Crypto Carnage On Massive Cross Asset Risk Unwind

After a brief positive surge post the Trump speech at Nashville, the crypto market took a sharp turn as BTC plummeted from $70k to $50k and ETH from levels well above $3k to $2.1k. The drop in BTC aligns with a typical 30% retracement seen in market upcycles. Several factors contributed to the decline, including fears of selling from the U.S. government, Mt. Gox, and Genesis. The main trigger, however, was the historic global market decline, with the Nikkei suffering its worst drop in 40 years as the JPY carry trade unwind was triggered by the BoJ hiking rates.

Aggressive selling by Jump Trading and Paradigm VC exacerbated the downside volatility in ETH. As a result of the cross-asset risk unwind, the VIX spiked to levels unseen since the COVID-19 panic. Tensions in the Middle East and poor U.S. unemployment data have further fuelled risk-off flows. In response, global markets are on high alert.

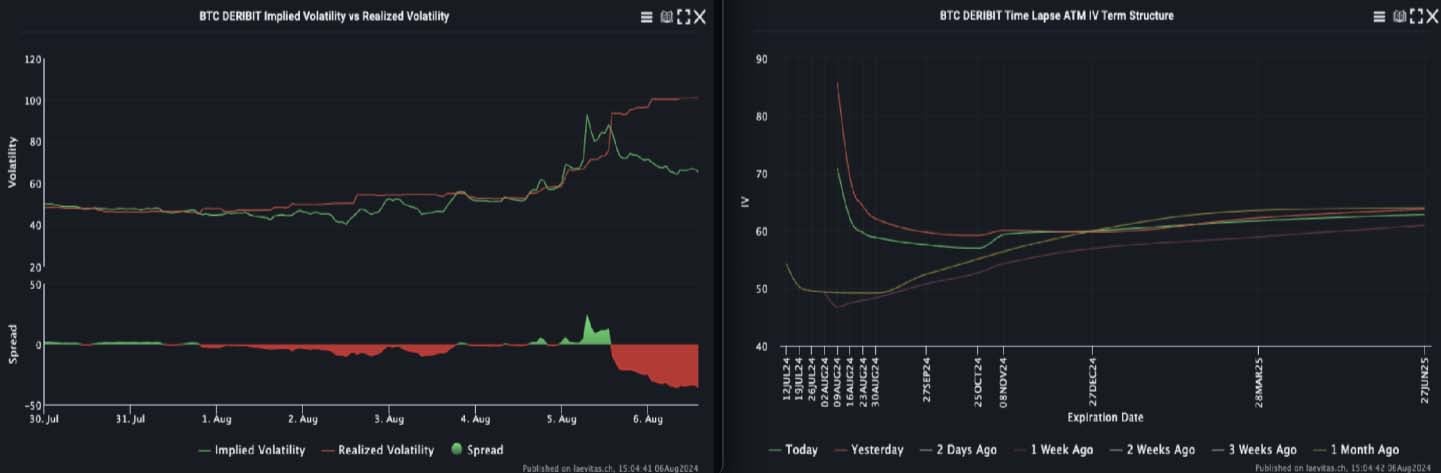

Crypto Vol Explodes

Crypto markets were rocked by a volatility surge, with realized volatility doubling and prices crashing by 15-20% on Monday. Implied volatility spiked but has since stabilized. Carry is deeply negative as the implied has come off, but realized still captures the outsized moves. The 56k level now acts as a critical point. If not regained, further declines could occur. Inverted term structures show that traders are wary of the current situation and expecting more volatility. Traders need to be prepared for continued uncertainty and size down positions to reflect the higher vol environment.

Short Term Skew Flips to Put Premium

In terms of BTC, we saw a pick-up in skew for the puts with weeklies trading up to 12 premium and then on Monday we saw weeklies up to 17 vols for puts. That has normalised a lot, but we still see a put premium in the weeklies of about 7 to 8. Only out to 3 months we see a flip back to call premium.

In ETH we see a similar story. So, the main takeaway is that while short-term we may see further downside risks, 3 months out, the market is still very feeling bullish.

