up, especially further out on the curve, but front-end vol remains anchored as sellers fade the spikes.

- The vol spread is now 9-11 across the curve, aligning with the realized spread of 10 vol ETH.

- The skew term structure is flat, but ETH upside becomes more appealing further out on the curve.

Option Flows

BTC options volumes are up 20%, reaching $8.3 billion, with a 52/48 split favoring calls over puts. March 25th calls continue to be sold, keeping VEGA under pressure, while bullish call buying appears in October and November. September sees balanced two-way flows in both puts and calls.

ETH volumes jumped 40% to $1.95 billion as renewed interest followed its outperformance. Calls lead at 55/45. October put buying centered on 2300 and lower strikes, with some 2100/2400 risk reversals and 3000 calls showing demand. Vol sellers targeted 11Oct and 25Oct straddles.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)