Soft Price Action Despite the Positive Catalysts

Summer trading is off to a soft start for BTC and ETH, despite Bloomberg analysts predicting a July 2nd launch for the spot Ether ETF. While a softer CPI initially boosted crypto last week, gains were lost post-FOMC due to hawkish FOMC signals, projecting less cuts than initially expected. BTC faces additional pressure vs its counterpart ETH due to miners’ capitulation and potential Mt. Gox sell-offs. Long-term holders have also been selling, adding to the downward trend.

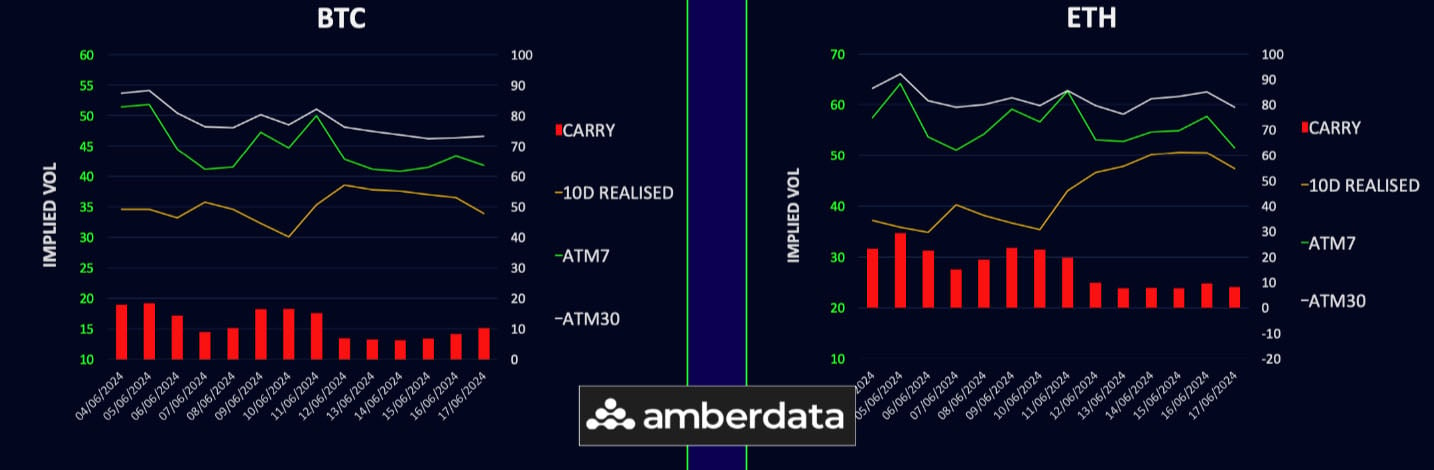

Implied Vols Flat to Lower

BTC's realized volatility remains in the mid-30s, while ETH has surged to 50. Implied volatilities are slightly softer, keeping carry positive. With light data and the Juneteenth holiday, expect stable ranges and continued short gamma performance. Speculation around the July 2nd ETH ETF launch isn’t boosting prices due to expected lower inflows. Mixed macro signals, with disinflationary data but hawkish FOMC tones, have dampened optimism. Powell hints at an overstated labour market, suggesting potential rate cuts – buy the dip!

ETH Term Structure Steepening

BTC term structure is shifting lower, with a 2-4 vol drop to September 2024 and around 1 vol point drop in longer maturities. Call skew fades out to August 2024, with long-dated calls retaining their premium. ETH term structure steepens, with short-end vol down 5-8 vols and a slight bid in Dec24- Mar25. ETH call skew is holding up better than BTC, anticipating the early July ETF launch.

ETH/BTC Spot Spread Revisits Key Support

ETH/BTC vol spread rises slightly for 1-month and longer maturities as BTC vols drop more significantly. Weekly ETH is under relative pressure. ETH vol retains a significant premium across the curve, likely unchanged until ETF launches and inflows occur. The ETH/BTC spot spread is nearing support, suggesting a potential entry for call switch trades using long-term options for cheaper vol spread.

Skew Drifts Lower for Calls

Call skew for BTC and ETH is drifting lower as spot price action remains uninspiring, with bullish trades already positioned for the ETF launch. BTC call skew has faded more than ETH, which holds a higher premium for 1-month and longer. Weekly skew indicates more hedging demand in ETH due to weaker technical, despite positive news. No change in overall options market setup—near-term caution, but a rally is expected later this year unless 3300 (and/or 3000) support breaks.

Option Flows And Dealer Gamma Positioning

BTC option volumes are down 10% to around $8Bn, with mixed flows including year-end hedging and bullish bets. Sellers targeted 28Jun 70k straddles to earn premium. ETH volumes rose 5% to $3.4Bn, dominated by short-term call sellers avoiding the ETF potential launch date on 02Jul. With ETH implied vol well above BTC, overwriters focus on this part of the curve, expecting no spike before July.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)