In a data-laden week starting down a debt ceiling impasse, cryptocurrencies continued to dart in desultory fashion, with bitcoin having once more failed to find traction north of 27,000 and ether falling prey to a nominally insurmountable gamma magnet at 1800.

The nascent decoupling between majors and equities faded similarly as US bill yields topped 6%. Yet there were modest signs of life in the volatility space as tier-1 crypto native players stepped up in a meaningful way to scoop value priced optionality. Even as gamma buckets continued to languish on a high 30-handle and one month 30 delta calls in ETH were offered as low as 44% before a spate of bids saw a modest 3-point spurt in 30th June IVs Tuesday which subsequently retraced all the way back to 44.5% mids by the close of the Wednesday session in New York. The looming specter of a US default is, apparently, an insufficient catalyst for a repricing of volatility risk premia.

Nor are fears of banking instability, which remain sidelined for the moment. Following Bullard and Kashkari’s confounding ‘one lump or two’ commentary, neither were ho-hum Fed minutes nor incremental global inflation prints – which set a 30 year record in the UK – able to serve as much of a catalyst for materially heightened gyrations in cryptocurrency prices. The midweek tape accordingly encompassed one-way lower price action in BTC that witnessed an unrequited retest of the 26,000 threshold. At the same time, ETH found firmer bids near 1780 as the gravitational force of >150,000 units of OI at 1800 for May and June expiries still held some sway.

It’s unclear whether the listless, if bearish, tape owes at all to the harrowing tone of recent SEC declarations (to the effect that it will regulate via enforcement rather than legislation) or the Former CFTC chair Dan Berkowitz’ baleful comments that ETH may be both a security and a commodity. Either way, such a vacuum is unlikely to muster decisive action on the part of all but a dedicated handful of institutional players, including the aforementioned call buyers who, it seems, believe they know a bargain when they see one.

