The economic uncertainty caused by COVID 19 has increased the institutional interest in digital assets. However, even though more participants of the traditional sector are entering the crypto space, the adoption still is slow. This article looks into how an advanced and widespread custody solution can accelerate this process.

Institutional adoption is considered to be among the leading long-term value drivers for Bitcoin. The process, however, has been slow. Nonetheless, in less than two years, attitudes towards digital assets have changed drastically. From an asset class once ridiculed as a scam, it is now viewed as a beneficial portfolio diversifier.

Institutional adoption is only in its early stages, however, the effect it has already had on the market is undeniable. A survey of 800 institutions by Fidelity Digital Assets, revealed that more than 80% of respondents see the appeal of crypto trading, with one third already having some exposure to the asset class. Moreover, Grayscale’s fund reported more than $1.4- billion inflow in the first half of 2020 alone. 81% of its investors being institutional clients.

The effects can also be observed in derivatives markets. Since the black Thursday, regulated exchanges and options markets have been reporting new turnover records each month. However, the big question remains – is the crypto trading infrastructure ready to facilitate the growing institutional demand?

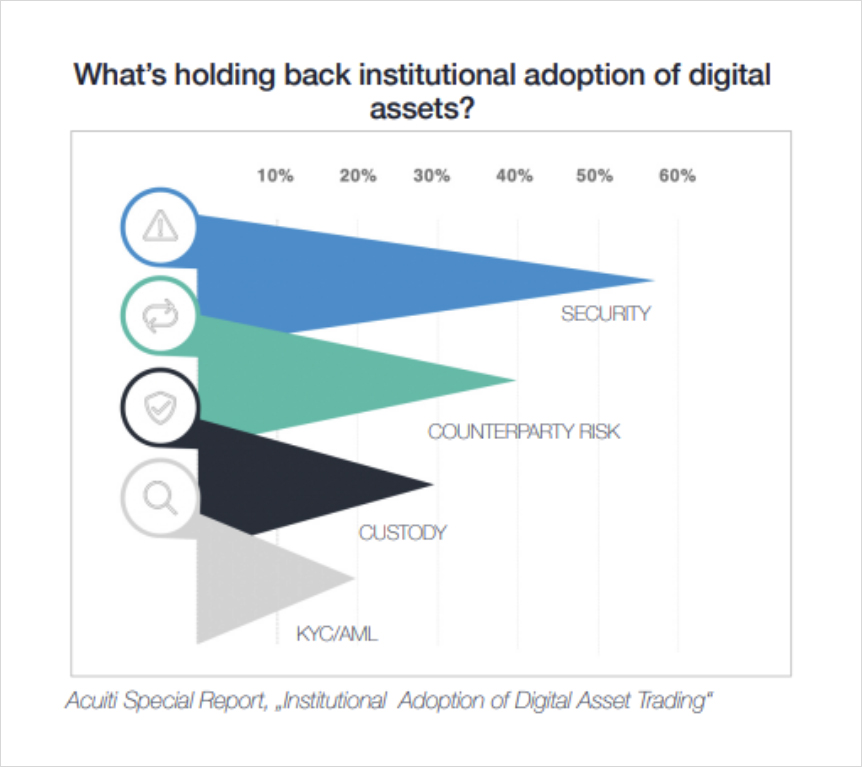

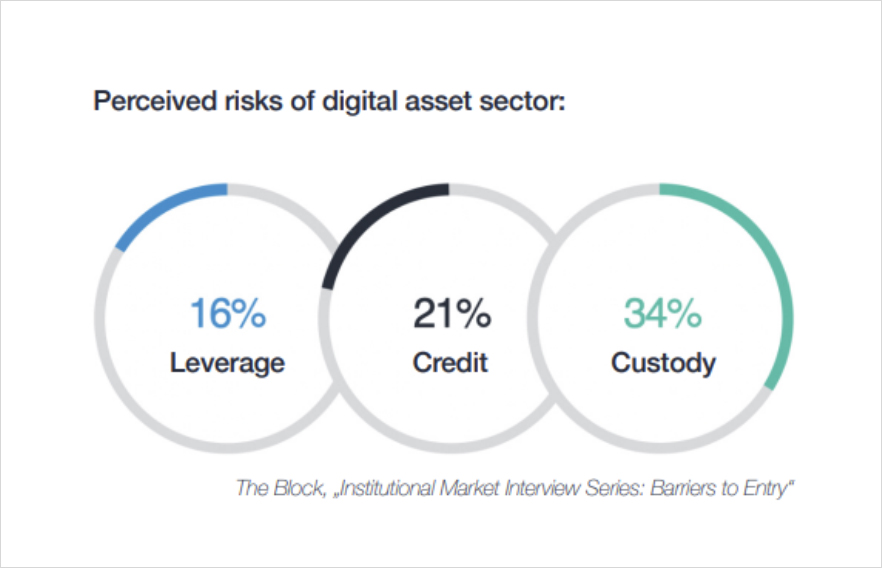

The research by Acuiti revealed that the main concerns of institutional clients are exchange security, counterparty risk and custody. Therefore, it is no surprise that already more than 100 custody and settlement network firms are competing to eliminate these hurdles. However, the varying opinions about what should be the industry standard might hinder widespread adoption and subsequently slow down the speed of market growth.

Security

Due to the irreversible nature of blockchain, security must be the top priority when storing or transacting digital assets. However, it can be challenging for clients to evaluate the security measures of exchanges, as most are unregulated, and there is no standard security framework in place. Therefore, a licensed, third party custody solution can mend the gap between the unregulated, top-liquidity exchanges and the institutional user base.

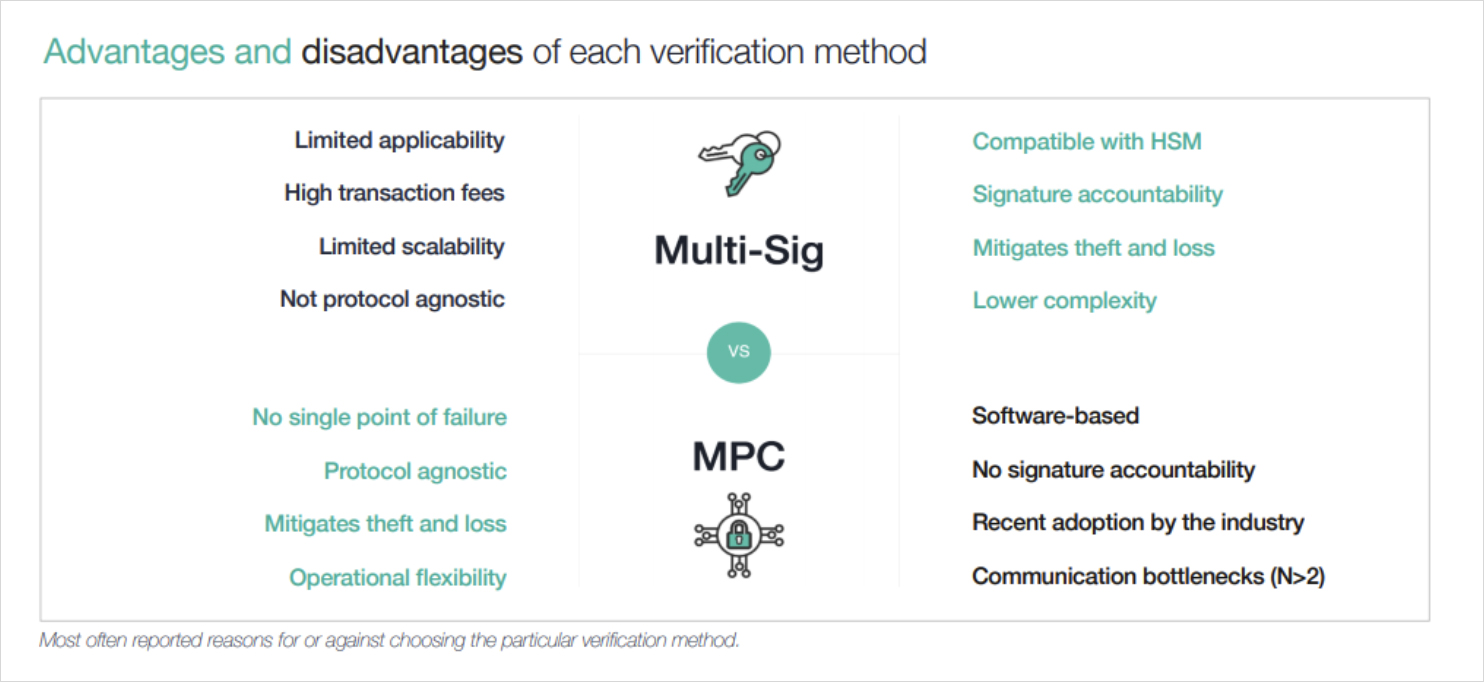

Currently, the most used key management systems are MPC, Multi-Sig and HSM. However, opinions of the superiority of each solution differ significantly. We look at the risks and advantages of these solutions as perceived by institutions, and how a combination of all can create an ecosystem of more efficient crypto-asset trading.