ETH/BTC Breaks Down

The ETC/BTC pair fell 20% to 0.04, while the ETH/BTC vol spread jumped due to recent price action. Despite attempts to rally, ETH couldn’t gain momentum on ETF flows and spot tumbled back below key supprts, leading to a 10 vol shift in the spread. The front-end vol spread hit 25 vols, exaggerated by liquidations, and has since corrected to 13 vols. The skew between ETH and BTC is balancing, with call skew dominating in long-term positions as the bullish outlook for ETH remains strong.

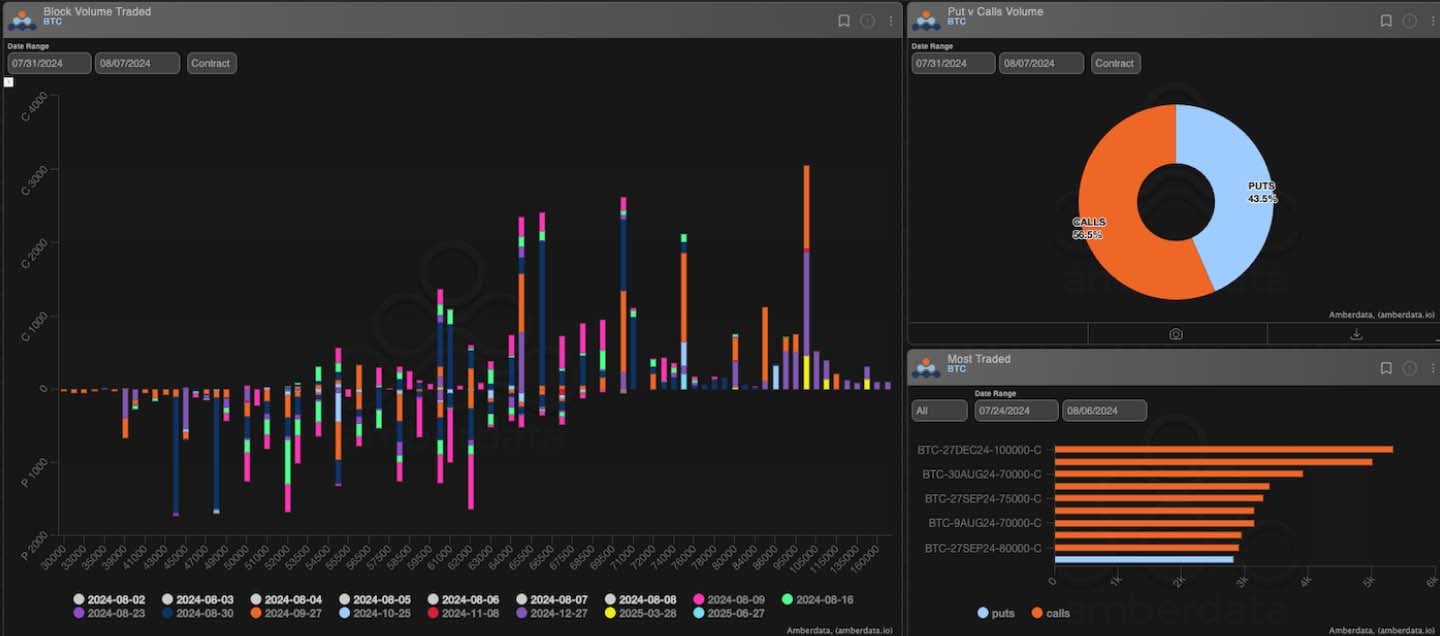

Option Flows

BTC options volume surged 20% to $13Bn, with strategic moves such as buying 30Aug24 48k/44k put spreads for hedging. The market saw 27Sep24 75k/85k call spreads and a bullish 55k/85k risk position in September. Short-term puts are still favoured for hedging.

ETH trading saw a 10% drop to $3.1Bn. However, volatility buying continues with Sep 3200 straddles and longer-dated calls in September and December. Iron condors in 30Aug, are traders safest expression to sell vol post-spike.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)