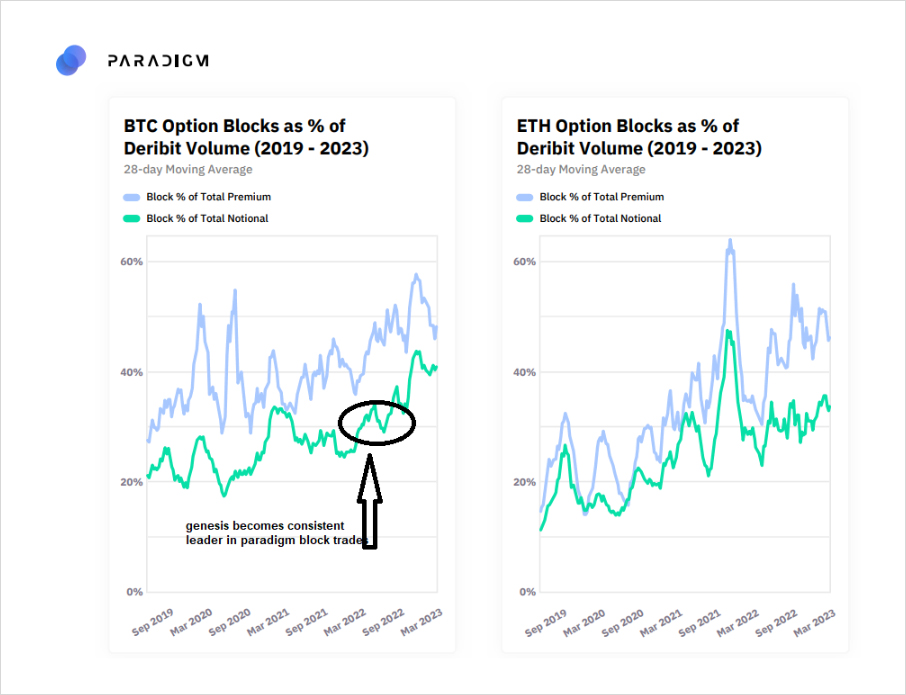

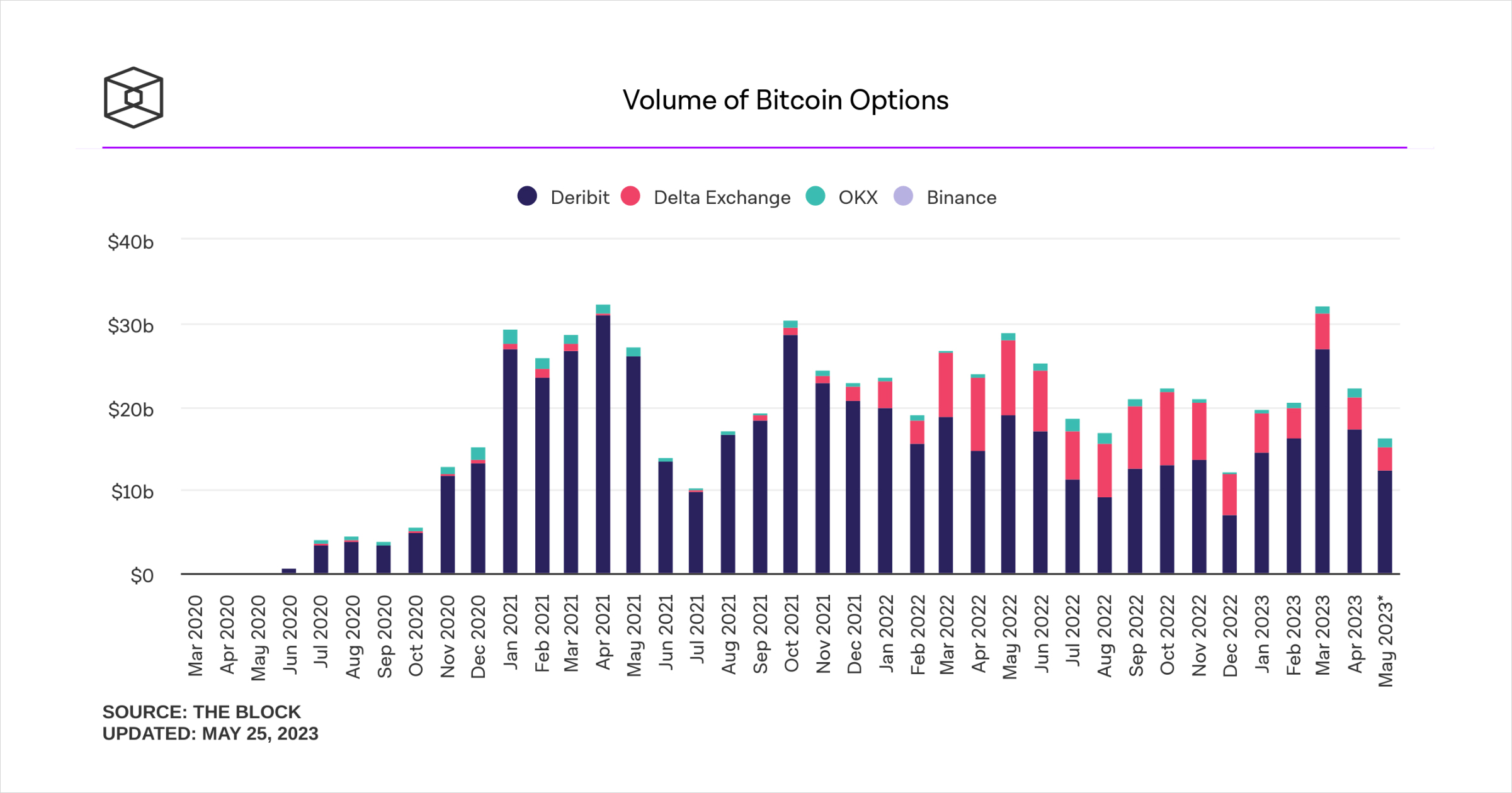

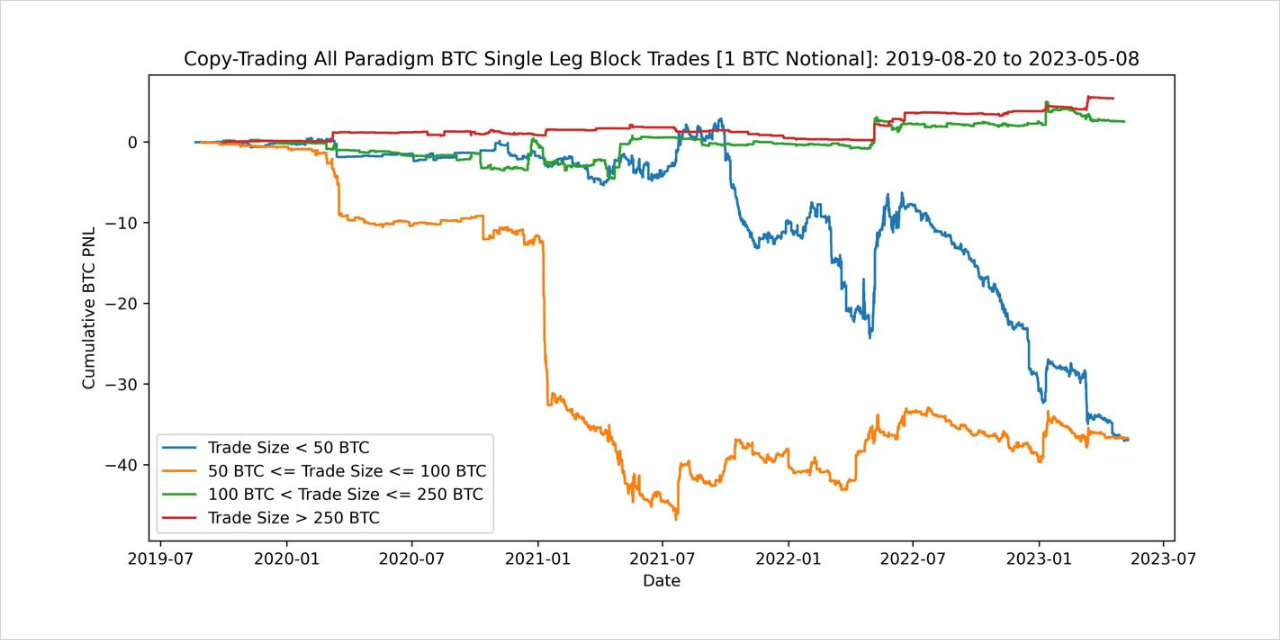

In some sense, that’s fitting, for a concentrated subset of the industry’s most well capitalized and committed names has been driving volumes and perhaps also price action for quite some time. A recent Paradigm Institutional Liquidity Network special report highlighted the secular rise in block traded volumes as a proportion of overall Deribit volumes (and as a percentage of gross premiums). While saw toothed, that trend has stayed the course over the last two years, with block trades rising from 20% to 40% of all volumes and block premiums now exceeding 50% of the market in an erratic if steady upward move. Those gains in block market share have occurred as overall bitcoin options volumes (in both coin and $ terms) hit all-time highs in Q1 2023. And as the cumulative profitability of the biggest tickets (>250x BTC) continues to far outstrip low-information-ratio ‘small dollar’ (<50x BTC) prints, even amongst block-sized trades, according to a recent report by LedgerPrime. Therefore, the thematic arc binding those triple telltales would appear to be one of ‘the revolution will be institutionalized’ as the largest players grab the lion’s share of activity (and alpha) in this burgeoning market.

This is all by way of observing that this week’s determined buy-side flow, which took down ~20,000 units of 30th June ETH ~10% OTM calls at cyclical lows in implied volatility, may be notable for more reasons than one.