Multi-Sig

Multi-signature transactions use an “N of M” quorum scheme, where N out of M signatures are required to sign off on a transaction, thus eliminating the risk of a single point of failure.

This signing mechanism has become the industry standard and has a long-tested history. It is also compatible with HSMs, which ensure defence-grade security for creation and storage of the private keys. Most importantly, HSMs have a unified security framework and can be validated by the international government standard FIPS 140-2. Multiple custody providers have already been granted Level 3 certification – a security benchmark recognised by the institutional clients.

Moreover, the keys used for signing the transaction are entirely separate and do not interconnect, thus significantly lowering the complexity of the verification process. However, this means that each recognised signature is verified and signed on the chain separately, substantially increasing the amount of data accommodated, processing time and costs. It also reveals the quorum structure, limiting user anonymity. A significant fallback is also the lack of flexibility. Multi-sig was originally developed for Bitcoin. Therefore, support of any new asset requires additional development time and custom code. The same applies to approval policies. And as the system becomes more complex, it becomes more prone to security risks.

Altogether, it is a well-tested and highly secure method, which minimises security risk by enabling a geographical and institutional distribution of the keys. However, limited operational flexibility makes it more suitable for cold storage management.

MPC

Multiparty computation scheme (MPC) using threshold signature mechanism is the latest advancement in the crypto security space. Similarly to Multi-Sig, also MPC uses “M of N” principle and removes the risk of a single point of failure. However, rather than distributing the responsibility by creating multiple keys, MPC eradicates it. MPC model is based on splitting the key into numerous shares, each located on a separate device. When signing a transaction, M out of N devices will compute a cryptographic algorithm, thus enabling respective parties to compute the function jointly. In the blockchain, it is signed as one signature, and full privacy is maintained. It is a highly secure method, as shares never get united, are continuously refreshed, and if hacked, separately reveal nothing of the key.

MPC is also fully protocol agnostic. This is a superior advantage over multi-sig, as it does not require the use of smart contracts for ETH support, making it faster, cheaper and more secure. MPC’s threshold signing also provides flexibility for defining the quorum, thus allowing for more advanced operational governance.

MPC is a relatively new technology that applies highly advanced algorithms. In addition to that, more shares increase the number of interaction rounds required, which in turn can lead to communication bottlenecks and slow down the signing process.

As the first research on multiparty ECDSA protocol was published only less than two years ago, MPC still requires a test of time. However, this could be overcome by more transparent and standardised implementation process, based on established and recognised principles, thus eliminating the uncertainty associated with its recent adoption.

Altogether, MPC has excellent potential, and due to its multiple benefits, it can be expected that MPC soon will be the new industry standard. NIST has already started its threshold cryptography project, and the first virtual HSM was FIPS 140-2 Level 2 certified this summer.

A combination of various security methods – the key to widespread adoption

With so many contrasting opinions, the industry is still divided. However, until a consensus is reached, a combination of both can diversify the risk and allow for more efficient asset management. As HSM-backed multi-sig solution has already proven itself in crypto and traditional markets, it remains to be the most used option for cold storage. Therefore, a long-term use case and familiarity should not be underestimated. However, due to its efficiency, MPC is rapidly taking over, and demonstrating its superior performance for hot wallet and altcoin management.

Moreover, numerous advantages of MPC are fastly driving the advancement of technology to overcome the criticisms faced. Offline, air-gapped signing is already a reality, and more MPC projects are now developed on open-source protocol allowing for greater transparency and algorithmic scrutiny.

Custody enabled off-exchange settlement

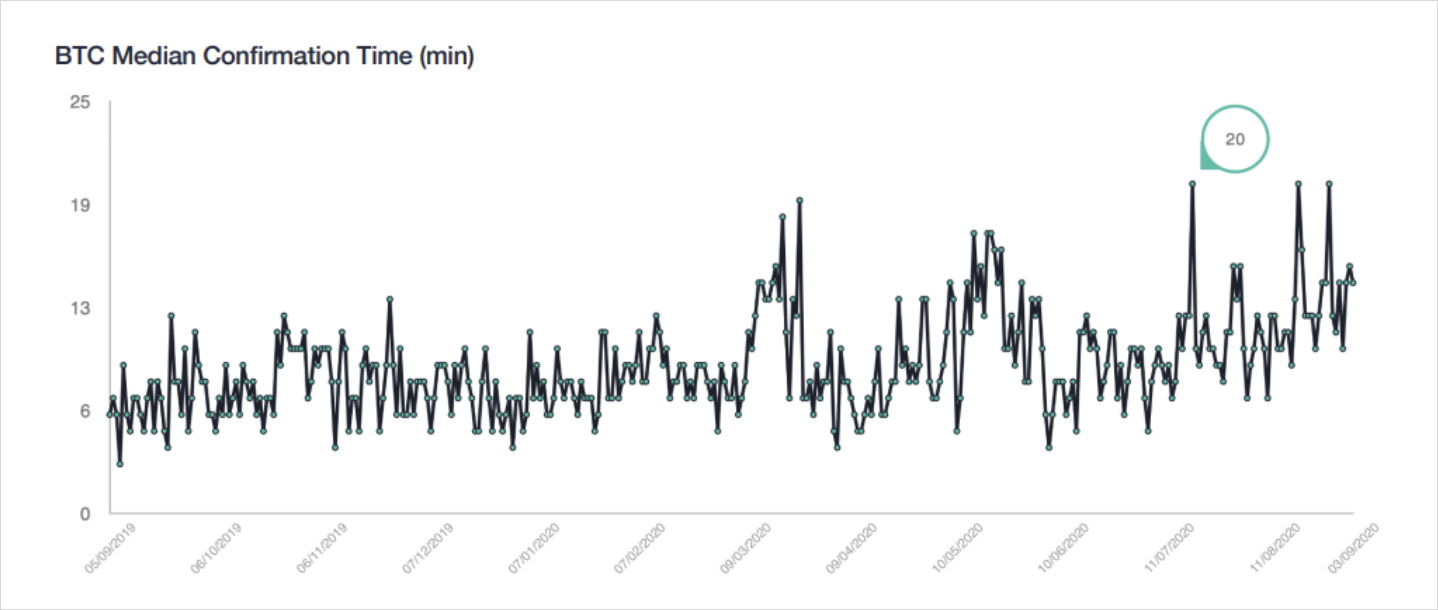

Custody can provide more benefits than just security. As transaction times continue to increase, a BTC deposit can take from 10 minutes to 2 hours, and even longer during network congestion in high-volatility periods. In fast-moving markets, traders are unable to add or move their margin fast enough to meet margin calls or take advantage of arbitrage opportunities. This limits their ability to trade and can lead to significant trading losses.

A survey of institutional investors by Fidelity Digital Assets also revealed that volatility is among the main barriers for entering the crypto space. And although volatility should not be perceived as a risk, and can be hedged with various derivatives strategies, it does require an efficient infrastructure at all market conditions.

An off-exchange settlement solves this issue. Due to leverage trading and the auto-liquidation mechanism, derivatives markets are more likely to suffer from market inefficiencies caused by a slow collateral transfer.

Custody solution can eliminate this by enabling traders to react faster and execute significantly higher volumes per transaction. Historically, asset managers have limited the value of assets stored in the exchange’s hot wallet to mitigate security and counterparty risks. However, this risk is eliminated if the assets are not transferred to the exchange until the trade is complete. In a walled custody environment, all deposits and settlements are off-exchange, and the transaction time is reduced to 100 milliseconds.

This setup significantly minimizes all the main concerns reported in Acuiti research – security, custody and counterparty risk. Therefore, custody has a further-reaching impact than just security; it also improves market efficiency.

Deribit custody network

Deribit’s product offering and system infrastructure make it the preferred choice of professional and institutional traders. Therefore, also, our custody offering had to follow and meet their advanced standards.

We believe that the future of crypto trading heavily relies on efficient custody and settlement networks. With the current trend of more capital entering the crypto industry, this requires security solutions to be one step ahead of the curve.

John Jansen co-founder and CEO of Deribit

Due to this, we have partnered with two top tier custody partners to offer the best solution to our customers. Our custody network is advancing the ecosystem of the crypto trading and making it more suited for institutional demand.

Ulla Rone

Business Development Manager at Deribit

AUTHOR(S)