Disclaimer

Genesis Global Trading, Inc. and its global affiliates (collectively, “Genesis”) do not provide legal, compliance, tax or accounting advice. Genesis is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing this material, which cannot be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The information contained herein has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NEITHER A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION NOR RESEARCH MATERIAL.

This material contained herein is confidential and may not be distributed in whole or in part to anyone other than the intended recipients. Unauthorized reproduction or distribution of all or any of this material or the information contained herein is strictly prohibited. These materials are incomplete without reference to, and should be viewed solely in conjunction with, the terms and disclosures set forth on the Genesis website, which are deemed incorporated herein.

The information provided in this communication does not constitute investment advice, financial advice, trading advice, or other advice. If any person elects to enter into transactions with Genesis, whether as a result of this material or otherwise, Genesis will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to your interests. Therefore, you are advised to make your own assessment of whether a Genesis service that you are considering is suitable for you and ensure that you have the necessary experience and knowledge to understand the risks involved in relation to those particular services, transactions or investments. Prior to entering into any transaction, you should determine, without reliance upon us or our affiliates, the economic risks and merits (and independently determine that you are able to assume these risks) as well as the legal, tax and accounting characterizations and consequences. In this regard, by accepting this material, you acknowledge that (a) we are not in the business of providing (and you are not relying on us for) legal, tax or accounting advice, (b) there may be legal, tax or accounting risks associated with any transaction, (c) you should receive (and rely on) separate and qualified legal, tax and accounting advice and (d) you should apprise senior management in your organization as to such legal, tax and accounting advice and our disclaimer as to these matters. By accepting receipt of this material, the recipient will be deemed to represent that they possess, either individually or through their advisers, sufficient investment expertise to understand the risks involved in any transactions or services discussed herein and that they have not relied in whole or in part on any of the information provided by Genesis in making such determination.

The trading of digital currency as herein described is an inherently risky activity. Digital currency does not benefit from the protections afforded by the Securities Investor Protection Corporation. A counterparty’s ability to enter into derivatives with Genesis depends on satisfying a number of regulatory requirements imposed on derivatives under the Dodd–Frank Wall Street Reform and Consumer Protection Act and applicable law.

Any prices or levels contained herein are preliminary and indicative only and do not represent bids or offers. These indications are provided solely for your information and consideration, are subject to change at any time without notice and are not intended as an offer to sell or a solicitation to purchase any financial instrument. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate or other market or economic measure. In preparing this material, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by us. Genesis does not make any representations or warranties, express or implied, as to the accuracy or completeness of the information provided herein. Any estimates included herein constitute our judgment as of the date hereof, are subject to change, may or may not be realized, and are not a complete analysis of every material fact. We and/or our affiliates may make a market in these instruments for our customers and for our own account. Accordingly, Genesis may have a position in any such instrument at any time.

Genesis and Genesis Trading are marketing names for certain businesses of Genesis Global Trading, Inc. and its global affiliates and if and as used herein may include as applicable employees or officers of any or all of such entities irrespective of the marketing name used. Products and services may not be available to all counterparties or in all jurisdictions. Securities and digital assets are not deposits or other obligations of any commercial bank, are not guaranteed by any commercial bank and are not insured by the Federal Deposit Insurance Corporation. GGC International Limited is incorporated in the British Virgin Islands (“BVI”). Genesis Global Trading, Inc, a Delaware corporation, has been granted a Virtual Currency License by the New York State Department of Financial Services and is registered with the U.S. Securities and Exchange Commission as a broker dealer. Genesis Asia Pacific Pte. Ltd. Is a private limited company organized under the laws of Singapore. Genesis Global Capital, LLC is a limited liability company organized under the laws of Delaware. Genesis Custody Limited is registered as a cryptoasset business with the UK Financial Conduct Authority.

© 2022 Genesis Global Trading, Inc. All rights reserved. “Genesis”, the Genesis logo, and other Genesis trademarks and service marks referenced herein are trademarks and service marks of Genesis and are used and registered throughout the world.

AUTHOR(S)